A Financial Report Form is an essential tool used by businesses to communicate their financial performance over a specified period. This form compiles critical financial data, offering insights into revenue, expenses, profitability, and cash flow. By using structured Report Form and Financial Form templates, companies can ensure consistency and accuracy in reporting. This guide will provide you with detailed examples and step-by-step instructions to master the art of financial reporting. Whether you’re a small business owner, a corporate accountant, or a financial analyst, understanding how to craft a comprehensive Financial Report Form is crucial for tracking financial health and making informed decisions.

Download Financial Report Form Bundle

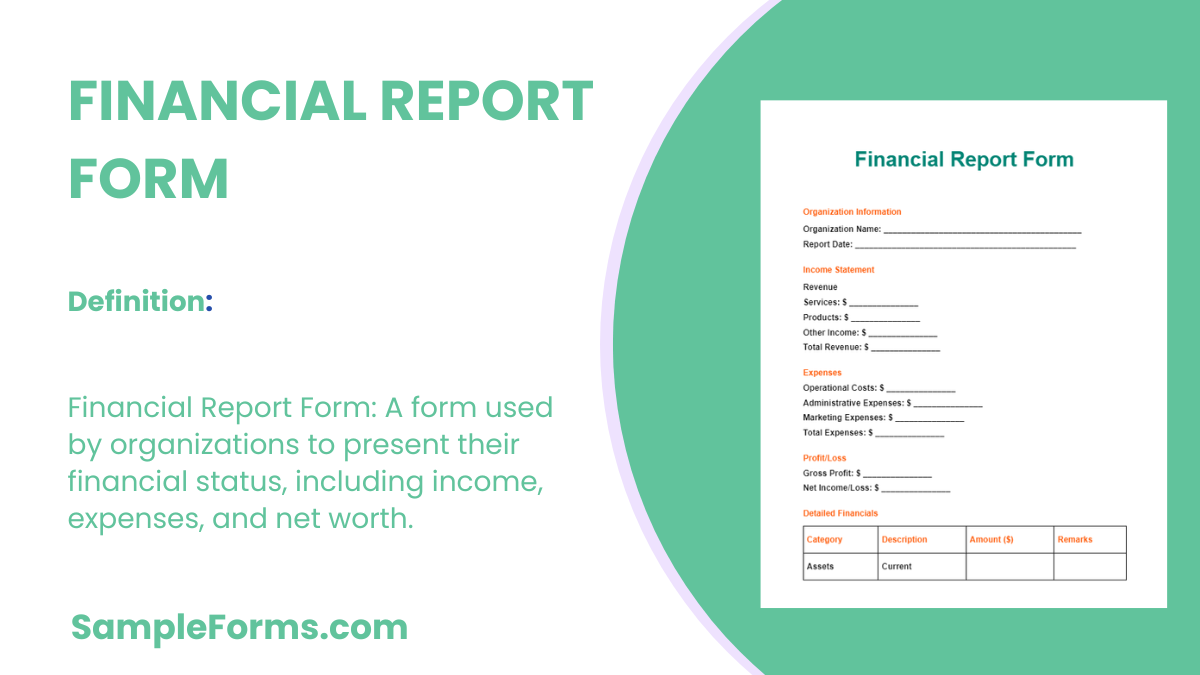

What is a Financial Report Form?

A Financial Report Form is a structured document that businesses use to present their financial status comprehensively. This form typically includes the balance sheet, income statement, and cash flow statement. It serves to provide stakeholders, such as investors, creditors, and management, with crucial information regarding the company’s financial outcomes, asset management, and profitability. Simplifying complex financial data into an understandable format allows for better transparency and aids in strategic decision-making. These forms are pivotal in maintaining accurate financial records and ensuring regulatory compliance.

