A loan refers to an amount of money to be borrowed by someone in exchange for repayments in the future with added interests. Loans can range from auto loans to mortgages. A Personal Loan is a term used for loans which are aimed for personal or household use, such as for medical and educational purposes. When a third party is obligated to pay the debtor’s loan interest, it is called a Subsidized Loan. A Non-Performing Loan is a specific loan in which the debtor is not required to pay the interests and other principals in line with his loan.

A Loan Agreement Form is the type of document that is used between a debtor, or a borrower, and a lender. The agreement centers on the mutual terms and regulations agreed by both parties. The debtor’s character, financial status, and some possible collateral are to be stated in the form. These aspects will be the basis of the lender if he will consider granting a loan to that person or not. Loan agreements may also be on an oral contract, but for legal representation, most agreements are written and distributed to both parties.

Sample Loan Agreement Forms

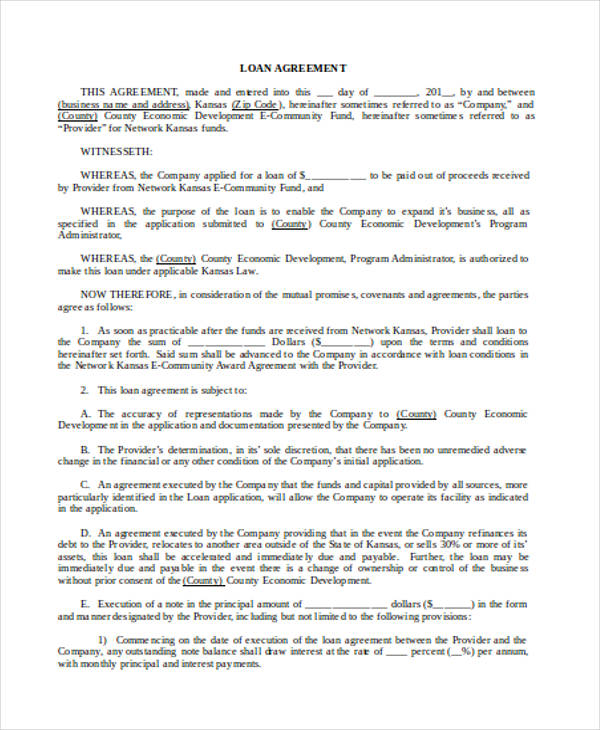

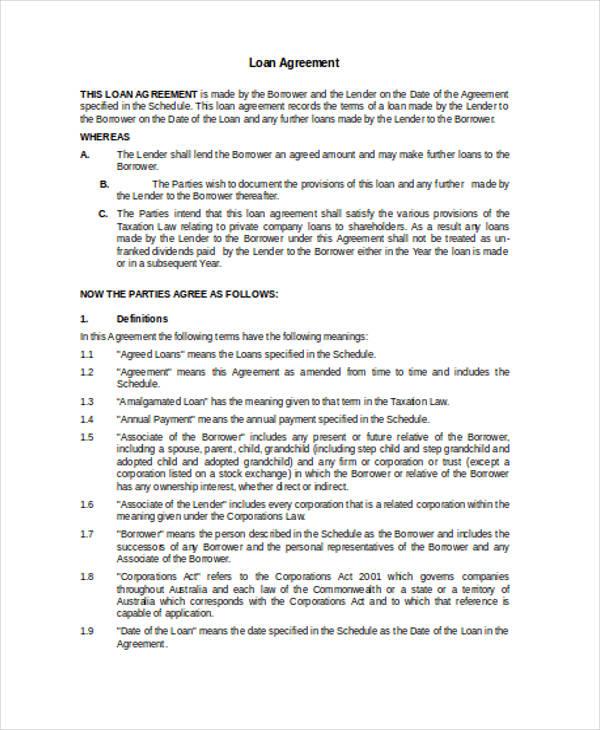

Free Loan Agreement Doc

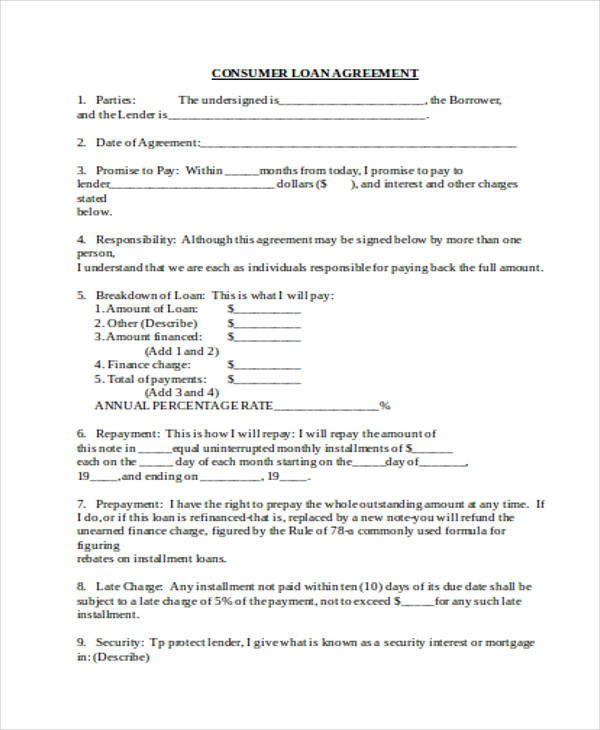

Consumer Loan Agreement

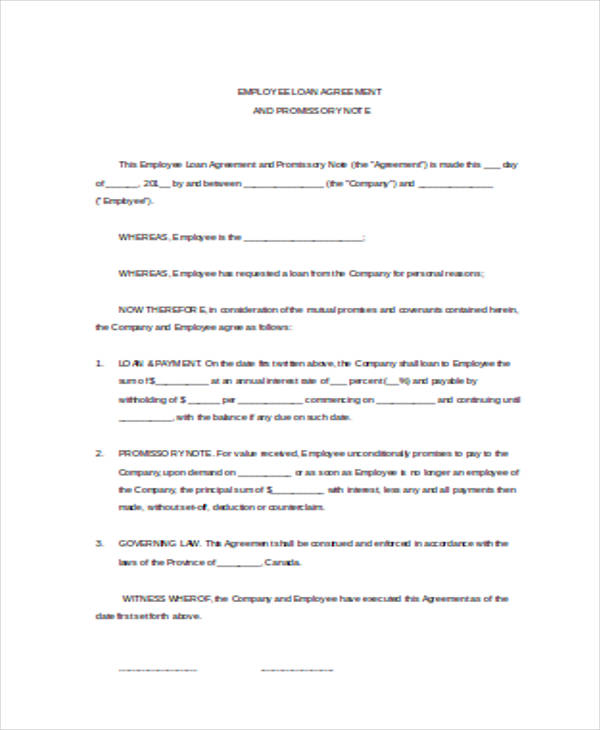

Employee Loan Agreement

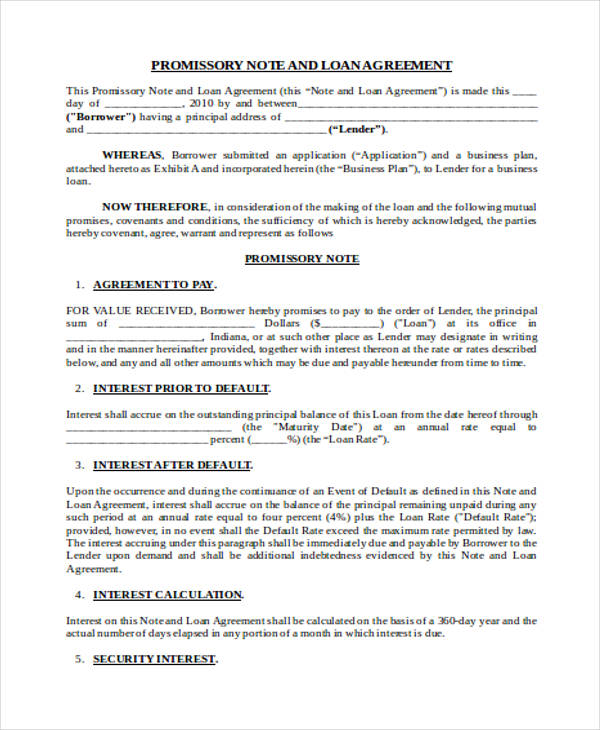

Loan Agreement with Promissory Note

Loan Agreement Forms

Personal Loan Agreement

Employee Home Equity Financing Guaranty Agreement Format

