Navigating the complexities of financial documentation can be daunting, but with our comprehensive guide to the Ledger Account Form, it doesn’t have to be. This essential Accounting Form and Fillable Form is a cornerstone of accurate financial tracking and vendor management. By exploring its structure and usage through practical examples, we make mastering the art of ledger maintenance straightforward and efficient. Whether you’re reconciling accounts or managing vendor ledgers, our insights will empower you to handle financial records with confidence and precision.

Download Ledger Account Form Bundle

What is Ledger Account Form?

A Ledger Account Form is a foundational document used in accounting to record all the transactions affecting a particular account. It serves as a detailed record, showcasing the balance of each account within a company’s financial statements. This form is instrumental in tracking debits and credits, allowing for a clear view of financial health and vendor transactions. By maintaining an accurate and up-to-date ledger, businesses ensure their financial data is reliable, facilitating informed decision-making and efficient vendor ledger management.

Ledger Account Format

Heading: Ledger Account

Sub-Headings:

- Account Name: ____________

- Account Number: ____________

Columns:

- Date

- Description

- Reference No.

- Debit

- Credit

- Balance

Authorized by: ___________________________

Date: ___________________________

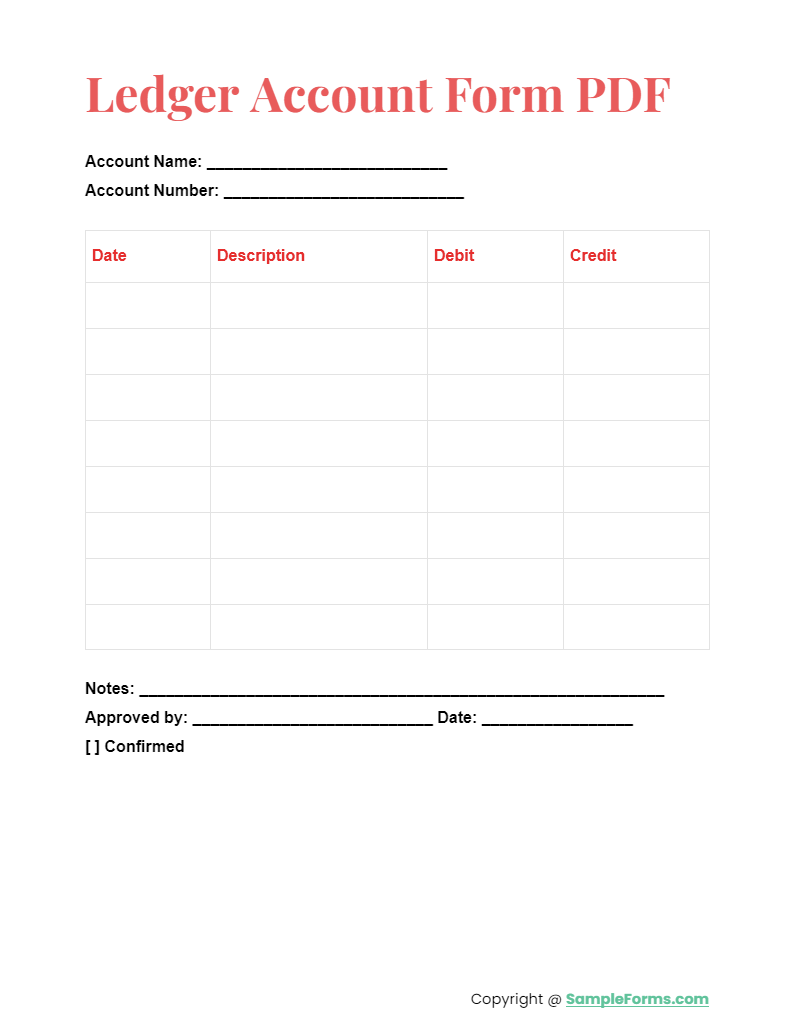

Ledger Account Form PDF

Discover the ease of financial tracking with a Ledger Account Form PDF. Ideal for digital record-keeping, it simplifies the Application Accounting Form process, ensuring precision in financial documentation. You may also see Proforma Invoice Form.

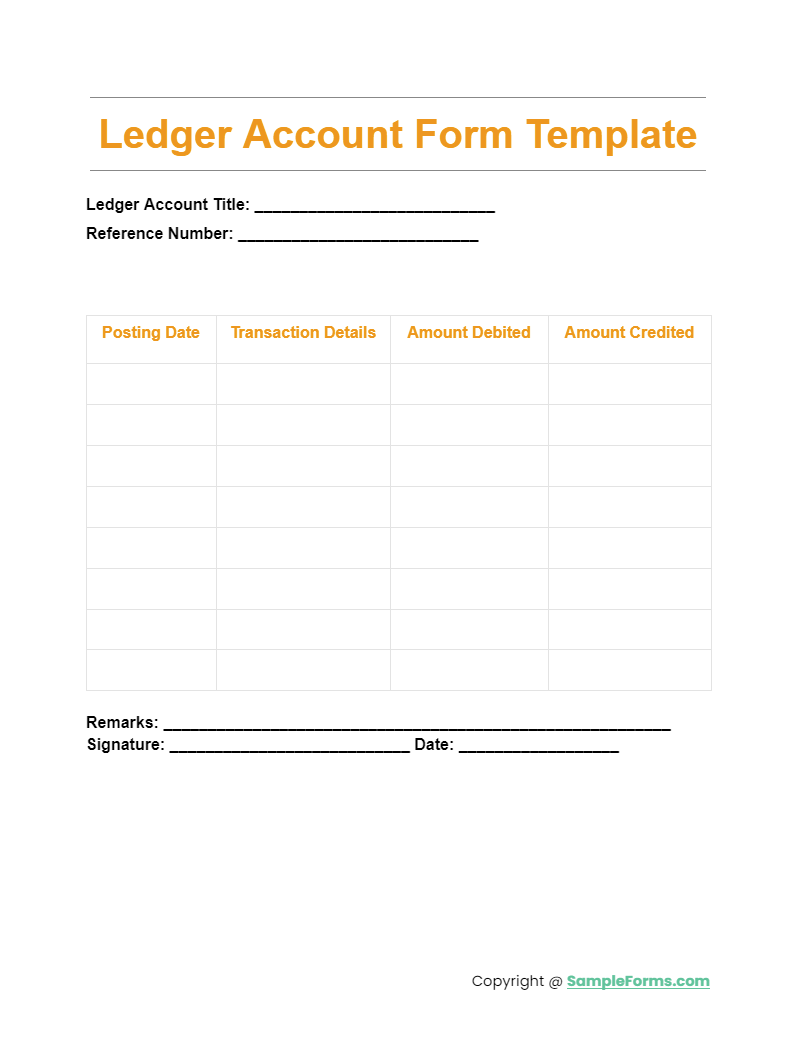

Ledger Account Form Template

Streamline your accounting with our customizable Ledger Account Form Template. Perfectly designed to accommodate any Account Code Request Form, it sets the standard for meticulous financial management. You may also see Rent Invoice Form

