A Business Credit Application Form is essential for businesses seeking credit from financial institutions or suppliers. This complete guide covers everything you need to know about filling out and submitting a Business Form effectively. From understanding the key components of a Credit Application Form to ensuring accuracy in your submissions, our guide provides detailed examples and practical tips. Whether you’re a startup or an established business, this guide will help you navigate the credit application process with ease. Learn how to maximize your chances of approval and secure the financing you need to grow your business.

Download Business Credit Application Form Bundle

What is Business Credit Application Form?

A Business Credit Application Form is a document used by businesses to apply for credit from lenders or suppliers. This Credit Application Form collects essential information about the business’s financial status, credit history, and repayment ability. It helps lenders assess the risk and determine the creditworthiness of the applicant. Completing this form accurately and thoroughly increases the chances of securing business credit.

Business Credit Application Format

Business Credit Application Form

- Business Information:

- Business Name:

- Address:

- Contact Number:

- Email Address:

- Type of Business:

- Date Established:

- Financial Information:

- Annual Revenue:

- Net Profit:

- Bank Name:

- Account Number:

- Credit Request Details:

- Amount Requested:

- Purpose of Credit:

- References:

- Trade References:

- Name:

- Contact Information:

- Trade References:

- Authorization:

- Applicant’s Name:

- Signature:

- Date:

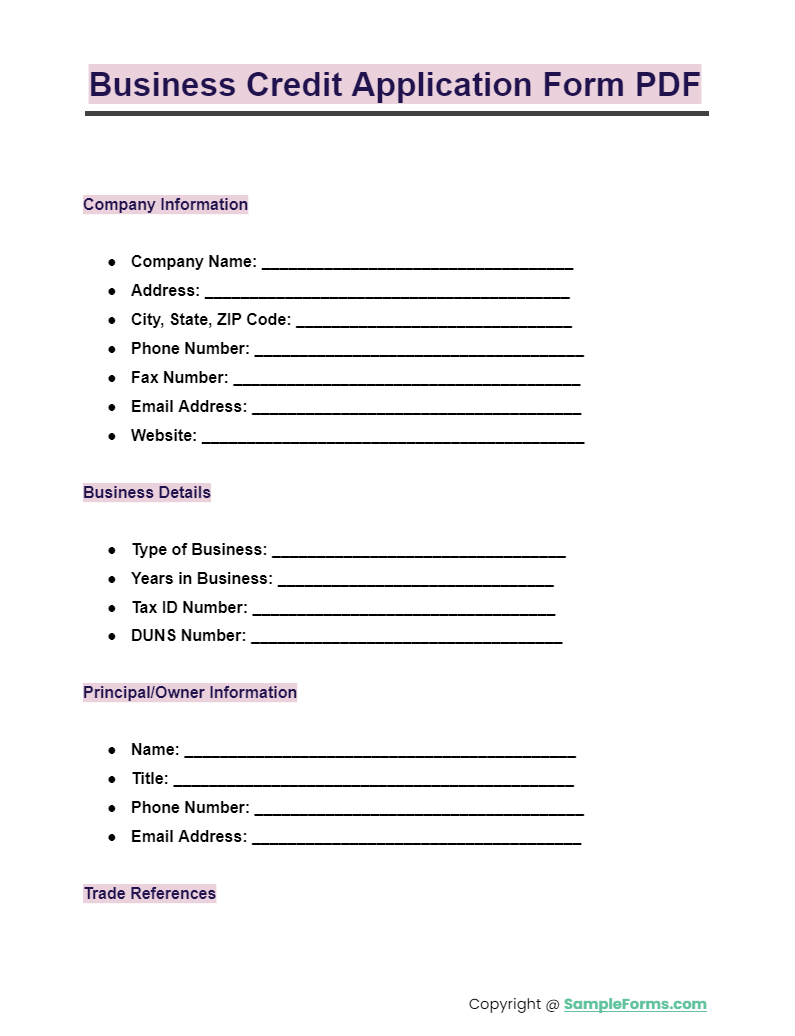

Business Credit Application Form PDF

A Business Credit Application Form PDF provides a standardized format for businesses to apply for credit. It ensures that all necessary financial information is included, similar to how a Job Application Form ensures comprehensive employee details.

