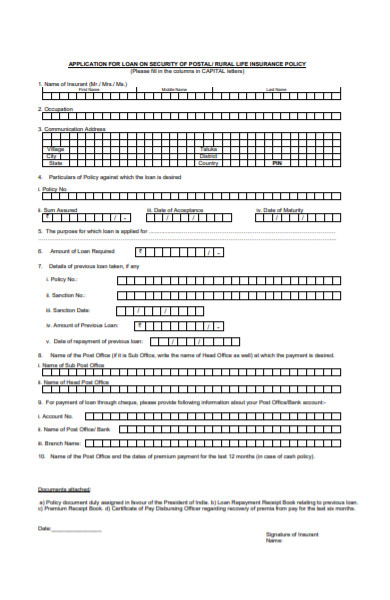

When the funds are low and landing a high-paying job seems difficult to accomplish, and when expenses are challenging to manage and maintain over a long period loaning becomes a viable option for many Americans. Loaning is a possible solution, and anyone can apply for one with the assistance of a loan application form. Moreover, there are numerous types of loans to select from, with each catering to a different need.

FREE 55+ Loan Forms in PDF | MS Word | Excel

What Is a Loan Form?

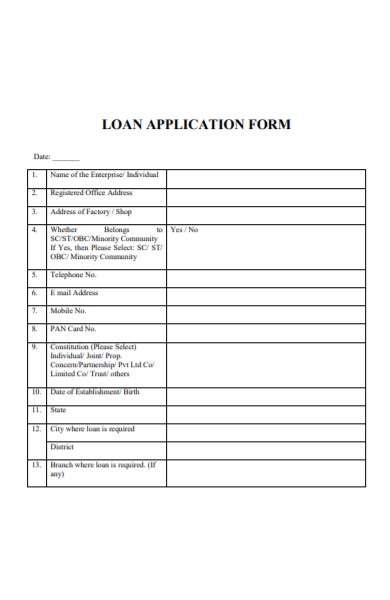

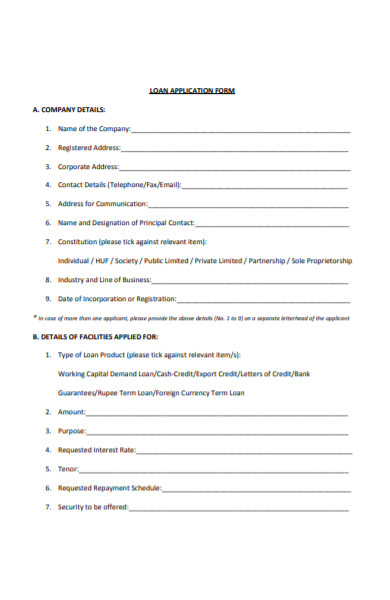

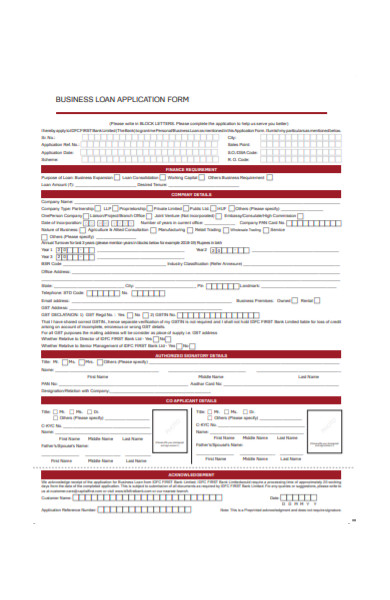

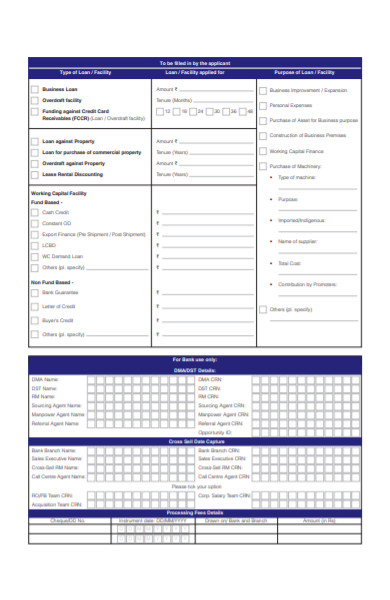

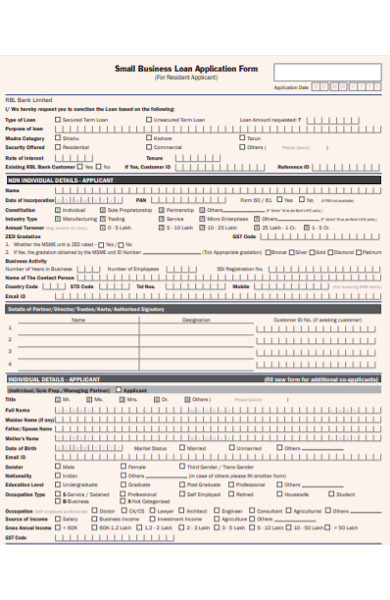

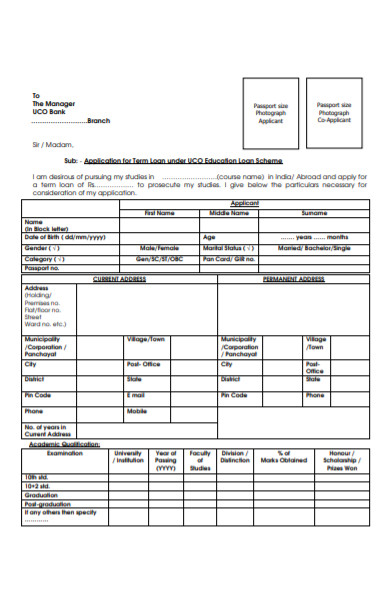

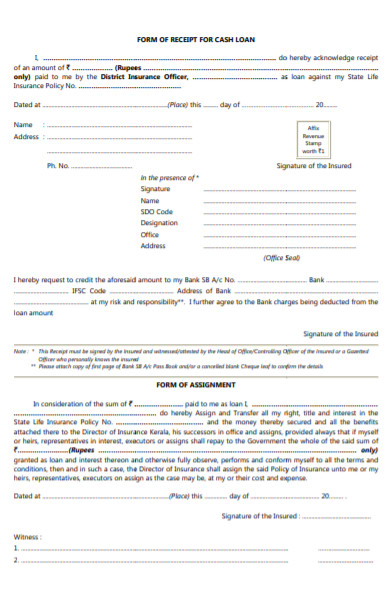

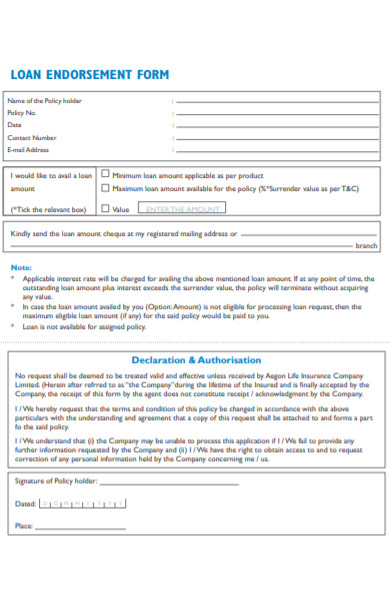

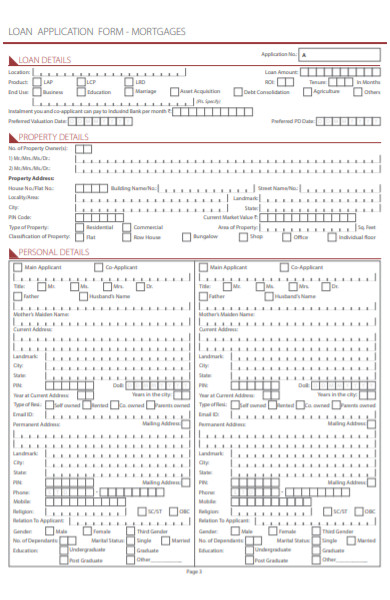

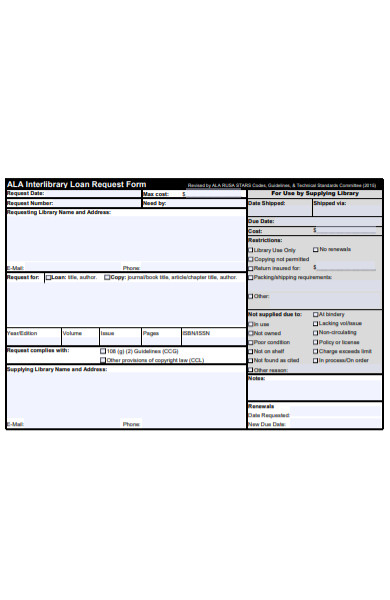

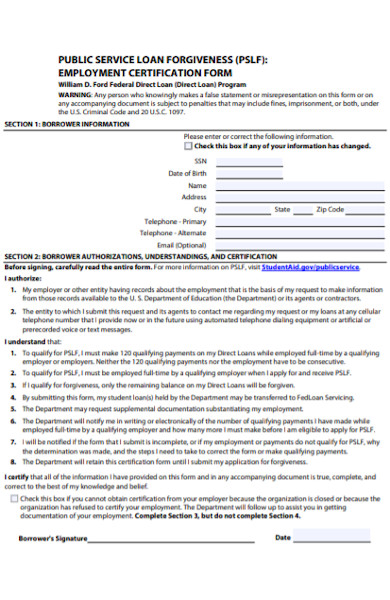

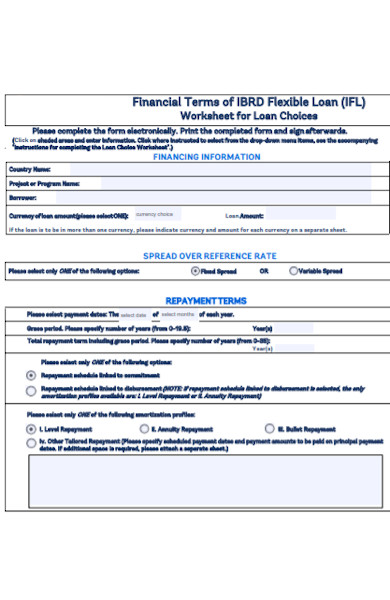

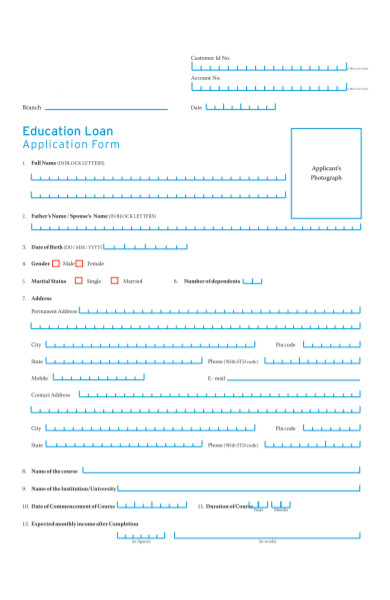

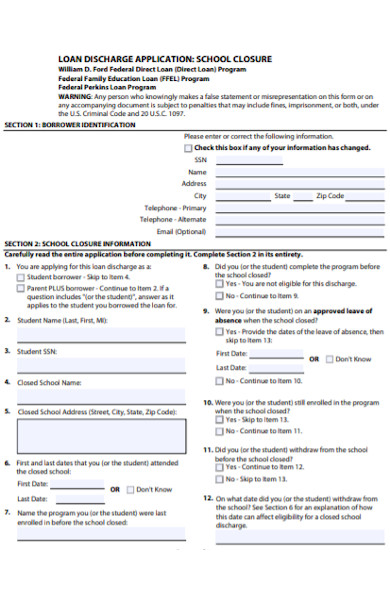

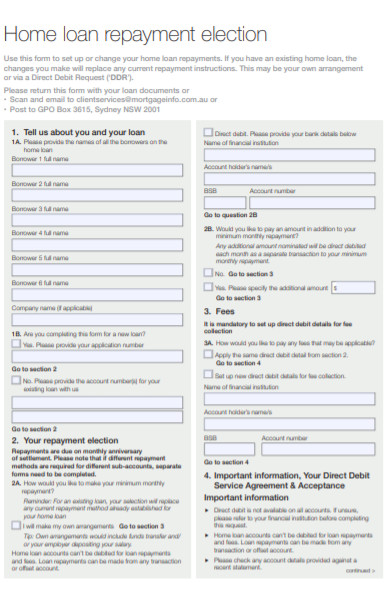

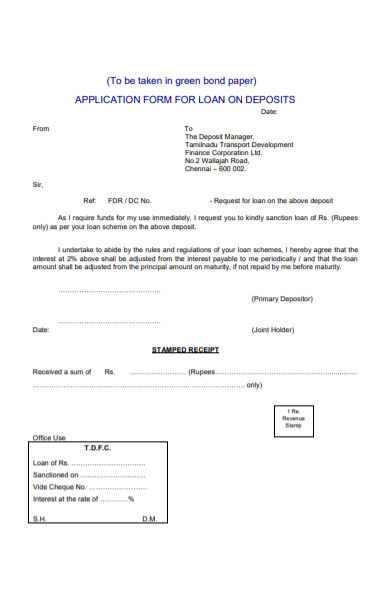

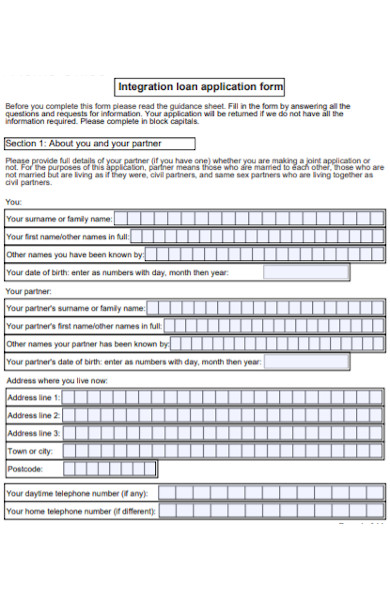

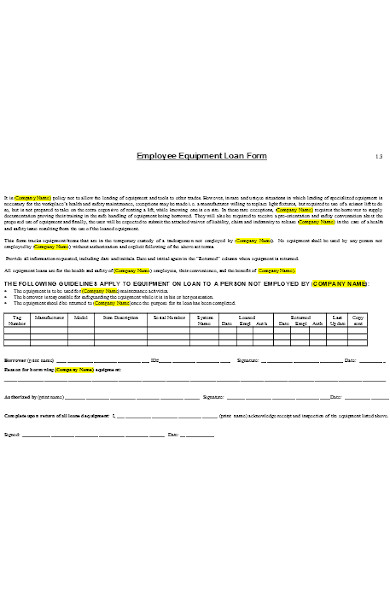

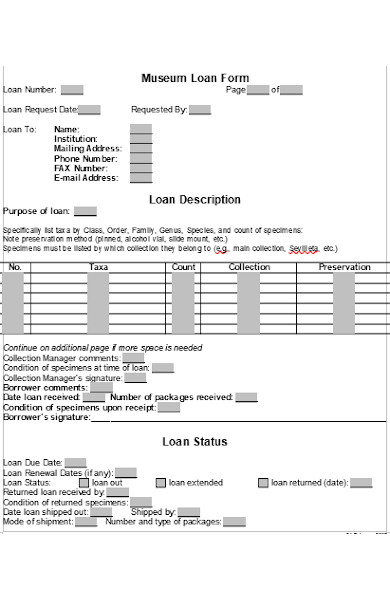

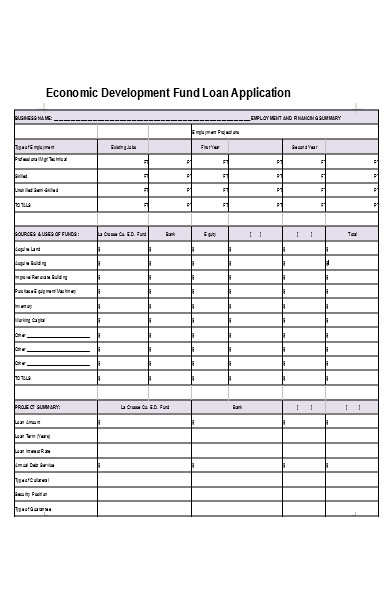

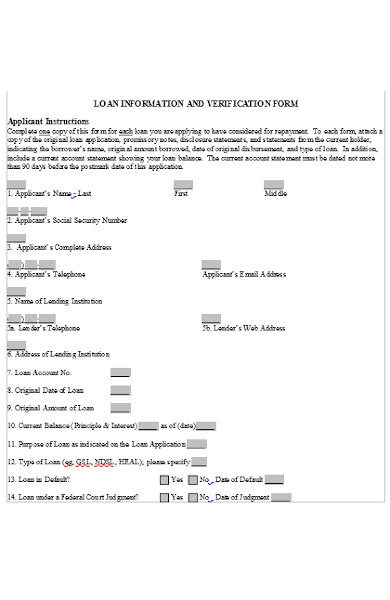

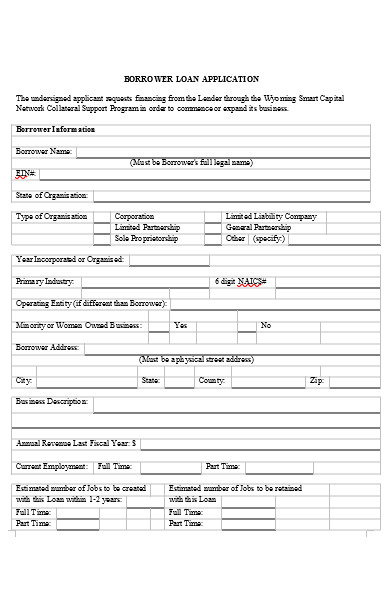

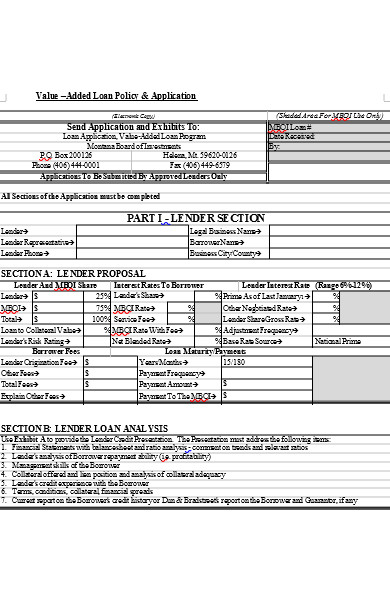

Loan forms are business documents that provide substantial information about the borrower, including the amount of the borrowed money. Countless Americans submit loan applications every year, and these business forms do a great job of simplifying the loaning process including the agreement for them. But then, why do people loan money? Some used it to purchase items while some pay off other loans. Whatever the reason behind it, loaning is a common trend even before.

A Brief History of Loaning and Loan Forms

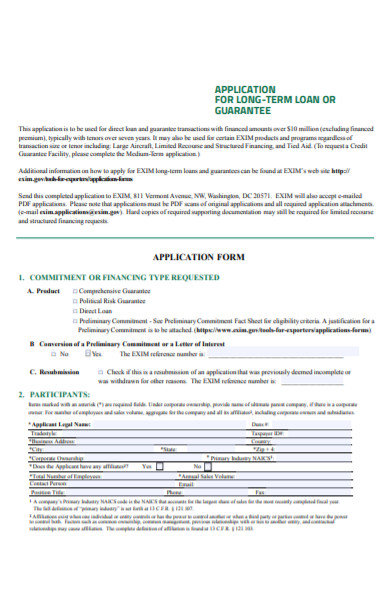

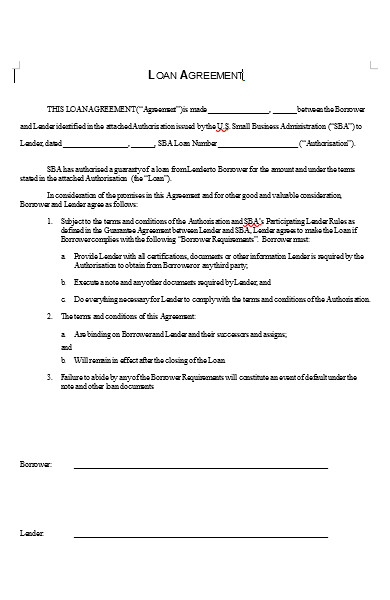

Lending institutions and banks came into existence since the peak of early civilizations. People needed money, and some were willing to lend theirs in exchange for proper compensation. However, loaning money wasn’t a practical business back then since this type had no official collateral secured to the loan. With that, some borrowers didn’t return the money and even went to another country to avoid paying the lender the money they borrowed. And so, early versions of loan agreement forms also existed because the lender needed proof that the transaction happened, in case he found the borrower.

Eventually, loaning rose out of the dark and became an industry on its own. Specific laws now exist to punish those that don’t follow the policies found in the loan agreement forms. And running away isn’t an option anymore since enhanced technology can easily trace people with the details they left in the loan forms. But how do lenders decide the amount of money they lend to a borrower?

Loan Application Assessment: What You Need to Keep In Mind

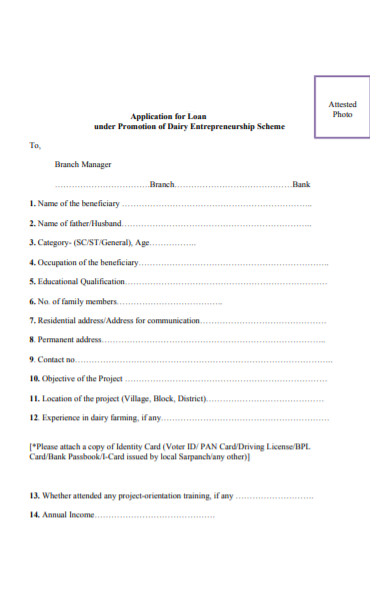

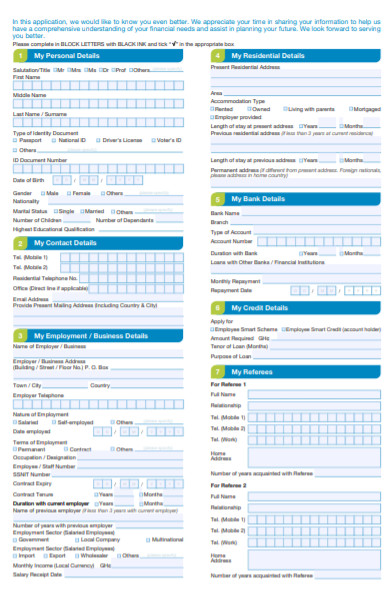

Submitting various personal information is a requirement if one wants to apply for a loan. And a lender takes upon himself the decision to assess how much he’ll give to a borrower based on the applicant’s details. Much like the businessman, a lender must weigh in if the borrower can return the money when the time comes. If not, the lender opens himself to a high risk of losing profit and cash. And so, what must be the right information that will aid in knowing the right amount to lend to a borrower? Listed below are information or data that will assist in loaning application.

-

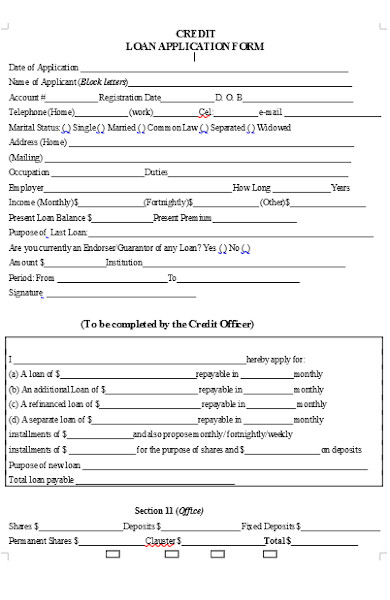

Credit Score and Credit History

Before any transaction takes place, loan application assessments occur firsthand. And to aid the procedure, specific information such as one’s credit history and credit scores must be given by the borrower. Credit score and credit history are a determiner of how much the lender is willing to give. If a loan applicant possesses an excellent credit score, the lender takes it as a sign that the applicant complies with his previous loan obligations on time. Moreover, an excellent credit score translates to a higher chance of receiving a significant sum of money.

-

Applicant’s Income

Even when the credit scores are significantly above average, a lender may hold doubts about an application since his money is at stake. Convincing the lender entails that the borrower must then present more proof of his capability to return what he intends to loan. Such needed documentation is the borrower’s source of income. Moreover, the usual first source of income is from work if you’re an employee, and thus, an applicant needs to provide a certificate of employment to the lender. With this, the lender may observe that the borrower possesses the finances to meet his loan deadlines.

-

Payment Obligations

A person’s income is a fraction of the assessment requirement, and lenders require more viable information. Such data is the applicant’s other payment obligations. For the lender, the borrower may hold financial stability, but that doesn’t guarantee any assurance if he has other payment obligations. The average working American has other priorities that he must tend to, and the borrower must divulge this information. However, this doesn’t equate to the rejection of the application. The lender will assess how much money he’ll give to the applicant with the other payment obligations in mind.

Common Types of Loans That You Should Know

The American dream consists of multiple factors such as a large house, a nice car, a white fence, and many more. And to help many blue-collar Americans achieve this goal, loaning businesses made it possible to acquire such items through loans. Listed below are the loan options along with some details about their mechanics.

-

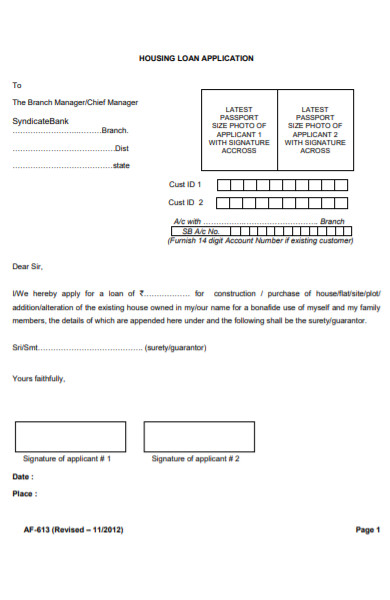

Mortgage

A mortgage is a type of loan for real estate properties. A person who wants to purchase a house or a property but does not have the financial means at the moment may opt for this loan option. However, the borrower must take into account that this type of loan requires collateral. A collateral is a repayment that is of high marketing value, and this repayment is usually present in the loan agreement form’s terms and conditions.

-

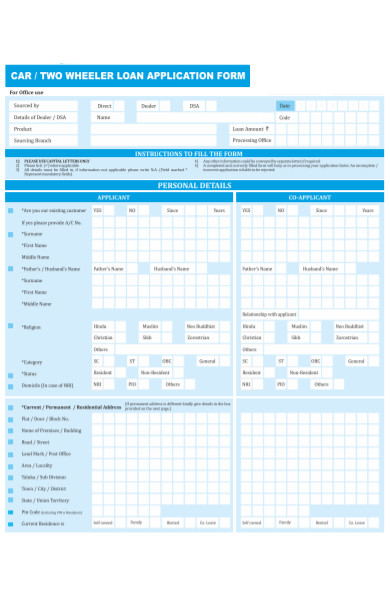

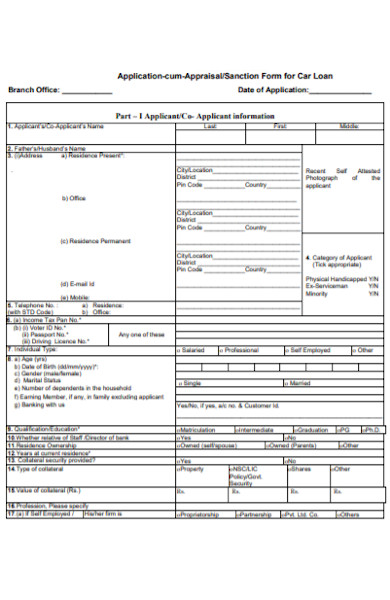

Car Loan

Cars are highly useful in America because the roads are long, and most states are connected. Moreover, newly-bought cars are usually paid through loans. With that, the average American lists cars as a possible asset. All that a person needs to do to gain one is filling up a car loan form. A car loan functions similarly to how a mortgage or housing loan does, providing the means to purchase the vehicle, but the only difference is the item up for loaning, which is the vehicle.

-

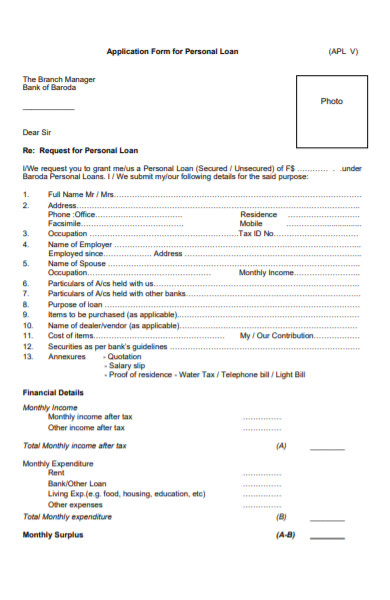

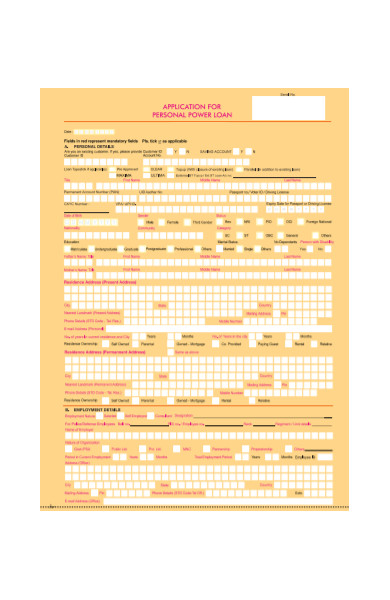

Personal Loan

Personal loans are borrowed money that a person uses for personal matters, and banks are usually where this type a borrower can acquire. Some examples of personal load usage include weddings, house innovation, and others more. And similar to the previous loan types, collateral is a requirement as an assured form of repayment.

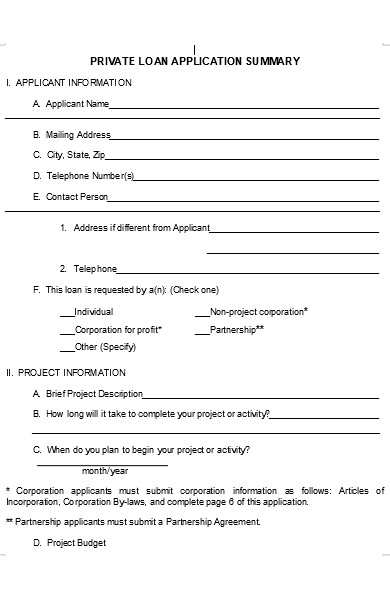

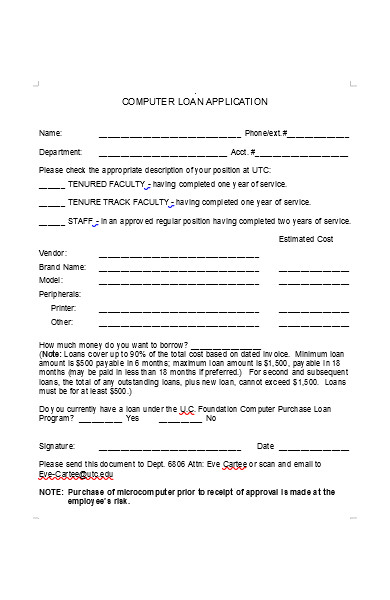

How to Create a Loan Form

As we mentioned, loan forms simplify the assessment and shorten the transaction process. However, a loan form may fail if, in the first place, the creation didn’t entail effort and precision. But then, how does one craft an efficient loan document? There are various ways on how one can go about this, but we already prepared a simple four-step guide to help you with creating the right kind of loan form.

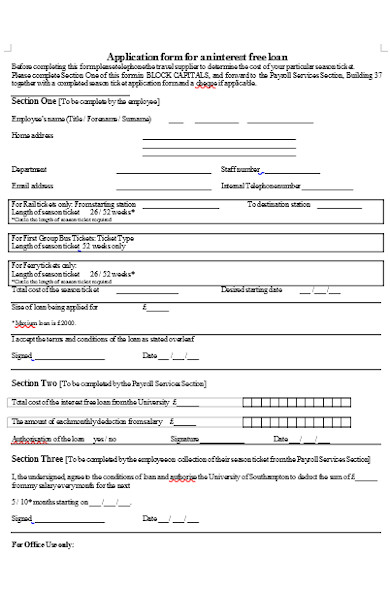

Step 1: Observe Proper Rules on Formal Writing

Loan forms are formal business documents, and users expect that the content contains a formal business tone, too. A formal business style doesn’t mean that you should make use of fancy jargon or eloquent words. The method emphasizes directness of delivery of information while maintaining a professional language, of course.

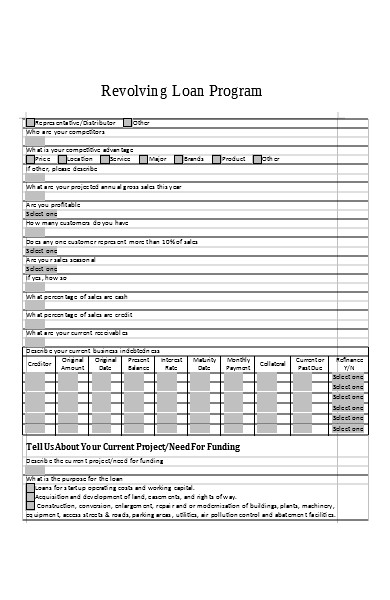

Step 2: State the Intention for Loaning

Contrary to what others might believe, a lender wants to understand the reason for those who will borrow money from him. And so, it is best to provide a short description of the borrower’s intention for loaning. Moreover, this section need not be lengthy, and a short one will suffice. Furthermore, the brief explanation might even help persuade the lender to gives his approval to one’s loan application.

Step 3: Enumerate the Assets and Liabilities

Provide a list of all the assets and liabilities that you possess, so the lender does not need to flip through various papers during the assessment. By doing so, you are opening yourself to critique, and in the list, the assets must outweigh the liabilities to gain a better standing.

Step 4: Clean Up the Evident Mess

After making the output, you must make sure that there are no more residual errors left in it. And to do so, you must assess your work. Look at all the angles of your document and see if there might be mistakes that you missed.

FAQs

Is a loan counted as credit or debit?

The perception of loans differs, depending on who addresses. For a borrower, a loan is a liability. Although loaning grants access to purchase items, it still adds to the borrower’s list of debts. However, the lender sees loaning as additional income since interest and loan fees play a part in the process, thereby increasing the money returned to the lender.

Can I apply for a loan even if I have no job?

An unemployed applicant gains the chance to apply for a loan but must then provide proof of another source of income, such as their savings or an external source. Moreover, the applicant must also bear an excellent credit score and history. Granted that the loaning business approves the worth of the applicant’s income or credit score, the categorization of this scenario must then be as an unemployed loan transaction.

Does a loan agreement need other witnesses?

There is simply no need for additional witnesses since this is not a deed or a transfer of right. A loan transaction needs the only presence of the lender and the borrower, and the document gets signed as merely a contract. However, this is not to say that additional witnesses are not allowed. Under specific circumstances, like the absence of the lender or the borrower, can the presence of other witnesses come into play.

The average American’s financial capability pales in comparison to the expenses in store. However, various methods do exist, and loaning money is the most viable one. Countless loaning businesses grant borrowers a variety of loan options in the loan application forms, such as cars, mortgage, and many more. Moreover, borrowers should prove that they have various sources of income to gain the lender’s approval. Moneylenders may provide such services that assist in fulfilling the American dream, but they also need assurance that the loaned money gets returned, too.

Related Posts

FREE 8+ Sample Loan Contract Forms in PDF MS Word

FREE 7+ Loan Contract Forms in PDF MS Word

FREE 8+ Sample Personal Loan Contract Forms in MS Word PDF

FREE 4+ Car Loan Application Forms in PDF MS Word

FREE 34+ Loan Agreement Forms in PDF MS Word

FREE 9+ Sample Personal Loan Agreement Forms in PDF MS Word

FREE 37+ Loan Agreement Forms in PDF MS Word

FREE 11+ Loan Proposal Forms in PDF MS Word

FREE 10+ Loan Application Review Forms in PDF MS Word | RTF

FREE 56+ Loan Agreement Forms in PDF MS Word

FREE 4+ Entrance Counseling Forms in PDF

FREE 6+ Promissory Note Agreement Forms in PDF MS Word

FREE 40+ Printable Loan Agreement Forms in PDF MS Word

FREE 7+ Sample Loan Estimate Forms in PDF MS Word

FREE 11+ Sample Loan Application Forms in PDF Excel | MS Word