Navigating the complexities of a loan application form can be daunting, but with the right guidance, it becomes a straightforward task. Our comprehensive guide is designed to walk you through every step of the loan application process, providing you with valuable examples to illustrate each point clearly. Whether you’re applying for a personal loan, mortgage, or business financing, understanding how to accurately complete an Application Form is crucial. This guide ensures you’re well-equipped with the knowledge to fill out your Loan Form accurately, enhancing your chances of approval. By including essential tips and shedding light on common pitfalls, we aim to make the loan application process as smooth as possible for you.

Download Loan Application Form Bundle

What is a Loan Application Form?

A loan application form is a standardized document provided by financial institutions that applicants must fill out when seeking a loan. This form collects essential personal, financial, and employment information from the applicant, which lenders use to evaluate their creditworthiness and decide on the loan approval. It typically includes sections for the loan amount requested, purpose of the loan, applicant’s income and debts, and sometimes collateral details. Simplified, it’s the first step in the loan process, acting as a bridge between potential borrowers and lenders, ensuring that all necessary data is gathered for a loan decision.

What is the Best Sample Loan Application Form?

This sample loan application form is designed to collect necessary information from individuals applying for a loan. It can be customized to suit the specific requirements of different financial institutions.

Loan Application Form

Personal Information

- Full Name: ___________________________

- Date of Birth: ________________________

- Social Security Number: _______________

- Phone Number: ________________________

- Email Address: ________________________

- Current Address: ______________________

- Previous Address (if less than 2 years at current): ______________________

Employment and Income Information

- Current Employer: _____________________

- Employer Address: _____________________

- Position: ____________________________

- Length of Employment: _________________

- Monthly Income: ______________________

- Other Income Sources: __________________

Loan Information

- Loan Amount Requested: ________________

- Purpose of Loan: ______________________

- Loan Term (Years): ____________________

Financial Information

- Bank Account Type (Checking/Savings): ____

- Account Number: ______________________

- Outstanding Debts: ____________________

- Monthly Obligations (Rent, Loans, etc.): ____

References

- Reference 1 (Name, Relationship, Contact): ____

- Reference 2 (Name, Relationship, Contact): ____

Declaration and Signature I hereby declare that the information provided is true and accurate to the best of my knowledge. I authorize [Lender’s Name] to verify the information provided and to conduct a credit check.

- Signature: ___________________________

- Date: _______________________________

Instructions for Applicants:

- Fill out all sections completely and accurately.

- Provide additional documentation as required (e.g., proof of income, identification).

- Read and understand the terms before signing.

Note: This form is a basic template and should be adapted to comply with local laws and the specific requirements of the lending institution.

Loan Application Form Format

Section 1: Applicant Personal Information

- Full Name

- Date of Birth

- Social Security Number/Identification Number

- Marital Status

- Contact Information (Phone Number and Email Address)

- Current Residential Address

Section 2: Employment and Income Details

- Current Employer and Job Title

- Type of Employment (Full-Time, Part-Time, Self-Employed)

- Monthly or Annual Income

- Length of Current Employment

- Other Sources of Income

Section 3: Loan Information

- Desired Loan Amount

- Purpose of the Loan

- Preferred Loan Term (Duration in Months or Years)

Section 4: Financial Information

- Monthly Expenses (Include rent/mortgage, loans, credit cards)

- Assets (Property, Investments)

- Liabilities (Existing Debts)

Section 5: References

- Reference 1: Name, Relationship, Contact Information

- Reference 2: Name, Relationship, Contact Information

Section 6: Declarations and Consent

- Agreement to Terms and Conditions

- Consent to Credit and Background Checks

- Applicant’s Signature and Date

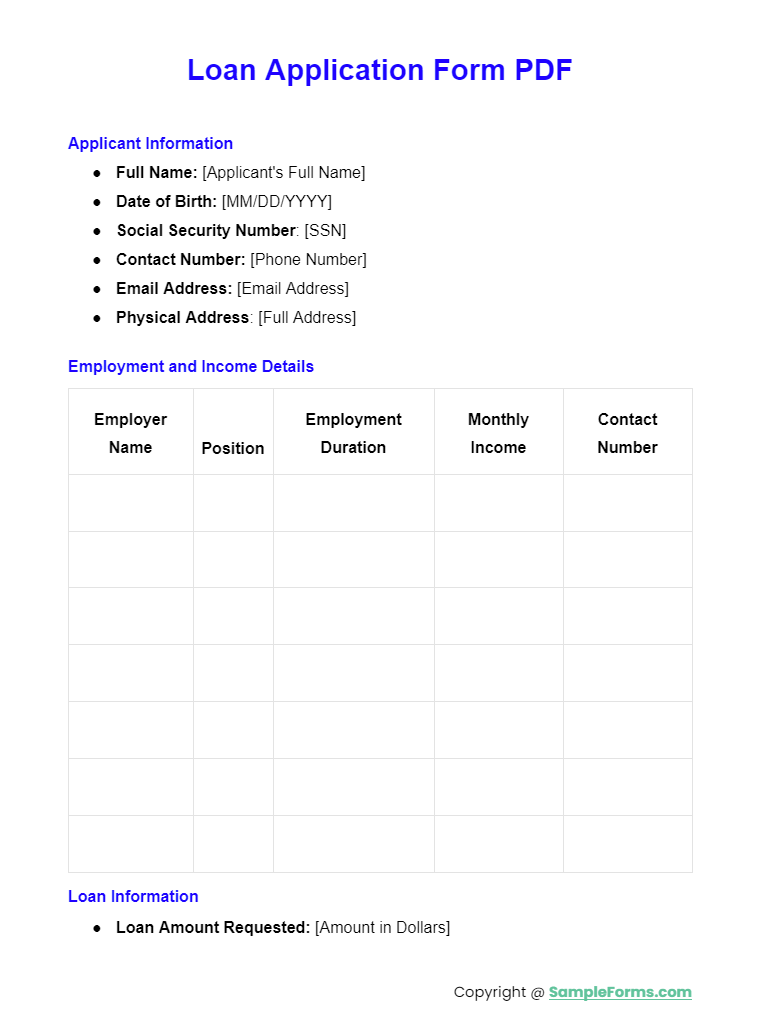

Loan Application Form PDF, Word, Google Docs

A Loan Application Form PDF simplifies the lending process, providing a digital Loan Confirmation Form and Loan Agreement Form Word document. It ensures accuracy and ease in compiling necessary financial details for both lender and borrower.