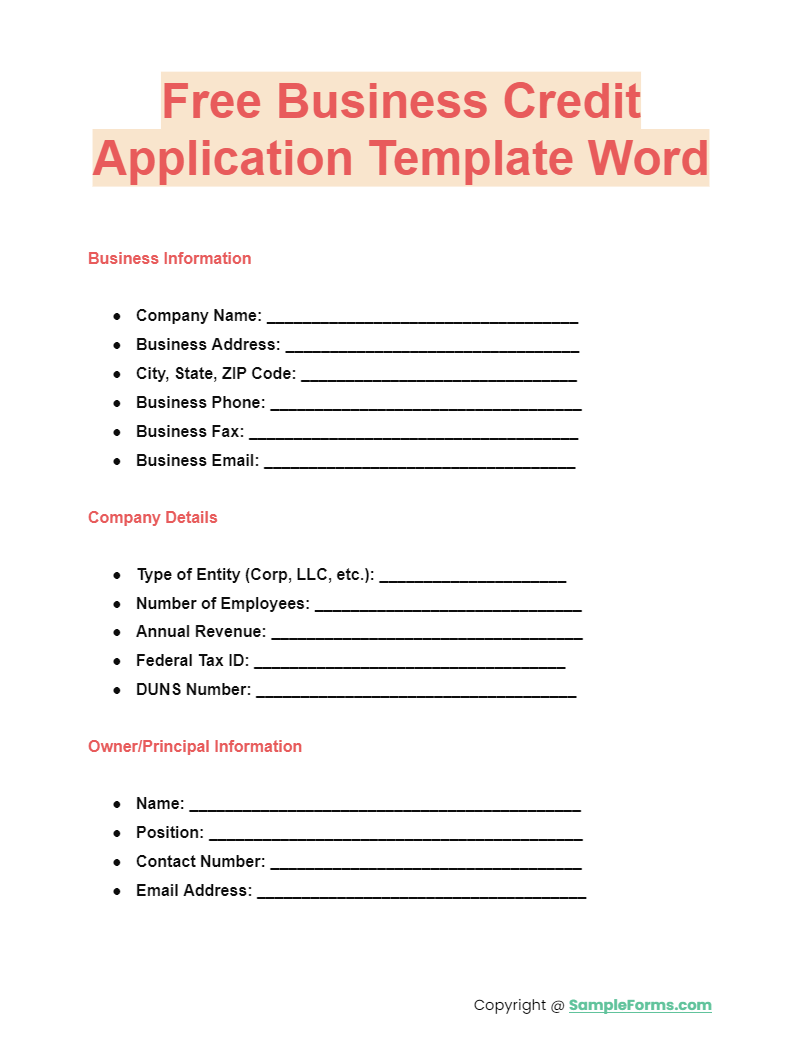

Free Business Credit Application Template Word

A Free Business Credit Application Template Word offers a customizable document for businesses seeking credit. This template simplifies the process, much like a Loan Application Form does for individuals, ensuring all necessary details are covered.

