You and a farmer friend of yours decided to come into a loan agreement. Being a man of honor, your farmer friend then offered his tractor as collateral for the money he intends to borrow. The tractor, being a movable property, cannot be held as collateral without informing the government first. Desperate to overcome such hurdle, you logged in to the world wide web to ask for google’s help. You then came across a site that suggests that Uniform Commercial Code Forms should be filed beforehand in order to give notice to the government and the general public that a property has a lien or claim attached to it. You then set out the next day, eager to file a Uniform Commercial Code Form to the nearest state secretary’s office.

What are Uniform Commercial Code Forms?

Uniform Commercial Code Forms are legal forms that are filed by creditors to give notice to the public that a lien or interest is attached to the borrower’s property as security for a loan. These are submitted to the office of the state secretary, in the state where the debtor is located. Uniform Commercial Code Forms, in essence, formalizes the claim the creditor has over the debtor’s property as reflected on their security agreement.

FREE 4+ Uniform Commercial Code Forms in PDF

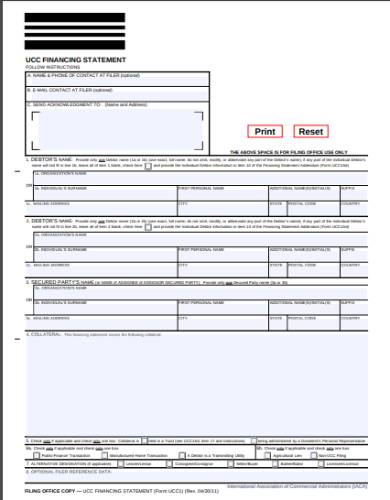

1. UCC Financing Statement

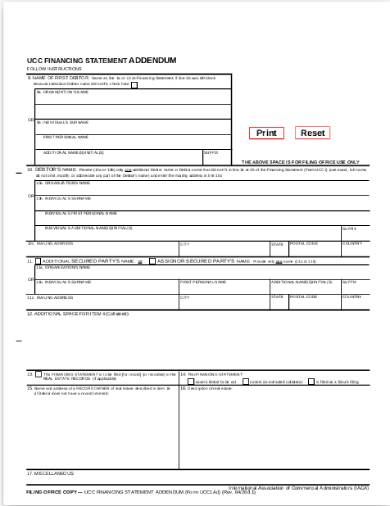

2. UCC Financing Statement Addendum

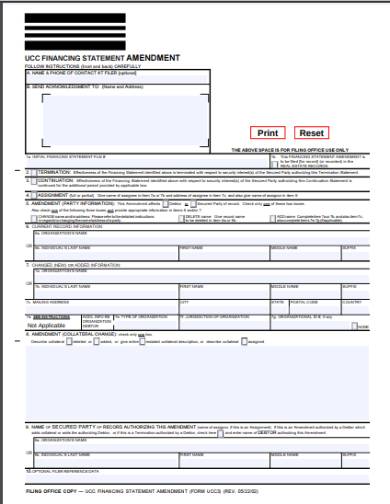

3. UCC Financing Statement Amendment

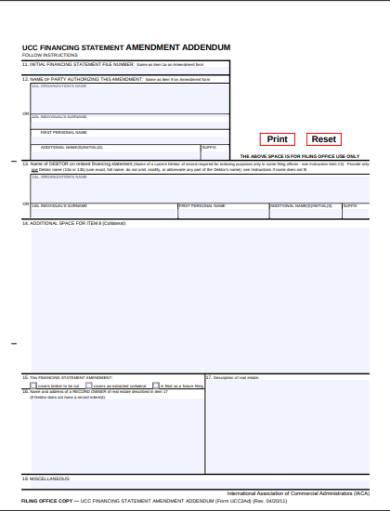

4. UCC Financing Statement Amendment Addendum

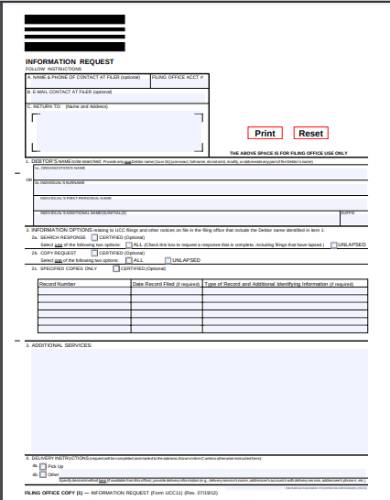

5. UCC Information Request

Types of Uniform Commercial Code Forms

Uniform Commercial Code Forms are filed to lay claim over the debtor’s property as collateral formally. The formal claim against the debtor’s property is made through a public notice which informs the general public that the property is used as collateral against a loan. It means that when a property is used as collateral to a loan, the property will no longer be subject for sale or disposition unless the obligation attached to it is extinguished or paid.

Uniform Commercial Code Forms are covered by the Uniform Commercial Code, which regulates and harmonizes the practice and conduct of sales and other commercial transactions. The code aims to provide a uniform set of rules and regulations on how commercial transactions are to be done, especially those that involve properties, both movable and immovable. More importantly, this code also aims to promote fair practice among stakeholders, especially in claims, interests, guarantees, and collaterals.

Uniform Commercial Code Forms come in different forms for different purposes and usage. Listed below in order are the different types of Uniform Commercial Code Forms for various purposes.

1. UCC1 – Financing Statement

The UCC1 Financing Statement is an application form for filing a notice of claim against the debtor’s property. This form is the first form that a creditor submits whenever he wishes to place a property under lien or claim, whether movable or immovable. The UCC1 Financing Statement is issued and submitted to the state secretary’s office in the state where the debtor and his property is located.

2. UCC1AD – Financing Statement Addendum

The UCC1AD Financing Statement Addendum is an addendum form used as an attachment or appendix to the UCC1 Financing Statement. This form is where additional information and details are written, which includes modifications and ommissions to the information written in the UCC1 Financing Statement.

3. UCC3 – Financing Statement Amendment

The UCC3 Financing Statement Amendment is an amendment form used to add or change the information in the previously filed UCC1 Financing Statement. This form is where amendments such as termination, assignments, and continuation are written. The UCC3 Financing Statement Amendment can also be a series or combination of changes made for the previously filed UCC1 Financing Statement.

4. UCC3AD – Financing Statement Amendment Addendum

The UCC3AD Financing Statement Amendment Addendum is a combination of an addendum and amendment form to the UCC1 Financing Statement. This form is mainly used in the assignment of additional parties as claimants listed in the UCC1 Financing Statement. It happens when the same piece of property is placed as collateral under different loans.

5. UCC11 – Information Request

The UCC11 Information Request form is a standalone form used separately from the UCC1 Financing Statement and its accessory documents. This form is used by stakeholders to request or obtain copies of UCC1 records filed in the state secretary’s office. Each request is related to an individual debtor, and interested parties will have to make a separate request for each debtor.

How to File your Uniform Commercial Code Forms

You are approached by your friend asking you to lend him some money for his farm. Your friend, in turn, then offered one of his farm equipment as collateral for the loan. Since the law requires properties under lien to be publicly recorded, you then run to the nearest state secretary’s office to file a Uniform Commercial Code Form. Being the first-timer that you are, you are utterly clueless as to what to do or how to file such form. But don’t worry, this article will show you the steps on how to submit a Uniform Commercial Code Form from start to finish. And, enumerated below are the steps on how to file your Uniform Commercial Code Form.

Step 1. Choose a Uniform Commercial Code Form

The first step in filing your Uniform Commercial Code Form is to download one online. Uniform Commercial Code Forms come in different forms, each for a different purpose. Choose one of the types included in this article, according to the nature of the transaction that you’ll make.

Step 2. Complete the Uniform Commercial Code Form

Complete the Uniform Commercial Code Form right after downloading the form that you wish to use. The form will ask for certain information aside from the usual ones, such as personal information. The information asked will vary according to the type of Uniform Commercial Code Form that you’re using. After answering the Uniform Commercial Code Form, affix your signature on the space provided on the bottom part of the form.

Step 3. Submit the Uniform Commercial Code Form

After completing the Uniform Commercial Code Form, submit the form to the state secretary office near you. Uniform Commercial Code Forms should be filed in the same state where the debtor and property placed as collateral is located. Make sure that you submitted the form in the correct location to prevent disappointment.

Step 4. Pay the Filing Fee

Filing a Uniform Commercial Code Form doesn’t come for free. You might have to pay a minuscule amount for it to be processed and signed by the state secretary himself. Filing fees for Uniform Commercial Code Forms vary from state to state, so it’s best to do a little homework before setting out to file your Uniform Commercial Code Form.

Step 5. Wait for Approval

After completing and submitting your Uniform Commercial Code Form, the last and final step is to sit down and wait for its approval. Once approved, the government will then recognize your notice of lien against the debtor’s property, which therefore becomes available to the general public.

Related Posts

FREE 8+ Sample Waiver Forms in Sample, Example, Format

9+ Hospital Release Form Samples

Sample Bond Release Forms

9+ Sample Acord Forms

Sample Media Release Forms

FREE 5+ Mortgage Release Forms PDF

FREE 5+ Contractor's Mechanic's Lien Release Forms PDF

FREE 10+ Mechanic's Lien Forms in PDF DOC

FREE 6+ Lien Waiver Forms in Samples, Examples, Formats

FREE 11+ Lien Release Sample Forms in Word PDF

FREE 8+ Sample Construction Lien Waiver Forms in PDF WORD

7+ Satisfaction of Mortgage Forms in PDF DOC

FREE 5+ Appraisal Waiver Forms in Samples, Examples, Formats

Sample Generic Waiver Forms

Sample Athlete Waiver Forms