Financial Report Format

1. Executive Summary

- Overview of Financial Performance

- Key Financial Highlights

2. Balance Sheet

- Assets

- Liabilities

- Equity

3. Income Statement

- Revenue

- Expenses

- Net Income

4. Cash Flow Statement

- Operating Activities

- Investing Activities

- Financing Activities

5. Financial Analysis

- Liquidity Ratios

- Profitability Ratios

- Debt Ratios

6. Notes to the Financial Statements

- Accounting Policies

- Commitments and Contingencies

7. Auditor’s Report

- Independent Auditor’s Opinion

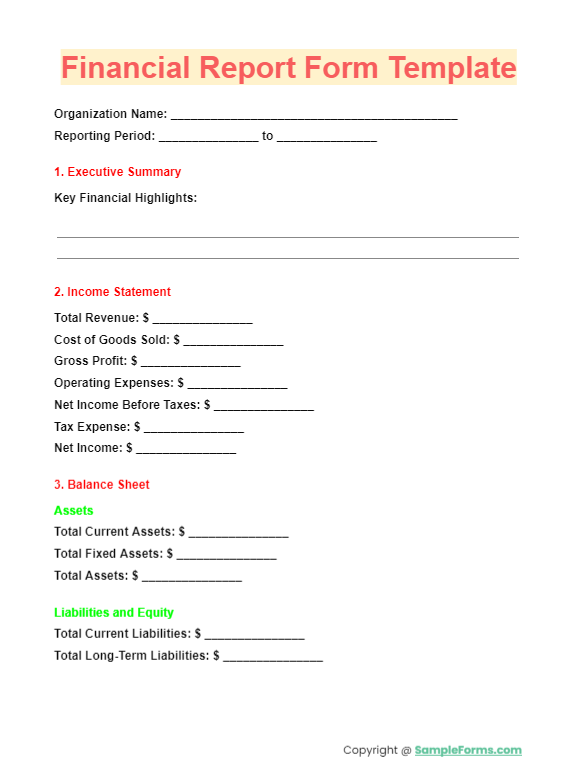

Financial Report Form Template

Utilize our customizable Financial Report Form Template to streamline financial data presentation. Integrate sections from the Affidavit of Financial Support Form to assure compliance and support claims of financial stability.

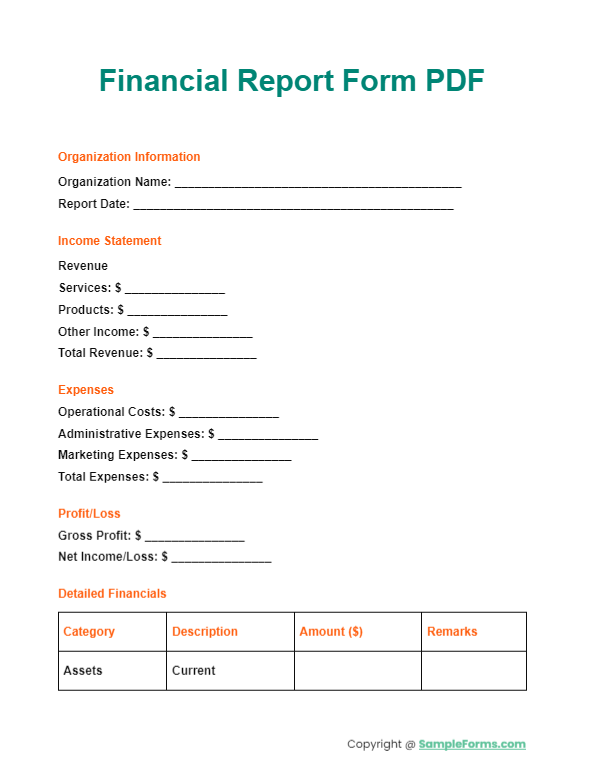

Financial Report Form PDF

Download our ready-to-use Financial Report Form PDF for a quick, reliable method of reporting your financial status. Incorporate elements similar to a Financial Questionnaire Form to enhance data collection and accuracy.

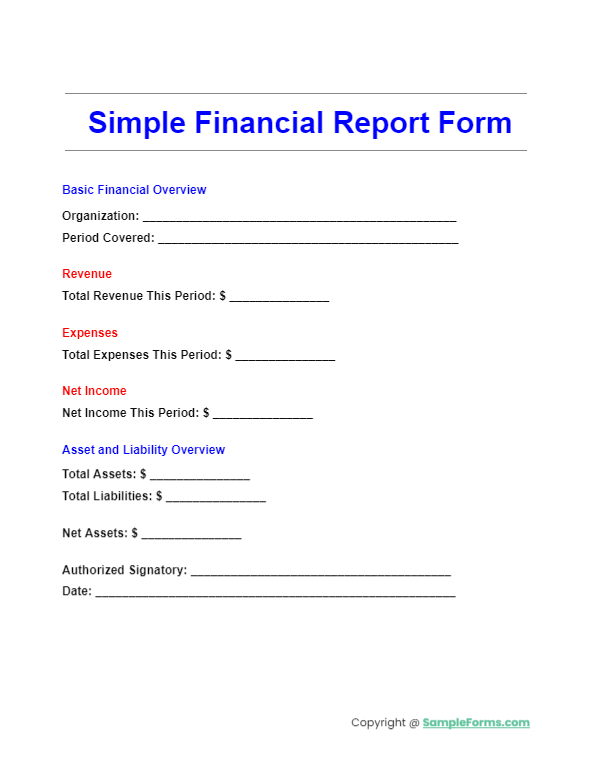

Simple Financial Report Form

Our Simple Financial Report Form offers an easy way to report basic financials without complexity. Adapt the straightforward layout from the Financial Affidavit Form to ensure all necessary financial details are captured and certified.

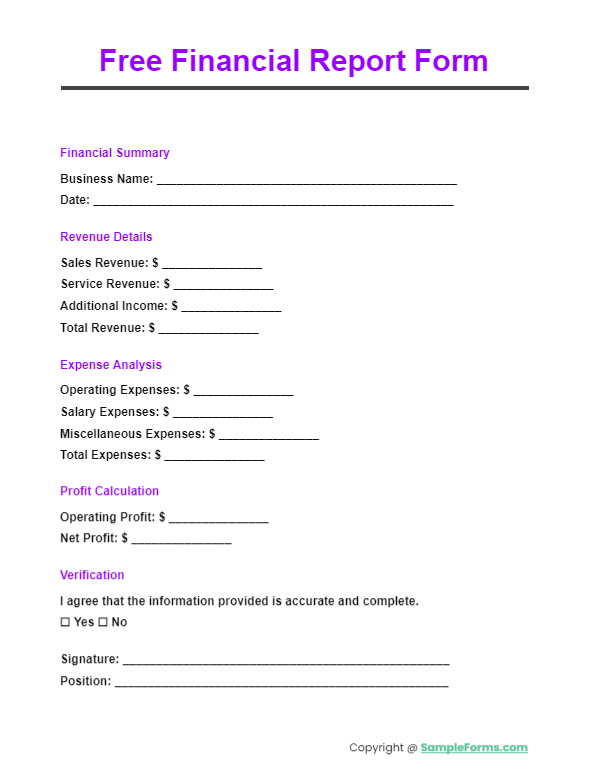

Free Financial Report Form

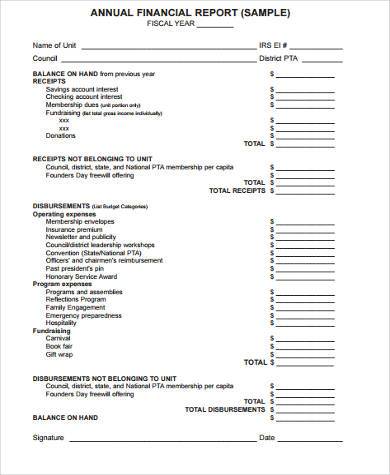

Annual Financial Report Form

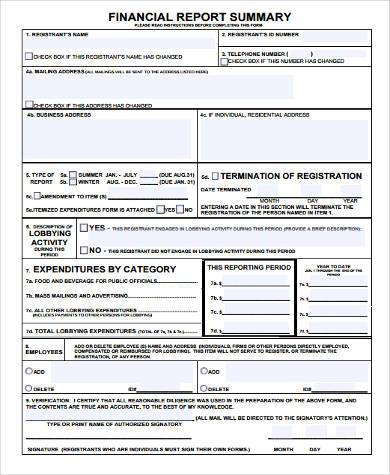

Financial Report Summary Form

Financial Report Form in PDF

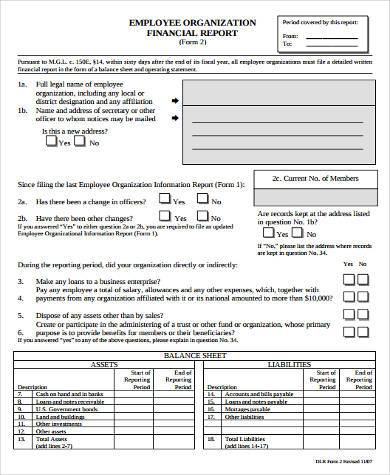

Employee Organization Financial Report Form

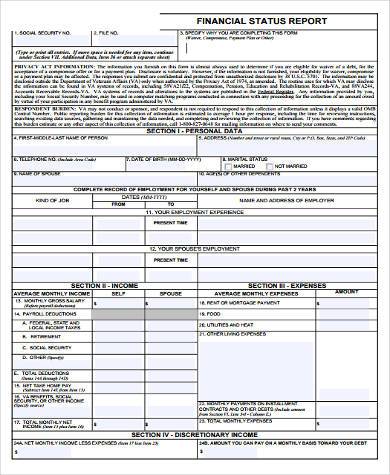

Financial Status Report Form

Financial Report Form Example

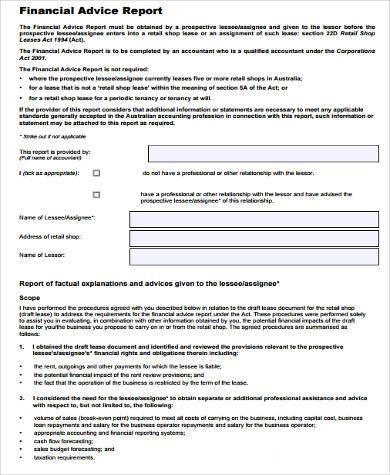

Financial Advice Report Form

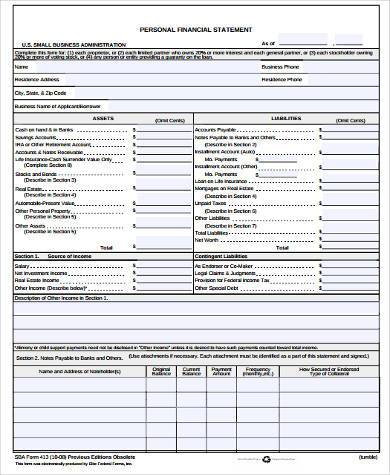

Personal Financial Statement Form

Financial Report Form in Word Format

How to create a financial report?

Creating a financial report involves collecting, analyzing, and presenting financial data clearly.

- Gather Financial Data: Compile all relevant financial information using a Financial Statement Form.

- Categorize Data: Organize data into categories like revenue, expenses, assets, and liabilities.

- Analyze Trends: Identify trends over the reporting period to provide context and insight.

- Summarize Findings: Provide a summary of financial health and performance.

- Review and Revise: Ensure accuracy by reviewing and revising the report before finalization. You may also see Financial Information Release Form

What should a financial report include?

A comprehensive financial report provides a detailed view of an entity’s financial health.

- Balance Sheet: Display assets, liabilities, and owner’s equity through a Financial Agreement Form.

- Income Statement: Summarize revenues, costs, and expenses to show profit or loss.

- Cash Flow Statement: Track the flow of cash in and out of the business.

- Equity Statement: Report changes in equity throughout the reporting period.

- Notes to Financial Statements: Include explanatory notes detailing accounting policies and methodologies. You may also see Financial Evaluation Form

How to make a simple financial report?

A simple financial report focuses on the essentials of financial tracking.

- List Income Sources: Use a straightforward Personal Financial Statement to track all income.

- Document Expenses: Record all operational expenses clearly.

- Net Income Calculation: Subtract expenses from income to calculate net income.

- Highlight Cash Positions: Summarize cash holdings and bank balances.

- Provide a Summary: Offer a concise financial summary to stakeholders. You may also see Financial Waiver Form

What are the three types of financial reports?

Three fundamental financial reports provide insights into a business’s financial status.

- Income Statement: A key report found in any Financial Contract Form, showing profitability.

- Balance Sheet: Reflects the company’s assets, liabilities, and equity at a specific point.

- Cash Flow Statement: Details the cash inflows and outflows, as critical as any Financial Assistance Form.

What are the five basic financial reports?

Five basic financial reports are crucial for comprehensive financial analysis.

- Balance Sheet: Offers a snapshot of financial standing.

- Income Statement: Provides profitability and operational results.

- Cash Flow Statement: Shows liquidity and cash management.

- Statement of Retained Earnings: Tracks changes in earnings.

- Equity Statement: Details movements in shareholder’s equity. You may also see Joining Report Form

What are the 4 main financial accounting reports?

The four main financial accounting reports document a company’s financial trajectory and status.

- Balance Sheet: Integral for any Financial Disclosure Form, showing real-time financial condition.

- Income Statement: Measures financial performance over a period.

- Cash Flow Statement: Vital for understanding cash flow activities.

- Statement of Changes in Equity: Records changes in equity throughout the fiscal period. You may also see Medical Report Form

What are the 4 general purpose financial reports?

General purpose financial reports address the broad needs of diverse stakeholders.

- Balance Sheet: A crucial snapshot of financial status.

- Income Statement: Essential for evaluating profitability and operational success.

- Cash Flow Statement: Critical for liquidity assessment.

- Notes to Financial Statements: Provides essential clarifications and additional information, as comprehensive as a Financial Aid Form.

General Types of Financial Reports

- Report of Financial Position: Also known as the Balance Sheet, this report or statement presents the financial status of a business or organization at a given time. Assets, Liabilities, and Equity comprise this report. You may also see Student Progress Report Form

- Income Report: This report is also called the Profit and Loss Statement, which shows a company’s net profit or loss during a specified period. The elements that comprise this statement are Income and Expense. You may also see Internship Report Form

- Cash Flow Report: The Cash Flow Statement indicates the movement of cash and bank balances that companies acquire over a period of time. It is divided into Operating Activities, Investing Activities, and Financing Activities. This is where financial Incident Report Form come in handy in case of emergencies. You may also see Visit Report Form

- Report of Changes in Equity: Also called the Statement of Returned Earnings, it details a business owner’s equity over a specified time. Its components are Net Profit or Loss, Share Capital Issued or Repaid, Dividend Payments, as well as gains or losses in direct relation to equity, effects of a change in accounting policy, or correction of an accounting error. You may also see Audit Report Form

Necessities of Financial Reports

- For business owners and managers: For business owners and managers, the need to be always updated with the firm’s financial condition is imperative. Financial reports such as a Business Expense Report Form will help them make decisions in the future. You may also see Financial Report Form

- For investors: Investors commit valuable money to businesses and expect to grow them through financial returns. Hence, investors should always be aware of the financial status of companies for further investments. You may also see School Report Form

- For lenders:Just like investors, lenders allow businesses to borrow money to make profits from interests. But first, the business has to have good financial health in order for the company to return the money borrowed and have good credit standing. You may also see Confidential Report Form

- For employees: Aside from the management, employees also need to have an idea of the financial status of the company they are working for. They need to be assured that the business is making profits and not losing funds. You may also see Service Report Form

- For Suppliers: Suppliers would want to know the financial condition of the company or business they are supplying products or services to. In this way, they are certain that their clients will be able to pay the supplies they deliver. You may also see Testimonial Report

How to format a financial report?

To format a financial report, structure it for clarity and comprehensiveness, incorporating elements from the Financial Responsibility Form to ensure accountability and thoroughness.

