Financial planning is an important part of an earning adult’s life. As independent individuals, we have to be able to live within our means. This means that our income should never exceed our expenses. This allows us to adequately provide for our family and maybe even have extra income to spend on things we enjoy or even start a business. But how are you to know if you are indeed financially stable? How are you to measure exactly how much your net worth is? That is what a Personal Financial Statement is for. It is one of the many Financial Forms used to assess a person’s financial stability to help him make guided decisions regarding his finances.

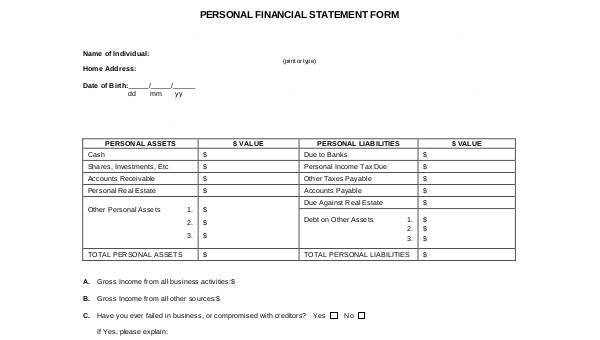

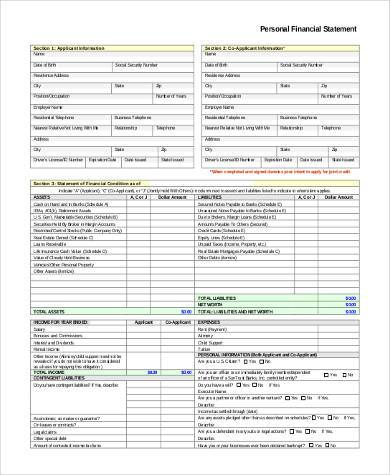

Fillable Personal Financial Statement Form

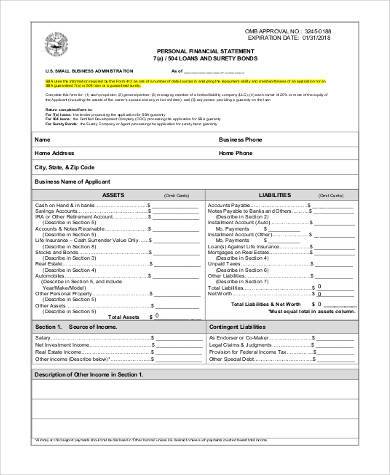

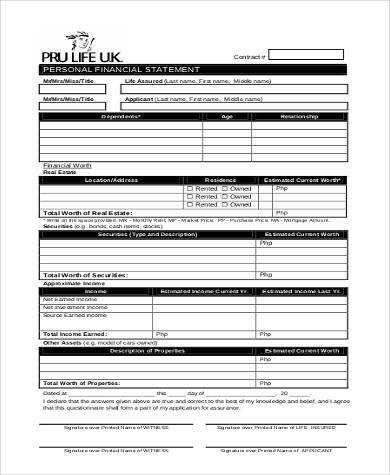

Blank Personal Financial Statement Form

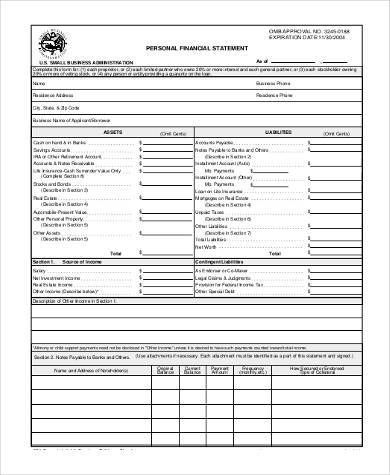

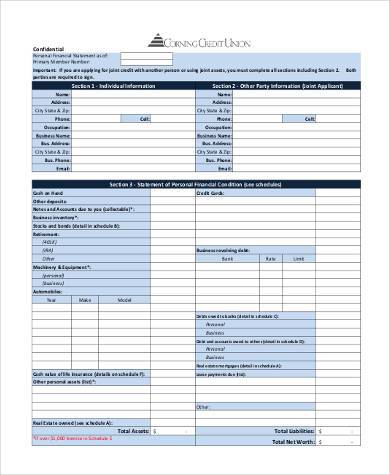

Basic Personal Financial Statement Form

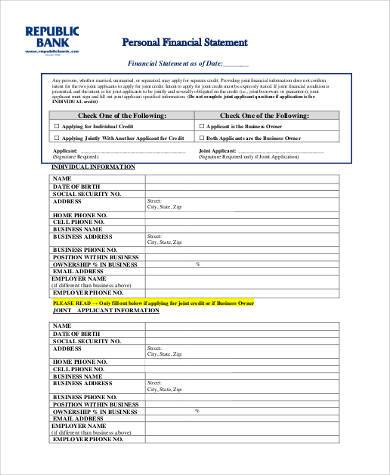

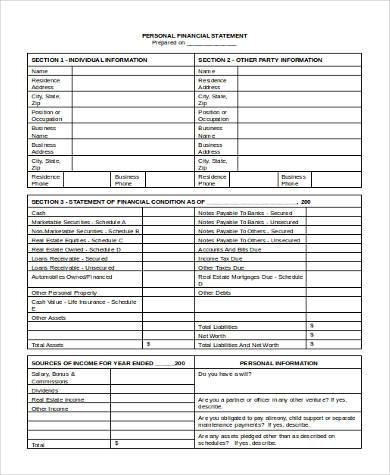

Free Personal Financial Statement Form

Personal Financial Statement Template Excel

Types of Personal Financial Statement Forms

To better understand the types of Personal Financial Statement Forms, we first have to understand what it is. A Personal Financial Statement Form is a document that outlines a person’s financial standing at a given point in time. It lists the person’s assets and liabilities from which his net worth will be calculated.

- Personal Cash Flow Statement: This is a list of all cash inflow and cash outflow to calculate the net cash flow over a given period of time. Cash inflow includes salaries and basically anything that brings in money, while cash outflow represents your expenses, like utilities, gas, and rent. This is important in determining whether you spent more than you earned, or if it was the other way around.

- Personal Balance Sheet: This is an outline of a person’s assets and liabilities, from which a person’s net worth is calculated. The value of your assets, which are the things you own, is subtracted from the total liabilities you have, which are the things you owe, like loan repayments, bills, and credit card balances. If you own large assets like houses, cars, boats, and furniture, it is important to list the market value for those items. That means the amount for which it can be sold now, not the amount you first bought it with.

