You are a junior HR specialist in a fledging outdoor equipment manufacturer. Being in a company that is constantly occupied with research and development, the higher-ups are planning to reallocate part of the salary budget for a new project that they’re currently working on. To start the reallocation process, your immediate superior charged you with the responsibility of distributing Payroll Reallocation Forms to employees in a certain department. Those forms are used to collect employee information and also those of their salaries, which is the first step in the payroll reallocation process.

What Is a Payroll Reallocation Form?

A Payroll Reallocation Form is a type of business form that is used to file a reallocation of the salary budget to somewhere else. These forms are filed by the HR department to the senior management for approval to prepare a resolution to reallocate some portion of the payroll to another department or a certain project. Payroll Reallocation Forms are to be filled out by the employees themselves to gather information about their salary to give accountants a bigger picture from its sum.

FREE 4+ Payroll Reallocation Forms in PDF | XLS

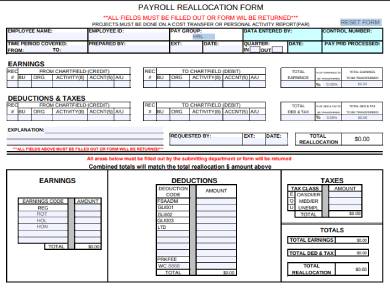

1. Payroll Reallocation Form Sample

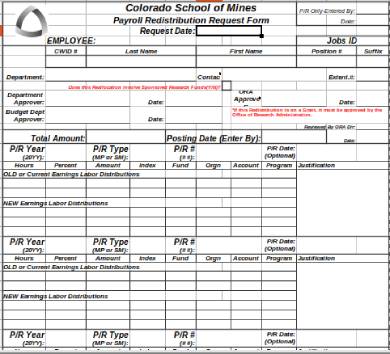

2. Payroll Reallocation & Redistribution Request Form

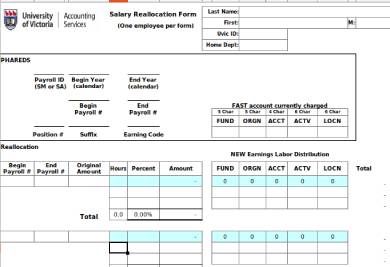

3. Salary & Payroll Reallocation Form

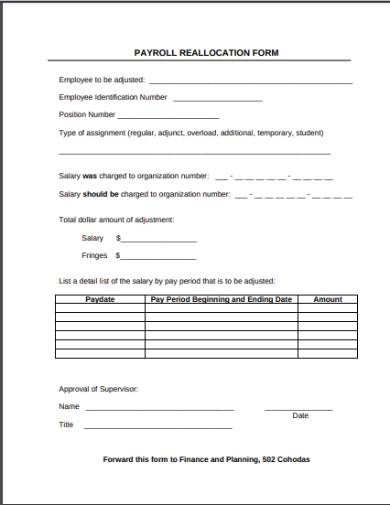

4. Sample Payroll Reallocation Form

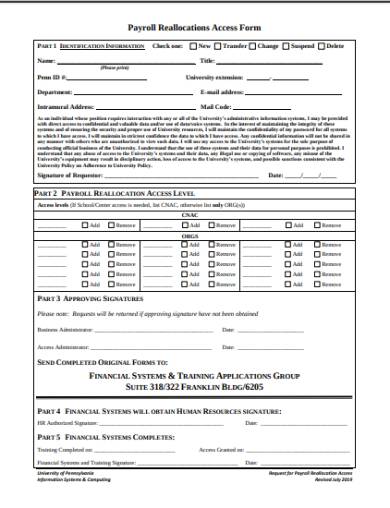

5. Payroll Reallocations Access Form

Why Are Payrolls Reallocated in the First Place?

Payroll Reallocation is the act of setting aside the proposed salary budget for a company’s employees. Budget redistribution is done for a variety of reasons. Most of the time, this is done due to socio-economic influence and intervention, which, as described by Scottish-American Economist, Adam Smith, as the “Invisible Hand.” The invisible hand is defined as an unseen force that significantly influences the relationship between the economy and society on a grander scale. On a micro-scale, the invisible hand pushes individual businesses to make financial decisions such as payroll adjustments, mostly due to government regulations, prevailing economic conditions, and matters related to production.

1. Salary or Wage Adjustment

Salary or Wage Adjustments are seen as one of the reasons why payroll allocations are done in the first place. These adjustments are usually caused by minimum wage hikes set by government agencies and the prevailing costs of living. A memorandum from the senior management first implements these adjustments before they are reflected on the employee’s payroll.

2. Wage Tax

Wage tax or, what we commonly know as an income tax, is a tax levied on income generated by businesses and employees. When the government implements a new wage tax rate, the existing payroll system will be significantly affected, depending on whether if its an increased or decreased tax rate, which leads companies to reallocate and adjust another budget for salaries.

3. Budget Transfers

Another reason why payroll reallocation happens is when a portion of its budget will be transferred elsewhere. Most likely, the funds will be directed to activities related to production, most notably for research and development of another product line. Also, budget transfers are caused by the downsizing of companies to recycle capital.

How to Make a Payroll Reallocation Form

As mentioned earlier, you are a junior HR specialist tasked to prepare and distribute Payroll Reallocation Forms to the employees. The Payroll Reallocation Forms that you’re tasked to prepare and distribute are part of the payroll reallocation process being planned by the senior management. While you’re on your way to make the Payroll Reallocation Forms, you found out, much to your horror, that there are none available for distribution. To remedy the situation, you set out to the wild and into the vastness of the world wide web in search of a template for such form. And by sheer luck, you finally found a template for your Payroll Reallocation Form and begin the process of making it. To help you with such a process, here are the steps on how to make a Payroll Reallocation Form.

Step 1. Obtain a Payroll Reallocation Form Sample

To get started in making a Payroll Reallocation Form, you must first take the convenient way by obtaining a template of the form. To do that, choose and download a Payroll Reallocation Form sample from a list of templates in this article. Downloading a template for your Payroll Reallocation Form will help you speed up the process of making such a form, especially if time is most critical.

Step 2. Edit and Customize the Payroll Reallocation Form Sample

Edit and customize the template right after you’ve chosen and downloaded a Payroll Reallocation Form sample. To edit the template, replace the company name and logo in the template with your company’s name and logo. You can place your company name and logo at the header located at the top part of the Payroll Reallocation Form. Putting your company name and logo makes the Payroll Reallocation Form yours distinctively. Plus, it also gives your company a standard Payroll Reallocation Form to use in the future.

Step 3. Print the Payroll Reallocation Form

After customizing and editing the Payroll Reallocation Form sample, print the Payroll Reallocation Form using your office printer. Print multiple copies of the form since you will be distributing it to several people that your company employs. You might also want to print extra copies for future use.

Step 4. Distribute the Printed Payroll Reallocation Forms

After printing the Payroll Reallocation Form, distribute them to the employees so that they can answer it immediately. Before letting them answer the Payroll Reallocation Form, provide them with clear instructions on how and which fields to answer or to leave blank. Also, instruct them where to submit the Payroll Reallocation Form after they’re done answering it.

Step 5. Compile the Completed Payroll Reallocation Forms

After they’re done answering the Payroll Reallocation Forms, collect and compile them in a file box. Then, after receiving and organizing the filled out Payroll Reallocation Forms, forward them to the department responsible for processing them. What they’ll do is to sift the information contained in those individual Payroll Reallocation Forms. The filtered information will then be forwarded to the senior management, where it will be further processed.

Related Posts

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF