Every working person is required to pay taxes to the government each year. This involves declaring his income and other savings to the government. For this purpose, the person is required to fill a form which is known as the payroll tax form. Every citizen of a country irrespective of whether he is an employee, an employer or a business firm needs to fill in this form in order to pay his taxes and to file for returns. You may also see Certified Payroll Forms

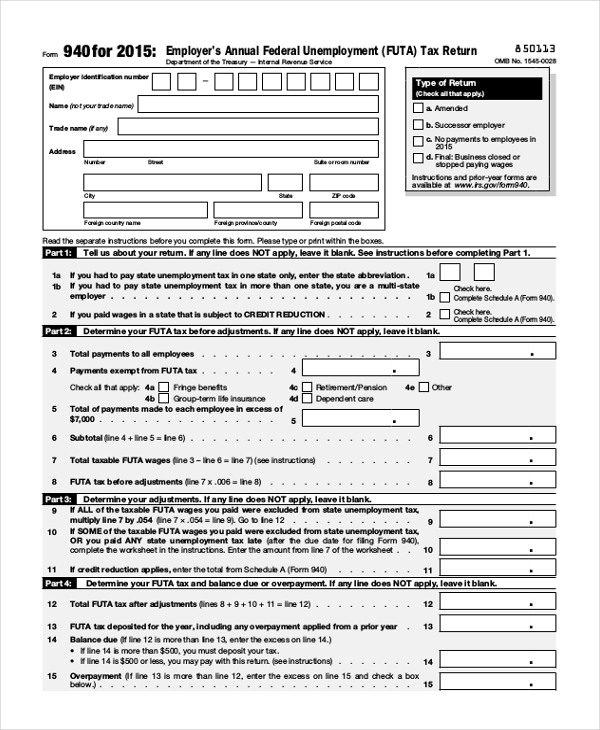

Sample Payroll Tax Form 940

This is a payroll tax form that is used by a business organization to calculate and declare the Federal Unemployment Tax to the government. This money is then used to offer compensation to people who might have lost their jobs.

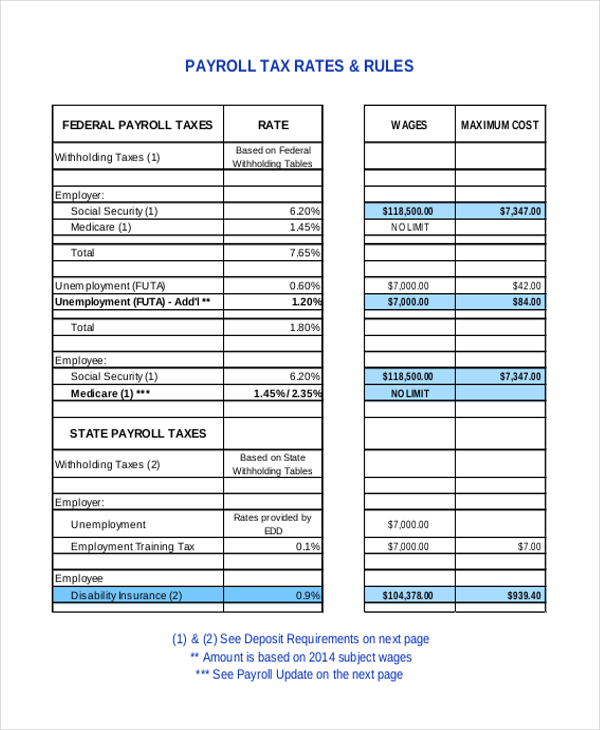

Federal Payroll Tax Form

This is a tax form that is required to be filled in by the employers and business owners who make tax deductions against the income, medical care and security amounts of their employees.