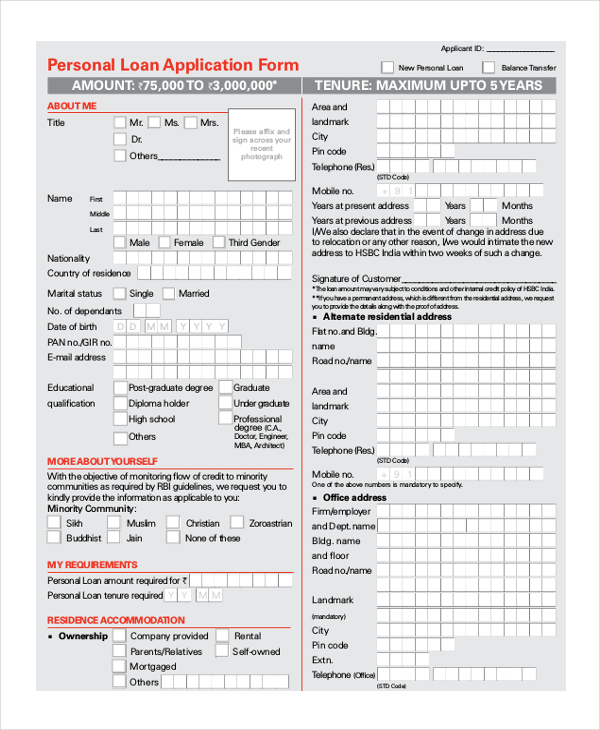

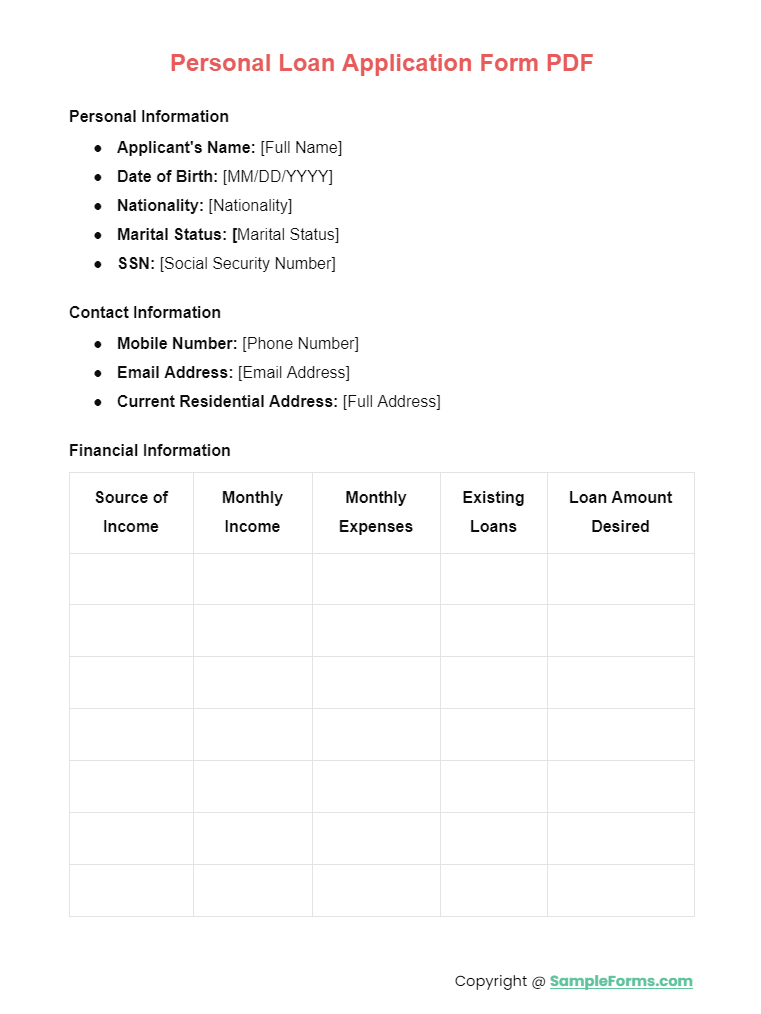

Personal Loan Application Form PDF

The Personal Loan Application Form PDF streamlines applications for personal needs, incorporating elements of a Business Application Form and Volunteer Application Form. It’s a comprehensive solution for various loan application requirements.