Interest Free Loan Agreement

Free Loan Agreement Forms

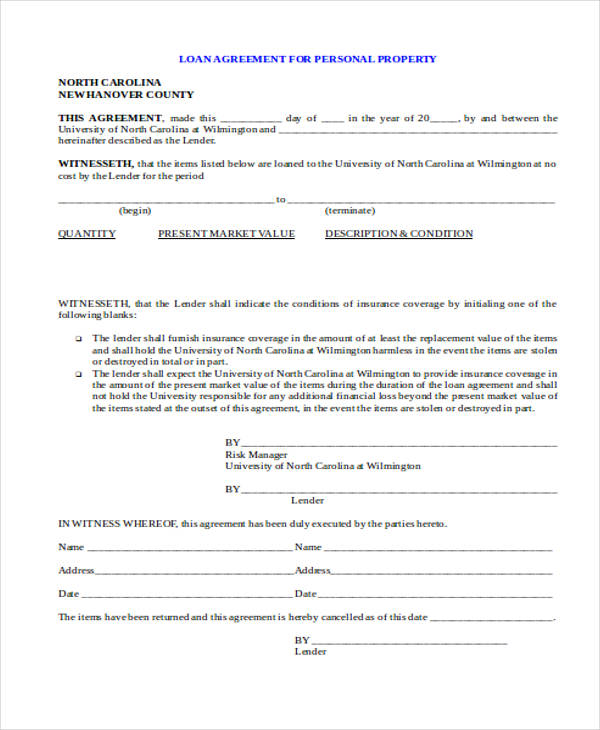

Free Personal Property Loan Agreement Form

Free Printable Loan Agreement Form

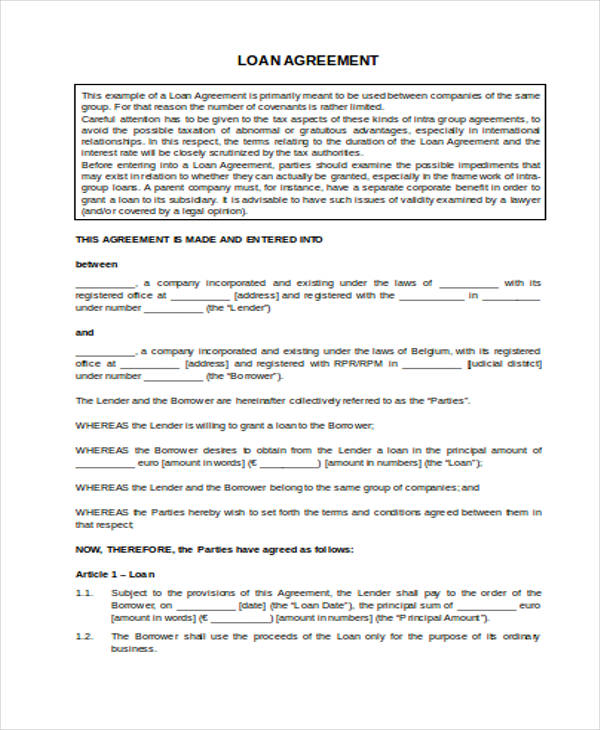

Free Inter Company Loan Agreement Form

Importance of Loan Agreement Forms

Agreements are important for conducting transactions which involves funds and finances. The main importance of having to sign an agreement is for documenting the statements of both parties. Here are more of the reasons why you should make and write a Loan Agreement Form:

To know both parties. Verbally, a person can deny on the court that he is the one who is borrowing an amount of cash from his colleague, but with the evidence of the agreement form, his denial will be a subject for an offense. The form will contain the names and the affixed signatures of the lender, the debtor, and the possible guarantor.

To define terms. Some words depict varying definitions depending on what the reader understands. The lender, with the help of an attorney, may include a list of terms that he used within the contract to have an equal interpretation of the agreement.

To specify guidelines and conditions. Both parties should be able to agree with the conditions of the form. Though the lender has greater weight with deciding on what he prefers, the borrower should also contribute to sustaining equal rights between both of them. The conditions and guidelines may include the amount to be borrowed, the due date and the penalties that may require lawful action.

