Sale and purchase is a relationship that largely characterize the world of business and commerce. And between them, are a variety of goods and services that are both subjects and objects everytime they interact and meet. Sales and purchase are commercial activities themselves through which, documents and forms are used to conduct and accomplish an array of sub-activities relating to them—sales, orders, leases, and rentals.

FREE 51+ Sale & Purchase Forms in PDF | MS Word | XLS

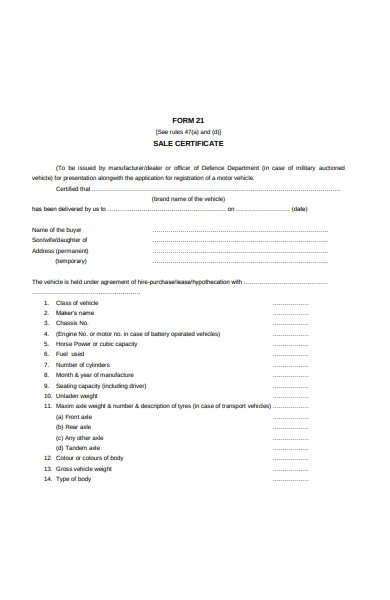

1. Sale Certificate Form

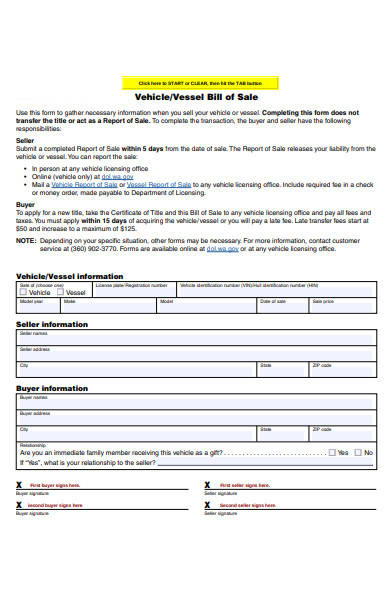

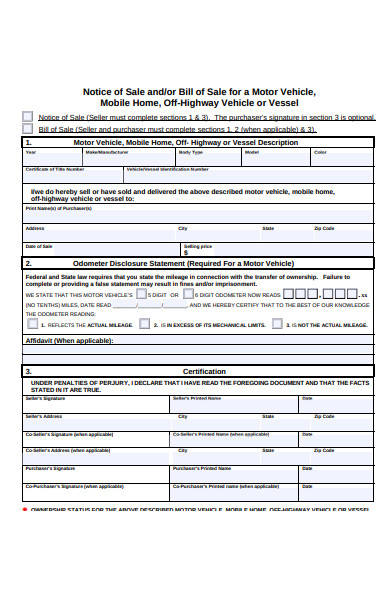

2. Vehicle Sale Form

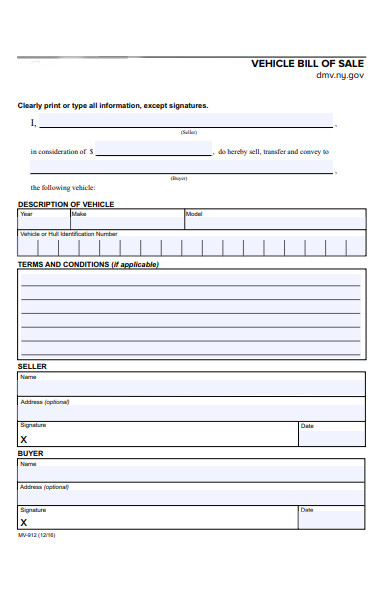

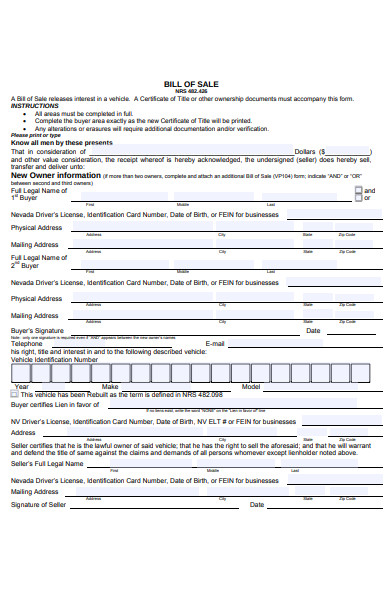

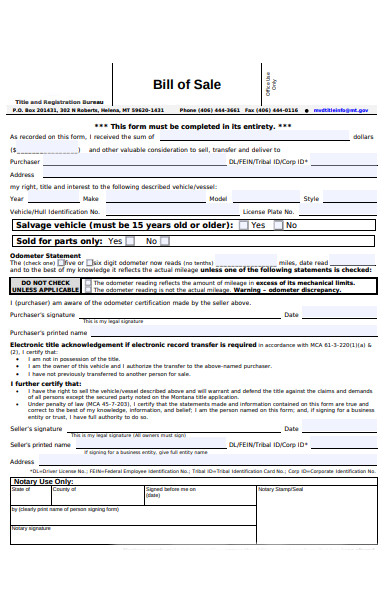

3. Bill Sale Form

