A Payment Authorization Form serves as the linchpin for secured and consented financial transactions, ensuring that payments, whether one-time or recurring, are approved by the involved parties. These forms, while simple in appearance, carry significant weight, authorizing entities to process payments from bank accounts or credit cards. With a range of types tailored to varied payment scenarios, understanding their essence, proper execution, and best practices is paramount. Embark on this comprehensive guide to delve into the intricacies of Payment Authorization Forms and their significance in the financial landscape.

What is a Payment Authorization Form ? – Definition

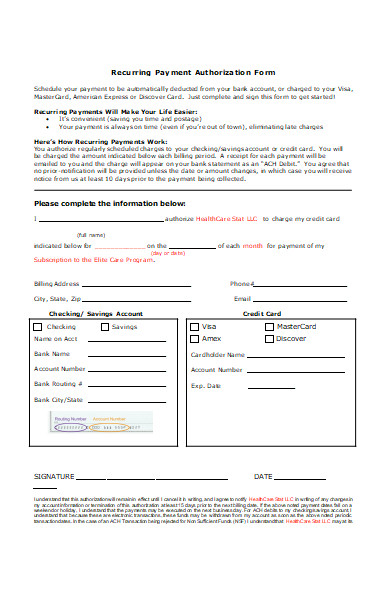

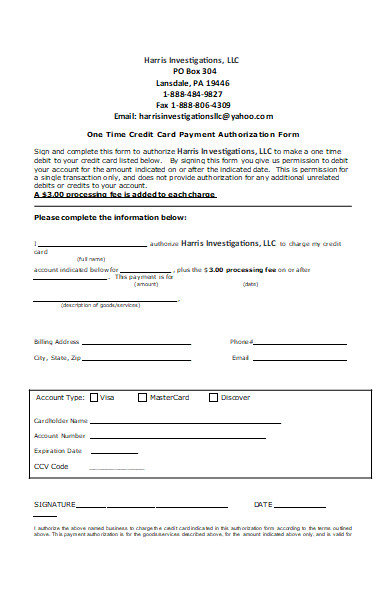

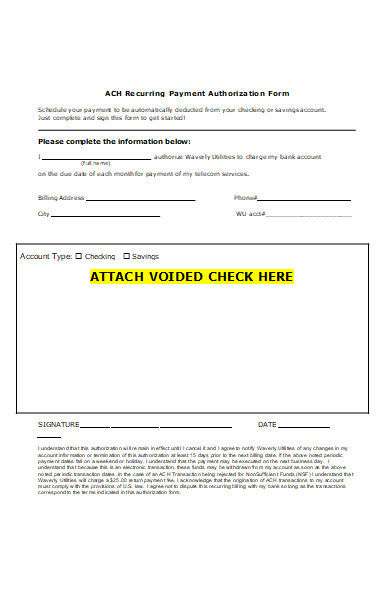

A Payment Authorization Form is a formal document that grants permission to a business or organization to process a specific payment using an individual’s or company’s financial details. It ensures that the payer has willingly provided their information and consented to the transaction or series of transactions. These printable form can be used for single, recurring, or multiple payments, and it typically includes details like the payer’s account information, the payment amount, frequency of payment (if recurring), and a declaration signifying the payer’s consent.

What is the Meaning of a Payment Authorization Form?

The meaning of a Payment Authorization Form centers on its role as a written agreement, signifying that an individual or entity has granted explicit permission for a business or organization to carry out a financial transaction using their designated payment method. This consent ensures that transactions are processed in good faith and with transparency. The form is a testament to the payer’s acknowledgment and willingness to allow specified charges to be made, either as a one-time event or on a recurring basis. In essence, it acts as a protective measure, mitigating unauthorized transactions and potential disputes.

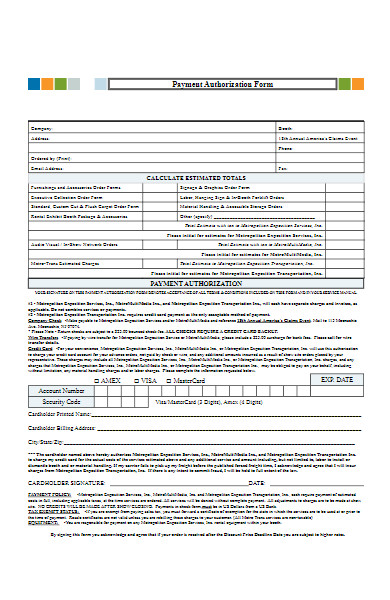

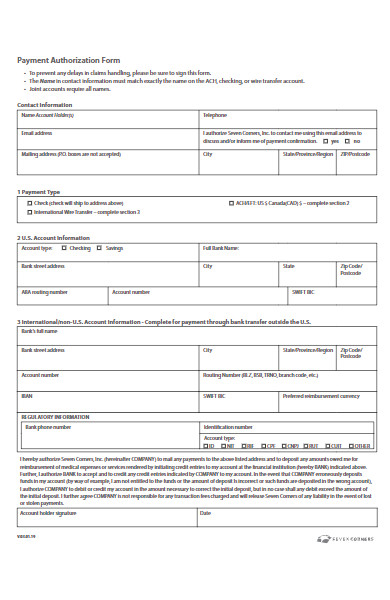

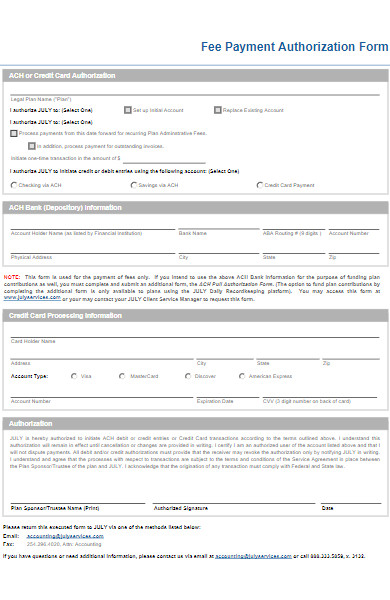

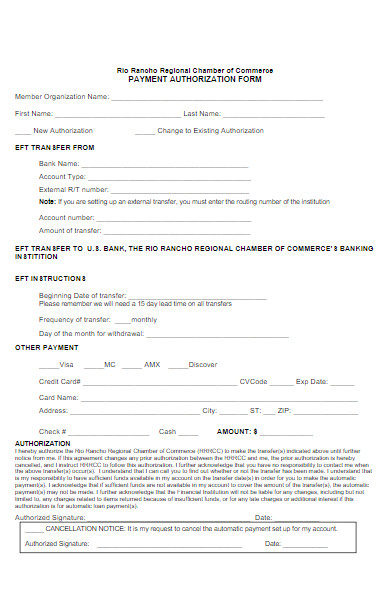

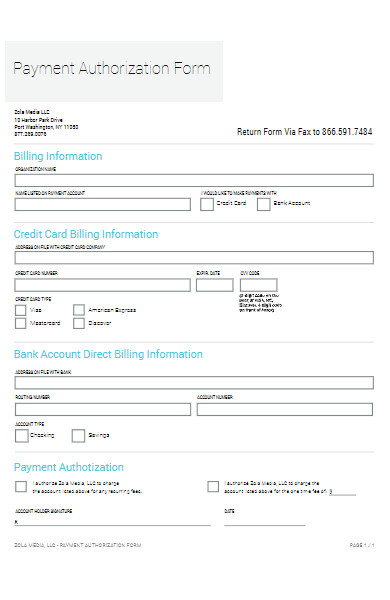

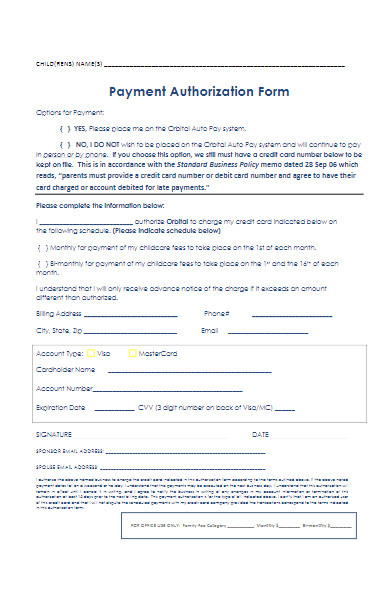

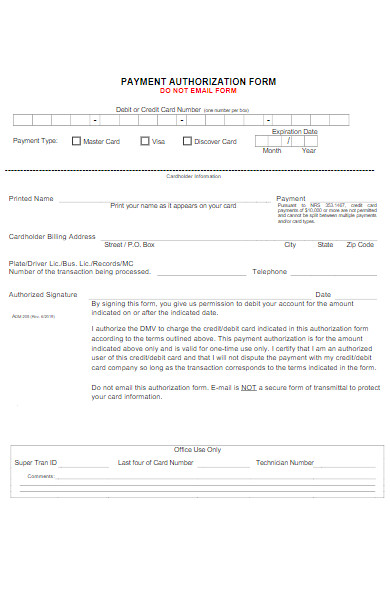

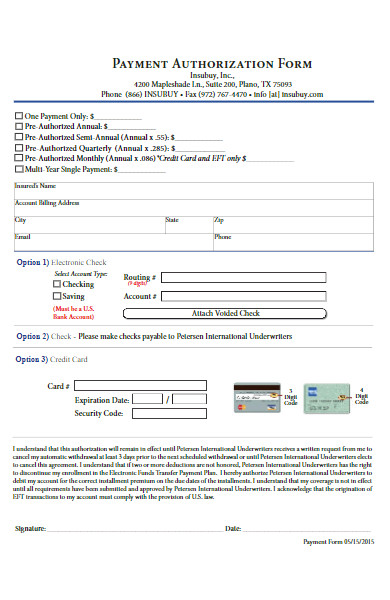

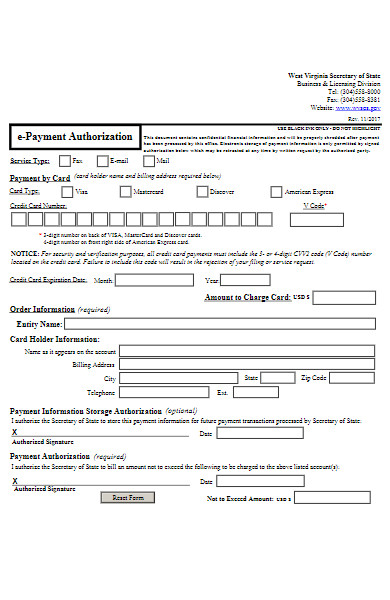

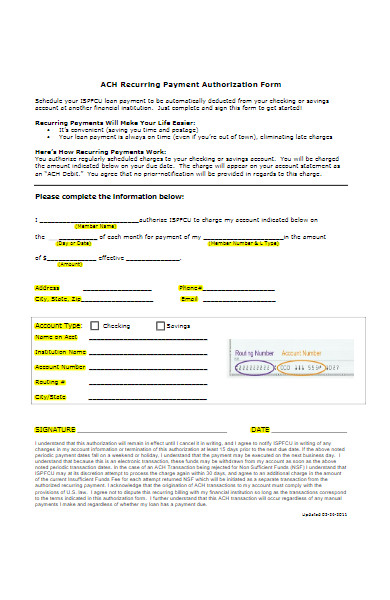

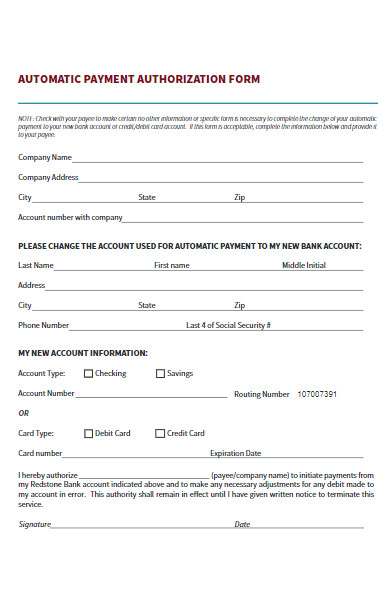

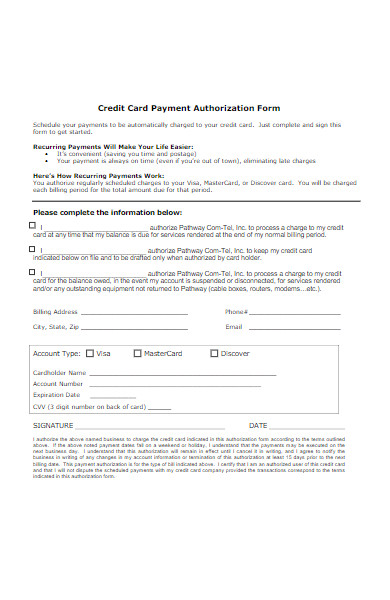

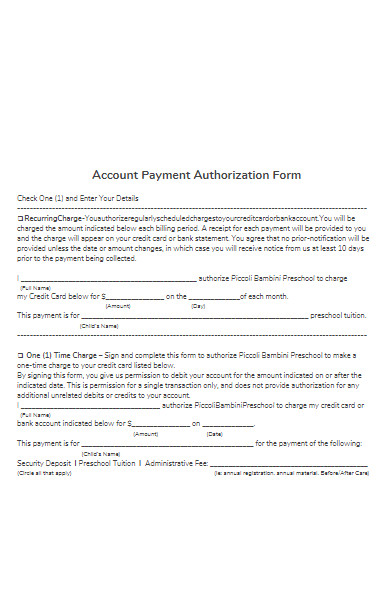

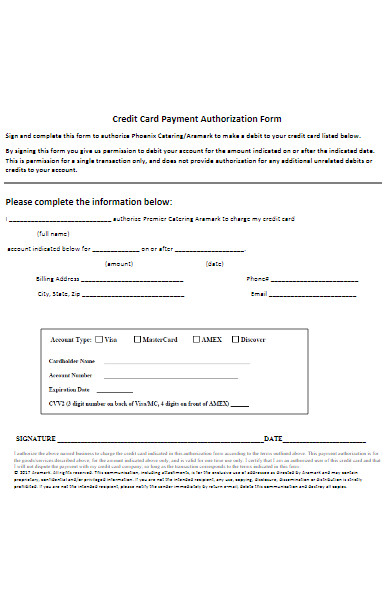

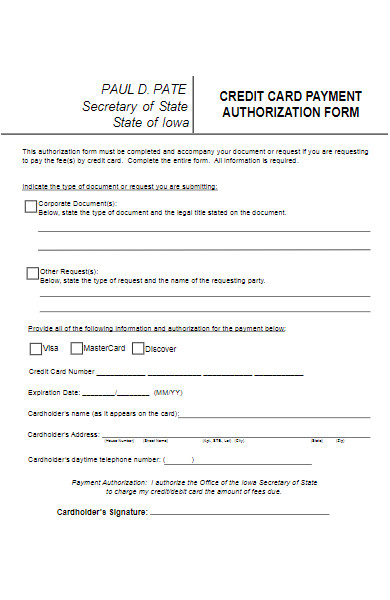

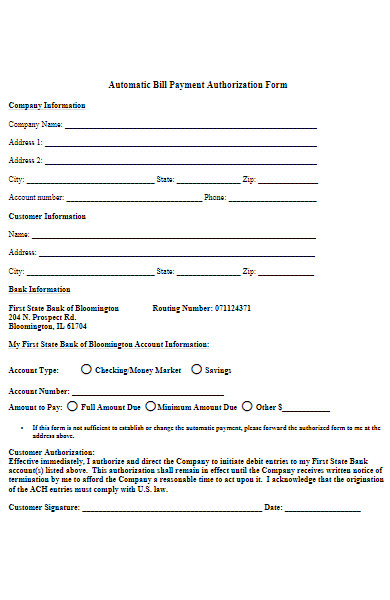

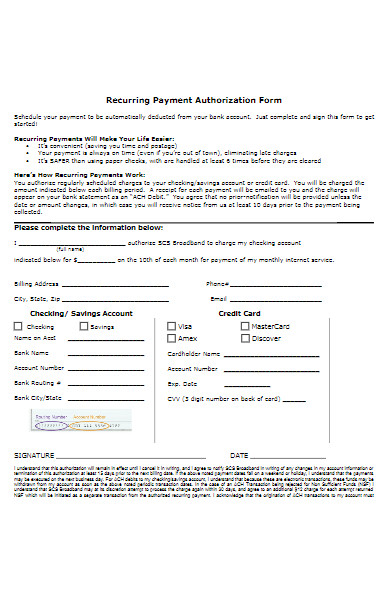

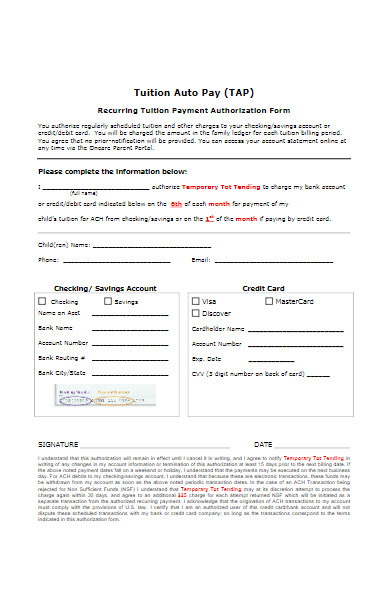

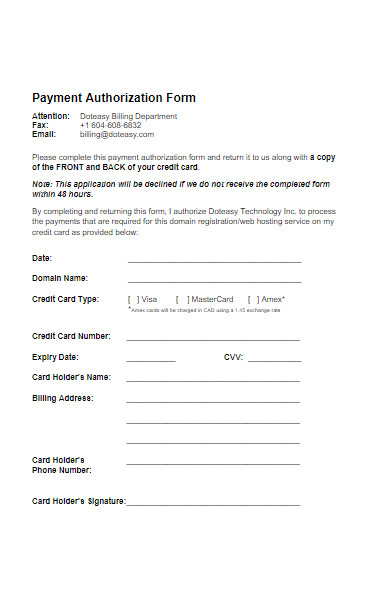

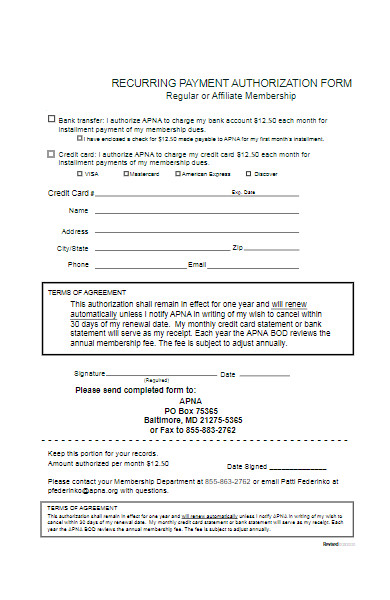

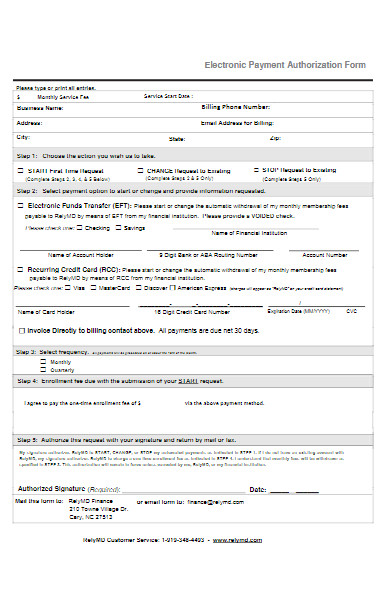

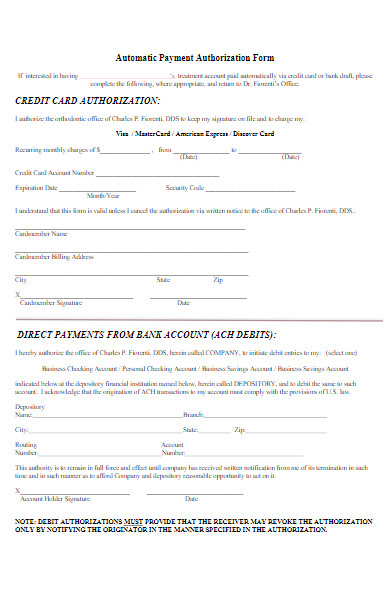

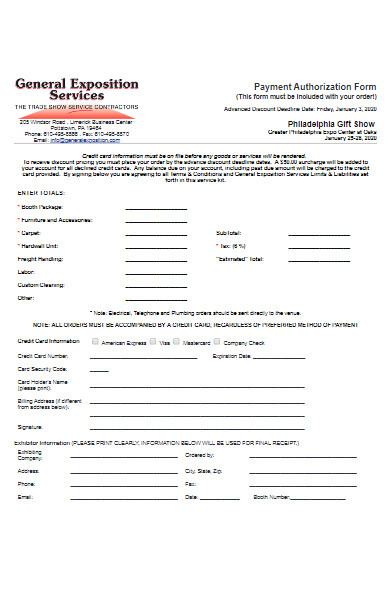

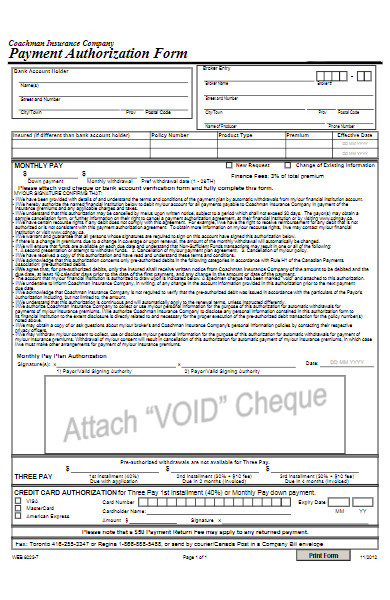

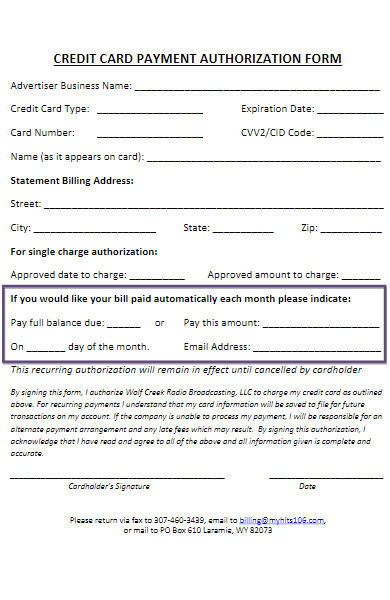

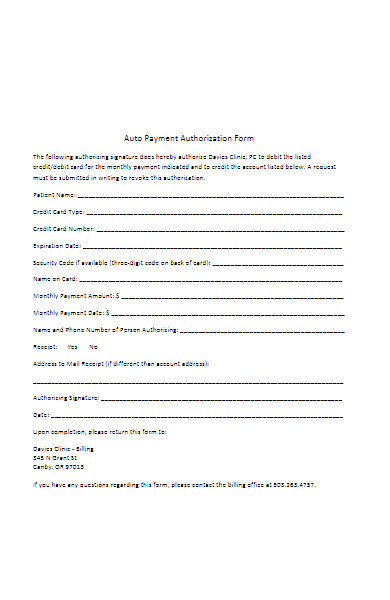

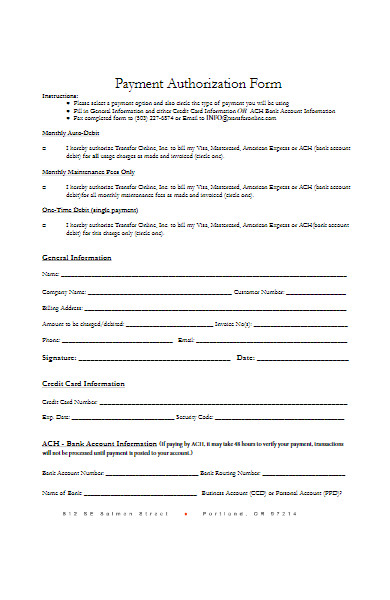

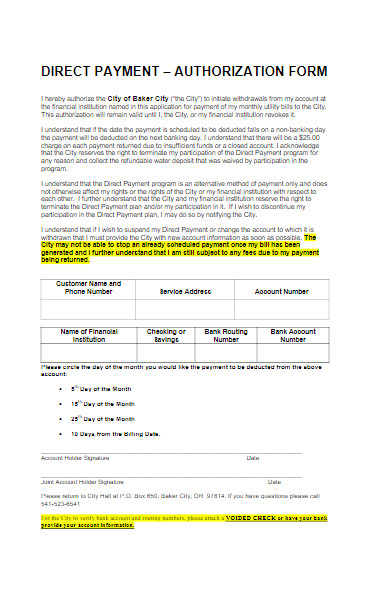

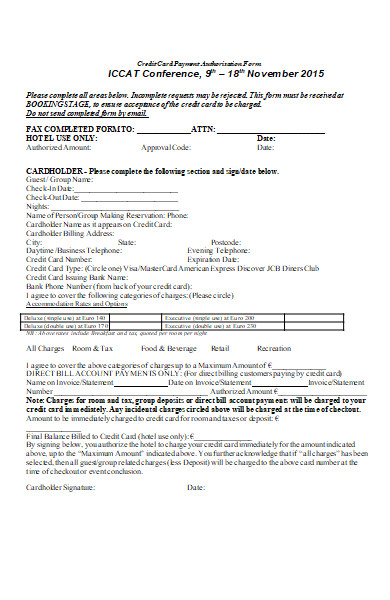

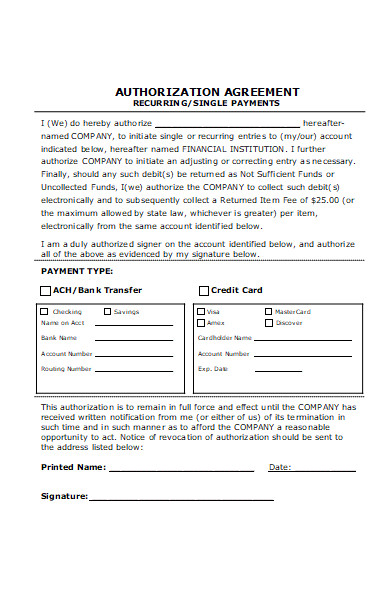

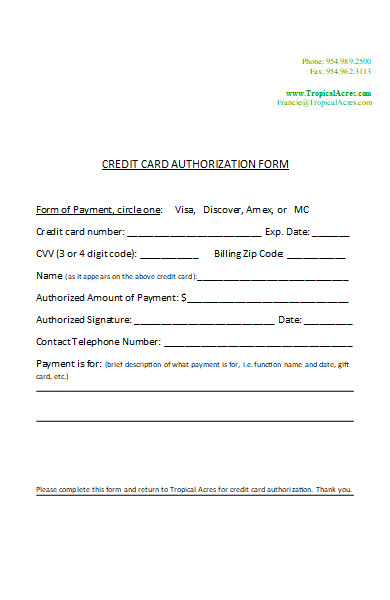

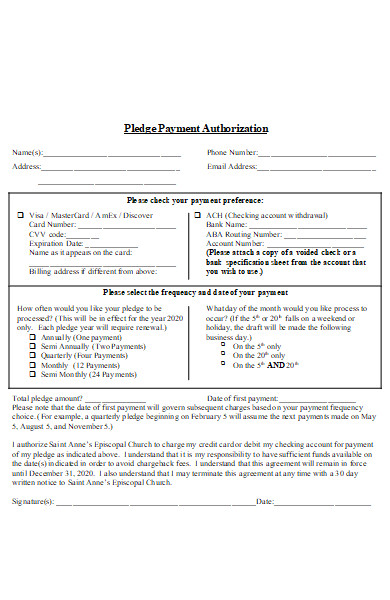

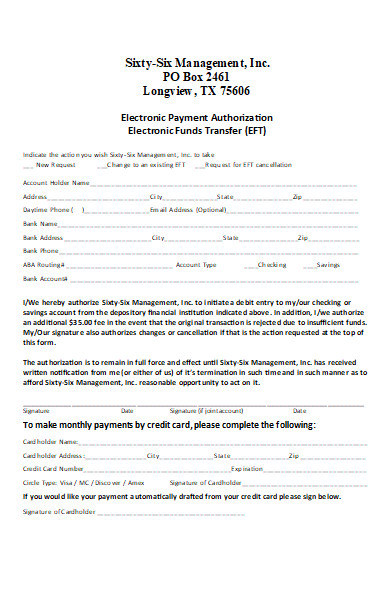

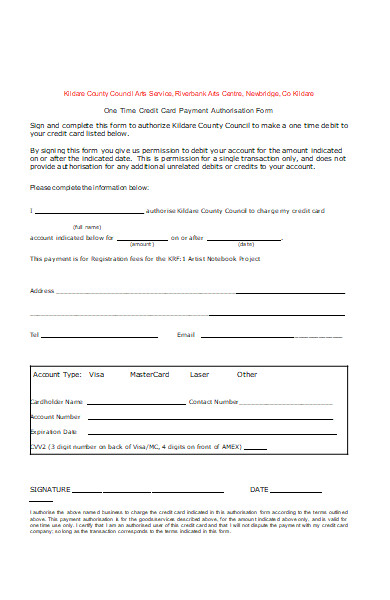

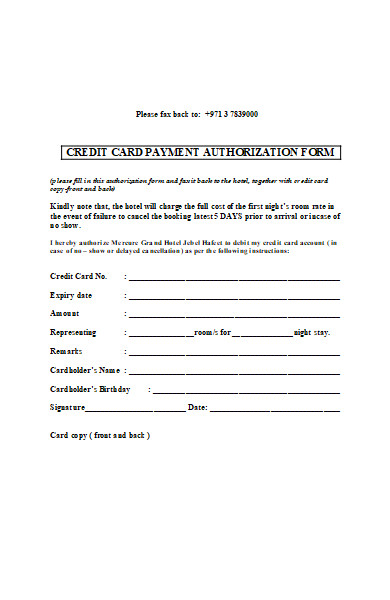

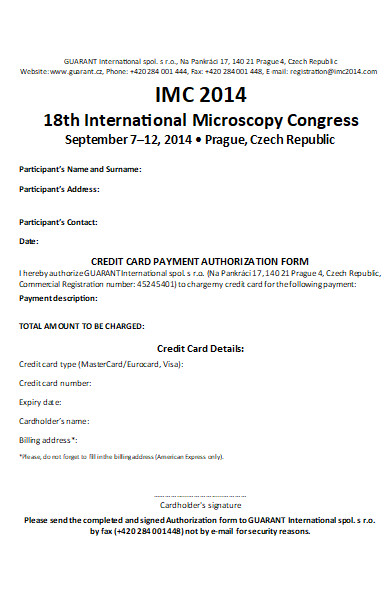

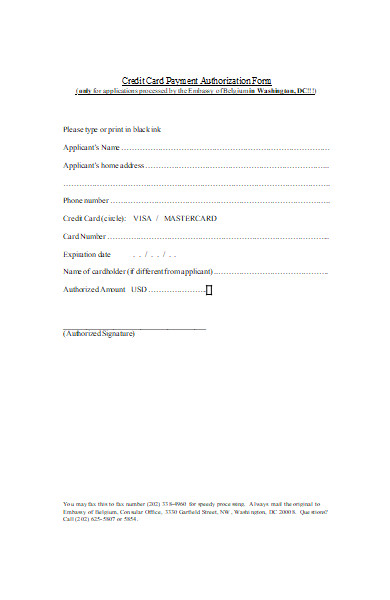

What is the Best Sample Payment Authorization Form?

The ideal sample Payment Authorization Form should be clear, concise, and capture all essential details for the transaction. While the specifics can vary based on the requirements of a business or organization, here’s a generic sample for your reference:

Payer Details:

- Full Name: ___________________________

- Address: ___________________________ ___________________________ ___________________________

- Phone Number: _______________________

- Email Address: _______________________

Payment Details:

- Payment Type: [ ] One-Time [ ] Recurring [ ] Other (Specify): ___________

- Payment Amount: $___________

- Frequency (if recurring): [ ] Weekly [ ] Monthly [ ] Quarterly [ ] Annually

- Start Date: //____ End Date (if applicable): //____

Payment Method:

- Credit/Debit Card:

- Card Type: ________ (e.g., Visa, MasterCard)

- Card Number: ####-####-####-####

- Expiry Date: / CVV: ___

- Bank Account (Direct Debit):

- Bank Name: ___________________________

- Account Holder Name: ___________________________

- Account Number: ___________________________

- Routing Number: ___________________________

Authorization: I, [Full Name], hereby authorize [Business/Organization Name] to charge the account specified above for the amount and frequency mentioned. I understand that I can cancel or change this authorization by notifying [Business/Organization Name] in writing.

Signature: ____________________________ Date: //____

This is a basic template, and the actual fillable form might require more specific fields or clauses based on legal requirements, industry standards, or the nature of the transactions. Always consult with legal counsel when creating such forms to ensure they’re compliant with local regulations and capture all necessary details.

FREE 50+ Payment Authorization Forms

51. Employee Credit Card Payment Authorization Form

- MS Word

How to fill out a Payment Authorization Form correctly?

Filling out a Payment Authorization Form correctly is essential to ensure that the intended transactions are processed accurately and securely. Here’s a step-by-step guide to doing so:

- Read the Form Carefully: Before filling out any information, familiarize yourself with the entire form. Ensure you understand the terms and the implications of what you’re authorizing.

- Payer Details:

- Write your full legal name, ensuring it matches the name on your payment method.

- Provide your current address, including city, state, and zip code.

- Add contact details such as phone number and email address for any necessary communications.

- Payment Details:

- Choose the payment type (e.g., one-time, recurring).

- Indicate the exact amount to be charged. If it’s a variable amount (like utility bills), ensure you understand how the amount will be determined.

- For recurring payments, select the desired frequency (e.g., weekly, monthly) and specify the start and end dates, if applicable.

- Payment Method Information:

- For credit/debit card payments:

- Choose the card type (e.g., Visa, MasterCard).

- Enter the card number without spaces or dashes.

- Provide the card’s expiry date and CVV (the 3 or 4-digit security code, usually on the back of the card).

- For bank account (direct debits):

- Enter the bank’s name.

- Provide the name of the account holder, ensuring it matches the bank records.

- Add the account number and routing number. Double-check for accuracy.

- For credit/debit card payments:

- Review Terms and Conditions: Some forms might have terms and conditions or specific clauses related to the payment. Ensure you read and understand them.

- Signature and Date: Once you’re certain that all the information provided is accurate and you agree with the terms, sign and date the form. This is your acknowledgment and consent for the stated transactions.

- Keep a Copy: After submitting, retain a copy of the filled-out form for your records. This can be useful for reference or in case of disputes.

- Update If Necessary: If any of your payment details change, such as a new card or account number, ensure you submit a new form to the company or organization with the updated information.

Remember, when dealing with sensitive financial information, always ensure you’re sharing details with a reputable company or organization. If you’re uncertain about any part of the form, don’t hesitate to reach out to the company for clarification before signing. You should also take a look at our Blank Authorization Forms.

Are Payment Authorization Forms secure?

The inherent security of a Payment Authorization Form largely depends on how it’s managed, transmitted, and stored by both the payer and the recipient (usually a business or organization). Here are some aspects to consider regarding the security of Payment Authorization Forms:

- Physical Forms:

- Handling: If the form is in paper format, it should be handled with care and discretion, especially because it contains sensitive financial information.

- Storage: Once filled out, such forms should be securely stored in a locked cabinet or safe. Unauthorized access can lead to fraudulent transactions or identity theft.

- Disposal: When no longer needed, the form should be shredded or destroyed to prevent accidental leaks or intentional misuse.

- Electronic/Digital Forms:

- Encryption: Digital forms should be encrypted both in transit (when being sent) and at rest (when being stored).

- Secure Platforms: If the form is filled out online, ensure the platform or website uses SSL (Secure Socket Layer) encryption, typically indicated by “https://” in the URL.

- Limited Access: Only authorized personnel should have access to the stored data from these forms.

- Data Retention: Companies should only retain the form and the information within for as long as it’s needed. After which, it should be securely destroyed or deleted, in compliance with data protection regulations.

- Regulations and Compliance: Many jurisdictions have specific regulations about how financial data can be collected, stored, and processed. For instance, the Payment Card Industry Data Security Standard (PCI DSS) sets guidelines for companies that handle credit card information. Compliance with such standards and regulations ensures a higher level of security.

- Regular Audits: Companies should conduct regular audits and assessments to ensure that their security measures are up-to-date and effective against potential breaches.

- Transparency: Organizations should have clear policies about how they manage and protect sensitive data. As a consumer or user, you can request this information to gauge the security measures in place.

- Awareness: As the person filling out the form, be wary of phishing attempts or scams. Ensure you’re providing your details to a legitimate and reputable organization.

In conclusion, while Payment Authorization Forms in PDF themselves are neutral tools, their security largely hinges on how they are managed. It’s a shared responsibility: businesses must implement robust measures to safeguard this data, and individuals must be cautious and discerning when providing their information.

Can I cancel a Payment Authorization Form after submission?

Yes, you can typically cancel a Payment Authorization Form after submission, but the process and timeframe for cancellation may vary based on the agreement and the entity to which you’ve given authorization. Here’s a general overview of how you might go about it:

- Review the Form or Agreement: Before attempting to cancel, it’s wise to review the original Payment Authorization Form or any related agreement. Some forms may have specific instructions or conditions about cancellations.

- Written Notice: Most businesses and organizations will require you to provide a written notice of cancellation. This ensures there’s a record of your request.

- Be sure to include your name, contact information, account details (like your last four digits of the credit card or bank account), and any other relevant information that identifies the original authorization.

- Clearly state your desire to cancel the authorization.

- Consider dating the letter and keeping a copy for your records.

- Contact Directly: It might be beneficial to contact the company’s customer service or billing department directly, either via phone or email, to expedite the process. They can provide guidance on the cancellation process and any additional steps you might need to take.

- Time Considerations: If you’re looking to stop an imminent transaction, act as quickly as possible. Some businesses might require a specific notice period (e.g., at least three business days before the next scheduled transaction).

- Monitor Your Accounts: After cancelling the authorization, keep a close eye on your bank or credit card statements to ensure no unauthorized charges occur. If a charge does go through after cancellation, contact the company immediately.

- Bank or Credit Card Provider: If the entity doesn’t honor your cancellation request or if there’s any dispute, consider reaching out to your bank or credit card provider. They might offer assistance in stopping the payment or reversing charges. In some cases, you may need to close an account or change card numbers if unauthorized charges persist.

- Recurring Payments: If the authorization was for recurring payments, ensure that all future payments are also stopped.

- Document Everything: It’s a good practice to document all communications regarding the cancellation. If there’s a dispute later, this could serve as evidence of your intent and actions.

In conclusion, while it’s generally possible to cancel a Payment Authorization, the ease and immediacy of the process might vary based on the company or organization and the nature of the agreement. It’s essential to act proactively and keep all records of your communications.

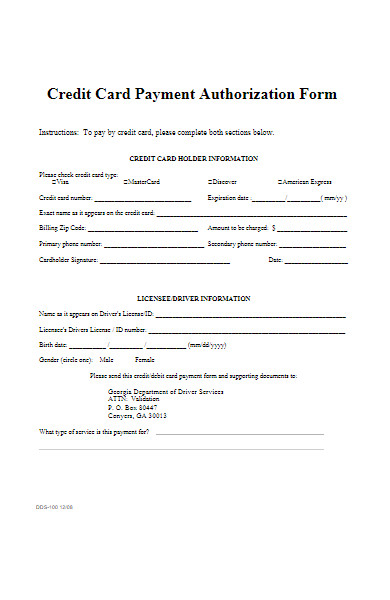

What information is needed on a Payment Authorization Form?

A Payment Authorization Form is designed to grant permission to a third party, usually a business or organization, to charge a payer’s bank account or credit card for a specified amount. To ensure the process is carried out effectively and securely, several essential details are typically included on the form:

- Payer’s Personal Details:

- Full Name: The legal name of the person or entity responsible for the payment.

- Address: Current mailing address, including city, state, and zip code.

- Contact Information: Phone number and email address for potential queries or clarifications.

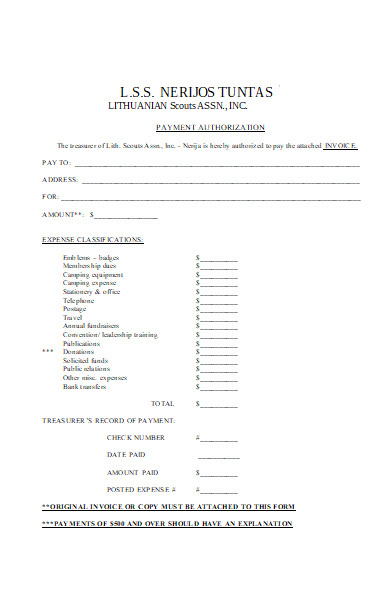

- Payment Details:

- Payment Amount: Specify the exact amount to be charged. For recurring or variable payments, clearly define the criteria for determining the amount.

- Payment Frequency: For recurring charges, specify how often the charge will occur (e.g., monthly, quarterly).

- Payment Date: Define when the charge will be made. For recurring payments, specify the start and end dates.

- Payment Method Information:

- Credit/Debit Card Details:

- Card Type (e.g., Visa, MasterCard).

- Card Number.

- Expiry Date.

- Cardholder’s Name (as it appears on the card).

- CVV or Security Code (usually a 3 or 4-digit number on the back or front of the card).

- Bank Account Details (for Direct Debits):

- Bank Name.

- Account Holder’s Name.

- Bank Routing Number.

- Bank Account Number.

- Credit/Debit Card Details:

- Type of Authorization: Clearly specify whether this is a one-time authorization, a recurring charge, or an authorization for a variable amount based on certain conditions.

- Statement of Authorization: A declaration that the payer understands and agrees to the charges. It typically reads something like: “I hereby authorize [Business Name] to charge my [credit card/bank account] for [specific service or product].”

- Signature and Date: The payer’s signature and the date of signing, validating the authorization. For digital forms, an electronic signature or verification method may be used.

- Terms and Conditions: This section might detail any special conditions, responsibilities of the payer, cancellation policies, or other essential information.

- Additional Information (if applicable):

- Invoice or Order Number: If the payment is associated with a specific order or invoice.

- Customer ID or Account Number: Especially for businesses with recurring customers or clients.

- Notes or Special Instructions: Any other relevant details about the payment or service.

To ensure transparency and build trust, many Payment Authorization Forms also provide details on data handling, privacy policies, and how the payer can revoke the authorization in the future. Our Expense Payment Authorization Form is also worth a look at

How long is a Payment Authorization Form valid?

The validity of a Payment Authorization Form can vary based on several factors:

- Stipulated Duration on the Form: Some Payment Authorization Forms will specify the duration for which the authorization is valid. For instance, a form might grant permission for a single transaction or for recurring transactions over a set period (e.g., monthly charges for one year).

- One-time vs. Recurring Payments: A one-time payment authorization is valid just for that singular transaction. In contrast, recurring payment authorizations are valid for the duration specified, such as monthly until canceled.

- Legal and Banking Regulations: Some jurisdictions or banking institutions may have regulations or policies in place that determine the validity of payment authorizations. For example, in certain regions or with some payment gateways, recurring payment authorizations might need to be renewed every year.

- Expiry of Payment Method: If the payment method, like a credit card, expires, then the authorization form becomes invalid because the payment cannot be processed. In such cases, businesses usually contact the customer to update their payment details.

- Cancellation by the Payer: If a payer cancels the authorization, it becomes invalid immediately from the date of cancellation. The process to cancel might be stipulated in the authorization form or agreement.

- Merchant’s Policies: Some businesses might have their own internal policies regarding the duration of payment authorizations. For instance, a business might require customers to renew their authorization periodically as a security measure.

It’s crucial for both businesses and customers to review the terms and conditions of a Payment Authorization Form carefully and to be aware of any stipulated validity periods or conditions. If in doubt, it’s always a good idea to consult directly with the concerned business or organization, or even seek legal advice if necessary. In addition, you should review our Third Party Authorization Form.

How to revoke a Payment Authorization Form?

Revoking a Payment Authorization Form essentially means withdrawing the permission given to a business or entity to charge your bank account or credit card. Here’s a step-by-step guide on how to revoke such an authorization:

- Review the Form or Agreement: Begin by reviewing the original Payment Authorization Form or any related agreement you signed. This document might contain specific instructions or conditions related to revoking the authorization.

- Written Notice: Many organizations and businesses require a written notice to revoke an authorization to ensure clarity and maintain a record of the transaction.

- Detail your intent clearly in the notice.

- Include necessary details such as your name, contact information, account details (like the last four digits of the credit card or bank account number), and any other relevant information linked to the original authorization.

- Date the letter and keep a copy for your records.

- Contact the Business or Entity: Reach out to the company’s billing or customer service department.

- Inform them of your intent to revoke the payment authorization.

- Ask for any specific procedures or forms they might require for this process.

- Follow Up: If the company continues to charge you post-revocation, contact them immediately to rectify the issue. If the unauthorized charges continue, you may need to involve your bank or credit card company.

- Contact Your Bank or Credit Card Provider: If you’re facing challenges in revoking the authorization directly with the company:

- Inform your bank or credit card provider about the situation.

- Some banks offer the service of blocking specific companies from making charges if you’ve revoked authorization.

- For unauthorized charges, you may have the option to dispute the transaction with your bank or credit card company.

- Keep Records: Maintain all documentation related to the revocation, including written notices, email correspondence, and any confirmation messages. This could be crucial if there’s a dispute later.

- Stay Informed: Some jurisdictions have specific laws that govern the revocation of payment authorizations. Familiarize yourself with these, if applicable, to ensure your rights are protected.

- Recurring Payments: If your authorization was for recurring payments, ensure you monitor subsequent bills or account statements to ensure no further charges are made post-revocation.

It’s essential to act proactively, ensure all communications are clear, and keep a record of all interactions. If there are any discrepancies or unauthorized charges post-revocation, address them immediately.

What are the legal implications of a Payment Authorization Form?

A Payment Authorization Form is a legally binding document once signed or agreed upon, which grants permission to a third party to process payments from an individual’s bank account or credit card. Here are the primary legal implications related to such forms:

- Consent for Transaction: The primary purpose of a Payment Authorization Form is to get the account holder’s consent to process a payment or series of payments. Without this consent, the transaction would be unauthorized and, in many cases, illegal.

- Binding Agreement: Once signed or digitally acknowledged, the Payment Authorization Form usually becomes a binding agreement. This means both the payer and the entity processing the payment must adhere to the terms laid out in the form.

- Disputes: If the terms of the Payment Authorization Form are breached – for example, if a business charges more than the agreed-upon amount or outside the specified date range – the signer may have grounds for a legal dispute.

- Recurring Payments: For recurring payments, the authorization typically remains valid for the duration stipulated in the form or until the payer revokes the authorization. Unauthorized charges after revocation can lead to legal consequences for the charging entity.

- Data Privacy and Security: Collecting and storing payment information carries legal responsibilities. Companies must ensure they comply with data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in Europe or the Payment Card Industry Data Security Standard (PCI DSS) globally.

- Revocation: As discussed earlier, a payer usually has the right to revoke a payment authorization. If the company fails to honor this revocation, they could be liable for legal penalties or be subject to disputes.

- Unauthorized Transactions: If a company processes a transaction without a valid Payment Authorization Form, the transaction is unauthorized. This can have legal ramifications, including potential fines and damage to the company’s reputation.

- Jurisdictional Differences: The legal implications and regulations regarding Payment Authorization Forms can vary based on jurisdiction. It’s crucial for businesses to be aware of local laws and regulations governing such transactions.

- Consumer Rights: Many jurisdictions have laws to protect consumers from unfair billing practices, including unauthorized charges. If a company doesn’t adhere to these regulations, they may be subject to legal action.

Given these implications, businesses should be meticulous in drafting, storing, and processing Payment Authorization Forms. Similarly, consumers should thoroughly understand the terms of any Release authorization form they sign and monitor their bank statements for any discrepancies. If there are concerns about potential legal ramifications, both businesses and consumers should consult with legal professionals for guidance.

Where can I find sample Payment Authorization Forms online?

You can find sample Payment Authorization Forms online through various sources. Here are a few places to start:

- Legal Websites: Websites like LegalTemplates, Rocket Lawyer, and Nolo often have sample forms for a range of legal needs, including payment authorizations.

- Business Software Platforms: Websites like DocuSign, Adobe Sign, or PandaDoc, which facilitate electronic agreements, sometimes have template libraries that may include Payment Authorization Forms.

- Banks and Financial Institutions: Many banks provide downloadable templates for recurring payment authorizations, especially for businesses that need to set up regular payments from customers.

- Government Websites: Depending on the country or state, government websites related to business, commerce, or consumer protection may offer standard forms or templates to help businesses adhere to local regulations.

- Business Websites: Websites related to business management, like SCORE, the U.S. Chamber of Commerce, or the Small Business Administration, may have resources, templates, or guides that include Payment Authorization Forms.

- Template Websites: There are numerous websites online dedicated to providing templates for various purposes, from business to education. Websites like Template.net or JotForm may have payment-related templates.

- Educational Resources: Universities or colleges with robust business departments may offer resources, including template forms, as part of their educational outreach.

- Online Forums and Communities: Websites like Stack Exchange (for business) or specific subreddit forums on Reddit can sometimes have users share templates or direct you to resources where you can find them.

Whenever you use a sample or template from the internet, make sure to review it carefully. It’s essential to ensure it fits your specific needs and complies with any local regulations or specific requirements you may have. For legal security, it’s always a good idea to have any template reviewed by a legal professional before using it in an official capacity. You may also be interested in our Compensatory Time Payment Authorization Form.

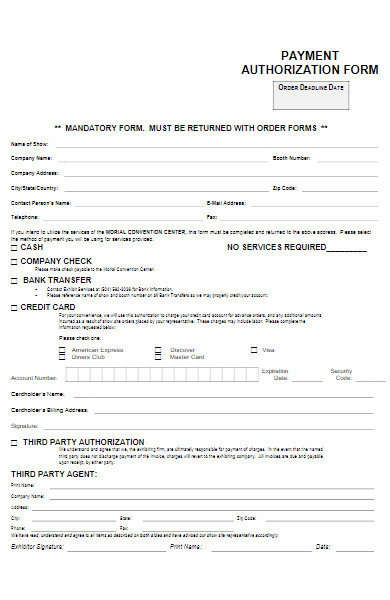

How to Create a Payment Authorization Form?

Creating a Payment Authorization Form requires meticulous attention to detail and a clear understanding of the purpose it serves. Here’s a step-by-step guide to help you draft a comprehensive and legally sound Payment Authorization Form:

-

Purpose and Introduction:

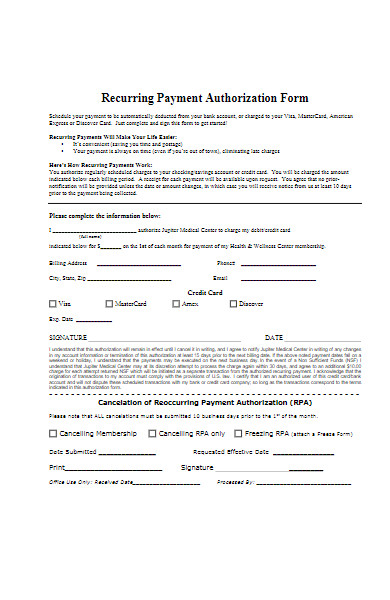

- Clearly define the purpose of the form at the top. This could be “Credit Card Payment Authorization,” “Recurring Payment Authorization,” “Direct Debit Authorization,” etc.

- Add a brief paragraph explaining why the form is needed and what will be done with the information provided.

-

Personal Details Section:

- Fields for the payer’s full name.

- Contact details including address, phone number, and email.

-

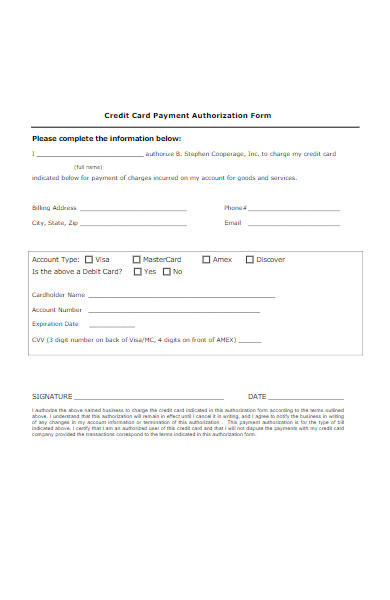

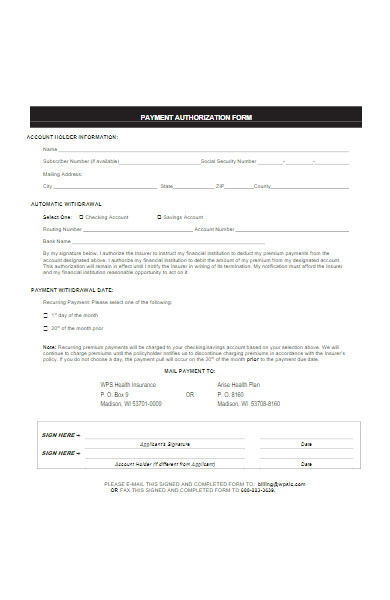

Payment Method Information:

- If it’s for a bank account: include fields for bank name, account type (savings/checking), account number, and routing number.

- For credit cards: fields for credit card type (Visa, MasterCard, etc.), cardholder name, credit card number, expiration date, and CVV.

-

Transaction Details:

- Specify whether the authorization is for a one-time payment or recurring transactions.

- If recurring, specify the frequency (e.g., monthly, weekly) and the amount.

- Include a space for a total transaction amount for one-time payments.

-

Duration of Authorization:

- Define how long the authorization will last. It can be for a single transaction, until a specified date, or until further notice.

-

Terms and Conditions:

- Outline any terms related to the payment, such as fees for declined transactions or policies regarding changes or cancellations.

- Clearly state data protection measures to assure payers their financial details are secure.

-

Revocation Clause:

- Include a statement about how the payer can revoke the authorization and the process or requirements to do so.

-

Declaration and Signature:

- A statement where the payer acknowledges understanding the terms and gives consent.

- Fields for the payer’s signature and date.

- Consider adding a witness signature field if required or for added security.

-

Footer:

- Add contact details for queries regarding the form or the payment process.

- Mention any legal regulations or standards you adhere to, such as PCI DSS compliance for credit card data protection.

-

Formatting and Accessibility:

- Use clear, easy-to-understand language.

- Ensure the form’s design is clean and organized. Use bold headings and clear divisions between sections.

- If the form will be filled out electronically, ensure it’s accessible and user-friendly. Consider tools like Adobe Acrobat or online form creators like JotForm or Google Forms.

-

Review and Legal Counsel:

- Before finalizing and distributing, review the form for clarity and completeness.

- It’s advisable to have a legal professional review the form to ensure it adheres to all regulations and protects your interests.

-

Backup and Storage:

- Ensure you have a secure method for storing completed forms, respecting data privacy regulations.

By following this guide and ensuring a thorough review process, you’ll be well on your way to creating an effective Payment Authorization Form that serves both your needs and the needs of the payer.

Tips for creating an Effective Payment Authorization Form

Creating an effective Payment Authorization Form ensures clarity, compliance, and a smooth transaction process. Here are some tips to ensure your form is both efficient and user-friendly:

- Clarity is Key: Use straightforward language and avoid legal jargon. Make sure that all terms are understandable to the average person.

- Organized Layout: Structure the form in a logical order, starting with personal details, moving on to payment information, and ending with signature fields.

- Specify Transaction Details: Clearly mention whether the authorization is for a one-time payment or recurring charges. If recurring, detail the frequency and amount.

- Provide Clear Instructions: If there are specific ways to fill out the form or if certain fields require specific formats (like date formatting), mention them clearly.

- Include Revocation Information: Clearly explain how the payer can revoke the authorization, specifying any notice period or method.

- Ensure Data Security: Assure users that their data will be stored securely and not shared unnecessarily. This builds trust and encourages form completion.

- Use Consistent Terminology: Stick to consistent terms throughout the form. For instance, if you start with “payer,” don’t switch to “customer” or “client” halfway through.

- Limit to Essential Fields: Only ask for information that’s absolutely necessary. The shorter the form, the more likely it is to be completed.

- Provide Contact Information: Offer a clear point of contact for any questions or concerns regarding the form or the payment process.

- Legal Review: Ensure the form adheres to all relevant laws and regulations. It’s always a good idea to have it reviewed by a legal professional.

- Responsive Design: If the form is online, ensure it’s mobile-friendly. Many users might access and fill out the form from mobile devices.

- Clear Confirmation: If online, once the form is submitted, provide a clear confirmation message. If possible, send a confirmation email as well.

- Backup and Archival: Implement a system to backup and archive submitted forms, ensuring data isn’t lost and can be accessed if disputes arise.

- Provide Sample Data: Especially for fields that might be confusing, show examples of how they should be filled out.

- Use Visual Cues: For digital forms, consider using color coding, icons, or tooltips to guide users.

- Regularly Update the Form: Laws, regulations, and business practices change. Ensure your form remains up-to-date by revisiting and revising it regularly.

- Feedback Mechanism: Allow users to provide feedback on the form itself. This can help you identify areas of confusion or improvement.

By keeping these tips in mind and always prioritizing clarity and user experience, you’ll create a Payment Authorization Form that’s both compliant and easy for payers to use.

A Payment Authorization Form is a vital document allowing businesses to charge a payer’s account. Essential for smooth financial transactions, these forms come in various types tailored to specific needs. With careful crafting, clarity, and adherence to legal standards, they ensure a seamless, trustworthy payment process. Regular updates and reviews guarantee their continued efficiency and compliance in a constantly evolving financial landscape. You may also be interested to browse through our other Medical Treatment Authorization Form.

Related Posts Here

-

FREE 13+ Check Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Pre Authorization Forms in PDF | Excel

-

FREE 9+ Sample Authorization Request Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Travel Authorization Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Travel Authorization Forms in MS Word | PDF | Excel

-

FREE 10+ Sample Credit Authorization Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Medicare Authorization Forms in PDF | MS Word

-

FREE 8+ Hotel Credit Card Authorization Forms in PDF | MS Word | Excel

-

FREE 9+ Medical Records Authorization Forms in PDF | MS Word | Excel

-

FREE 13+ Payroll Authorization Forms in PDF | MS Word | Excel

-

FREE 8+ Medical Treatment Authorization Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Medical Authorization Forms in PDF | MS Word | Excel

-

FREE 7+ Recurring Credit Card Authorization Forms in PDF | MS Word

-

FREE 5+ Daycare Authorization Forms in PDF

-

FREE 10+ Compensatory Time Authorization Forms in PDF | MS Word