Creating a budget plan is a necessary process for companies, businesses, and even in managing a household. A lot, if not most, businesses are able to thrive because they conduct successful budget planning and financial management. Budget plans are also a necessity in conducting projects, business proposals, and most especially startup companies.

A budget plan is the process of creating a plan on how to spend your money in order for you to pre-determine if you are able to afford the things that you would like to do or the things that you want to buy. Simply put, planning a budget is devising a strategy for you to properly balance your incoming finances with your outgoing ones. You can download from our wide array of budget forms, available in Doc format. Our sample budget forms range from household budget forms to financial budget forms and are easily accessible to help you not just save time but to cut back on costs as well.

Household Budget Forms

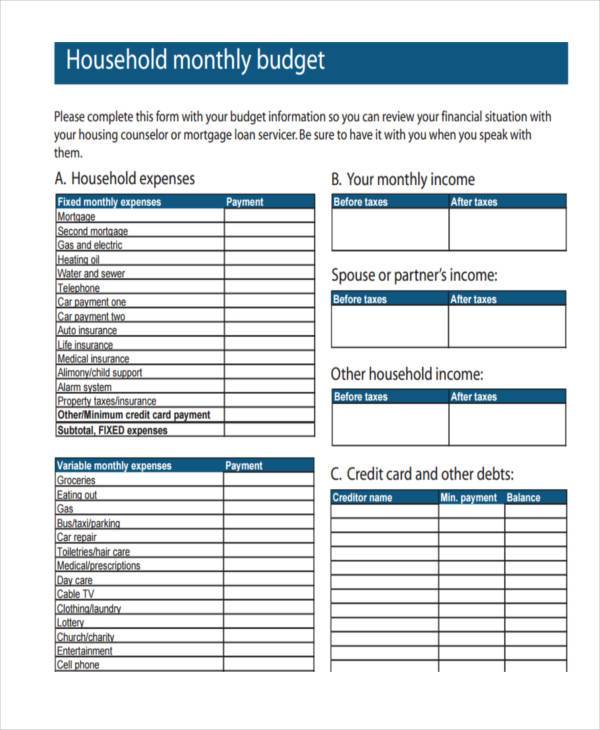

Household Monthly Budget Form

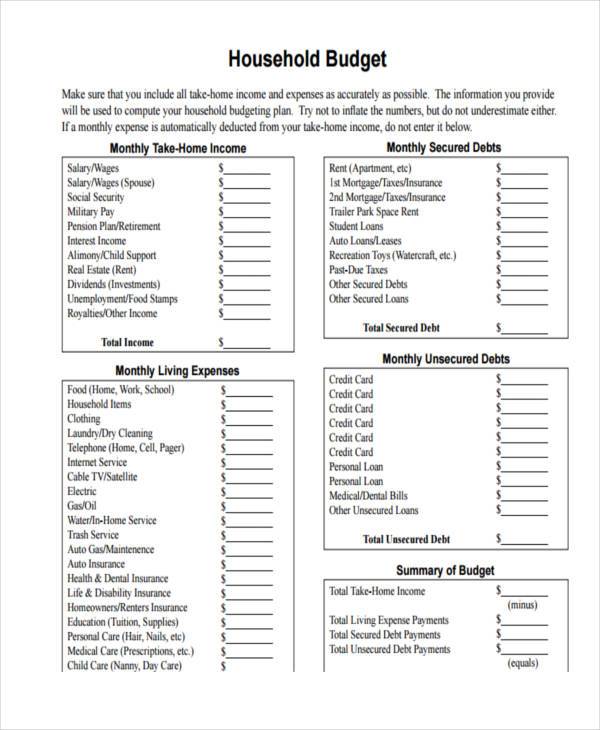

Basic Household Budget Form

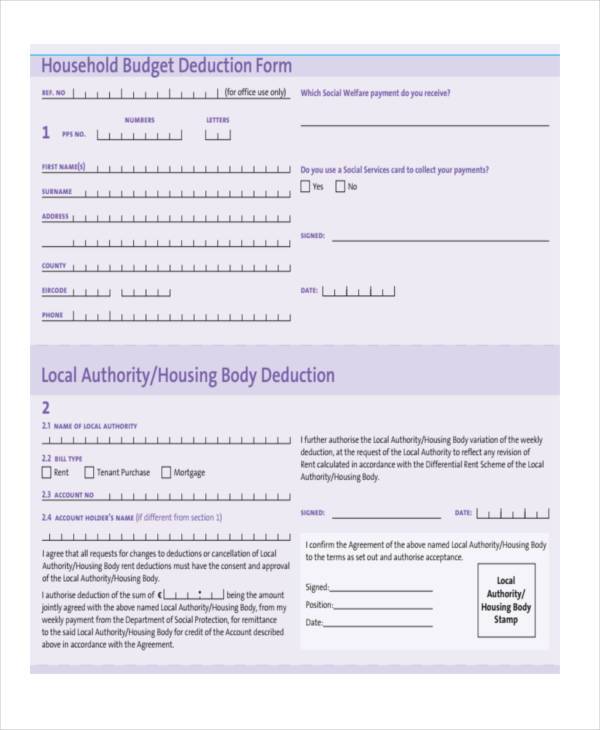

Household Budget Deduction Form

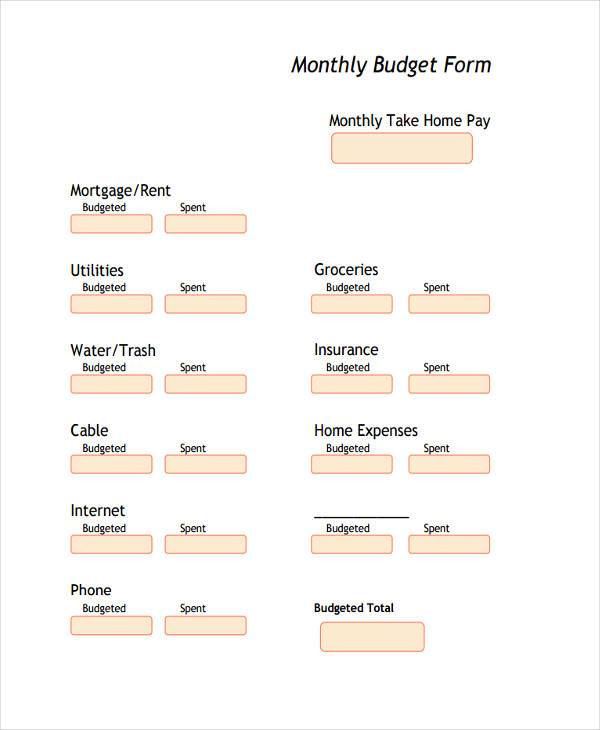

Monthly Budget Form

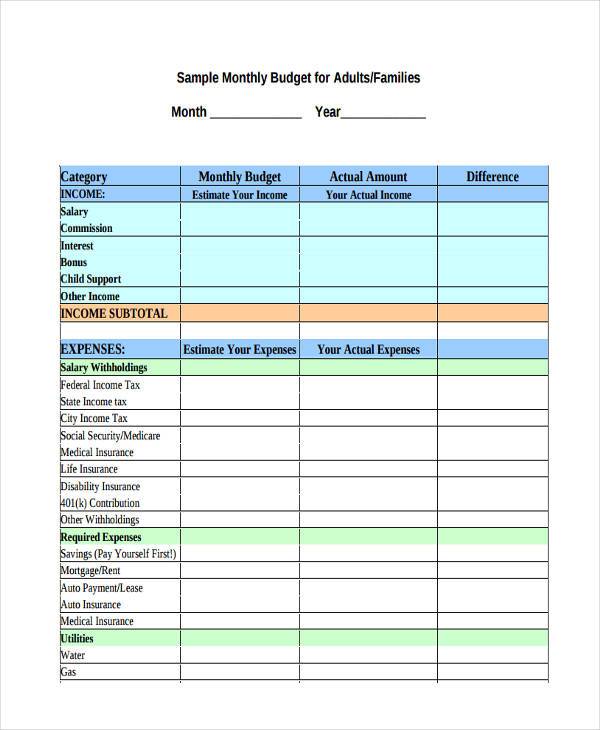

Monthly Budget Form for Families

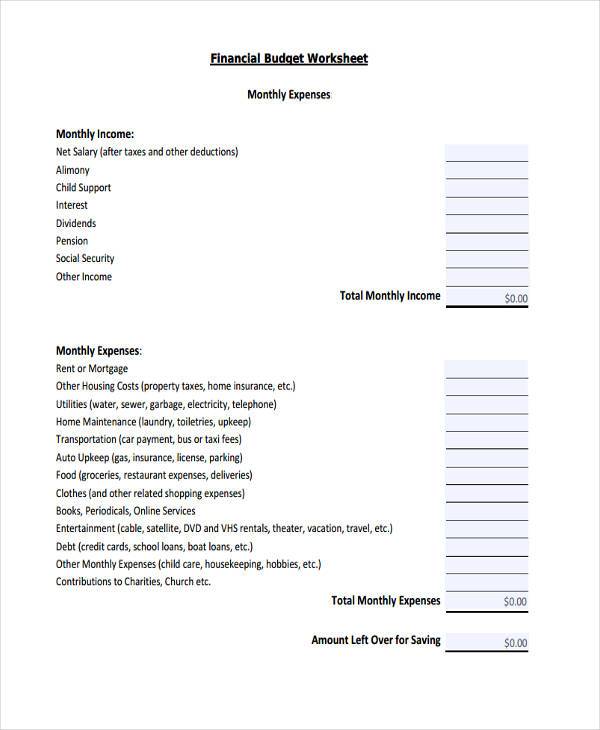

Monthly Financial Budget Form

Monthly Budget Form Sample

Construction Budget Form Free

Free Construction Budget Form

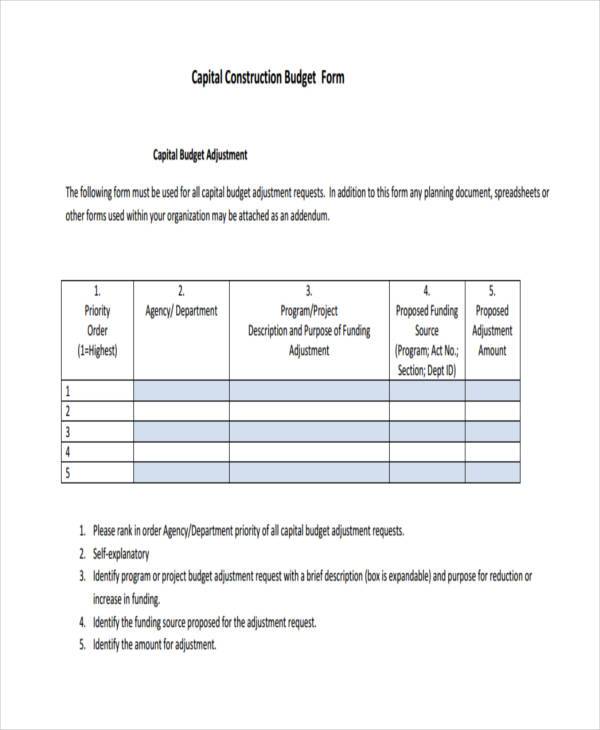

Construction Capital Budget Form

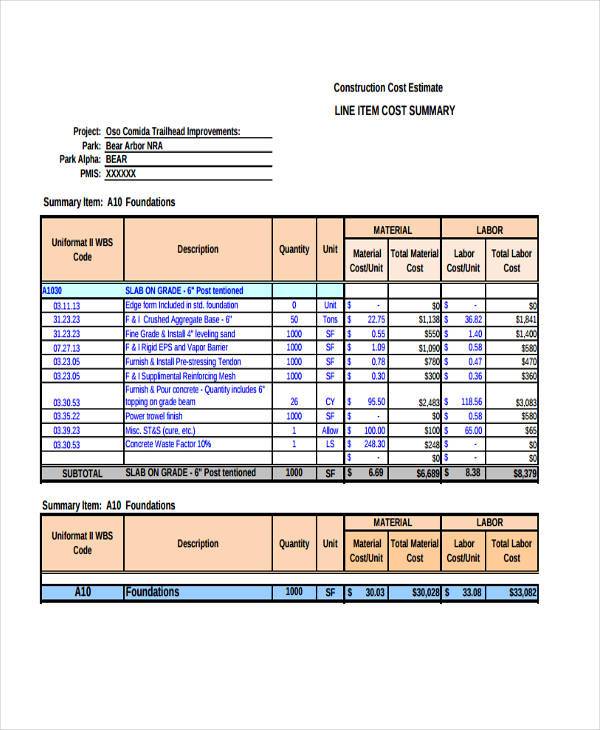

Construction Cost Estimation Form

Home Budget Form

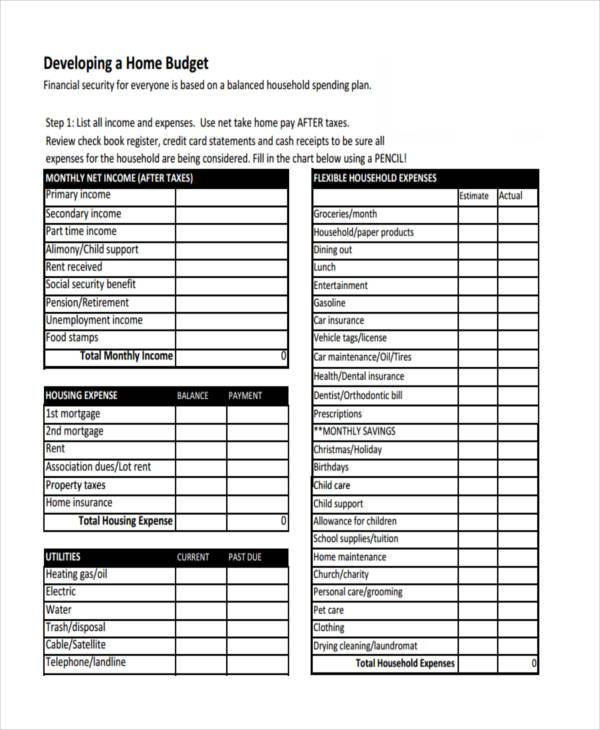

Developing Home Budget From

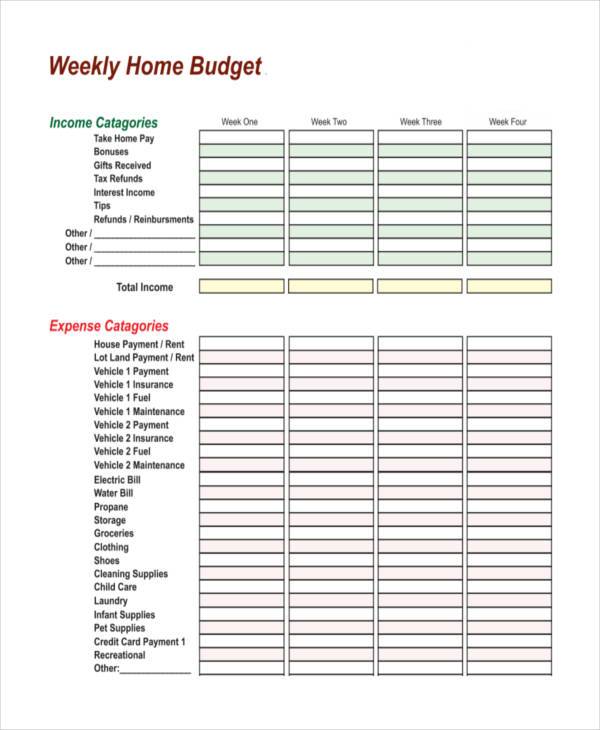

Weekly Home Budget From

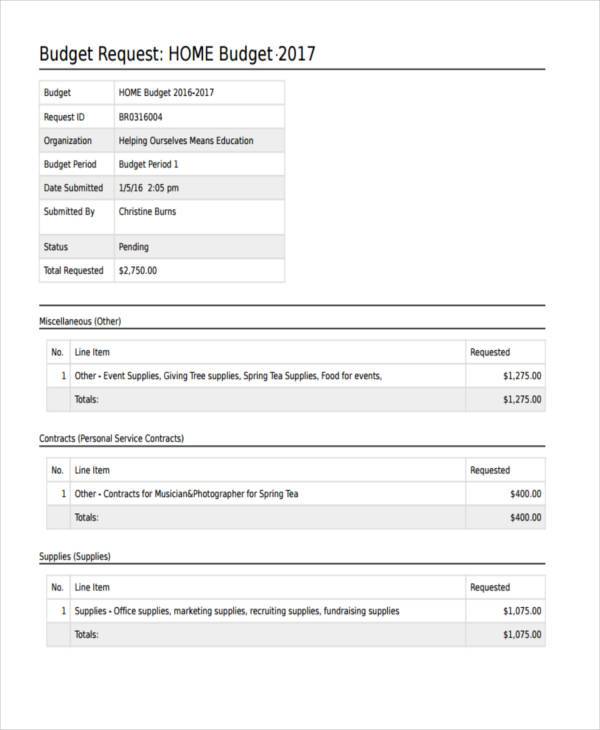

Home Budget Request From

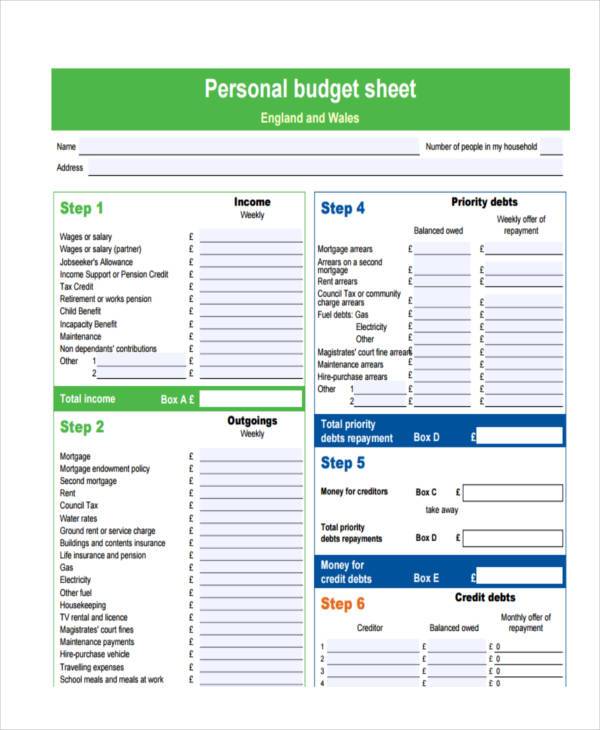

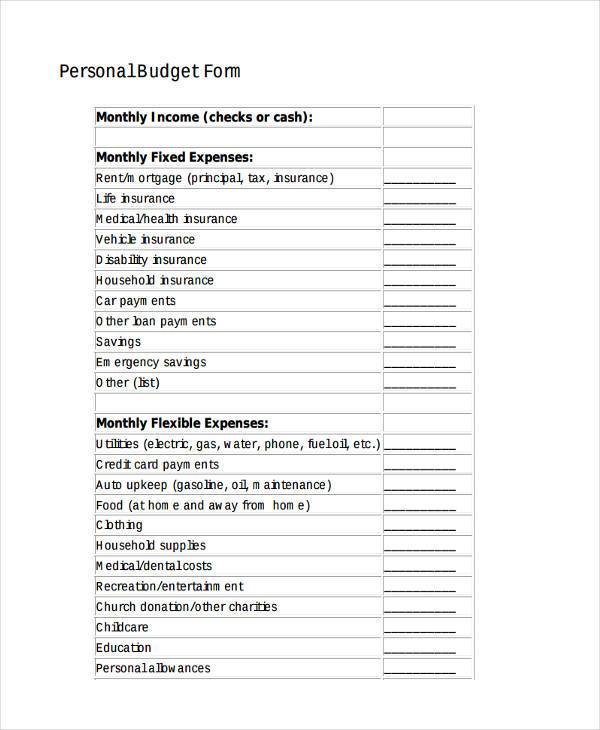

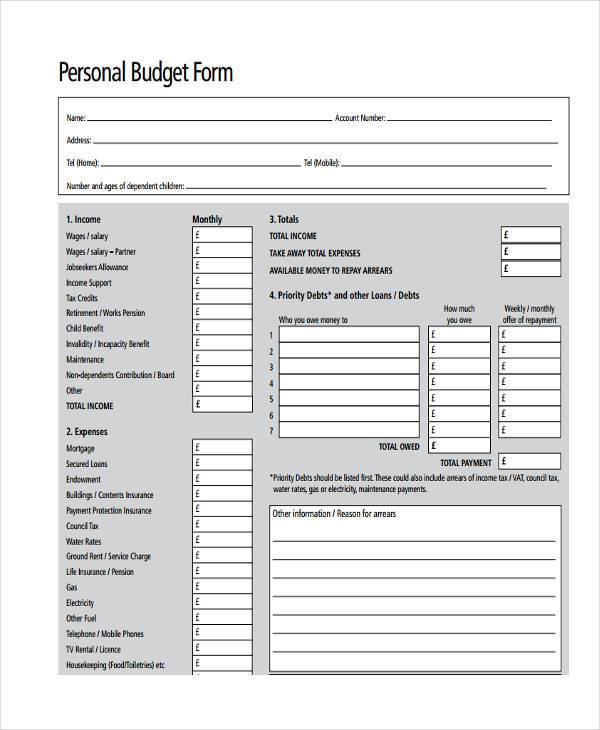

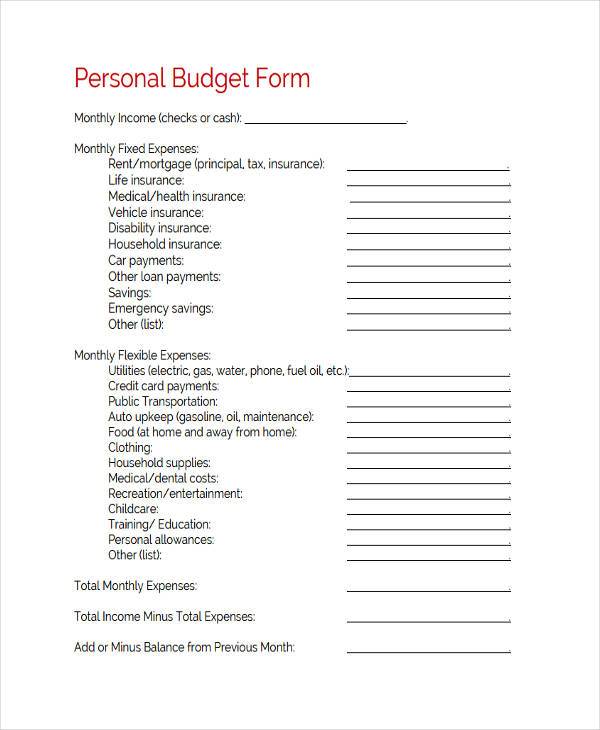

Personal Budget Form

Blank Personal Budget Form Free

Monthly Personal Budget Form

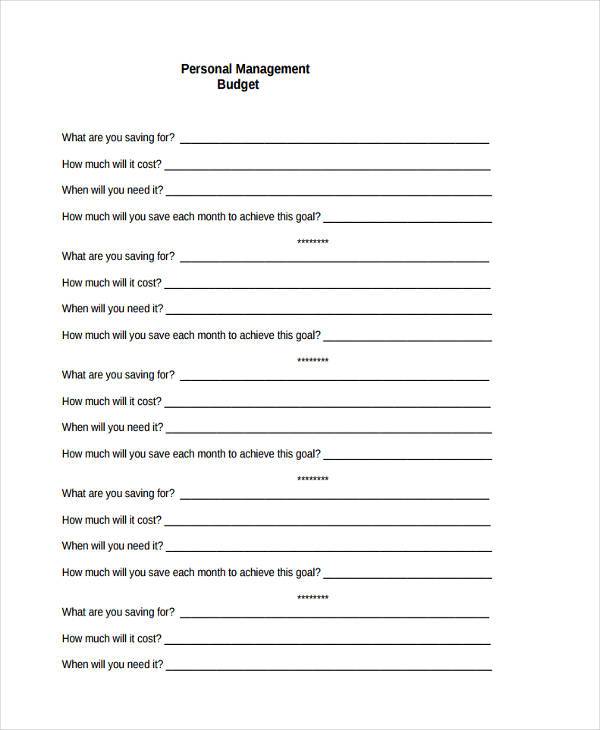

Personal Management Budget Form

Why Is Budgeting Necessary?