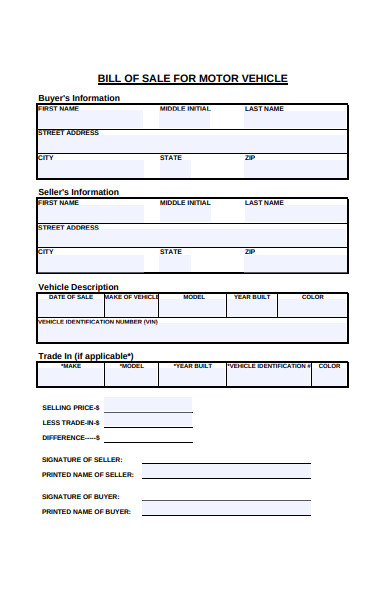

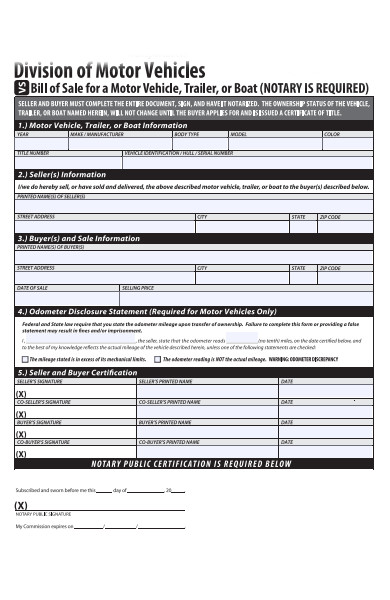

4. Motor Vehicle Sale Form

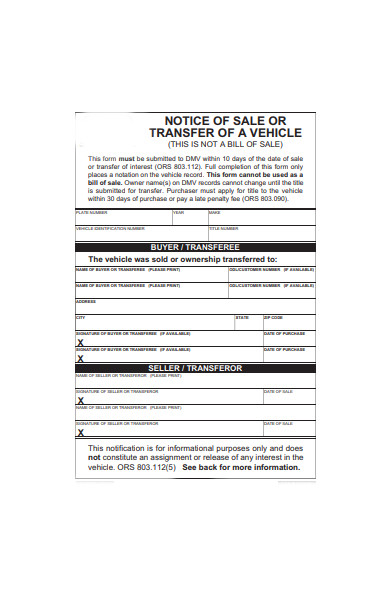

5. Notice of Sale Form

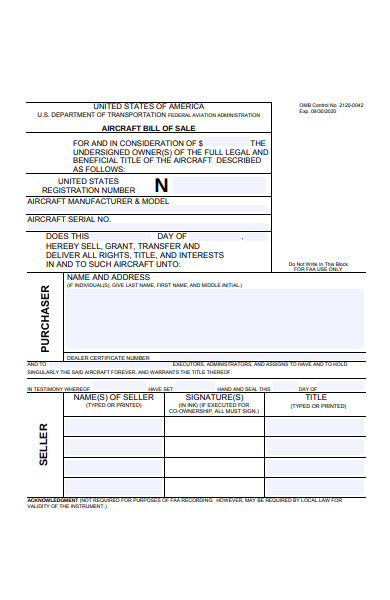

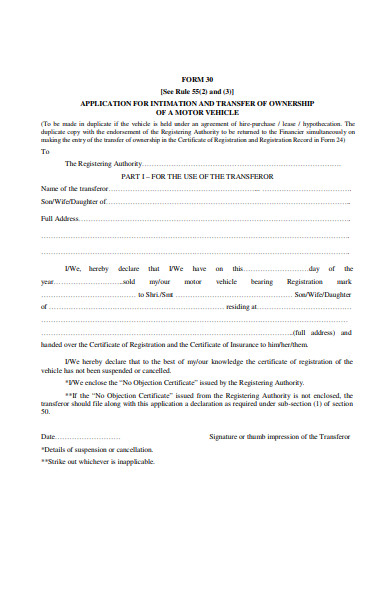

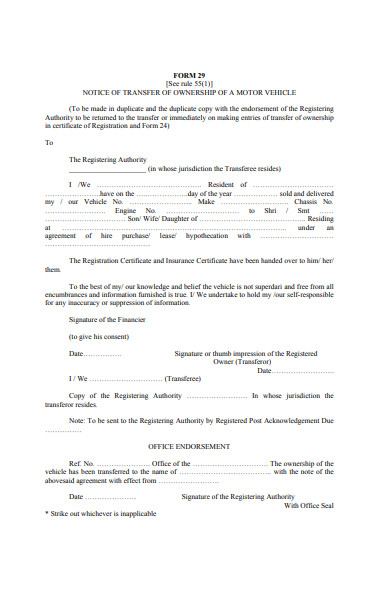

6. Transfer Sale Form

7. Sale Form Sample

8. Buyer Sale Form

9. Simple Sale Form

10. Sale Information Form

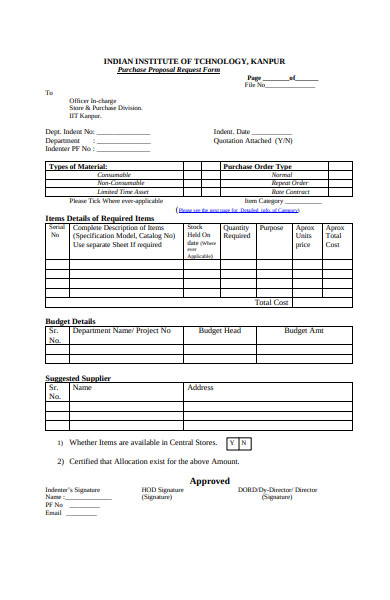

11. Purchase Request Form

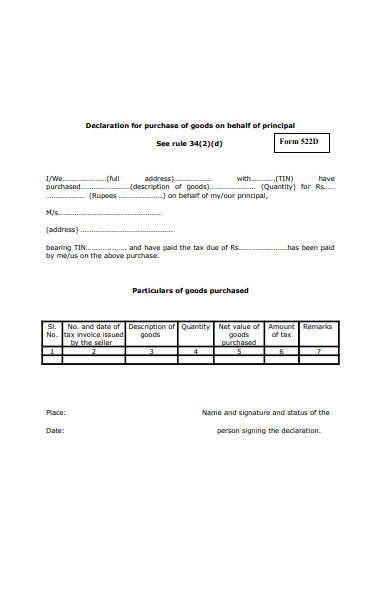

12. Purchase Good Form

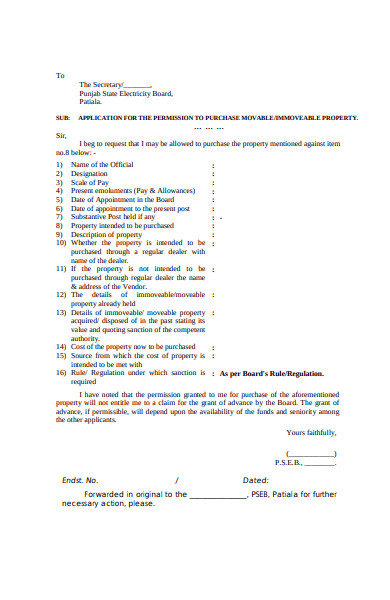

13. Purchase Application Form

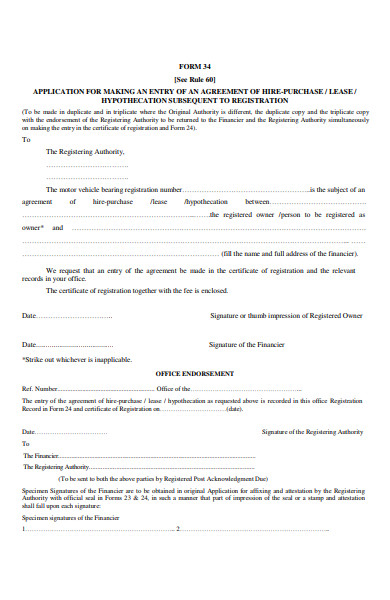

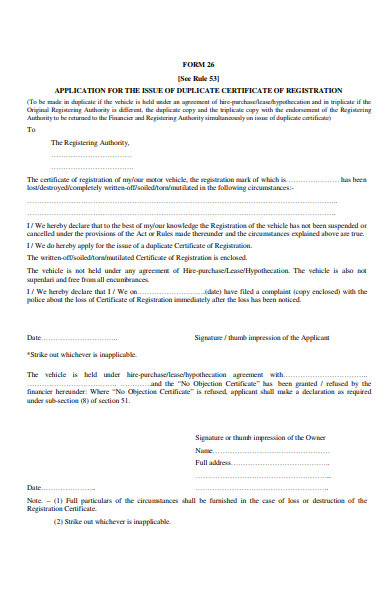

14. Purchase Lease Form

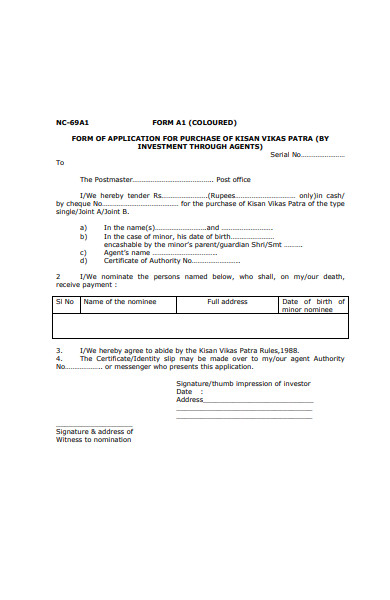

