Benefits mandated by the government often doesn’t suffice to make an employee’s life seemingly bearable and satisfying. As a consequence, they often enroll themselves in private benefit providers or insurance companies to augment the benefits already provided to them by the state. These are often done with their family’s future in mind. Thus, they also voluntarily elect to have a portion of their salaries deducted as part of the insurance agreement they signed with the provider. Voluntary Deduction Agreements are documents signed by both, the creditor and borrower, as a testament of voluntarily subtracting a certain amount from their salary, as security of payment for the loan they applied for.

What are Voluntary Deduction Agreements Forms?

Voluntary Deductions Agreement Forms are agreement forms that stipulates the borrower’s consent to have a certain amount deducted form their salaries. These deductions are used by creditors as means of securing payment of the loan made by the borrower. Voluntary Deduction Agreement Forms usually come in a form of a separate document and is attached on the principal document, which is the loan application form. This form is also used by auditors to determine an employee’s taxable amount before or after making tax deductions on their salaries.

FREE 6+ Voluntary Deduction Agreement Samples in PDF

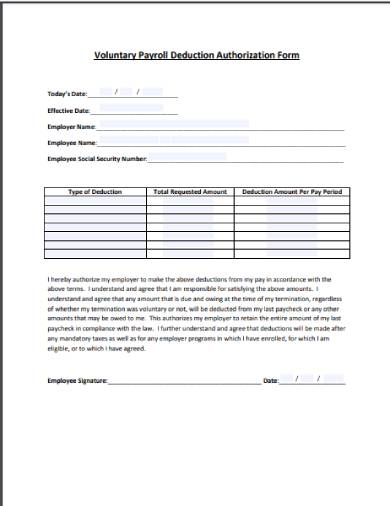

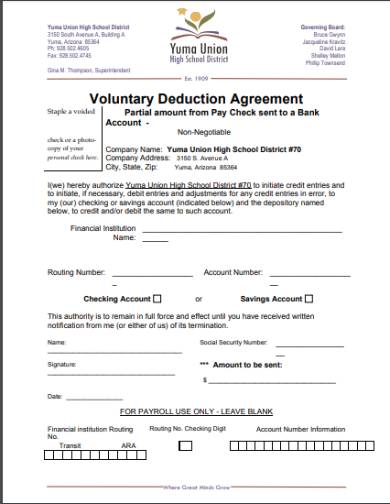

1. Voluntary Payroll Deduction Agreements & Authorization Form

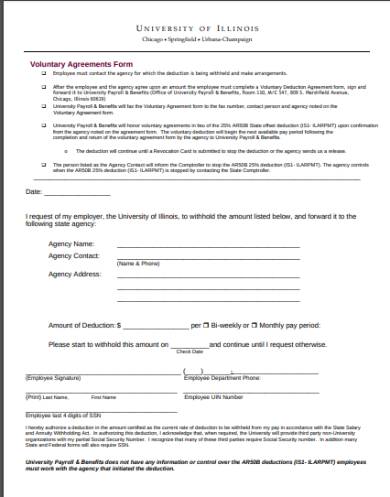

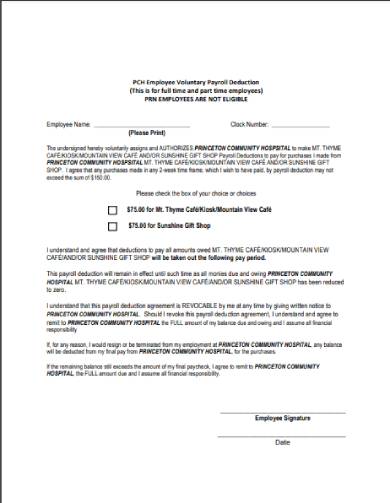

2. Voluntary Deduction Agreements Form

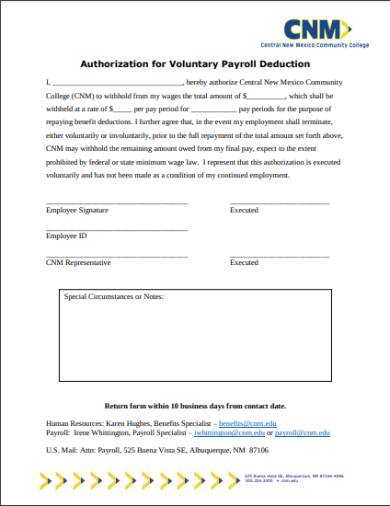

3. Sample Voluntary Deduction Agreements & Authorization Form

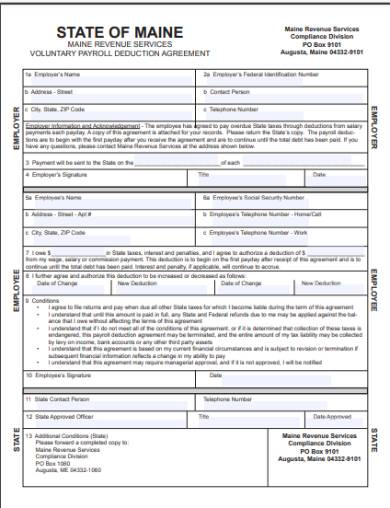

4. Voluntary Payroll Deduction Agreement Form

5. Voluntary Deduction Agreement Form Sample

6. Agreements & Authorization for Voluntary Payroll Deduction Form

7. Employee Voluntary Deduction Agreement Form

Reasons for Filing a Voluntary Deduction Agreement Form

Voluntary Deduction Agreement Forms are used by creditors as a guarrantue and security of payment for the money loaned by the borrower. This agreement form is part and parcel of the loan agreement signed by the borrower, by which, the borrower agrees to deduct a portion of his salary as a form of deferred payment for the loan. Voluntary deductions are regulated by the payment of wages act of 1991. This act was legislated by the congress as a:

“Protection against unlawful deductions from wages. An Employer’s right to make a deduction, or require a payment, from an employee is restricted in the following circumstances:

– Where the requirement to make a deduction or require payment from the employee arises due to any act or omission of the employee e.g. breakages or

– Where the requirement to make a deduction or require payment from the employee arises in relation to any goods or services provided by the Employer which are necessary for employment.”

Also, this act further enumerates the circumstances that allow employers to deduct an employee’s salary such as:

- “Any deduction required by law.”

- “Any deduction authorized by a term of an employee’s contract.”

- “Any deduction agreed in writing.”

Voluntary Deductions are reflected on the third item listed on the list of reasons allowed for the employers to do. By that, for example, when employees enroll in an insurance policy or apply for a loan, both signs a consent agreement for the voluntary deduction of an employee’s salary to pay for the service applied flexibly. This agreement benefits the employer, employee and creditors alike by:

