A satisfaction of mortgage form is a document which is to be issued by a lender to acknowledge that the borrower has fully paid the mortgage loan. The form will be used for proving that the mortgage no longer liens the property of the borrower and that all other required obligations had been met.

Types of Satisfaction of Mortgage Forms

There are different varieties of satisfaction of mortgage forms which can be used by financial providers and lenders for their borrowers:

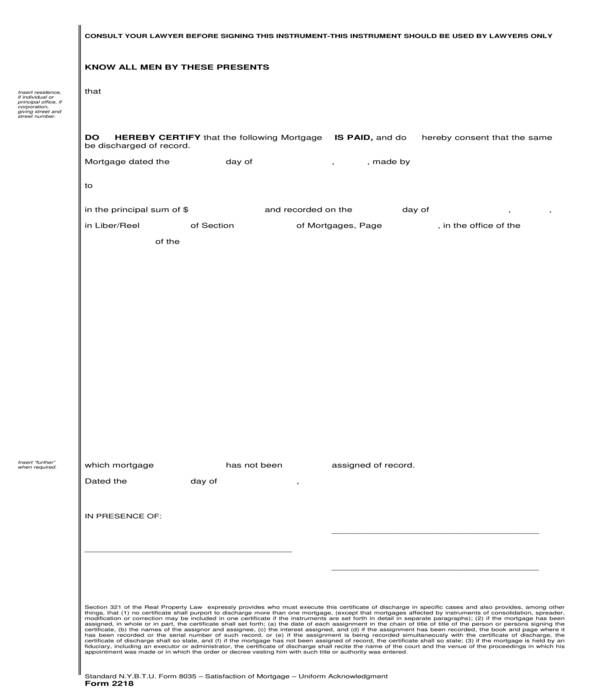

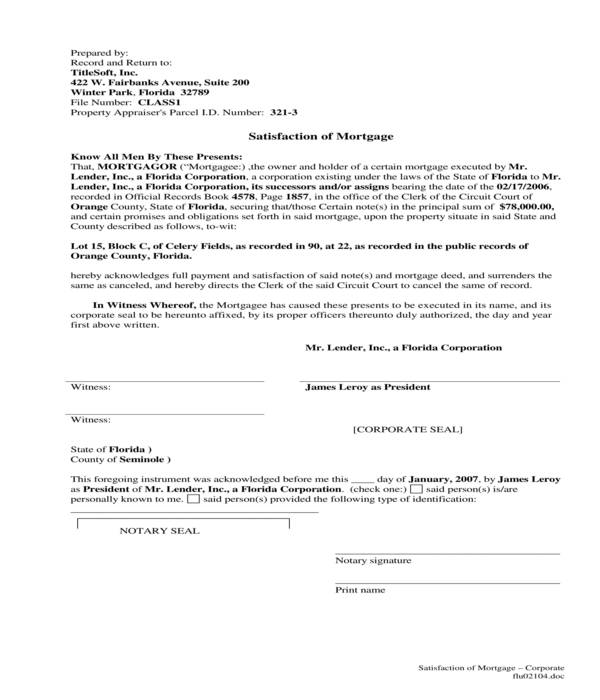

Legal Satisfaction of Mortgage Form – This type of form contains five sections and should be used in the presence of a lawyer or an attorney who can guide throughout the process of finalizing the fulfillment of the mortgage. The first section of this legal form is allotted for the certification of the parties involved about the mortgage, while the other succeeding sections are for the acknowledgments and the signatures of the witnesses, the borrower, and the lender.

Legal Satisfaction of Mortgage Form

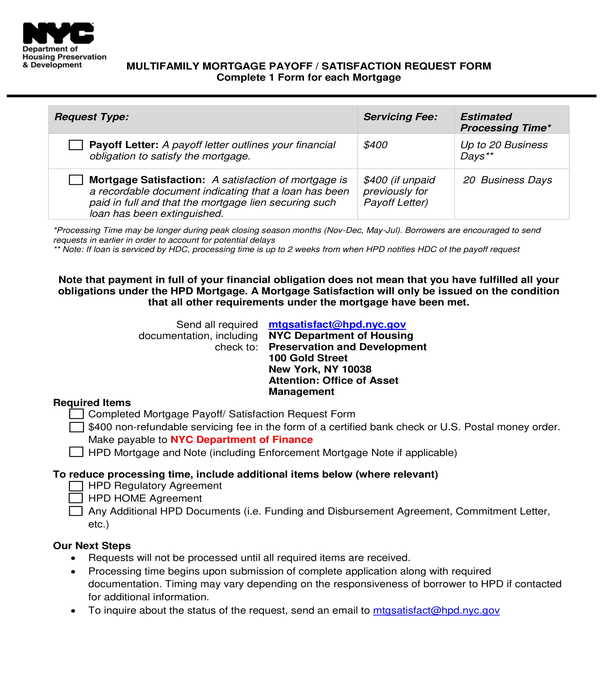

Multifamily Mortgage Payoff Satisfaction Request Form – One benefit of using this form is that it is easily fillable or automated which only requires the user to click on each entry field and box to input data. To fill out the form, the user first needs to indicate the type of document that he is requesting which is the satisfaction form, then he must mark the items that he had submitted which were required for the request. The general information of the mortgage, the reason for the request, the information of the property and the borrower, and the borrower’s contact information are some of the other details which should be disclosed in the form.

Multifamily Mortgage Payoff Satisfaction Request Form

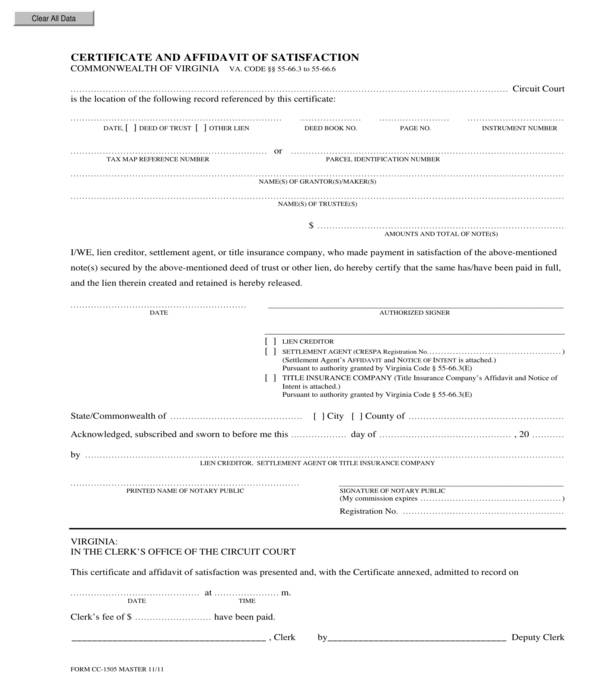

Satisfaction of Mortgage Certificate and Affidavit Form – Three sections comprise this form wherein the first and second sections are where the certifications and affidavit statements are indicated. The third section, on the other hand, is to be filled out by the State court to document that the form was presented, annexed, and recorded by the court. The time and date when the form was recorded, the clerk’s fee which had been paid by the involved parties, and the names of the clerks and the deputy clerk must be stated in order to complete the affidavit form.

Satisfaction of Mortgage Certificate and Affidavit Form

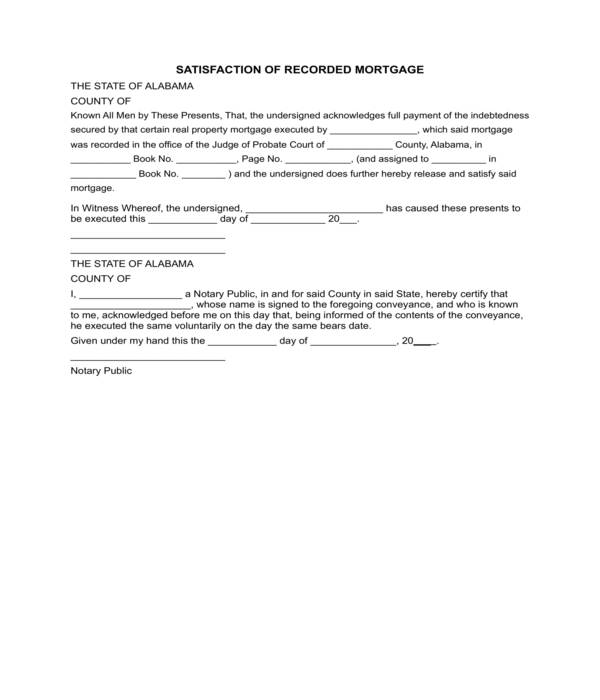

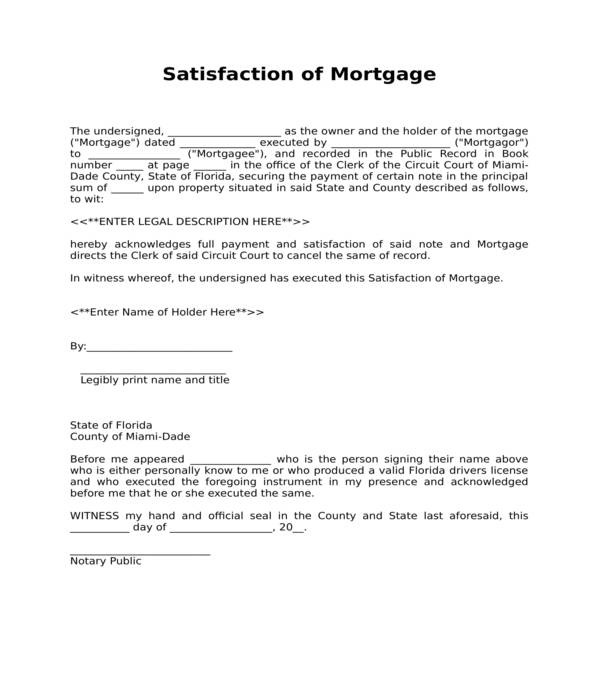

Satisfaction of Recorded Mortgage Form – As compared to the aforementioned form types, this document has two sections. Furthermore, this form will not be completed without the notarization of a notary public since the second section is intended for the notary’s signature and seal as an indication that the form had been verified and is legally acknowledged.

Satisfaction of Recorded Mortgage Form

How to Use our Satisfaction of Mortgage Forms

The first step to take when planning to use our forms is to identify the needs of the parties involved, especially since each form targets different matters and has different layouts and inclusions. Once identified, the form that suits and meets the needs of the involved parties should be downloaded and extracted from its zip file. The form can then be opened and be used immediately.

Satisfaction of Mortgage Letter Sample

How to Get a Satisfaction of Mortgage Form

In order to get a satisfaction of mortgage form, a loan borrower must first pay off his debt from the lender. Then the form can be acquired either from an attorney or from online, and the involved parties should complete the entry fields and required data in the form. After completing the contents, the form should be sent to the registry or recorder’s office to clear out the property from the lien.

Satisfaction of Mortgage Form in DOC

Satisfaction of Mortgage Form FAQs

How long does it take for a satisfaction of mortgage form to be provided to the borrower?

A minimum of a week or two would be the ample period which should be given by a borrower to the lender who will release his lien property. On the other hand, there are also other lenders who take longer since it depends on the processing time or other agencies and organizations where the property is named as part of the mortgage.

What other documents should be used to prove that a mortgage loan had been paid?

Aside from a satisfaction of mortgage form, a lender should also provide a deed form, specifically a deed of reconveyance. The purpose of this document is to transfer the property title back to the borrower since the loan was already paid.

What are other terms or names used for satisfaction of mortgage forms?

The other common terms which are used alternatively are “Mortgage Release Forms” and “Lien Release Forms”.

What happens if a completed satisfaction of mortgage form is not filed to the registry?

Penalties may be dealt by both the lender and the borrower even though the lender is the one responsible for filing the form and informing the registry while the borrower’s role is to follow up on the process of the release.

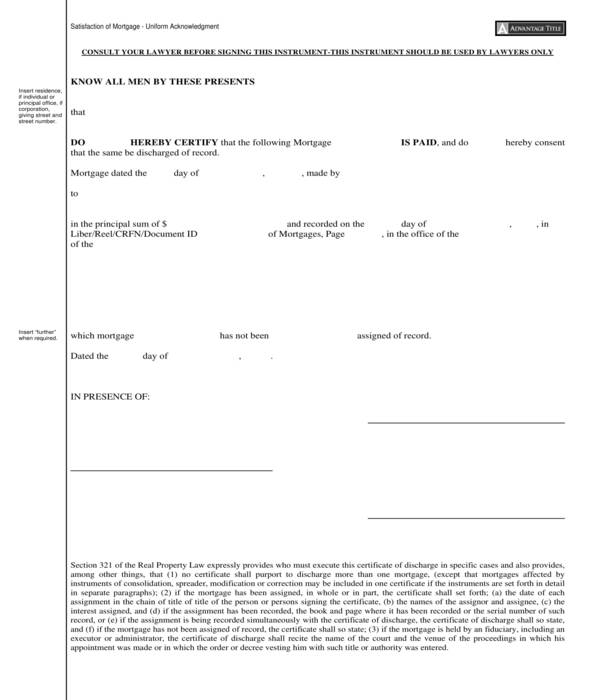

Satisfaction of Mortgage Uniform Acknowledgment Form

Essential Information to Input in a Satisfaction of Mortgage Form

The information to put in a satisfaction of mortgage form would be the following:

- The identification of both parties: This includes their full legal name and residential addresses. If one of the parties is representing an organization or a company, then the name of the company and its business address should be stated into the form along with the name of the representative.

- The mortgage amount: The amount which had been paid by the borrower and the actual amount of the loan should be included in the form to document the financial obligation of the borrower. In addition, other fees and payments which are required to be fulfilled by the borrower as well can also be included such as deposits and interests.

- The legal description of the lien property: The address and the property’s tax number can be some of the details to include as part of the property’s legal description.

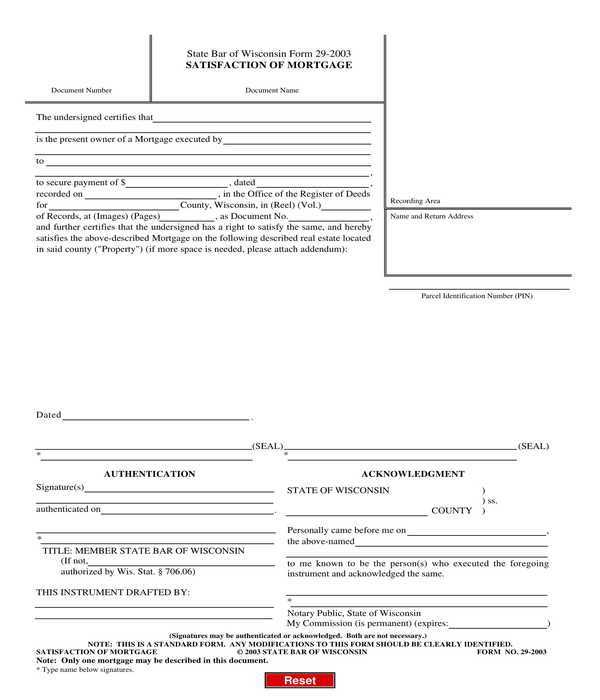

State Satisfaction of Mortgage Form

Nevertheless, there are also other sections and information which can be added into the form depending on the requirements and rules of the State, as well as what the attorney deems necessary to disclose which will benefit the parties involved.

Related Posts

-

FREE 13+ Trademark License Agreement Forms in PDF | MS Word

-

FREE 12+ Legal Agreement Forms in PDF | MS Word

-

FREE 14+ Legal Waiver Forms in PDF | MS Word

-

FREE 14+ Legal Consent Forms in MS Word | PDF

-

FREE 4+ Limited Partnership Agreement Long Forms in PDF | MS Word

-

FREE 5+ Movable Hypothec Long Forms in PDF | MS Word

-

FREE 4+ Articles of Association Long Forms in PDF | MS Word

-

Character Reference for Court Recommendation Letter

-

Notary Acknowledgment Form

-

License Agreement Short Form

-

Legal Ownership Form

-

Legal Petition Form

-

Legal Declaration Form

-

Legal Form