For transparency. The agreement will show everything that the lender and the debtor agreed to. Therefore, it minimizes the possibilities of corruption within the contract. Both parties may report to the authority if there has been a false statement on the form. This also aids the attorney in viewing the scope of the contract and to know who is really accountable for a sanction.

What’s Inside a Loan Agreement Form?

Listed below are the contents of the form:

The parties. Of course, the first part of the Loan Agreement Form should indicate the names and addresses of the lender and the debtor to easily track them whenever there are cases that they are accountable for.

The purpose. Every loan should have a purpose, whether for educational purposes or for buying property. The debtor should clearly state his purpose since the amount of his loan may depend on it.

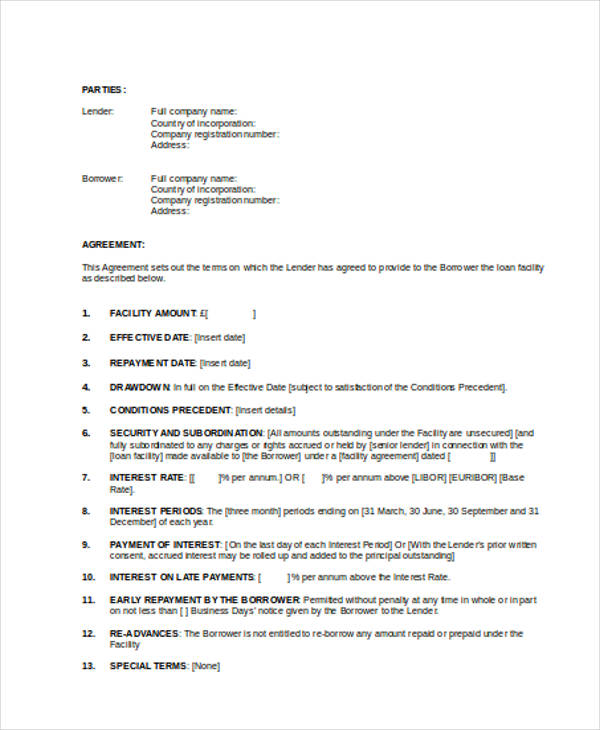

The debt amount and interest. The agreement should have the amount that the debtor will borrow and the associated interest per payment, or per month. It will be up to the lender to decide for the percentage of interest to add in the payment. In an Interest-Free Loan Agreement, the lender should state that there is 0% interest with the debtor’s borrowed amount.

The due date. The date for the end of contract should be stated clearly in the agreement wherein both parties should have agreed. There should also be an ample amount of time for the extension if the debtor will ask to stretch the deadline.

The penalties for damages. Liquidation damages are vital for the Loan Agreement Form. The lender should state what the possible sanctions would be if the debtor will not meet the contract’s arrangements. The penalties will include the breach of contract, the additional fees and the lawsuit to be filed if one of the parties are exceeding the limitations of negligence in the agreement.

The clauses. This should state the rights, privileges, and duties of both parties. It may include the right of a lender to change and modify the terms in the agreement, and the duty of the borrower to submit a Promissory Note to update the lender whenever he is in a situation where his payment will be delayed.

