A Credit Card Authorization Form is essential for securely authorizing payments and managing transactions. This complete guide offers detailed examples and practical advice on creating an effective Authorization Form. Whether you’re managing hotel bookings, online orders, or recurring payments, understanding how to use a Hotel Credit Card Authorization Form can streamline your processes and enhance security. Our guide covers key elements to include, best practices for ensuring data protection, and tips for smooth integration into your business operations. By following our comprehensive advice, you can improve transaction efficiency and customer satisfaction.

Download Credit Card Authorization Form Bundles

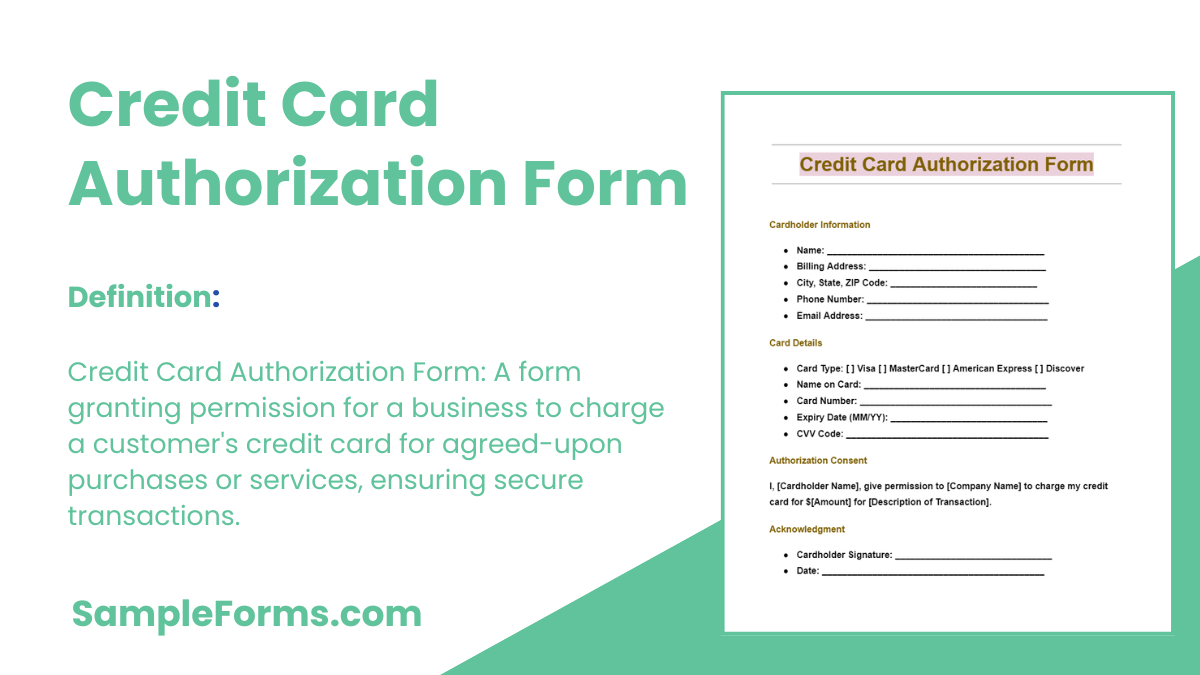

What is Credit Card Authorization Form?

A Credit Card Authorization Form is a document that allows a business to charge a customer’s credit card for agreed-upon purchases or services. This Authorization Form collects necessary card details and customer consent, ensuring secure and authorized transactions. It’s commonly used in various industries, including hospitality, retail, and services, like a Hotel Credit Card Authorization Form. Understanding this form helps businesses protect against fraud and manage payments effectively, ensuring both parties have a clear agreement on the transaction terms.

