An Accounts Receivable Ledger Form serves as a critical tool for businesses to track customer payments, outstanding invoices, and payment histories. Acting as a detailed record, it provides clarity on financial transactions, enabling organizations to maintain accurate and transparent accounts. This guide explores the purpose, structure, and examples of an effective ledger, showcasing how businesses can leverage this form for streamlined financial management. Whether you’re new to financial documentation or seeking ways to optimize your accounting processes, this resource offers insights and practical tips for maintaining a precise Ledger Account Form.

Download Accounts Receivable Ledger Form Bundle

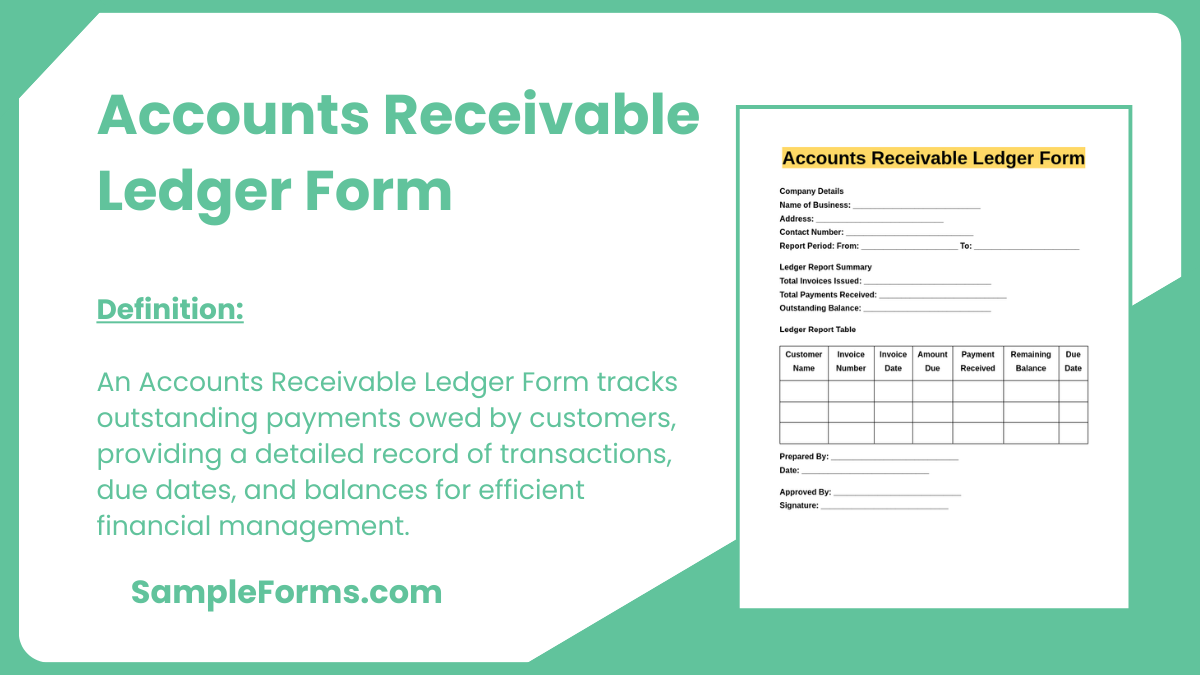

What is Accounts Receivable Ledger Form?

An Accounts Receivable Ledger Form is a document that tracks customer transactions, including invoices, payments, and outstanding balances. It organizes financial data, ensuring accuracy in account management and simplifying reconciliation. This form helps businesses monitor cash flow, identify overdue payments, and maintain financial transparency. By providing a comprehensive overview of receivables, it supports effective decision-making and accounting compliance.

Accounts Receivable Ledger Format

Customer Name: _____________________________

Customer ID: _____________________________

Invoice Number: _____________________________

Invoice Date: _____________________________

Due Date: _____________________________

Amount Owed: _____________________________

Payment Details:

Date of Payment: _____________________________

Amount Paid: _____________________________

Payment Method: _____________________________

Balance Remaining:

- Provide updated balance after payment deduction.

Notes:

- Include remarks about payment status, disputes, or special conditions.

Authorized By: _____________________________

Date: _____________________________

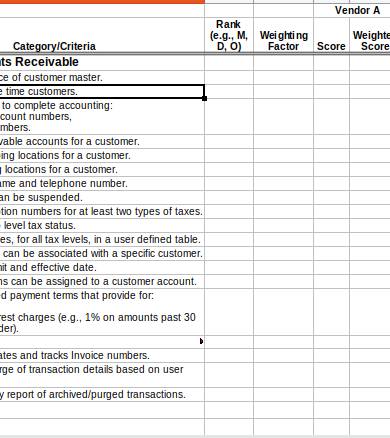

Accounts Receivable Sales Ledger Form

An Accounts Receivable Sales Ledger Form is essential for tracking customer transactions, recording sales invoices, and monitoring payments. Similar to an Account Report Form, it provides detailed insights into outstanding balances and ensures financial accuracy.

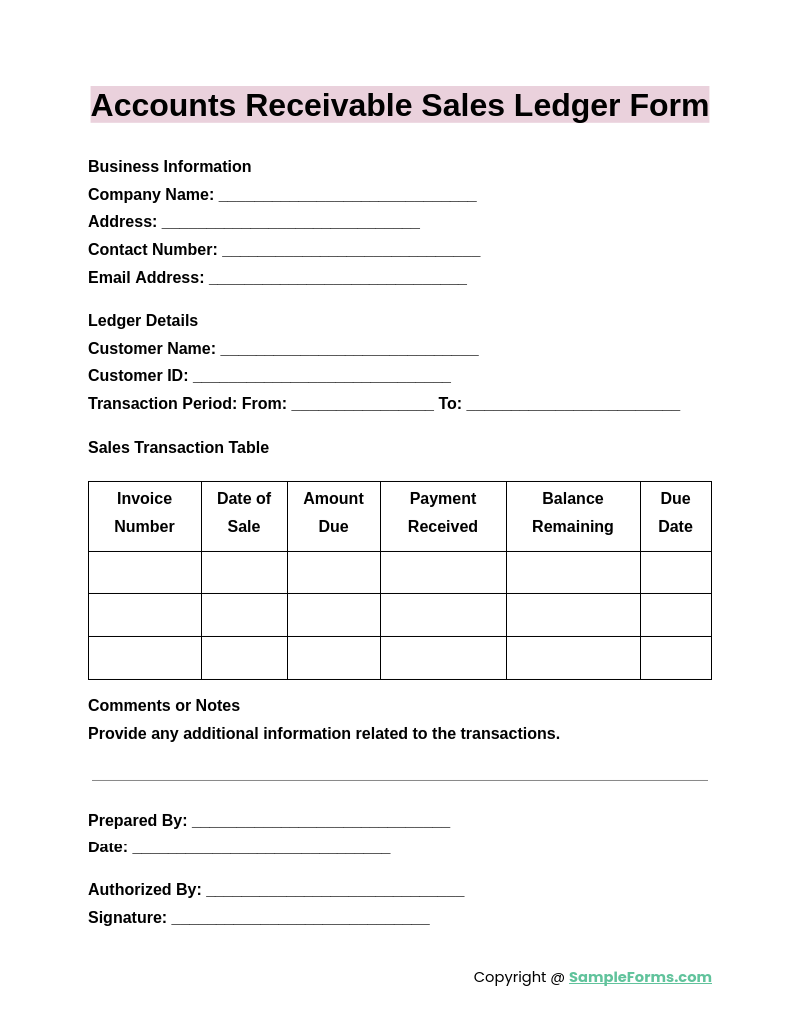

Accounts Payable Receivable Ledger Form

The Accounts Payable Receivable Ledger Form consolidates accounts payable and receivable data, enabling businesses to track incoming and outgoing payments efficiently. Like an Accounting Form, it maintains balance between obligations and receivables for smooth financial operations.