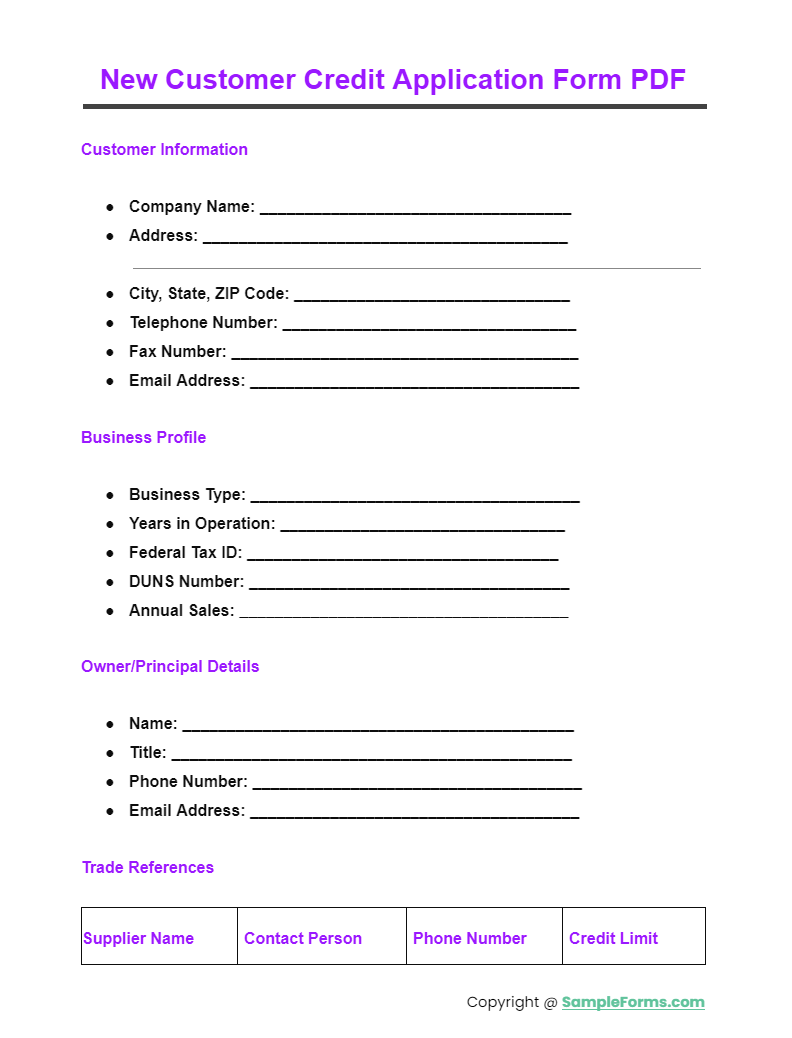

New Customer Credit Application Form PDF

A New Customer Credit Application Form PDF is essential for onboarding clients needing credit. This form ensures all relevant financial and business details are collected, akin to a Marriage Application Form gathering essential personal information.

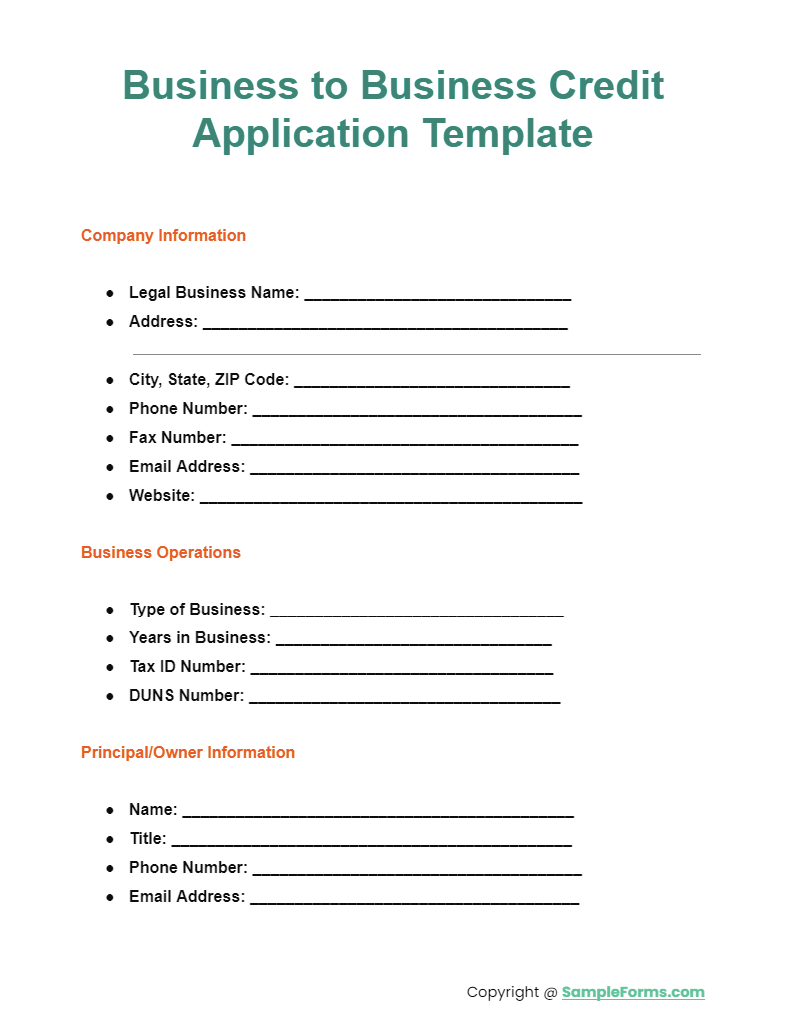

Business to Business Credit Application Template

A Business to Business Credit Application Template streamlines the credit application process between companies. This template, similar to a School Application Form, ensures that all required information is systematically captured for review.

More Business Credit Application Form Samples

Blank Business Credit Application Form

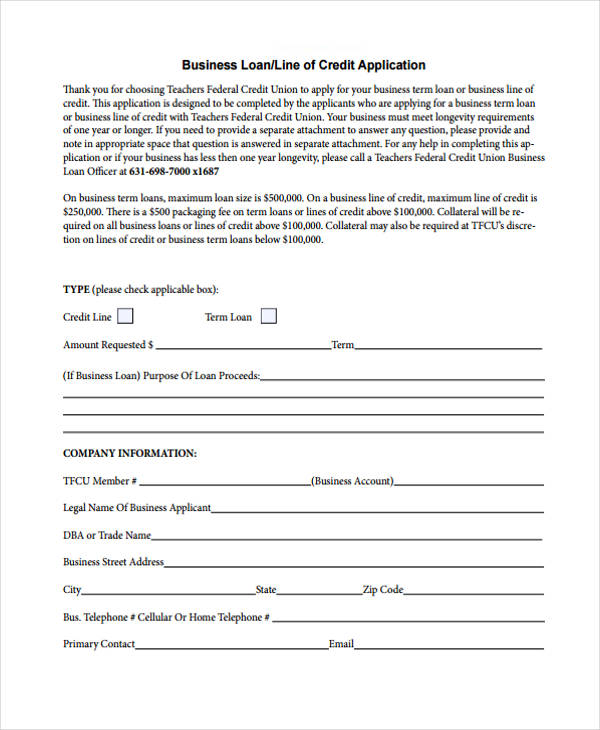

Business Line of Credit Application Form

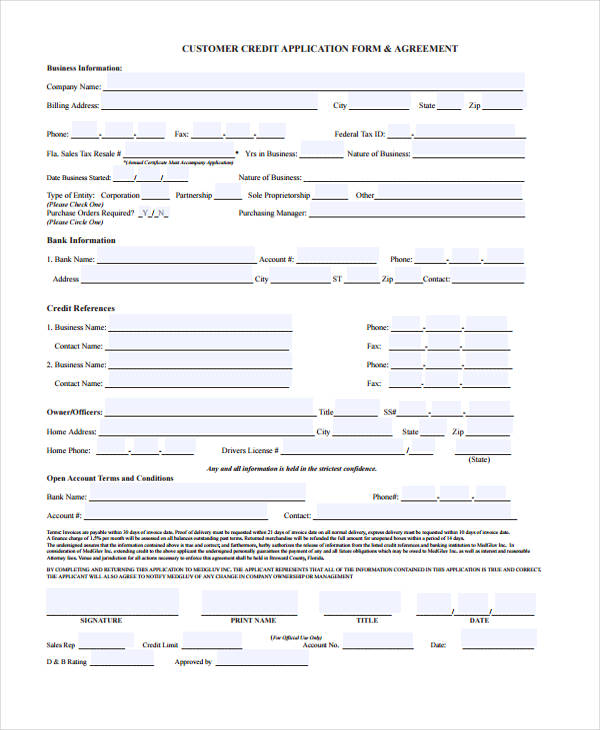

Business Customer Credit Application Form

Free Business Credit Application

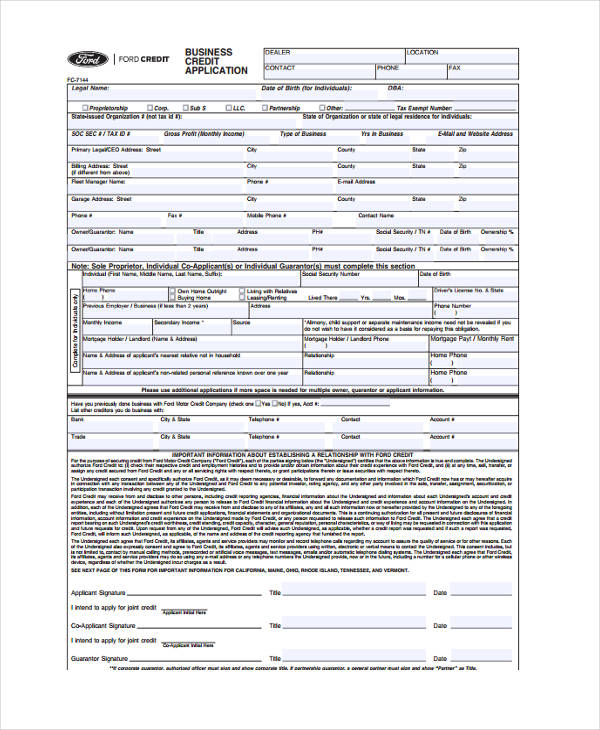

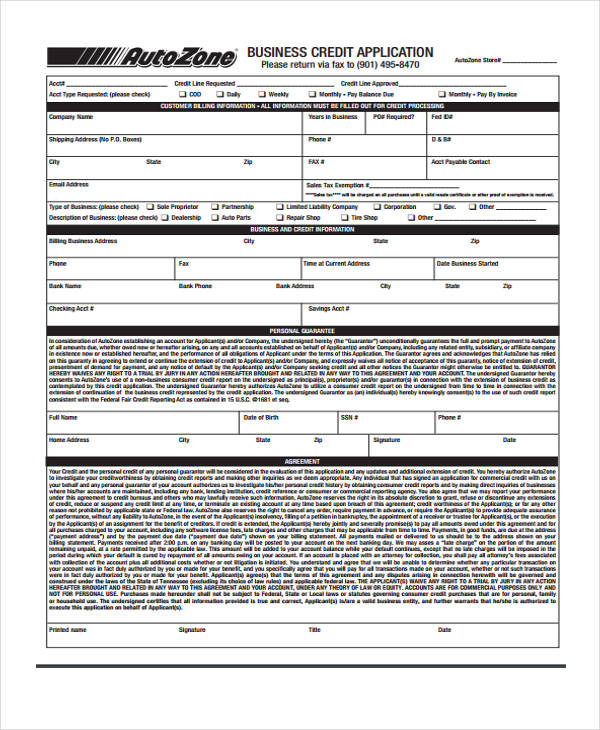

Business Credit Card Application Form Sample

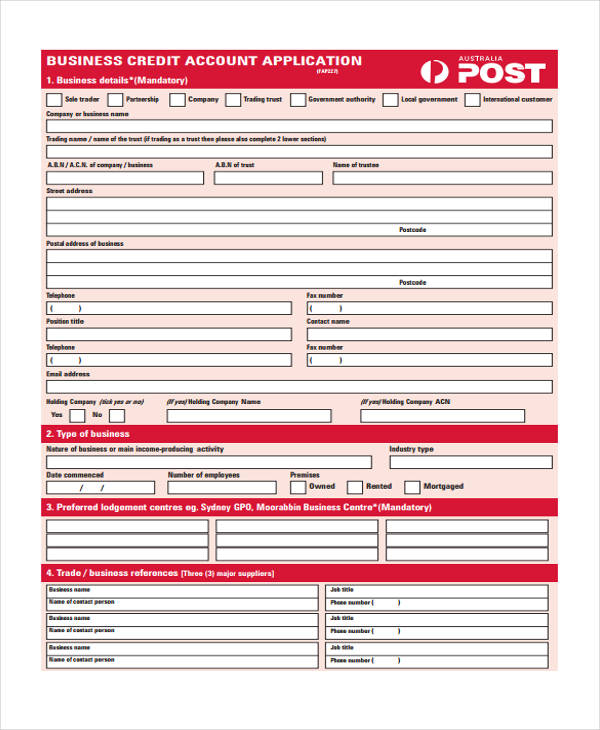

Business Credit Account Application

Standard Business Credit Application

Sample New Business Credit Application Form

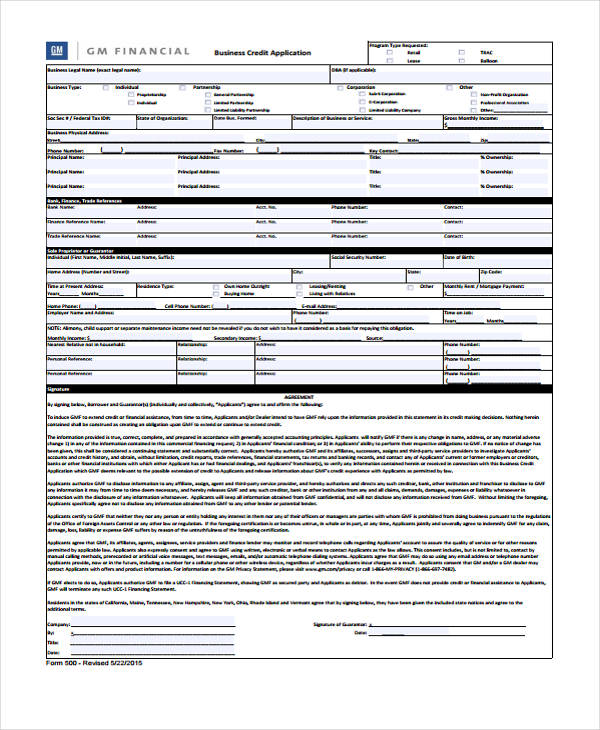

Financial Business Credit Application

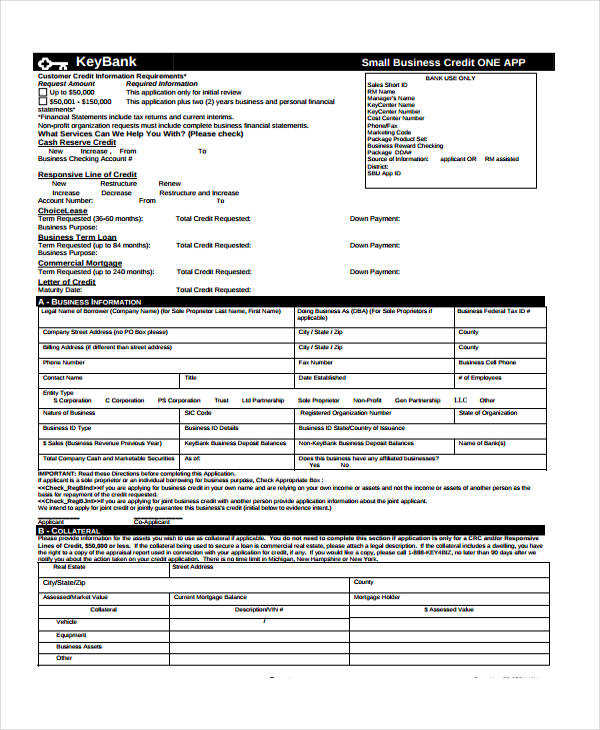

Small Business Credit Application Form

Small Business Credit Application Form

Business credit is a risky and huge step to involve in your business. One must know an individual’s credit history, employment status and their capability to repay the amount of credit. Once you are permitted to contact reliable references, then please do so. Businesses cannot take chances when it comes to approving Business Credit Applications. You may also see Business Credit Application Form

With forms widely used by people and organizations these days, we are pleased to inform you that our website provides you with Business Credit Application form samples and many other legal forms and documents. These downloadable and Printable Application Forms are specifically catered for your needs and we guarantee you that these forms are very simple and easy to use. With only one click from your laptops and desktop computers, you can easily have access to these forms. You may also see Application Form

What Information Is Included In A Business Credit Application?

Similar to Business Application Forms, when applying for Business Credit Application Forms, basic information such as your personal and contact information are requested. A Business Credit Application is usually a statement of request for an extension of credit in an organization.

When applying for a Business Credit Application, the following details should be included:

- Customer Information

- Customer Financial Information

- Bank Information

When a credit application is validated, it will provide the amount and type of credit requested. But keep note of one thing. You need to verify a creditor’s existence. One can simply indicate fraudulent and misleading information in a Business Credit Application form. You may also see Membership Application Form

To avoid any misconceptions and misfortune for your company, it is best for the management to verify a customer’s legitimate identity. An individual’s credit scores are one of the major factors that an organization should evaluate in the business credit application. You may also see Internship Application Form

Another major factor to consider is an individual’s credit history. If an individual has regularly paid their bills, then they are most likely a legitimate creditor. But if you find out that an individual does not have the ability to pay or repay the credit on a regular basis, then you may make the decision to reconsider their application, as approving their application may prove to be disastrous for your business in the future. You may also see Business Application Form

Who and How to fills out the credit application form?

A credit application form is typically filled out by the business owner or an authorized representative. Key steps include:

- Identify the Applicant: The business owner or a designated representative completes the form, similar to a Credit Card Authorization Form.

- Provide Business Information: Include business name, address, contact details, and type of business.

- Financial Details: Enter financial information such as annual revenue, net profit, and existing credit obligations.

- References: List trade references that can vouch for the business’s creditworthiness.

- Sign and Date: The authorized representative must sign and date the form, ensuring its authenticity. You may also see Permit Application Form

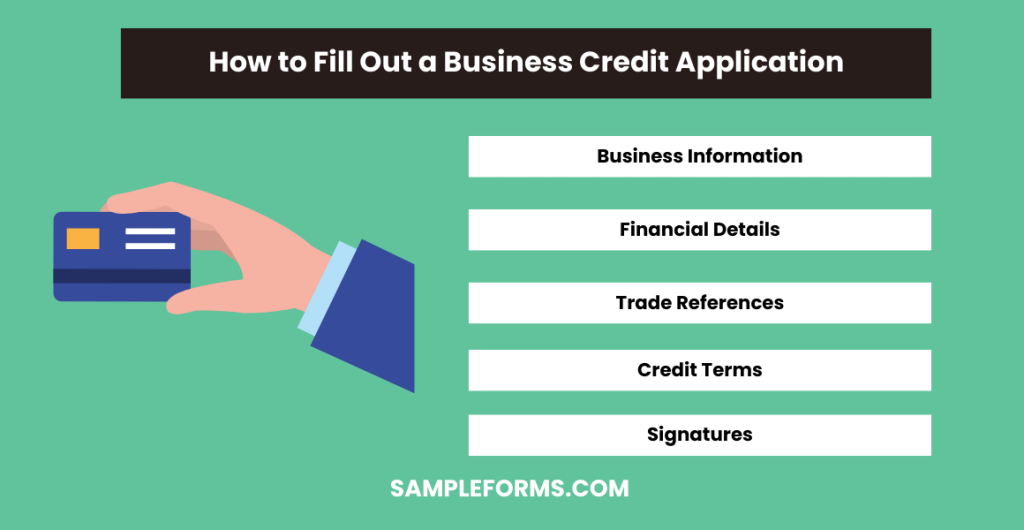

How do I fill out a business credit application?

Filling out a business credit application involves providing comprehensive business and financial details. Follow these steps:

- Business Information: Enter the business name, address, and contact details.

- Financial Details: Provide financial statements, annual revenue, and existing debts, similar to completing a Credit Report Form.

- Trade References: List references from suppliers or creditors.

- Credit Terms: Specify the credit terms being requested.

- Signatures: Ensure the application is signed by an authorized representative. You may also see Grant Application Form

How do you politely decline a credit application?

Declining a credit application requires tact and professionalism. Key steps include:

- Review the Application: Carefully review the application and reasons for decline, similar to handling a Credit Inquiry Form.

- Prepare a Response: Draft a polite and concise decline letter.

- State the Reason: Clearly explain the reason for the decline without disclosing sensitive information.

- Offer Alternatives: Suggest other financing options if possible.

- Close Positively: End on a positive note, thanking the applicant for their interest. You may also see Work Application Form

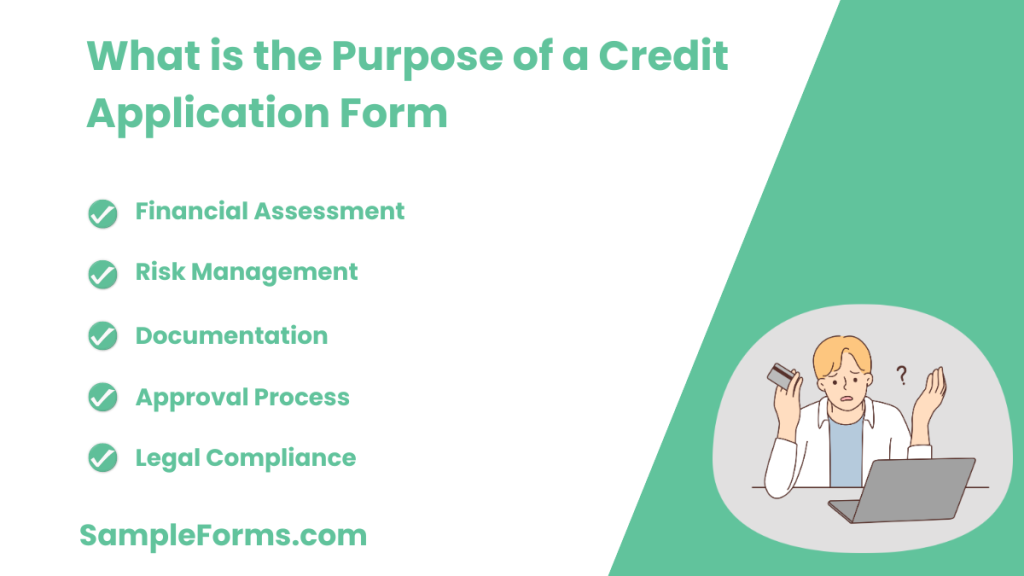

What is the purpose of a credit application form?

A credit application form assesses a business’s creditworthiness. Key purposes include:

- Financial Assessment: Evaluates the financial stability of the business, akin to a Credit Debit Form.

- Risk Management: Helps lenders manage risk by assessing credit history and financial health.

- Documentation: Provides a formal record of the credit request.

- Approval Process: Facilitates the approval process by collecting all necessary information.

- Legal Compliance: Ensures compliance with financial regulations. You may also see Credit Authorization Form

What happens if you make a mistake on a credit application?

Mistakes on a credit application can delay processing or lead to denial. Key steps to rectify include:

- Identify the Error: Review the application to spot mistakes, similar to checking a Credit Dispute Form.

- Correct the Mistake: Correct the error and provide accurate information.

- Notify the Lender: Inform the lender about the mistake and submit a revised form.

- Provide Supporting Documents: Include additional documents to support the correction.

- Follow Up: Follow up with the lender to confirm the changes have been received and processed. You may also see Work Application Form

Is it safe to fill out a credit application online?

Yes, it is safe to fill out a credit application online if the website is secure and reputable, similar to filling out a Mortgage Application Form.

How do I ask customers to fill out my credit application?

Politely request customers to complete your credit application by highlighting its benefits and ensuring the form is straightforward, akin to a Rental Application Form.

Who signs credit applications?

Credit applications are signed by the business owner or an authorized representative, much like a Car Loan Application Form requires the applicant’s signature.

Do credit applications check income?

Yes, credit applications often check income to assess the applicant’s ability to repay, similar to the process in a Medical Application Form.

Who pays for a letter of credit?

Typically, the applicant requesting the letter of credit pays for it, similar to fees associated with a Housing Application Form.

What happens if my credit application is rejected?

If your credit application is rejected, review the reasons, address issues, and consider reapplying or exploring alternative financing options, like when a Citizen Application Form is denied.

What do banks look at when applying for business credit?

Banks evaluate financial statements, credit history, business plan, and income, similar to the criteria used in a Summer Camp Application Form to assess suitability.

In conclusion, a Business Credit Application Form is crucial for businesses seeking credit to support their operations and growth. Our guide provides detailed samples, forms, and letters to assist you. Utilizing a comprehensive Business Credit Checklist Form ensures all necessary information is included and increases the likelihood of approval. Understanding and correctly completing this form is vital for securing the financing your business needs to thrive. By following the strategies and examples in this guide, you can streamline your credit application process and achieve better financial outcomes.

Related Posts

-

FREE 35+ Tenant Application Forms in PDF | MS Word

-

FREE 32+ Rental Application Forms in PDF | MS Word | XLS

-

Job Application Form

-

Internship Application Form

-

Recruitment Application Form

-

FREE 18+ Leave Cancellation Forms Download – How to Create Guide, Tips

-

FREE 8+ Commercial Property Application Forms in PDF

-

FREE 6+ Background Check Application Forms in PDF | MS Word

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 9+ Articles Of Organization Forms in PDF

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word