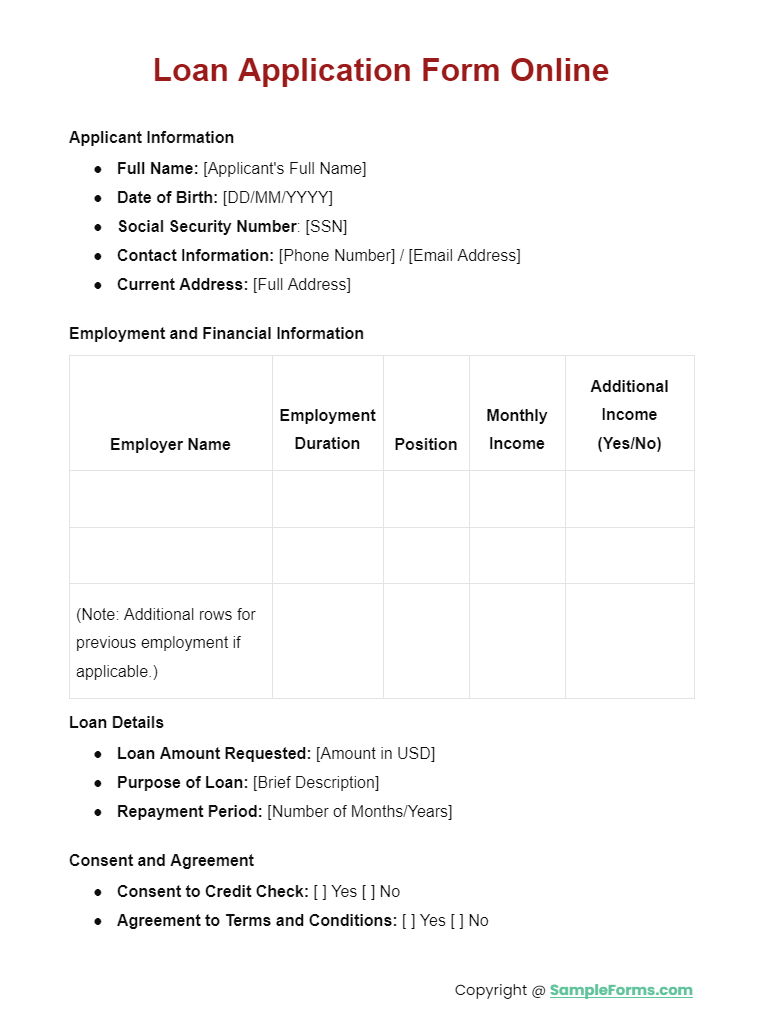

Loan Application Form Online

Applying for loans becomes more accessible with an Online Loan Application Form, integrating the Personal Loan Agreement Form and Loan Agreement Form. This digital format enhances convenience and efficiency in loan processing.

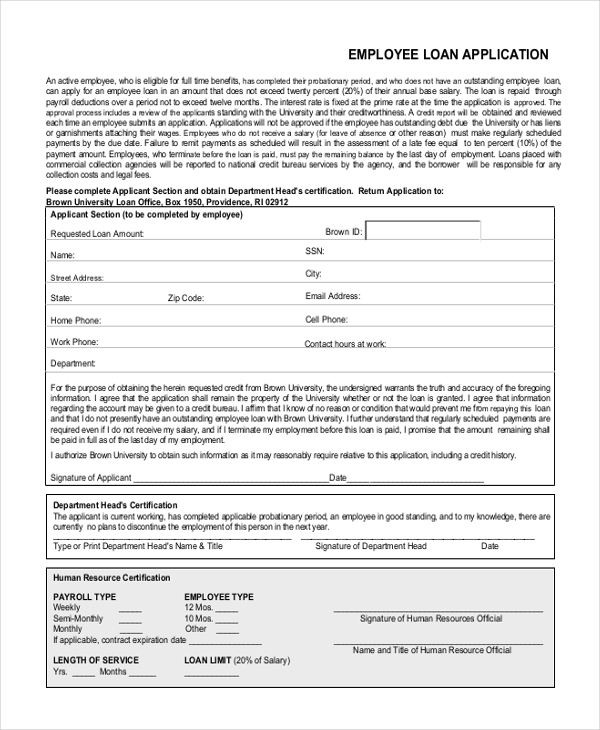

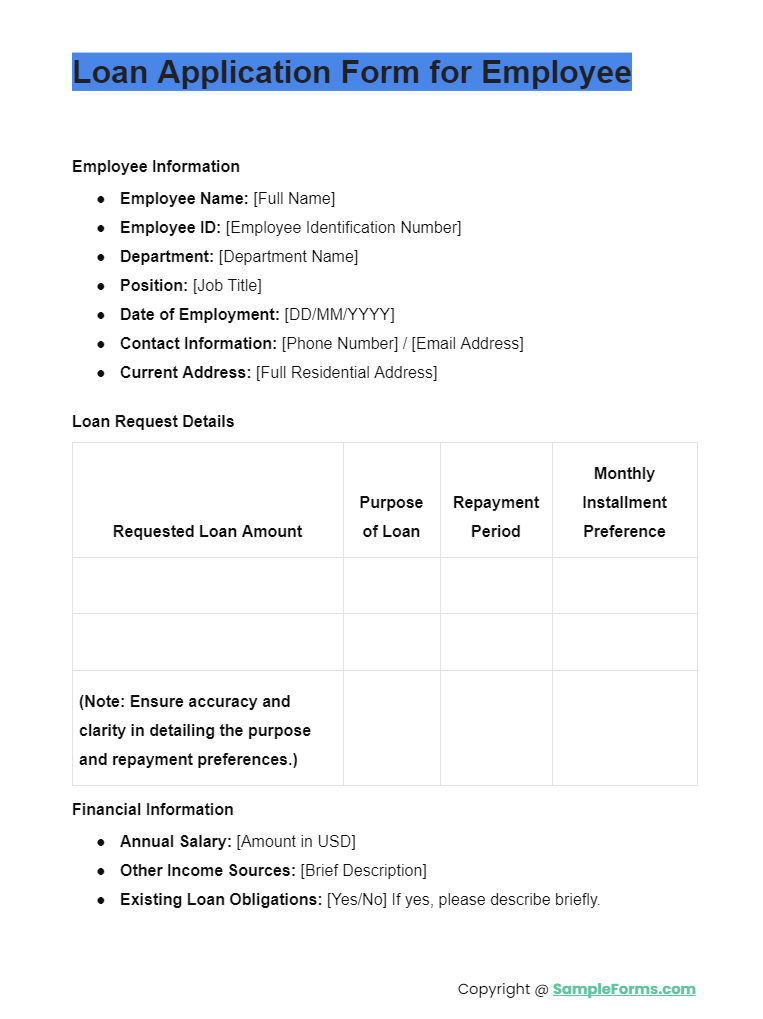

Loan Application Form for Employee

An Employee Loan Application Form caters specifically to working professionals, including terms of an Employee Loan Agreement, Car Loan Application Form, and Internship Application Form. It facilitates employees in navigating loan options seamlessly.

