A Credit Card Authorization Form plays a pivotal role in modern transactions, offering a secure bridge between merchants and customers for payment approvals. This document, which grants permission to charge a cardholder’s account, ensures streamlined financial processes while minimizing potential disputes. With various types tailored to distinct transactional needs, understanding its nuances, from its meaning to its crafting, is vital. Dive into the realm of this form to discern its significance, exemplary structures, and best practices for its effective creation and utilization.

What is a Credit Card Authorization Form ? – Definition

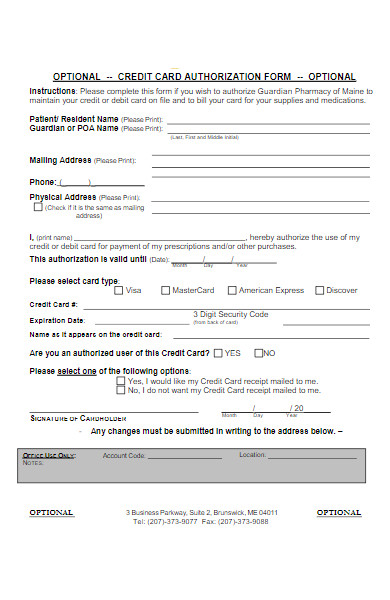

A Credit Card Authorization Form is a written document that a cardholder signs to grant a merchant or business permission to charge a specified amount to their credit card for a defined purpose. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the merchant can securely process the charge. It’s especially useful for recurring payments, phone or mail orders, and other situations where the physical card isn’t swiped or inserted directly by the merchant.

What is the Meaning of a Credit Card Authorization Form?

The meaning of a Credit Card Authorization Form centers on its role as a consent tool in the financial landscape. It signifies a cardholder’s explicit permission to a merchant or service provider to process a specific transaction or series of transactions on their credit card. By using this form, merchants safeguard themselves against potential disputes or unauthorized charges, as they have a tangible record of the cardholder’s consent. In essence, it acts as a protective measure, ensuring transparency and trust in credit card transactions, especially in cases where the card is not physically present.