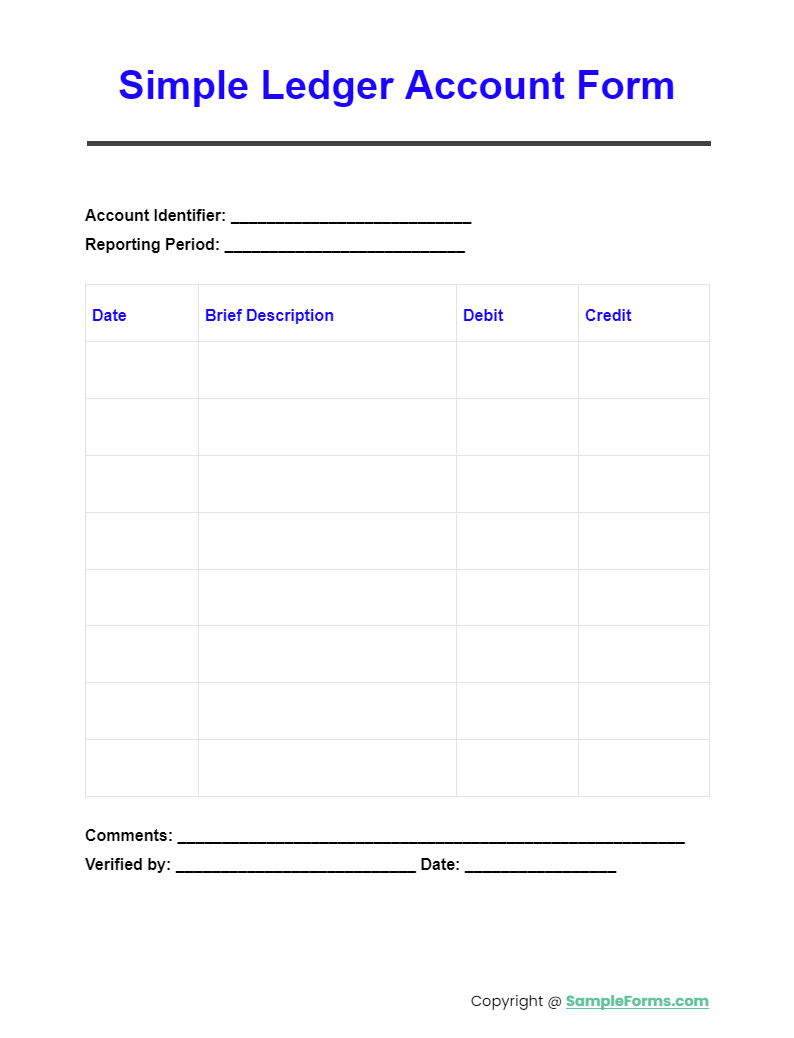

Simple Ledger Account Form

Embrace simplicity with our Simple Ledger Account Form, designed for straightforward financial transactions. It’s an essential tool for managing Account Report Form submissions, catering to businesses of all sizes. You may also see Plumbing Invoice Form