1. By giving the employee a convenient method of payment to the loan they made.

2. By providing creditors a sure means to secure the payment of the loan made from them.

3. By enabling employers to make accurate deductions thereby avoiding the penalties of making unlawful deductions.

How to File a Voluntary Deduction Agreement Form

You have recently enrolled in a particular insurance policy to compensate for the lack of sufficiency given by the government benefits already provided to you. Thus, you are also required to file a Voluntary Deduction Agreement Form to your creditor for you to be able to pay for it. Filing a Voluntary Deduction Agreement Form gives you the option to make payments on an installment basis by allowing your employers to make deductions to your salary. By allowing your employers to deduct your salary to pay for the loan, this also gives you an affordable and convenient way to pay for it, on your behalf. Listed down below are the steps to help you file a Voluntary Deduction Agreement Form to your creditor.

Step 1. Download a Voluntary Deduction Agreement Form

Download a Voluntary Deduction Agreement Form by selecting from an assortment of sample forms provided in this article. Downloading a Voluntary Deduction Agreement Form sample allows you to have a ready-to-use form to go along with your loan and credit application. This also prevents you from the hassle of finding a Voluntary Deduction Agreement Form which takes a lot of precious time.

Step 2. Print the Voluntary Deduction Agreement Form

Print the downloaded Voluntary Deduction Agreement Form after downloading it. Print three copies of the Voluntary Deduction Agreement Form. Two of those copies will be submitted to the creditor and employer, while the third copy is yours to keep. Each copy will serve as a piece of evidence which states that such an agreement is made between you, the creditor and your employer.

Step 3. Fill-in Voluntary Deduction Agreement Form

After printing, fill-in the Voluntary Deduction Agreement Form with the information asked. The form will usually ask for personal information such as your name, age, date of birth, address and contact details. It will also ask for information about your employment such as your job position. Make sure that the information you provide is true and correct. This is to prevent you from facing fraud charges.

Step 4. Sign Voluntary Deduction Agreement Form

After filling the Voluntary Deduction Agreement Form, affix your signature on the signature block provided on the form. The signature block can be found at the bottom-most part of the fillable sections of the Voluntary Deduction Agreement Form. Affixing your signature shows that you agreed with what is stipulated on the form.

Step 5. Submit the Voluntary Deduction Agreement Form

Submit the Voluntary Deduction Agreement form after you completely filled and signed each copy of it. First, show the copies of the Voluntary Deduction Agreement Form to your employer and the creditor, respectively. Have them sign each copy of the form and have it notarized by a public notary. This makes your Voluntary Deduction Agreement Form legally binding and enforceable.

Related Posts

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 9+ Management Agreement Samples in PDF | MS Word

-

FREE 8+ Consulting Agreement Forms & Samples in PDF | MS Word

-

FREE 9+ Partnership Agreement Form Samples in PDF | MS Word