Security is a big concern nowadays due to the rise of incidents involving delinquents and other sorts of fraudsters, which is why people have come up with different Agreement Forms to ensure their security in every transaction they make and to protect their rights and interests. A Security Agreement Form is a contract entered into by a borrower and a lender to secure a loan. It basically involves a security interest that allows the lender to seize and sell a collateral in the event that the borrower defaults. This is important so that the lender can feel at ease that he will be repaid, thereby ensuring the continuity of his business.

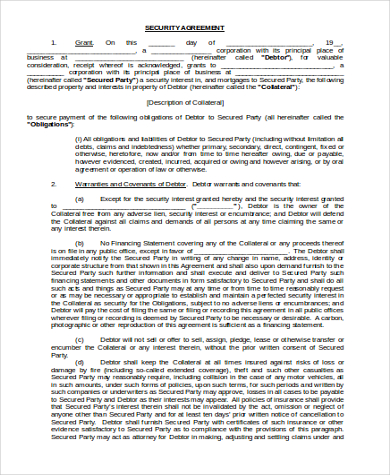

General Security Agreement Form

Loan Resolution Security Agreement Form

Transaction Security Agreement Form

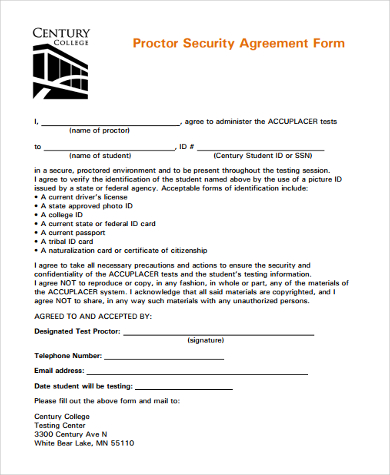

Proctor Security Agreement Form

Vehicle Security Agreement Form Example

Parts of a Security Agreement Form

- Identification of the borrower and the lender: The borrower is the owner of the collateral that will secure the loan.

- Granting the security interest: There has to be an explicit statement that the borrower grants the lender security interest to the collateral once a default occurs.

- Indication of the Loan: The date and loan amount should be included, along with the date of repayment.

- Description of the Collateral: It has to be made clear what the collateral is so it has to be described in detail. If the collateral is a motor vehicle, then the make, model, and serial number should be indicated. A lot of properties and assets can serve as collateral, even intangible properties.

- Placing of Terms and Conditions regarding the Collateral: Security Agreement Forms need to have restrictions set regarding the collateral. For example, if the lender is in possession of it, you should explicitly indicate that he is not allowed to sell it except during the event of a default. He should also maintain the collateral in good condition so that it’s value will not decline, and if necessary, maintain the insurance on it as well.

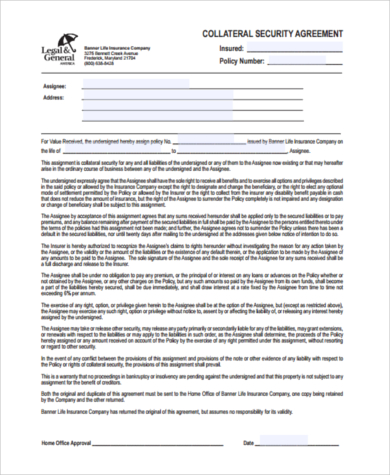

Collateral Security Agreement Form

Security Agreement Form in Word Format

Security Agreement Form in PDF

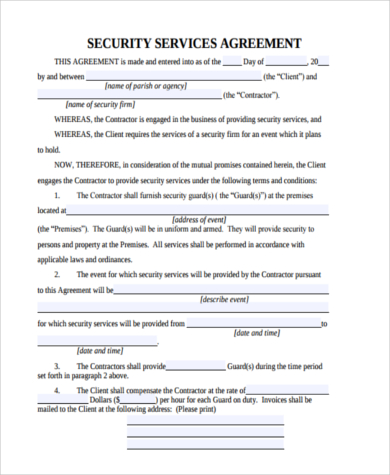

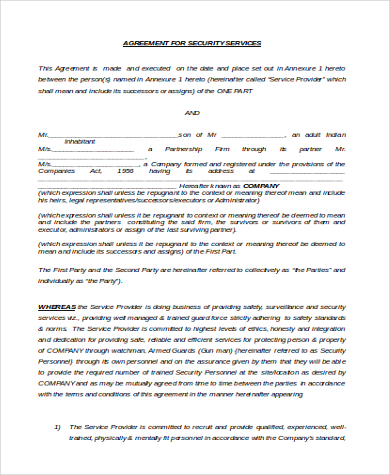

Security Services Agreement Form

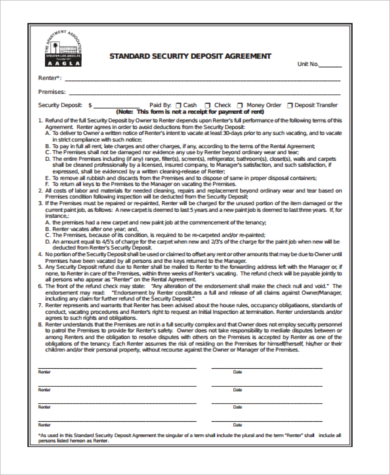

Security Deposit Agreement Form

- Addition of Debtor Warranties: This is a legal promise that the borrower legally owns that collateral and that no one else has claim to it. It should also not have been placed as collateral in another security agreement.

- Definition of Defaults: A default can happen in one of three ways. First is if the borrower fails to repay the loan amount or violates any conditions set in the agreement. Second is if there was any misrepresentation regarding the security agreement or any other related document. The last one is if another secured party claims its rights against the collateral.

- Signatures of Both Parties: This makes the Security Agreement Form official.

Aside from the Collateral Security Agreement Form, there are other kinds of Security Agreement Forms that you can download on this page. One is the Transaction Security Agreement Form that secures a financial transaction and ensures every information is held confidential. Another type is the Proctor Security Agreement Form, which makes sure that a testing environment is secure and proctored. It also makes sure that the proctor is impartial to prevent any bias. You may also see our Contract Agreement Forms for samples of contracts.

Related Posts

-

FREE 9+ Sample Release Agreement Forms in PDF | MS Word

-

FREE 29+ Sample Contract Agreement Forms in PDF | MS Word

-

FREE 30+ Sample Purchase Agreement Forms in MS Word | PDF

-

FREE 8+ Sample Joint Venture Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Subordination Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Shareholder Agreement Forms in PDF | MS Word

-

FREE 10+ Sample Transfer Agreement Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Cooperation Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Reaffirmation Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Asset Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Investment Club Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Patent Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Security Agreement Forms in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word