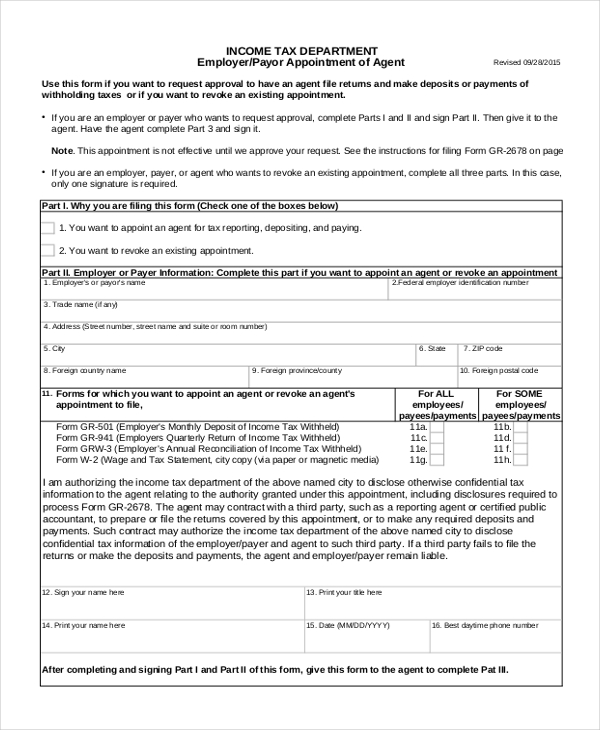

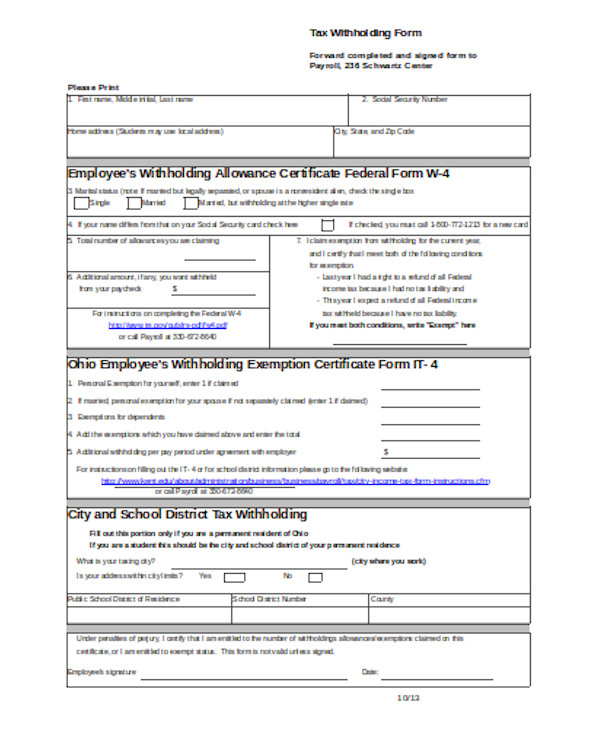

Sample Employer Withholding Tax Form

This form is used by business owner to calculate and declare the amount of tax that he deducts from his employee’s pay check every month. The employee can file for returns on this at the end of the annual year.

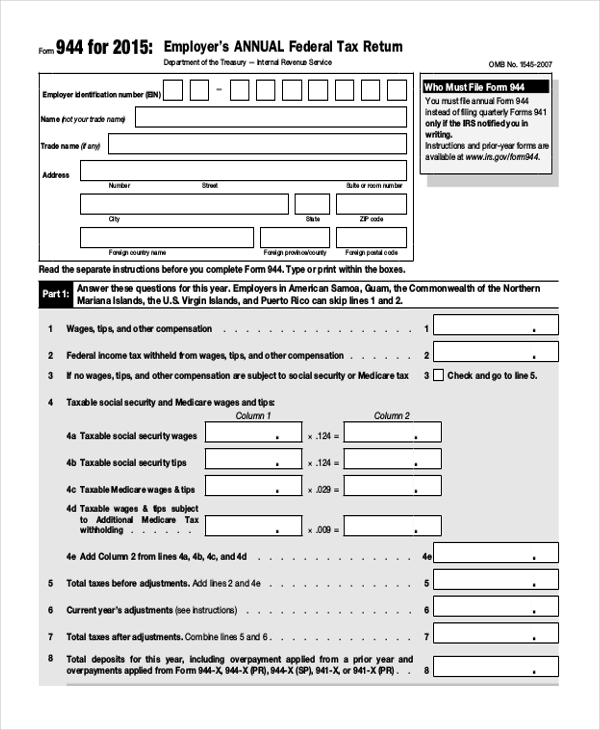

Annual Payroll Tax Form

As the name indicates, this is the form used by a earning person to declare his annual income along with the savings to the government. This is used to calculate the amount of tax he is liable to pay and the returns that he may get.

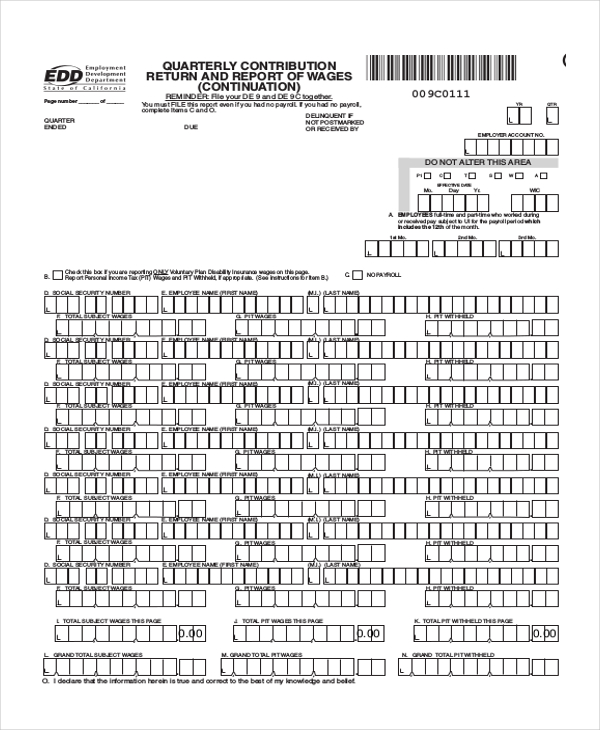

Sample California Payroll Tax Form

This form is used by the people living and working in the state of California to declare their tax information based on the various regulations introduced by the government in the state.