Personal Financial Statement Form in PDF

Personal Financial Statement Form Example

Personal Financial Statement Form in Word Format

Printable Personal Financial Statement Form

Importance of Personal Financial Statement Forms

A Personal Financial Statement Form can help you gain perspective on your finances before you apply for a loan or mortgage. You can calculate your monthly expenses and income so that you can see if you have room in your budget to pay off your loan or mortgage. If not, you may hold off on applying for a loan or you may assess your monthly expenses to find areas where you can adjust it to make room in your budget for paying off a loan or mortgage. Not only that; this is where creditors base their decisions if you apply for a loan. Your application will be approved or denied based on your financial capacity.

Personal Financial Statement Forms also help you identify your net cash flow and net worth so that you can assess whether or not you need to increase your assets and decrease liabilities. This way, you can learn how to protect your assets, build your business, and maximize your income, profits, and investments. When you know how you spend your money, you can adjust your expenses and plan ways to manage your finances so that you can increase your net worth and achieve higher financial security.

Related Posts

-

FREE 5+ Financial Waiver Forms in MS Word | PDF

-

FREE 6+ Financial Consent Forms in MS Word | PDF

-

What are The Different Forms of Financial Aid? [ Types, Benefits, Purposes ]

-

How to Fill Out Financial Aid Forms? [ Include, Importance, How to, Steps ]

-

FREE 8+ Financial Responsibility Forms in PDF | Ms Word | Excel

-

What are Financial Forms? [ Types, Purposes, Guidelines, Components, Importance ]

-

FREE 8+ Sample Financial Aid Forms in PDF | MS Word

-

FREE 10+ Sample Financial Disclosure Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Financial Information Release Forms in PDF | MS Word

-

FREE 9+ Sample Financial Assistance Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Planning Forms in PDF | MS Word

-

Business Financial Statement Form

-

FREE 9+ Sample Financial Statement Forms in PDF | MS Word | Excel

-

Check Register Form

-

Investment Trading Journal Form