Several “Startups” or small businesses are sprouting like mushrooms these days. Most of these startups are founded by millennials engaged in different industries, such as online platforms and handicrafts. Millennials both love to group with like-minded people and to be versatile in all things. The same goes for when they start building businesses. Most “Startups” are registered as LLCs or Limited Liability Companies which features the versatility and flexibility of a partnership, and, the limited liability of a corporation.

bb_toc content=”][/bb_toc]

What Is An LLC?

An LLC or a Limited Liability Company is a business structure that combines the tax flexibility properties of a Sole Proprietorship and Partnership, and the limited liability of a Corporation. It means that their income is treated and taxed as personal income at the same time. Like corporations, LLCs are also protected from personal liability, especially if the company has gone insolvent due to debt. LLC is a flexible business structure. While its income can be taxed as personal income, members of the board can also elect for the company to be taxed as a corporation.

How Are LLCs Formed

Forming an LLC starts with a business partners’ meeting. Here they’ll decide on the name their business would carry, draft a limited liability as a legal agreement, creating a corporate statute and its articles of organization. After the meeting, they will then hire the services of a registered agent to receive legal service, government forms, and notice on behalf of the company. An LLC should also comply with the State’s business licensing requirements during its formation.

Articles Of Organization

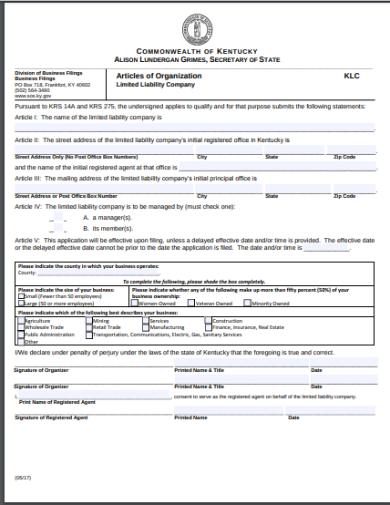

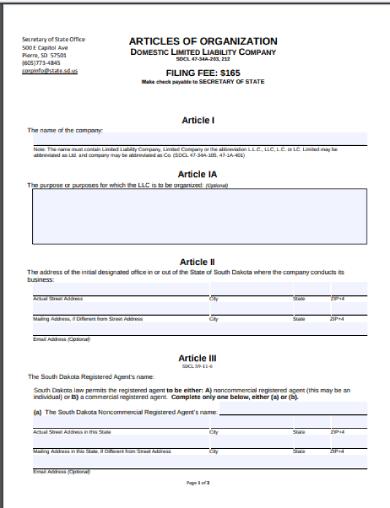

One of the most important documents in forming an LLC is completing an Articles of Organization. Articles of Organization are similar to Articles of Incorporation. It details a business’s identity, management structure, and its members. The Articles of Organization also establishes the LLC members’ powers, responsibilities, obligations, rights, and duties in the company and to its fellow members.