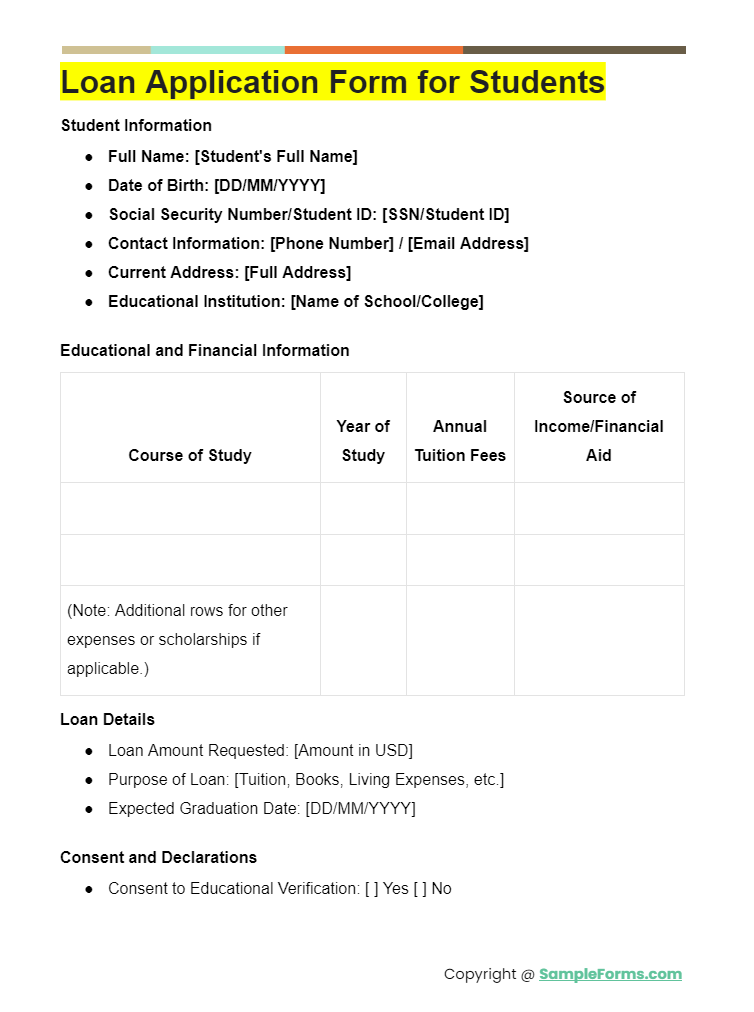

Loan Application Form for Students

More Loan Application Form Samples

Sample Personal Loan Application Form in PDF

A lender needs to know a lot about you before they can concede to give you a loan. As such, this form requires that you fill in as much information as required by the lender.

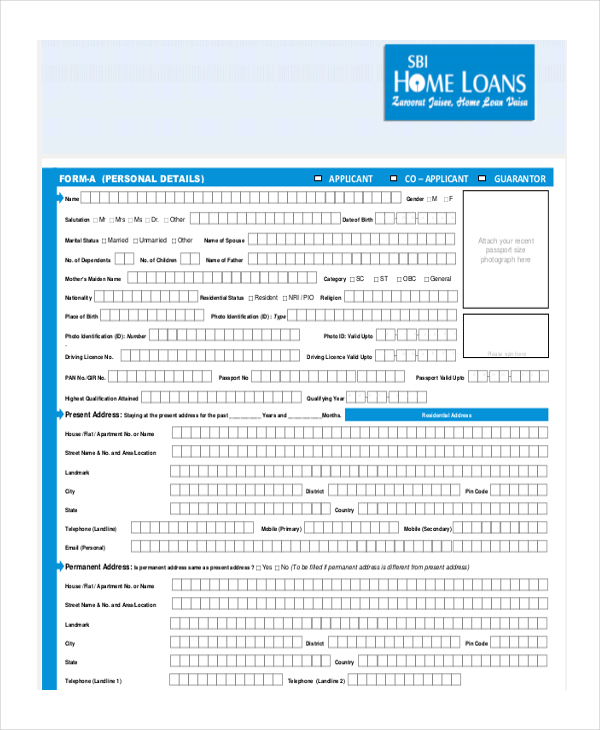

Home Loan Application Form Example

Did you know that you could now get a home loan from any bank only a few days after submitting your application? If you seriously need the loan to build a new home, use this from to apply for one.

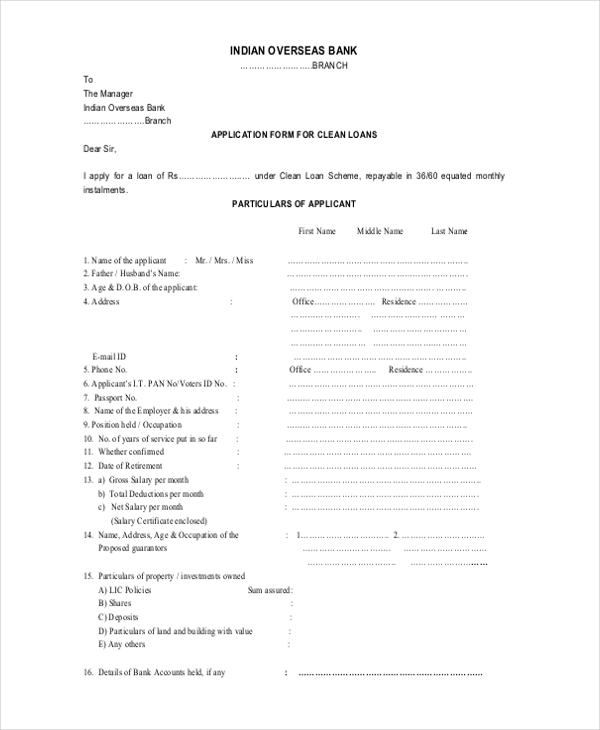

Simple Application Form for Clean Loans

If you have a healthy credit history, you can use this form to apply for whatever amount of loan from a bank or any other lending institution. The form is easy to fill. you may also see Bank Loan Application Form and Checklist Forms.

