A Loan Contract is an agreement that is legally binding between two or more parties and establishes the formality of the loan process. A Loan Contract can differ according to the type of loan being made and the deal that was established during the negotiation process between the borrower and the lender.

A Loan Contract usually includes a covenant, the terms of interest, the length of time it will take to pay up the loan, and the collateral involved. You can download our Contract Forms, Loan Contract Forms, and Personal Loan Agreement Forms to help you save on time and save you from the hassle of making an agreement form from scratch.

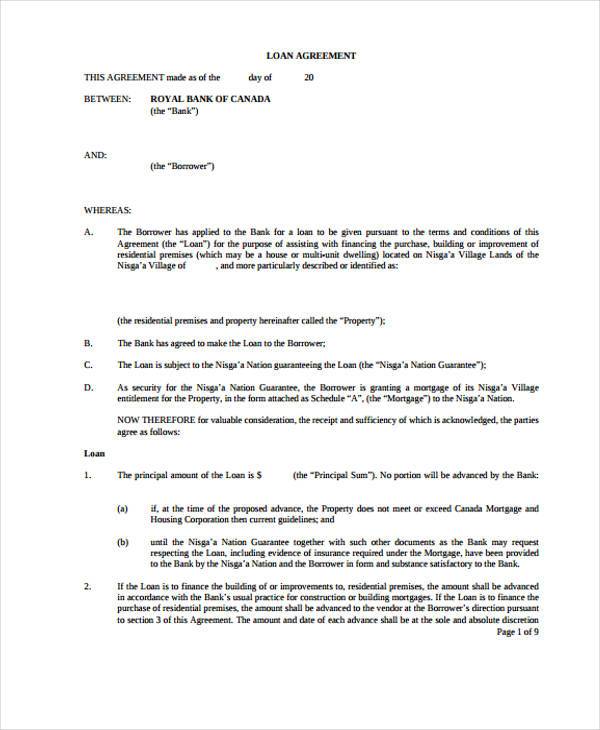

Sample Personal Loan Contract Form

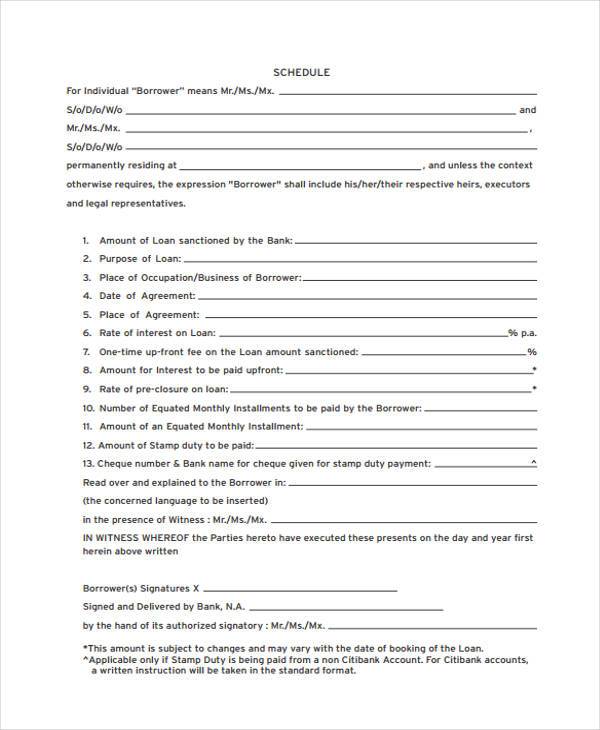

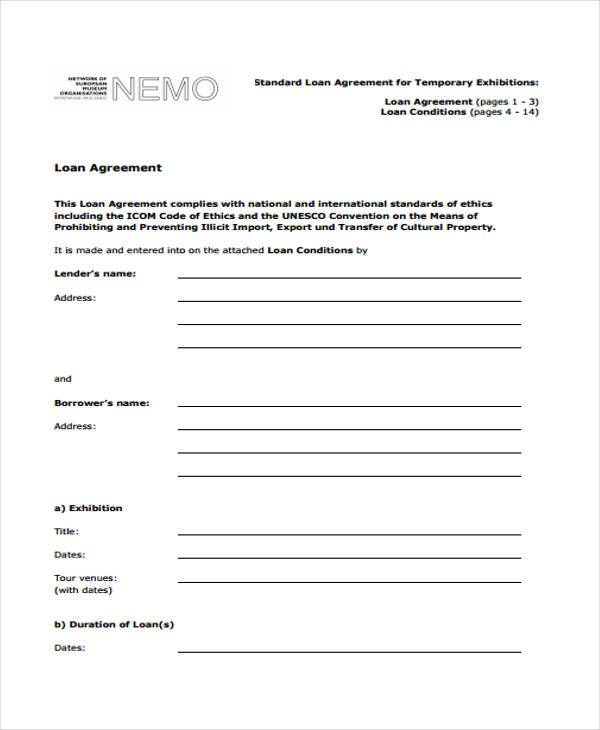

Loan Agreement Contract Form

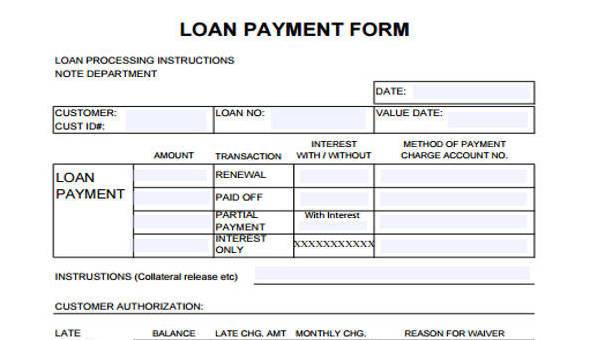

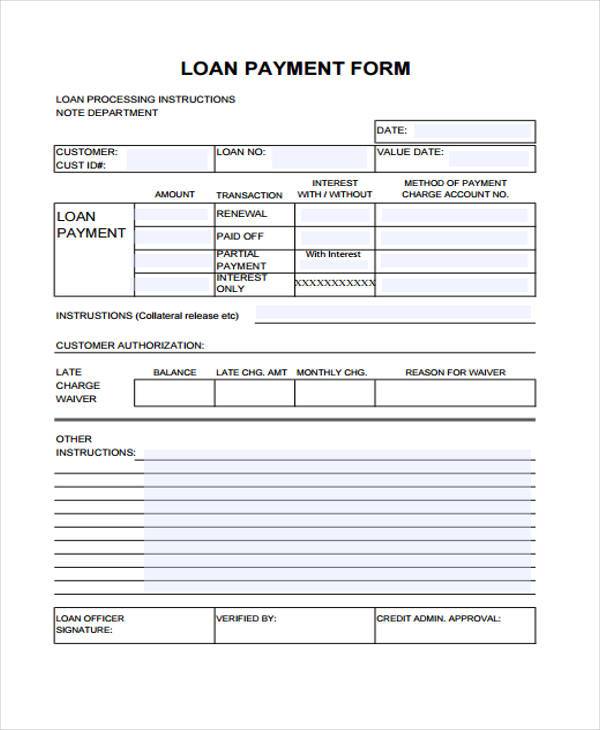

Loan Payment Form

Loan Repayment Form

Why Loan Contracts Are Important

Borrowing money requires a huge amount of financial commitment and trust. But in an imperfect world where people lie, cheat, and steal, the guarantee of trust and commitment with the mere shake of hands just cannot be banked on nowadays. This is why Loan Contracts are essentially needed in loan transactions. Loan Contracts serve as tangible evidence which proves that the money given to the borrower was not a gift but was actually borrowed and needs to be repaid – with interest.

How to Construct an Enforceabe Loan Contract

Indicate the Type of Loan Being Made

Specific details about the type of loan made should be clearly stated in the agreement. Examples of a loan type are a housing loan, a car loan, a student loan, etc. The amount of money being borrowed and the specific conditions that the borrower needs to meet in order for the loan to be approved also need to be provided in the contract.

Indicate the Drawdown Date

Loan Contracts need to specify the date on which the amount being advanced by the borrower is given. This date is referred to as the Drawdown Date and is set by the lender. Depending on the type of loan and the deal established between both the borrower and the seller, the Drawdown Date may be given in lump sum or through installments.

