As a business-minded person, you must be mindful not only in the field of marketing and sales but also in overseeing the movement of the company funds. Business-minded people must have this sense of awareness of how the company uses the funds. A business owner must never let a penny slip his eyes, but having an all-seeing inescapable eye can be difficult to emulate every single day. How can you fully know where your funds go? Certain business forms can do the trick. Accounts payable forms, specifically expense reports, will surely be of much help to your dilemma. Create an accounts payable form to help maximize the management and utilization of your company funds!

What Is an Accounts Payable Form?

Accounts payable are purchase orders and expenses made by the company which accountants place under credit. Usually, companies pay their accounts payables within a year since this is the standard duration that specific laws gave.

Accounts payable forms are business documents that help business owners keep track of the list of business expenses or accounts payables that the company incurred. With this, business owners will know how much of the company funds are left and how they can use the balance for company-related reasons.

Keeping track of the expenses, in turn, helps accountants during financial auditing. This function is just one of the many that an accounts payable form can offer. Accounts payable forms also comes in various types, such as expense reports, cash request forms, loan forms, etc.

FREE 6+ Accounts Payable Forms in PDF

As what we have previously mentioned, sample accounts payable forms come in various types and functions aside from the focus of this article, which is keeping record of expenses that the company incurred. Presented below are seven examples of different types of accounts payable forms that we fished from the Internet. Examine each of the samples and look carefully at the elements in the content.

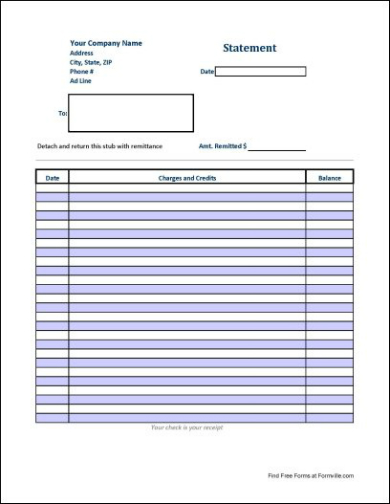

1. Sample Accounts Payable Blank Form

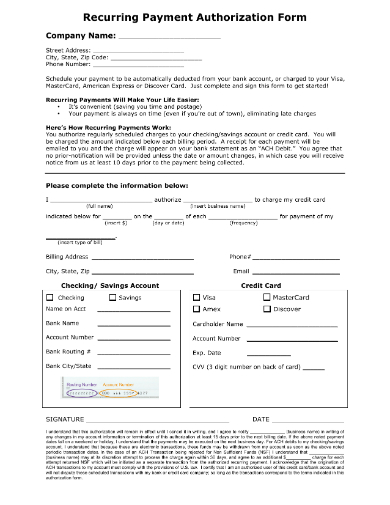

2. Sample Recurring Payment Authorization Form

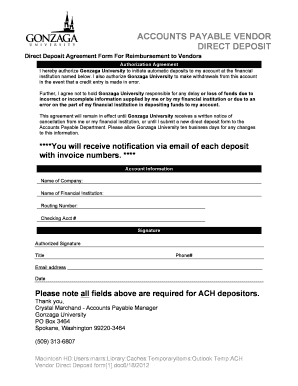

3. Sample Accounts Payable Vendor Direct Deposit Form

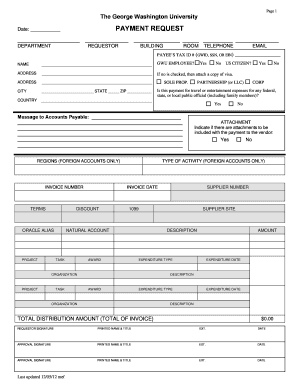

4. Sample University Payment Request Form

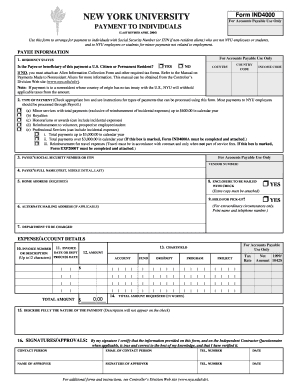

5. Specific University Payment to Individual Form

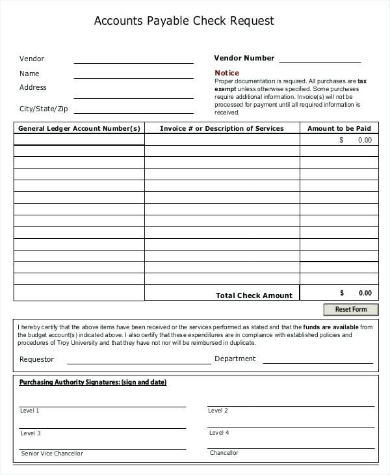

6. Sample Accounts Payable Check Request Form

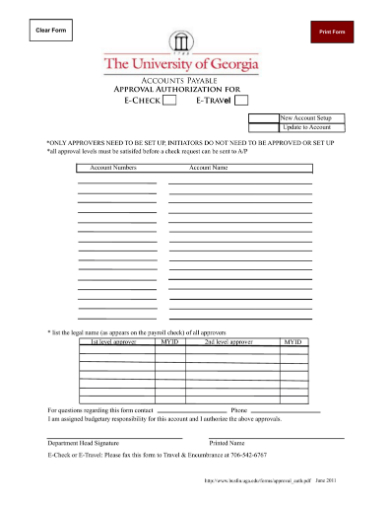

7. Sample University Accounts Payable Approval Authorization Form

Other Types of Accounts Payable Forms

Accounts payables encompasses various functions, from documenting company-incurred expenses to giving students loan money. Although the focus of this article is on keeping track of expenses, there are other functions of accounts payable forms that we want to share with you. We selected four commonly used accounts payable forms from the Internet. Read the types to get an understanding of how each function and how each contribute to the convenience of the company.

1. Expense Report Form

The most basic type among the types, an expense report form aims to tally and list company-related expenses incurred by an employee during a business trip or meeting.

2. Cash Advance Request Form

A cash advance request form aims to ask money from a bank or a loan-service provider to pay for product but the applicant must eventually pay the bank or the loan-service provider the amount, along with a fee, he borrowed or requested.

3. Request for Student Payment

A request for student payment functions similarly to a cash advance request form. A request for student payment aims to loan money to the student to pay for his tuition and school-related materials.

4. Charge/Credit Form

A charge/credit form functions to help business transfer expenses information from one account to another. This business form is helpful when a loan-service provider charged a wrong account when it should be your company’s account.

How to Create an Accounts Payable Forms

We prepared an organized step-by-step process on the construction of an accounts payable form. In this case, the focus of this guide is to help you create an expense record tracker. Tread carefully in the writing process but be confident in your skills. Start reading the manual now so you can begin constructing ideas on how to go about the process!

Step 1: Traverse the Web, and Look for a Template

Search the Internet for a credible website that hosts accounts payable templates. To further minimize the process, we strongly suggest you pay a visit to

Step 2: Utilize Sans-Serif Font Styles in the Business Template

Business documents nowadays prefer the style of the fonts than how it appears to the readers. Utilize readable sans-serif font styles in the accounts payable template. Sans-serif font styles were once not recognized as useful for printed materials. This style was seen only in online documents, but times are changing. Use this style now!

Step 3: Create a Table for the Itemized List of Expenses

Dedicate a section for the list of expenses that you want to include in the output. Create a three-columned table. The first column must contain the date of the purchase. The second column must be about the names and brief descriptions of the products you purchased. The last column must be for the prices of the products or services that you purchased. At the bottom part of the table, you must dedicate a space for the total amount of the products and services on the list.

Step 4: Add a Signature Block on the Business Template

After the table, add a signature block. The accounts payable form functions as a confirmation letter in this situation. The signature of your boss must be evident after the table to confirm that he agrees that the expenses you presented in the table are correct.

Step 5: Review and then Edit the Overlooked Errors

Review the output for any overlooked or missed errors. When you see there are still errors left, you must edit the file. Print the output once you are sure that the document is free of any mistake.

Related Posts

-

Accounts Receivable Ledger Form

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF