A Mortgage Loan Application Form serves as the gateway to homeownership for many, functioning as a detailed record of a potential borrower’s financial standing and intent. While the core purpose remains consistent, various types of these forms cater to different loan scenarios and lender preferences. With each type offering its nuances, understanding the form’s essence and its creation can be pivotal. In the subsequent sections, we’ll dive into the intricacies of this form, its significance, types, creation, and tips for a smoother application journey.

What is a Mortgage Loan Application Form ? – Definition

A Mortgage Loan Application Form is a standardized document used by lenders to assess the creditworthiness and financial stability of individuals or entities seeking to secure a mortgage loan. The form collects detailed information about the applicant’s personal, employment, and financial background, current debts, assets, and the property in question. It aids lenders in determining the applicant’s ability to repay the loan, the loan amount, terms, interest rates, and other conditions. This form serves as a foundational step in the mortgage approval process.

What is the Meaning of a Mortgage Loan Application Form?

The meaning of a Mortgage Loan Application Form lies in its role as a comprehensive tool designed to capture an applicant’s financial and personal profile for mortgage lenders. It provides a snapshot of the borrower’s financial health, employment history, creditworthiness, and intentions regarding the property. By evaluating the data on this form, lenders can make informed decisions about granting a mortgage, determining the terms, and assessing potential risk. Essentially, it acts as the first and critical step in the journey of acquiring or refinancing a home, linking borrowers to potential lenders.

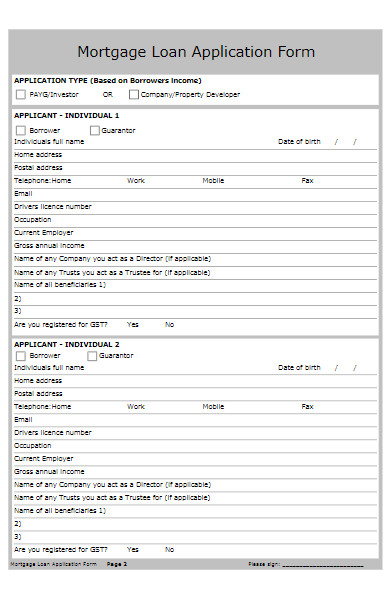

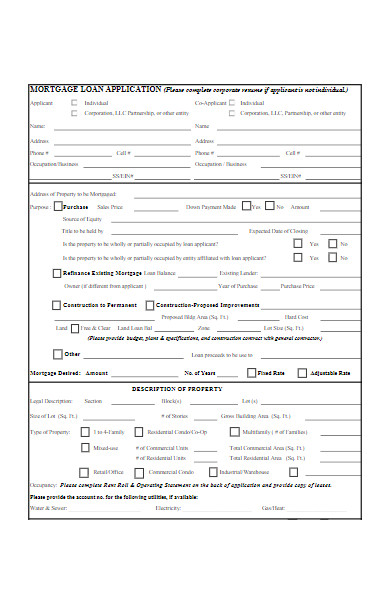

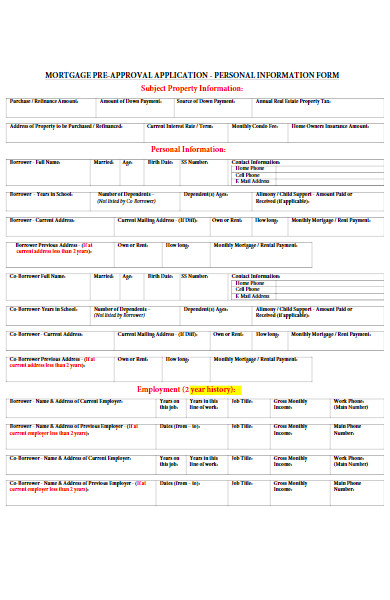

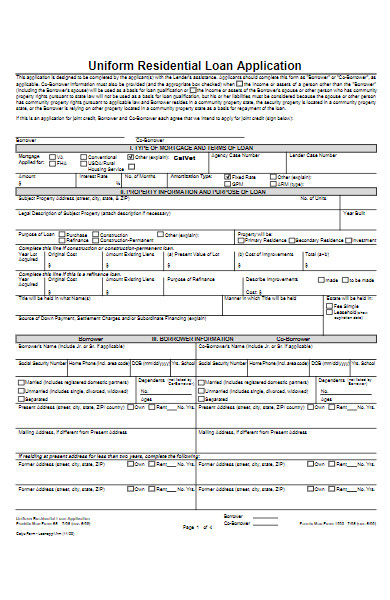

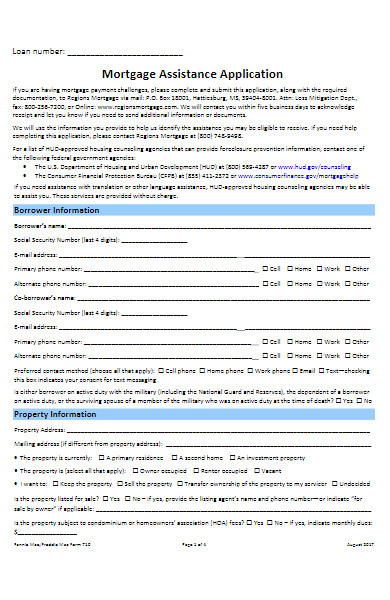

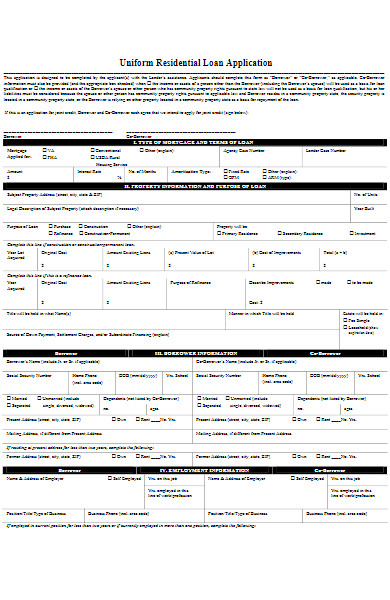

What is the Best Sample Mortgage Loan Application Form?

Creating a full best Mortgage Loan Application Form sample here might be extensive, but I can provide a simplified outline of what one might typically contain. It’s important to note that the specific format and details of these forms can vary based on country, state, and individual lender requirements. Here’s a basic structure:

Personal Information:

- Full Name:

- Date of Birth:

- Social Security Number/ID:

- Current Address:

- Previous Address (if less than 2 years at current):

- Phone Number:

- Email Address:

- Marital Status:

Employment Information:

- Current Employer:

- Position/Title:

- Duration of Employment:

- Previous Employer (if less than 2 years at current job):

- Monthly Income:

- Other Sources of Income:

Financial Information:

- Bank Accounts (Checking, Savings):

- Outstanding Debts (Credit Cards, Other Loans):

- Monthly Expenses:

- Assets (Property, Investments):

Property Details (For the mortgage):

- Property Address:

- Property Type (Single Family, Multi-Family, Condo, etc.):

- Estimated Value:

- Loan Amount Requested:

- Down Payment:

Declarations:

- Have you declared bankruptcy in the last 7 years?

- Have you ever had a property foreclosed upon?

- Are you involved in any ongoing lawsuits?

- [Other relevant legal/financial questions]

Acknowledgment and Consent: I hereby declare that the information provided is true and accurate. I authorize the lender to check my creditworthiness and verify the details mentioned above.

Signature: _______________ Date: _______________

Remember, this is a basic structure. Real-world Mortgage Loan Application Forms are more detailed and might require additional information, such as co-applicant details, detailed property specifications, or specifics about the type of mortgage being applied for (e.g., fixed-rate, adjustable-rate). Always refer to local regulations and specific lender requirements when creating or filling out such forms.

FREE 5+ Mortgage Loan Application Forms

How do I start filling out a Mortgage Loan Application Form?

Filling out a Mortgage Loan Application Form can be an involved process, but with preparation, it becomes straightforward. Here’s a step-by-step guide to help you:

- Gather Necessary Documentation: Before starting, have all relevant documents at hand. This can include proof of income, recent tax returns, credit reports, bank statements, details of other debts (like car loans or credit cards), and information about your down payment source.

- Read the Form Thoroughly: Before entering any details, read the form from start to finish. This will give you an understanding of the information required and allow you to spot any sections where you might need additional details.

- Fill Out Personal Information: Start with the basics – name, address, date of birth, and other personal details.

- Provide Employment Details: Enter information about your current job, position, duration of employment, and income. If the form asks for past employment details, be prepared to provide those as well.

- Enter Financial Details: Detail your assets (e.g., savings accounts, other real estate or valuable possessions) and liabilities (e.g., existing loans, credit card balances). Be accurate; lenders will verify this information.

- Property Information: If you’ve chosen a property, provide its details. If not, you might be filling out a pre-approval form where specific property details aren’t necessary yet.

- Answer Declarations Honestly: Sections that ask about financial hardships, bankruptcies, or other legal matters are crucial. Answer these truthfully, as they’ll be verified.

- Double-Check Everything: Before finalizing, review all the information. Ensure there are no errors, and all the provided details are accurate.

- Sign and Date: Once you’re confident all information is correct, sign and date the form. Your signature is a declaration that all provided information is accurate to the best of your knowledge.

- Submit the Form: Depending on the lender, you might submit the form online, via mail, or in person. Ensure you’re sending it to the correct place to avoid delays.

- Keep a Copy: Always retain a copy of the filled-out form for your records.

Remember, honesty is vital when filling out the form. Misrepresenting information can lead to delays, extra costs, or outright rejection of your application. If uncertain about any section, it’s wise to consult with the lender or a mortgage advisor.

Can I save and resume my Mortgage Loan Application Form online?

Whether or not you can save and resume a Mortgage Loan Application Form online largely depends on the platform or lender’s website where you’re filling out the form. However, many modern online application systems offer this feature for the convenience of the users. Here’s a general perspective on this feature:

- User Accounts: Most platforms that allow saving and resuming applications require users to create an account. This account will store your form’s progress, letting you return to it later.

- Auto-Save Features: Some online systems auto-save your progress as you fill out the form. This ensures that even if your session is interrupted (e.g., due to a power outage or internet disconnection), the information you’ve entered isn’t lost.

- Manual Save Options: Other platforms might require you to click a “Save” or “Save Draft” button to store your progress.

- Security Concerns: Always make sure the platform is secure when filling out a form with personal and financial information. Look for “https://” in the URL and other security certifications.

- Expiration: Some platforms might have a time limit for saved forms. Ensure you complete and submit the form before any deadlines to avoid losing your progress.

- Resume: When you return to the platform, you typically log in to your account, find the saved form or draft, and continue from where you left off.

- Notifications: Some systems send reminder emails or notifications if you’ve started but not completed the application.

If you’re unsure about the save and resume functionality on a specific platform, it’s a good idea to check the FAQs, help section, or contact the lender’s customer service.

What documents are needed alongside the Mortgage Loan Application Form?

When applying for a mortgage, lenders need to assess your creditworthiness and ability to repay the loan. Alongside the Mortgage Loan Application Form, various supporting documents are required. While the exact requirements might vary based on the lender, loan type, and specific regulations in your region, the following is a general list of documents you might need:

-

Proof of Identity:

- Government-issued photo ID (passport, driver’s license, etc.)

- Social Security Number or equivalent, if applicable

-

Proof of Legal Residency:

- For non-citizens, relevant visa, green card, or residency documents

-

Proof of Income:

- Recent pay stubs (usually the last 2-3 months)

- W-2 or 1099 forms from the past two years (for U.S. applicants)

- Tax returns (often the last 2 years)

- If self-employed: Profit and Loss statements, business tax returns, and other relevant documentation

-

Proof of Assets:

- Bank statements from checking, savings, and possibly other accounts (like CDs or mutual funds)

- Retirement account statements (e.g., 401(k), IRA)

-

Credit History:

- Lenders will typically perform this step themselves by running a credit check, but they’ll need your consent.

-

Personal Assets and Liabilities Statement:

- Details of personal assets (e.g., other properties, valuable possessions)

- Information on current debts (e.g., car loans, student loans, credit card balances)

-

Proof of Down Payment:

- Bank statements or other documentation showing the source of your down payment

-

Property Information (if already chosen):

- Purchase agreement or sales contract

- Property tax assessments

- Recent utility bills

- Details about the property, like a description, size, age, and any major improvements

-

Other Documentation:

- Divorce decree or separation agreement (if applicable)

- Proof of additional income sources (e.g., bonuses, alimony, rental income)

- If refinancing: Details of the current mortgage

-

Debt Information:

- Information on current debts, such as car loans, student loans, or credit card balances.

It’s a good idea to gather these documents before starting the application process. Additionally, always check with your lender for their specific requirements, as there may be unique documents or criteria based on your circumstances and the loan product you’re pursuing.

How long does it take to process my Mortgage Loan Application Form?

The processing time for a Mortgage Loan Application Form can vary widely based on various factors. Generally, it can take anywhere from a few days to a couple of months for a mortgage application to be processed and approved. Here are some factors and stages that contribute to the processing time:

- Initial Review: Once you submit your application and all required documentation, the lender performs an initial review, usually within a few days, to ensure all necessary information has been provided.

- Appraisal: The lender will order an appraisal of the property to determine its market value. This can take anywhere from a few days to a couple of weeks, depending on the availability of appraisers in the area and the property’s uniqueness.

- Underwriting: This is the most time-consuming step. The underwriter reviews the application, checks credit history, verifies the information provided, and assesses the loan’s risk. Depending on the loan’s complexity, underwriting can take from a few days to several weeks.

- Title Search and Insurance: This process ensures that the property’s title is clear of any liens or issues. It can take a week or more.

- Loan Approval: After underwriting, you’ll receive a loan approval, conditional approval (requiring more documentation or steps), or denial.

- Final Steps: Once approved, there might be additional requirements or conditions to meet. This could involve providing additional documentation, getting property insurance, or addressing specific issues raised during the appraisal or title search.

- Closing: After all conditions are met, you’ll proceed to the closing stage, where all the documents are signed, and the loan funds are disbursed.

Factors that can affect processing time include:

- Loan Type: Some loan types, like VA or FHA loans, may have additional requirements that can extend the processing time.

- Application Volume: If a lender has a high volume of applications, it can cause delays.

- Incomplete Applications: Missing information or documentation can cause significant delays. It’s crucial to provide accurate and complete information upfront.

- Market Conditions: During times of high demand, such as periods with exceptionally low-interest rates, there might be delays due to the sheer volume of applications.

- External Factors: Issues with the property, findings during the title search, or complications during the appraisal can also extend the processing time.

While many lenders aim for a 30-day turnaround, it’s not uncommon for the mortgage application process to take 45-60 days. It’s always a good idea to ask your lender about their estimated timeline upfront and stay in regular communication to ensure the process moves smoothly. You should also take a look at our Loan Application Review Forms.

What’s the deadline for submitting a Mortgage Loan Application Form?

The deadline for submitting a Mortgage Loan Application Form can vary based on several factors:

- Promotional Offers: If a lender is offering a special interest rate or promotional terms, there might be a specific deadline associated with those offers.

- Lock-in Rates: If you’ve been quoted a specific interest rate that’s locked in for a set period (e.g., 30 days), you’d need to submit your application and often complete the entire loan approval process within that timeframe to secure that rate.

- Property Purchase Deadlines: If you’re purchasing a property and have signed a purchase agreement, it might specify a deadline by which you need to secure financing. This isn’t directly a deadline for the application form per se, but it does dictate how quickly you need to get through the entire mortgage process.

- Specific Lender Deadlines: Some lenders might have internal processing timeframes due to their workflow or volume of applications. However, these aren’t typical “deadlines” but rather guidelines for efficient processing.

- Regulatory or Program Deadlines: Some government-backed mortgage programs or special loan programs may have specific application periods or deadlines.

- Refinancing Considerations: If you’re refinancing to take advantage of lower rates, there isn’t a specific “deadline,” but the sooner you apply, the more likely you are to secure the current low rate. Rates can fluctuate daily.

In general, there isn’t a universal deadline for submitting a Mortgage Loan Application Form. Instead, potential borrowers should be aware of the factors and timelines relevant to their specific situation. If in doubt, communicate directly with the lender or a mortgage broker to understand any time-sensitive elements of your loan application process. Our Loan Proposal Forms is also worth a look at

Can I edit details on my Mortgage Loan Application Form after submission?

Once you’ve submitted your Mortgage Loan Application Form, making changes directly to the form may not be straightforward. However, it’s essential to ensure all the information on your application is accurate, so if you realize there’s an error or something has changed, you should act promptly. Here’s what you can typically do:

- Contact Your Lender Immediately: As soon as you realize there’s an error or a change needed, reach out to your mortgage broker or the lending institution’s representative. They will guide you on the best way to update your information.

- Provide Written Documentation: Depending on the nature of the change, you may be required to provide written documentation or evidence to support the change. For instance, if your income has changed, you might need to provide a new pay stub or letter from your employer.

- Amendments and Updates: Some lenders might allow you to make formal amendments to your original application. This might involve filling out an additional form or signing an amendment to the original application.

- Resubmission: In some cases, particularly if significant details have changed, the lender might require you to resubmit the application entirely. This could potentially delay the application process.

- Potential Re-evaluation: Be aware that significant changes (especially those related to income, employment, or debt) can affect your loan approval chances. The lender might need to re-evaluate your application based on the updated information.

- Impact on Rate Locks: If you’ve locked in a specific mortgage rate and the correction delays your application, there’s a possibility (depending on the length of the delay) that your rate lock could expire. It’s crucial to keep this in mind and discuss potential impacts with your lender.

It’s always essential to provide accurate and honest information on a mortgage application. Mistakes and changes can happen, but addressing them promptly and transparently will help ensure the best possible outcome for your loan application process.

Where can I find a sample of a Mortgage Loan Application Form?

You can often find a sample of a Mortgage Loan Application Form on the websites of many lenders, mortgage brokers, or relevant financial institutions. Here are some steps and sources to help you locate a sample form:

- Lender Websites: Most banks, credit unions, and other mortgage lenders will have their own versions of a Mortgage Loan Application Form available for download or online completion on their websites.

- Government Agencies: If you’re in the U.S., the Consumer Financial Protection Bureau (CFPB) has a standardized form called the Uniform Residential Loan Application (URLA), which is widely used across the industry. You can visit the CFPB website or the Federal National Mortgage Association (Fannie Mae) website to view and download the URLA.

- Online Mortgage Platforms: Websites that offer online mortgage services or comparisons often have sample application forms or templates to give users an idea of what information will be required.

- Real Estate or Mortgage Resources: Websites dedicated to providing resources for real estate agents or mortgage brokers may also have sample forms, templates, or checklists related to the mortgage application process.

- Local Libraries or Community Centers: Sometimes, these institutions may have real estate or mortgage-related resources available, including sample application forms.

- Mortgage Brokers: If you’re working with a mortgage broker, they can usually provide you with a sample of the application form they use with various lenders.

- Legal Template Websites: There are many online platforms that offer legal templates, including mortgage loan application forms, for a variety of purposes. Websites like Rocket Lawyer, LegalTemplates, or LawDepot might have these forms available. However, always ensure that any form you use is applicable and appropriate for your specific jurisdiction and purpose.

Remember, while you can find many samples and templates online, it’s crucial to use the specific form provided by your chosen lender when you’re actually applying for a mortgage. These fillable form they provide will be tailored to their requirements and will ensure you provide all the necessary information for your application.

Is my personal information secure on the Mortgage Loan Application Form?

When you submit a Mortgage Loan Application Form, whether online or in paper format, the security of your personal information is a critical concern. Here’s what you need to know:

- Regulatory Protections: In many jurisdictions, there are strict regulations governing the collection, storage, and use of personal information by financial institutions. For instance, in the U.S., the Gramm-Leach-Bliley Act mandates that financial institutions protect the confidentiality and security of consumer information.

- Secure Online Platforms: If you’re applying online, ensure the lender’s platform uses HTTPS (the padlock symbol in the browser’s address bar), which encrypts data transmitted between your computer and the server. Many financial institutions also use additional security measures, such as two-factor authentication, secure sockets layer (SSL) encryption, and strong firewalls.

- Privacy Policies: Before submitting your application, review the lender’s privacy policy. This document will detail how they handle, store, and potentially share your information. It’s essential to understand and feel comfortable with their practices.

- Internal Protections: Reputable lenders will have internal policies and controls to protect customer information. This can include secure physical storage for paper applications, controlled access to digital data, regular security training for employees, and strict rules about sharing information with third parties.

- Beware of Phishing: Always be cautious about unsolicited communications asking you for personal or financial information. Ensure that you’re communicating directly with the lender and not a malicious third party. It’s a good idea to type in the lender’s web address manually or use trusted bookmarks rather than clicking on email links.

- Ask Questions: If you’re unsure about any aspect of the application process or how your data will be used and protected, don’t hesitate to ask the lender. They should be able and willing to provide clear answers.

- Regular Monitoring: After submitting a mortgage application, it’s wise to regularly monitor your credit reports and financial accounts for any suspicious activity. Quick detection can help mitigate potential issues.

In summary, while reputable lenders and financial institutions take extensive measures to ensure the security of the information you provide on a Mortgage Loan Application Form, it’s also crucial for applicants to be proactive in understanding and ensuring their data’s security.

How to Create a Mortgage Loan Application Form?

Creating a Mortgage Loan Application Form requires careful thought, as it needs to gather all necessary information to evaluate a borrower’s creditworthiness and ensure regulatory compliance. If you’re a lender or simply looking to understand the process, here’s a step-by-step guide:

-

Understand Regulatory Requirements:

- Different jurisdictions have specific regulations regarding what information you can request and how you handle it.

- In the U.S., for example, you’ll need to be compliant with laws such as the Truth in Lending Act, the Equal Credit Opportunity Act, and others.

-

Start with Personal Details:

- Full name

- Current and previous addresses (typically for the last two years)

- Social security number or taxpayer ID

- Date of birth

- Contact details (phone, email)

-

Employment and Income Information:

- Current and past employment details

- Position, duration, and employer contact details

- Monthly or annual income

- Additional income sources (if any)

-

Property Information (if already identified):

- Address

- Type of property (single-family, multi-family, condo, etc.)

- Expected purchase price or estimated value

- Property use (primary residence, rental, vacation home)

-

Loan Information:

- Desired loan amount

- Type of loan desired (fixed, adjustable, etc.)

- Down payment amount

-

Financial Information:

- Assets (bank accounts, retirement accounts, other real estate or valuable possessions)

- Liabilities (current mortgage, loans, credit card debts, etc.)

- Monthly expenses

-

Disclosure Questions:

- These can include questions about past bankruptcies, foreclosures, or pending lawsuits. It’s crucial to make sure these questions adhere to local regulations.

-

Declarations:

- Questions about citizenship status, any outstanding debts, and other relevant declarations as required by law.

-

Consents:

- Permission to perform a credit check

- Consent regarding data processing and storage based on privacy laws

-

Add Instructions:

- Clearly state what supporting documents are needed (e.g., proof of income, identity verification).

- Include guidelines on how to fill the form, especially for complex sections.

-

Design for Clarity:

- Use a logical flow, grouping related fields together.

- Make use of checkboxes, drop-down menus, and radio buttons for easy selection.

- Ensure there’s enough space for applicants to provide detailed answers where necessary.

-

Review and Test:

- Before finalizing, have the form reviewed by legal and compliance teams to ensure it meets all necessary standards.

- Pilot the form with a small group to get feedback and ensure clarity.

-

Implement Security Measures:

- If the form is online, ensure data encryption and secure storage. If it’s a paper form, establish secure storage and handling procedures.

By carefully designing a Mortgage Loan Application Form and ensuring it aligns with both regulatory requirements and the needs of your institution, you can create an effective tool to gather essential information from potential borrowers.

Tips for creating an Effective Mortgage Loan Application Form

Creating an effective Mortgage Loan Application Form not only facilitates a smoother application process for potential borrowers but also ensures that lenders obtain all the necessary information in a structured manner. Here are some tips to ensure the form’s efficiency and user-friendliness:

- Keep It Clear and Concise: Avoid jargon. Use simple language to ensure that applicants of all backgrounds can understand and complete the form without confusion.

- Logical Sequencing: Organize questions in a logical order, starting with basic personal details, followed by financial, property, and loan information.

- Use Section Headings: Divide the form into clear sections with relevant headings to help applicants navigate the form easily.

- Provide Instructions: Offer clear instructions on how to fill out the form, especially for more complex sections or where specific formats are required.

- Include Tooltips or Help Icons: For online forms, consider using tooltips or help icons next to questions that might require further clarification.

- Make Essential Fields Mandatory: Mark essential fields as required, ensuring you get all the vital information needed for processing.

- Opt for Responsive Design: If your form is online, ensure it’s mobile-friendly. Many people might access the form via smartphones or tablets.

- Use Drop-Downs and Checkboxes: These can make it easier for the applicant to respond and reduce the likelihood of errors or inconsistent data.

- Ensure Security: Make sure the form, especially online ones, is secure. Assure applicants that their personal and financial information is safe.

- Add a Save and Return Feature: For longer online forms, give applicants the ability to save their progress and return later.

- Provide Contact Information: Include a contact number or email in case applicants have questions or encounter issues while filling out the form.

- Compliance is Key: Always ensure that the form complies with local and national regulations regarding data collection and processing.

- Regularly Update the Form: As regulations, market conditions, and internal policies change, ensure the form remains updated.

- Feedback Loop: Consider gathering feedback from applicants about their experience with the form and make necessary adjustments.

- Use Conditional Logic: For online forms, use conditional logic to show or hide questions based on previous answers. This can make the form shorter and more relevant to each applicant.

- Clarify on Supporting Documents: Clearly list out any additional documents or proofs that need to be attached or submitted alongside the form.

- Proofread and Test: Before making the form live or distributing it, make sure to proofread it for errors and test it to ensure all functionalities work as expected.

By following these tips, lenders can create a Mortgage Loan Application Form that not only gathers all the necessary information efficiently but also offers a hassle-free experience for the applicants.

A Mortgage Loan Application Form is a pivotal document that borrowers complete to request financing for property purchases. This form, encompassing various types from pre-qualification to full applications, collects personal, financial, and property-related details. Creating a streamlined, compliant form is essential for both lenders’ assessments and borrowers’ ease. By understanding its significance, types, and crafting methods, lenders ensure efficient loan processing and enhanced customer experience. In addition, you should review our Student Application Forms.

Related Posts

FREE 7+ Satisfaction of Mortgage Forms in PDF MS Word

FREE 39+ Estimate Forms in PDF Ms Word

FREE 7+ Assignment of Lease Forms in PDF MS Word

FREE 8+ Bank Verification Forms in PDF

FREE 9 + Sample Credit Report Authorization Forms in MS Word ...

FREE 9+ Sample Loan Agreement Forms in MS Word PDF | Excel

FREE 9+ Sample Subordination Agreement Forms in PDF MS Word

FREE 7+ Sample Loan Agreement Forms in PDF MS Word

FREE 35+ Loan Agreement Forms in PDF

FREE 10+ Loan Application Review Forms in PDF MS Word | RTF

FREE 10+ Sample Mortgage Application Forms in MS Word PDF

FREE 11+ Sample Loan Application Forms in PDF Excel | MS Word

FREE 55+ Loan Forms in PDF MS Word | Excel

FREE 9+ Sample Rent Application Forms in PDF MS Word

FREE 4+ Car Loan Application Forms in PDF MS Word