15. Purchase Investment Form

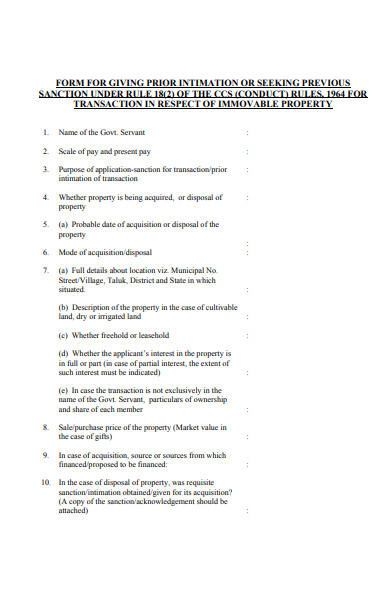

16. Purchase Transaction Form

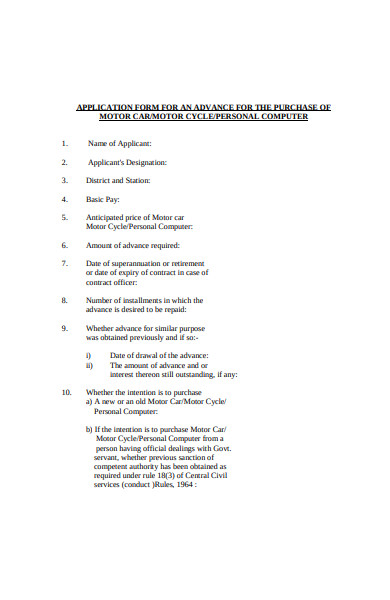

17. Motor Car Purchase Form

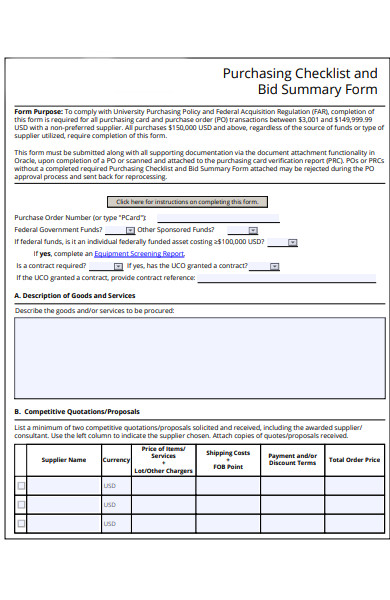

18. Purchase Checklist Form

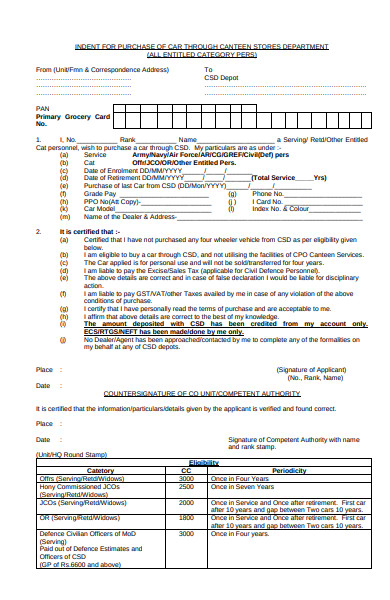

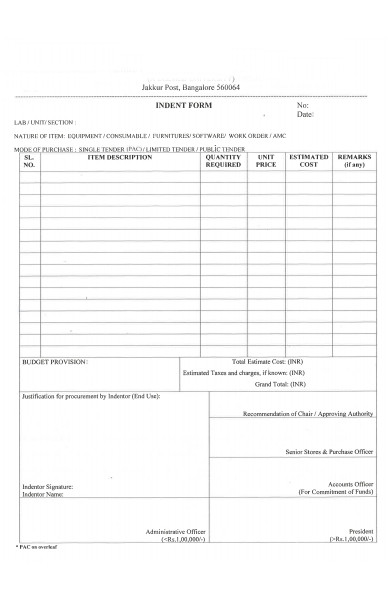

19. Purchase Indent Form

20. General Purchase Form

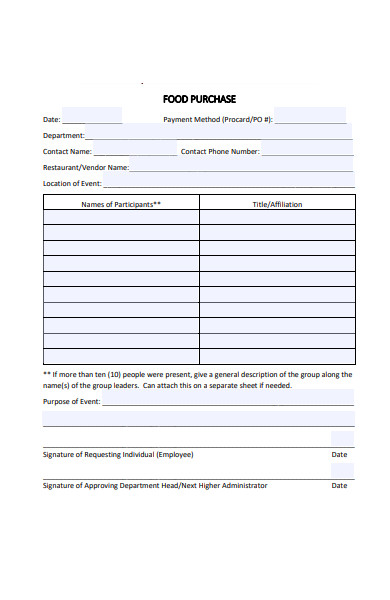

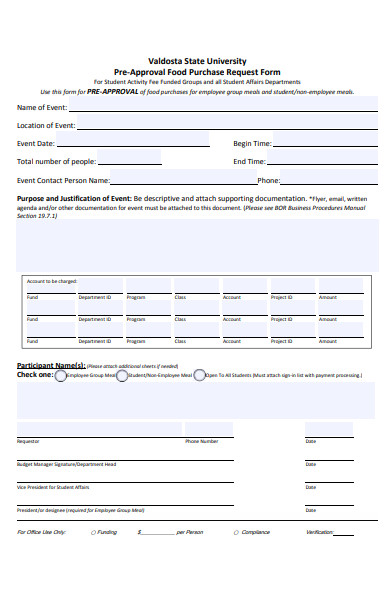

21. Food Purchase Form

22. Purchase Agreement Form

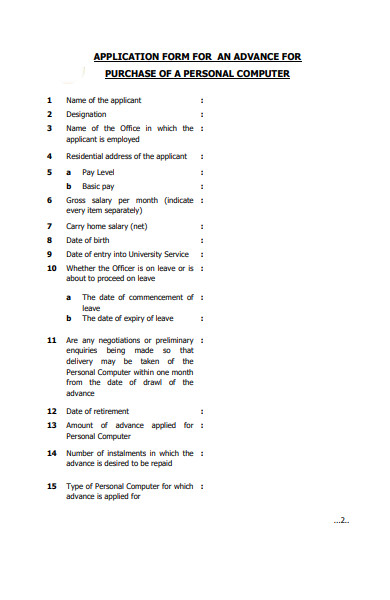

23. Personal Computer Purchase Form

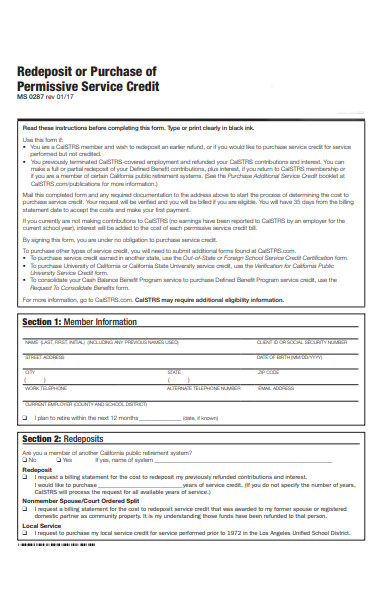

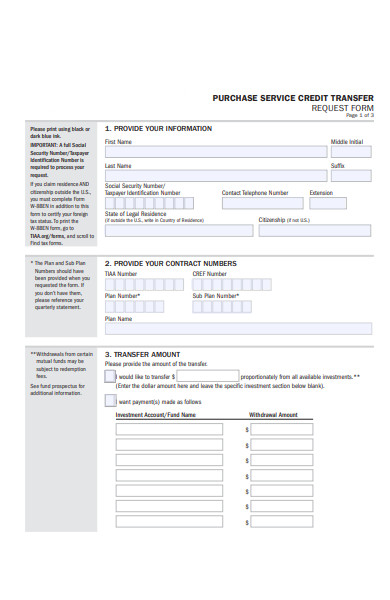

24. Purchase Service Form

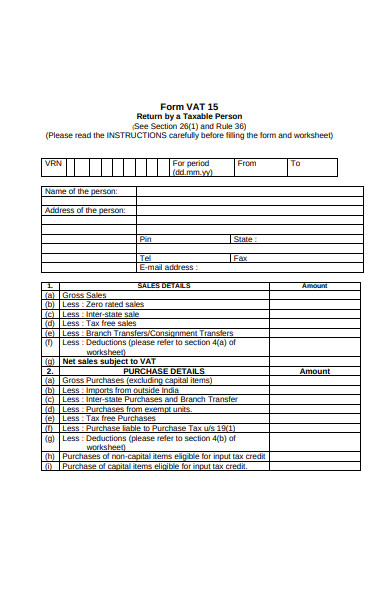

25. Purchase Details Form

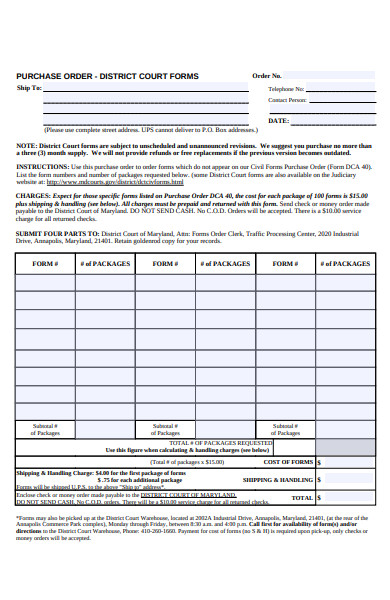