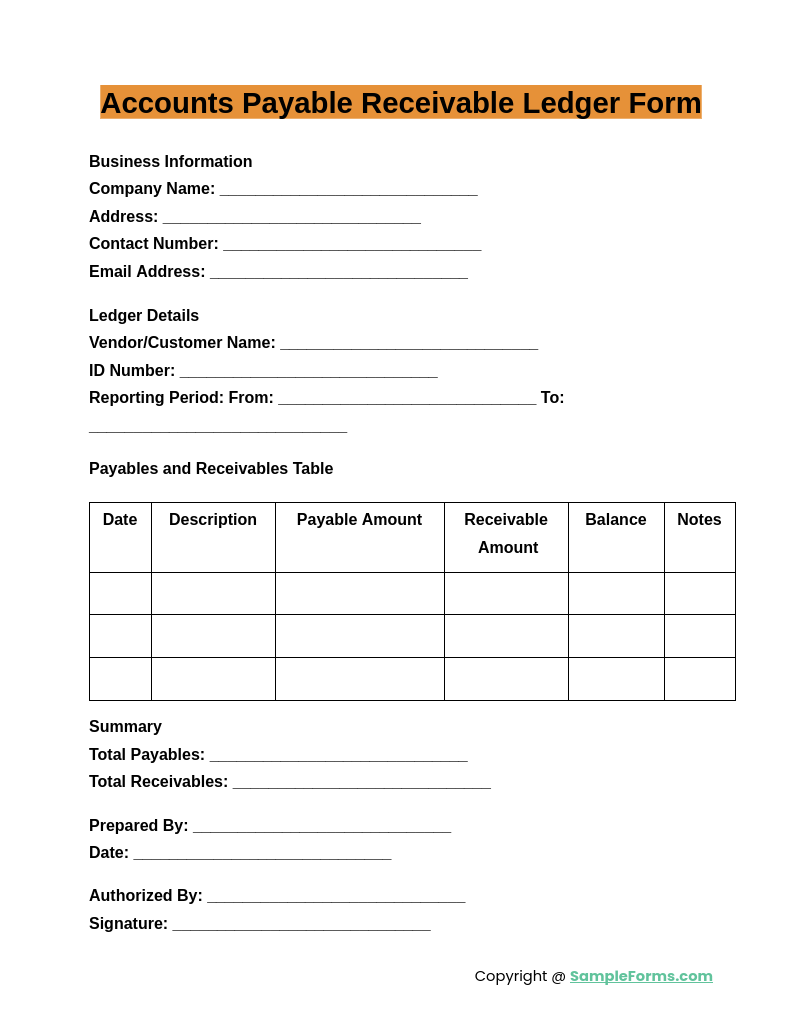

Accounts Receivable Reconciliation Ledger Form

An Accounts Receivable Reconciliation Ledger Form is used to compare and verify records between general ledgers and sub-ledgers. Much like an Application Accounting Form, it ensures discrepancies are addressed promptly and financial records are consistent.

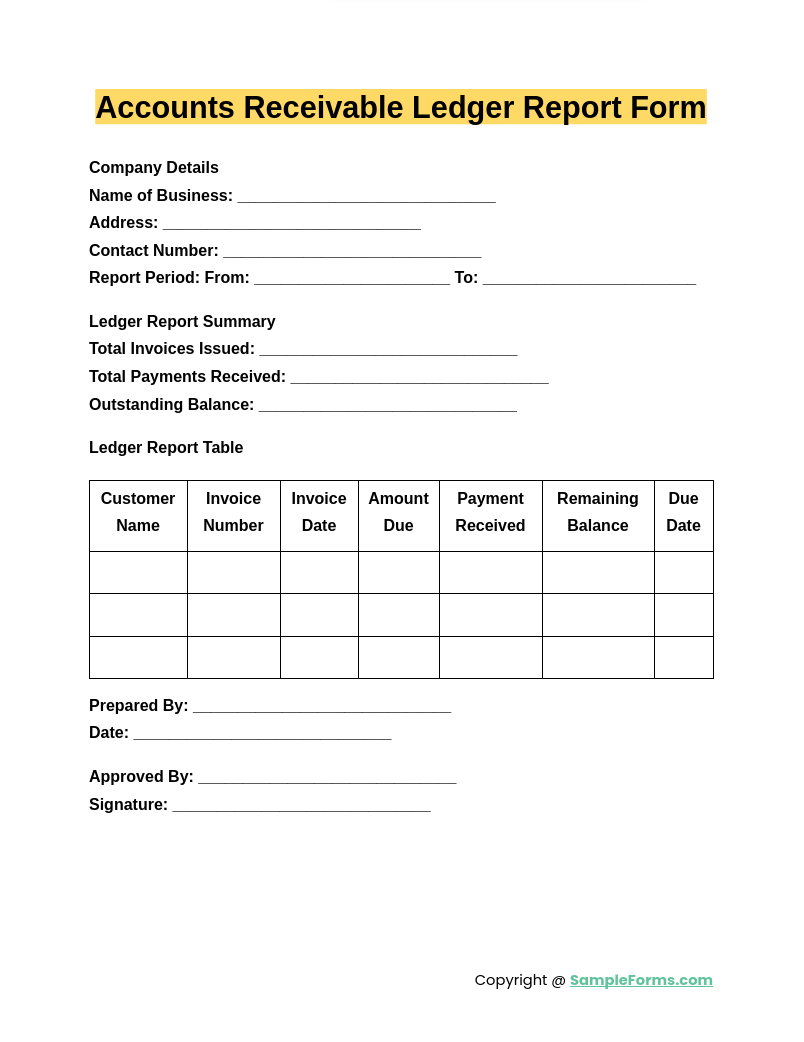

Accounts Receivable Ledger Report Form

The Accounts Receivable Ledger Report Form summarizes all outstanding customer balances and payments, helping businesses evaluate financial health. Similar to an Account Code Request Form, it provides precise details for decision-making and enhances accounting transparency.

Browse More Accounts Receivable Ledger Forms

1. Sample Accounts Receivable Ledger Form Template

2. Accounts Receivable Ledger Form Sample Template

3. Ledger Template for Accounts Receivable Form

4. Monthly Accounts Receivable Ledger Form Template

5. Accounts Receivable Ledger Form Template

How to make an account receivable ledger?

