Owning a dream house is a reality through credit, such as housing loans and bank financing. However, in the purchase of such properties, certain obligations must be fulfilled to have the absolute ownership of such property. Those obligations are called a lien, or the creditor’s legal claim against the property to secure the full payment of the property itself. In summary, a lien gives the creditor the legal right over the property, thus prohibiting you from effectively owning it.

What is a Real Estate Lien Release Form?

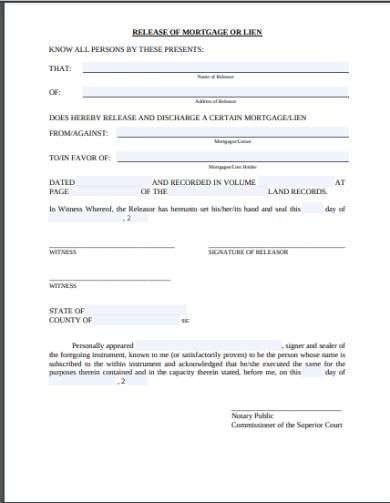

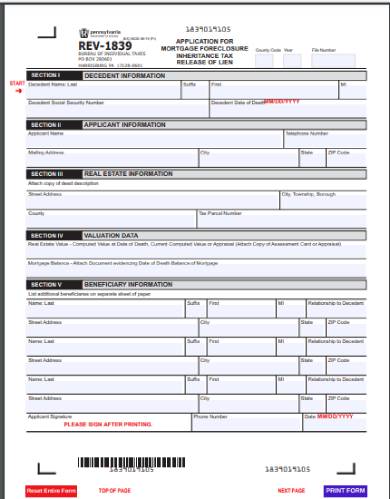

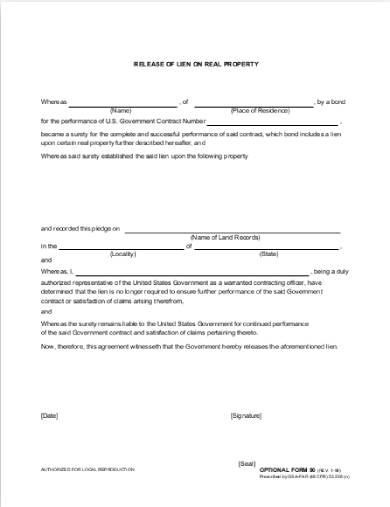

A Real Estate Lien Release Form is a release form that expresses the release of a lien over a property, more specifically, real property. This document is executed by the lienholder, the party that financed the property, to inform that the obligations related to the purchase of property is fulfilled. A signature from bothe lienholder and the property owner is required for the Real Estate Lien Release Form to be legally binding.

5+ Real Estate Lien Release Forms

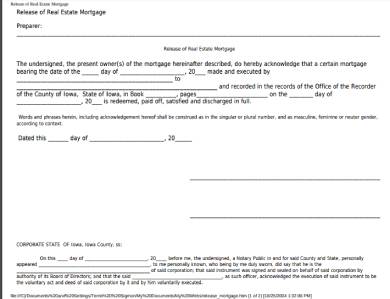

1. Real Estate Mortgage Lien Release Form

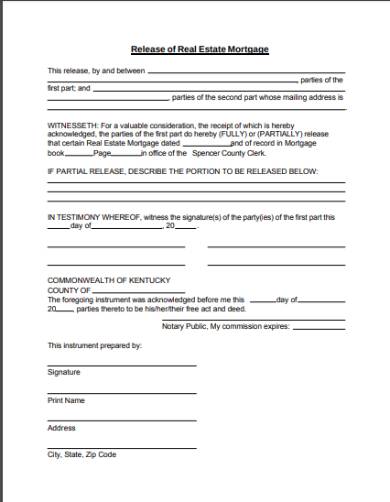

2. Release of Real Estate Mortgage Lien Form

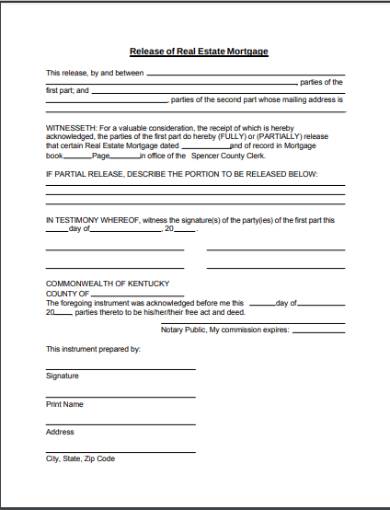

3. Release of Real Estate Lien Form

4. Real Estate Lien Release Form

5. Real Estate Release of Lien Form

6. Release of Lien Real Property Form

Types of Lien

1. Voluntary Lien: A Voluntary Lien is a legal claim placed on the property to which the property owner agrees to. Putting a property under a voluntary lien does not hamper nor negatively affect the property, title, and the owner’s ability to tranfer its title.