What is form 10 k used for?

Form 10-K is a comprehensive annual report filed by publicly traded companies, detailing financial performance and required by the SEC, similar to a Financial Audit Form.

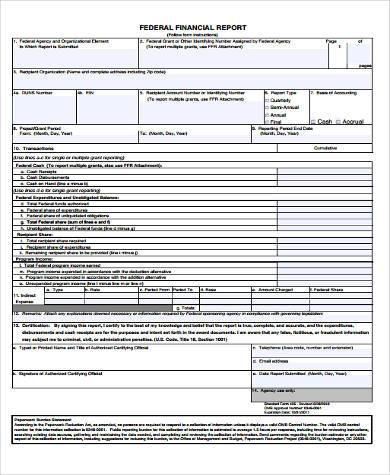

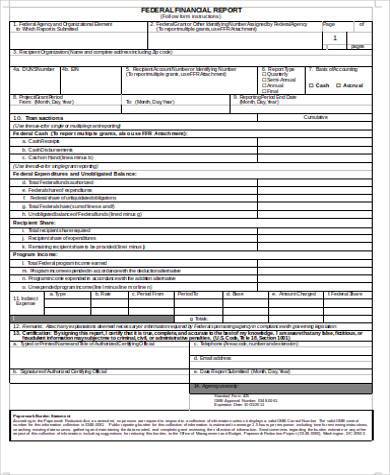

What is a SF 425 report?

The SF 425, or Federal Financial Report, is a standardized form used to track grant usage and financial accountability, similar to the Financial Assessment Form.

How often is SF 425 required?

SF 425 is typically required semi-annually or annually, depending on the grant agreement, to ensure continuous monitoring akin to a Financial Review Form.

Can I prepare my own financial statements?

Yes, you can prepare your own financial statements if you understand accounting principles and maintain accurate records, using a guide like the Financial Planning Form.

What amount of income requires filing?

In the U.S., single filers need to report income over $12,400, which changes annually, a threshold reminiscent of criteria in a Financial Hardship Form.

What happens if a company doesn’t file a 10-K?

If a company fails to file a 10-K, it faces SEC penalties, potential stock delisting, and investor trust issues, necessitating a Financial Consent Form for rectification.

The Financial Report Form is a pivotal document that supports transparency and accountability in business operations. As essential as a Mileage Report Form is for tracking travel expenses, the Financial Report Form provides a snapshot of a company’s financial vitality, influencing strategic planning and operational adjustments. This article has explored various samples, forms, and practical applications, guiding you through creating and utilizing these forms effectively. For anyone involved in business finance, mastering these forms is indispensable for accurate reporting and informed financial management.

Related Posts

-

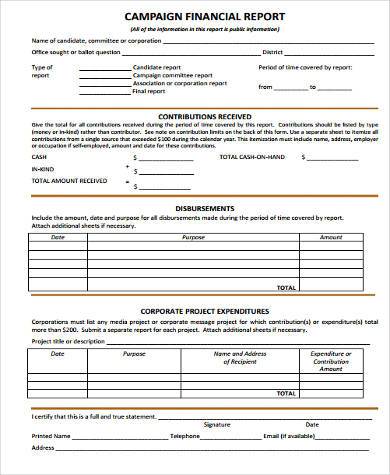

FREE 4+ Campaign Finance Forms in PDF

-

Internal Audit Form

-

FREE 15+ Case Report Forms in PDF | MS Word

-

Referee Report Form

-

Joining Report Form

-

Laboratory Report Form

-

FREE 5+ Sponsorship Report Forms in PDF | MS Word

-

FREE 9+ Final Report Forms in PDF | MS Word | Excel

-

11+ Confidential Report Form

-

FREE 6+ Rent Report Forms in PDF

-

FREE 5+ Mileage Report Forms in MS Word | PDF | Excel

-

FREE 4+ Management Report Forms in PDF | MS Word

-

Petty Cash Log

-

FREE 17 + Disciplinary Report Forms in MS Word | PDF | Google Docs | Apple Pages

-

Damage Report Form