Budgeting is the act of creating a plan to spend your money, and it allows you to predetermine if the money you are expecting to come in is sufficient enough for your plan or your budget. Implementing a budget allows you to have enough money for the things that you need and will help you have enough money to buy the things that you want, to keep out of debt, or to work your way out of debt — especially when following organized budget templates for tracking and planning.

Creating a Budget Plan and following it to the letter can be quite a challenge. It is never easy to control oneself from spending money excessively, especially when temptations lurk just around the corner. Our budget forms and sample budget forms are easily accessible and can be printed out for your convenience. You can choose from a wide array of budget form templates raging from event budget forms, church budget forms, personal management budget form, and many more.

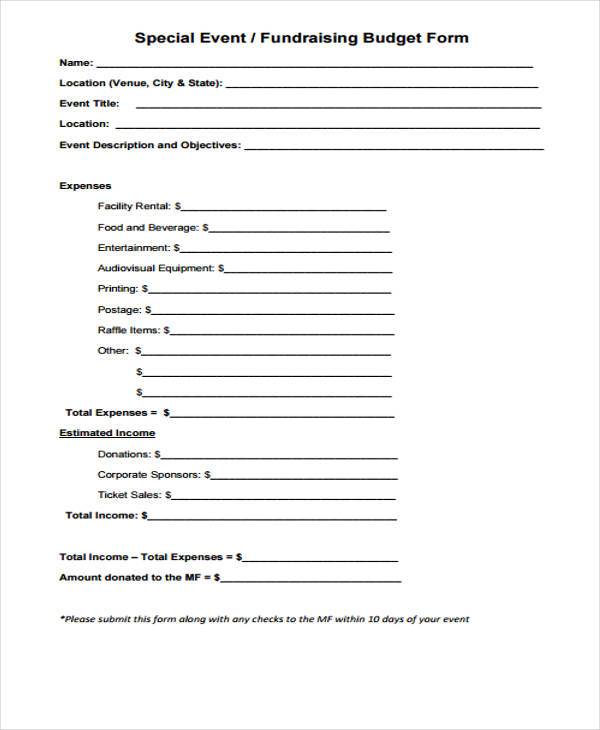

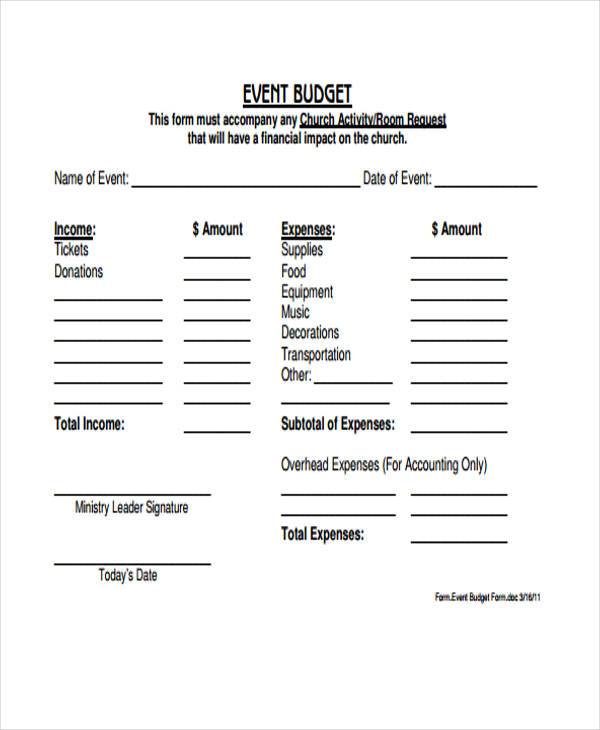

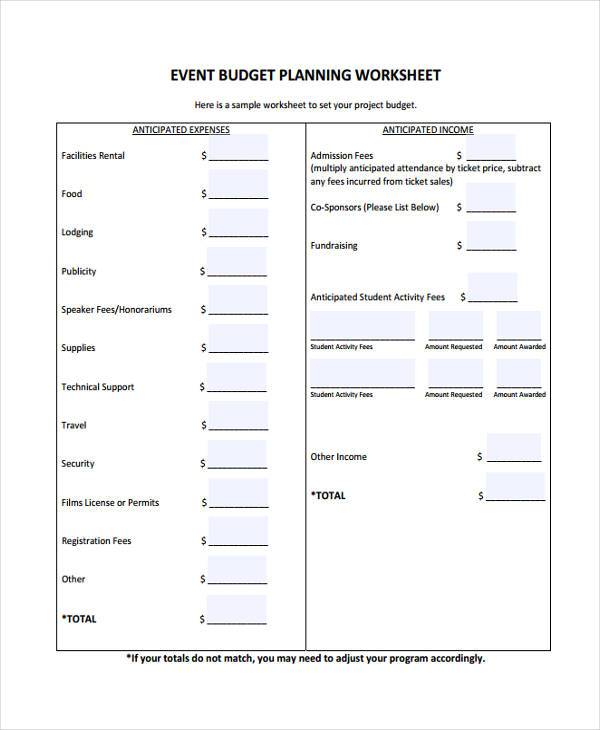

Event Budget Form Templates

Fundraising Event Budget Form

Church Event Budget Form

Event Planning Budget Form

Project Budget Forms

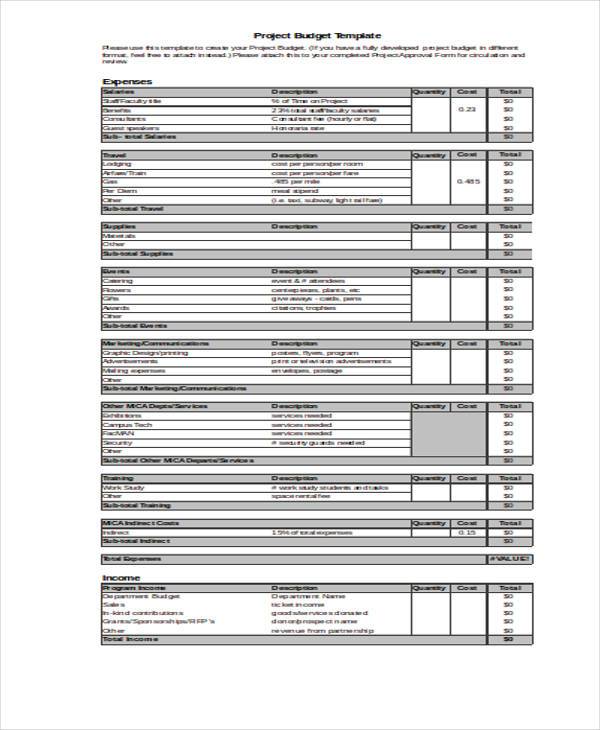

Project Budget Template

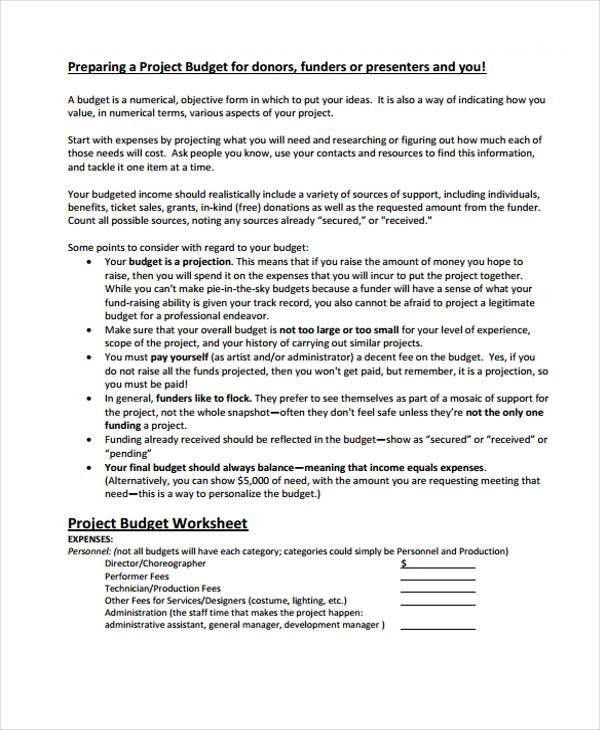

Project Budget Worksheet Form

Printable Project Budget Form

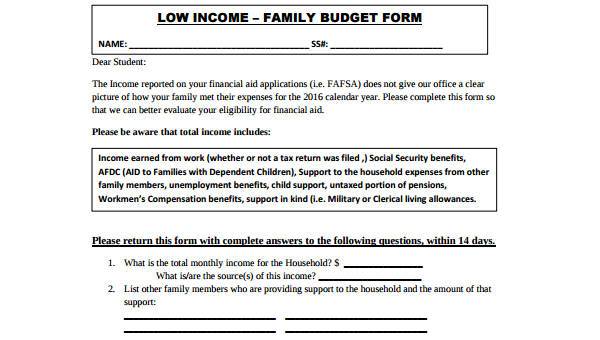

House Hold Budget From Templates

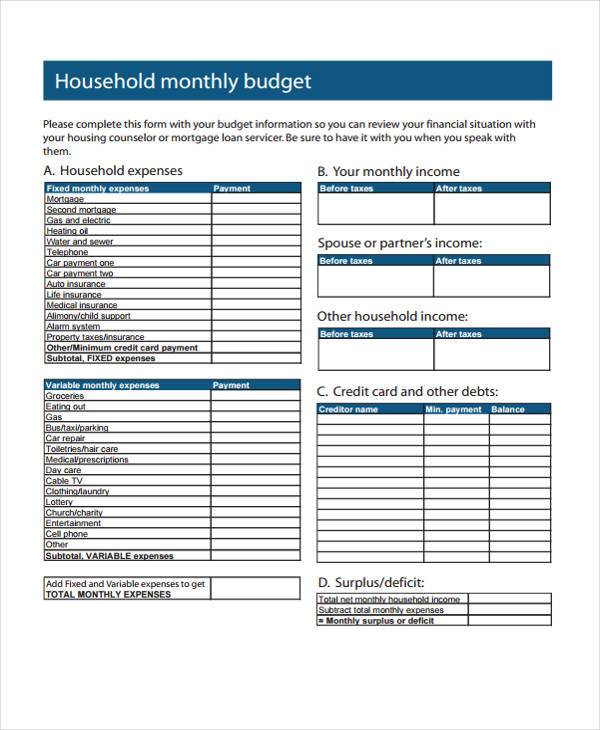

Monthly Household Budget Form

Household Budget Worksheet Form

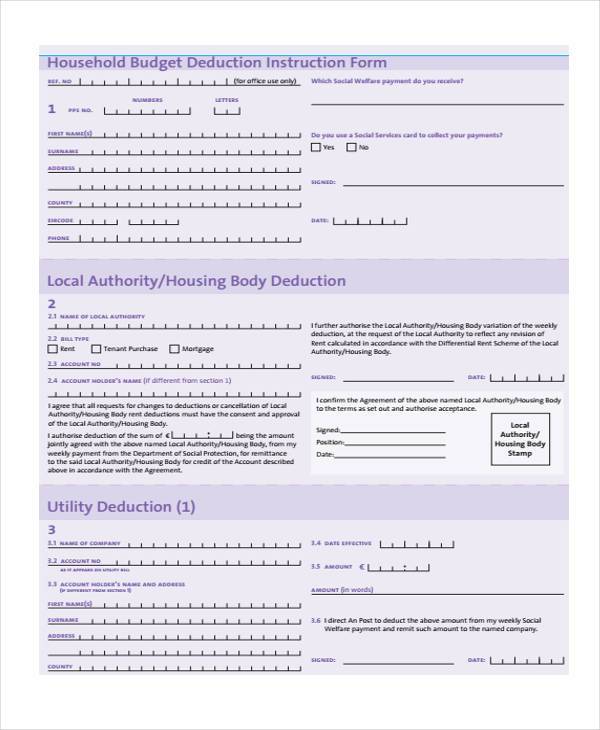

Household Budget Deduction Instruction Form

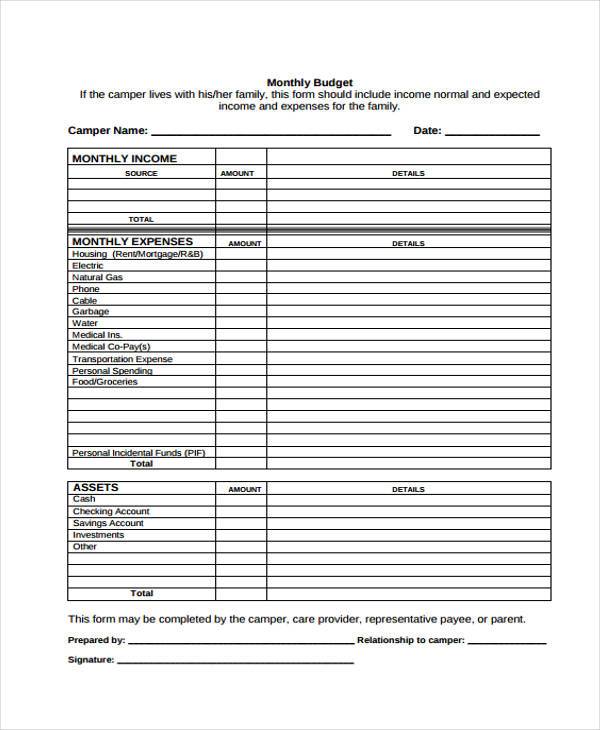

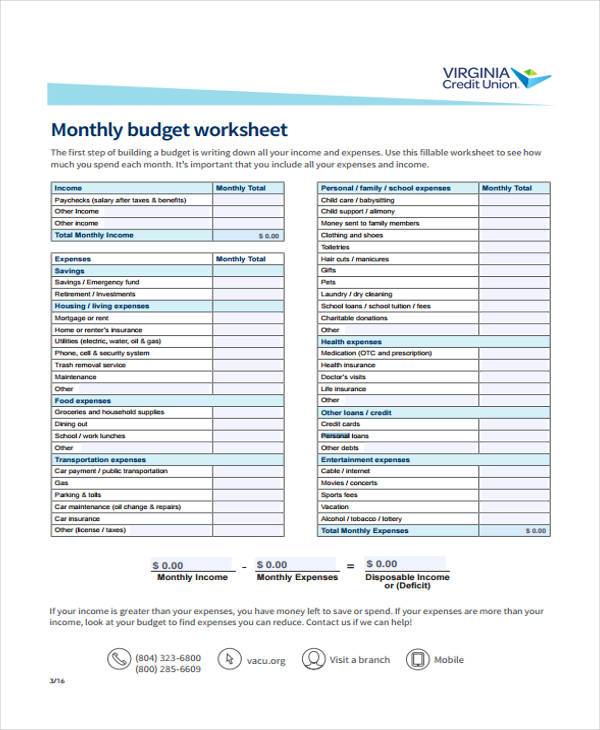

Monthly Budget Forms

Household Budget Deduction Form

Family Monthly Budget Form

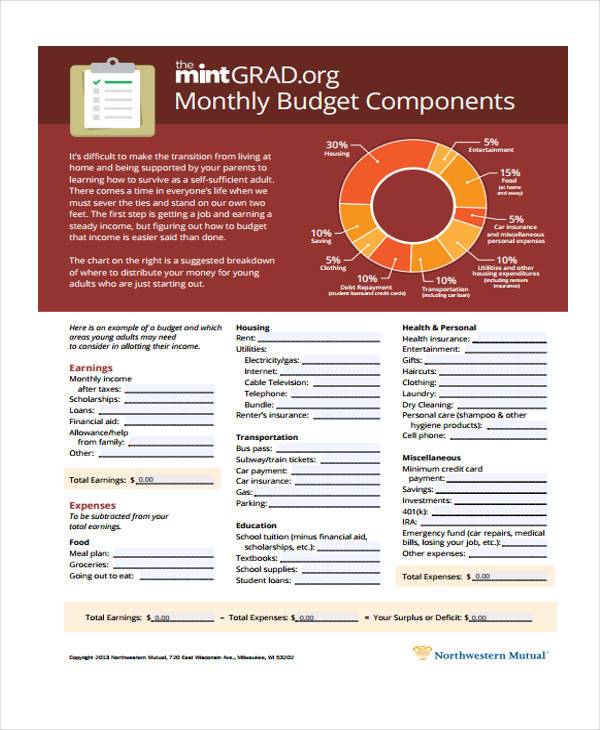

Monthly Budget Components Form

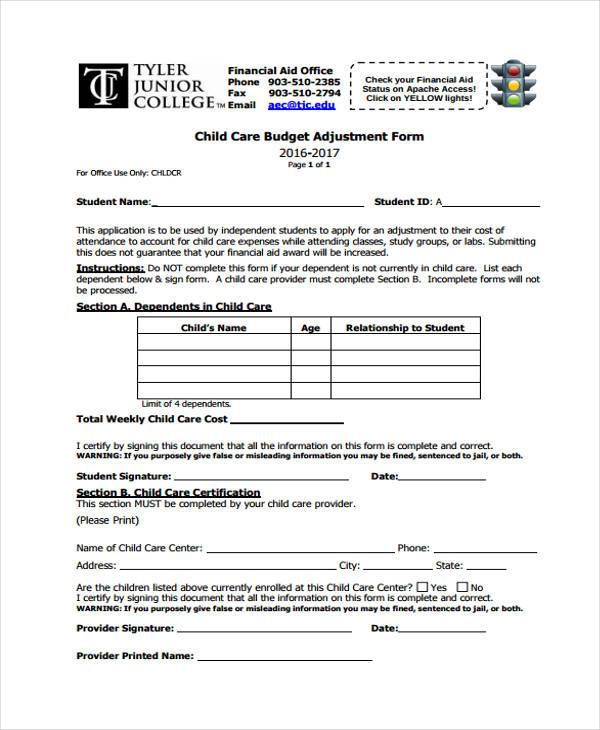

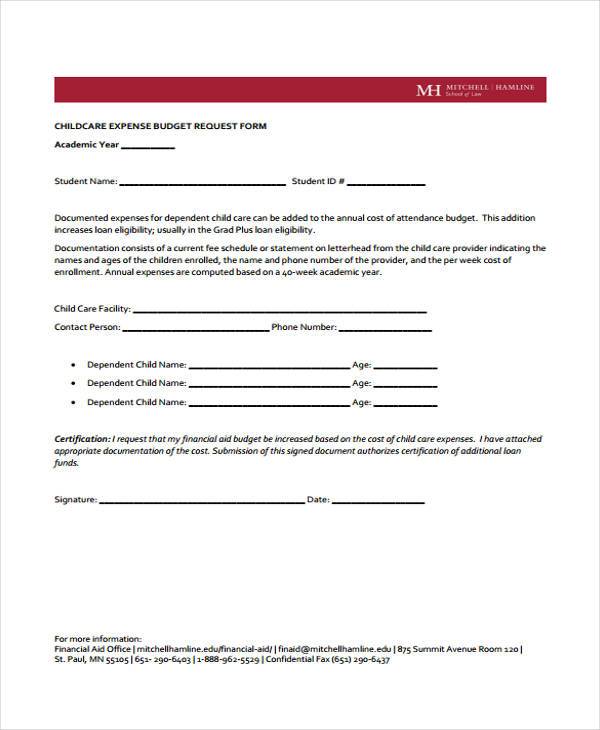

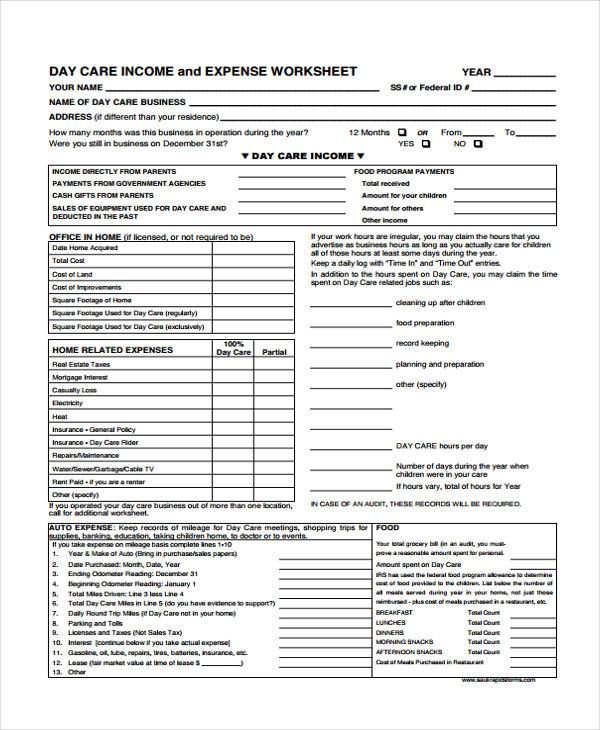

Child Care Budget Forms

Child Care Budget Adjustment Form

Child Care Expense Budget Request Form

Day Care Income and Expense Worksheet Form

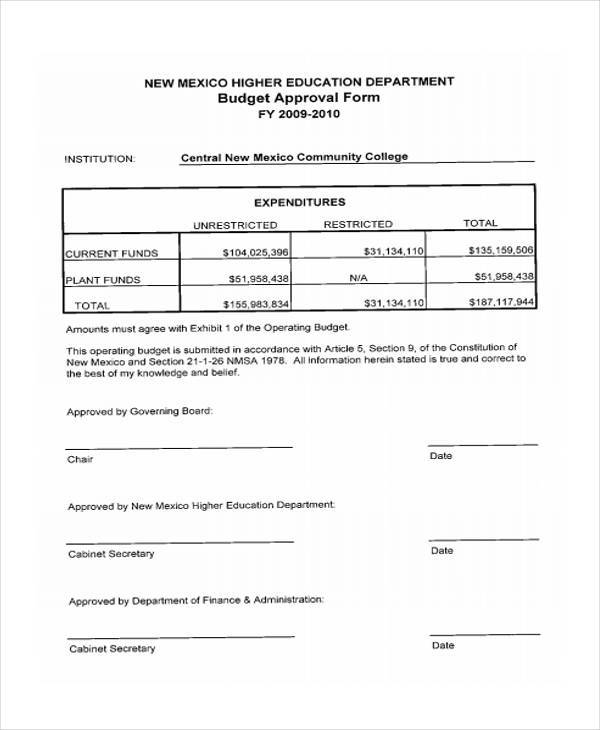

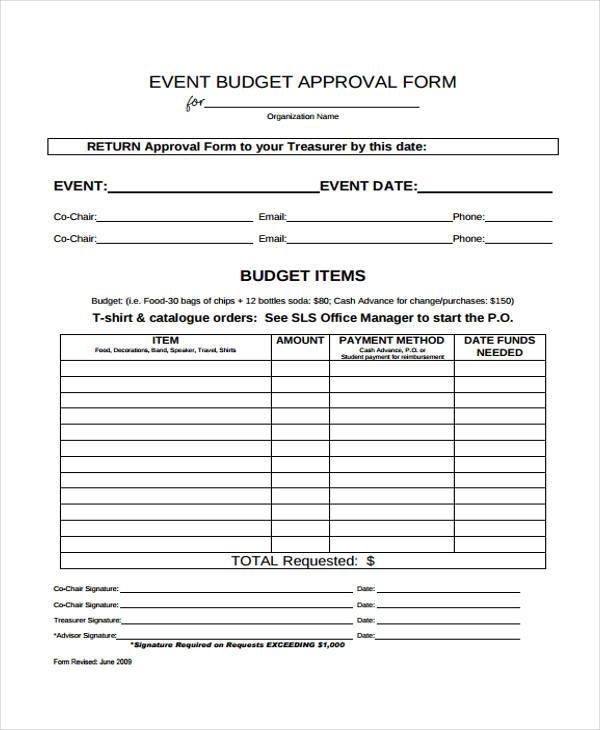

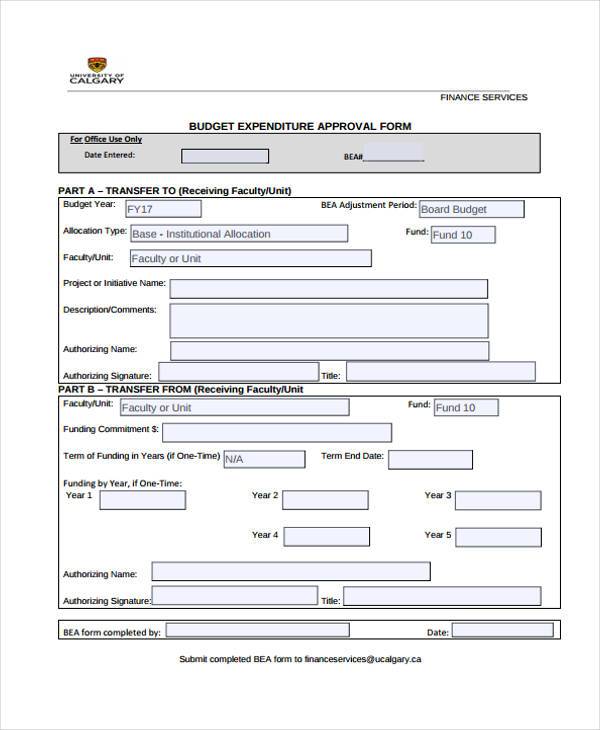

Budget Approval Form Templates

College Budget Approval Form

Event Budget Approval Form

Budget Expenditure Approval Form

The Perks of Creating a Budget

Although a budget is not really the most fun and adventurous thing to do, it can help you be free from financial woes that could keep you up all night. Here’s a list of reasons as to why you need to start printing a budget form and start jotting down your financial ins and outs:

1. Allows You to Control Your Money

The knowledge on proper budgeting will help you to identify your strengths and weaknesses both as a spender and as a money saver. Hence, budget planning can truly help you to properly control your monetary resources. Why? Because it saves you from feeling anxious or stressed about the sudden lack of funds, and helps you prioritize your finances. By creating a plan, you can avoid spending on small and unnecessary things and focus on your bigger goals, such as saving for a new TV set.

2. Lets You Know Where Your Money Goes

Creating a budget will allow you to make a physical document which you can use to identify the items or services that you have purchased or acquired. This process will allow you to know where you money is being spent on. There will be times where you do not know where you spend your money, and that is because you have no proper budget allocation. The small items that you buy can actually contribute to big spending through time. If you will be aware of your cash flow, then it is most likely that you will also identify the transactions where you need to cut back from spending on.

3. Helps You Determine if You Are Capable of Taking More Debt

Even if being in debt is not suggested, there will really be times where you need to borrow money either from your friends, the bank, or any other entity. If you have a budget plan set for a particular time period, it will be easier for you to know whether you can still ask for financial help. Measuring your capability to pay through a continuous source of income, it will help you to spend on your needs while saving for the amount of money that you need to given back to any of your lenders.

How Do You Make An Attainable Budget Plan?

If making a budget is challenging, sticking to it is a tricky thing. Here’s how you can make a plausible budget plan that is not so difficult to achieve:

1. Track Your Incoming and Outgoing Cash

By using our Sample Budget Forms, keep track of the amount of money that you earn or the amount of money that comes in and the amount of money that you spend every month. Tracking your receipts from previous purchases will help you make an average cost of the money you put out each month and determine which item costs too much and if you can cut back on it.

2. Categorize Your Expenses

It is highly recommended for you to make categories where you can place your expenses. If you will allocate particular amounts on ways where you plan to use them, there will be a more strategic and organized way on how you will spend your income. Your categories must be based on your needs down to your wants. Your needs must be your priority while the additional money from your resources can be translated to your savings or you can also use them to buy your wants or other extra items that are not included in your list of needs.

3. Be Flexible with Extra Expenses

Look through your list of extra expenses and mark those that you do not immediately need to purchase or pay immediately.

4. Add Up the Total Amount for Both Categories

Add up the total cost of expenses for both extra and essential expenses. Get the separate total for your extras and a separate total for your essentials.

5. Take the Total Amount of the Cost for Essentials from Your Income

Deduct the total amount of essential expenses from your total income and if you still have extra, see if it is able to cover for the expenses listed in your extra expenses.

6. Learn to Cut Back

If you still have extra money left after covering both essential and extra expenses, then good for you! You can use that extra money to add into your savings. However, if covering your essential costs alone already gives you a negative amount, then look into your list again and see where you can cut back.

One necessary point in budgeting is to live within your means. If your current salary does not give you enough leeway to buy a new car, then don’t. When people live beyond their means, they usually end up in a pit of debt.

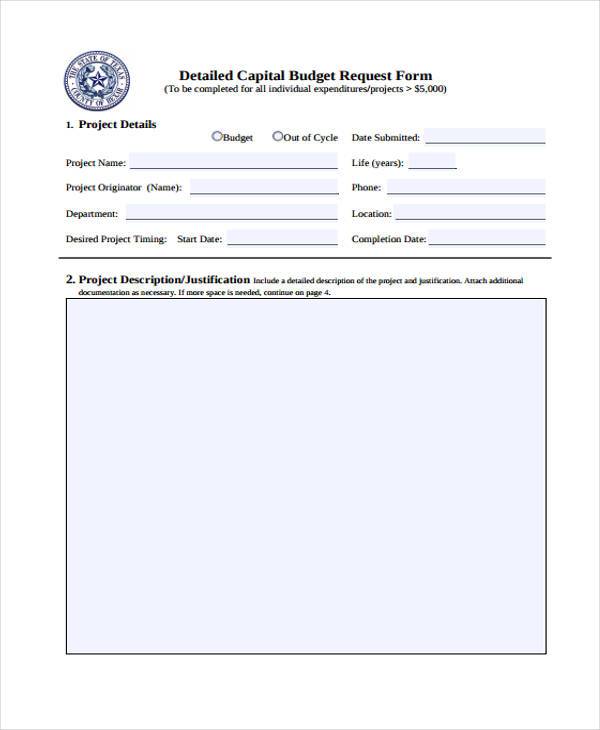

Budget Request Forms

Detailed Capital Budget Request Form

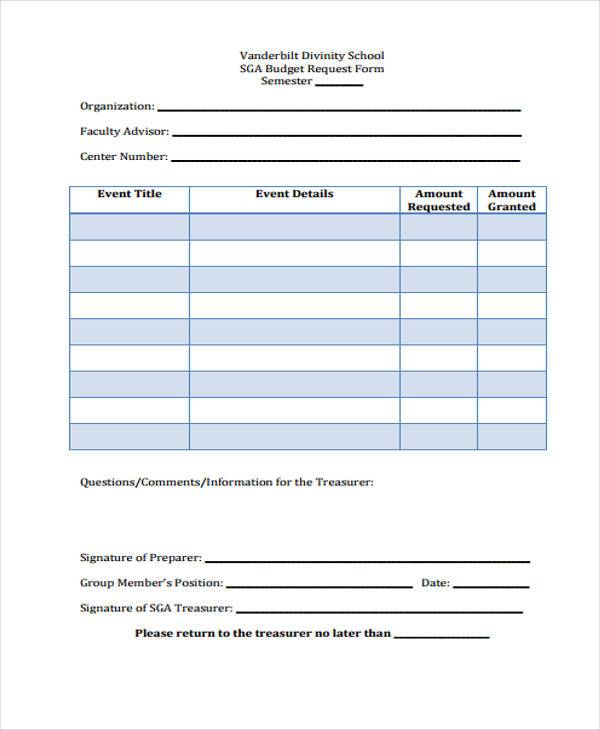

School Budget Request Form

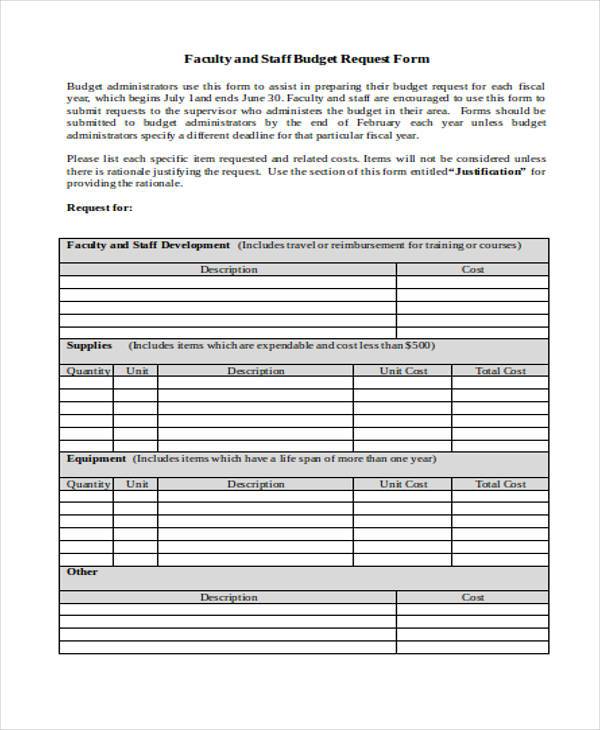

Faculty and Staff Budget Request Form

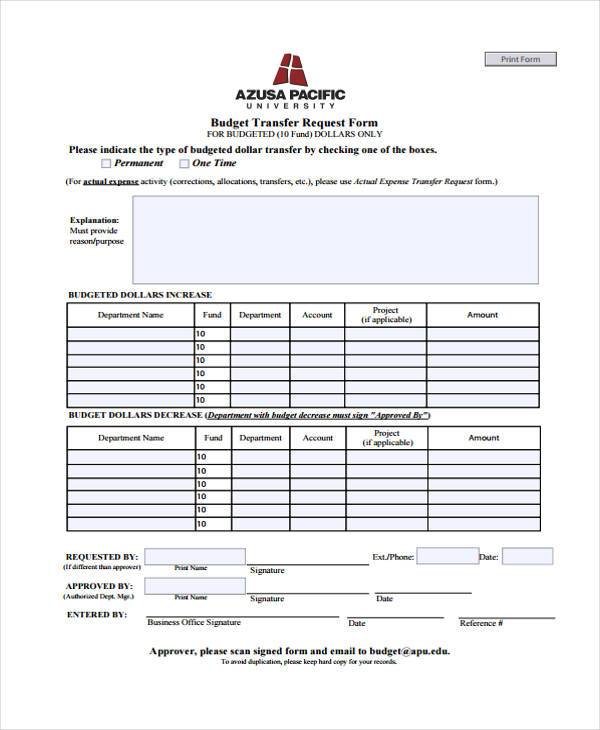

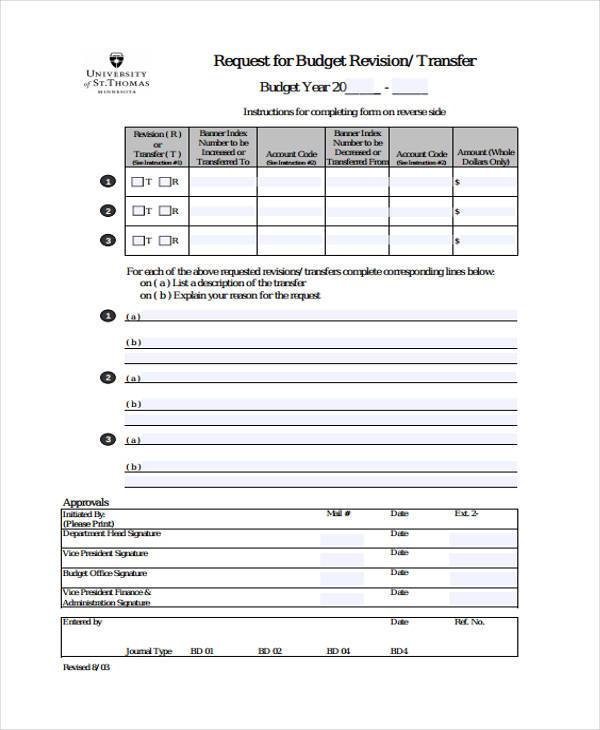

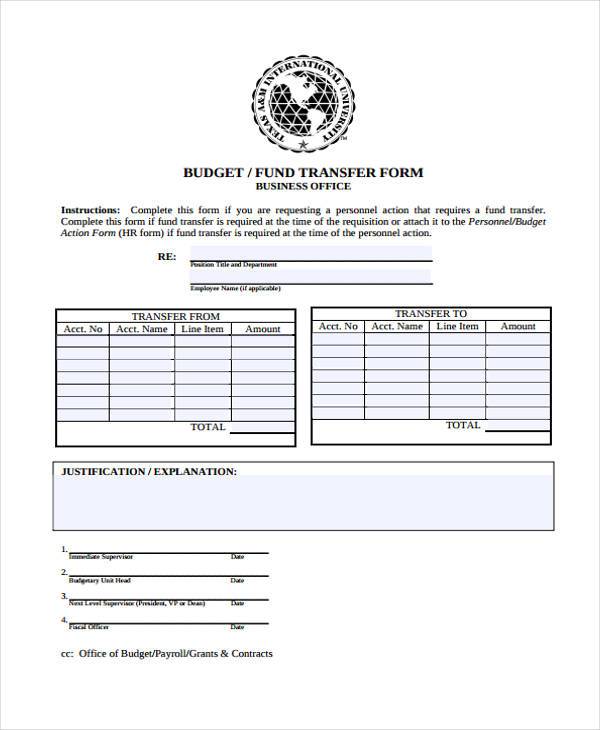

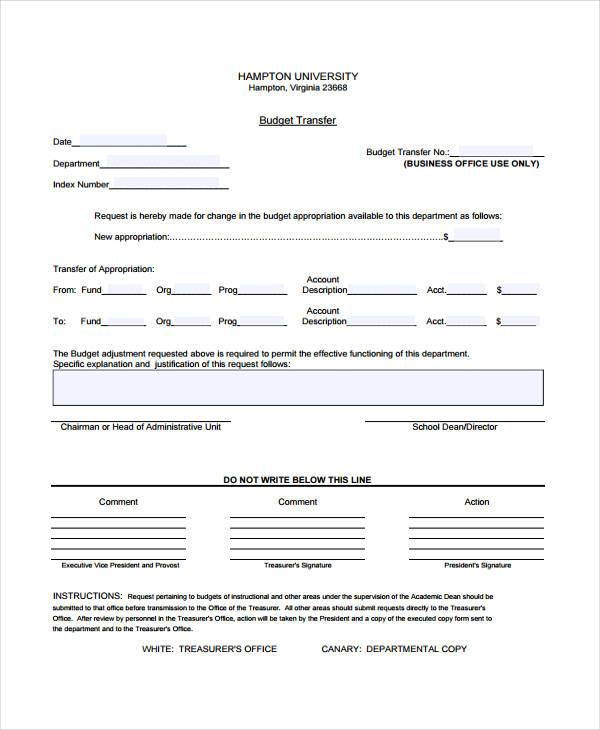

Budget Transfer Forms

Budget Transfer Request Form

Request for Budget Transfer Form

Budget and Funds Transfer Form

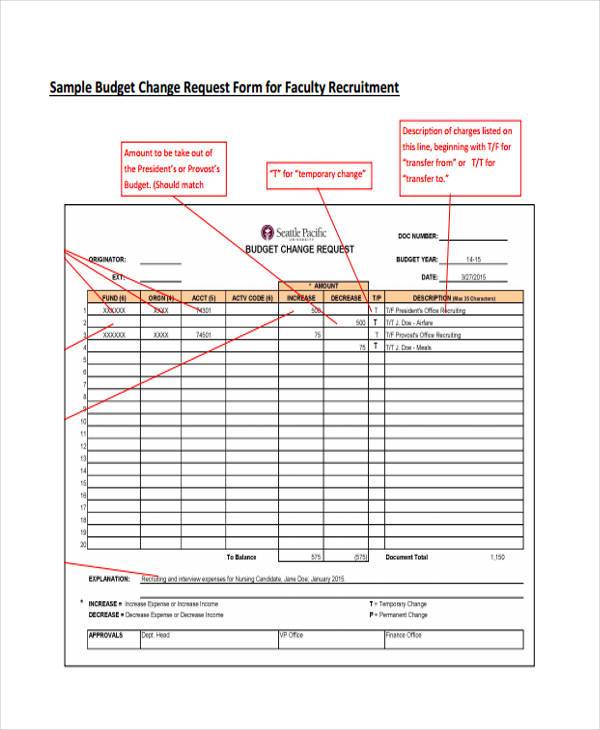

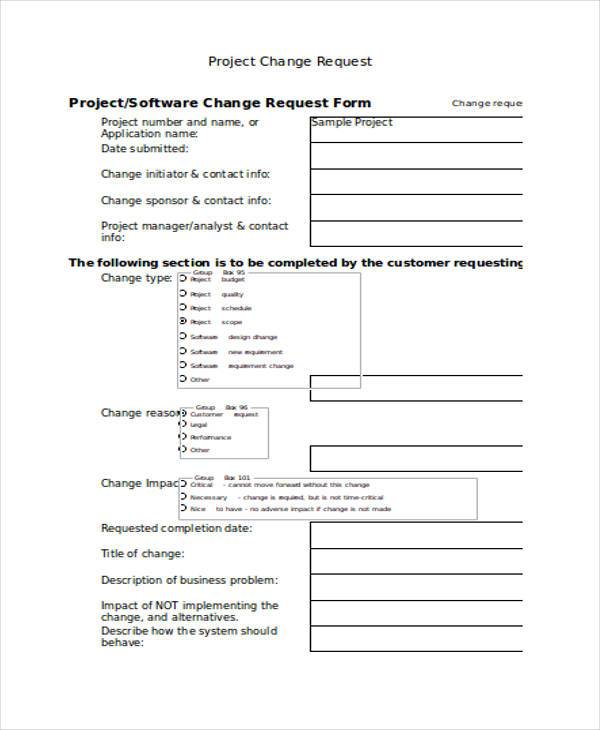

Budget Change Request Transfer Forms

Budget Change Request Transfer Form For Faculty Recruitment

Project Budget Change Request Transfer Form

Budget Change Request Transfer Form Sample

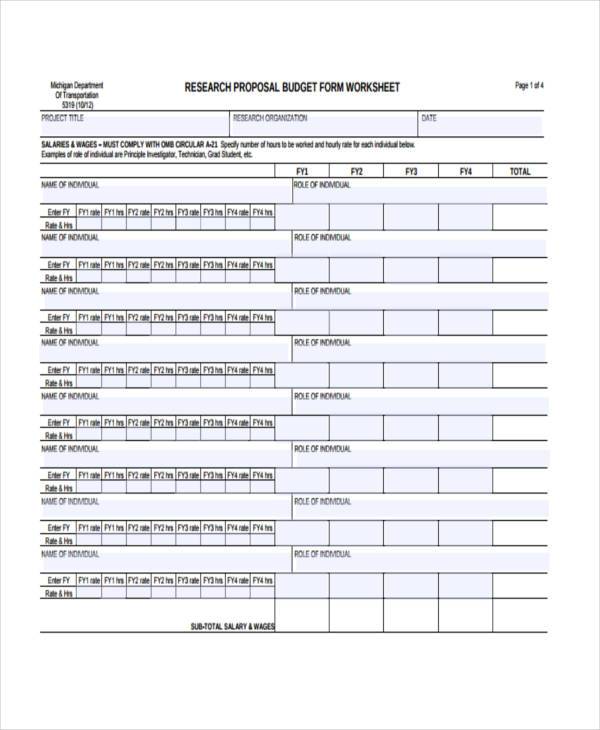