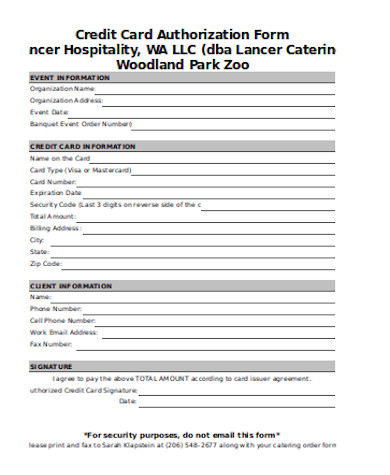

Credit Card Authorization Format

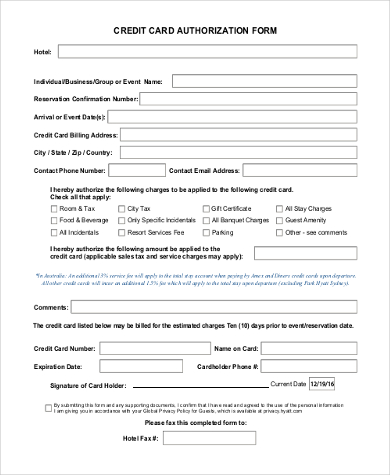

Credit Card Authorization Form

1. Cardholder Information

- Full Name:

- Billing Address:

- Contact Number:

2. Credit Card Information

- Card Type (Visa, MasterCard, etc.):

- Card Number:

- Expiration Date:

- CVV:

3. Authorization Details

- Amount Authorized:

- Date of Transaction:

- Description of Purchase/Service:

4. Authorization

- Cardholder Signature:

- Date:

5. Company Information

- Company Name:

- Address:

- Contact Information:

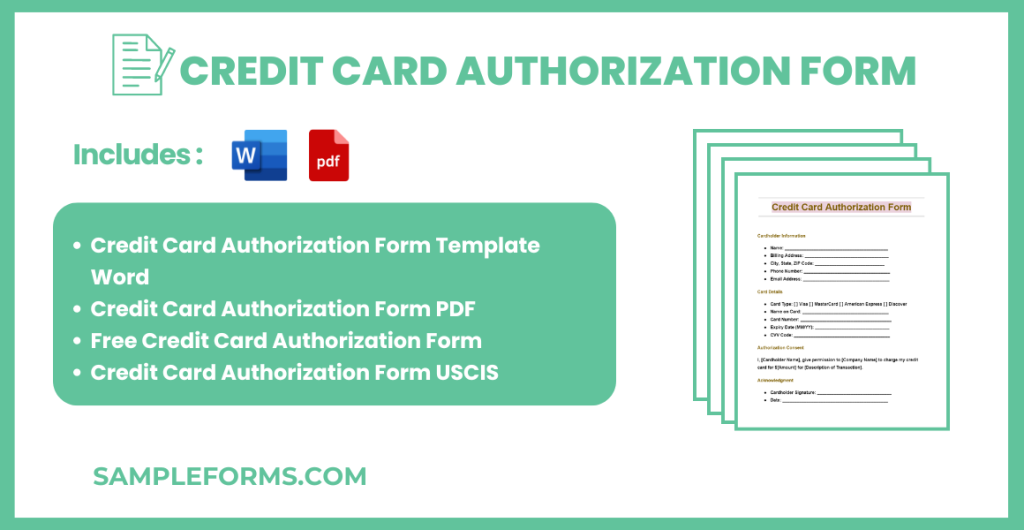

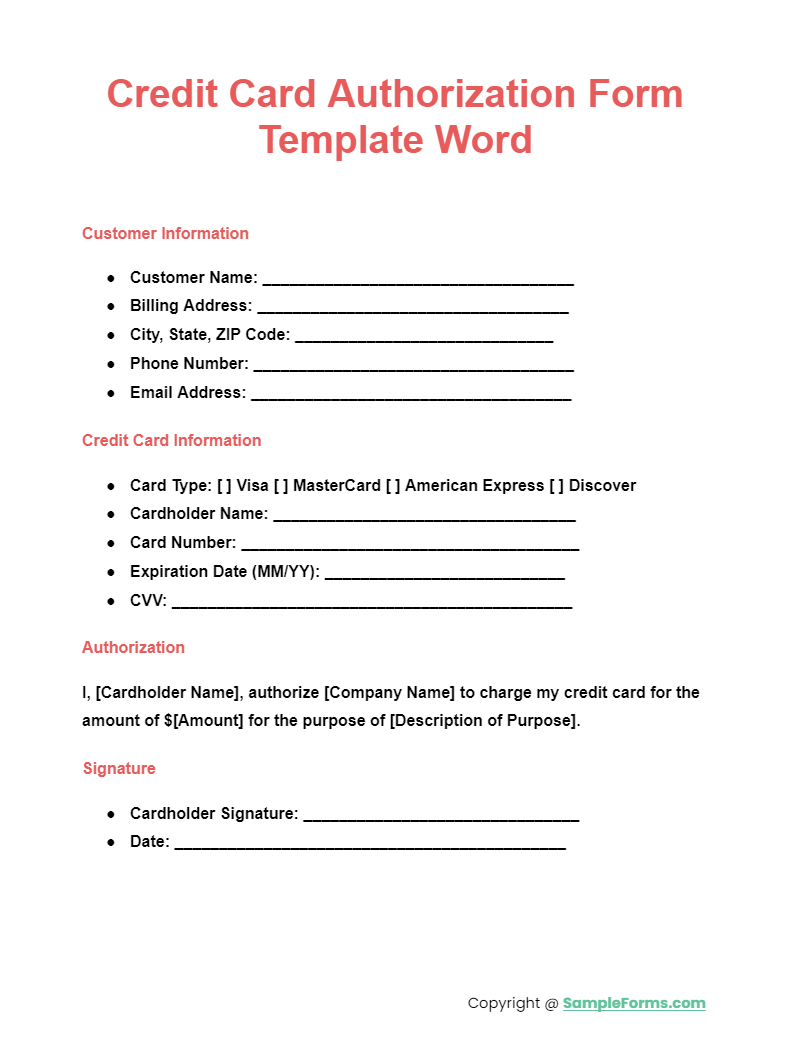

Credit Card Authorization Form Template Word

A Credit Card Authorization Form Template Word offers an easily editable format for businesses to authorize credit card transactions securely. This template ensures consistency and professionalism, similar to a Vehicle Authorization Form, providing a structured approach to collecting necessary cardholder information. You may also see Security Authorization Form

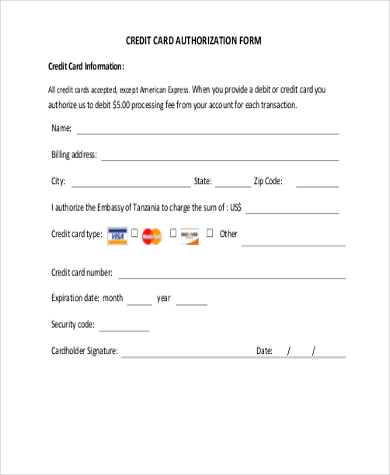

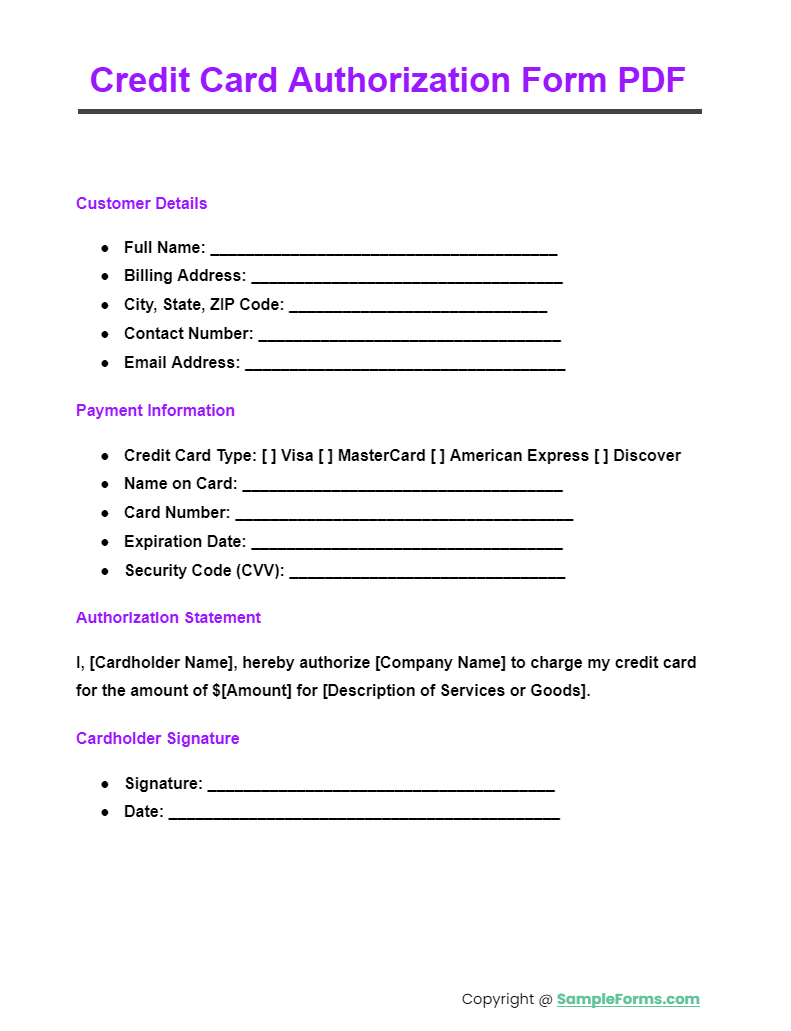

Credit Card Authorization Form PDF

A Credit Card Authorization Form PDF provides a secure, non-editable format for authorizing credit card payments. This form, akin to an Overtime Authorization Form, ensures that all transaction details are accurately captured and securely stored, making it ideal for various business transactions. You may also see Direct Deposit Authorization Form

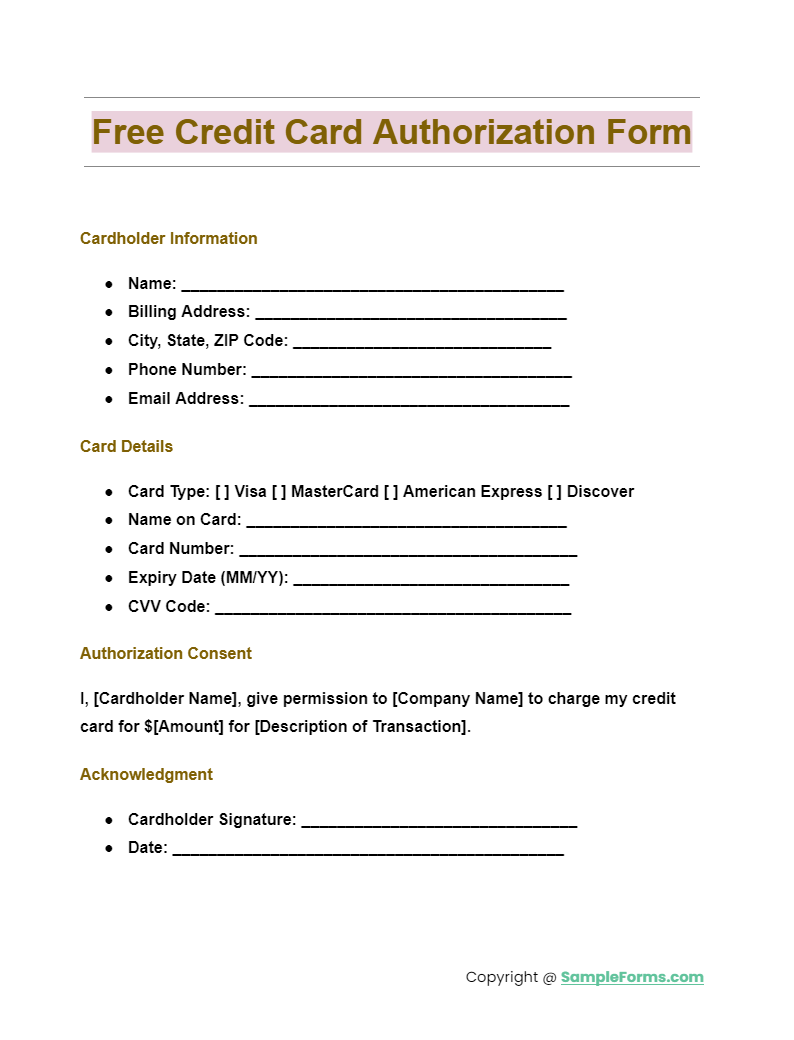

Free Credit Card Authorization Form

A Free Credit Card Authorization Form allows businesses to authorize payments without additional costs. This form, much like a Return Authorization Form, facilitates easy access and utilization, ensuring that businesses can efficiently manage transactions while maintaining security and compliance.

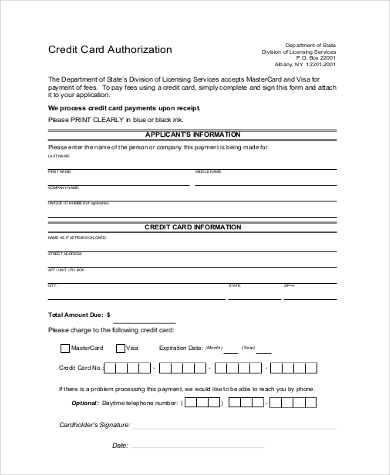

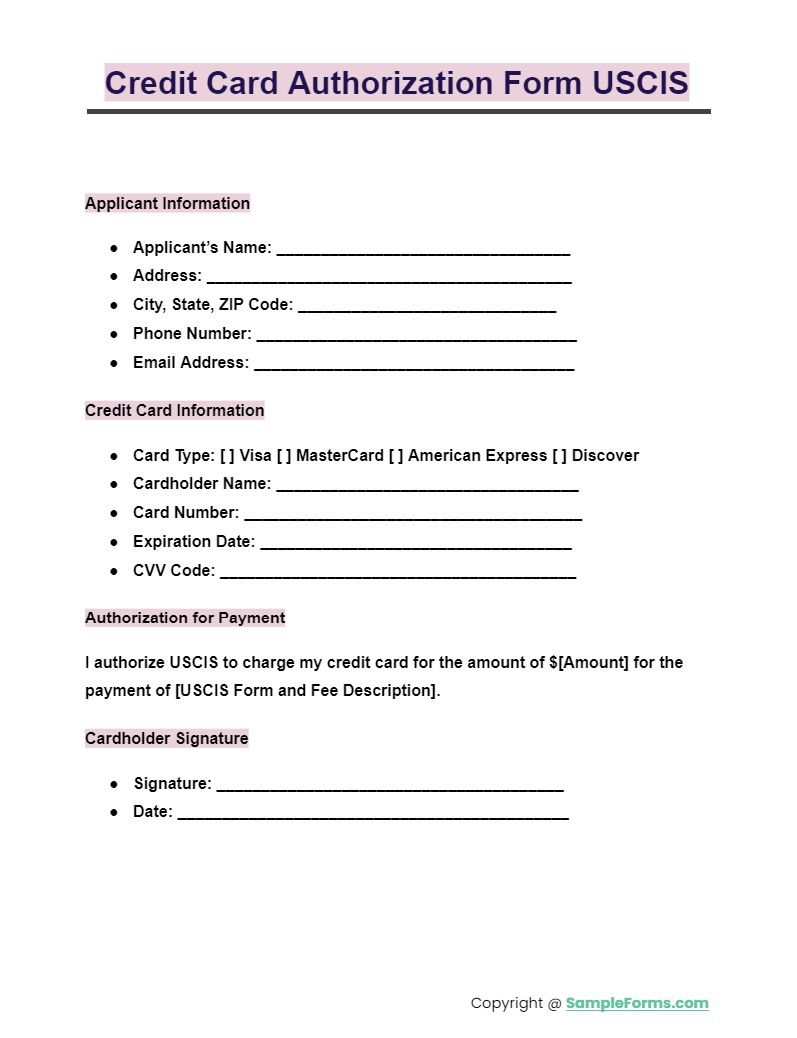

Credit Card Authorization Form USCIS

The Credit Card Authorization Form USCIS is specifically designed for processing immigration-related payments. This form, similar to a Payment Authorization Form, collects all necessary credit card information required by the U.S. Citizenship and Immigration Services, ensuring secure and authorized payment processing for immigration fees.

More Credit Card Authorization Form Samples

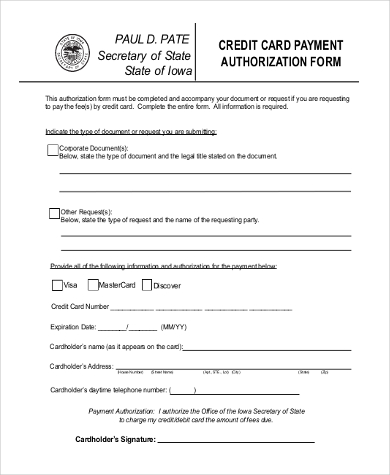

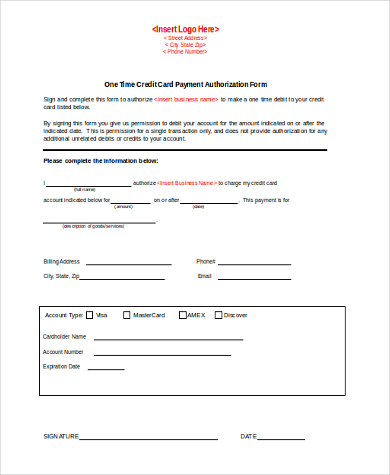

Credit Card Payment Authorization Form

Credit Card Charge Authorization Form in Word

Generic Credit Card Authorization Form Sample

Sample Credit Card Authorization Form in PDF

One Time Credit Card Payment Authorization Form

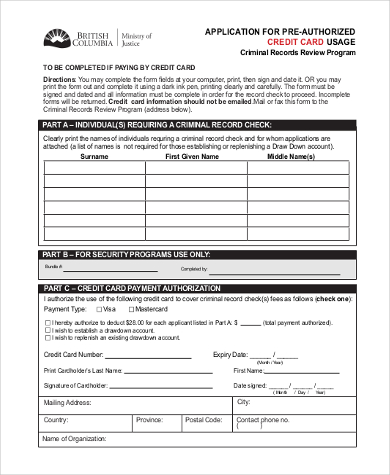

Application for Pre-Authorized Credit Card Form

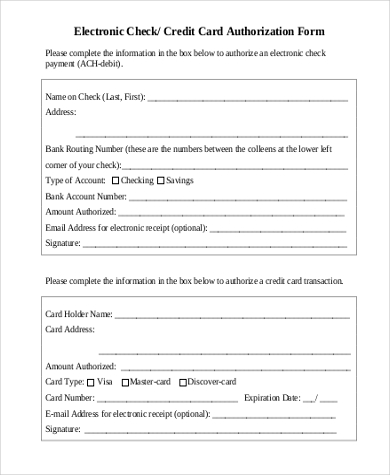

Electronic Check/Credit Card Authorization Form

Basic Credit Card Authorization Form Free

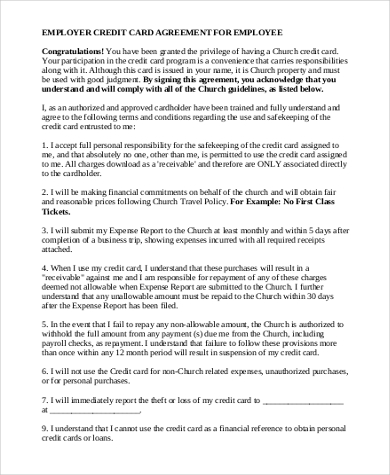

Employee Credit Card Authorization Form

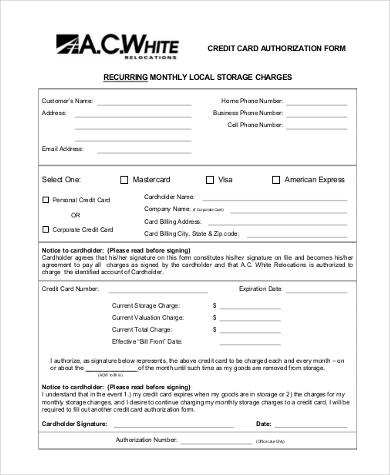

Credit Card Monthly Authorization Form

Credit Card Authorization Form Sample

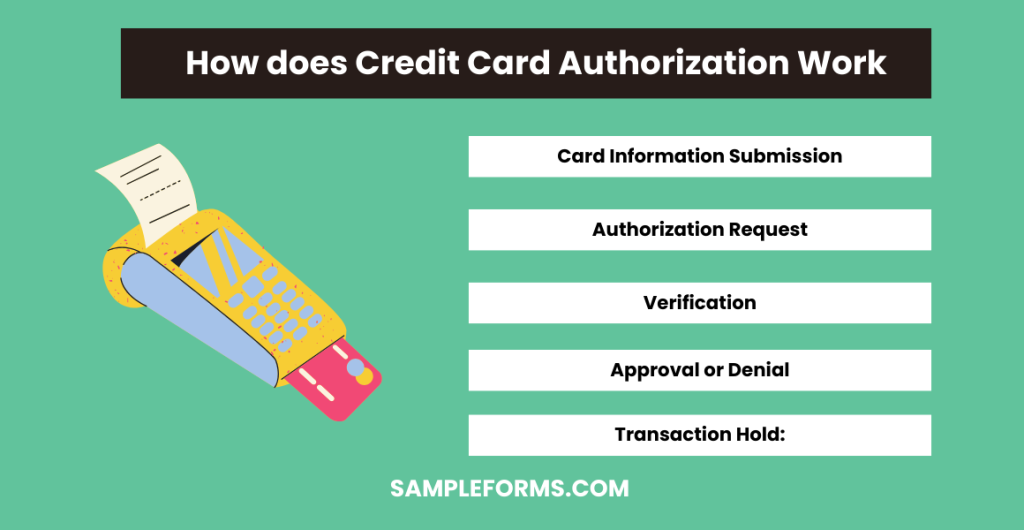

How does credit card authorization work?

Credit card authorization ensures the cardholder has sufficient funds and the card is valid for a transaction. Key steps include:

- Card Information Submission: The cardholder provides card details.

- Authorization Request: The merchant sends an authorization request to the issuing bank.

- Verification: The bank verifies card details and available funds. You may also see

- Approval or Denial: The bank approves or denies the transaction.

- Transaction Hold: If approved, funds are held until the transaction is completed, similar to a Background Check Authorization Form.

How do I create a secure credit card authorization form?

Creating a secure credit card authorization form involves safeguarding sensitive information. Key steps include:

- Use Encryption: Encrypt data to protect information during transmission.

- Collect Necessary Details Only: Ask for essential information only. You may also see

- Include Legal Disclaimers: Inform users about data use and storage.

- Secure Storage: Store authorization forms securely, much like a Travel Authorization Form.

- Regular Audits: Conduct regular security audits to ensure compliance.

How do credit card authorized users work?

Authorized users can use the primary cardholder’s account but are not legally responsible for repayment. Key points include:

- Permission: The primary cardholder authorizes another person.

- Card Issuance: The authorized user receives a card.

- Spending: Authorized users can make purchases. You may also see Hotel Credit Card Authorization Form

- Account Impact: Activity affects the primary cardholder’s account.

- Termination: The primary cardholder can remove authorized users, similar to handling a Third Party Authorization Form.

Why Do We Need Credit Authorization?

Everything to do with your credit card has to be properly and carefully monitored, with authorization given at certain junctures to ensure the original card holder does not suffer from a bad credit record thanks to fraudulent charges. From Credit Application Forms to credit card authorization, businesses that deal with their clients’ cards will need all sorts of paperwork to make sure the proper documentation and procedures are being followed. You may also see Paycheck Pickup Authorization Form

Yes, it can seem like a hassle, but it is really in your best interests. Approval and authorization can protect you from a spotty credit line arising from fraudulent transactions. You may also see Prior Authorization Form

What do you need to be an authorized user on a credit card?

To be an authorized user, certain requirements must be met. Key requirements include:

- Primary Cardholder Consent: Approval from the primary cardholder.

- Personal Information: Provide necessary details like name and date of birth.

- Credit Card Issuer Policies: Adherence to issuer’s rules. You may also see Check Authorization Form

- Usage Agreement: Understanding terms of use.

- Responsibility Acknowledgment: Acceptance of the role, much like signing a Release Authorization Form.

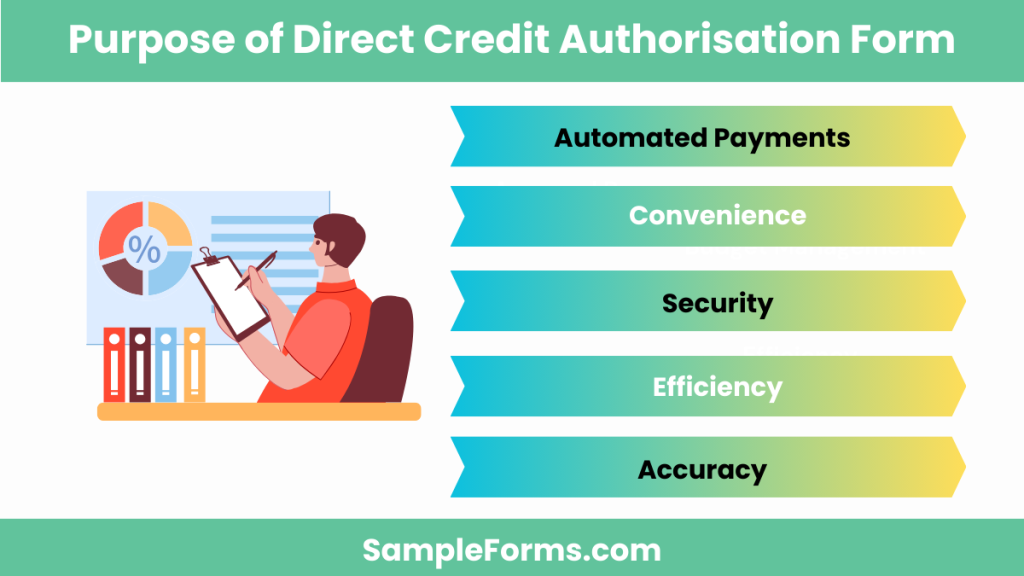

What is the purpose of direct credit Authorisation form?