Sample Loan Agreement Forms

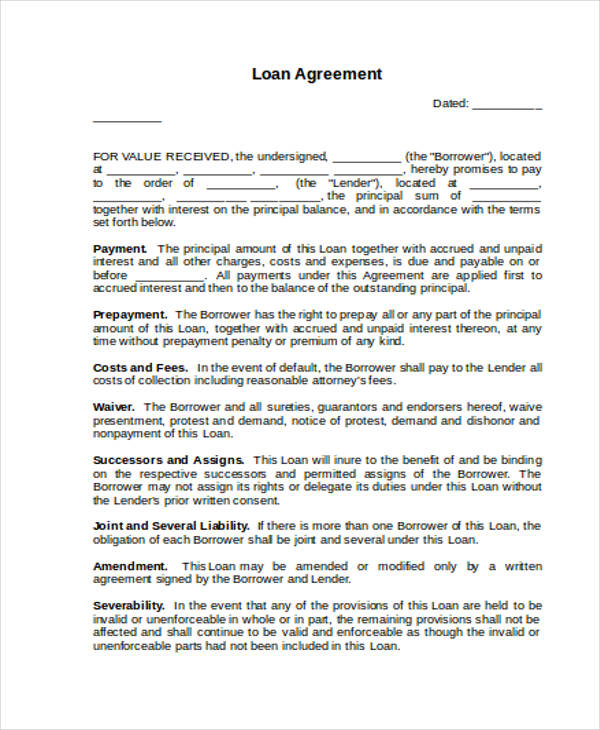

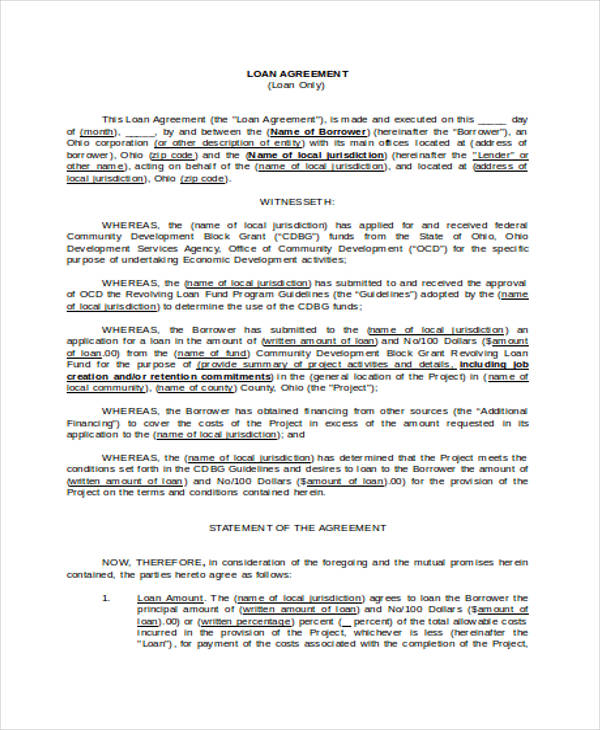

Sample Loan Agreement

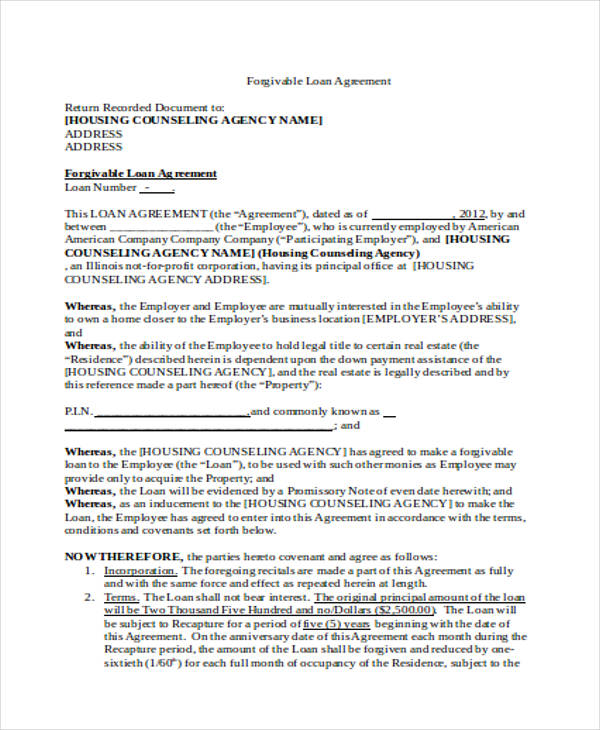

Sample Employee Forgivable Loan Agreement

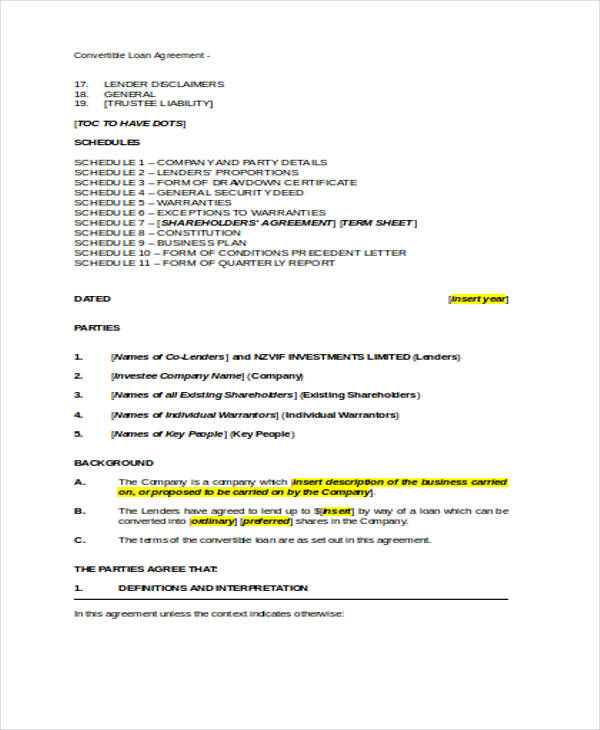

Sample Convertiable Loan Agreement

Printable Vehicle Agreement Forms

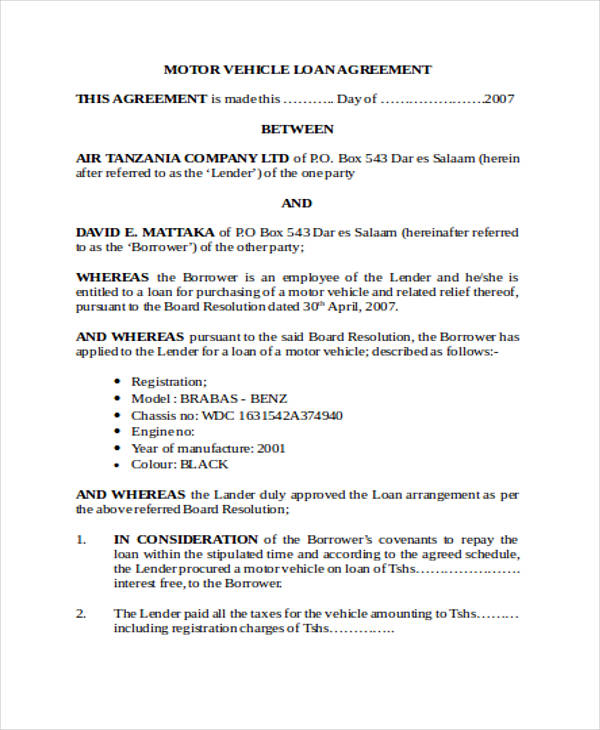

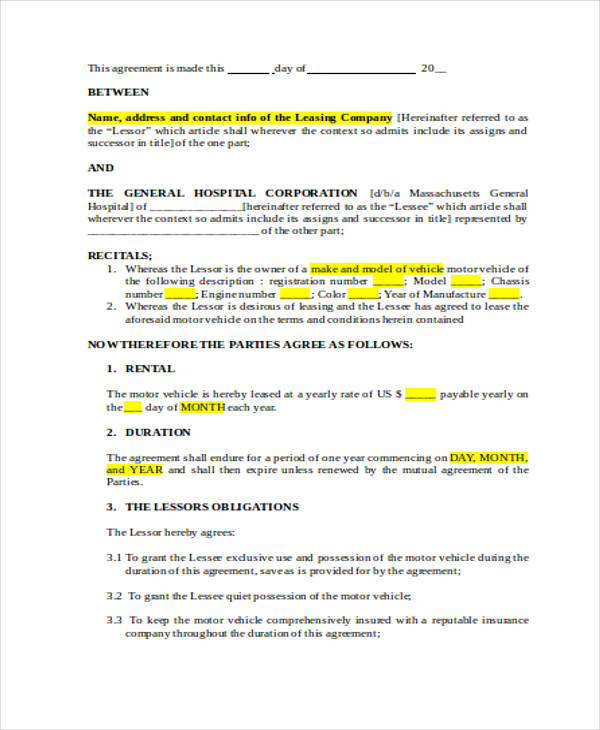

Printable Motor Vehicle Loan Agreement

Printable Vehicle Loan Agreement

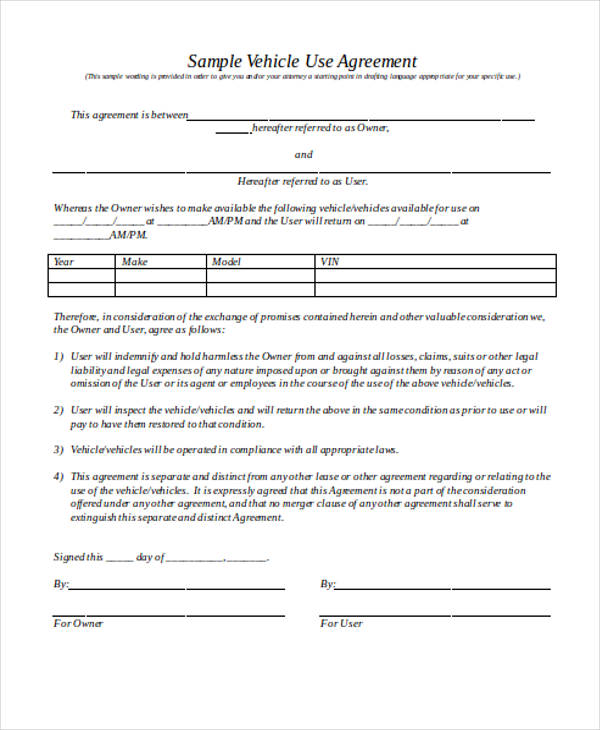

Printable Sample Vehicle Use Agreement

Personal Loan Agreement Forms

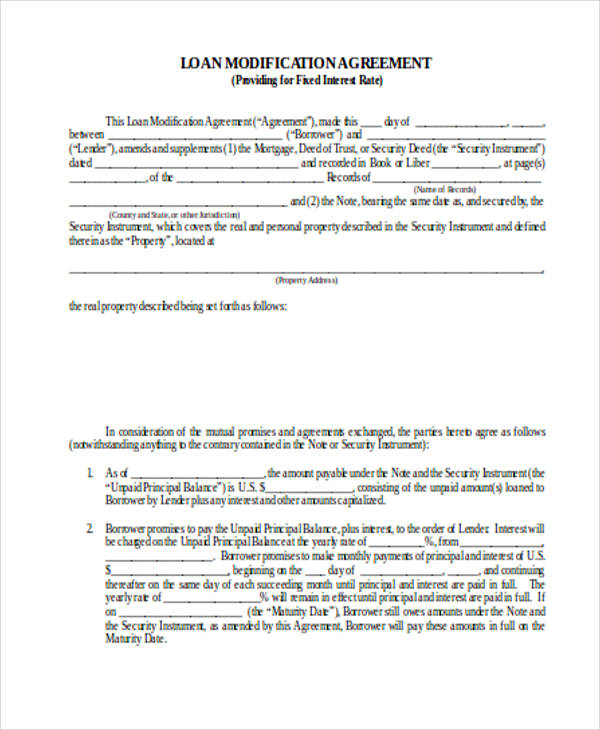

Sample Loan Modification Agreement

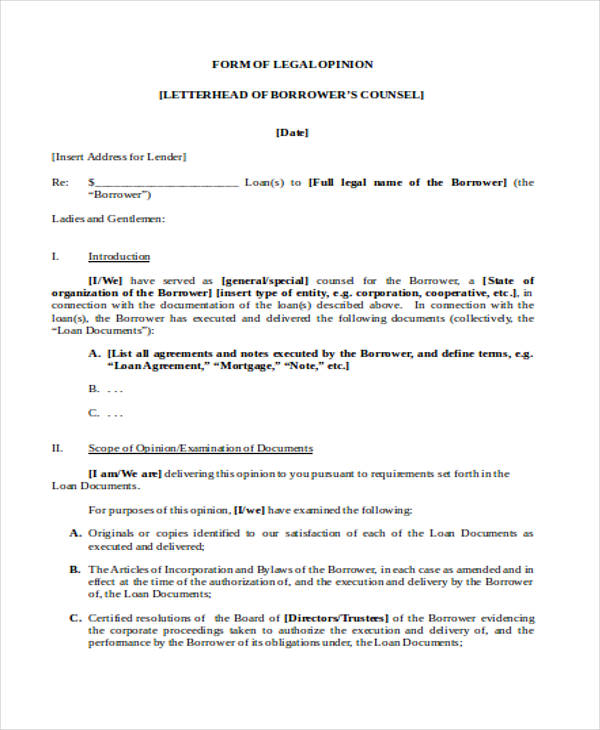

Loan Agreement with Legal Opinion

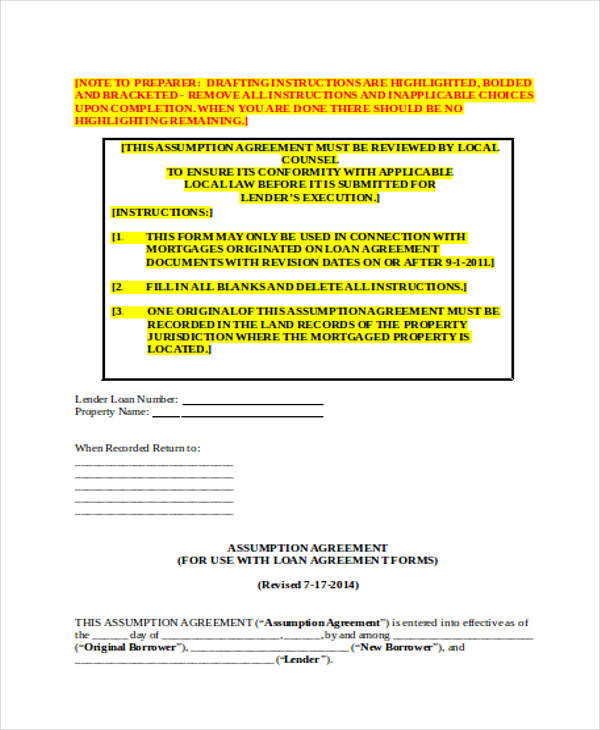

Loan Form with Assumption Agreement

Loan Agreement Contract Forms

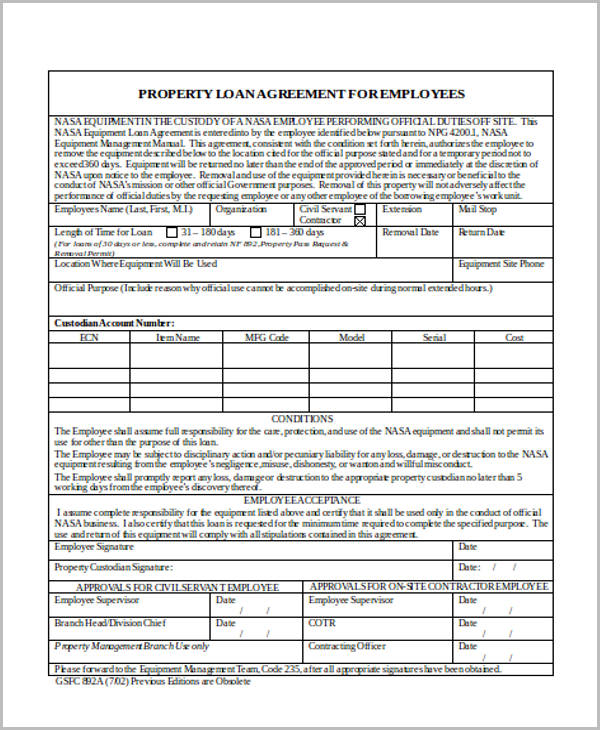

Property Loan Agreement Contract

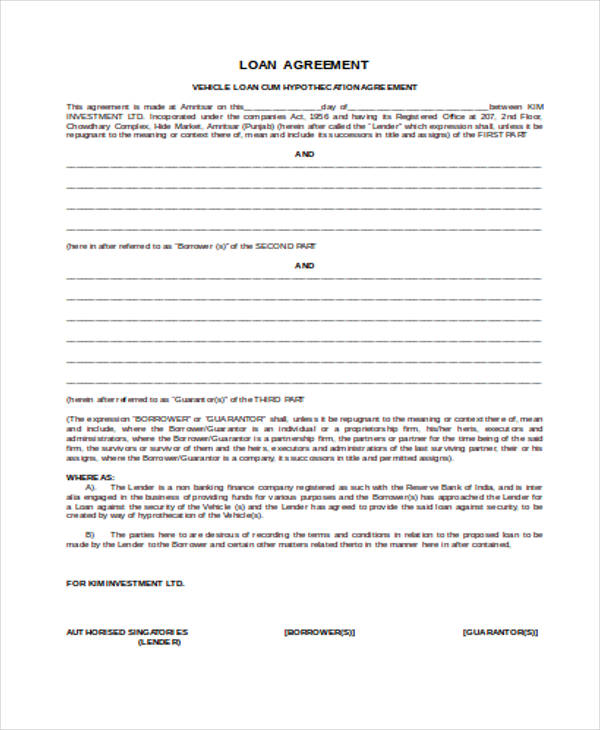

Vehicle Loan Agreement Contract

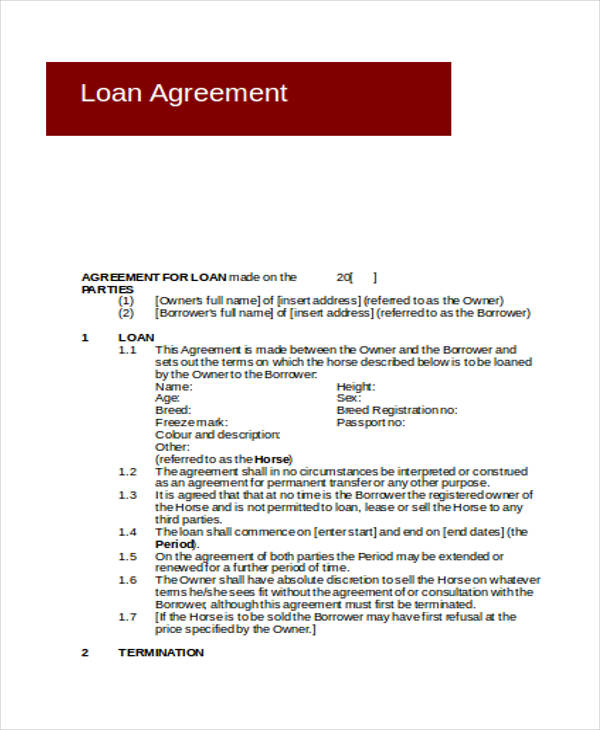

Loan Agreement Example

Loan Agreement Contract Sample

When to Use a Loan Agreement Form?