Budgeting can be a challenging feat. Although deep down we know how important a budget plan is, many of us have been guilty of mentally scolding ourselves time and time again for failing to come up with one and end up regretting the time and money that we wasted. In this tough economy where job retrenches are common and wallets are tight, creating a budget plan is the first step to help you save yourself from a ton of debt and unplanned, impulsive expenses. If you’re still not convinced, here are some plausible reasons as to why you need a budget asap and why you need to stick to it:

1. Keeps You Motivated

A budget helps you to keep your eye on the prize. Budgeting enables you to have a long-term goal and to focus on working toward that goal. Your goal could be to buy a new car or to spend a month’s vacation in Bali, or even to just buy that new TV you’ve been eyeing for months now. Focus on the prize instead of spending every single shilling you have on nonsense stuff.

Other than helping you to achieve your dreams, having a target goal – especially big and long-term ones – can help you see where your money is going instead of you wondering where all your money went. Long-term goals may be difficult to reach at times, especially when they cost so much and are pretty much more than your actual life savings; however, reminding yourself that you are saving for something that you actually want is a good form of motivation. So, chin up. You can do this.

2. Prevents You From Getting into Debt

According to statistics, the average credit card debt per household is about $15,779 in December of last year. That is about $936 billion dollars in outstanding revolving debt. Thanks to the birth of credit cards, a lot of people have been spending more than what they can actually afford.

Having a budget plan allows you to live within your means because you are able to physically see how much you actually make in a month and you are able to determine beforehand what you can and cannot afford as soon as you have considered your other basic and essential costs, such as utilities and rent.

Although creating a budget can sometimes be disappointing and disheartening – especially if not much money is left right after you include you necessary expenses – however, this disappointment will be bitter yet short compared to the taxing and frustrating feeling of having to always keep up with your debt payments. Credit card debt can sometimes take years and years to pay. Think about it, do you really want to live the rest of your life working only to pay off your debts? Or would you rather create a budget plan, work out your finances, take in the disappointment, and sleep it off?

3. Helps You Save Up for Your Future

Budget plans do not just help you control your expenses or to help you save up for that trip to Bali. It can also lead you to saving up some money to help you live a comfortable life for when you eventually retire. You can invest in retirement funds or remit a portion of your income to your IRA. In time, you will eventually find yourself building a safe and secure nest for retirement.

4. Keeps You Financially Secure

Sometimes you wish that life were as calm and as placid as a lake, but it isn’t. Life can be a roller-coaster ride for some where it is full of unexpected occurrences. In the blink of an eye, you could lose someone you love, or you could discover that you need medical attention, or any type of incident that could lead to financial turmoil.

Having a budget plan allows you to set up an emergency fund that consists of at least 6 months’ to a years’ worth of your income or your living expenses. This emergency fund can serve as your threshold to last you for about that long when an emergency happens, such as a layoff or a sudden death in the family. Emergency funds are important to ensure you that you do not get into a lot of debt during or after a life crisis. You can slowly build up your emergency fund by setting aside a portion of your income for savings.

5. Keeps You Aware of Unnecessary Expenses

Budget planning makes you physically see how much you actually spend in a month and where you spend it on. This can help you spot unnecessary expenditures such as buying 3 bags in one month, subscribing to a cable plan when you barely stay at home, or eating out when you have tons of food in the refrigerator.

6. Lets You Have a Good Night’s Sleep

Financial turmoil can lead to long nights of you mentally calculating how to pay off your debts or where you’re going to get the cash to pay your electricity bills. Having a budget plan helps you control your finances instead of having your finances control you. Don’t lose sleep over unnecessary financial problems, make sure you are able to properly budget your money to pay for what you need to pay for while having enough left to buy the things that you want.

Project Budget Form

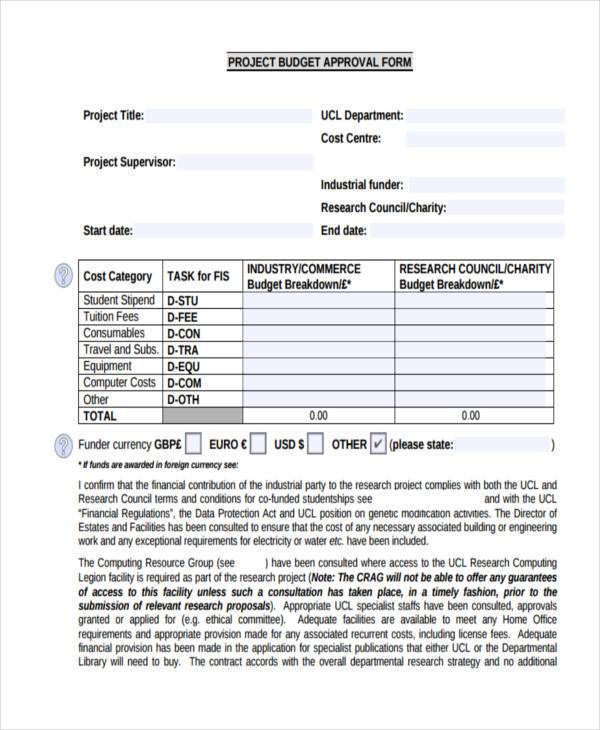

Project Budget Approval Form

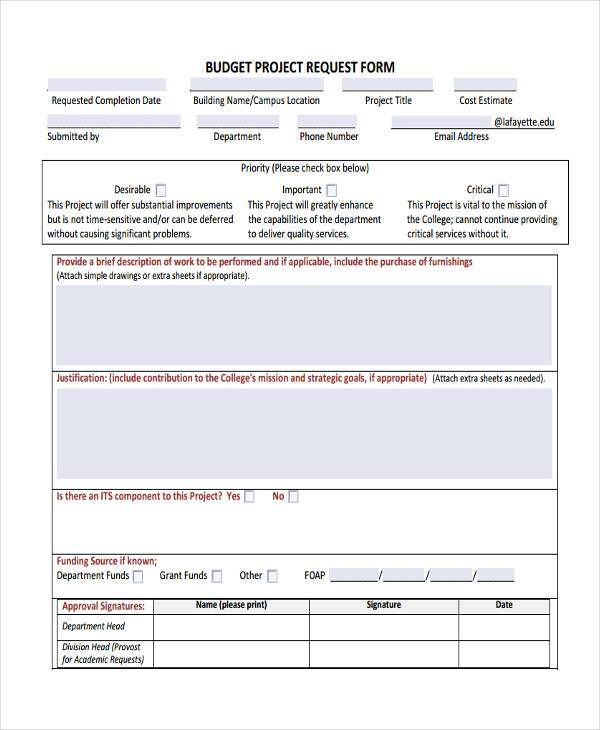

Project Budget Request Form Free

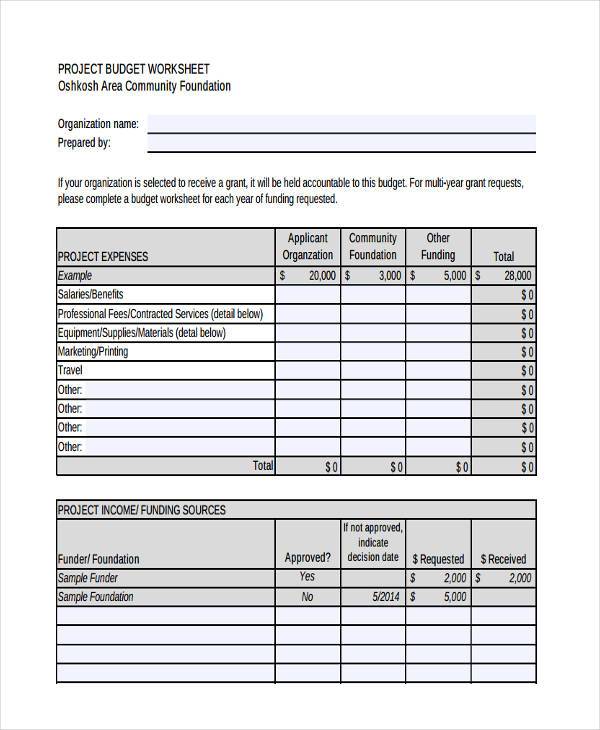

Project Budget Worksheet Form

Child Care Budget Form

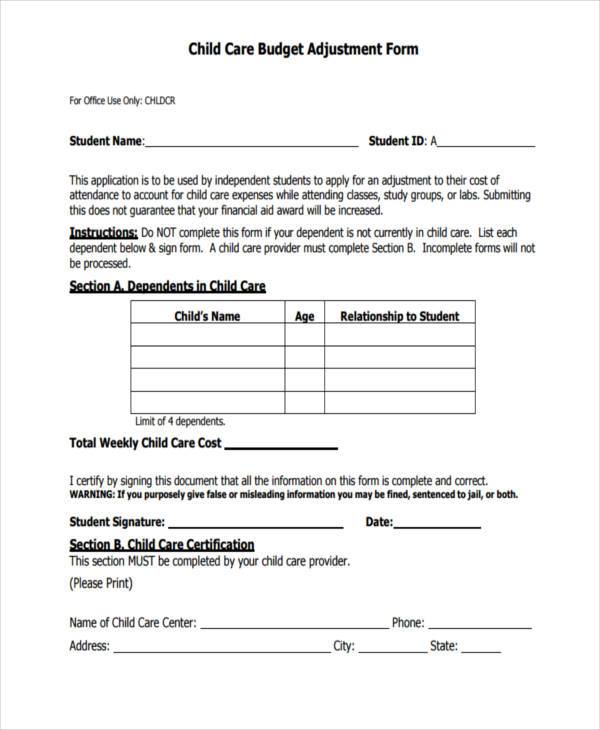

Child Care Budget Adjustment Form

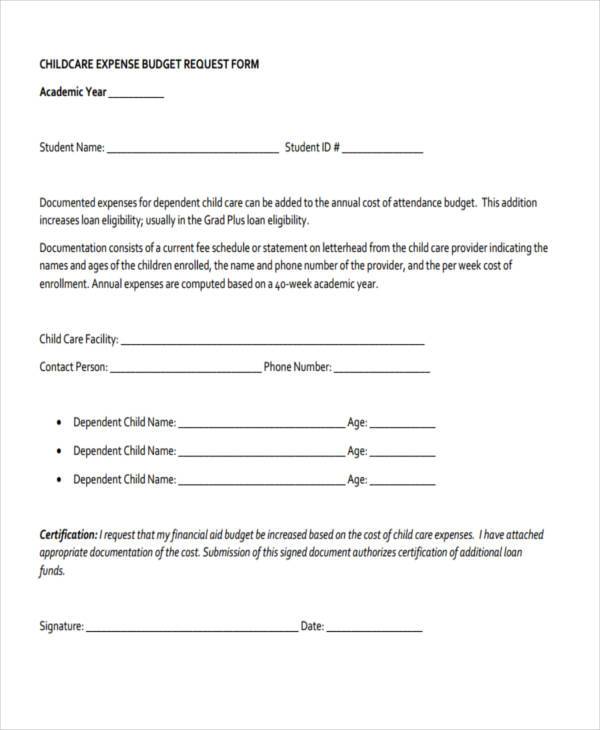

Child Care Expense Budget Request Form

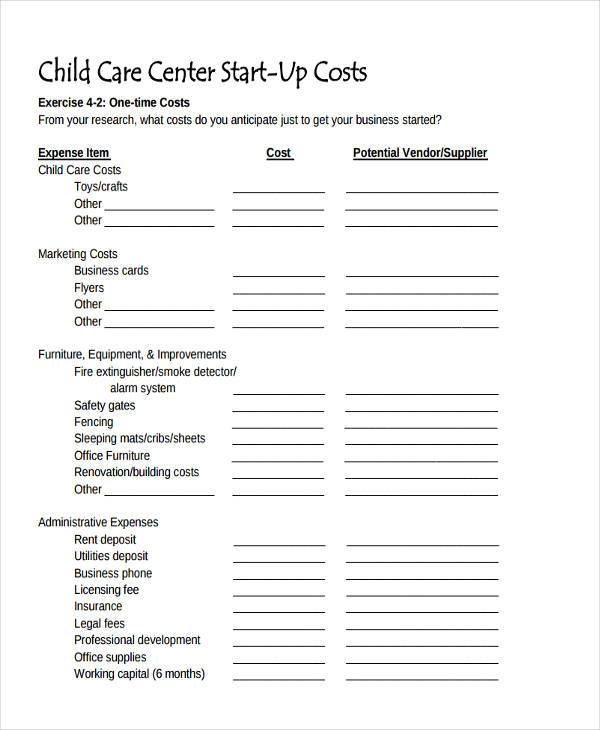

Child Care Center Start-Up Cost Form

Marketing Budget Form

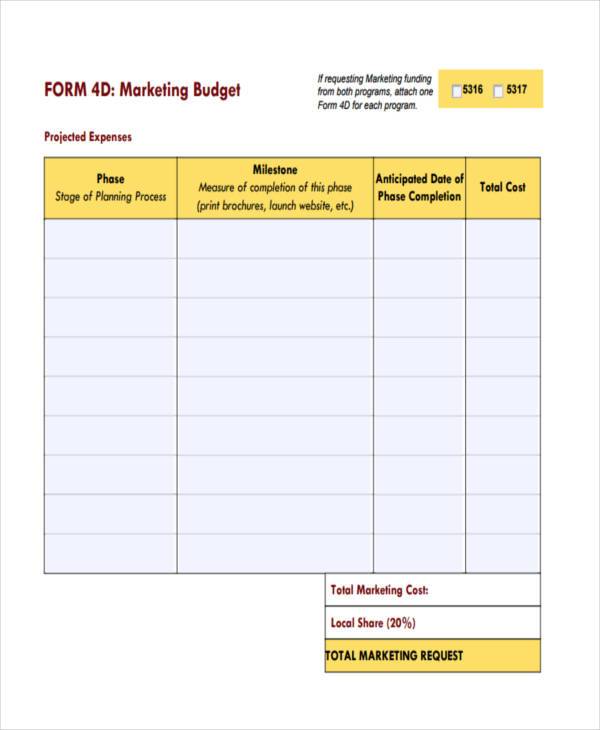

Marketing Budget Form Free

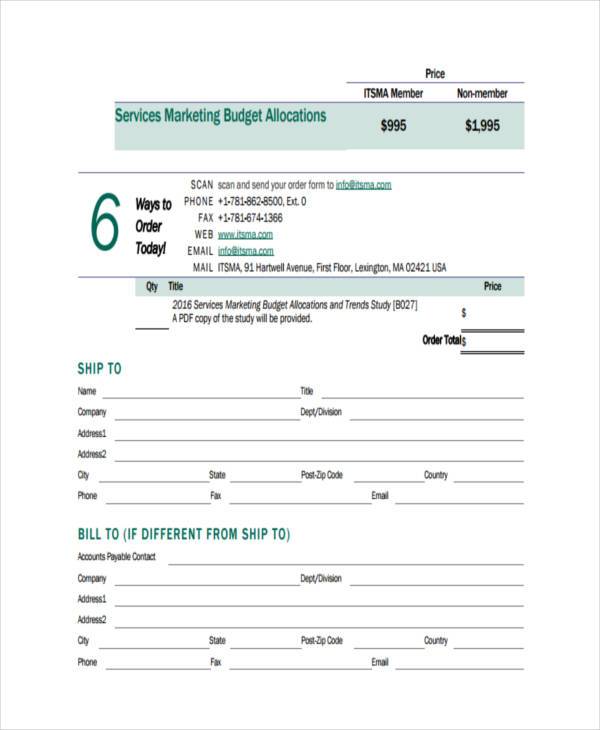

Marketing Budget Allocation Form

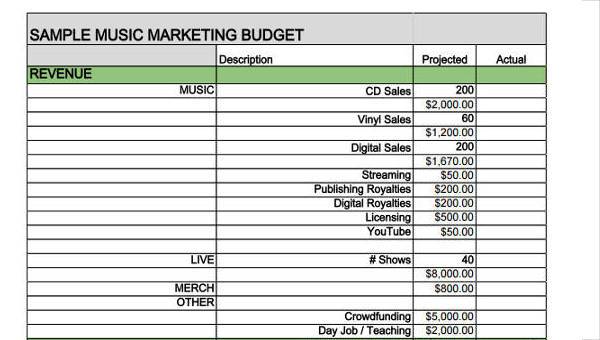

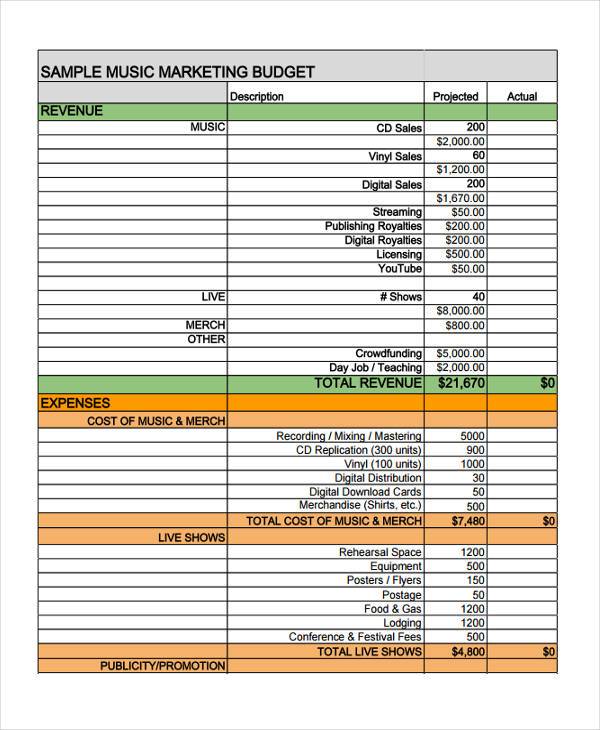

Music Marketing Budget Form

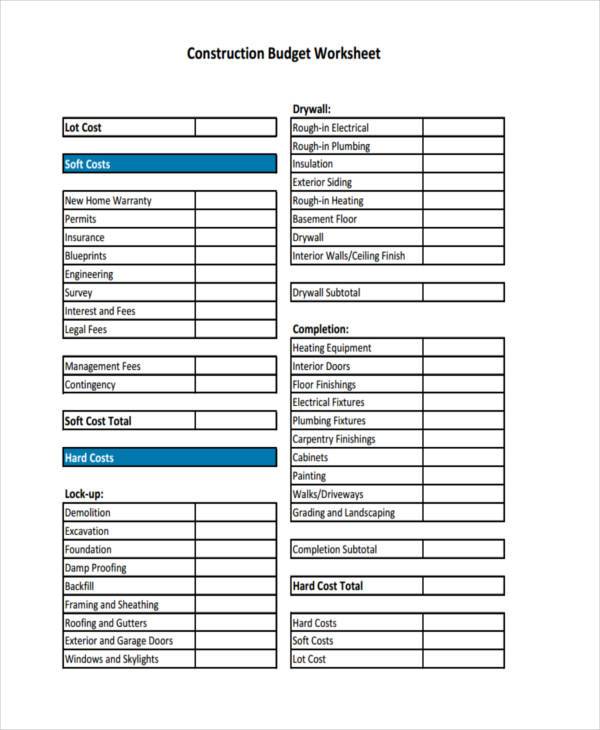

Construction Budget Form

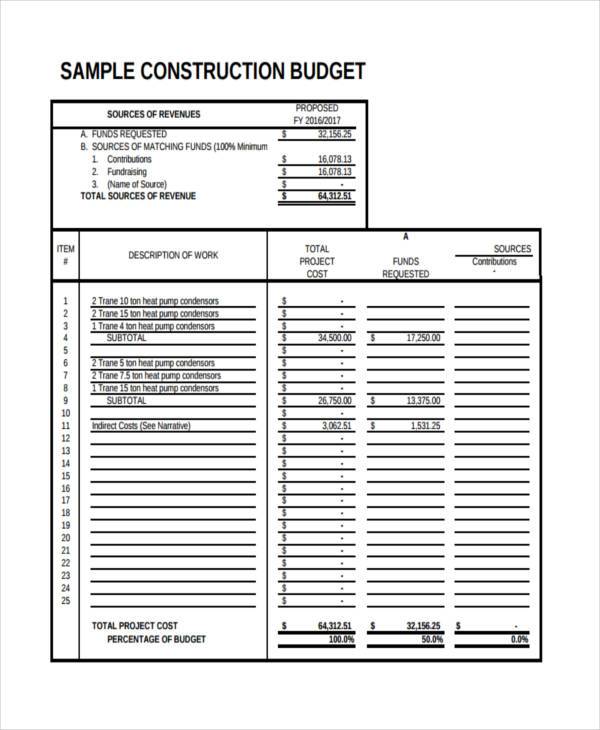

Sample Construction Budget Form

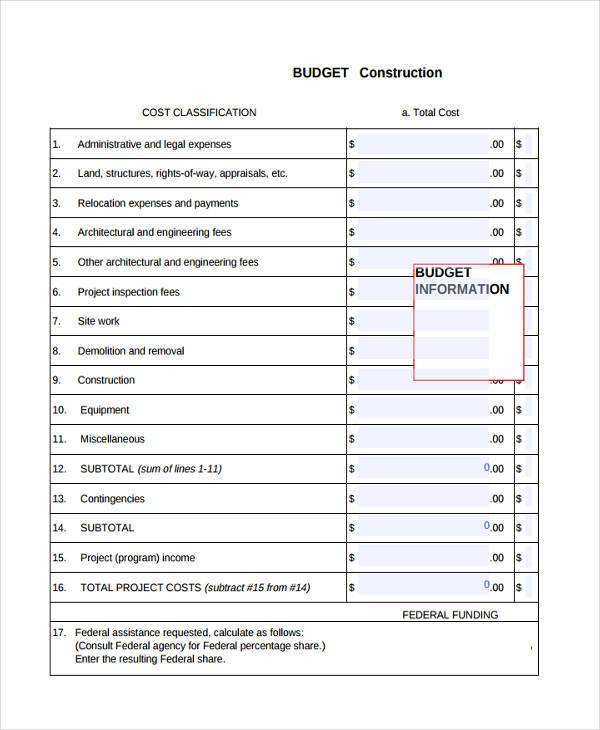

Basic Construction Budget Form

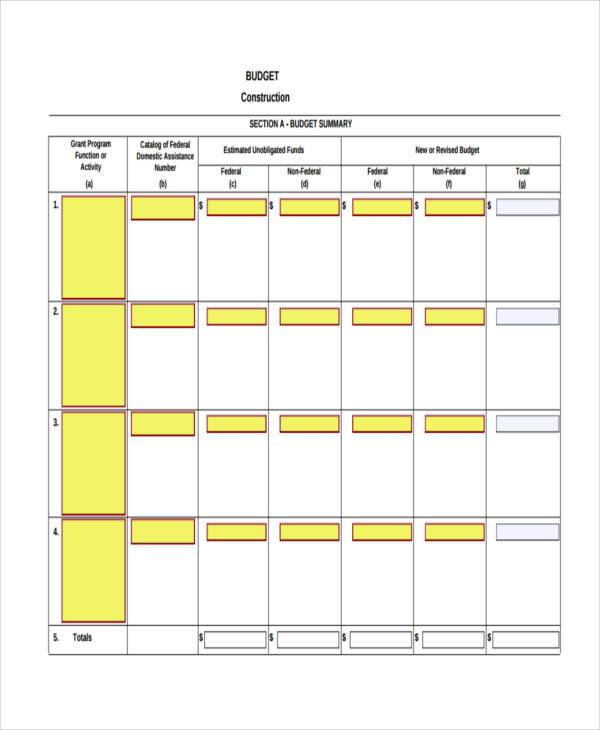

Free Construction Budget Form Example

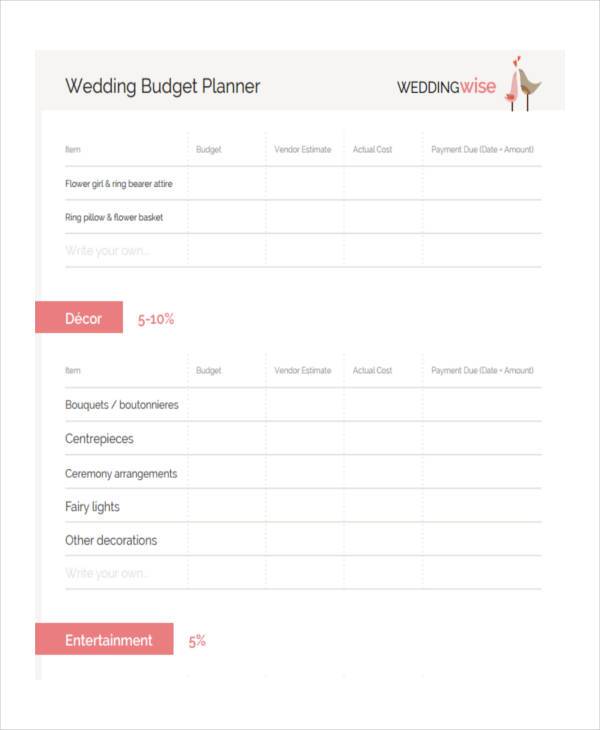

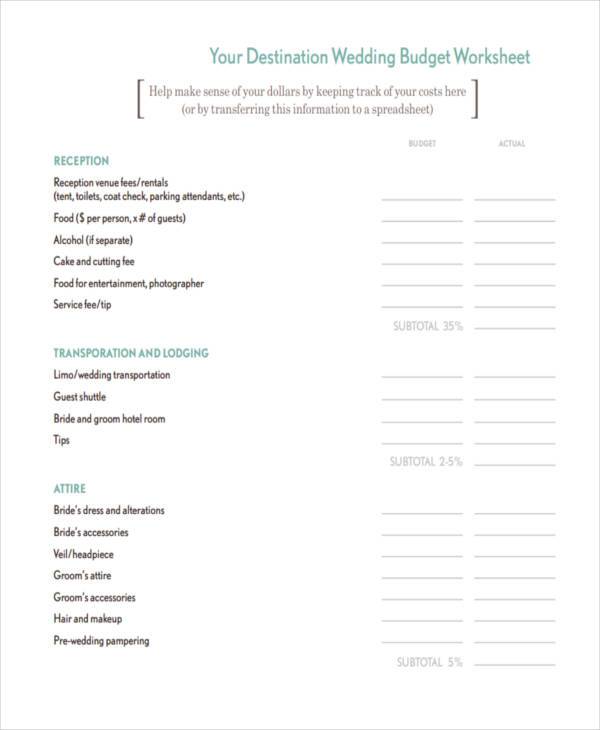

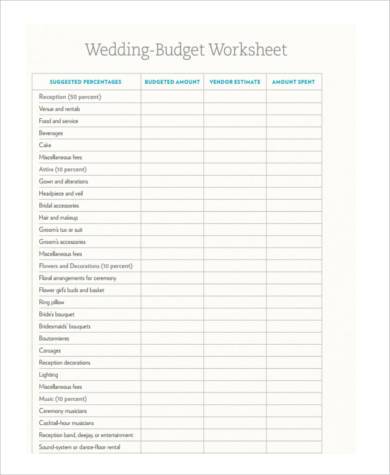

Wedding Budget Form Free

Wedding Planning Budget Form

Destination Wedding Budget Form

Wedding Budget Worksheet Form

Personal Budget Form Free

Basic Personal Budget Form

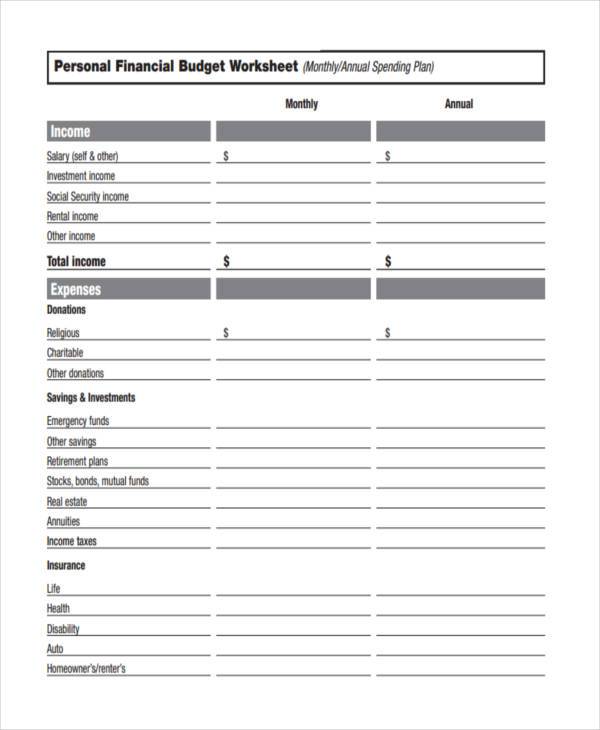

Personal Financial Budget Form

Personal Budget Form Sample

How Important Is Budgeting in Business?

Budget planning is not only exclusive for personal use or for household management. This also rings true for entrepreneurs and businesses in order for their business to thrive. Here’s why:

1. Hones Your Forecasting Abilities

If you are a manager, you might want to get all the practice that you need in order to be skilled at budgeting. Budgets, when done appropriately, are extremely helpful in calibrating and perfecting your ability to predict and handle a business. Budgeting is also often used by CEOs to test whether managers can be relied upon.

2. Aids in Raising Funds

Some investment terms often require an annual budget to be provided by the management to investors or to the board. Being able to establish a practice in your company that keeps a record of the results of the company’s budget can help entrepreneurs meet and exceed the expectations of their investors.

3. Prevents You from Losing Money

Having a budget plan in business allows you to forecast your expenses and your revenue. This is especially true for startup businesses that potentially fluctuate between a conservative goal and an aggressive dream state.