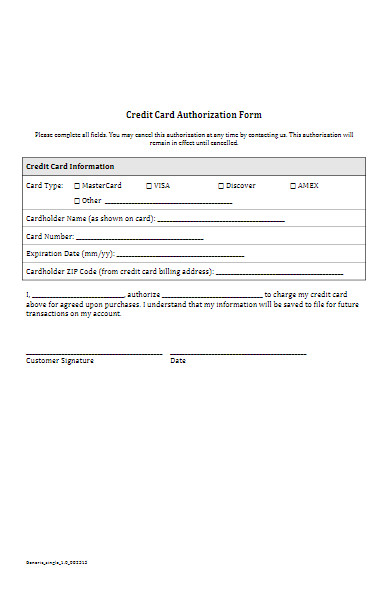

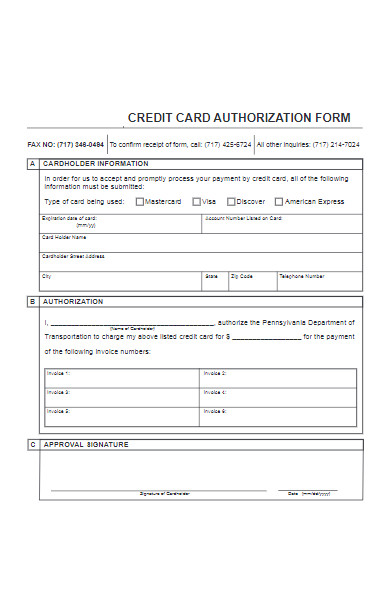

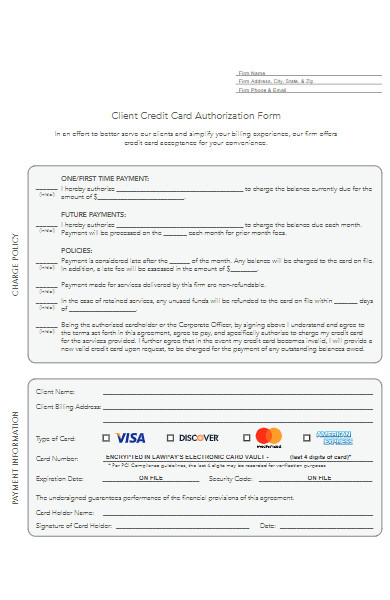

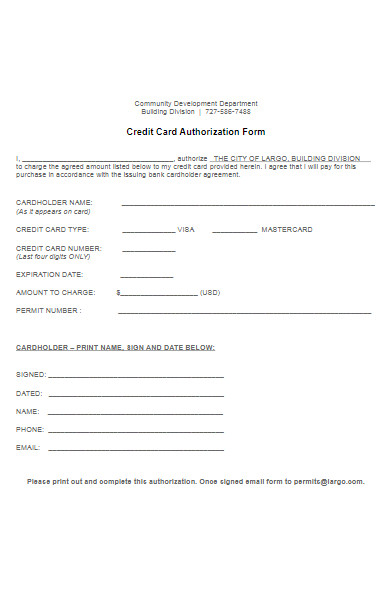

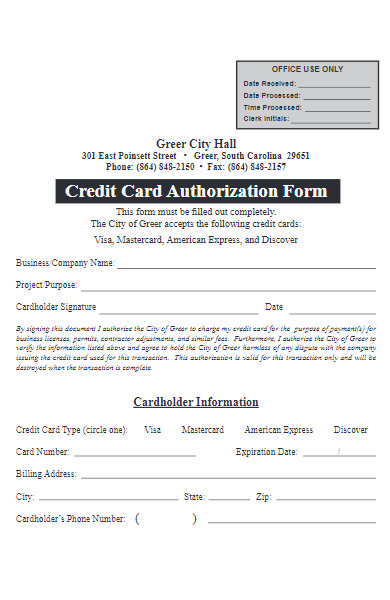

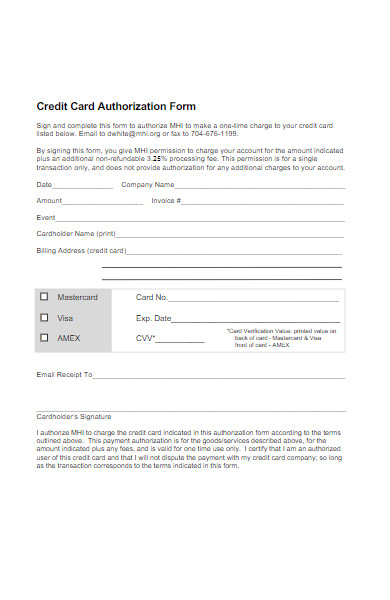

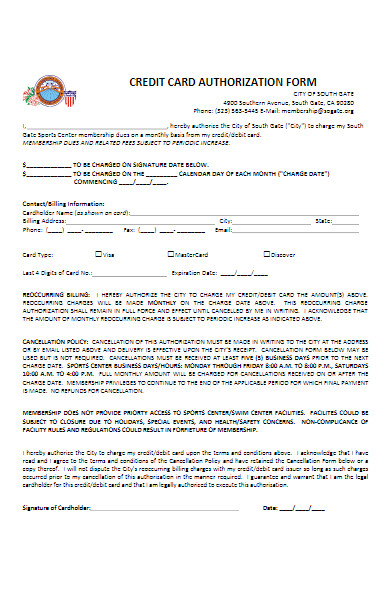

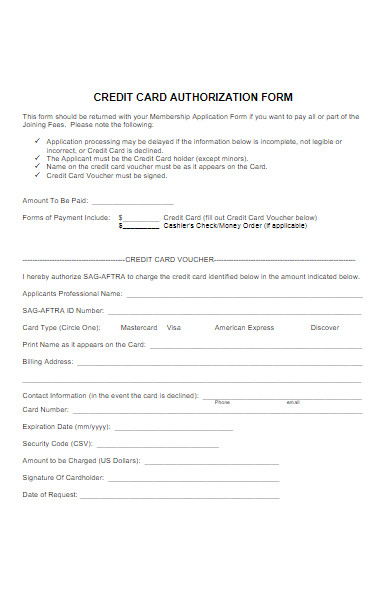

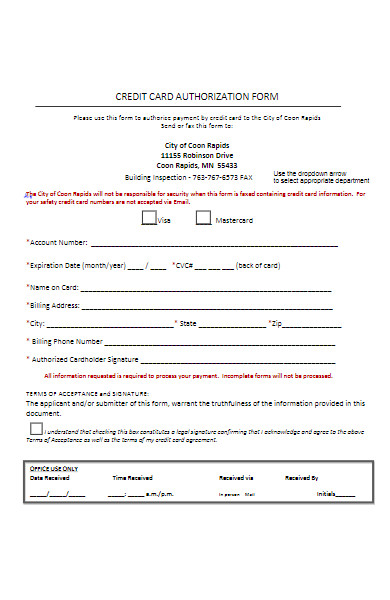

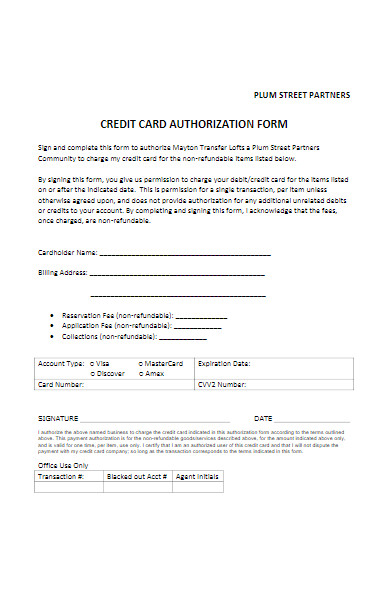

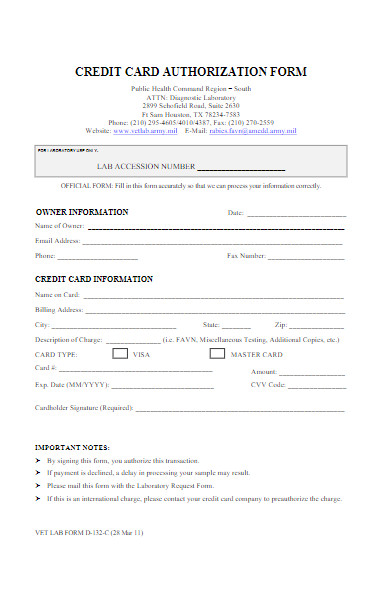

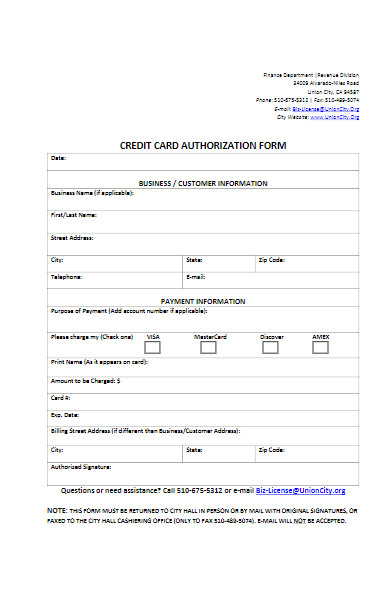

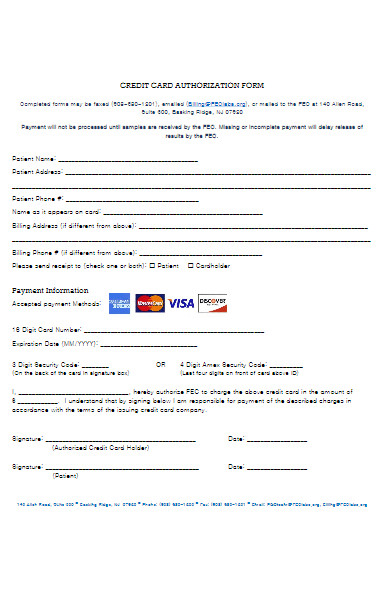

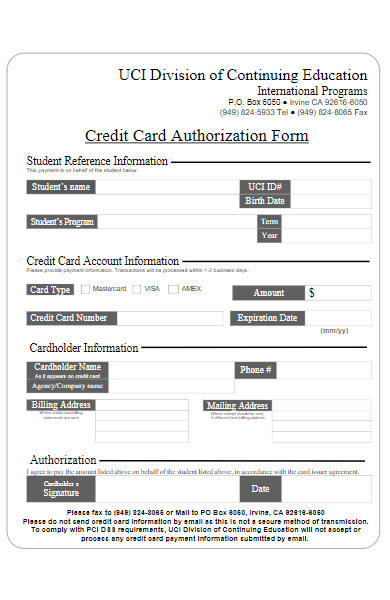

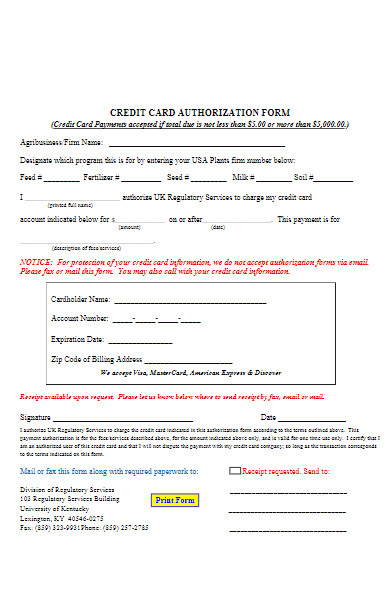

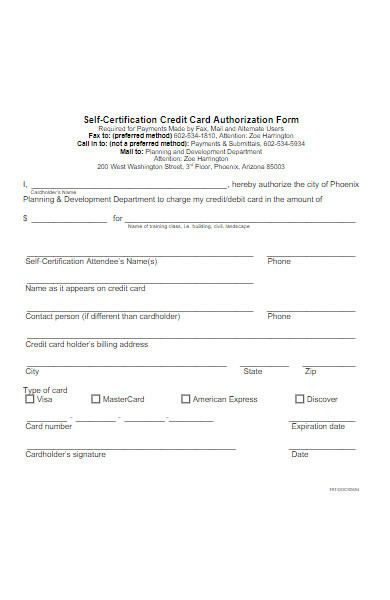

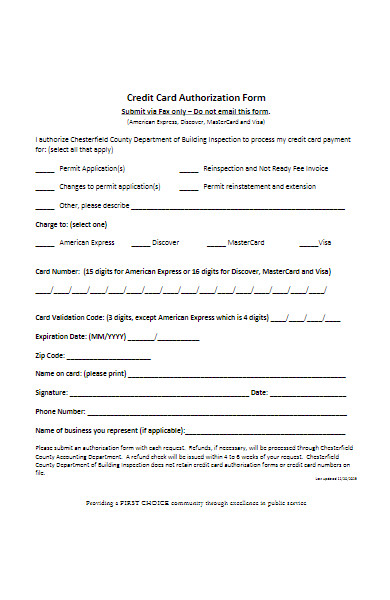

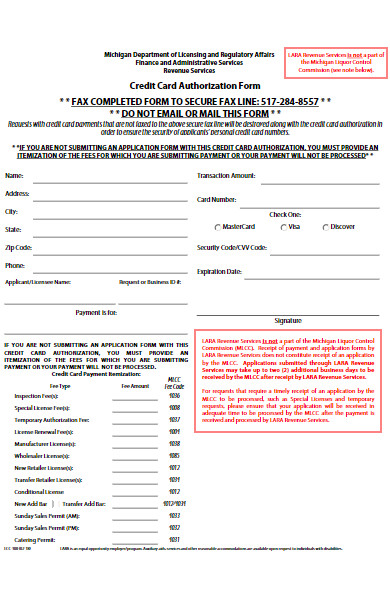

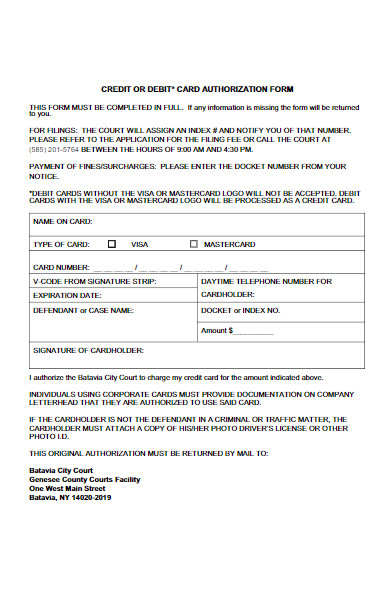

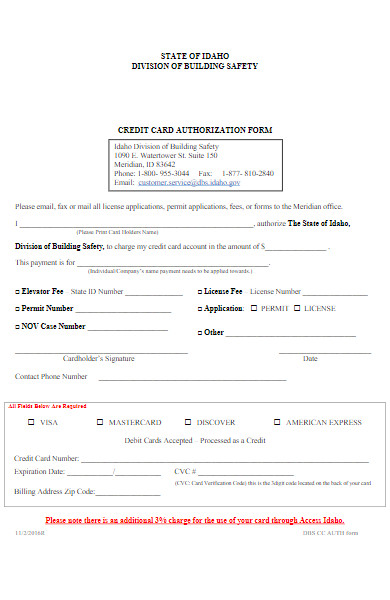

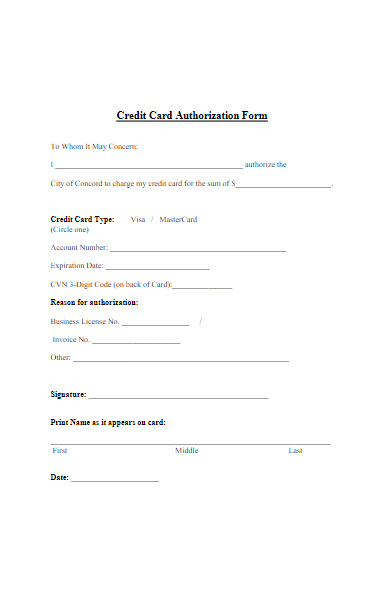

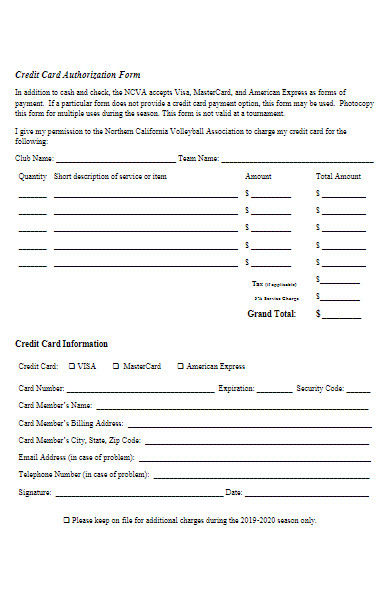

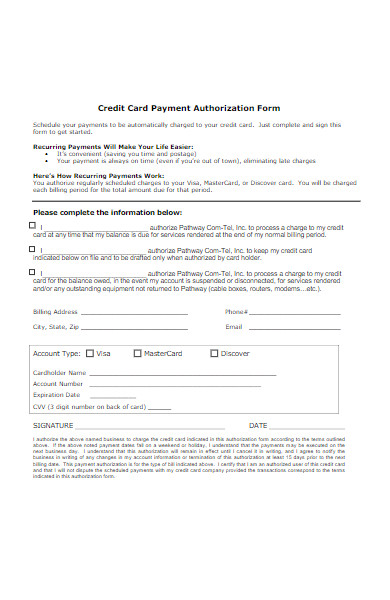

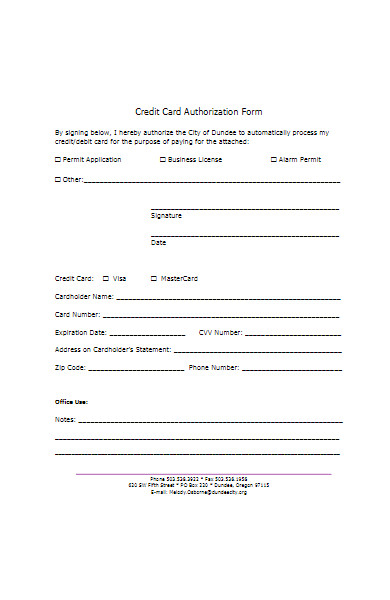

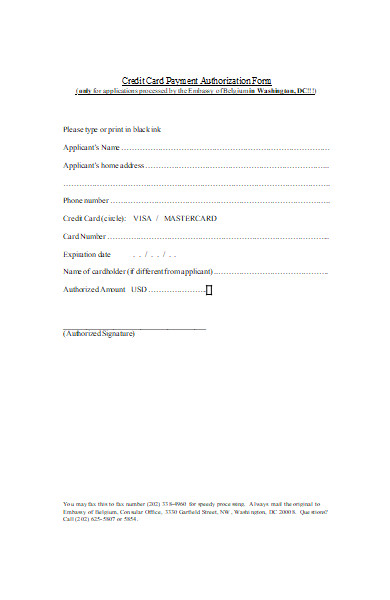

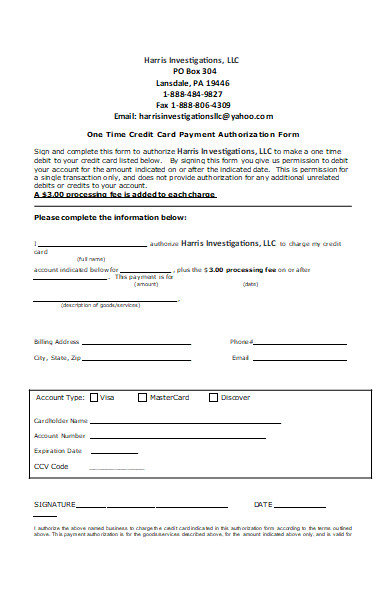

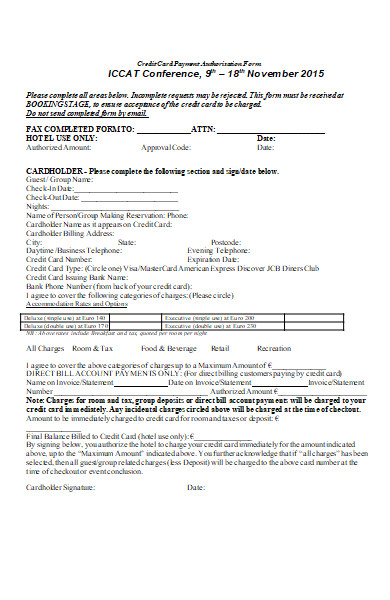

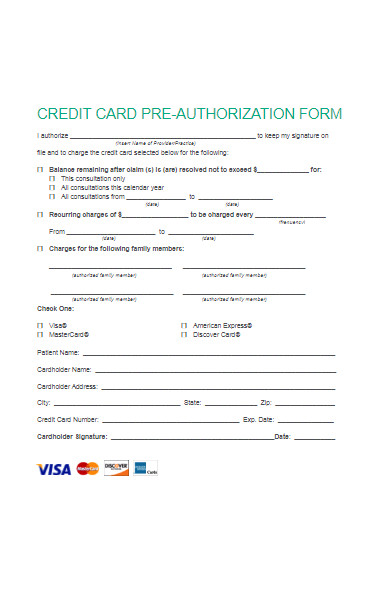

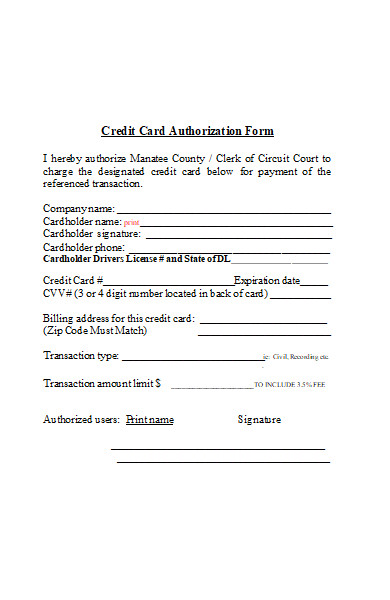

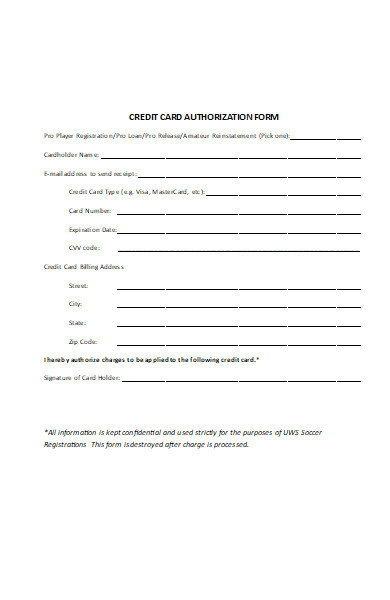

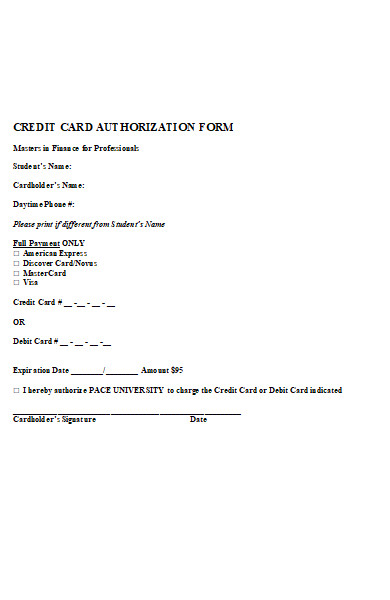

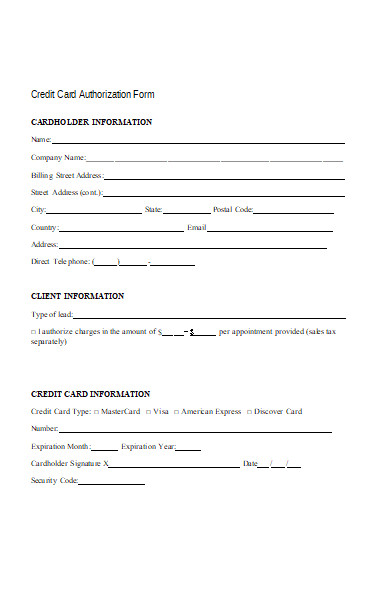

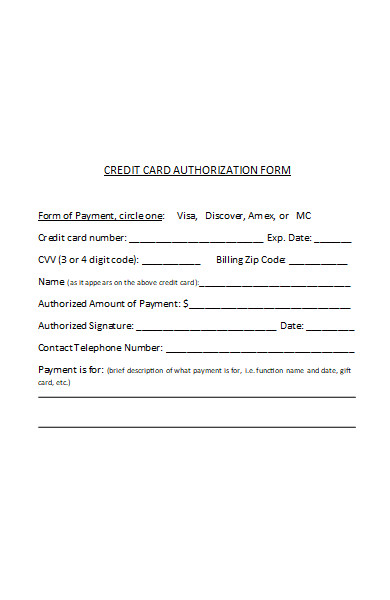

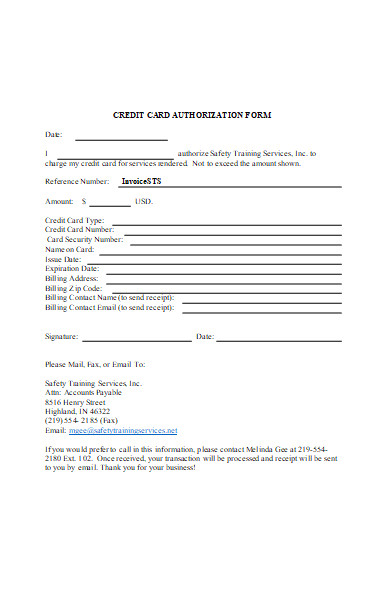

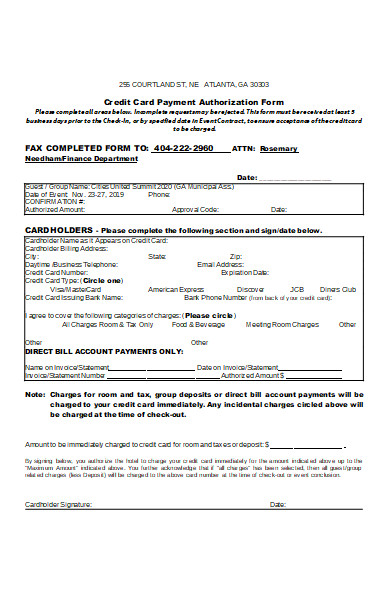

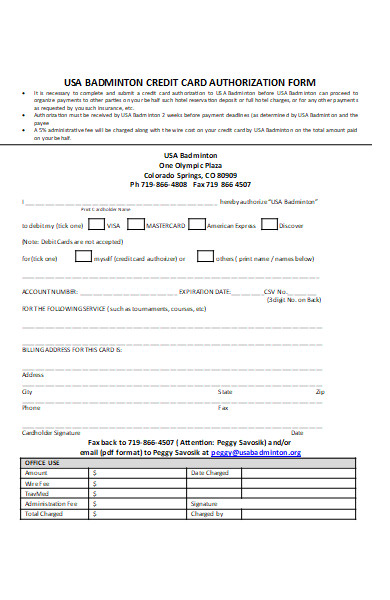

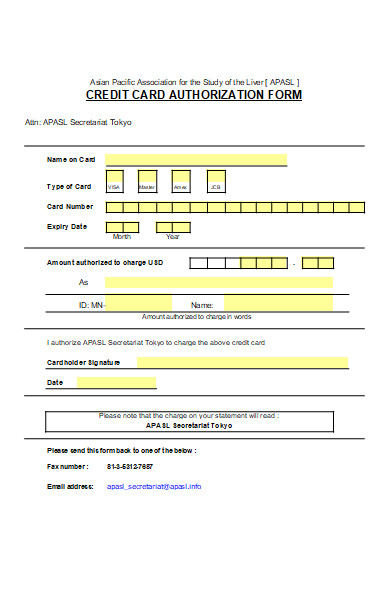

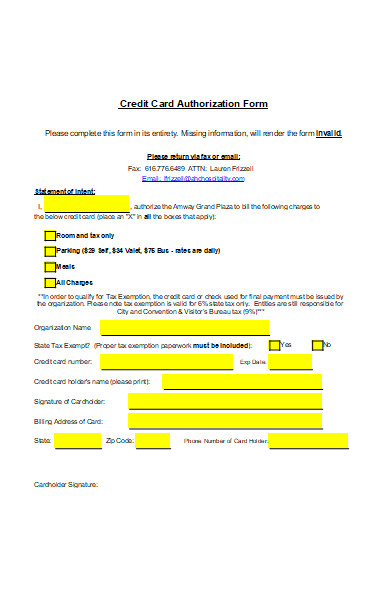

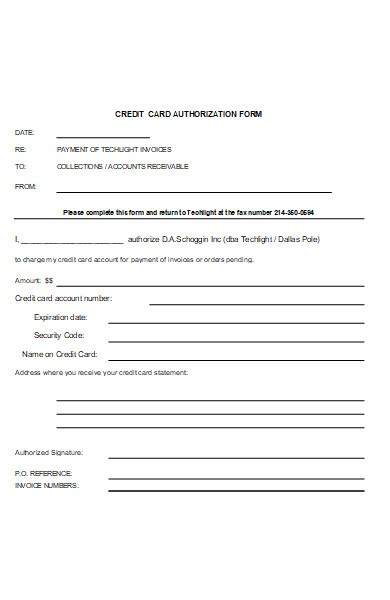

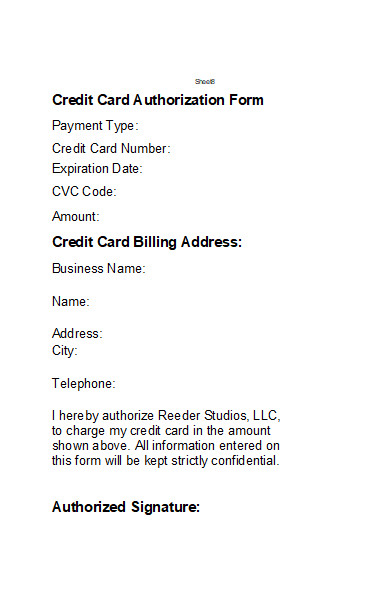

What is the Best Sample Credit Card Authorization Form?

A good sample Credit Card Authorization Form will cover all essential details for both one-time and recurring transactions. Here’s a generic template for your reference:

Cardholder’s Information:

- Full Name: ____________________________

- Address: ____________________________

- City: __________ State: __________ Zip: __________

- Phone Number: ____________________________

- Email Address: ____________________________

Credit Card Details:

- Card Type: ( ) Visa ( ) MasterCard ( ) American Express ( ) Discover ( ) Other: _______

- Credit Card Number: ____________________________

- Expiration Date: MM/YY: ______

- Security Code (CVV): ______

Transaction Information:

- Amount to be Charged: $__________

- Description of Purchase/Service: ____________________________

- One-Time Authorization: ( ) Yes ( ) No

- Recurring Authorization: ( ) Yes ( ) No

- Frequency (if recurring): _______ (e.g., monthly, weekly)

- Start Date: _______ End Date (if applicable): _______

Authorization:

I, the undersigned, authorize [Merchant/Company Name] to charge the amount listed above to the credit card provided herein. I agree to the terms and conditions set forth and will not dispute the scheduled charges with my credit card company; so long as the transactions correspond to the terms indicated in this form.

Signature: ____________________________ Date: ______

Please note that this is a basic template. Depending on the business or service, additional details or clauses might be necessary. Always consult with legal counsel when drafting or using such forms to ensure compliance with local regulations and to address potential liability issues. Also, ensure secure handling and storage of these fillable forms to protect sensitive cardholder information.

FREE 50+ Credit Card Authorization Forms

51. Blank Credit Card Authorization Form

How does a Credit Card Authorization Form work?

A Credit Card Authorization Form operates as a mechanism to facilitate and secure transactions, especially in situations where the cardholder cannot present their credit card physically. Here’s how it generally works:

- Issuance: The merchant or service provider issues the Credit Card Authorization Form to the cardholder when a transaction or series of transactions requires prior consent. This often happens for phone orders, online purchases, recurring billings, or any situation where a card isn’t directly swiped or inserted.

- Completion: The cardholder fills out the form with the necessary credit card details, such as card number, expiration date, CVV, and personal information. They also specify the transaction details, like the amount or description of the service.

- Consent: By signing the form, the cardholder provides explicit consent for the merchant to process the transaction(s). This signature is a critical component, as it indicates the cardholder’s agreement.

- Processing: Once the merchant receives the completed and signed form, they can process the transaction as authorized. For recurring payments, merchants will charge the card at the specified intervals.

- Storage: After processing, merchants must securely store the form. This ensures they have a record of the cardholder’s consent, which can be crucial in case of disputes or chargebacks. Due to the sensitive information on the form, secure storage is essential to prevent unauthorized access or breaches.

- Revocation: If a cardholder wishes to halt recurring charges or revoke their authorization, they typically need to notify the merchant in writing. The merchant then stops future transactions and, in some cases, might destroy or securely archive the authorization form.

In essence, the sample Credit Card Authorization Form in pdf serves as a bridge of trust between the cardholder and the merchant, providing a clear record of agreed-upon transactions and ensuring both parties are protected.

Can I cancel a Credit Card Authorization Form after submitting?

Yes, you can cancel a Credit Card Authorization Form after submitting it, but the process and implications may vary based on the agreement’s terms and the merchant’s policies. Here’s a general overview of the cancellation process:

- Immediate Notification: If you change your mind shortly after submitting the form, contact the merchant or service provider as soon as possible. The sooner you notify them, the higher the chances of preventing any unwanted charges.

- Written Revocation: Most businesses require a written notice to cancel a credit card authorization, especially for recurring charges. Ensure your notice clearly states your intent to revoke the authorization, includes pertinent details (like the date of the original authorization and any transaction references), and is dated and signed.

- Check the Agreement’s Terms: The authorization form or associated agreement might stipulate specific procedures or timelines for cancellations. Adhering to these guidelines will facilitate a smoother cancellation process.

- Monitor Your Statements: After submitting your cancellation request, closely monitor your credit card statements to ensure no further charges occur. If unauthorized charges appear after cancellation, contact the merchant and your credit card provider promptly.

- Document Everything: Keep copies of any communication related to the cancellation, whether it’s the initial cancellation request or subsequent follow-ups. This documentation can be crucial if disputes arise.

- Be Aware of Potential Fees: Some agreements might have penalties or fees associated with early termination or cancellation. Review the terms before canceling to avoid unexpected charges.

Remember that while you can cancel future transactions through the revocation of a Credit Card Authorization Form, this action doesn’t negate any valid charges made prior to the cancellation or any other obligations under the initial agreement (e.g., payments for services already rendered). You may also be interested in our Credit card billing authorization forms.

Do you need CVV for Credit Card Authorization Form?

The inclusion of the CVV (Card Verification Value) on a Credit Card Authorization Form depends on a few factors:

- Security Protocols: The CVV is a security feature designed to prove that the cardholder has the physical card in their possession when making a purchase, especially for “card-not-present” transactions. If a merchant is processing a transaction where the card isn’t present, the CVV can provide an additional layer of security.

- Merchant Agreements: Some payment processors or merchant service agreements might require the CVV to process certain types of transactions. Merchants should consult with their payment processors to understand any specific requirements.

- PCI Compliance: According to the Payment Card Industry Data Security Standard (PCI DSS) guidelines, merchants are prohibited from storing the CVV after a transaction has been authorized. This means that if a business is keeping a Credit Card Authorization Form on file for future transactions, they shouldn’t record or store the CVV. The form can collect the CVV for an initial transaction, but it must not be stored afterward.

In practice, while many merchants might ask for the CVV to verify the initial transaction, they should be cautious about how this sensitive data is handled, ensuring it isn’t stored improperly or for longer than necessary.

If you’re a cardholder, be discerning about when and where you provide your CVV. Ensure you trust the merchant or service provider and understand the reasons they’re requesting this information. If you’re a merchant, always prioritize the security of cardholder data and adhere to PCI DSS guidelines. You may also be interested to browse through our other Sample Payment Authorization Forms.

How often should I update my Credit Card Authorization Form?

The frequency with which you should update your Credit Card Authorization Form depends on several factors:

- Card Expiry: If the credit card listed on the form is nearing its expiration date, an update will be necessary. Some recurring payment systems might automatically decline transactions with expired cards.

- Card Details Change: If there’s a change in the credit card number (e.g., due to loss, theft, or a card upgrade), the form will need to be updated with the new card information.

- Change in Transaction Details: If there are changes in the nature of the transaction, such as different payment amounts for a subscription or a change in the frequency of payments, it’s advisable to update the form to reflect these alterations.

- Periodic Review: Even if no specific changes necessitate an update, it’s a good practice for businesses to periodically review and revalidate authorization forms, especially for long-term or recurring transactions. This can be done annually or at another suitable interval. This not only ensures the details are still accurate but also reaffirms the cardholder’s consent.

- Security Incidents: If a company experiences a data breach or has reason to believe that their stored authorization forms might have been compromised, it’s prudent to request all customers or clients to submit updated forms. This is a precautionary measure to ensure the continued security of transactions.

- Regulatory or Policy Changes: If there are changes in regulations governing credit card transactions or internal company policies, you might need to update the form to remain compliant.

For cardholders, it’s essential to notify merchants or service providers whenever there’s a change in your card details to ensure uninterrupted service and avoid potential late fees or service disruptions. For businesses, maintaining up-to-date authorization forms can minimize transaction declines and potential disputes. You can also browse our hotel credit card authorization forms.

What details are needed for a Credit Card Authorization Form?

A Credit Card Authorization Form typically requires the following details to ensure a successful and secure transaction:

-

Cardholder’s Personal Information:

- Full Name (as it appears on the card)

- Billing Address (where the card statements are sent)

- Contact Information (phone number, email address)

-

Credit Card Information:

- Credit Card Number

- Expiration Date (Month/Year)

- CVV (Card Verification Value) – This is the 3-digit code on the back of Visa, MasterCard, and Discover cards, or the 4-digit code on the front of American Express cards. (Remember, while this can be used to verify an initial transaction, storing CVV post-transaction is against PCI DSS guidelines.)

-

Transaction Details:

- Amount to be charged (or a statement indicating that the cardholder authorizes variable amounts up to a certain limit, especially for recurring payments or services where the final amount might vary)

- Description of goods/services being provided

- Frequency of charge (for recurring payments, e.g., monthly, quarterly)

- Date of the transaction or the start date for recurring charges

-

Authorization Statement:

- A clear statement indicating that the cardholder grants permission to the merchant or service provider to charge the listed card for the specified goods/services.

-

Signature and Date:

The cardholder’s signature and the date of signing. The signature signifies that the cardholder agrees to the terms of the transaction and confirms the accuracy of the information provided.

-

Additional Terms or Conditions:

- Depending on the nature of the transaction or the merchant’s policies, there might be other terms or conditions specified on the form, like cancellation policies, potential fees, or details about service delivery.

-

Special Instructions:

- If there are any unique instructions regarding the transaction, such as specific billing dates or notification preferences, they might also be included.

For security reasons, it’s crucial to handle and store these forms with care, ensuring they’re protected against unauthorized access or misuse. If a form is being stored for recurring transactions, remember to adhere to PCI DSS guidelines and avoid storing sensitive data like the CVV. You should also take a look at our recurring credit card authorization forms.

How do I send a Credit Card Authorization Form?

Sending a Credit Card Authorization Form requires careful attention to security and privacy, given the sensitive nature of the data involved. Here are steps and best practices for transmitting a Credit Card Authorization Form:

-

Digital Methods:

- Secure Online Portal: If you’re a business accepting these forms, it’s best to have a secure online portal where clients can fill in their details directly. This system can encrypt the data for transmission and storage, ensuring the details are protected.

- Encrypted Email: If you must send the form via email, use an encrypted email service to protect the information from potential eavesdropping. Remember to advise the recipient to return the completed form using an equally secure method.

- Fax: While somewhat dated, faxing is still considered a relatively secure method for transmitting sensitive information. Ensure the fax machine is in a secure location and the received form is promptly retrieved and stored safely.

-

Physical Methods:

- Mail: You can send the form via postal mail, preferably using a trackable and secure method.

- In-Person: For local businesses, having clients fill out and submit the form in person can be the safest method, provided the form is then stored securely.

-

Safety Precautions:

- Avoid Standard Email: Unless encrypted, standard email isn’t a secure method for sending sensitive financial information.

- Avoid Text Messages: Like standard email, SMS text messages aren’t secure for transmitting sensitive data.

- Secure Storage: Once received, store the form securely. Digital forms should be stored in encrypted databases, and physical forms should be kept in locked cabinets or safes.

-

Follow PCI Compliance:

- Businesses that handle credit card data need to adhere to the Payment Card Industry Data Security Standard (PCI DSS). This set of standards ensures that companies handle credit card information in a way that prevents fraud and data breaches.

-

Inform the Client:

- Make sure the client knows and trusts the method they’re using to send the form. Provide clear instructions, and if using an online portal, ensure the website has visible security certifications.

-

Confirmation:

- Once you’ve received the form, it’s a good practice (and reassuring for the client) to send a confirmation receipt. This acknowledges the form’s safe receipt but doesn’t detail the sensitive data in the confirmation.

Remember, the key is to prioritize the security of the information at every step, from transmission to storage. Ensure that the process is transparent and straightforward for clients or customers, and always keep their data security at the forefront. Our Holiday Credit Card Authorization Form is also worth a look at

Is it safe to fill a Credit Card Authorization Form?

Filling out a Credit Card Authorization Form inherently involves sharing sensitive financial information. Whether it’s safe largely depends on the context, the recipient, and the measures taken to protect that data. Here are factors to consider and precautions to take:

- Trustworthiness of the Recipient: Ensure you’re dealing with a reputable and legitimate business or individual. Do your due diligence to verify their authenticity.

- Secure Transmission: If you’re sending the form electronically, ensure that the transmission is secure. This could be through a secure online portal, encrypted email, or fax. Avoid sending sensitive information via regular email or text message.

- Physical Security: If delivering a form physically, make sure it gets directly to the intended recipient. If mailing, consider using tracked and secured mail services.

- Storage by the Recipient: Ask the recipient about their storage practices. Digital forms should be stored in encrypted databases, and physical forms should be in locked storage. They should also adhere to PCI DSS guidelines which prohibit the storage of certain card details like the CVV after the transaction is authorized.

- Purpose of the Form: Understand why the form is needed. Typically, Credit Card Authorization Forms are used for transactions where the card isn’t physically present, such as phone orders, recurring payments, or initial deposits. Be wary if asked for such a form in situations where it doesn’t seem necessary.

- Limit the Scope: If possible, limit the authorization to a specific amount and time frame. For instance, instead of giving blanket permission for all future charges, specify an amount or time period (e.g., “charges up to $100” or “charges until December 2023”).

- Keep Records: Maintain a copy of any authorization form you fill out, so you have a record of what permissions you granted.

- Cancellation or Expiry: Understand the process to revoke the authorization if needed. Some forms might have an expiration date, after which a new form would be required for further transactions.

- Regularly Review Statements: Even with precautions, it’s wise to regularly check your credit card statements for any unauthorized or suspicious transactions. If you notice anything amiss, contact your credit card provider immediately.

- Use Dedicated Cards: If you frequently provide card details for such forms, consider having a credit card dedicated to these transactions. This can limit potential damages and make monitoring easier.

In summary, while Credit Card Authorization Forms can be safe when handled correctly, it’s crucial to be vigilant and proactive in safeguarding your financial information. Always prioritize your data’s security and be cautious about where and how you share it. In addition, you should review our third party authorization form.

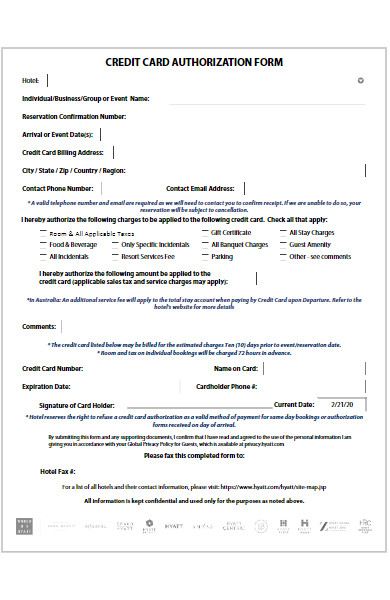

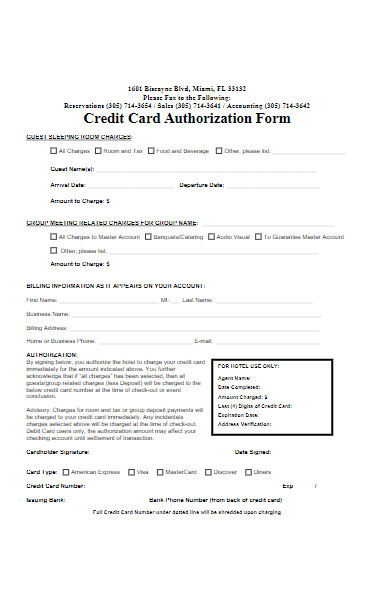

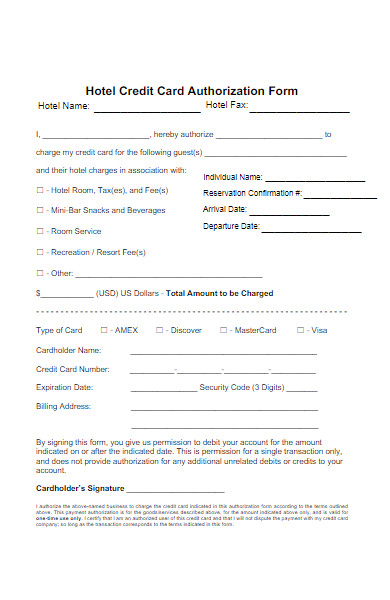

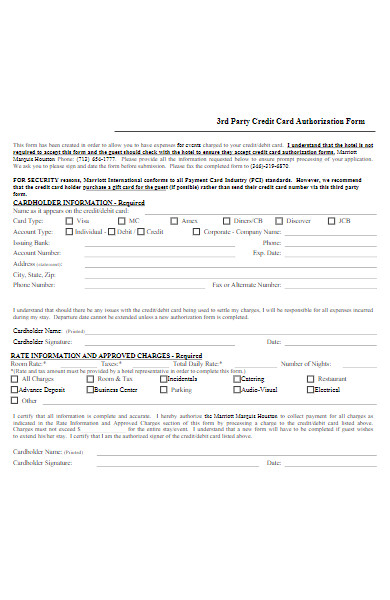

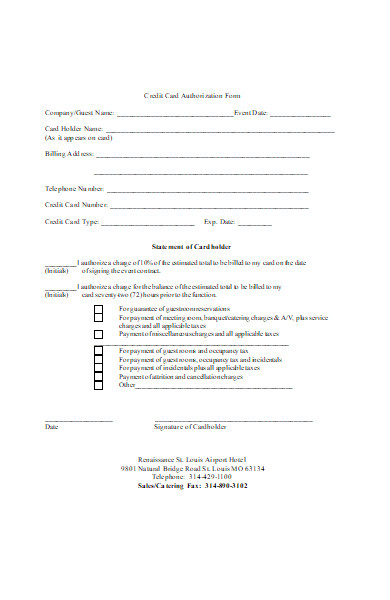

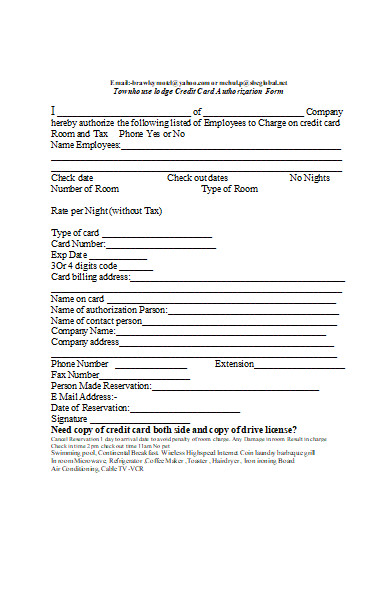

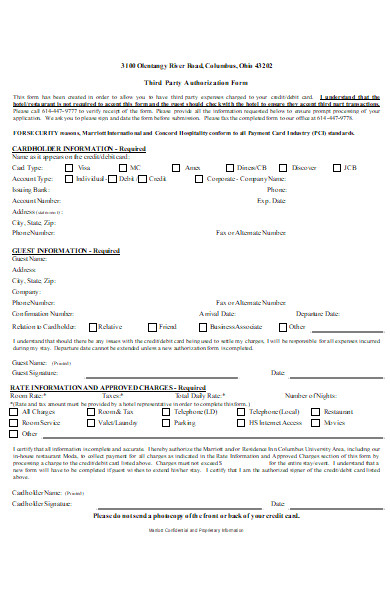

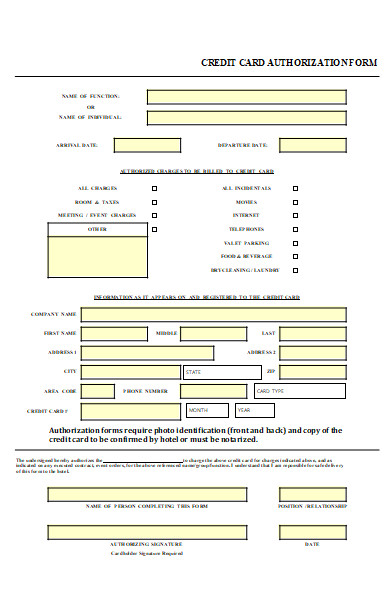

What is a Credit Card Authorization Form hotel?

A Credit Card Authorization Form for hotels is a specific type of authorization form used in the hospitality industry. It allows guests to use a credit card to secure a reservation or allow third parties (like companies or family members) to cover the costs associated with a hotel stay. This form grants the hotel permission to charge the card for expenses that may arise during the guest’s stay or for any cancellation or no-show fees.

Key components of a Credit Card Authorization Form for hotels typically include:

- Guest Information: Details about the guest, such as name, check-in and check-out dates, and reservation number.

- Cardholder’s Information: If different from the guest, this includes the cardholder’s name, address, and contact details.

- Credit Card Details: This section captures the credit card number, expiration date, and CVV. Some forms may also ask for the type of card (e.g., Visa, MasterCard).

- Charges Authorization: The form will specify what charges the card can be used for. This might include room rate, taxes, resort fees, and incidental charges like room service, minibar use, or damage fees.

- Duration of Authorization: Some forms specify how long the authorization lasts, especially if it’s for incidentals or potential damages.

- Signature: The cardholder’s signature is required to validate the authorization, along with the date of signing.

- Documentation: Some hotels may request a photocopy of both the credit card (front and back) and the cardholder’s ID (like a driver’s license or passport) to verify the cardholder’s identity.

Why hotels use these forms:

- Third-Party Payments: If someone other than the guest wants to pay for the room (for example, a company covering an employee’s travel expenses), the hotel will require this form to process charges without the card being physically present.

- Guaranteed Reservations: Hotels use the form to guarantee the reservation. If the guest doesn’t show up or cancels after the hotel’s cancellation deadline, the hotel can charge the cancellation or no-show fee to the provided card.