2. Involuntary Lien: An Involuntary Lien is a legal claim placed involuntarily on the property due to unfulfilled obligations like a tax, installments, and home improvement expenses. It is also known as a mechanic’s lien. This lien often makes the property harder to sell. An Involuntary Lien is the type of lien placed on the property under third-party financing.

Effects of a Lien on Real Estate

With the advent of real estate financing on real estate purchases, it relatively easy for an average Joe to own a house or a piece of land. But, real estate financing, however, functions as a debt that you have to pay for you to have ownership over a property. Aside from the fact that liens over a property inhibit you from absolute ownership, liens also can affect your property in many other ways. Here’s how:

1. Unresolved Lien scares off prospective buyers of the property.

2. It greatly diminishes the value of the property.

3. Unresolved Liens will subject the property to foreclosure or repossession.

How to File your Real Estate Lien Release Form

Since liens over a property affect the absolute ownership of the property, it also, therefore, hampers your right to free disposition of it. To regain your right over the property, here are the steps on how to file a Real Estate Lien Release Form.

Step 1. Consult Public Records about the Property’s Lien Status

Consult public records about the property’s lien status. A real estate lien is usually specified in the sales agreement that you signed upon purchasing the property. Since real estate sales agreements are legal documents, the details about the sale, especially the lien attached to it, are recorded by your local public registrar’s office. Consulting public records about the property’s lien status will allow you to know if the property has multiple liens attached to it.

Step 2. Pay-Off Debts and Obligations

If a lien is confirmed to be attached to your property upon examining public records, the next thing to do is to settle those obligations. Meet your creditor to discuss the terms of payment or settlement of the debt. Paying those debts and obligations is the first step of having your lien over your property released.

Step 3. Obtain and Fill-out a Real Estate Lien Release Form

The next step after settling the obligations and debt you have with your creditor is to obtain a Real Estate Lien Release Form. You can download Real Estate Lien Release Forms provided in this article for free. Downloading our Real Estate Lien Release Forms lets you avoid the hassle of obtaining one manually or making one from scratch.

After downloading the Real Estate Lien Release Form online, immediately fill in the blank spaces with the required information. That information will confirm that you own the property subject to the lien. Print the form after completing it.

Step 4. Sign the Form in the Presence of a Notary Public

After filling and printing the form, both you and the creditor should sign the Real Estate Lien Release Form in the presence of a notary public. Have the form stamped with a notary seal right after signing it. Notarizing your Real Estate Lien Release Form means that the notary public acknowledges the release of the lien as true and can not be contested. You may also want to accomplish a notary acknowledgment to attach to your notarized Real Estate Lien Release Form.

Step 5. File the Real Estate Lien Release Form

File the Real Estate Lien Release Form to your local public registry after notarizing it. Doing so makes the announcement of the lien release as official and public. Also, this means that the lien attached to your property is lifted, therefore granting you the absolute ownership over it. Also, filing your Real Estate Lien Release Form to your local public registry may require you to pay a filing fee.

Step 6. Ask for a Lien Waiver if Necessary

Aside from accomplishing a Real Estate Lien Release Form to prove the release of a lien over a property, it may also be necessary for you to ask for a Lien Waiver from your creditor. A Lien Waiver is a document used to request a lien on a property to be removed. A Lien Waiver will also serve as a proof of a release of such lien along with your Lien Release Form.

Related Posts

-

Release of Lien Form

-

Lien Release Form

-

Minor Photo Release Form

-

Bond Release Form

-

FREE 22+ Print Release Forms in PDF | MS Word

-

Print Release Form

-

Copyright Release Form

-

Emergency Release Form

-

Patient Release Form

-

Release Form

-

FREE 9+ Property Release Forms in PDF | MS Word

-

FREE 10+ Equipment Release Forms in PDF

-

FREE 9+ Deed Release Forms in PDF | MS Word

-

FREE 10+ Artwork Release Forms in PDF | MS Word

-

FREE 10+ Image Release Forms in PDF | MS Word | Excel