Creating an accounts receivable ledger involves organizing customer transactions systematically to track outstanding invoices and payments.

- Set Up Customer Accounts: Include details like name, address, and contact information.

- Record Transactions: Log invoices, payments, and outstanding balances accurately.

- Use Appropriate Columns: Include invoice number, date, and payment status.

- Maintain Regular Updates: Ensure the ledger reflects current balances.

- Utilize Tools: Leverage software or an Accounts Payable Form for efficient tracking.

How do you record accounts receivable in a ledger?

Recording accounts receivable requires tracking sales on credit and payments received, ensuring accurate financial records and cash flow management.

- Identify Credit Sales: Note the details of invoices issued.

- Enter in Debit Column: Record the amount in the accounts receivable section.

- Update Payments: Credit payments received to the account.

- Balance the Ledger: Ensure totals are accurate.

- Cross-Verify Records: Match with an Accounting Request Form for consistency.

What does account receivable ledger do?

An accounts receivable ledger tracks customer transactions, providing a detailed view of outstanding balances, payments, and credit sales for financial clarity.

- Organizes Data: Categorizes invoices, payments, and customer details.

- Monitors Balances: Tracks overdue payments and credit limits.

- Facilitates Audits: Simplifies financial reviews and reconciliations.

- Enhances Decision-Making: Informs strategies based on payment trends.

- Supports Compliance: Aligns with regulations using an Accounting Registration Form.

How do you record ledger account receivables?

Recording ledger account receivables involves documenting credit sales and payments systematically for accurate financial tracking.

- Create a Ledger Entry: Open an entry for each customer.

- Log Transactions: Record sales invoices under debit.

- Document Payments: Credit payments against respective invoices.

- Track Adjustments: Note discounts or write-offs.

- Use Templates: Simplify the process with a Request Accounting Form.

What are the golden rules of accounting?

The golden rules of accounting ensure accurate financial entries based on the nature of accounts involved.

- Debit What Comes In: Applicable to real accounts for tracking assets.

- Credit What Goes Out: Ensures outgoing transactions are recorded.

- Debit the Receiver: Tracks personal accounts.

- Credit the Giver: Ensures liabilities are acknowledged.

- Maintain Consistency: Align entries with a Ledger Account Form for reliability.

What are two methods of recording accounts receivable?

The two methods are the accrual method, recording revenue when earned, and the cash method, recognizing revenue when received, similar to a Vendor Ledger for detailed tracking.

What is the double entry for accounts receivable?

The double entry involves debiting accounts receivable and crediting sales, ensuring financial accuracy as seen in a Financial Statement Form for balance verification.

Is a receivables ledger a debit or credit?

A receivables ledger is primarily a debit as it records amounts owed to the business, aligning with details in a Financial Report Form.

What falls under accounts receivable?

Accounts receivable includes credit sales, outstanding invoices, and payments owed by customers, similar to details in an Affidavit of Financial Support Form.

Why are bad debts debited?

Bad debts are debited to record the expense of uncollectible receivables, impacting the company’s profit, as outlined in a Financial Questionnaire Form.

What is a ledger template?

A ledger template is a predefined format for organizing financial transactions, ensuring systematic record-keeping, much like a Financial Affidavit Form.

What is the best way to manage accounts receivable?

Timely invoicing, regular follow-ups, and accurate reconciliation are effective ways to manage receivables, similar to evaluations in a Financial Evaluation Form.

What is the treatment of accounts receivable?

Accounts receivable is recorded as a current asset and monitored for payments or write-offs, akin to entries in a Financial Assessment Form.

What is the journal entry for account receivable?

The entry involves debiting accounts receivable and crediting revenue, ensuring accurate financial reporting, as required in a Financial Assistance Form.

What is the second name for accounts receivable?

Accounts receivable is also referred to as “trade receivables,” highlighting customer debts, much like terms used in a Financial Contract Form.

The Accounts Receivable Ledger Form is an essential accounting tool for managing and tracking customer transactions. Its structured format ensures precise financial documentation, aiding in timely payments and effective cash flow management. With examples and templates, this guide highlights the practical applications of the form, emphasizing its role in maintaining transparency and accuracy. Whether you’re a small business or a large enterprise, incorporating this tool can streamline financial operations and improve overall efficiency. Use this guide to implement a reliable ledger system tailored to your needs.

Related Posts

-

General Journal Form

-

FREE 5+ Gross Profit Margin Forms in Excel

-

Balance Sheet Form

-

FREE 5+ Petty Cash Register Samples in Excel | PDF

-

Cash Receipt Journal Form

-

Credit Debit Form

-

FREE 4+ Financial Audit Forms in PDF

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

Daily Cash Log

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF