A mortgage release form is a document which is used by a mortgagee as a proof that the mortgagor or the borrower have fully paid the mortgage loan. In addition, the release form will also state that the lien in the mortgagor’s property or house will be removed due to the fulfillment of the required mortgage loan payment.

Types of Mortgage Release Forms

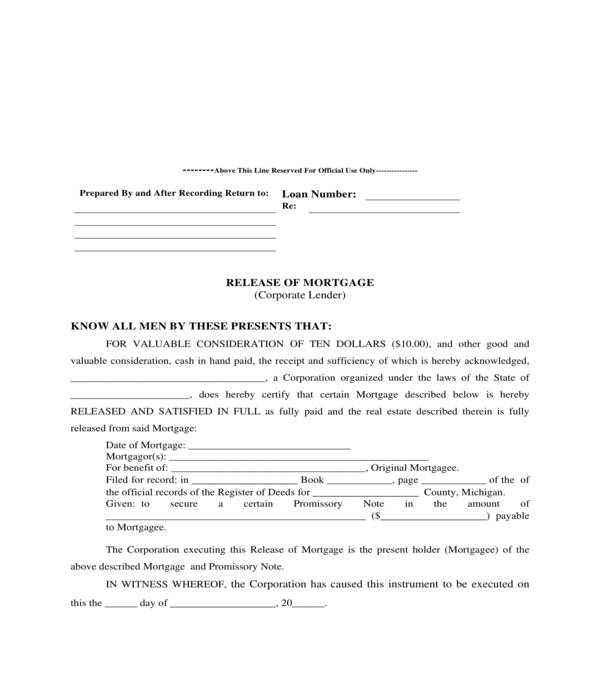

Corporate Lender Mortgage Release Form – This is the type of mortgage release form which will be used by corporate mortgage lenders. In the form, there are three sections to be filled out by the mortgagor, mortgagee, witnesses, and the notary public. The first section is intended for the return address of the release form along with the loan number of the mortgage. The second section documents the details of the mortgage such as the date of the mortgage, the beneficiaries, the name of the mortgagee, and the amount to be paid by the mortgagee. Moreover, the third and fourth sections of the form are for the signatures of the involved parties as well as the notary public’s acknowledgment and seal.

Corporate Lender Mortgage Release Form

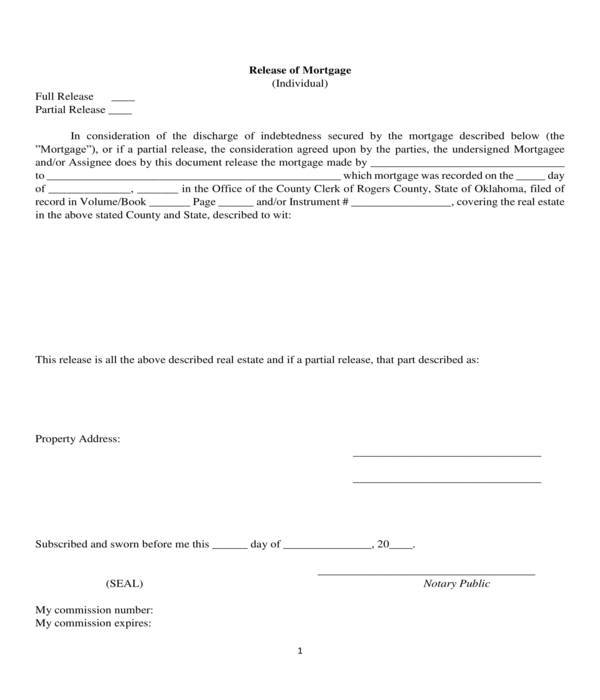

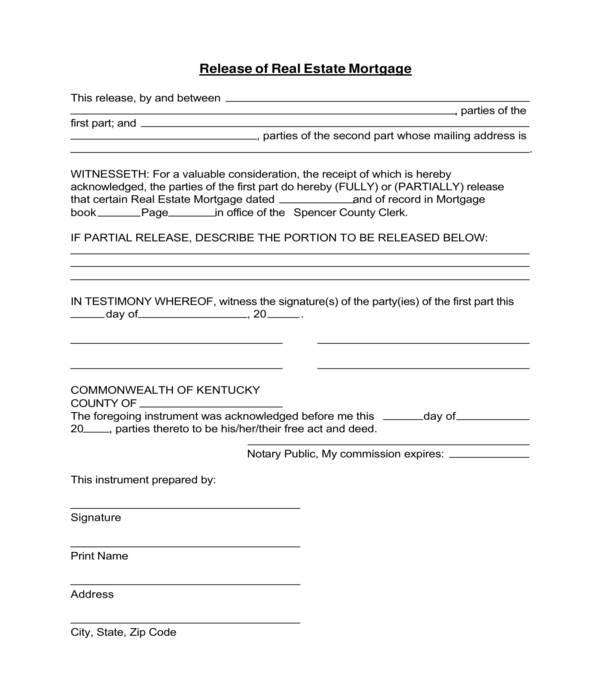

Individual Mortgage Release Form – As the aforementioned form is intended for corporate mortgage loans, an individual mortgage release form can be used by a private mortgage provider rather than from a bank or a financial institution. To complete the form, the user must first indicate the type of release being conducted, whether it is a full release or a partial release of the mortgage. Then, the names of the involved parties, the record information of the mortgage loan, and the address of the lien property must be stated.

Individual Mortgage Release Form

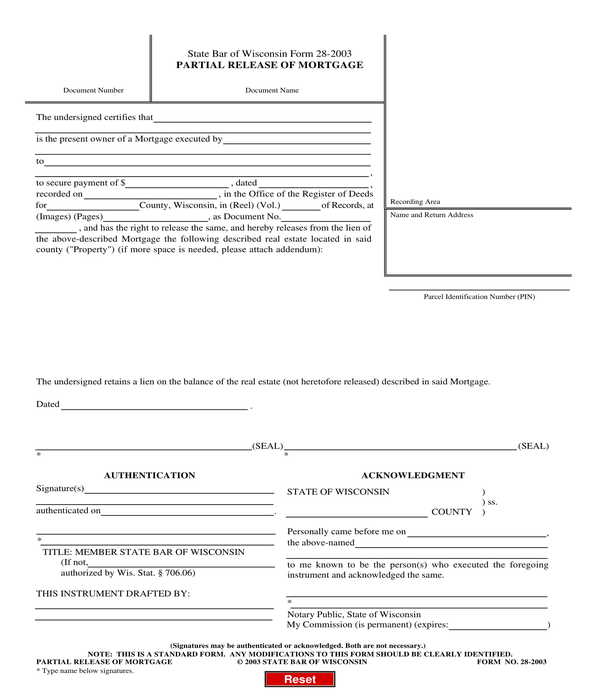

Partial Mortgage Release Form – If a mortgagor or a borrower have not yet paid the full amount of the loan, then a partial mortgage release form must be used by the mortgagee. Specifically, the purpose of the form is to document the payment and the dues of the mortgagor. Four sections comprise the form wherein the first two sections are to be filled out by the parties of the mortgage and the last two sections are to be completed by the State authenticator and a notary public.

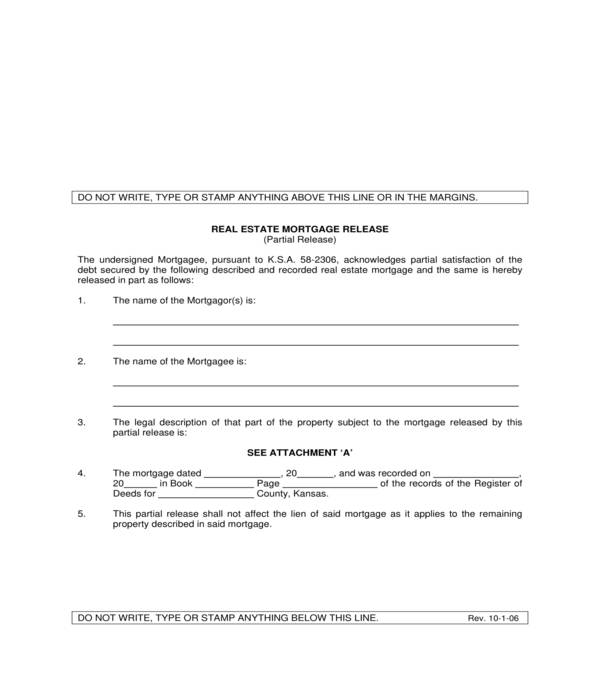

Partial Mortgage Release Form

How to Get a Mortgage Release Form

The one who will be providing the mortgage release form will be the lender or the mortgagee, and the only way to acquire the release is to pay for the dues of the mortgage loan. On the other hand, mortgagees can get a template online or from their mortgage agency in order to provide a release to their mortgagors or borrowers. The templates must be filled out with the right data and information which will identify to whom the release is addressed to, what property is being released from the lien, and the amount which had been paid by the mortgagor for his mortgage loan.

Mortgage Release Form Sample

How to Create a Basic Mortgage Release Form

For newly established mortgage loan providers, a basic mortgage release form can be beneficial to use. Follow the steps below to begin creating this type of form:

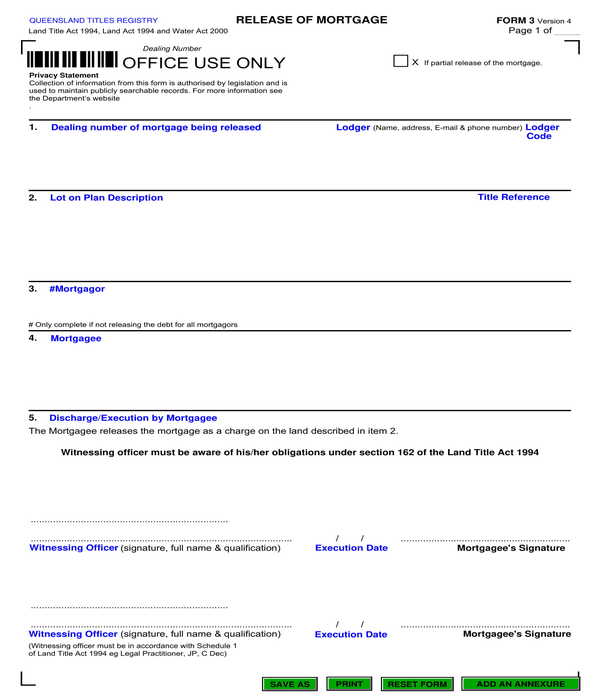

Step 1: Create the header for the form.

The header should indicate the title of the form being made which is specifically “Mortgage Release Form”. In addition, the dealing and document assignment numbers should also be placed in the header along with the address of the mortgage and property registry of the State.

Step 2: Describe the mortgage.

The dealing number of the mortgage, the date when the mortgage loan began, the description of the property which is part of the lien for the mortgage, and the names of both the mortgagee and the mortgagor should be indicated in a statement. Moreover, the price of the mortgage should also be included in the statement as well as the amount which was paid by the mortgagor to the mortgagee.

Step 3: Add a signature block and an area for the notary public’s acknowledgment and seal.

The signature block should be able to collect the signatures of the mortgagor, the mortgagee, and the witnesses or witnessing officer present in the execution of the release. The notary acknowledgment section of the form should contain statements indicating the notary public’s affirmation to the identities of the involved parties and the legalities of the release. Another signature block should be placed below the notary acknowledgment statement which will be for the signature, title, seal, and name of the notary public.

After the contents of the basic mortgage release form are reviewed and finalized, the form should be saved and be printed to collect the signatures. Then, duplicates or copies of the signed basic mortgage release form should be distributed to every party who affixed their signatures in the form. The purpose of distributing copies is to allow each party to have their own reference and proof that the mortgage and the lien had been released legally by the mortgagee.

Partial Real Estate Mortgage Release Form

Mortgage Release Form FAQs

Is a mortgage release form a legal document?

Yes, a mortgage release form is a legal form. This is the reason why it is important that the contents and data stated in the form are reviewed by a notary public or an attorney before anyone will sign the form. It is crucial that the amounts stated in the form and the description of the lien property are both accurate.

Is a mortgage release form the same as the satisfaction of mortgage form?

Yes, the term satisfaction of mortgage is often used interchangeably to a mortgage release form. Both of these forms, regardless of their names, are used for documenting the fulfilled loan payment of a mortgagee.

Real Estate Mortgage Release Form

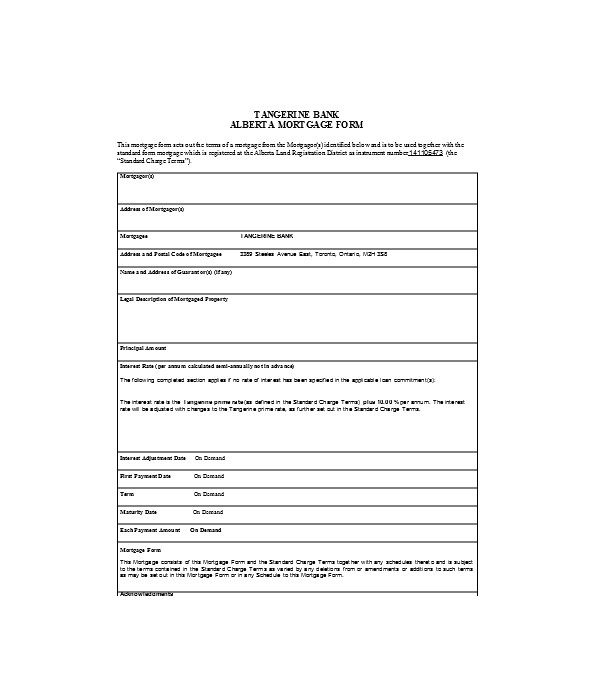

Bank Mortgage Release Form

Importance of Using Mortgage Release Form Templates

Mortgage release form templates are easier to use and edit, and only requires the user to allocate lesser time in preparing the form as compared to making one from scratch. The template can also be reused whenever needed by a mortgagee or a mortgage loan providing agency. In addition, a template also contains placeholders which can serve as a guide for the mortgagee to identify what types of information he will need to state in the form.

Related Posts

-

Minor Photo Release Form

-

Bond Release Form

-

FREE 22+ Print Release Forms in PDF | MS Word

-

Print Release Form

-

Copyright Release Form

-

Emergency Release Form

-

Patient Release Form

-

Release Form

-

FREE 9+ Property Release Forms in PDF | MS Word

-

FREE 10+ Equipment Release Forms in PDF

-

FREE 9+ Deed Release Forms in PDF | MS Word

-

FREE 10+ Artwork Release Forms in PDF | MS Word

-

FREE 10+ Image Release Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Reference Release Forms in PDF | MS Word

-

FREE 8+ Sample Tattoo Release Forms in PDF