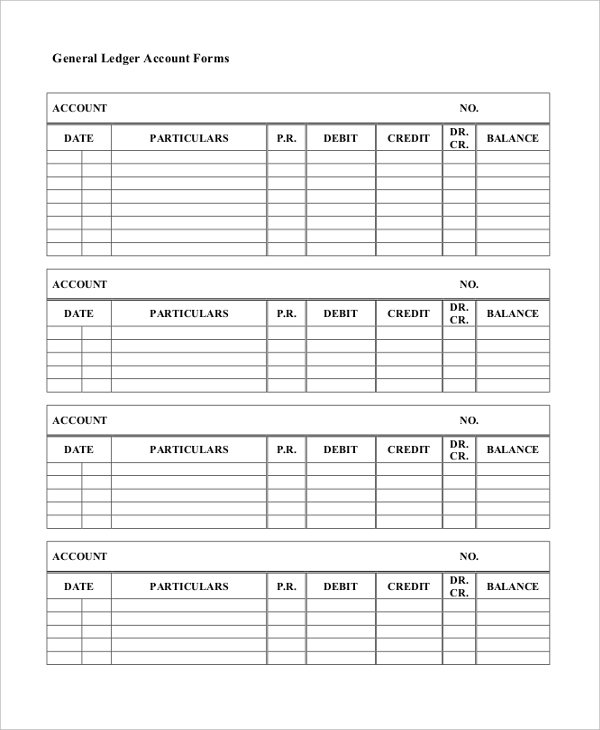

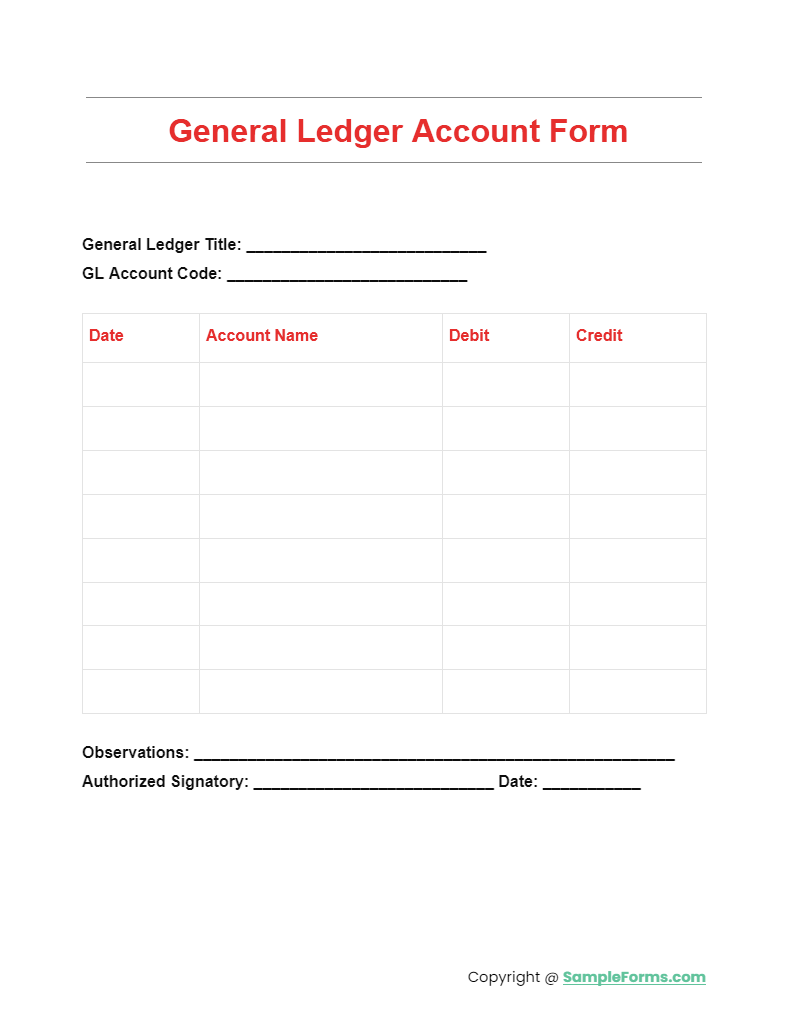

General Ledger Account Form

More Ledger Account Form Samples

Blank Ledger Account Form

This blank ledger account form presents the account number, date of the transaction, particulars of the transaction, post reference, debit, credit, and balance. One can take a printout of this ledger and use them easily. You may also see Voluntary Statement Form

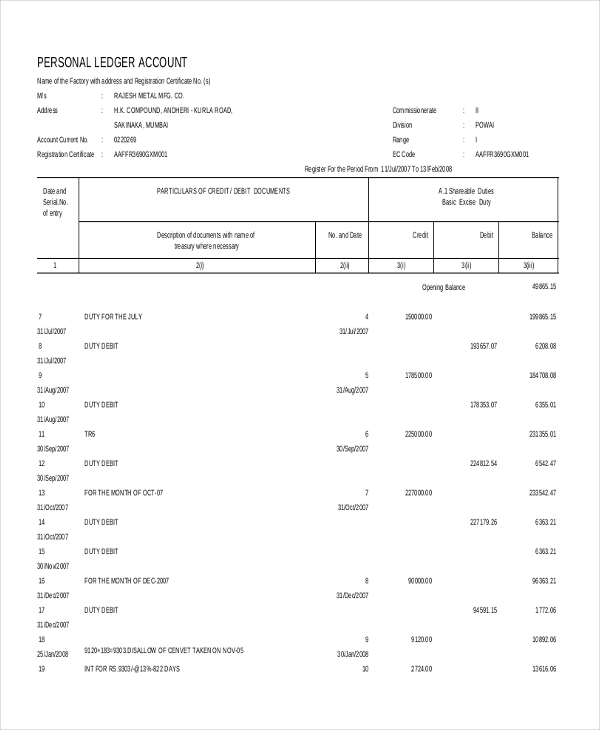

Personal Ledger Account Form

This personal ledger account form presents the company name, address, current account number, and registration number. It provides the list of ledger entries like date and serial number, particulars of debit or credit transactions, transaction number and date, debit or credit amount and balance amount. You may also see Property Statement Form

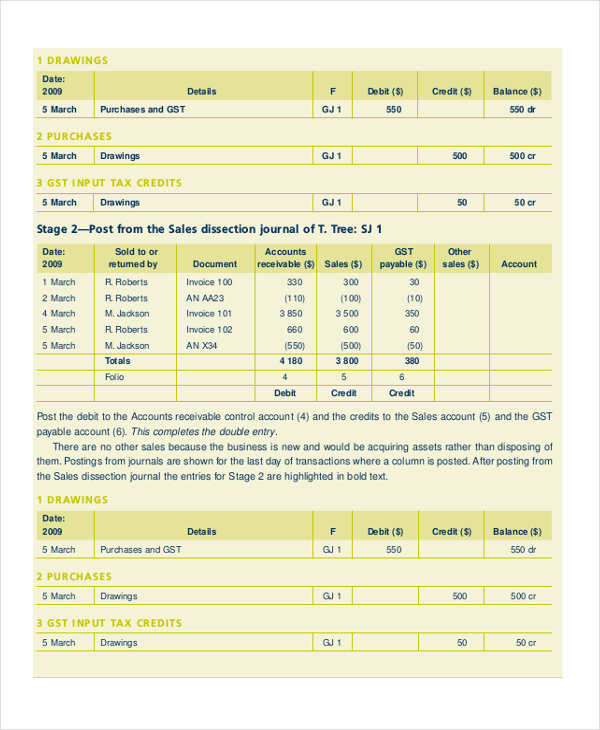

General Ledger Account Form

This general ledger account form presents the details of drawings, purchases, GST input tax credits and sales transaction details. It also presents the account receivable details like drawings, purchases, debit, credit and balance details. It also presents post from purchase journal, cash payments, and cash receipts journals. You may also see Student Statement Form

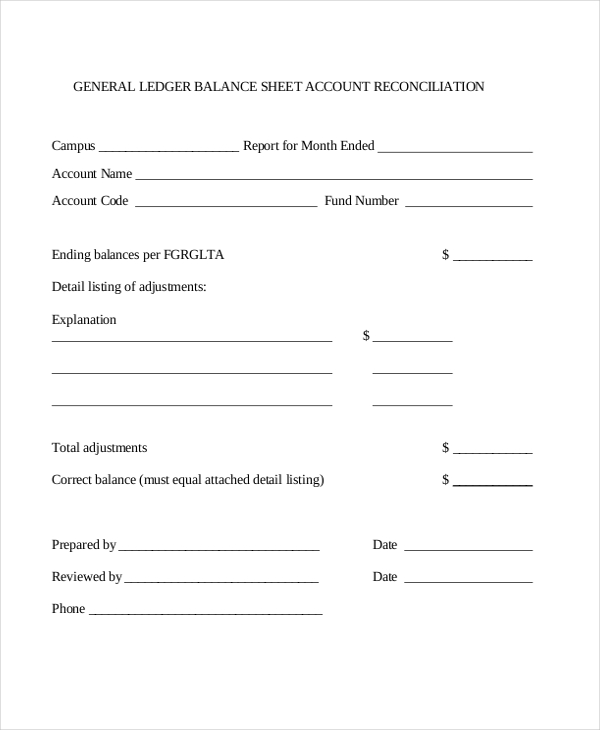

General Ledger Balance Sheet Accounting Reconciliation Form

This general ledger balance sheet account reconciliation form presents the campus name, the month of the report, account name, account code, fund number, ending balances, detailed listing of adjustments along with explanation and amount. You may also see Real Estate Statement Form

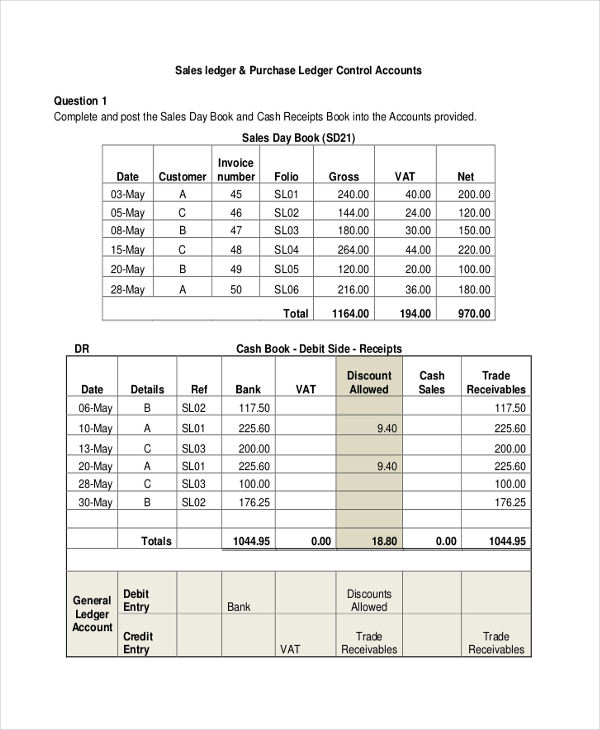

Sales Ledger Account Form

This sales ledger accounting form presents various questions on the sales day book, cash book, general ledger, sales ledger, purchase day book, purchase returns book, cash payments book and purchase ledger. Operating Statement Form

How to Fill Out a Ledger?

- Identify Transactions: Start by gathering all transaction details, similar to compiling a Request Accounting Form.

- Choose the Correct Ledger: Select the appropriate ledger account form based on the nature of the transaction.

- Record Dates: Enter the date of each transaction in the ledger, as you would in a Health Record Form.

- Detail Transactions: For each entry, describe the transaction, akin to filling out a Medical Record Request Form.

- Debit or Credit: Decide if the transaction is a debit or a credit, similar to categorizing in a Dental Record Release Form.

- Calculate Totals: After entries, calculate the total debits and credits, ensuring they balance like in a Medical Record Release Form.

What to Include in Ledger Account Form?

Ledger account form contains all the details and information about various accounting transactions that took place for any business. They include information about the transaction; cash or bank, the transaction date, purpose and narration of the transaction, whether the transaction is debited or credited to the account, the account balance. They include the above information for each ledger type like asset, expense, liability, etc. They also include transactions belongs to cash book, day book, purchases, sales as well as returns from purchases. They also contain a posting reference for each transaction. You may also see Wealth Statement Form

What are The Benefits of Ledger Account Form?

Some of the benefits of ledger account form are –

- They help in preparing trial balance by providing accounting details with high accuracy

- They enable to prepare final accounts and helps in preparing profit and loss account as well as balance sheet

- They help to post transactions to different ledger accounts easily using double entry system

- They enable to know the status of each account quickly

- They provide statistical information about accounts. You may also see Invoice Form

- They provide details of each transaction including narration and transaction date

- They help to build financial statements like balance sheet, profit, and loss, etc.

- They enable to sort various accounts into respective ledgers. You may also see Vehicle Invoice Form

There are enormous varieties of ledger account forms available on the internet and one can download the suitable one according to their accounting needs. They come in printer friendly formats like word or PDF documents and are easy to customize as well. These forms are highly dependable and valuable for any business firm to perform accounting process. You may also see Contingent Statement Explanation

Is Cash Book a Ledger?

Yes, a cash book is a type of ledger that specifically records all transactions involving cash inflows and outflows, acting similarly to a Personal Statement Form in tracking personal financial events.

Does a General Ledger Have to Balance?

Absolutely, a general ledger must balance, with the total debit balances equaling total credit balances, ensuring accuracy akin to a Financial Statement Form, which summarizes financial activities comprehensively.

What is the Most Commonly Used Ledger Account?

The most commonly used ledger account is the Sales Ledger, crucial for tracking sales transactions and closely related to maintaining a Witness Statement Form for transparency and verification purposes.

How Long Can Money Stay in Ledger Balance?

Money can stay in a ledger balance indefinitely as it represents the current balance of an account, similar to the ongoing tracking found in a Landlord Statement Form for rental transactions.

What Does a Ledger Look Like?

A ledger looks like a table with columns for dates, descriptions, debits, credits, and balances, organized in a manner similar to a Invoice Request Form, which itemizes personal assets and liabilities.

Can I Transfer Money from Ledger to Bank Account?

Transferring money directly from a ledger to a bank account isn’t typically possible since a ledger is a record-keeping tool, not an account from which funds can be transferred like in a Financial Statement Form.

What is the Average Ledger Balance?

The average ledger balance is calculated by summing the daily ledger balances within a period and dividing by the number of days, akin to determining average expenses in a Personal Financial Statement.

Related Posts

-

FREE 8+ Change Accounting Forms in PDF

-

What are Accounting Forms? [ Purpose, How to Create, Includes, Importance ]

-

Check Register Form

-

Investment Trading Journal Form

-

FREE 4+ Campaign Finance Forms in PDF

-

FREE 5+ Handyman Business Estimate Forms in MS Word | PDF

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 4+ Payroll Reallocation Forms in PDF | Excel

-

FREE 5+ Landscaping Business Estimate Forms in MS Word | PDF

-

FREE 6+ Contribution Margin Forms in Excel

-

General Journal Form

-

FREE 5+ Gross Profit Margin Forms in Excel

-

Balance Sheet Form

-

Cash Receipt Journal Form

-

FREE 5+ Petty Cash Register Samples in Excel | PDF