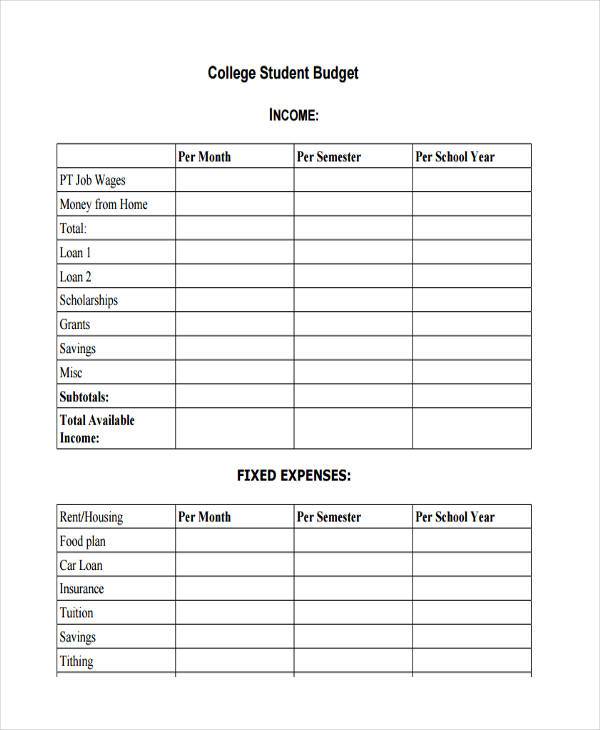

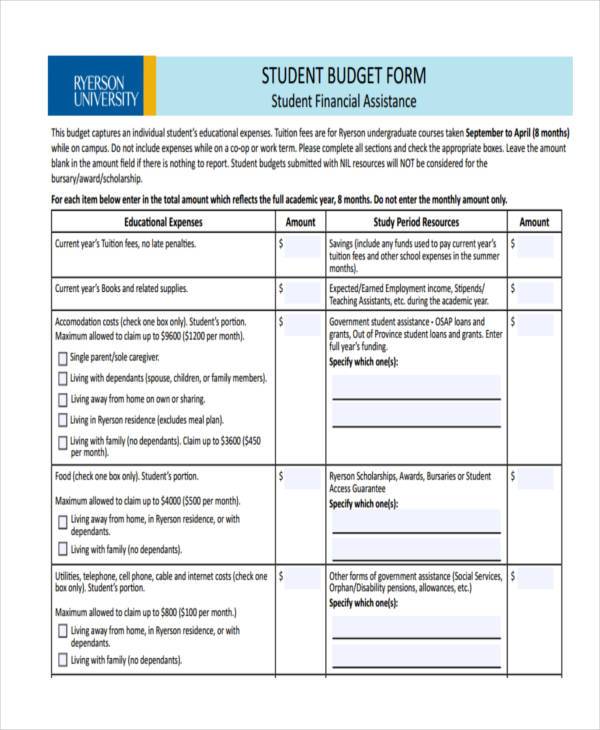

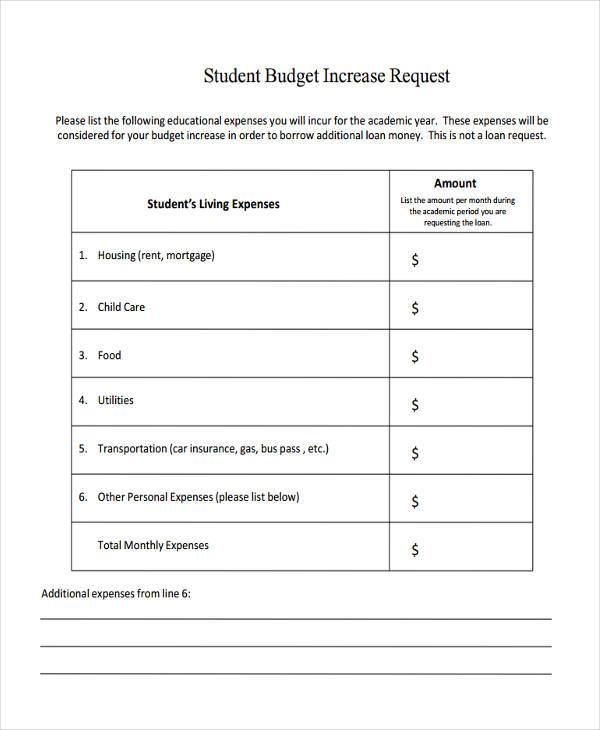

Student Budget Form

College Student Budget Form Free

Student Budget Form Sample

Student Budget Request Form

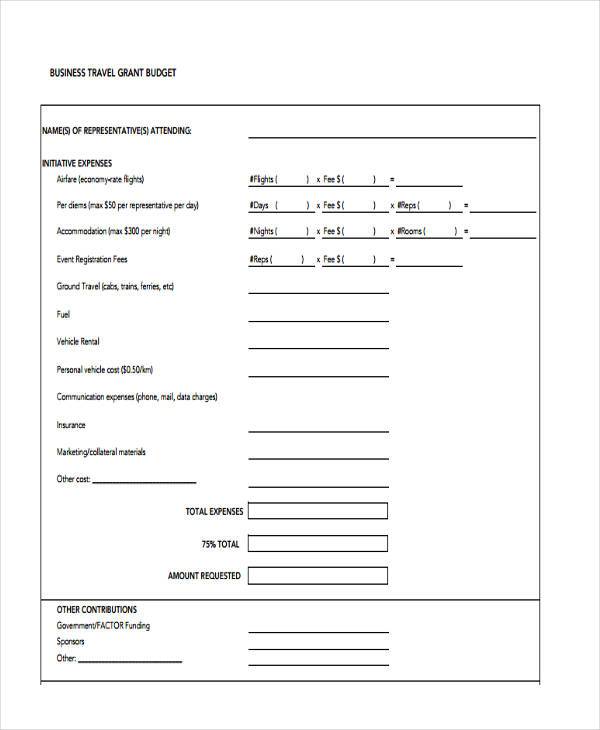

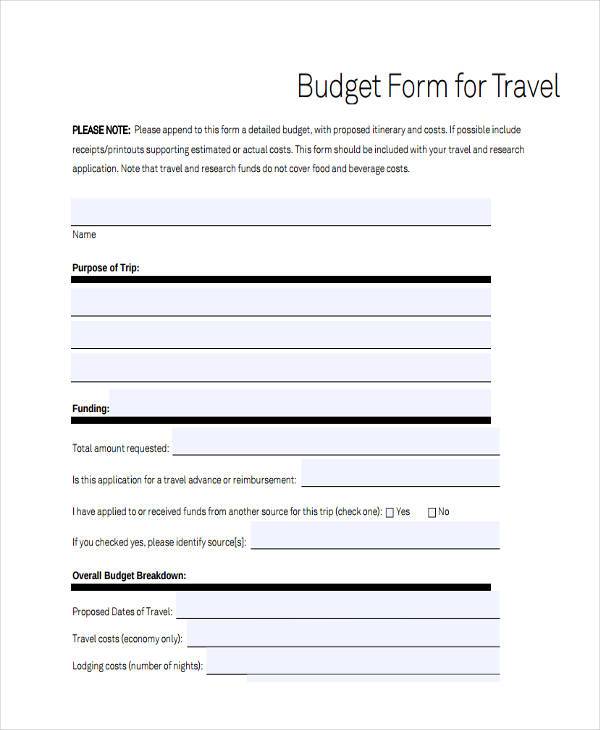

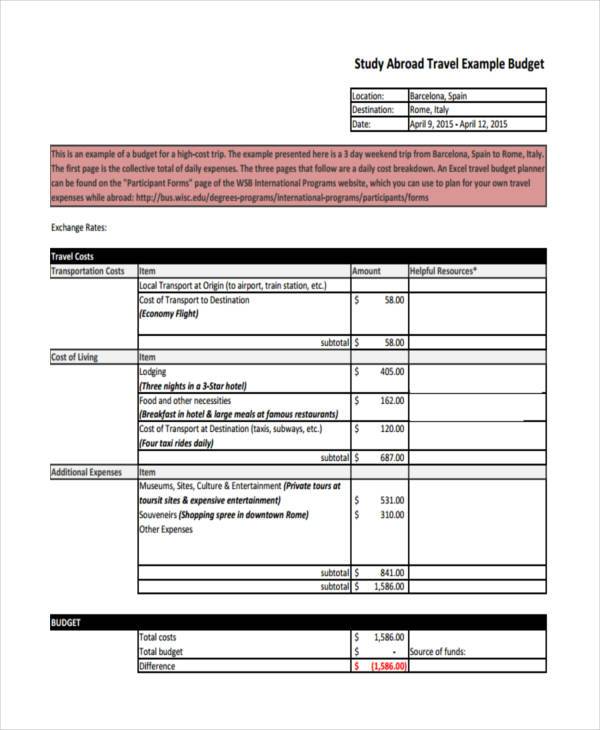

Travel Budget Form

Business Travel Grant Budget Form

Free Travel Budget Form

Travel Budget Form Example

Proposal Budget Form

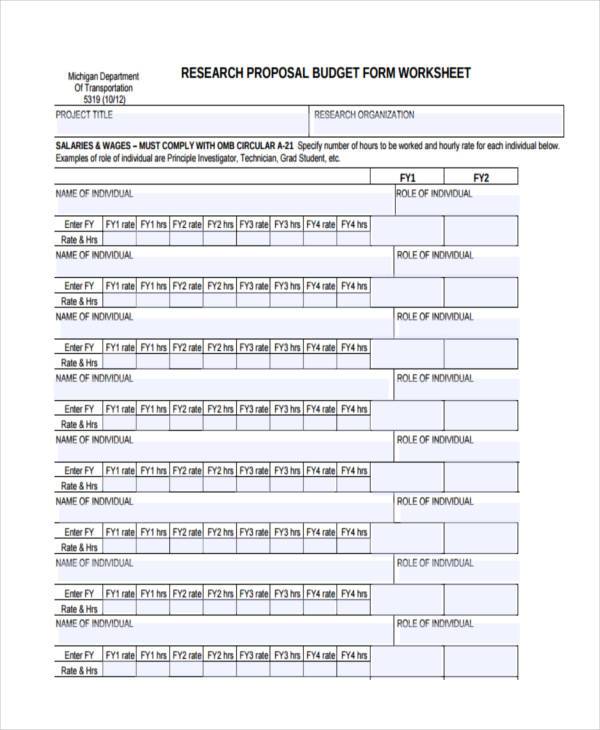

Research Proposal Budget Form

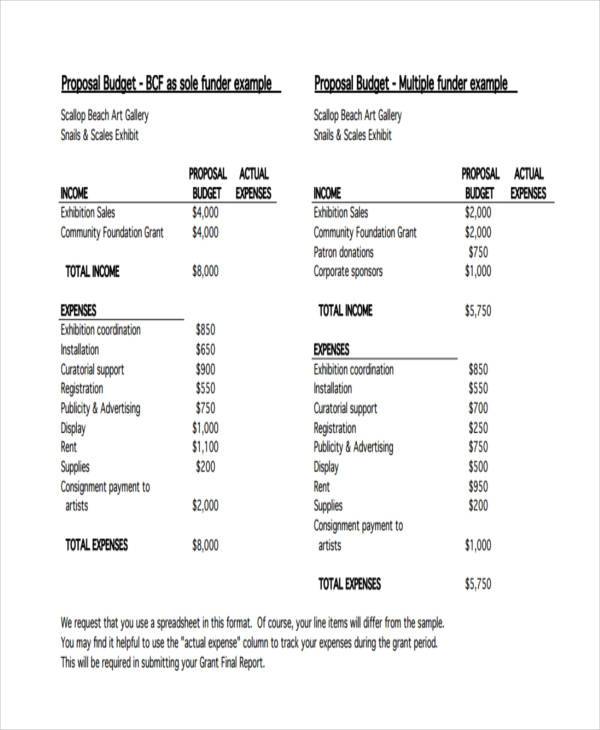

Basic Proposal Budget Form

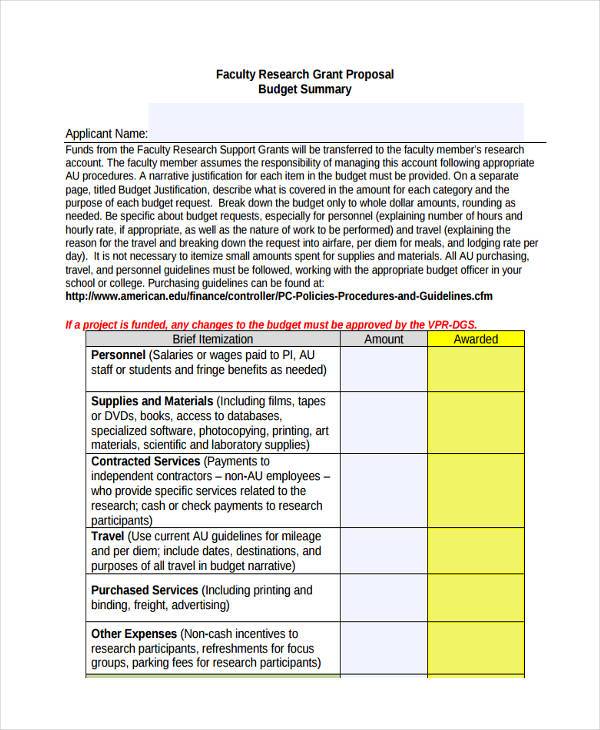

Faculty Research Proposal Budget Summary Form

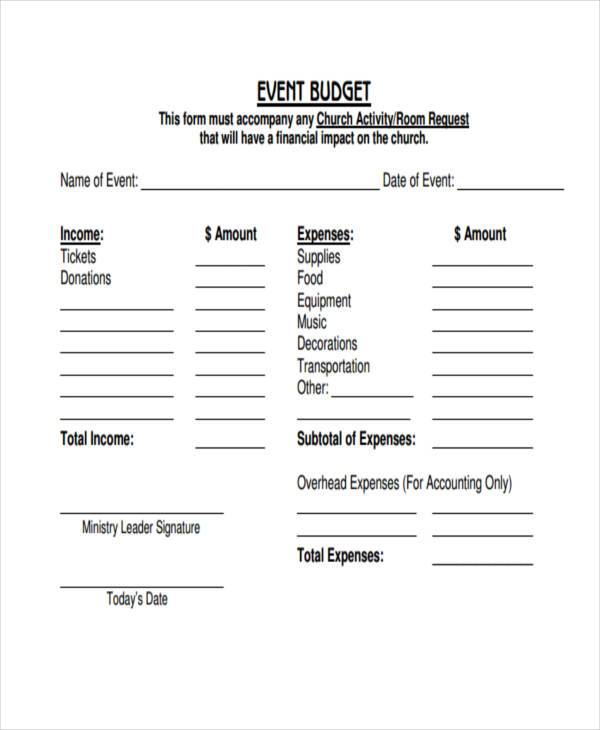

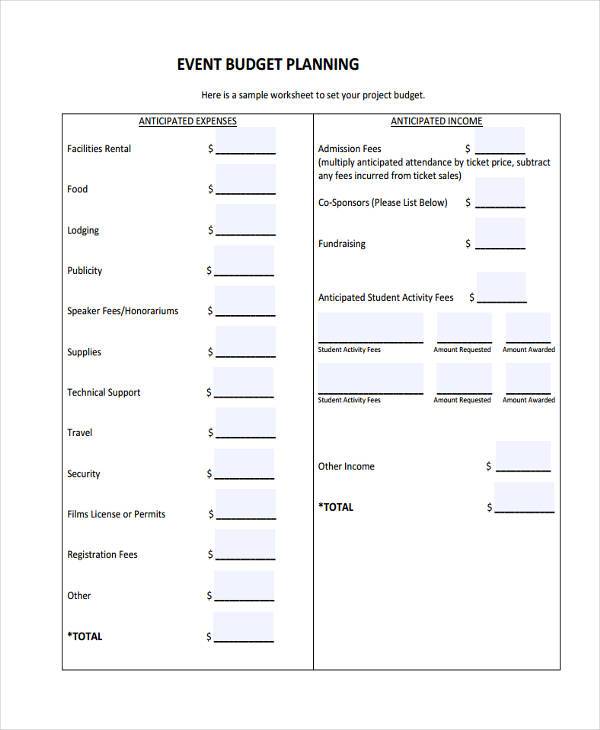

Event Budget Form

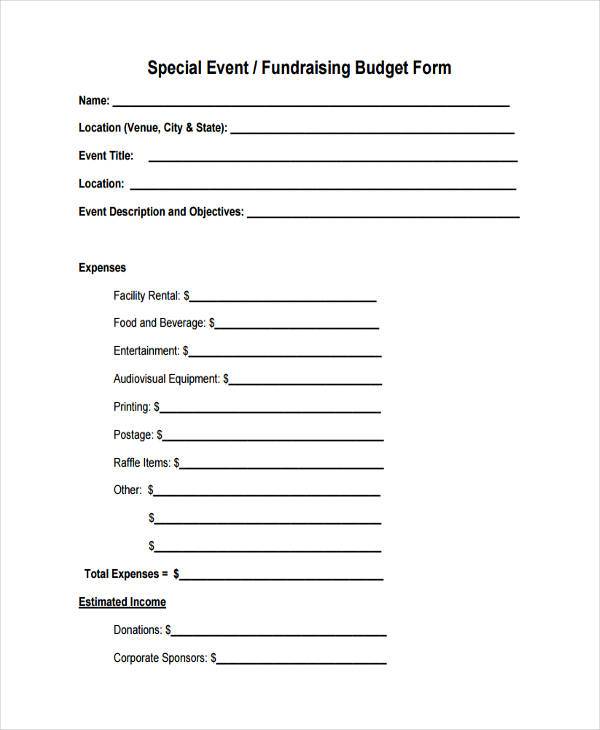

Fundraising Event Budget Form

Church Event Budget Form

Event Planning Budget Form

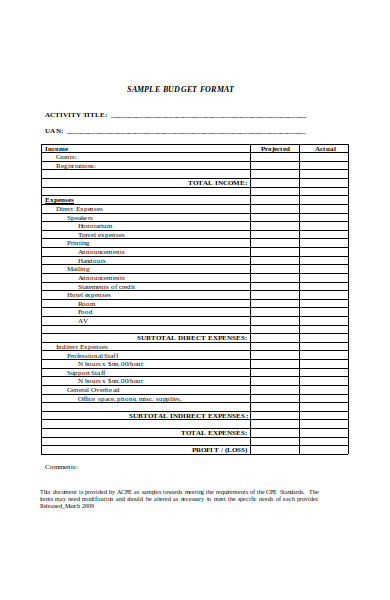

Budget Form Format in MS Word

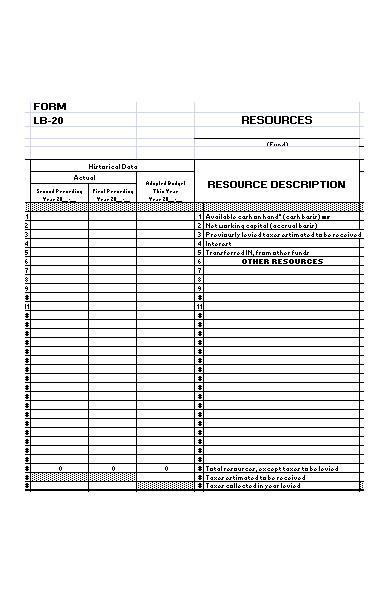

Local Budget Form

How Do You Make a Budget?

A budget is your road map to financial success, and as such, here are a few secrets to helping you plan your finances successfully:

1. Track Your Expenses

The best way to create a budget plan is to use a tracker to track your expenses. You can print out an online budget form from your computer so that you can record each and every little thing you purchase. You can download a budget form from our free budget form templates.

2. Pay Yourself First

And, no, we do not mean heading out to the salon every payday or going on a shopping spree. By pay, we mean investing in your life savings as soon as you receive your income. Allocate at least 10% of your earnings toward your savings. If possible, use direct deposit where you can automatically transfer the funds from your payroll account to your personal account. This helps you instantly separate money for your savings without having to consciously think about your money piling up on your savings account.

3. Identify Immediate Expenses

As soon as you’ve allocated at least 10% of your salary to savings, the other 35% of it should be allocated for immediate and necessary expenses such as utilities and loans. These are your priority expenses that should come on top of your budget plan list after savings and before any discretionary expenses. If you have extra after all of these, then you can spend it on what you want to buy such as eating out, clothes, entertainment, or vacation.

4. Steer Clear of Plastic