- Incidental Charges: Hotels often use credit card authorizations to cover potential incidental charges during a guest’s stay, such as room service, minibar charges, or any potential damages to the room.

For security reasons, guests and cardholders should ensure they’re providing this information to legitimate establishments and follow up after their stay to ensure no unauthorized charges were made. Likewise, hotels should store this sensitive information securely and dispose of it properly once it’s no longer needed.

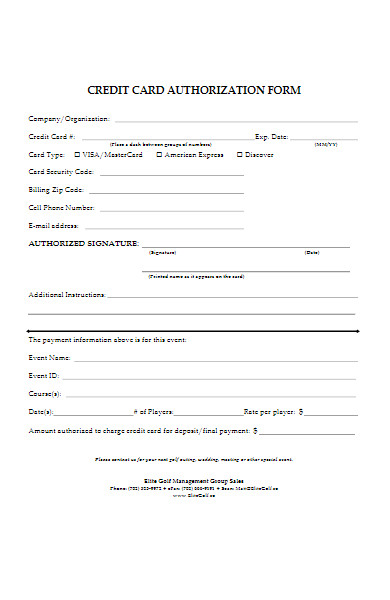

How to Create a Credit Card Authorization Form?

Creating a Credit Card Authorization Form requires attention to detail to ensure both clarity and security. Here’s a step-by-step guide to creating one:

- Header and Title:

- Start with your business name, logo, and contact details at the top.

- Use a clear title such as “Credit Card Authorization Form.”

- Guest or Client Information (if applicable):

- Full Name

- Reservation or Invoice Number

- Dates of service (e.g., check-in and check-out dates for hotels)

- Address

- Phone number

- Email address

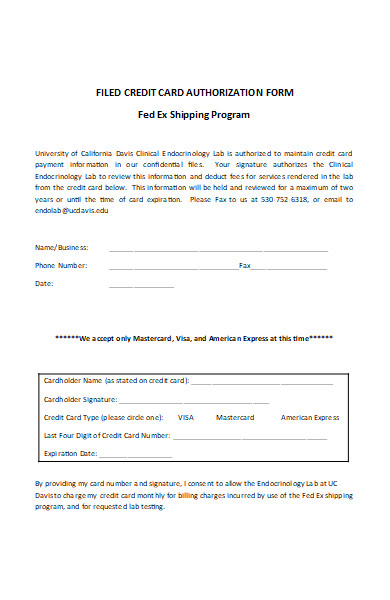

- Credit Card Information:

- Credit Card Type (e.g., Visa, MasterCard, American Express)

- Cardholder’s Name (as it appears on the card)

- Credit Card Number

- Expiry Date

- CVV (Card Verification Value)

- Billing Address (associated with the credit card)

- Authorization Details:

- Specify the type of charges permitted, such as room charges, services, incidentals, or a specific amount.

- Duration of authorization, indicating how long the authorization is valid.

- Terms and Conditions:

- State any terms related to the authorization, such as potential fees for cancellations, no-shows, or service charges.

- Include details about how the credit card information will be stored and protected, and for how long.

- Mention the protocol for any potential refunds or disputes.

- Signature Section:

- A statement like, “I, [Cardholder’s Name], authorize [Your Business Name] to charge the above-listed credit card for the services described.”

- Space for the cardholder’s signature and date.

- Documentation:

- Mention if additional documents, such as photocopies of the credit card (front and back) and the cardholder’s ID, are required.

- Footer:

- Include a confidentiality note, emphasizing that the form will be kept secure and private.

- Design and Layout:

- Ensure the form is well-organized and easy to understand.

- Use a clear and legible font.

- Consider using fields or boxes for each piece of information to make the form neat and easy to fill out.

- Security Considerations:

- If creating a digital form, ensure it’s on a secure platform.

- Ensure compliance with the Payment Card Industry Data Security Standard (PCI DSS) when storing or transmitting credit card data.

- Review and Legal Check:

- Before finalizing and distributing the form, have it reviewed by legal counsel to ensure it meets all necessary regulations and adequately protects your business.

- Feedback Loop:

- Test the form with a few trusted individuals or clients to gather feedback and make any necessary refinements.

By following these steps and prioritizing security, clarity, and compliance, you’ll have an effective Credit Card Authorization Form ready for use.

Tips for creating an Effective Credit Card Authorization Form

Creating an effective Credit Card Authorization Form is pivotal to ensure a smooth transaction process, safeguard sensitive information, and maintain trust between businesses and customers. Here are some tips to help in the creation of such a form:

- Clarity is Key: Use straightforward language. Avoid jargon or overly technical terms to ensure the cardholder understands what they’re authorizing.

- Limit Required Information: Only ask for the essential credit card and cardholder details necessary for the transaction. This reduces the risk associated with handling and storing excessive personal data.

- Highlight Security Measures: Clearly state how the credit card information will be stored, processed, and protected. This builds trust with the cardholder.

- Use Defined Sections: Group related information together in clear sections (e.g., cardholder details, card details, authorization details) to make the form more intuitive.

- Include Validity Duration: Specify how long the authorization is valid. Whether it’s for a one-time charge, recurring charges, or until a particular date.

- Transparent Terms and Conditions: Clearly mention any associated fees, penalties, or conditions related to the transaction.

- Provide Contact Details: Include contact information where cardholders can reach out with questions or concerns regarding the form or transaction.

- Use a Logical Flow: Arrange the sections in a logical order, typically starting with cardholder details, followed by card details, and ending with the authorization and signature.

- Opt for Digital Forms: If applicable, consider using digital forms with encrypted data transmission to enhance security.

- Compliance with Regulations: Ensure the form is compliant with the Payment Card Industry Data Security Standard (PCI DSS) and other relevant regulations. This is not only a best practice but often a requirement.

- Prompt for Signature: The signature section should be clear and accompanied by a statement where the cardholder acknowledges the charges and terms.

- Provide Clear Instructions: If you require additional documents (e.g., photocopies of the card or ID), clearly state this in the form instructions.

- Maintain a Professional Appearance: The design and layout of the form should be clean, organized, and professional. This adds to the legitimacy and trustworthiness of the form.

- Review and Update: Regularly review and update the form to address any changes in regulations, security standards, or business policies.

- Feedback and Refinement: After introducing the form, gather feedback from staff and customers to identify any areas of confusion or concern and make necessary refinements.

By adhering to these tips and prioritizing both clarity and security, businesses can develop a Credit Card Authorization Form that is both efficient and trusted by clients.

A Credit Card Authorization Form is a crucial document that grants businesses permission to charge a cardholder’s account. Its essence lies in its clarity, security, and adherence to regulations. With various types and uses, especially in sectors like hospitality, understanding its nuances aids in creating an effective form. Properly designed, it simplifies transactions while ensuring mutual trust between businesses and clients. You may also be interested in our Security Authorization Form.

Related Posts Here

-

FREE 13+ Check Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Pre Authorization Forms in PDF | Excel

-

FREE 9+ Sample Authorization Request Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Travel Authorization Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Travel Authorization Forms in MS Word | PDF | Excel

-

FREE 10+ Sample Credit Authorization Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Medicare Authorization Forms in PDF | MS Word

-

FREE 8+ Hotel Credit Card Authorization Forms in PDF | MS Word | Excel

-

FREE 9+ Medical Records Authorization Forms in PDF | MS Word | Excel

-

FREE 13+ Payroll Authorization Forms in PDF | MS Word | Excel

-

FREE 8+ Medical Treatment Authorization Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Medical Authorization Forms in PDF | MS Word | Excel

-

FREE 7+ Recurring Credit Card Authorization Forms in PDF | MS Word

-

FREE 5+ Daycare Authorization Forms in PDF

-

FREE 10+ Compensatory Time Authorization Forms in PDF | MS Word