Employee Loan Application PDF

Employees do take loans from their banks, especially when they feel financially stuck in the middle of the month. You can download and use this form to apply for a bank loan.

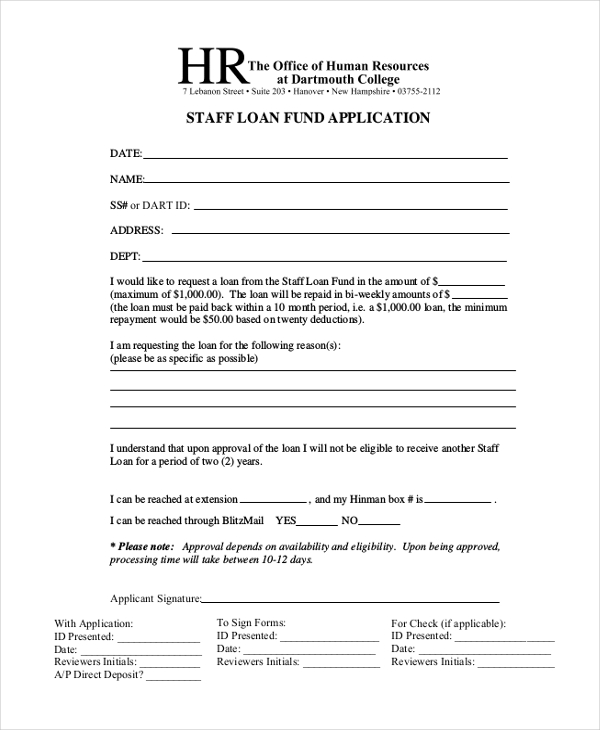

Staff Loan Fund Application Form

If you see the likelihood of running short of money before your next payday, you can use this form template to apply for a loan. The form is print-ready, and it is easy to fill.

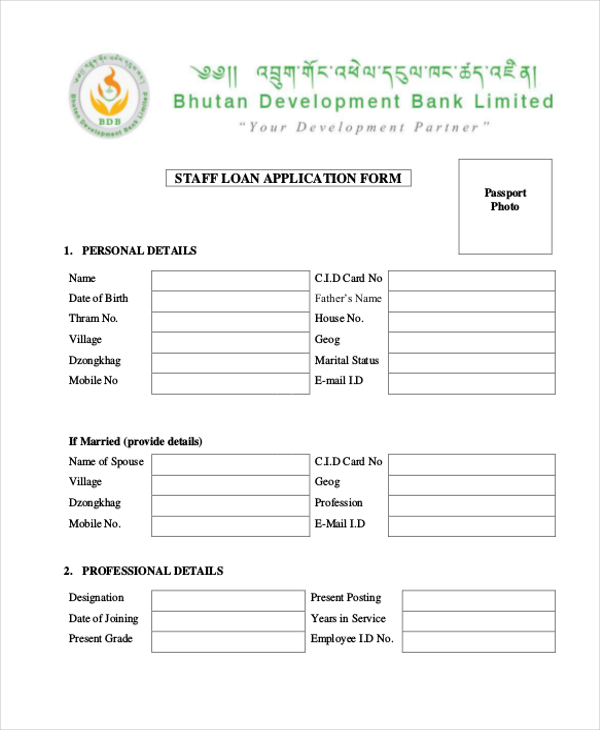

Company Staff Loan Application Form

The loan application form is easy to fill. All you have to do is to read it through, and then fill the application by answering the questions asked. Of course, the template is free to download.

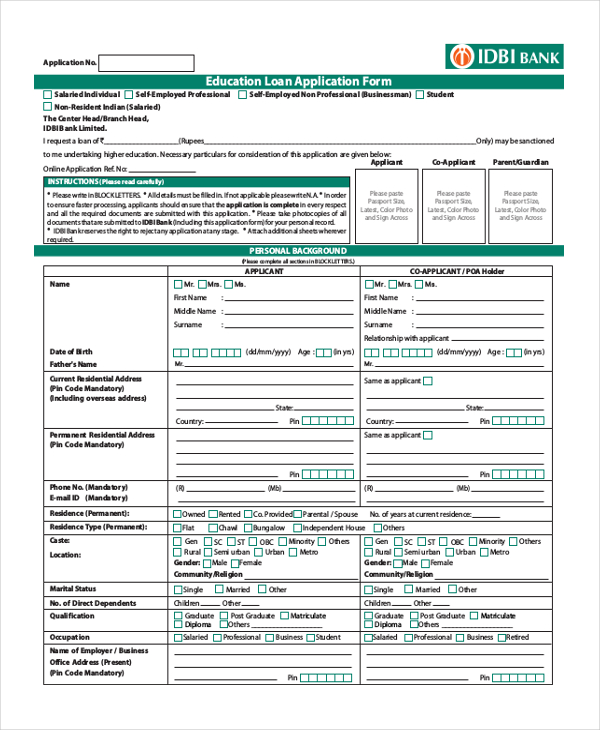

Blank Education Loan Application Form

Students who are not able to pay for their school fees can still go to school and further their studies. All they have to do is fill this loan application form, and then use the form to borrow money from a lending company.

