As an owner of a start-up company, keeping your business afloat will always be a constant game of seesaw. Businesses are built with capital, and, strictly speaking, your business wouldn’t come into being without the help of financial capital. Thus, to ensure your business’s survival, you may enlist the aid of well-established creditors and secure a loan from them. But, before extending a business credit for your fledgling business, creditors must first establish your credit-worthiness by way of a Business Credit Checklist.

What Is a Business Credit Checklist Form?

A Business Credit Checklist Form is a checklist and evaluation form used by credit lending companies and private businesses to evaluate and establish a business’s credit-worthiness. This checklist features a series of questions that look into the credit history and financial standing of a business that applied for a loan. Business Credit Checklist Forms are used by credit or loan officers when checking the applicant’s credit history with credit bureaus or credit reporting agencies.

FREE 6+ Business Credit Checklist Forms in PDF

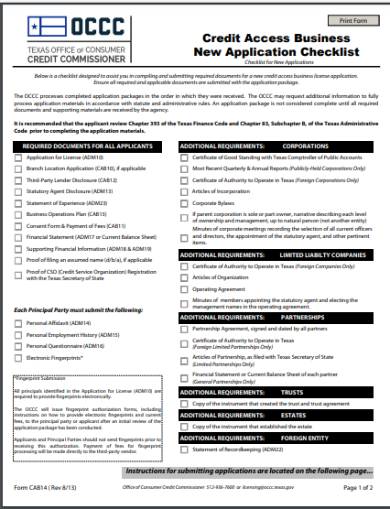

1. Credit Access Business New Application Checklist

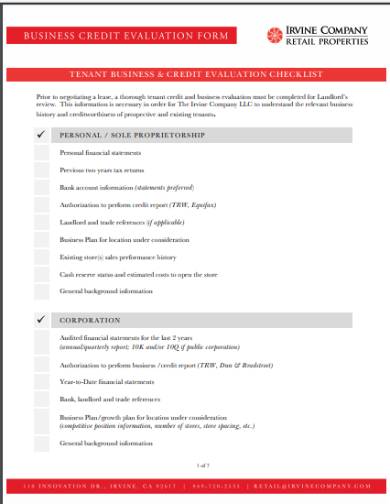

2. Business Credit Evaluation Checklist

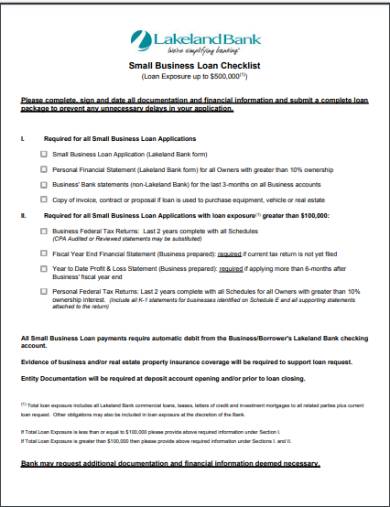

3. Small Business Loan & Credit Checklist

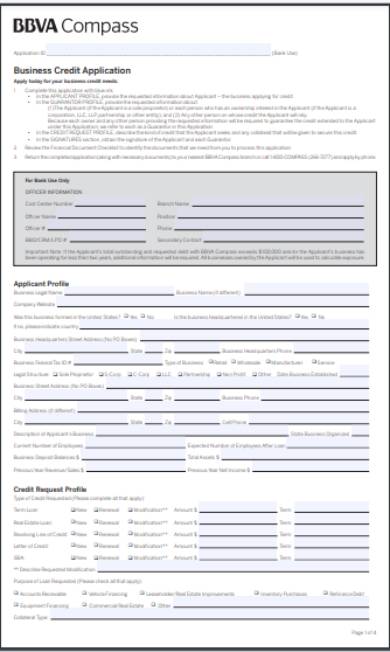

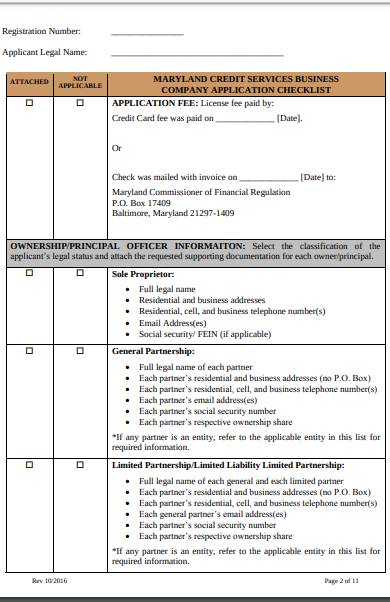

4. Business Credit Application Checklist

5. Application for Business Credit Checklist

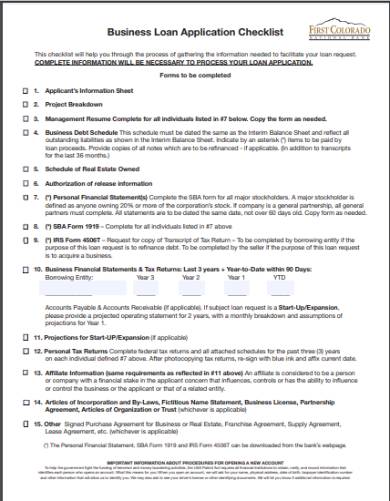

6. Business Credit & Loan Application Checklist

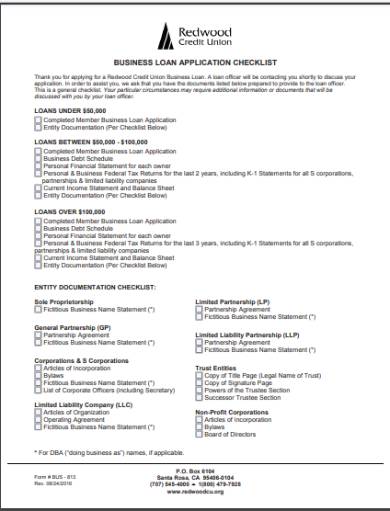

7. Application for Business Credit & Loan Checklist

Types of Business Credits

Business credits are an important part of a business. Some would even regard it as the lifeblood of a business. Without business credit, businesses would barely survive the harsh environment that the business world offers. Business credits give businesses, most especially the fledgling ones, a fighting chance to thrive and succeed. For start-ups or for those who are still new in the field of business, aside from applying for business credit, establishing a good business credit standing and maintaining it is essential for its success. But doing so is very hard, especially if your business doesn’t have its credit history at all. To help you start, here are the lists of business credits that your business can easily apply for and help you establish its credit history.

1. Business Credit Cards

Business Credit Cards are the easiest types of business credit that businesses can apply for when they first form their business. This type of business credit enables start-ups to separate their business credit from their personal credit. Business Credit Cards allow making business purchases without jeopardizing their personal credit history.

2. Vendor Credit

Vendor Credits are types of business credit extended by vendors in the form of products and services that businesses can purchase on short-term financing. This type of business credit offers capital goods such as office supplies to be purchased and paid on or before the date as specified by the credit agreement. Vendors usually extend such business credit with minimum requirements like an initial purchase of products and services they offer or a cash deposit.

3. Supplier Credit

Supplier Credits are types of business credits extended by suppliers to businesses by way of supplies needed on deferred payment. It means that this type of credit allows businesses to purchase and sell the goods before paying for them on a later date. This type of business credit is ideal for those who wish to conserve their business’s cash flow without busting their wallets.

4. Service Credit

Service Credits are business credits extended by service providers to small businesses by way of signing a service contract. Such business credit is in the form of utilities such as landline service, internet, and web hosting services. Service Credit is the simplest type of credit that small businesses can apply for, the first time.

5. Retail Credit

Retail Credit is a business credit in which a retail outlet or store extends to a business on a retail contract basis. Like vendor credits, retail credits are extended in the form of goods which a retail outlet or store sells. Stores extending such credit will issue a form of credit card which a business can use in purchasing goods such as grocery items for their office pantry.

How to Complete a Business Credit Checklist Form

Being the owner of a start-up business, you are actively searching for ways on how to keep your business afloat and self-reliant. In doing so, you must seek a well-established credit lender to secure a loan to add up to your business’s depleting capital. But before being granted the loan that you and your business badly need, creditors must first be assured that you can pay for the money that you’ll be borrowing from them. So, they will require you to answer a Business Credit Checklist Form to complete the application process. Since this is your first time encountering such form, here are the steps on how to complete the Business Credit Checklist Form.

Step 1. Choose and Download a Business Credit Checklist Form

First, choose a Business Credit Checklist Form from a variety of sample forms included in this article. The Business Credit Checklist Form samples are from established financial and credit lending institutions. Choose a specific Business Credit Checklist Form according to the financial and credit lending institutions that you applied a loan for.

Step 2. Answer the Business Credit Checklist Form

After downloading a Business Credit Checklist Form from a list of samples that we provided, you can now proceed in answering the form itself. To answer the form, just fill it out with the information that it asked. The form will usually ask for personal information, and your business’s as well. Some fields are intended to be answered by the loan officer him/herself, so leave it as it is.

Step 3. Print the Business Credit Checklist Form

Print the Business Credit Checklist Form right after answering it. You can easily print the Business Credit Checklist Form using your home or office printer. You can also print the Business Credit Checklist Form right after downloading its electronic copy if you wish to answer it manually.

Step 4. Sign the Business Credit Checklist Form

Sign the Business Credit Checklist Form right after printing it. Putting your signature signifies that you agree to terms and conditions specified in the form. Put your signature on the signature block provided on the bottom part of the Business Credit Checklist Form.

Step 5. Mail and Submit the Business Credit Checklist Form

Mail and submit the Business Credit Checklist Form to its respective financial institution. Mailing a printed Business Credit Checklist Form assures creditors of the accuracy and truthfulness of the information that the form contains. Thus, also preventing you from being doubted by your creditor and having your loan application denied.

Related Posts

-

Business Credit Application Form

-

FREE 8+ Sample Business Credit Application Forms in PDF | MS Word

-

Business Application Form

-

FREE 17+ Credit Application Forms in PDF | Excel | MS Word

-

FREE 12+ Sample Credit Application Form in PDF | MS Word | Excel

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 9+ Articles Of Organization Forms in PDF

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word

-

FREE 6+ House Rental Application Forms in PDF | MS Word | Excel

-

FREE 10+ Sponsor Application Forms in PDF | MS Word | Excel

-

FREE 4+ Retail Job Application Forms in PDF | MS Word