Loan Agreement Forms should be used whenever you are lending an amount of money to someone and you want to specify terms for the loan. There is also a great chance of reducing the risk of losing the interest if you are a lender when your borrower had signed the agreement. A person should also use the agreement if he wishes to set an amortization table for the interests of the loan.

With the help of a Loan Agreement, an individual will be able to determine the total amount to be paid on or before the due date. An individual should also consider making the agreement if he prefers to have an efficient loan negotiation and transaction.

When negotiating, both parties should be aware of the costs that they are required to pay if they will have a longer time to decide on the terms and conditions of the agreement. In this case, the form could also help both parties to state the duties with regards to paying the attorney’s session.

Types of Loan Agreement Forms

- Consumer Loan Agreement – This agreement form is the most known among the listed types. This contains the basic structure of a Loan Agreement Form which includes the responsibilities of both parties, the breakdown of the loan, the repayment and the prepayment, the late charges, rules of default and the names of the co-borrowers or the guarantors of the debtor.

- Employee Loan Agreement – this agreement form is used when an employee is borrowing money from the company or from an employer. Most purposes for granting an employee loan is often to be used for emergency situations. The agreement will simply state the due date of the loan and the terms of how the loan is to be paid, whether through subtracting the monthly payment from the paychecks or sending a cash on a monthly basis to the employer.

- Promissory Note – this is a type of document where the borrower will have a statement that he will promise to pay the borrowed amount on a specific date to the lender. Often, bank notes and mortgage notes are referred to as a promissory note since it is provided by the bank to the bearer of the note.

- Interest-Free Loan Agreement – this agreement form is for short-term loans wherein the lender will not require any type of interest to the borrower. There are also instances where the lender will request for interest after a few months when the borrower will start paying for the borrowed amount.