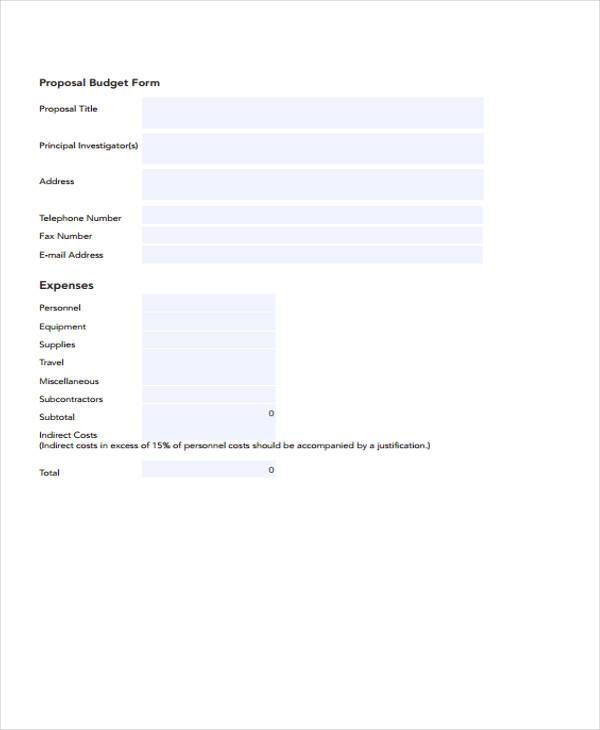

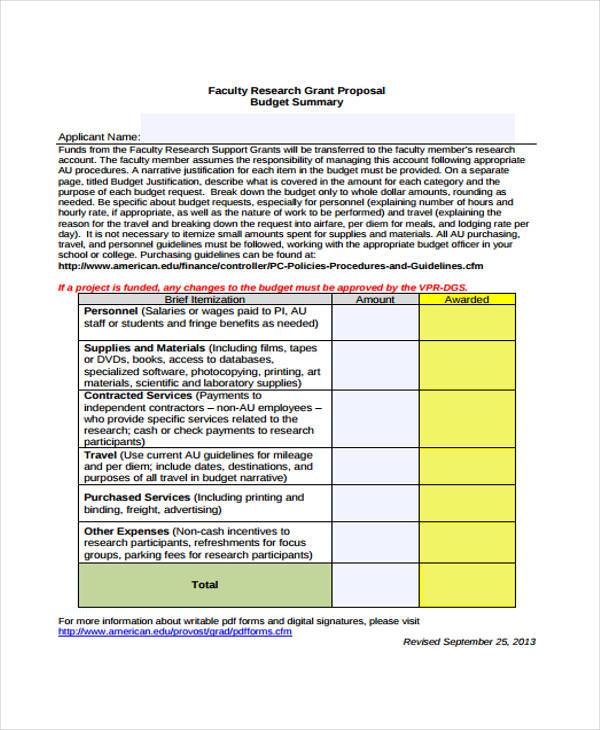

Proposal Budget Form Templates

Research Proposal Budget Worksheet Form

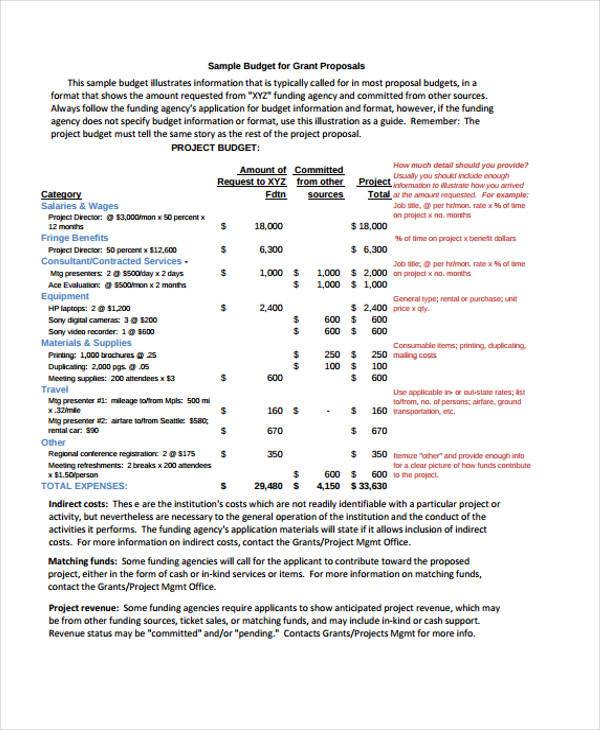

Grant Proposal Budget Form

Faculty Research Proposal Budget Summary Form

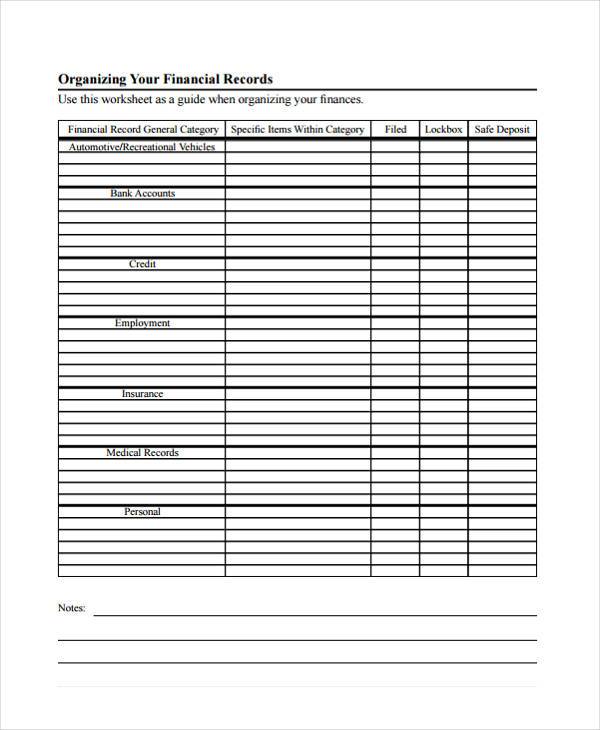

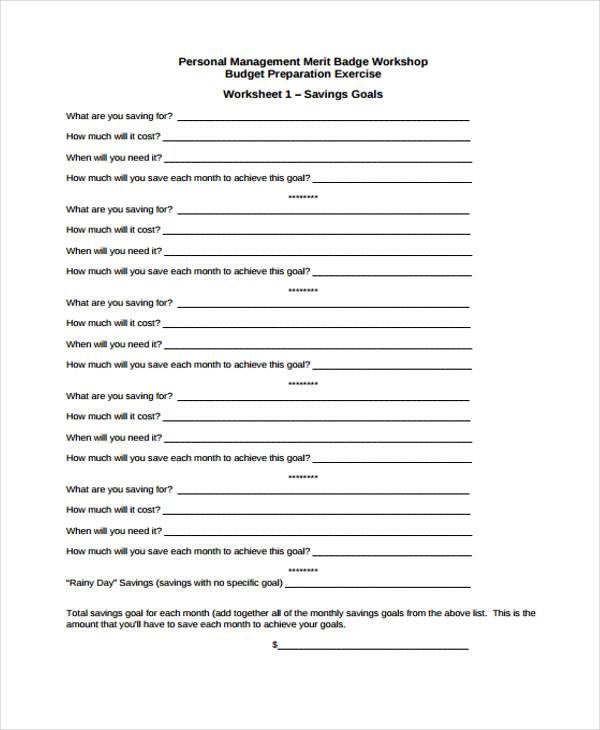

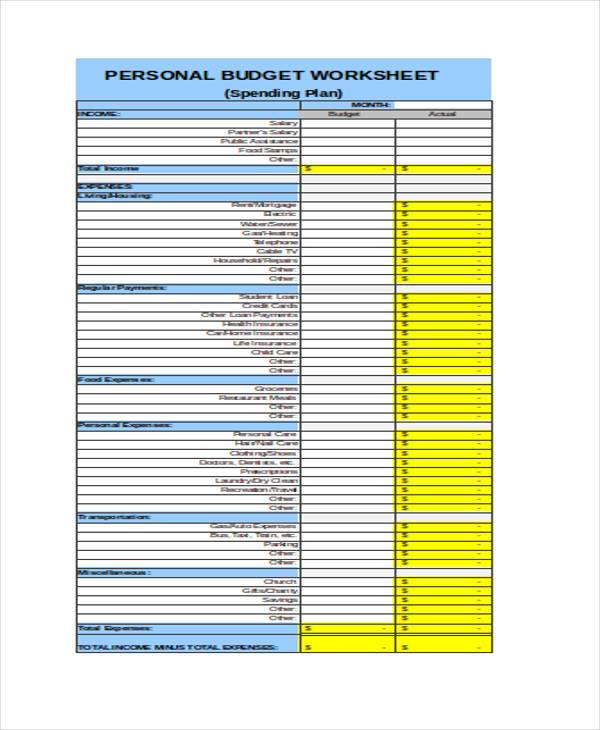

Personal Budget Forms

Monthly Personal Budget Worksheet

Personal Financial Worksheet Record

Personal Management Budget Form

Annual Budget Forms

The creation of annual budget forms can be for different purposes. A few reasons why this kind of budget form is created include the following:

- Individuals can create an annual budget form so they can precisely layout the major spending that they will be doing within the entire year especially those that concern travel and investments.

- Corporations also use annual budget forms so they will know how to properly allocate their resources based on the needs of the business. Most processes within a corporate environment where annual budget forms are necessary include marketing, sales, and operations.

- Government agencies and other organizations also use annual budget forms for them to be aware of the budget plan that they will follow for the next twelve months of operations.

If you want to fully implement an annual budget plan, you need to make sure that you are familiar with the expenditure and expected budget sources within the entirety of the duration that the plan will be able to cover. More so, you need to be realistic with your budgeting targets, goals, and objectives. If accurate implementation will not help you to be more efficient with how you spend your money, then making changes along the way based on varying factors that you do not have a hold of can be done. However, make sure that you will minimize these changes as they can affect the effectiveness of the initial plan that you have made.

The How-tos of Yearly Planning

1. Go Past Usual Expenses

Looking back on your previous habits of spending can help you to identify the kind of budgeting that you may apply for the next year. Make sure that you will track your major expenses and the small things where you continuously spend your money on. This will help you to properly budget based on your lifestyle and the amount of money that you get in specific time periods. If possible, you can look at your credit statements for the past months. You can also collect your utility bills and the receipts that you have kept so you can have an idea on where your money went.

2. Pin-point Your Exact Expected Income

Income is generally the money you expect to receive or earn over the next 12 months. Income can come in varying forms such as wages, tips, bonuses, rent or royalties, interests and dividends, alimony, child support, salary, retirement income, pension, benefits, entitlements, etc. For most people, determining the amount of expected income is easier than determining expenses. When your income is unpredictable or varies according to a project or through commission, the rule of thumb is to underestimate your amount of receivables rather than overestimating and be disappointed.

3. Estimate Your Expenses

To be able to plot your annual Budget Plan, you will have to accurately determine your projected expenses. This can be quite a challenging task, but is not entirely impossible. Determining your fixed expenses should be easy. Fixed expenses are those that you essentially spend on each month such as your rent payments, loans, mortgage, credit card bills, utility, car loans, etc. Variable expenses, on the other hand, are those that are a little tricky to determine. Variable expenses may eventually be a regular expense or a temporary expense, such as gasoline and electricity bills. These type of expenses usually vary from season to season.

4. Save Discretionary Expenses for Last

Discretionary expenses are expenses that you do not necessarily need but which you would like to have, such as a new office wing or a new office. Your discretionary expenses should be the last in your priority list when you draft your Budget Plan. If you still have some money left over after you have subtracted your fixed ad variable expenses from your expected income, then the money left over can be put into savings or used for discretionary spending.

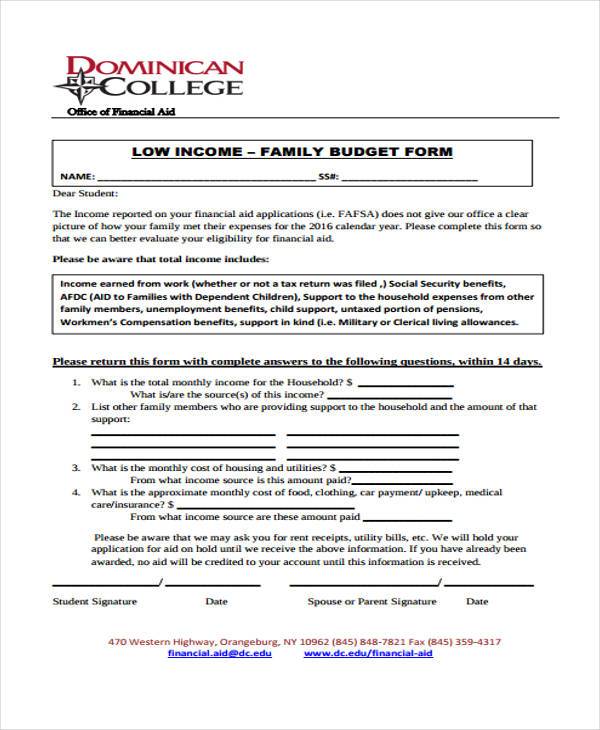

College Budget Forms

Being in college away from your parents and getting a taste of semi-independence allows you to view life from a completely different perspective, a perspective that goes beyond the walls of a classroom. College life can be a fun and liberating experience, but it also entails responsibilities and obligations, one of which is learning how to stretch your finances to get through your student loans, requirements, and college itself.

Budgeting and studying should be two of your main priorities when you get into college. Following a budget plan with the help of a budget form can help you save enough money to pay off your student loans and your other expenses such as food and lodging.

Budgeting can be quite a challenging thing to do, especially since it requires a great amount of self-control. Below are tips to help you get through college without having to drain your finances and be free of debt:

1. Make a List of Expenses

With the use of our Sample Budget Forms, write down your income and list down your expenses. Actually seeing the physical figures of your expenses creates more weight on your psyche and helps you become more aware of how much amount of money you spend every month, which items are a priority, and which ones need to be cut back such as learning to cook your own food or making your own coffee instead of buying one.

2. Organize Your Finances

Income, allowance, or loans are usually given in lump sums. Separating your money and putting it into different savings accounts can help you organize your finances and allows you to properly segregate the money that you need to use for different purposes.

3. Maximize Your Resources

Maximizing your resources could help your income and your allowances go a long way. One way for you to save is to learn how to cook instead of constantly eating out, or selling old textbooks and unwanted presents online or on campus noticeboards.

4. Manage Your Debt

Be cautious when applying for credit cards and student store cards. It would help you maximize your funds more if you apply for cards that offer 0% interest rates. Remember that having a pile of debt can be your biggest hindrance to proper budgeting and saving.

5. Monitor Your Expenses and Learn How to Cut Back

Carrying less cash and having more of it in the bank helps you spend less and makes you monitor your expenses more. Another way to save money and maximize profit is to learn how to cut back on unnecessary expenditures such as cigarettes or an over-indulgence of shoes or clothes.

6. Get a Part-Time Job

A part-time job is one of the quickest ways for you to increase your finances. Just be sure that your job does not get in the way of your schooling. A part-time job can also be a perfect way for you to expose yourself to the world of business and is an opportunity for you to meet with different people who work in different fields and can help you figure out what you might want to do or where you might want to work after you graduate.

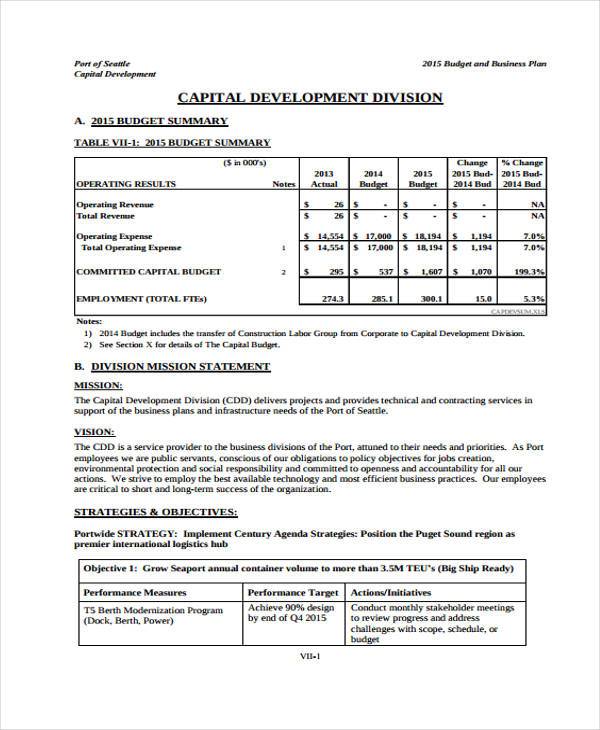

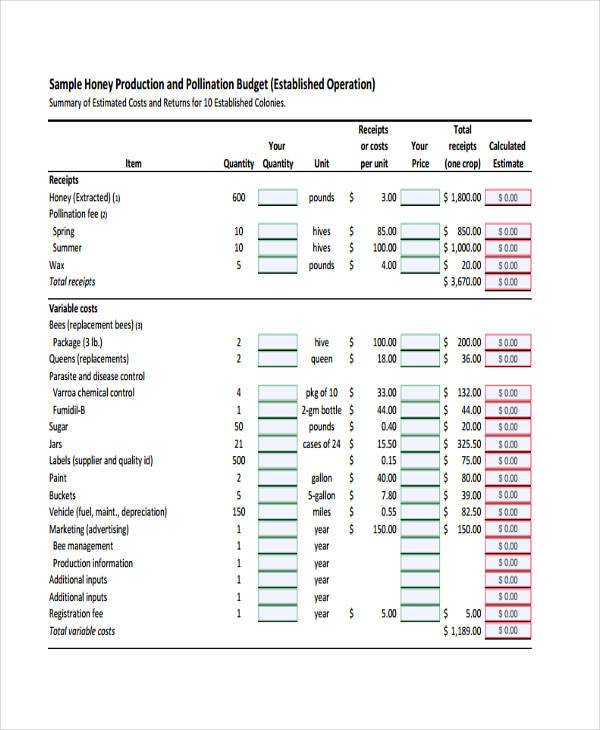

Business Budget Forms

Corporate Business Budget Summary Sample

Sample Production Budget Form

Personal Business Budget Form

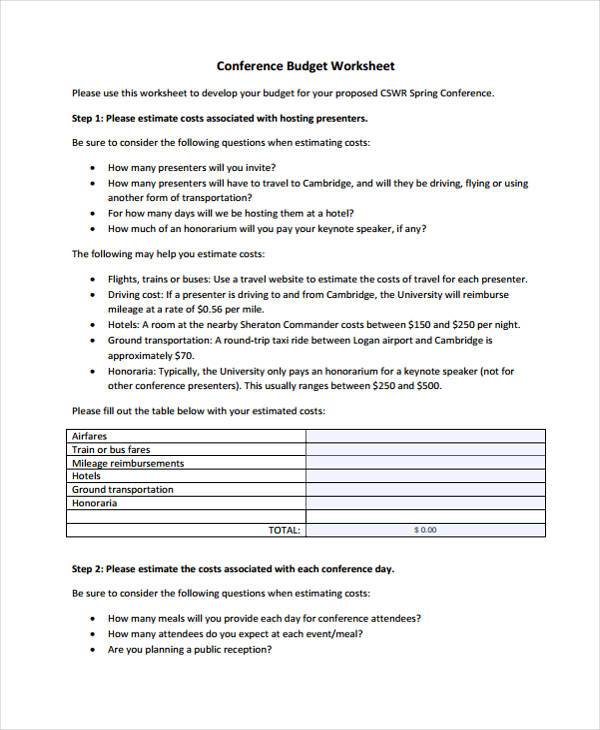

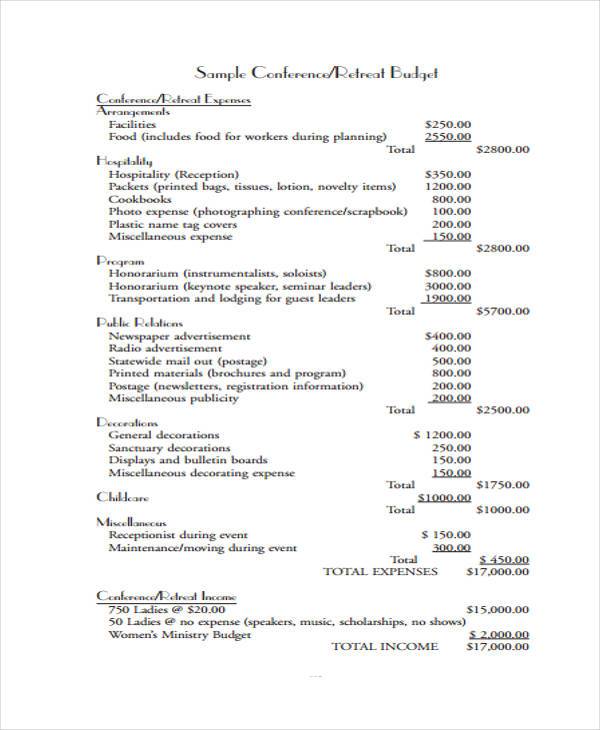

Conference Budget Form Templates

Conference Budget Worksheet Form

Sample Conference Retreat Budget Form

Annual Budget Forms

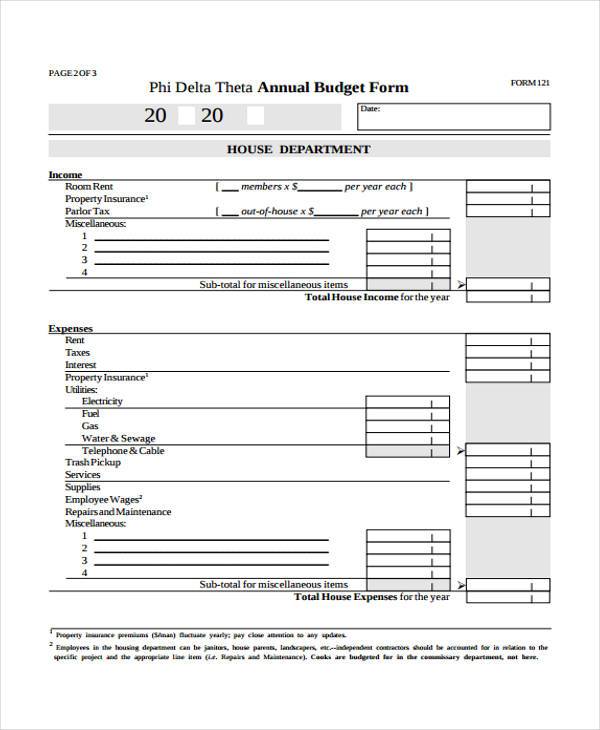

House Department Annual Budget Form

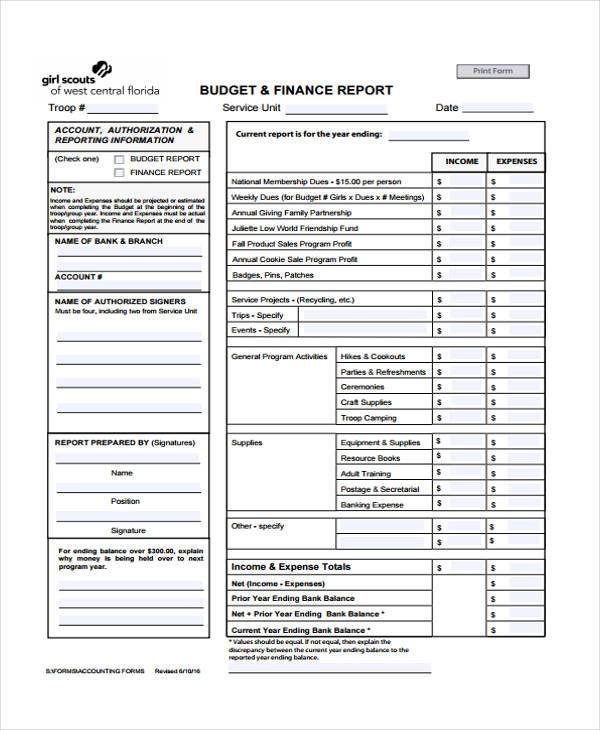

Budget Finance Report Form

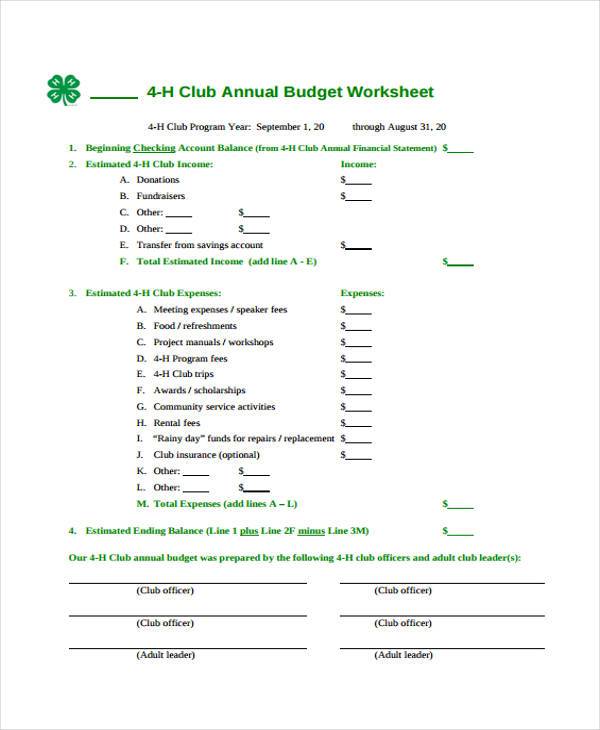

Annual Budget Worksheet Form

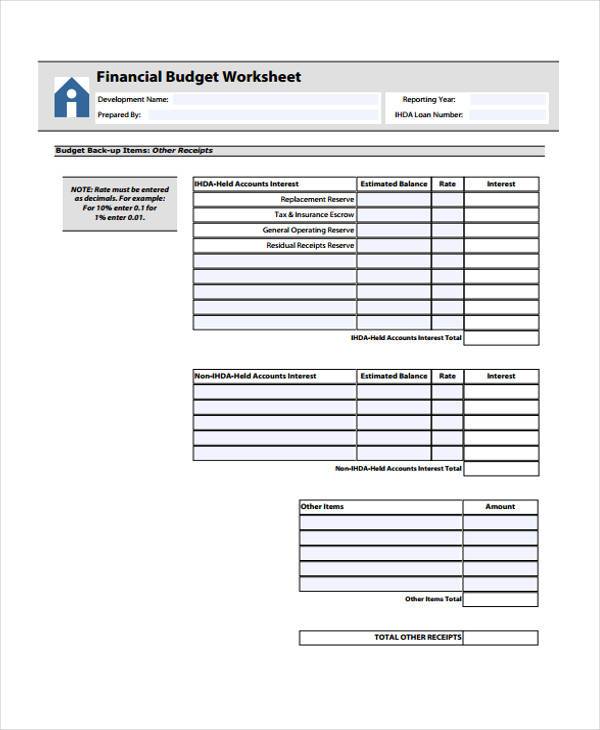

Financial Budget Form

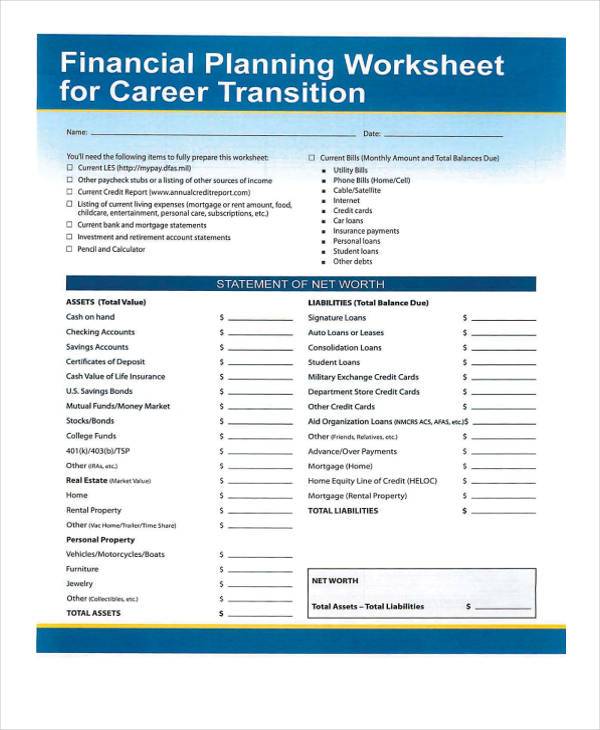

Financial Planning Budget Worksheet

Financial Budget Worksheet Form

Financial Family Budget Form

Grant Budget Form Templates

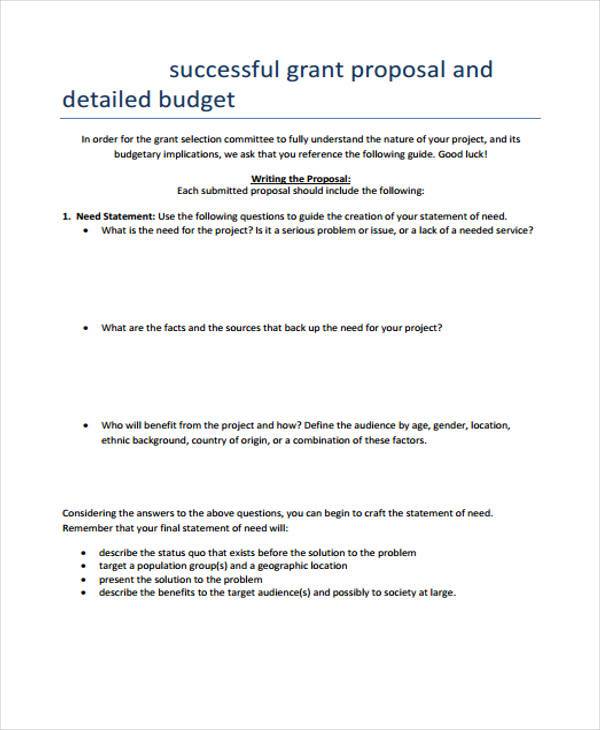

Successful Grant Proposal Budget Form

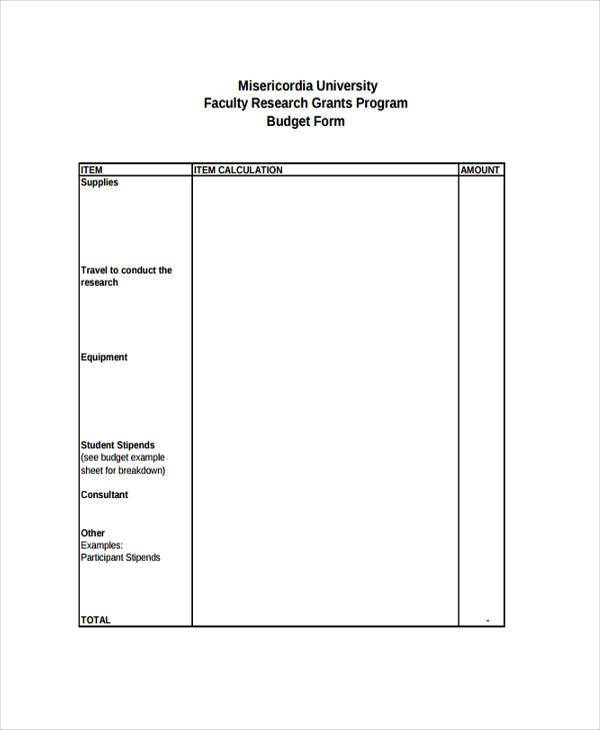

Faculty Research Grant Budget Form

Sample Grant Budget Proposal Form

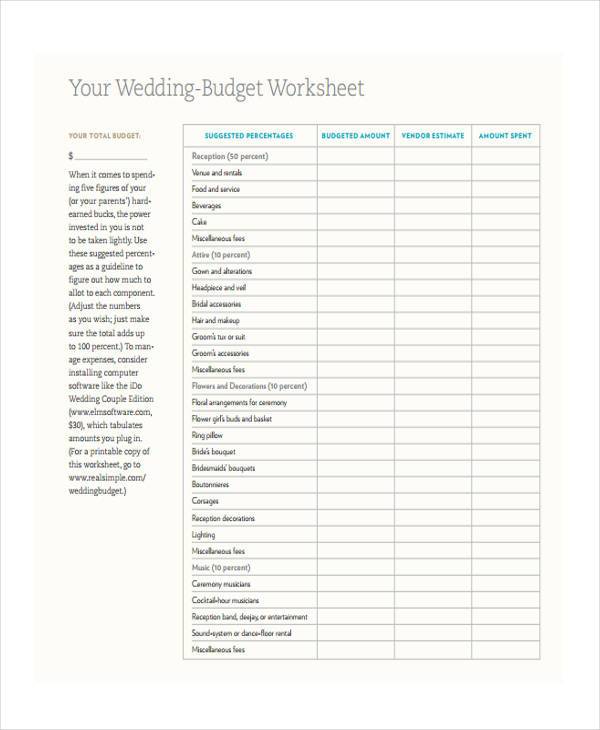

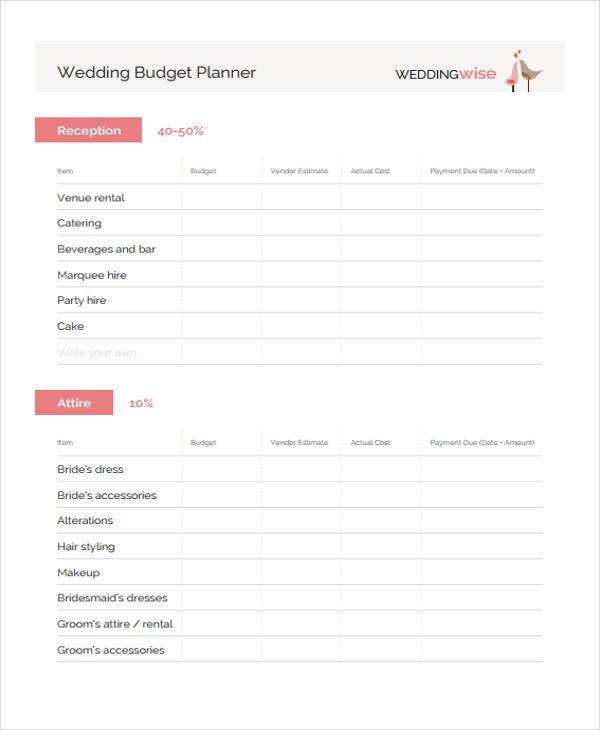

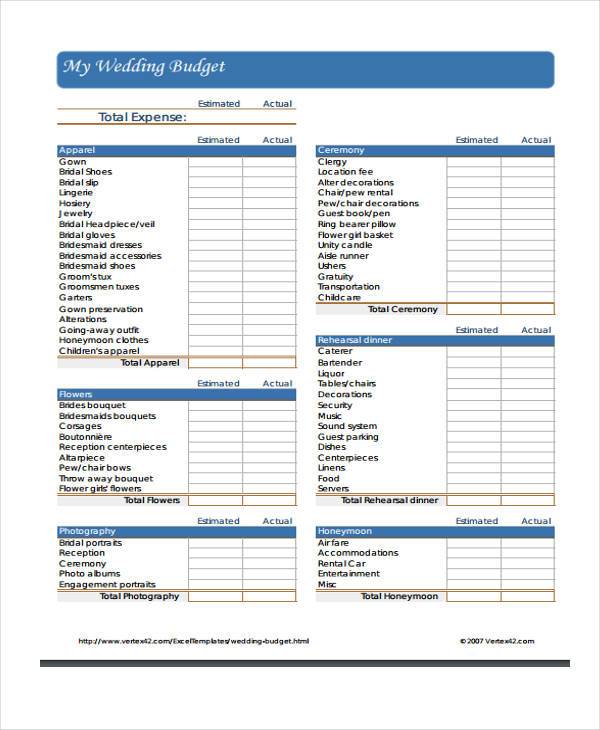

Sample Weeding Budget Forms

Wedding Budget Worksheet Form

Wedding Budget Planner Form

Wedding Budget Form Sample

Budget Proposal Forms

In the business world, a budget proposal is one crucial term in grant-making. It plays a key role in the process of determining the merits of funding projects. A budget proposal is exactly what it sounds; it is a proposal for funds to be given for the completion of a project.

Budget Proposals typically include the total cost of expenditures needed for a project, its individual expected expenses, and any other anticipated costs. Budget Proposals also include revenues that a project may generate and helps investors or grant providers determine if the project merits funding.

Since a Budget Proposal provides an estimate of a project’s future cost, revenues, and resources, both the business world and almost all types of government agencies utilize it as a means to obtain funding. Budget Proposal can be tailored to suit the requirements of complex financial figures or smaller financial numbers. The Proposal Forms we offer are designed for your easy access and are flexible enough to suit your Budget Proposal Needs. Our forms range from Business Proposals to Project Proposal Forms and even Construction Proposal Forms.

Developing a Budget Proposal can be quite a demanding situation. It is a type of document that needs to be carefully and thoroughly constructed in order to create a huge impact among investors so that they will be convinced to provide financial support to a project. Below are tips on how to make an effective Budget Proposal:

A Business Proposal must be able to quantify a business’s objectives and goals and must also be able to identify ways on how to reach those objectives. By conducting benchmarks, organizations are able to identify the level of performance that is needed to achieve the benchmarks provided. These benchmarks should be flexible, in a way that it permits the business to shift its goals and performance levels easily to make up for an adverse market condition that is financially permissible.

Budget Proposals must also be able to establish parameters for assessing performance in achieving goals and meeting benchmarks. By doing this, a business or an organization is able to forecast the potential of them meeting the goals that have been established in the proposal. Typically, the higher the standard is for measuring performance, the lower the chances of meeting goals.

Allocation of funds is considered to be the meat of a budget proposal because it provides information on how a department or an organization can use up the available funds to meet their goal. Cutbacks may be done by certain departments in an effort to decrease spending and increase the allocation of funds to more critical business departments or programs.

Use generally accepted cost estimation methods such as catalog prices, price quotations, or historical or current costs appropriately escalated. Cost estimates need to be as accurate as possible to cover the expenses proposed in the project.

Related Posts

-

Restaurant Budget Form

-

Church Budget Form

-

Line Item Budget Form

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel

-

FREE 6+ Sample Family Budget Forms in MS Word | PDF

-

FREE 8+ Sample Business Budget Forms in PDF | MS Word