Hypothec is referred to the obligation, right, and security that is held by the creditor (or to whom the money is owed) on the property of a debtor (or the borrower). Yet, there is no guarantee that the title or name and possession of property is transferred to the creditor. This hypothec is either given by the contract agreement or by the operation of law.

Technically, these movable hypothec long forms are utilized as a reference that both parties, the creditor and debtor, are engaged in a loan agreement of a certain corporeal property, and that there are some consequences if the debtor is in default or failed to comply with all the requirements and the obligations. Therefore, in order to ensure that the responsibilities are observed or heeded, a sample contract agreement such as this movable hypothec long form is secured.

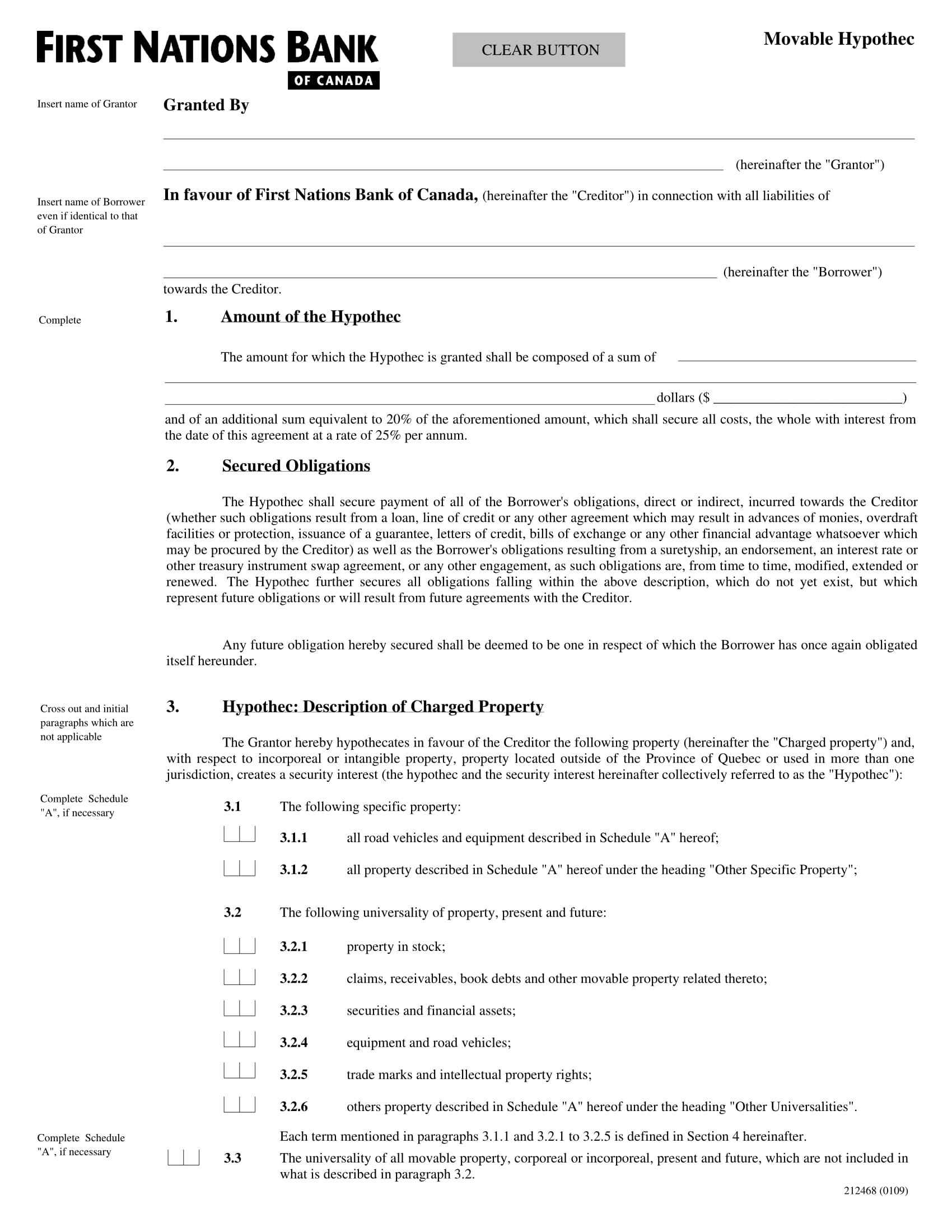

Movable Hypothec Long Form

Fillable Movable Hypothec Form

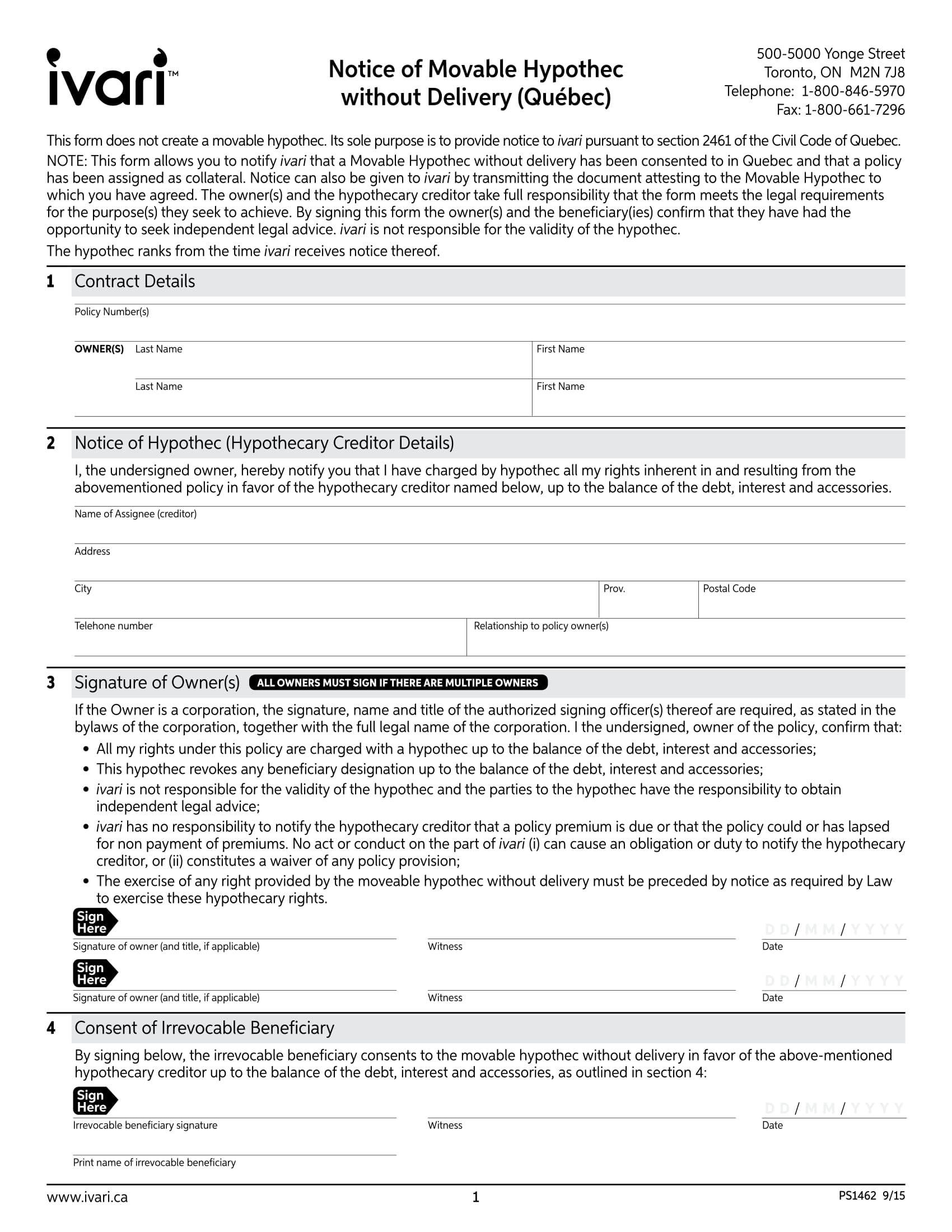

Notice of Movable Hypothec Form

The Essential Information in the Form

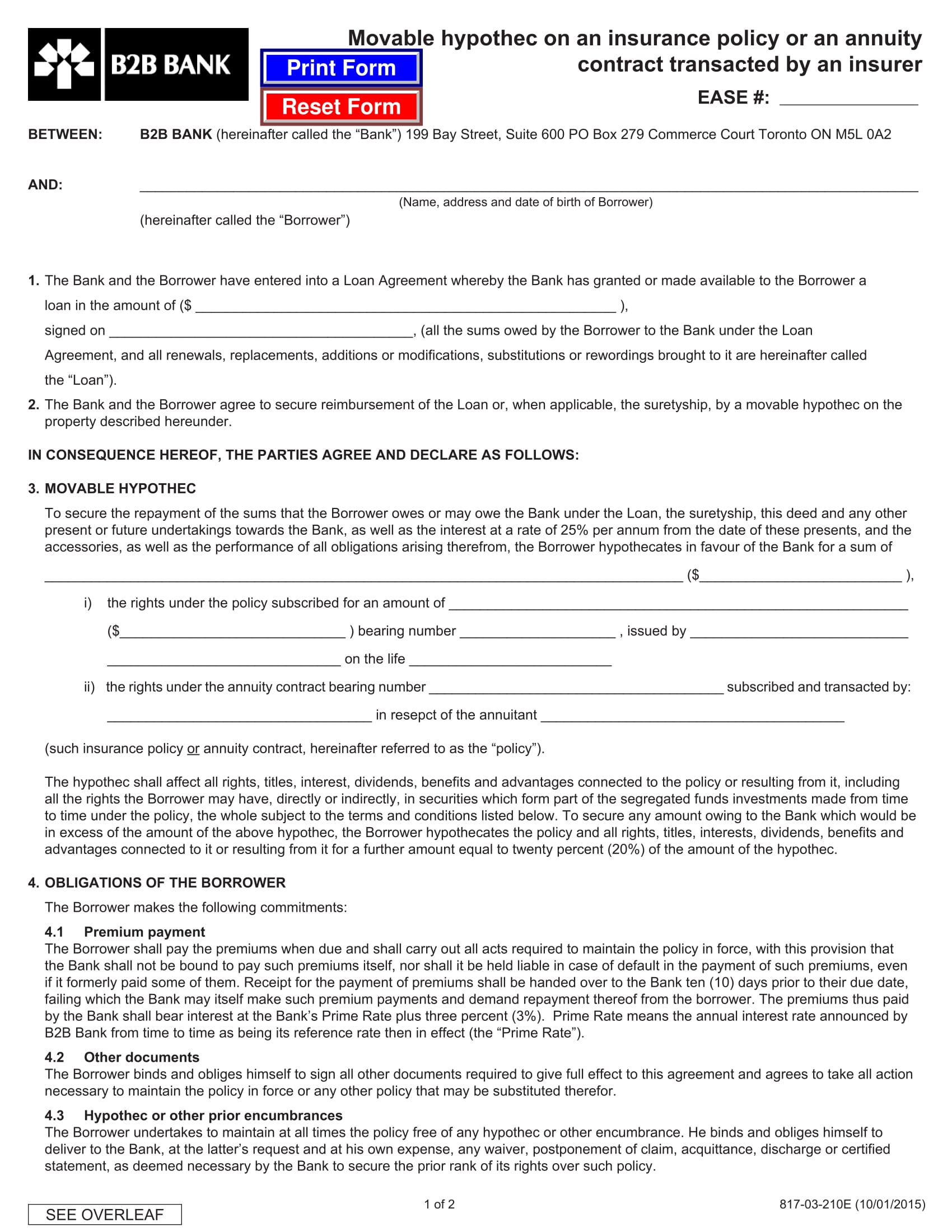

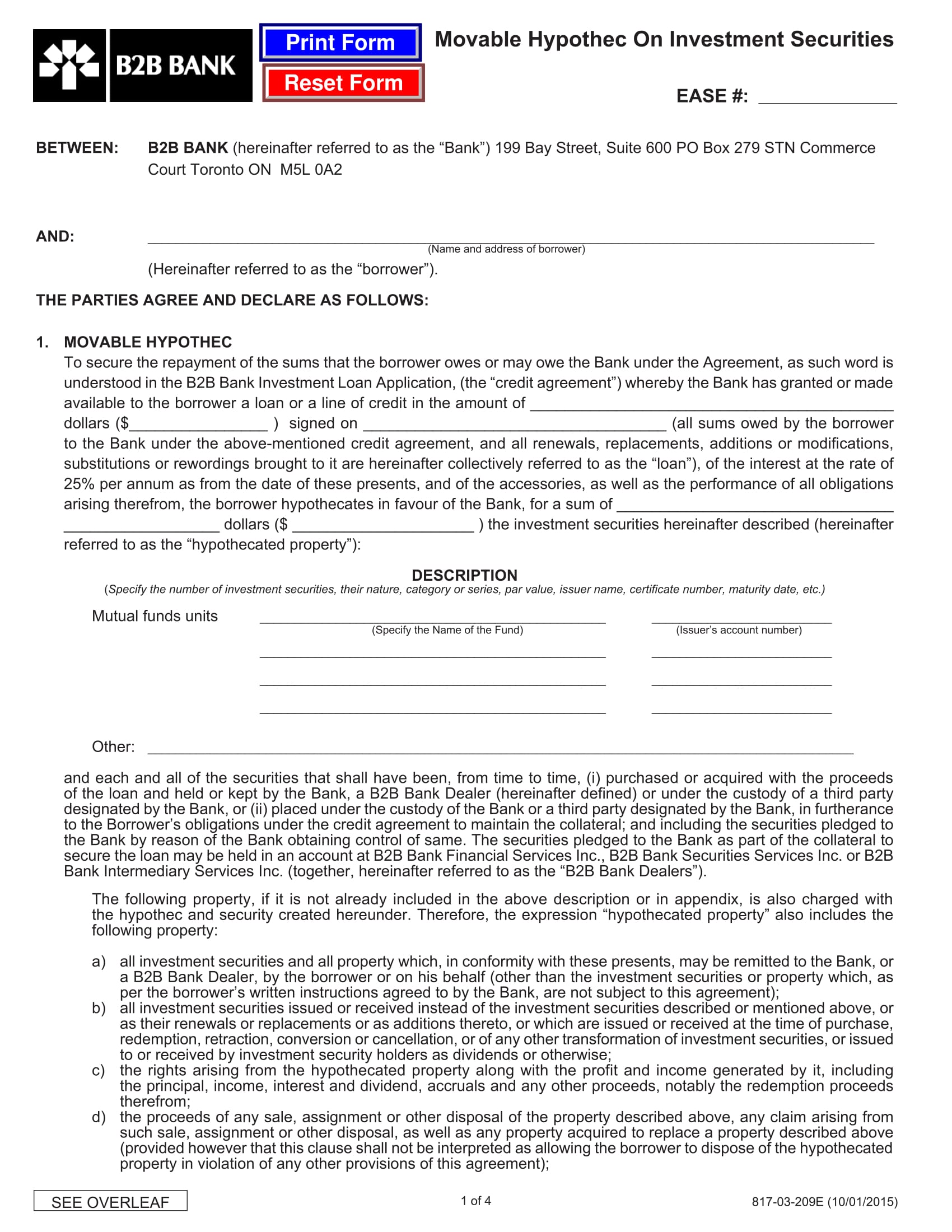

In a movable hypothec long form, it is made sure that all general information with regards to the property, the grantor, the creditor, and the debtor are secured. These information include the following:

- The name of the grantor

- The name of the creditor (corporation or a representative)

- The total sum amount granted for the hypothec

- The additional payment or interest rate starting from the agreement date

- The list of all secured obligations of the debtor or mortgagor

- The description of the specified property charged by the creditor

- The definition of terms used or stated in the long form

- The conditions with regards to the additional provisions to the hypothec on claims, and securities and financial review of assets

- The specifications of the representations and warranties

- The declaration of the covenants, agreements, or clauses in the contract that are made by the grantor for the debtor to take note of

- The situational events or occurrence of default

- The resources in cases of defaults

- The general provisions of the hypothec for the creditor

- The confirmation that the agreement has been drawn up

- The grantor’s personal information such as the address and date of birth

- The creditor’s signature affixed in the form

For the completion of the form, it is also mandatory for an affixed stamp to be incorporated. Thus, to signify that the contract agreement is validated. When all essential information are provided in the form, there is a resolution as the final part of the process. This is where all essential details such as the names of both parties, the total amount with the interest rate, the date, etc., are written in summary.

The resolution also includes the certification that the foregoing resolution is in full force and effect on the said date, and that this has been duly adopted by the board of directors corporation. The copy for this resolution should be printed in two, for the creditor (person or corporation) and debtor (or borrower). Refer to the provided sample forms in this article to have a quick view on how these forms are organized or designed. You can also like adverse action forms.

Insurance Policy Movable Hypothec

Movable Hypothec on Investment Securities

Summing it all up, these long forms for movable hypothec are utilized to ensure that the payment of all the obligations set or made according to what was written in the agreement or operated by the law are secured, and that both parties comprehend with each other, most especially the terms and conditions.

Related Posts

-

FREE 4+ Limited Partnership Agreement Long Forms in PDF | MS Word

-

FREE 4+ Articles of Association Long Forms in PDF | MS Word

-

FREE 4+ Legal Name Change Forms in PDF | MS Word

-

FREE 13+ Trademark License Agreement Forms in PDF | MS Word

-

FREE 12+ Legal Agreement Forms in PDF | MS Word

-

FREE 14+ Legal Waiver Forms in PDF | MS Word

-

FREE 14+ Legal Consent Forms in MS Word | PDF

-

Character Reference for Court Recommendation Letter

-

Notary Acknowledgment Form

-

License Agreement Short Form

-

Legal Ownership Form

-

Legal Petition Form

-

Legal Declaration Form

-

Legal Form