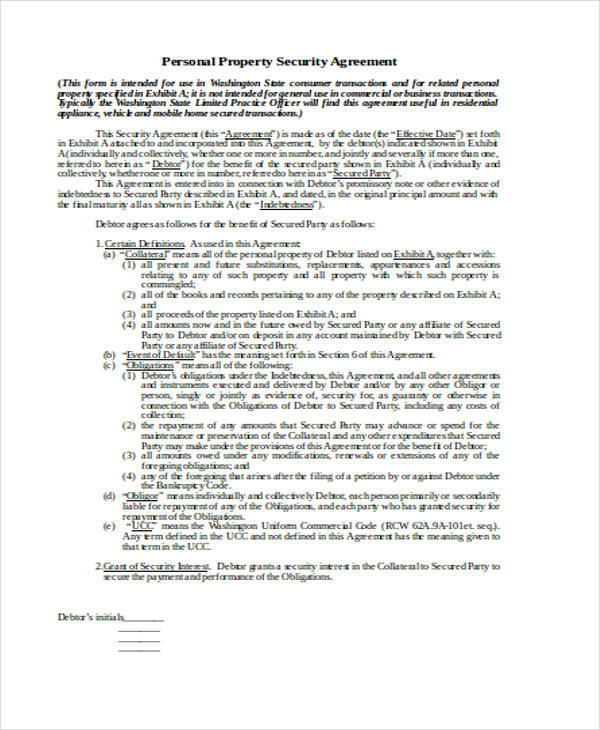

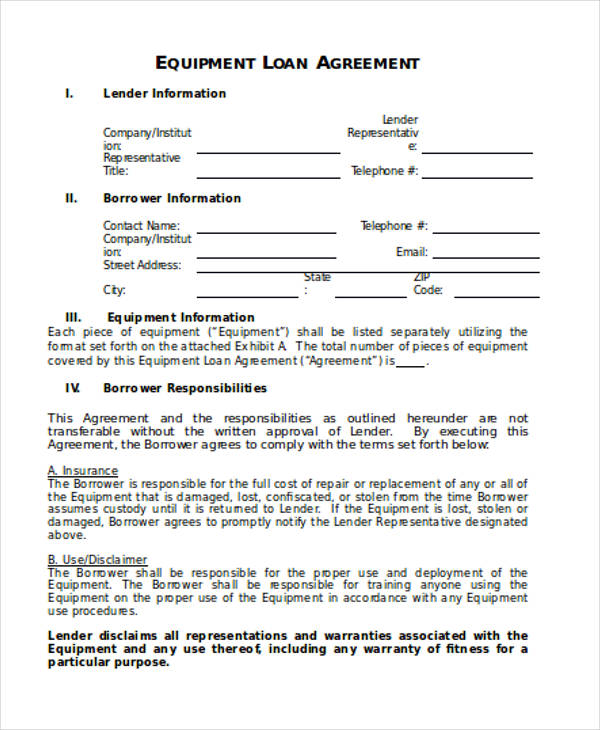

- Personal Property Loan Agreement – this loan agreement form is to be used when a lender will grant a loan type of payment for selling his personal property, such as collectibles, or a furniture. The debtor will be able to use the property as he will continue paying for the amount stated on the agreement. However, if the debtor is not able to pay on time, the lender may take back the property with a few added conditions to the other party. A Motor Vehicle Loan Agreement and an Equipment Loan Agreement are two other forms of agreements under this category.

- Inter-company Loan Agreement – this form is used when a company is granting a loan for another company. This scenario often happens if two companies are partners or if a company is investing unto the other.

- Loan Modification Agreement – this agreement will allow the lender to manipulate areas of the agreement. He may either make the loan more affordable or raise the interest in it.