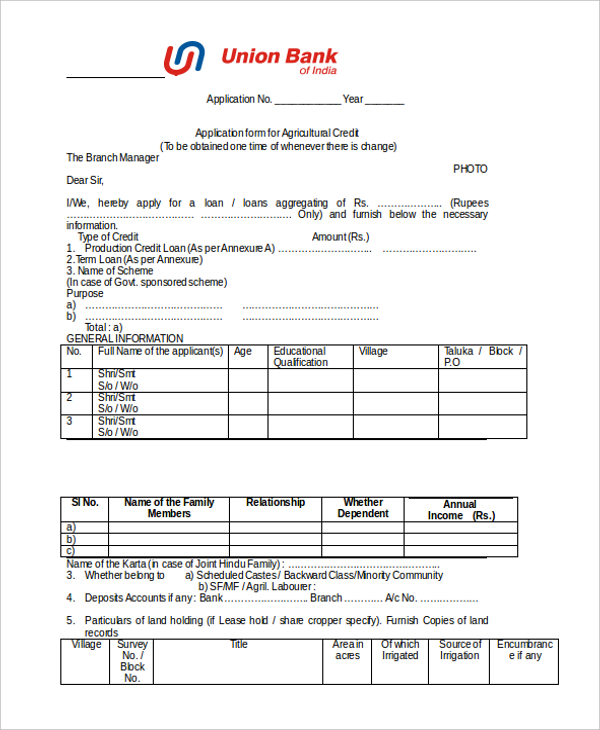

Agricultural Loan Application Form in Word

If you are planning to start an agriculture project but you don’t have enough money, you could fill this form, and then use it as your primary tool for borrowing money from a lending institution.

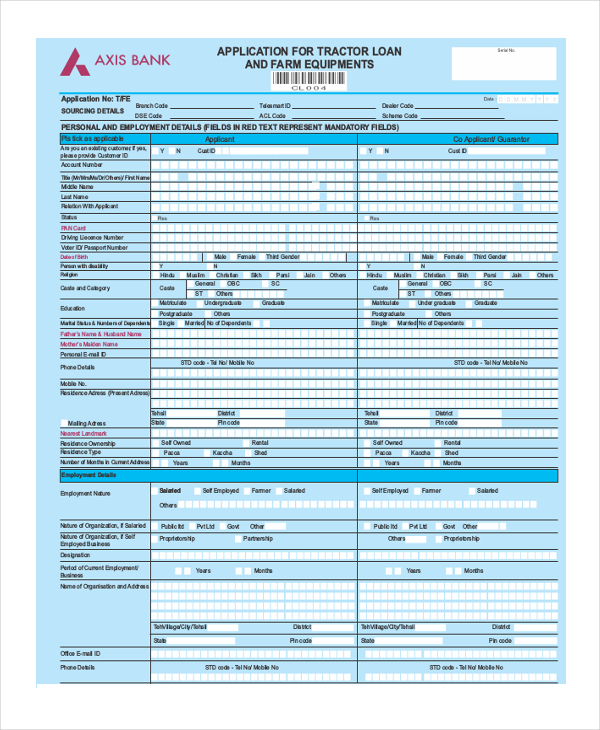

Tractor Loan Application Form in PDF Format

You can take a tractor loan if you are sure that you will not have a problem repaying the loan in the future. You can submit your application to a potential lender by filling this form.

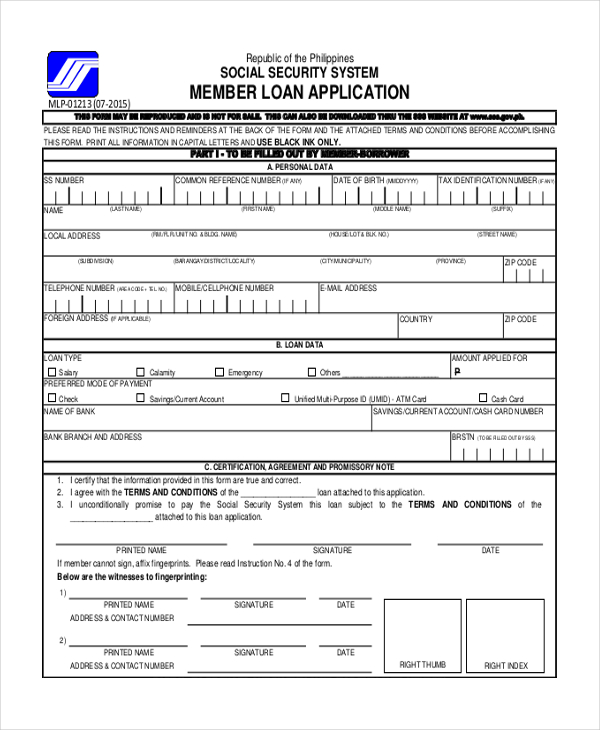

Free Member Loan Application Form

If you are a member of a profitable union, you could borrow a loan from a lending institution to be used to finance projects for your group. You can use this for to apply for the loan.

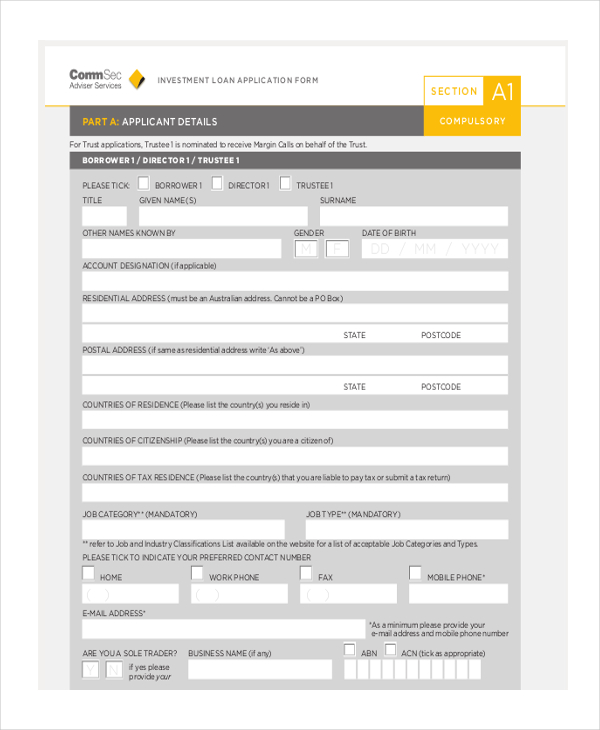

Editable Investment Loan Application Form

The best thing with investing is the assurance that you will be able to repay the funds to the borrower within the agreed time. You can use this form to send your application.