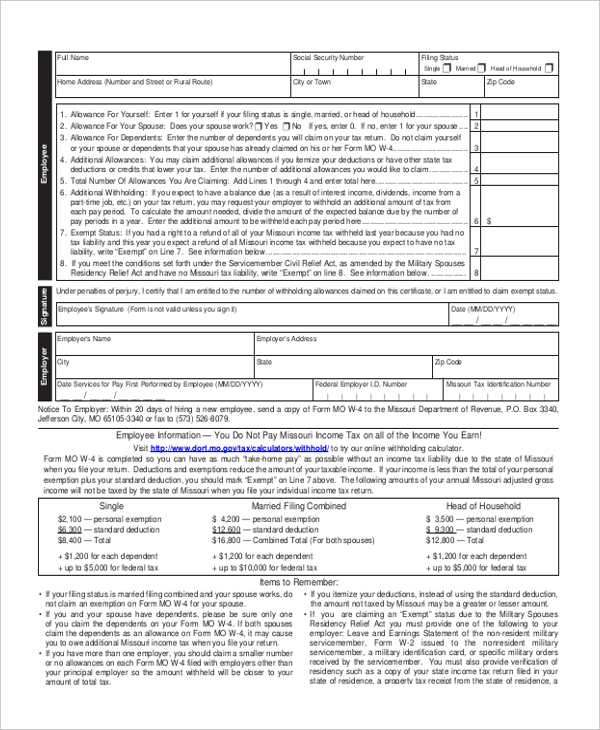

State Payroll Tax Form

Used by the employees of various organizations to declare their income and savings to the state, this form helps them to calculate the total taxes that they are liable to pay at the end of a financial year.

Basic Payroll Tax Form

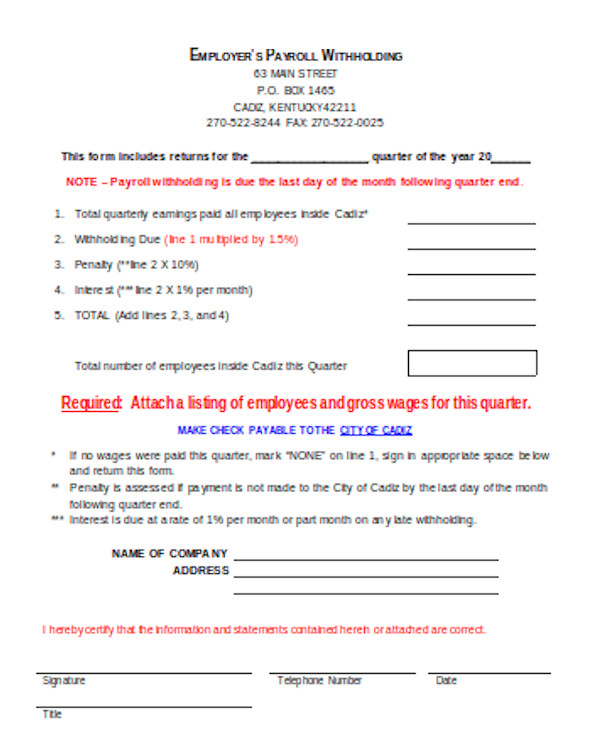

Quarterly Payroll Tax Form

Target Audience of Payroll Tax Forms

Payroll tax forms come in handy in declaring the income and other financial details that are required to calculate the taxes that a person owes to the government. The people who might use these forms are

Employees

The employees of an organization use this form to declare their annual income along with the details of their savings such that a perfect calculation of their taxes can be made.

Employers

Employers of an organization may use this form to declare the amount of tax that they may be deducting from their employee’s income under different segments like commission, medical etc.

Why should you Use Payroll Tax Forms?

Declaring ones annual income and other details like amount of savings made, transactions which are eligible for tax rebate etc is an essential for every person working in a firm. The employers too need to make declarations about the amount of tax they deduct against source from their employees. Using the payroll tax form makes it easier for the concerned parties to do this is in a systematic and organized manner. Useful Car Sale Contract Forms

What are the Benefits of Using Payroll Tax Forms?

The declaration of income and calculation of taxes comprises of filling in lots of figures under various figures. Doing this in a systematic and organized manner would prevent any kind of confusion and mix ups, thus making it easier for you or the accountant to make the calculations. Since the payroll tax forms are designed in such a manner, using them is the best bet. Once the tax details have been filed, these forms can be stored as records for future use.

How do you Design a Payroll Tax Form?

Start by adding in segments where the tax payer can enter his or her credentials along with employment details. Now, depending upon the regulations, add in various segments under which the person concerned can fill in relevant details like total income, HRA, DA etc. Make sure to include the relevant percentages that might be needed to calculate the final figures. You can also see Payroll Remittance Forms

A payroll tax form comprises of a number of segments which is why designing one can be quite a confusing and difficult task. But, thanks to these forms now being available online, you can now download them and make necessary changes to them. So, the next time you need a payroll tax form, you know where to look for them.

Related Posts

-

FREE 10+ Sample Payroll Direct Deposit Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel

-

Payroll Advance Form

-

Payroll Deduction Form