Legal Loan Agreement Forms

Loan Subordination Agreement Sample

Free Loan Agreement

Security Loan Agreement Forms

Personal Property Security Agreement

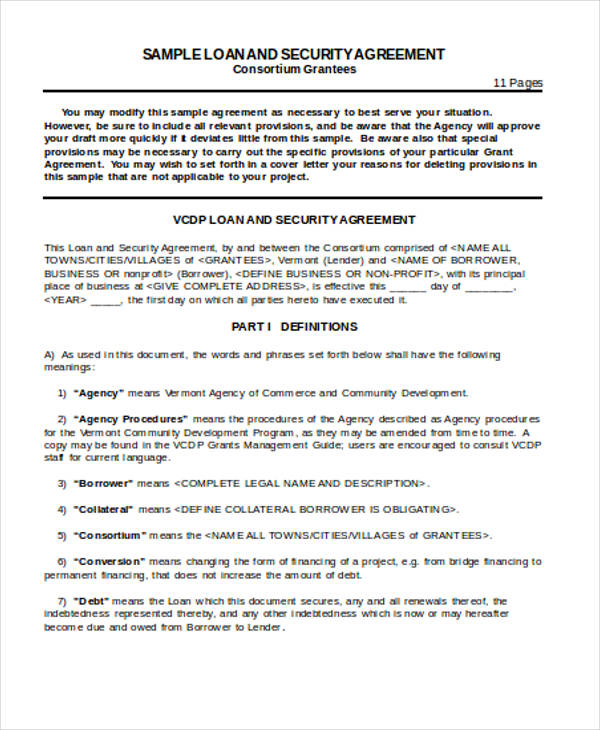

Sample Security Loan Agreement

Free Security Agreement Form

Loan Agreement Forms

Variable Rate Loan Agreement Form

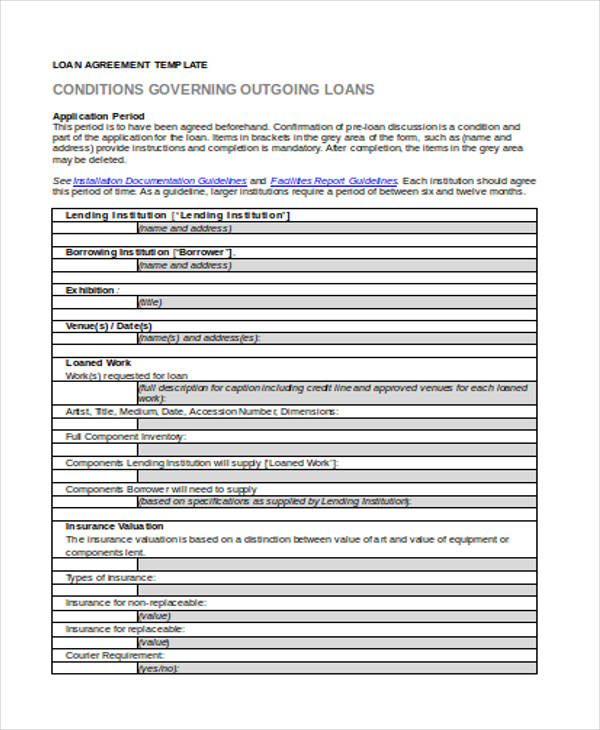

Fine Arts Loan Agreement Form

Sample Loan and Security Agreement Form

Simple Loan Agreement Forms

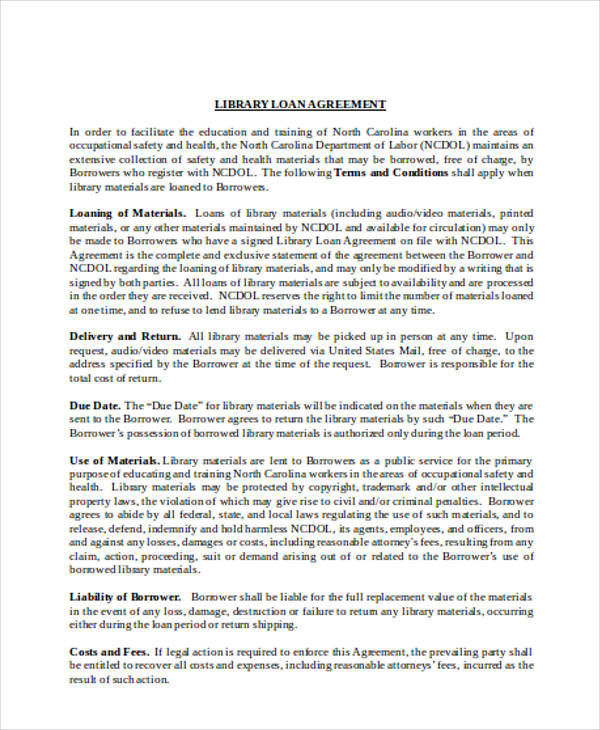

Simple Library Loan Agreement Doc

Simple Equipment Loan Agreement

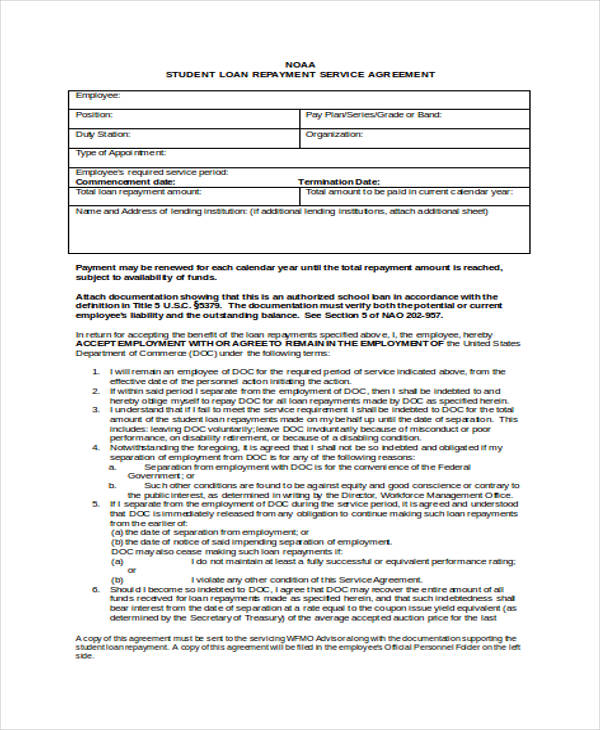

Simple Student Loan Repayment Service Agreement

Tips for Granting a Loan

If you are a lender, people who have borrowed money yet are unable to pay on time can causes a lot of trouble for you. These tips will help you filter those types of people before you let them be a debtor:

- Know the sufficiency. Always ask for the borrower’s assets and his financial stability.

- Know his endurance. This refers to the borrower’s ability in paying the loan even through business shortfalls.

- Make sure that he is clear. This involves the credit status of the borrower, if he is clear of any current credit reports from any organization or bank.

- Identify. Legal identification documents, such as employee ID’s for an Employee Loan Agreement and a university ID for a Student Loan Agreement, should be presented to the lender for a proof that a person is not hiding behind another person’s identity.

- Age limit. To be able to grant a loan, an individual should be on a legal age of 18 and above.

- The residency. Make sure that the debtor is stating the actual location where he is currently living. As much as possible, visit the address that he stated on the agreement form.

- The Guarantors. When the debtor listed down the names of the guarantors, ask for their contact details and addresses. Meet with the guarantor and let them sign with the agreement.

- Savings. For loans that involved large amounts of money, a statement confirming that the borrower has savings in his account is important. Some lenders require a minimum of 5% genuine savings on the borrower’s account to assure that he is fully prepared for any incoming financial difficulties.

- Complete submission. Lastly, the borrower should have submitted a Loan Application Form before the lender will grant his loan. Then, the lender may send in a Loan Estimate Form to grant the borrower’s request.

Real Property versus Personal Property

People are often confused with distinguishing a Real Property from a Personal Property. To ease up their definitions, a Real Property refers to immovable properties while the latter refers to movable properties. Immovable properties include land, machinery, dams and wells, mines, roads, houses, buildings, and real estates. Movable properties can include vehicles, furniture, clothing, artworks and sets of jewelry.

Compared to Real Property, it will be tougher for lenders and creditors to benefit from Personal Property assets since these may or may not be sold for higher prices. There is a tremendous risk when the collateral asset is a vehicle or any movable property since the debtor may just leave the location and move to another place without caring for his debts

Student Loan Agreements

A student of legal age can acquire various loans, such as a Library Loan and a Fine Arts Loan. The Library Loan Agreement Form will be used when a person will borrow a material from one library to another for research purposes.

Books, articles, software applications, DVDs, music and all other necessary research instruments are included in the loan. The Fine Arts Loan Agreement centers on having an artwork as a collateral asset for granting a loan. Often, an artwork from a renowned artist is accepted in loan agencies as long as the artwork is an original piece.

Related Posts

-

FREE 8+ Student Loan Agreement Forms in PDF | MS Word

-

Personal Loan Agreement Form

-

FREE 37+ Loan Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Loan Agreement Forms in PDF | MS Word

-

Employee Loan Agreement

-

FREE 7+ Sample Loan Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Personal Loan Agreements in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word