Stick to your budget plan and try your best to steer clear of using your credit card. This makes it all too easy to spend way beyond what you initially planned to spend and could lure you into a miasma of debt. Pay with cash as much as possible. Even debit cards sometimes have charging fees that could affect your budget. Take the time to withdraw enough money for what you need to spend on.

5. Prioritize Expensive Debts

Figure out a way for you to pay off debts or credit card payments with high interest rates. If you have multiple credit cards, prioritize those with high interest rates, while continuing on making minimum payments on the others. The longer it takes for you to pay off these expensive debts, the longer you will be denied from having to use that money instead on other expenses, such as for savings or discretionary expenses.

6. Live within Your Means

The biggest and the most crucial way to avoid getting involved with financial frustrations is to learn how to live within your means. A lot of financial experts cannot stress this enough. Living within your means does not mean living without your usual commodities. There are a lot of ways to cut back on your lifestyle expenses without having to lose your style. You can settle for an average-cost car, for example, instead of having to buy a luxury car. Or you can choose cheaper and generic brands for clothes instead of having to buy designer labels.

Sometimes we tend to buy what we actually do not need because we feel pressured to keep up with trends or with other people. However, what you don’t know is that they may be living lavishly yet they are drowning in a pile of debt. At the end of the day, a dress is just a dress and a car is just a car – no matter what brand it is. Of course, you also need to make sure that what you purchase is the best deal there is. You do not want to be scrimping on a car by buying your neighbor’s beat-up, secondhand auto only to have it constantly fixed.

Budgeting is an important way of life. It helps people attain financial security, avoid debt, and start up a life savings account. Do not trudge through your financial woes without a map in tow. Be sure to download a budget form and have it printed out so that you can list down your expenses and to determine if it equates to the amount of money that you earn. Download our sample budget forms and other forms here.

Related Posts

-

Restaurant Budget Form

-

Church Budget Form

-

Line Item Budget Form

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel

-

FREE 6+ Sample Family Budget Forms in MS Word | PDF

-

FREE 8+ Sample Business Budget Forms in PDF | MS Word