26. Purchase Order Form

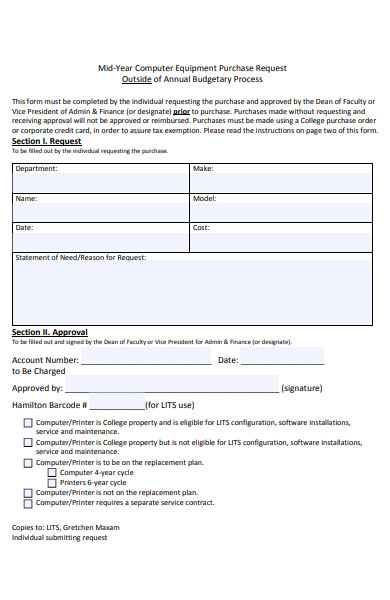

27. Computer Purchase Form

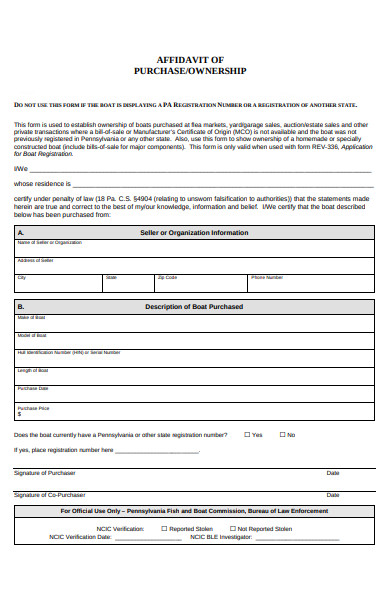

28. Purchase Ownership Form

29. Purchase Notice Form

30. Purchase Credit Transfer Form

31. Property Purchase Form

32. Employee Purchase Form

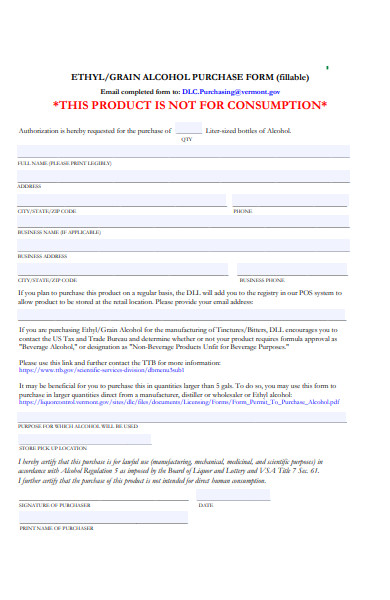

33. Grain Alcohol Purchase Form

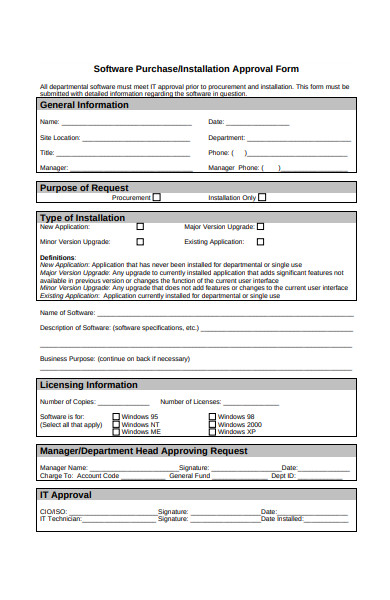

34. Purchase Approval Form

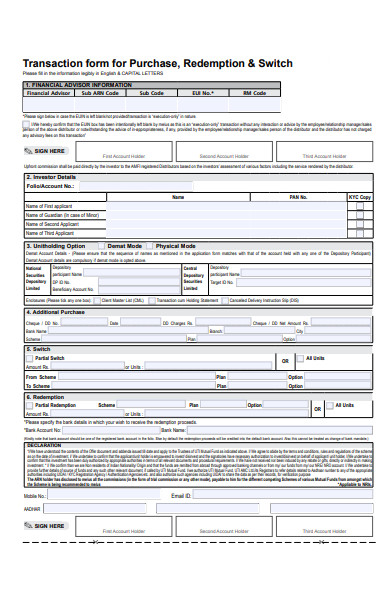

35. Purchase Form for Redemption

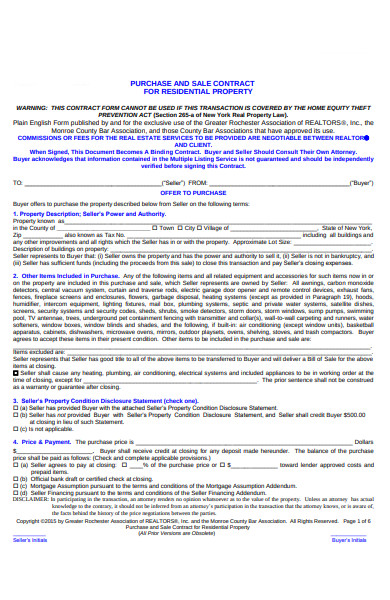

36. Purchase Contract Form

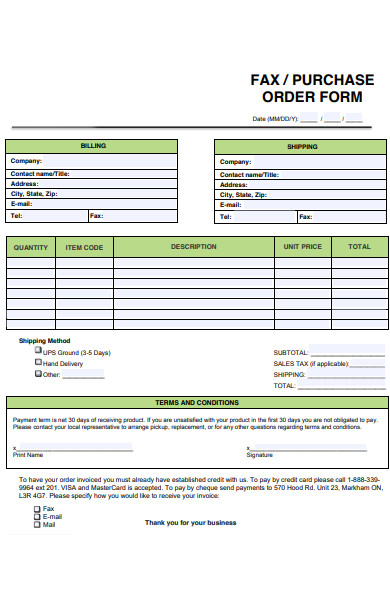

37. Fax Purchase Form

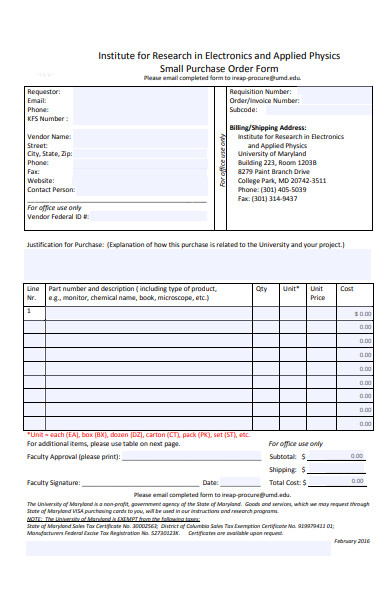

38. Small Purchase Order Form

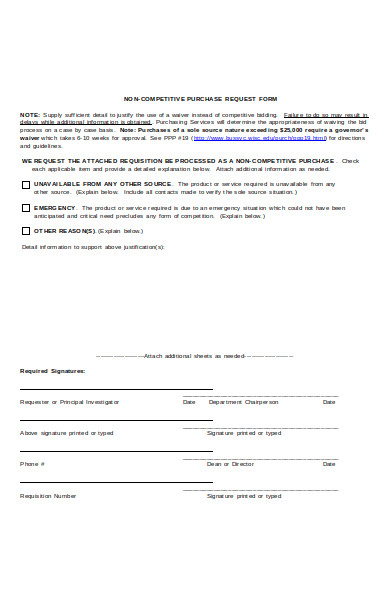

39. Non Competitive Purchase Form

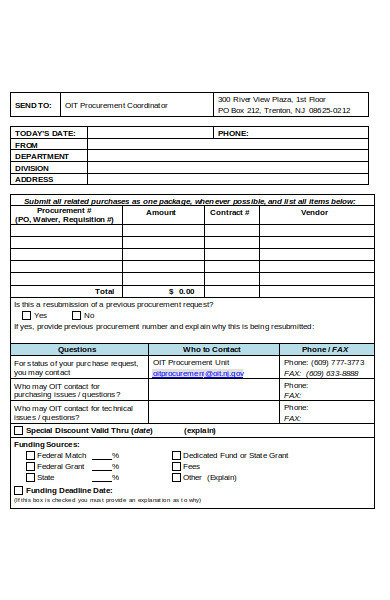

40. Purchase Order Checklist Form

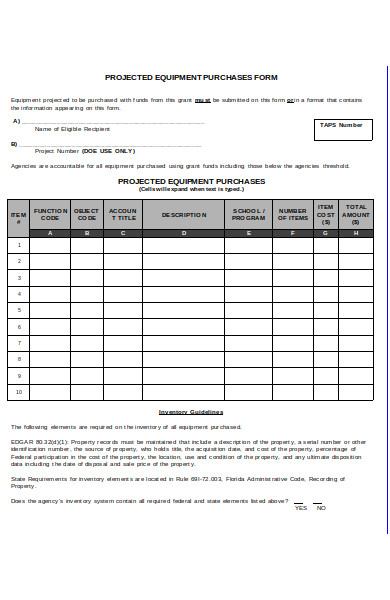

41. Purchase Equipment Form

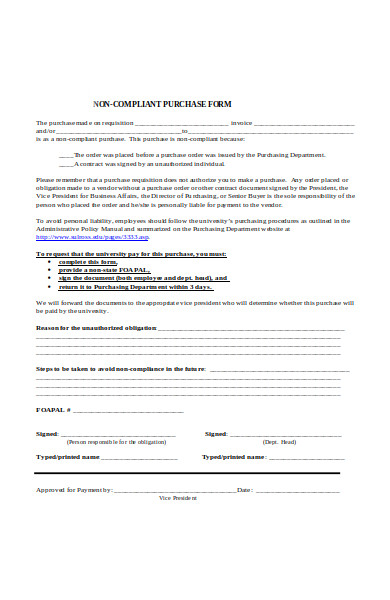

42. Non Complaint Purchase Form

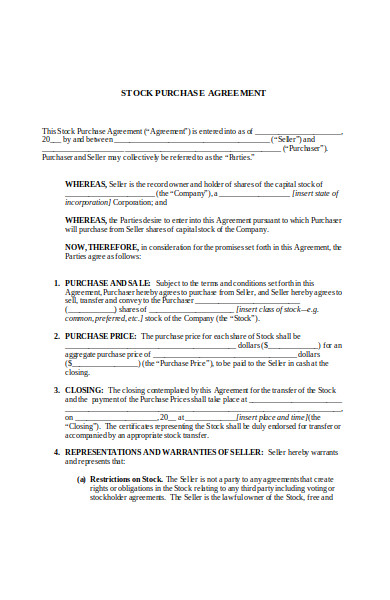

43. Stock Purchase Form

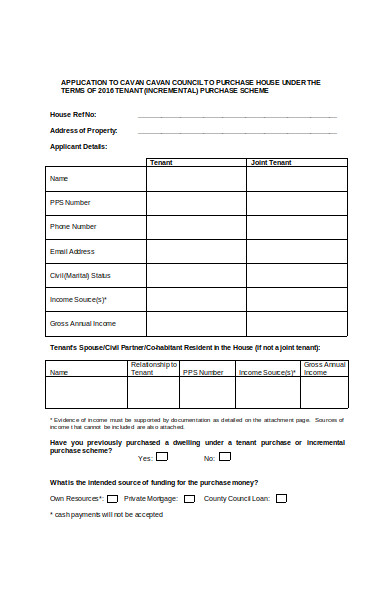

44. Tenant Purchase Form

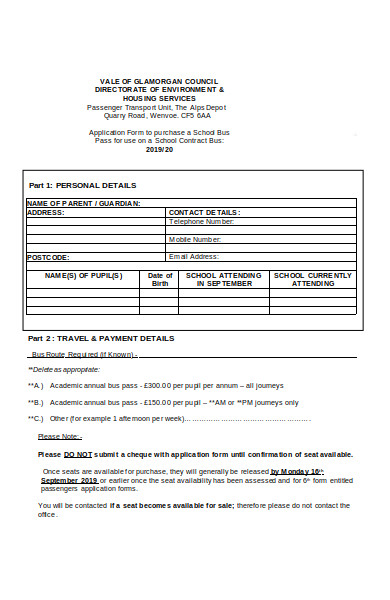

45. School Bus Application Purchase Form

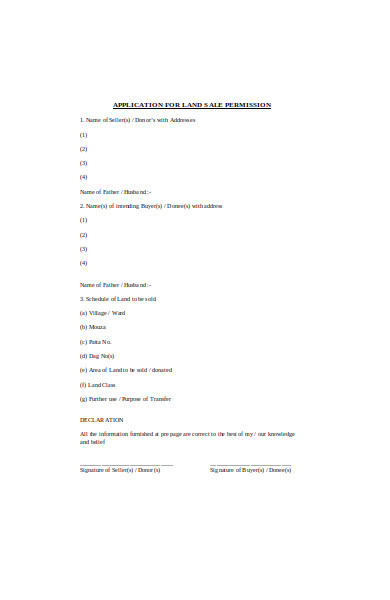

46. Land Sale Application Form

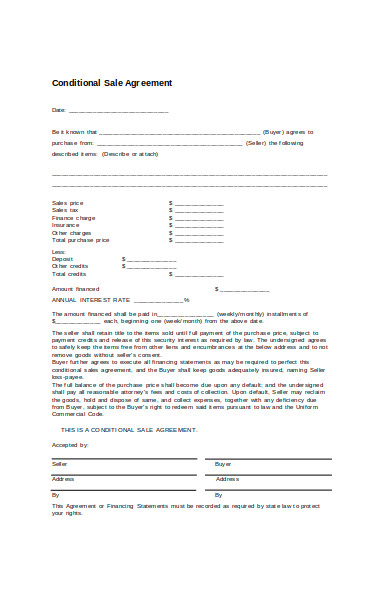

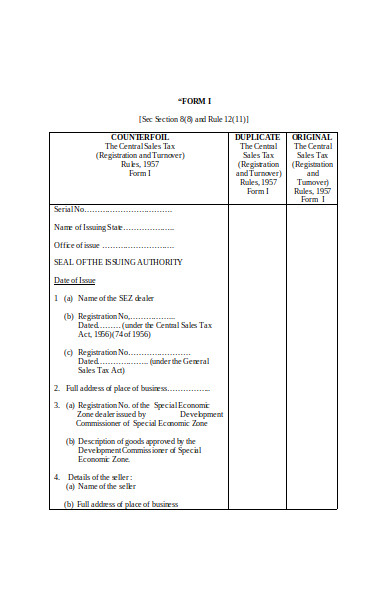

47. Conditional Sale Form

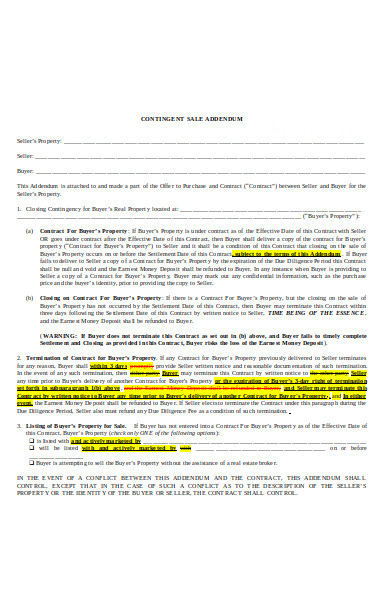

48. Sale Addendum Form

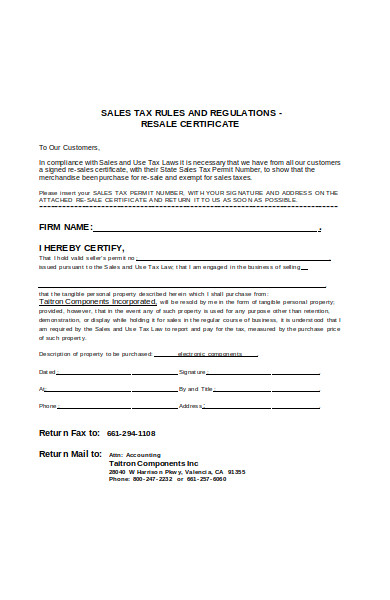

49. Sale Tax Exemption Form

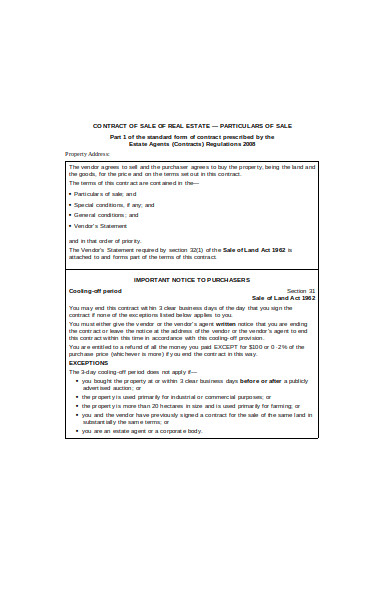

50. Real Estate Sale Form

51. Sale Authority Form

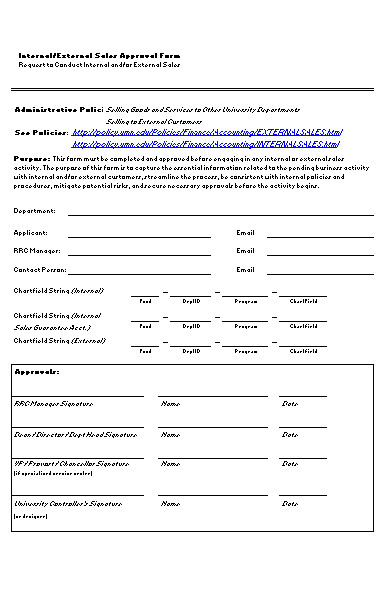

52. Internal Sales Form

What are Sales and Purchases?

Sales and purchases are commercial activities wherein the exchange of goods and services happen. Almost everything covered within the commerce of man is subject to the business transactions of sales and purchase. From AirPods, smartphones, cars, homes, and even the food we eat, getting all of them are objects subject to sales and purchase. And, everything mentioned, and not said, can be bought or sold if the price is right.

Like every activity that made the human world busy as ever, sales and purchases are conducted and concluded with the use of documents and forms. And, within the activity are a set of activities, tasks that need to be completed with the use of forms and documents. Activities that record transactions and earnings—accounting ledgers and journals—for the day and even for the whole year are one of the activities that use sale and purchase forms.

Sale and Purchase Forms and Its Many Types

Commercial transactions are the words used to describe the activity of sales and purchases. As simple as it may sound, these two components that make commercial transactions are made up of different activities. Simple and elaborate activities for objects, big and small. And these various activities, like every transaction, requires a corresponding form or document to complete each and every one of them. The forms and documents for each type of activity are listed below as follows.

- Receipts: The piece of paper handed to you after you pay for an item bought is called a receipt. Receipts are records of sale and purchases made by both the buyer and the seller. It contains an itemized list and breakdown of the items and amount in a transaction, which includes quantities, prices, and value-added tax.

- Invoices: Invoices are issued whenever you’re bills are due at the end of the month or when your good gardener hints that the job order is about to finish. Unlike receipts, invoices are given before actually paying for the product or service that you ordered. Although commonly practiced by the service industry, companies that ship their products abroad use invoices for their customer’s convenience.

- Deeds: Properties like houses and cars require legal formalities before one can own them. This is because of ownership transfers, and registration should be made into public records. Deeds of sale and purchase are prepared when a transaction of this magnitude requires a legal form, deals where a simple receipt or invoice doesn’t cut it. Deeds

- Contracts: Contracts of sale and purchase are contracts where the buyer and the seller agree on a specific price for a thing subject to sale. Supplier and consignment contracts are among the examples of a sales and purchase contract. These kinds of contracts are commonly used by both the manufacturing and retail industries.

How Does Sale and Purchase Forms Make Transactions Fair?

Sales and purchase transactions are recorded in documents and forms every time you make them. Sales receipts, for example, are the first documents to record them in a transparent and biased manner. In commerce, transactions are made with goodwill and good faith as its primary currency, with fairness as the first good to be sold. Sales and purchase forms of every kind are forms that show the exact details and amount of the transaction, thereby a material proof that neither sides win nor lose.

Sometimes sales and purchases are made by mistake or, with some errors, to say the least. Nothing in this world is indeed infallible. Sales and purchases by mistake usually involve the delivery of the wrong products. Product returns enable each of both sides of the transaction to correct such a mistake or error in the deal. All they have to do is issue a credit-debit form to each other. Thus, making it fair for both the buyer and seller alike.

How Do You Use Sale and Purchase Forms in Accounting

Sales and purchase forms are papers of utmost importance, especially in ascertaining the status of your business’s financial health. Accounting is the process of determining financial health. It involves financial forms and documents from different periods, which information from them, and then compiled to give you a map of your income and expenses for the month or for the year. You may already have some idea of how sales and purchase forms are essential for the accounting process. Perhaps, you need a refresher about the subject. If so, then here are the ways of how you can do it.

Step 1. Keep all Receipts from Every Transaction

Receipts are documents or records of every sale and purchase transaction as they happen. A “frontliner” at the forefront of the battle, if you must. Receipts contain information needed for the accounting process. Amounts, items, and names are the information that receipts record in real-time.

Sales and purchase is a transaction where the seller exchanges the product or services that he offers to the buyer, in exchange for other things as a medium of exchange. Sounds complicated? Well, lets put it this way. Say, you are selling candy to a kid, for example, and kids in general love candies of all sorts. For the kid to get his hands on that sweet piece of candy, he needs to have some means to exchange it with—money, a nickel, or a dime perhaps.

Selling and buying candies may or may not warrant a receipt to be written and handed out. Well, that will depend on the number of sweets involved. But regardless, receipts from things that you sold or things that you bought should be kept as your business’s or even your financial health is at stake here. Besides, receipts are the most basic financial paper needed in the accounting process itself.

Step 2. Record Every Transaction In a Journal

Journals are a compilation of transactions recorded on receipts and invoices, and they are one of the most important forms used in the process of accounting. Journals, as described, are divided into three sections, each recording the amount parted or earned according to the item’s price. They also contain the dates of when the transactions are made. Journals are individual records within a single package.

Preparing journals are a must in the accounting process because they make accounting more easy and convenient. Imagine having to browse every piece of receipts from every transaction. That would be time-consuming, isn’t it? Then add categorizing and computing to the equation, and the weight of the burden will be even more unbearable. And as said, journals are records of individual transactions compiled in a single and convenient package.

Step 3. Prepare Ledgers for Each Transaction

While journals are compilations of individual transactions taken from receipts, ledgers, on the other hand, are transactions organized according to their nature and category. However, like journals, ledgers are compilations in themselves. The manner by which a journal compiles every transaction made does not discriminate between the nature of the transaction itself. Ledgers, on their part, separate expenses from income, and receivables from payables, like separating oranges from lemons.

Ledgers allow you to categorize and organize different transactions into ledger accounts, debts, purchases, sales. And aside from being able to categorize and organize transactions into accounts, ledgers also enable you to make precise computations and adjustments, more particularly if there are discrepancies in numbers—In which a dedicated account is created for such purpose.

Step 4. Make a Financial Statement

After preparing the necessary documents and the steps to complete them, making a financial statement will then be the next order of business. Financial statements are where all the fun in accounting begins. It is where the bad apples are separated from the good ones, which are the expenses and the income. It is also here where playing with numbers—subtraction and addition, with a bit of multiplication and subtraction in between—happen.

Financial statements are accounting papers that determine the profit from this year’s sales and purchases derived from the difference between income and expenses or income minus expenses. But before that, the financial statement should be divided into two spaces, spaces for income and expenses to lay upon. Aside from that, an area for their respective amounts should be spared for them, which is generally placed on its righthand side. The magic and fun start when you list every item from the accounts into their places and then subtract them from each other. The difference that results from it will be the profit that you earn, the amount of money that’s yours to keep.

Sales and purchase are like bridges that deride the gap between us and our wants and needs. From the houses that we live in, the clothes that we wear, and the food sitting pretty on our plates, everything that makes us who we are, are all because of what we buy or sell. Aside from that, sales and purchases enable us to go to places and areas that we never imagine,

Related Posts Here

-

FREE 10+ Sample Waiver Forms in PDF | MS Word | Excel

-

FREE 12+ Sample Bill of Sales in PDF | Excel | MS Word

-

Contract Addendum Form

-

FREE 37+ Sample Claim Forms in PDF | Excel | MS Word

-

Report Form

-

FREE 49+ Budget Forms in PDF | MS Word | Excel

-

Profile Form

-

Menu Form

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form