Borrowing funds require an individual to be aware and knowledgeable about the different legal forms and contracts to sign in lieu of the intent to loan an amount, regardless of the purpose or where the loan will be used. One of the documents that lenders use and create for their borrowers is known as a subordination agreement form. This document can either be in a long version or in a short form which is the summarized version.

Subordination Agreement Long-Form Sample

Subordination Agreement Form in DOC

What Is a Subordination Agreement Long Form?

A subordination agreement long form is a document which is often used by lenders, business companies, and financial aid providers for their clients or borrowers. In the form, prioritization will be specified and defined, and the prioritized party’s claims will be acknowledged compared to the other parties involved in the agreement.

Accelerator Subordination Agreement Form

Blank Subordination Agreement Form

Elements of a Subordination Agreement Long Forms

The first element in any subordination agreement long form would be the introductory clause and a block for identifying the parties. This is where the names of the company, organization, or the borrower and the provider will be stated. Below the parties’ block are the following elements which should be included in the form:

- Recital: The purpose of the subordination agreement will be stated in this element which will also include stating the roles of the parties and the intent of all parties to attain an agreement regarding the debt, loan, or the subject where the agreement is focused on.

- Definition of terms: To avoid misunderstandings, the terms and phrases which will be used in the subordination agreement must be defined properly, especially if there are uncommon or jargon words to be used.

- Permissions clause: This is where the details of the permitted payments, liens, and properties will be indicated. For instance, if the subordination agreement form is for a mortgage loan, then the permissions clause must center on permitting the subordinate lenders in recording in the subordinate mortgages and documents against the mortgaged property in order to secure the obligations and liabilities of the borrower.

- Enforcement of rights: Each party involved in a subordination agreement will have his own set of rights which will be observed and can be claimed in the period of the contract agreement. These rights must be enlisted and be defined in the agreement to inform each party of what rights they can execute and exercise.

- Deliveries: This element of the form will specify the accepted methods of delivering notice forms and other documents to all the involved parties. The number of days as to when notices must be delivered before the day that the subjects in the notice will be executed will also need to be included in this element.

- Default clause: A default refers to an action which is a violation of the terms and conditions in the agreement or contract. The penalties and fees to be faced by the defaulting party should be indicated in the form as well as the procedures to be mandated in the event of a default. On the other hand, a default is also known as a breach of contract which often leads to the termination of the agreement.

Intercreditor and Subordination Agreement Form

Perpetual Loan Subordination Agreement Form

Varieties of Subordination Agreement Long Forms

Debt Subordination Agreement Form – Subordinated debts are loans or borrowed funds which could only be paid after the senior creditors of the debt will be paid. For this, a debt subordination agreement form will have to be filled out and be signed by the involved parties. In the form, the lenders and creditors will be referred to as the Beneficiaries of the debt while the client who borrowed and will be using the funds will simply be referred to as the Borrower. Details of the subordination agreement, its postponements, and the prioritization or the ranking of creditors will be the focus of the second article in the agreement.

Debt Subordination Agreement Form

The third article, on the other hand, indicates the acknowledgments of the subordinated creditor, the additional covenants for the agreement, and the representations and warranties. Moreover, the fourth article enlists the acknowledgments of the borrower while the fifth article details the termination clause. The last two articles of the agreement discuss the continuing subordination and the miscellaneous policies and regulations.

Intercompany Subordination Agreement Form – Compared to the aforementioned debt subordination agreement form, the borrowers are to be referred to as the Obligors who will be bound to the other parties in the agreement. In addition, the form is also comprised of fourteen sections which include details about the obligor’s endorsements and his obligations which will not be affected nor be terminated by his representation in the agreement that he will be signing.

Intercompany Subordination Agreement Form

There is also a section in the intercompany subordination agreement form which indicates the rights of the lenders which will not be impaired upon participating in the agreement along with details about the acquisition of liens and guarantees. Waiver statements, lender authorizations, and conflict remedies are also stated in the form.

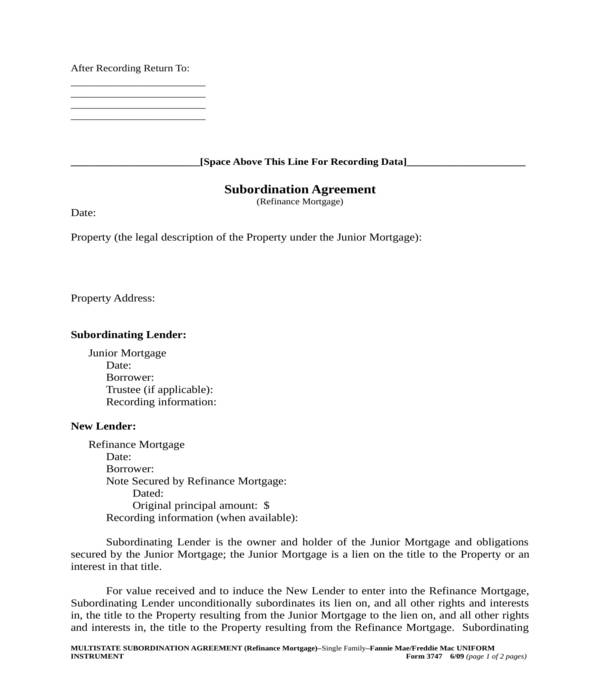

Mortgage Subordination Agreement Form – Basically, this form is to be used for refinancing a mortgage. The details of the subordinating lender and the new lender who will refinance the mortgage will be disclosed in the form along with the borrower’s information and the principal amount of the loan. An acknowledgment statement can also be incorporated below the agreement which should document the acceptance and the involvement of the new lender to the mortgage.

Mortgage Subordination Agreement Form

One benefit of using a subordination agreement long form is that all the details, descriptions, definitions, and terms will be specified in the form. This allows all the involved parties to communicate better and have a common understanding of the agreement and into what their obligations are.

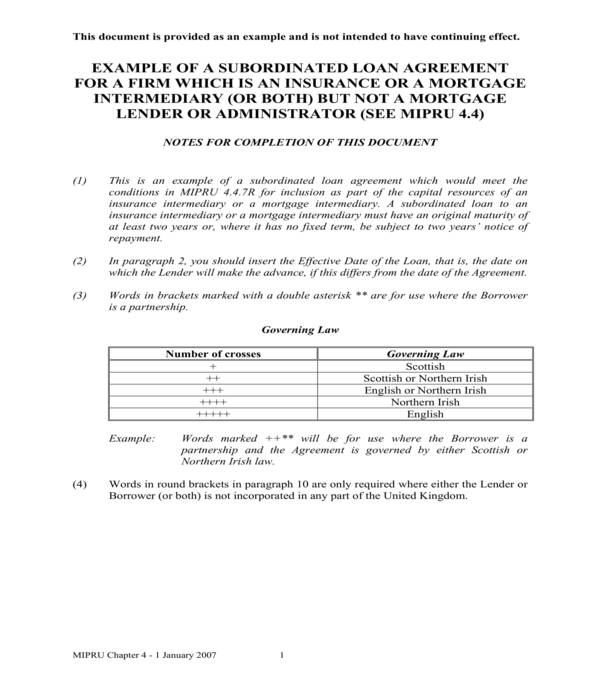

Subordinated Loan Agreement Form

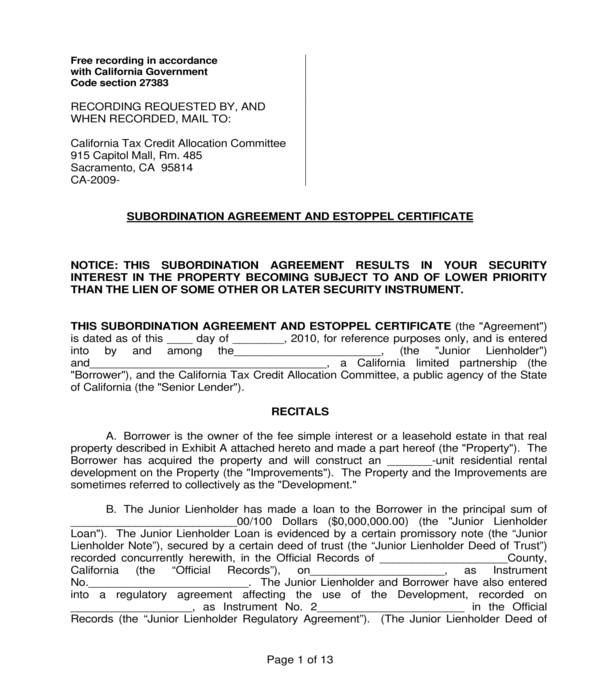

Subordination Agreement and Estoppel Certificate Form

However, regardless of the form variety that lenders and loan borrowers will be using, a subordination agreement long form must be reviewed efficiently to ensure that the terms, clauses, and statement are appropriate to the objective or goal of having the agreement. Afterward, duplicates must be sent to each party along with other loan documents which will be used as future references.

Related Posts

-

FREE 9+ Sample Subordination Agreement Forms in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Lottery Agreement Forms in PDF | MS Word