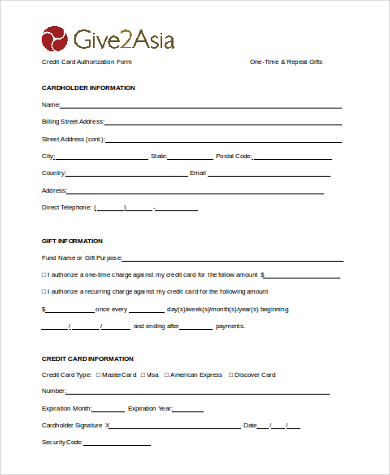

A direct credit authorization form allows automatic payment approvals from a credit card. Key purposes include:

- Automated Payments: Facilitate recurring payments.

- Convenience: Simplify payment processes for both parties.

- Security: Ensure secure transaction authorization. You may also see Expense Authorization Form

- Efficiency: Speed up the payment process.

- Accuracy: Reduce errors, similar to ensuring compliance with a HIPAA Authorization Form.

Is it safe to give credit card authorization form?

Yes, it is safe to give a credit card authorization form if the recipient uses secure methods to handle and store the data, similar to a Parental Authorization Form.

Why can credit authorization requests fail?

Credit authorization requests can fail due to insufficient funds, expired cards, incorrect details, or suspected fraud, much like issues encountered with a Medical Authorization Form.

Do credit card authorization forms help prevent chargeback abuse?

Yes, credit card authorization forms help prevent chargeback abuse by providing proof of authorization for transactions, similar to a Bank Authorization Form.

Can someone charge my credit card without authorization?

No, charging a credit card without authorization is illegal and constitutes fraud, similar to running medical procedures without a Tricare Authorization Form.

Can I authorize someone to use my credit card?

Yes, you can authorize someone to use your credit card by adding them as an authorized user, similar to granting a Leave Authorization Form.

Can someone run your credit without your authorization?

No, running a credit check without your authorization is illegal and violates privacy laws, akin to unauthorized Payroll Authorization Form checks.

How long does a credit card authorization last?

A credit card authorization typically lasts 1-30 days, depending on the issuing bank and merchant agreement, similar to the duration of a Compensatory Time Authorization Form.

How do I send a credit card authorization?

Send a credit card authorization securely via encrypted email or a secure online portal, ensuring privacy and security, much like submitting a Credit Authorization Form.

The Credit Card Authorization Form is a vital tool for secure and efficient payment processing. With various Sample, Forms, and Letters, this guide provides the resources needed to create and use effective authorization forms. Properly utilizing a Credit Card Authorization Form ensures that transactions are authorized, secure, and documented, much like the thorough checks required for a Credit Report Authorization Form. By implementing these forms, businesses can enhance payment security, reduce the risk of fraud, and ensure customer trust and satisfaction.

Related Posts

-

Overtime Authorization Form

-

FREE 10+ Background Check Authorization Forms in PDF | MS Word

-

FREE 11+ Bank Authorization Forms in PDF | MS Word

-

FREE 5+ Daycare Authorization Forms in PDF

-

FREE 10+ Paycheck Pickup Authorization Forms in PDF

-

FREE 10+ Compensatory Time Authorization Forms in PDF | MS Word

-

FREE 14+ Release Authorization Forms in PDF | MS Word | Excel

-

FREE 13+ Prior Authorization Forms in PDF | MS Word

-

FREE 12+ Security Authorization Forms in PDF | MS Word

-

Vehicle Authorization Form

-

FREE 8+ Sample Third Party Authorization Forms in PDF | MS Word

-

FREE 13+ Check Authorization Forms in PDF | MS Word

-

FREE 10+ Leave Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Pre Authorization Forms in PDF | Excel

-

FREE 7+ Sample Parental Authorization Forms in PDF | MS Word