Sample Articles Of Organization Form

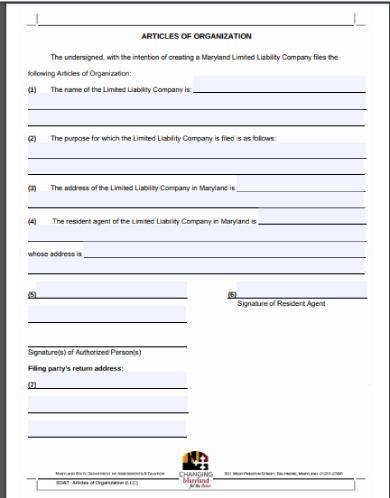

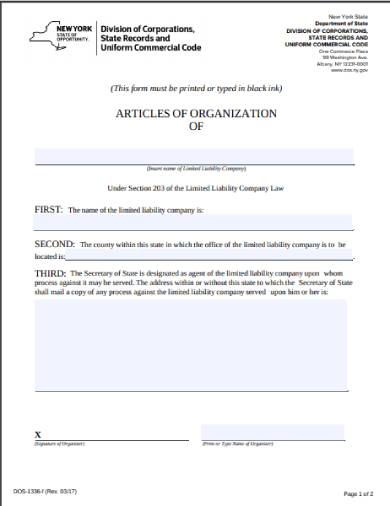

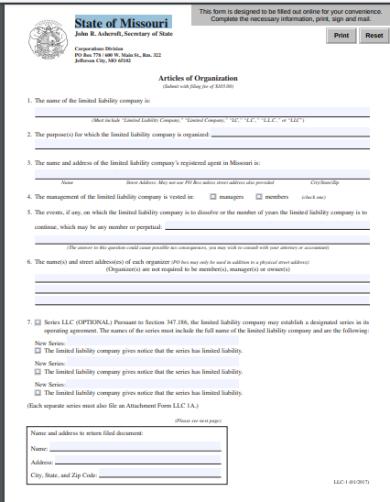

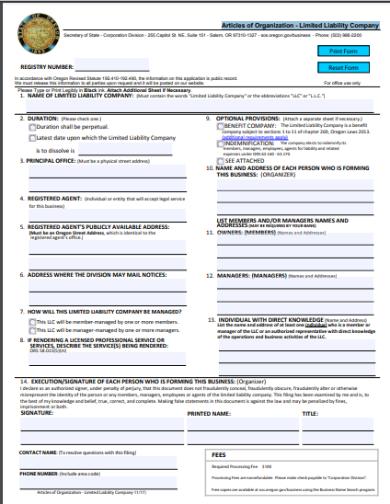

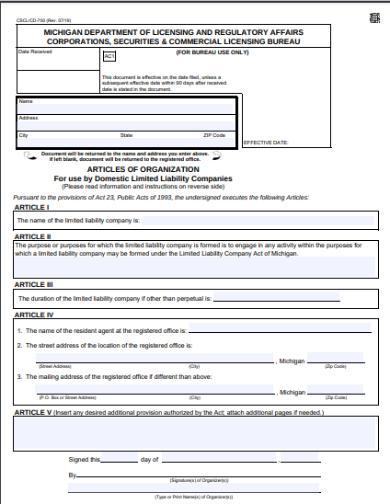

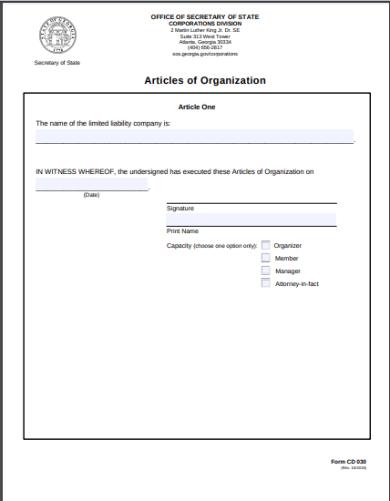

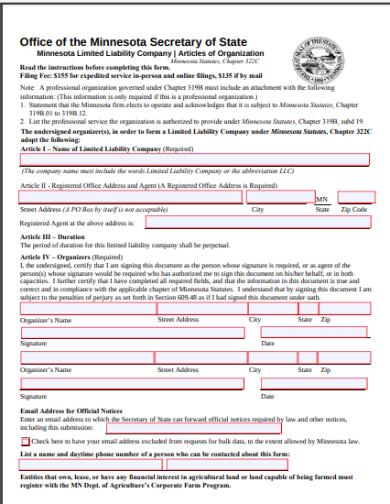

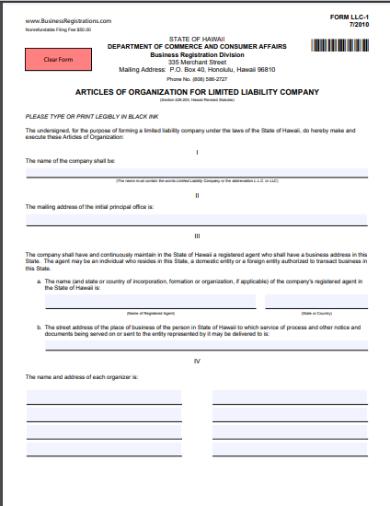

Below are samples of Articles of Organization Forms that you can download for free and fill out for submission.

State Of Maryland Articles Of Organization Form

New York State Articles Of Organization Form

State of Missouri Articles Of Organization Form

Oregon State Articles of Organization – Limited Liability Company

Michigan State Department Articles Of Organization Form

State Of Georgia Articles Of Organization Form

Minnesota State Articles Of Organization Form

Hawaii Articles Of Organization Form

Commonwealth Of Kentucky Articles Of Organization Form

South Dakota State Articles Of Organization Form

How To File Your Articles Of Organization.

The next big step after meeting with your partners, enlisting the services of a registered agent and licensing your business, is filing your company’s Articles of Organization. This makes your company a legal entity entitled to the rights and privileges provided by federal law. Here are the steps on how to file an Articles of Organization.

Step 1. Secure An Articles Of Organization Form

The first step in the filing process is by securing an Articles Of Organization Form. These forms can be manually obtained through your Registered Agent or by downloading one online. You can easily download these forms from your state using the sample forms provided by this article.

Step 2. Fill In The Articles Of Organization Form

After getting hold of an Articles Of Organization Form, immediately fill in the form with the needed information. Fill in the spaces with your LLC’s Name and Address, The LLC’s purpose, The Date of Effectivity you will start your LLC, The Name and Address of your Registered Agent, and The Name and Signature of the Organizer.

Step 3. Submit The Form And Pay The Filing Fee

The next step after filling out the Articles Of Organization Form is paying the filing fee. Filing fees differ and vary from state to state, ranging from $50 and $200. After paying the filing fee, submit the form and wait for its approval.

Step 4. Receive The Certificate of Formation

Right after approval, the State will hand you a Certificate of Formation along with a copy of the Articles Of Organization. The State will keep an original copy of both documents.

Step 5. Publish A Notification Of The LLC’s Formation

A publication of a notice of formation is required by some states, specifically in New York and Arizona. This notice is published in a local newspaper to inform the public of the newly formed LLC.

What To Do After Incorporating The LLC

An LLC’s journey does not stop with successfully filing the Articles Of Organization. After the formation and incorporating your LLC, there are other paperwork you need to accomplish for your business to run smoothly. Here are the list of additional documents that you need to maintain your LLC.

- Create An Operating Agreement: An Operating Agreement is a more detailed document that outlines the LLC’s financial decisions and functions, rules, regulations, and provisions. The LLC’s members sign this document in agreement with the terms and conditions specified by this document. Although not required, an operating agreement serves as a guideline and blueprint on running the business.

- Apply For An EIN (Employer Identification Number) If Needed: Applying for EIN (Employer Identification Number) only applies to businesses that have employees. An EIN is like a Social Security Number for businesses. LLCs that have no employees can skip this process.

- Prepare An Annual Report: Most States require an Annual Report to be filed by LLCs. Annual Reports typically contain information about the LLC’s business activities, income, and its members.

- Open A Business Bank Account: Opening a separate bank account for your business not only protects your company’s assets, but it also makes the distribution of dividends to your members easy. Your LLC’s certificate of formation and EIN or TIN will be required for opening a business bank account. You can also file a checking account for your business to add more legitimacy.

Related Posts

-

FREE 6+ Background Check Application Forms in PDF | MS Word

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word

-

FREE 6+ House Rental Application Forms in PDF | MS Word | Excel

-

FREE 10+ Sponsor Application Forms in PDF | MS Word | Excel

-

FREE 4+ Retail Job Application Forms in PDF | MS Word

-

FREE Department Store Job Application Forms in PDF | MS Word

-

FREE 3+ Cafe Job Application Forms in PDF

-

FREE 31+ Printable Application Forms in PDF | Ms Word | Excel

-

FREE 11+ Payment Application Forms in PDF | Ms Word | Excel

-

FREE 7+ Application For Membership Forms in PDF | Ms Word | Excel