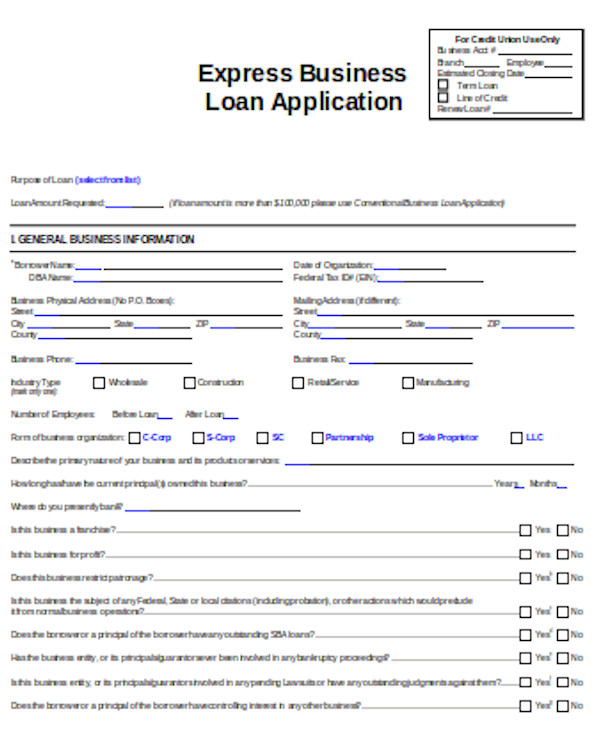

Business Loan Application Form in Word

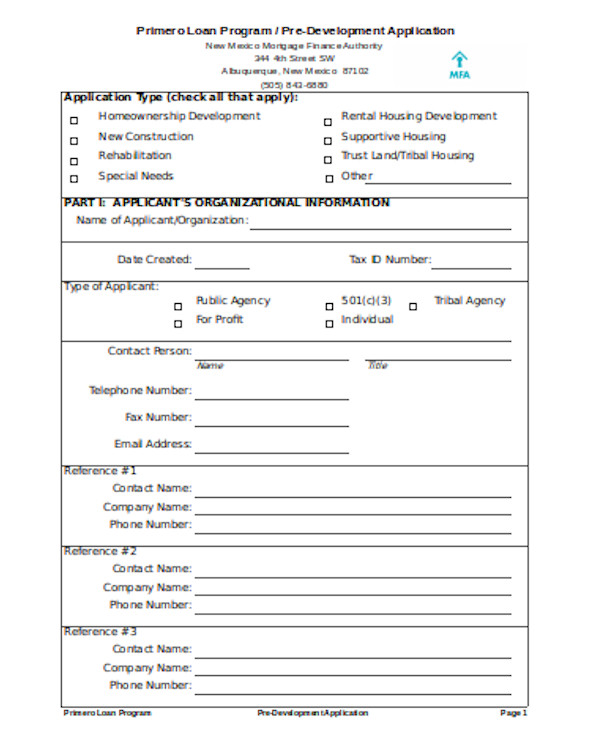

Printable Loan Program Application Form

The three things you must have before your lender can offer you any loan

Although it is easy to apply for a loan, chances that a lender will concede to your request almost always depends on three main things. Let’s look at each requirement. Useful Student Application Form.

Credit history

A lending institution will never lend you money unless they see your credit history. Understand one thing: financial lenders often look asks to have a look at your credit history to be sure that they will not be hitting below the belt by offering you the loan that you would like to borrow. They want to be sure that you can make repayments of your loans on time, and the best way to do this is to look at your credit history. If your credit history is bad, the lender may hesitate to give a loan – some won’t give you a loan until you correct your credit scores.

Bank Account

You cannot secure a loan from a financial lender or a bank if you do not have a bank account. Today, many banks that offer loans to customers only do so to customers that are member. If you are borrowing from a private lender that’s not a banking institution, a bank account will do. You can also see Marriage Application Form.

Collateral

Before lenders can offer you a larger sum of money, they need to know whether you have collateral or not. Of course, you must provide the security; otherwise, you cannot get the loan at all. For example, if you are taking a home loan, your car or piece of land can be the best security, just in case you fail to repay the loan.

How to apply for Loan Application?

Applying for a loan involves several steps to ensure you meet the lender’s requirements and understand the terms of the loan. Here’s a general guide:

- Determine Your Needs: Identify why you need the loan and how much you need to borrow.

- Check Your Credit Score: Your credit score will significantly impact your loan approval and terms. Obtain a credit report to understand your creditworthiness.

- Research Lenders: Compare different lenders, including banks, credit unions, and online lenders, to find the best rates and terms.

- Gather Necessary Documents: Prepare essential documents such as proof of income (pay stubs, tax returns), identification (driver’s license, passport), and employment verification.

- Complete the Loan Application: Fill out the loan application form provided by the lender. This can usually be done online or in person. Ensure all information is accurate and complete.

- Submit the Application: Submit your application along with the required documentation.

- Undergo a Credit Check: The lender will conduct a credit check to assess your credit history and repayment capacity.

- Wait for Approval: The lender will review your loan application form and make a decision. This process can take from a few hours to several days.

- Review the Offer: If approved, review the loan offer carefully. Pay attention to the interest rate, repayment terms, and any fees.

- Accept the Loan: If you agree to the terms, accept the loan. You may need to sign a contract.

- Receive Funds: Once everything is finalized, the lender will disburse the funds, often directly to your bank account.

- Repay the Loan: Make timely repayments as per the agreed schedule to avoid penalties and maintain a good credit score.

Remember, each lender may have specific requirements and processes, so it’s important to follow their guidelines closely. Additionally, consider the necessity and affordability of the loan before applying to avoid financial strain.

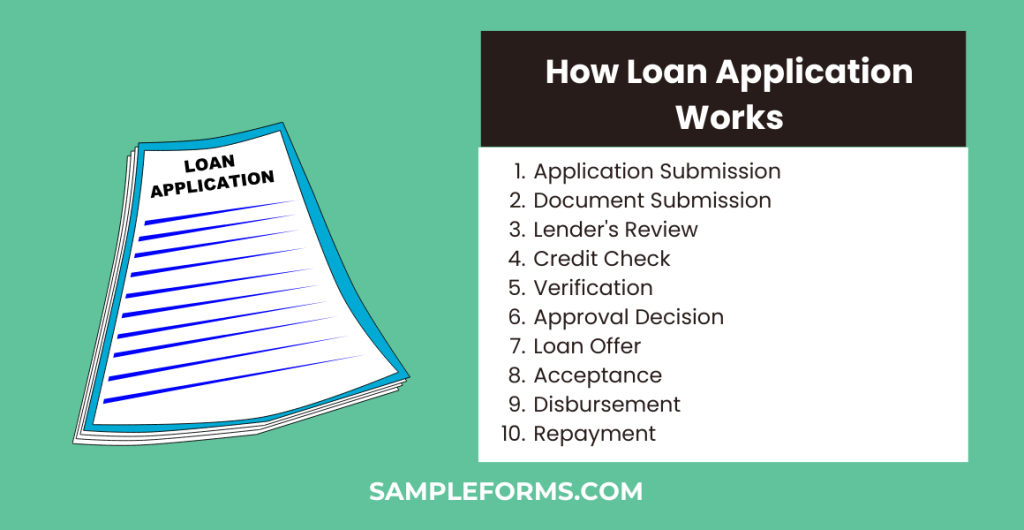

How does a Loan Application Work?

A loan application works as a formal process where an individual or business requests to borrow money from a lender, typically a bank or financial institution. Here’s how the process generally unfolds:

- Application Submission: The borrower fills out a loan application form, providing personal, financial, and employment information.

- Document Submission: The borrower submits necessary documents, such as proof of income, credit history, and identification.

- Lender’s Review: The lender reviews the application to assess the borrower’s creditworthiness, including credit score, income stability, debt-to-income ratio, and repayment history.

- Credit Check: The lender performs a credit check to evaluate the borrower’s credit history and risk level.

- Verification: The lender may verify the information provided, including employment status and financial data.

- Approval Decision: Based on the review and verification, the lender decides whether to approve or reject the loan application.

- Loan Offer: If approved, the lender presents a loan offer with details like loan amount, interest rate, repayment terms, and any fees.

- Acceptance: The borrower reviews the offer and, if agreeable, accepts the terms, often by signing a loan agreement.

- Disbursement: The loan amount is then disbursed to the borrower, either as a lump sum or in installments, depending on the loan type.

- Repayment: The borrower starts repaying the loan as per the agreed schedule, which includes principal and interest.

This process can vary slightly depending on the type of loan, the lender, and the borrower’s specific circumstances. Our Credit Application Forms is also worth a look at.

What happens after Loan Application is Accepted?

What is Loan Application Approval?

Loan application approval is the process where a lender, such as a bank or financial institution, agrees to provide a loan to an applicant. This decision is made after a thorough review of the applicant’s financial background, including credit history, income, employment status, and debt-to-income ratio. Approval indicates that the lender is confident in the applicant’s ability to repay the loan under the agreed terms and conditions, such as the loan amount, interest rate, repayment period, and any other relevant stipulations. Once approved, the borrower can proceed to finalize the loan agreement and receive the funds. You also see Passport Application Form.

Who Processes Loan Applications?

Loan applications are typically processed by loan officers or underwriters working at financial institutions such as banks, credit unions, or online lending companies. These professionals are responsible for reviewing the applications, assessing the creditworthiness of applicants, verifying financial information, and making decisions on loan approvals based on established lending criteria and guidelines. In addition, you should review our College Application Form.

How do I write a Loan Application Form?

To write a Loan Application Form, treat it like a Job Application Form. Include personal, financial details, and the loan amount, ensuring clarity and completeness in your application.

What is the most common Loan Application Form?

The most common Loan Application Form is akin to a Leave Application Form, typically used for personal, mortgage, and auto loans, due to its broad applicability.

How can I get a Personal Loan Immediately?

To get a Personal Loan immediately, complete a Scholarship Application Form or Membership Application Form. Ensure your credit score and documents are ready for quick approval.

What do you need to get approved for a Loan?

Getting approved for a Loan requires a process similar to an Examination Application Form. It involves providing financial records, employment verification, and credit history.

Do personal Loan Companies check your bank account?

Yes, similar to an Employment Application Form or Loan Proposal Form, personal loan companies may review your bank account to assess your financial stability and income flow.

Related Posts

-

Recruitment Application Form

-

FREE 8+ Commercial Property Application Forms in PDF

-

FREE 18+ Leave Cancellation Forms Download – How to Create Guide, Tips

-

FREE 6+ Business Credit Checklist Forms in PDF

-

FREE 6+ Background Check Application Forms in PDF | MS Word

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 9+ Articles Of Organization Forms in PDF

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word

-

FREE 6+ House Rental Application Forms in PDF | MS Word | Excel

-

FREE 10+ Sponsor Application Forms in PDF | MS Word | Excel

-

Security Guard Application Form