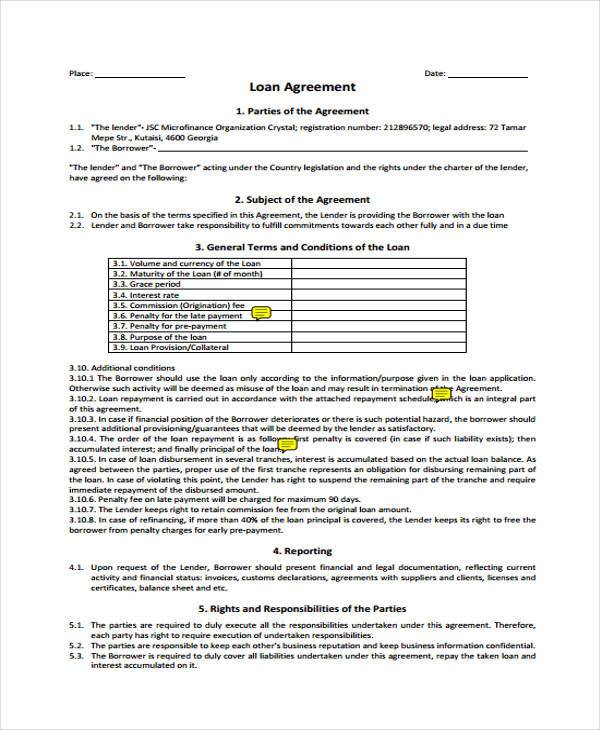

Loan Contract Form Example

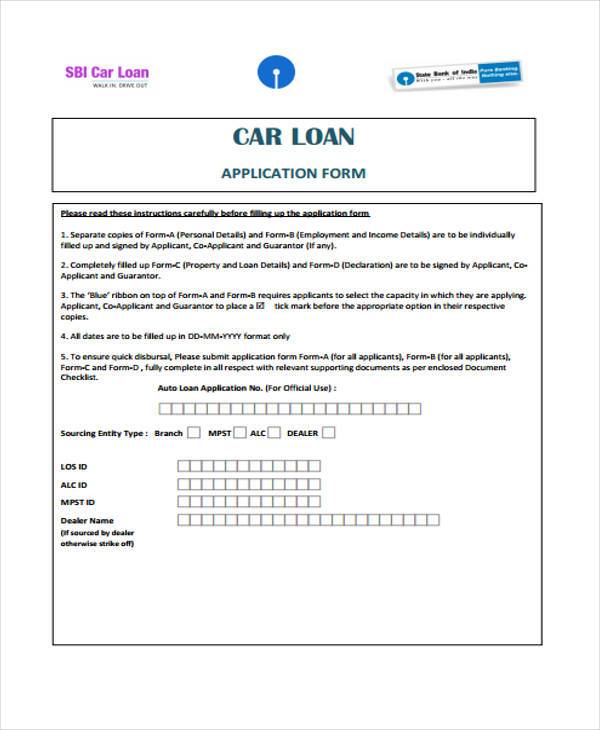

Car Loan Application Form

Loan Agreement Sample Form

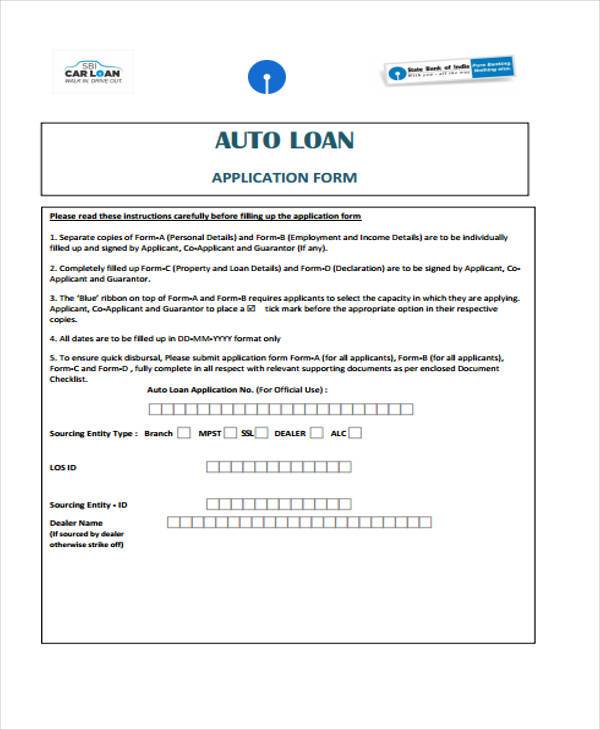

Sample Auto Loan Application Form

Personal Loan Contract Between Friends

State the Purpose of the Loan

Stating the use or the exact purpose of the loan in a Loan Contract is crucial because the approval of a loan and the amount allowed for loan is predominantly determined by its purpose. For example, a car loan will incur a different interest rate and will have a different risk profile than that of a student loan.

Conditions Precendent

Condition Precedent refer to the requirements or conditions that a borrower has to obtain in order for him to get his cash advance or the amount of money being borrowed.

Related Posts

-

FREE 8+ Sample Personal Loan Contract Forms in MS Word | PDF

-

FREE 8+ Sample Loan Contract Forms in PDF | MS Word

-

Contract Termination Letter

-

FREE 5+ Merger Agreement Contract Forms in PDF | MS Word

-

FREE 3+ Limited Partnership Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Medical Release Agreement Contract Forms in PDF

-

FREE 5+ Office Lease Agreement Contract Forms in PDF

-

FREE 6+ Pledge Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Medicaid Agreement Contract Forms in PDF

-

FREE 8+ Non-Competition Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Limited Liability Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Joint Venture Contract Forms in PDF | MS Word

-

FREE 3+ Sale of Goods Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Home Sales Agreement Contract Forms in PDF | MS Word

-

FREE 10+ Easement Agreement Contract Forms in PDF