Automation is beginning to be a normal practice even in the business and financial world. Automation expedites transactions and records them in a very organized fashion. But, despite the wonders and nearly miraculous functions that it can perform, there are times when errors and malfunctions occur. As a result, data that were stored in that system often gets lost. However, these systems are designed with a retrieval feature where users can readily retrieve the data that are lost during the malfunction. Financial Data such as codes for various accounts can be retrieved by submitting an Account Code Request Form. These forms are used to retrieve data lost during system malfunctions or to obtain information from a specific account.

What Is an Account Code Request Form?

Account Code Request Forms are request forms used specifically to retrieve data from specific accounts or to obtain information from those. To retrieve lost data, the account code of the account must first be secured to gain access to it. Account codes are codes used to identify individual accounts stored in a financial management system. In the event of a system crash or malfunction, an Account Code Request Form is submitted to obtain the code for a specific account and retrieve the data contained in it.

FREE 5+ Account Code Request Forms in PDF

1. Accounting Code Request Form

2. Financial Account Code Request Form

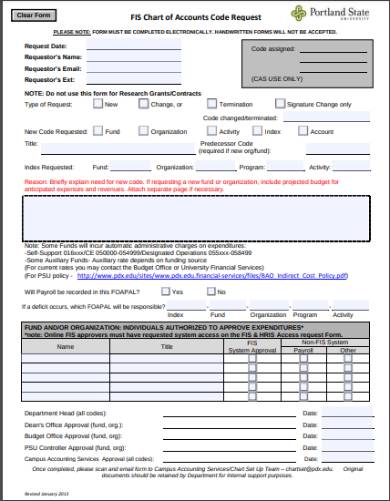

3. Chart of Accounts Code Request

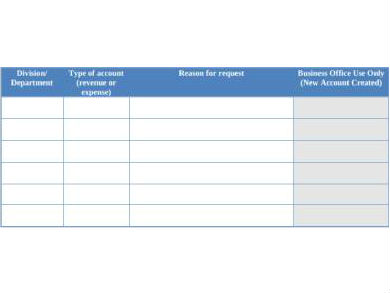

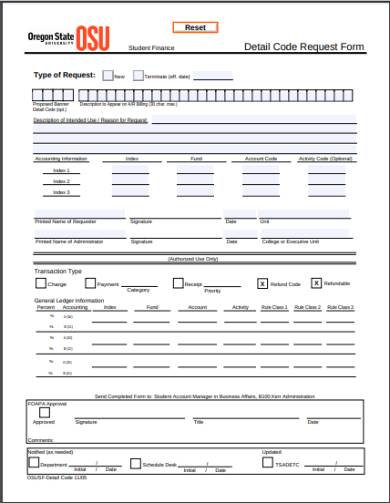

4. Account Detail Code Request Form

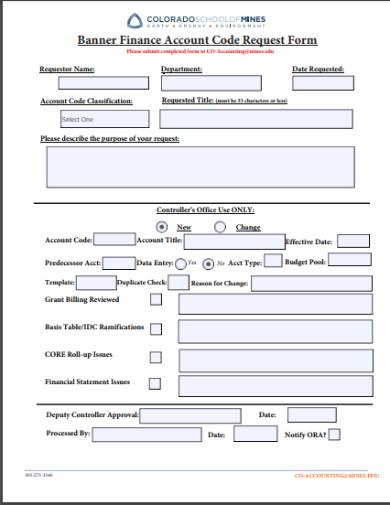

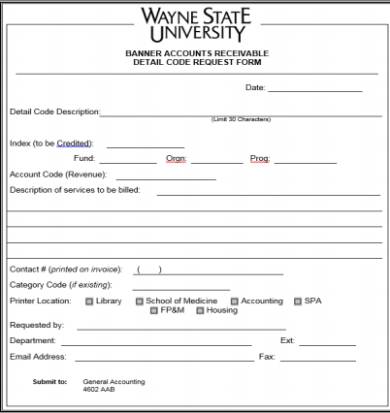

5. Accounts Receivable Account Code Request Form

What Is an Account Code?

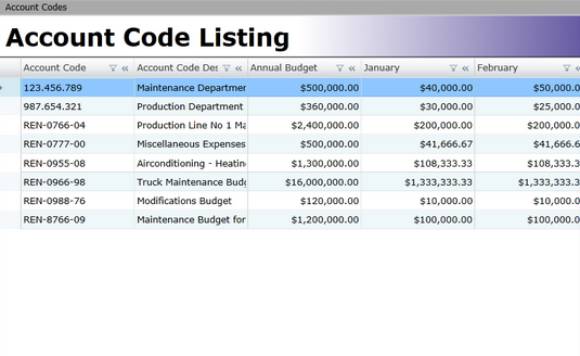

An Account Code is a six or four-digit numerical code, depending on the software, used to identify specific accounts stored and posted in a list called the chart of accounts. These codes designate the type of transaction contained within specific accounts. These transactions could either be designated as expenses, revenues, assets, or liabilities, depending on the account code. Account codes are essentially helpful to anyone who wishes to post a transaction or obtain information from a certain account. Listed below are the accounts found in a chart of accounts and the transactions posted under them.

1. Revenue Accounts

Revenue Accounts are accounts where transactions related to profits and gains are posted. In a general ledger, transactions under this account are listed as assets. In an automated system, however, these transactions are designated as codes beginning with the first two numbers that indicate the type of account they belonged to. Listed below are the following transactions that belong to this type of account.

- Sales

- Service Revenues

- Fees Earned

- Interest Revenue

- Interest Income

2. Expense Accounts

Expense accounts are accounts where transactions such as purchases and debits are posted. Expenses are treated as liabilities in general accounting. In a financial management system, transactions belonging to this account are expressed as codes beginning with the first two numbers indicating the account that they belong to. Listed below are the following transactions that belong to this account.

- Advertising Expenses

- Utility Expense

- Equipment Leases

- Rental Expenses

- Commissions

- Labor Costs

3. Transfer Accounts

Transfer Accounts are types of accounts that refer to the transfer of an amount to another account. This account could either record and post transactions such as transfers and deposits. Transfer accounts would either record such transactions as expenses or revenues.

Account codes are an integral feature of the Financial Management Information Systems (FMIS). The Financial Management Information Systems or FMIS is an automated financial management system that automates and integrates public financial management processes such as budget formulation, accounting, and reporting. The FMIS features a list called the chart of accounts. The chart of accounts is an electronic list where accounts and the transactions posted under them are stored. Using the FMIS, the user can easily access and update any account or post another transaction under them.

How to File an Account Code Request Form

You are in the middle of posting a transaction under a new account in your financial management database. And then, all of a sudden, a power outage happened. It took a while to restore power in the building where your office is located. After a few minutes, the power was restored, and business went back as usual. You felt relieved by the fact that you can now proceed to the work that was interrupted earlier. And then, to your horror, you suddenly remembered that you forgot to take note of the account code for the new account that you created a while ago. Although you know what course action to take in these situations, however, it is your first time encountering such a problem. To help solve that problem, here are the steps on how to file an Account Code Request Form.

Step 1. Select and Download an Account Code Request Form Sample

First off, select an Account Code Request Form from a list of samples that are provided in this article. Make sure to choose the right Account Code Request Form according to your respective financial management system administrators. After choosing an Account Code Request Form, download the sample form so that you can proceed in editing it.

Step 2. Fill in the Account Code Request Form Sample

Right after choosing and downloading an Account Code Request Form from a list of samples we provided, you can then proceed with editing it. To edit the form, provide the information asked by the Account Code Request Form. The form will usually ask for your information, such as the account title, transaction title, entity name for businesses, and so on. The form might also ask for some information specific to the type of account code requested.

Step 3. Submit the Account Code Request Form

After you’re done editing the Account Code Request Form, you can now submit the form to its respective financial management system administrators. You can also submit your Account Code Request Form to its respective administrators via email. Before sending the Account Code Request Form, it is best to review it for any errors to prevent the hassle of repeating the process.

Step 4. Wait for the Administrators Response

After submitting the Account Code Request Form to its respective financial management system administrators, all you have to do is wait for a response. Response time will vary from the financial management system that you use and the number of account codes that you requested.

Step 5. Pay an Expedited Service Fee if Necessary

If the long wait is too painful to endure and time is essentially critical, you can always choose to expedite your request at a small price. If you choose to have your account code request expedited, just pay the expedited service fee your system administration offered. Expedited service fees vary from administrator to administrator.

Related Posts

-

Accounts Receivable Ledger Form

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 6+ Credit Accounting Forms in PDF

-

FREE 7+ Accounting Registration Forms in PDF

-

FREE 8+ Change Accounting Forms in PDF

-

What are Accounting Forms? [ Purpose, How to Create, Includes, Importance ]

-

What are Financial Accounting Forms? [ Objective, How to, Benefits, Guidelines ]

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF