Budgeting is the act of creating a plan to spend your money and allows you to predetermine if the money you are expecting to come in is sufficient enough for your plan or budget. Implementing a Budget Plan allows you to have enough money for the things you need and will help you keep out of debt or work your way out of it.

Creating a Budget Plan and following it to the letter can be quite a challenge. It is never easy to control one’s self from spending money, especially when temptations are just around the corner. Our Budget Forms and Sample Budget Forms are easily accessible and can be easily printed out for your convenience.

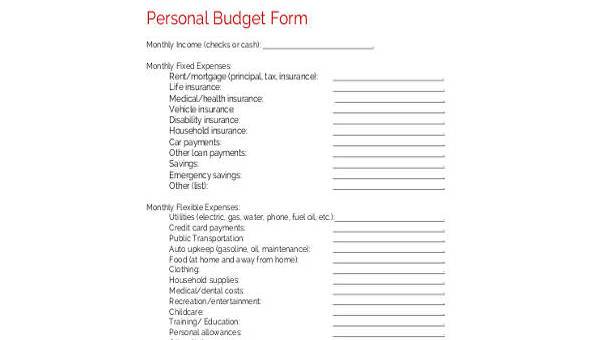

Blank Personal Budget Form

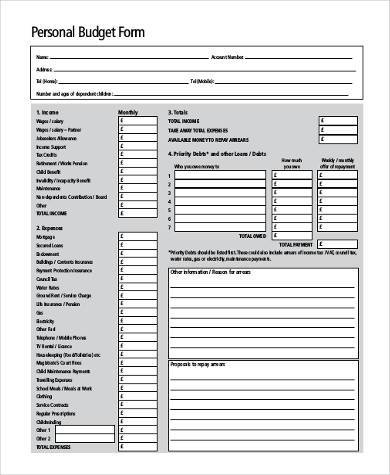

Printable Personal Budget Form

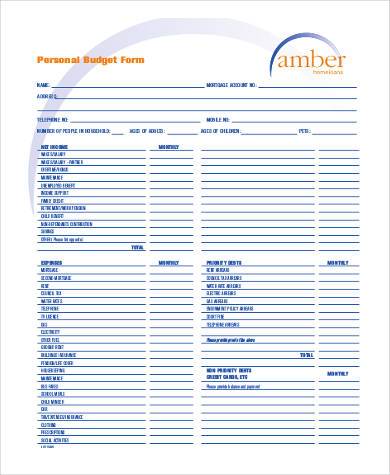

Monthly Personal Budget Form

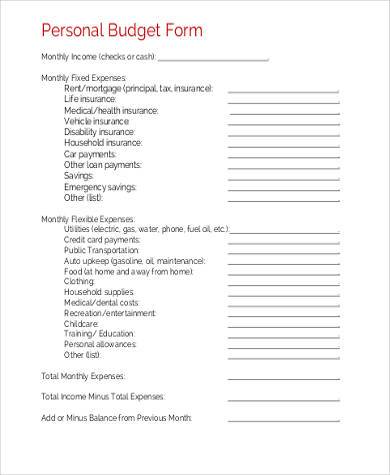

Free Personal Budget Form

Personal Budget Form in Word

The Benefits of Budgeting

Enables You to Control Your Money

Creating a budget plan allows you to control your money, saves you from feeling anxious or stressed about the sudden lack of funds, and helps you prioritize your finances. By creating a plan, you can avoid spending on small and unnecessary things and focus on your bigger goals, such as saving for a new TV set.

Lets You Know Where Your Money Goes

Have you ever been in that situation where you’ve lost all your income in a span of 3 days and you cannot even remember where or how you spent it? Budget Plans help to make you aware of where your cash is flowing, how to allocate your funds, which items cost so much, and which ones you need to cut back on.

Helps You Determine if You Are Capable of Taking More Debt

Having a Budget Plan allows you to determine if you can afford to have a debt and how much debt load you can realistically afford without having to be stressed about stretching your finances.

Personal Budget Form in PDF

Personal Financial Budget Form

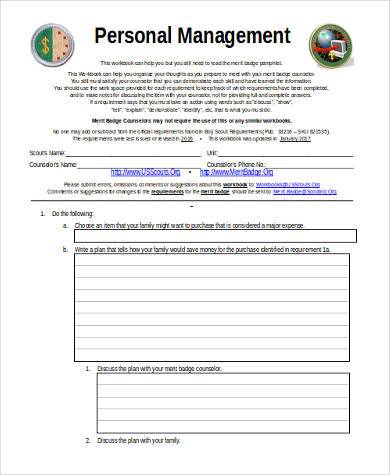

Personal Management Budget Form

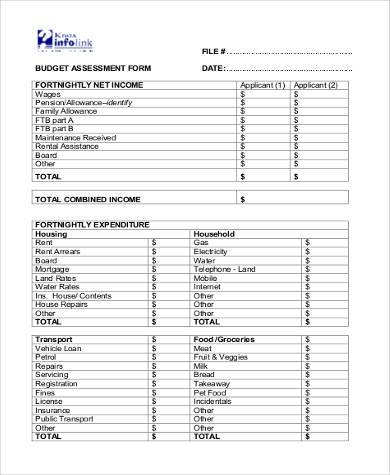

Personal Budget Assessment Form

How to Make an Effective Budget Plan

Track Your Incoming and Outgoing Cash

By using our Sample Budget Forms, keep track of the amount of money that comes in and the amount you spend every month. Tracking your receipts from previous purchases will help you make an average cost of the money you put out each month and determine which items cost too much and if you can cut back on them.

Categorize Your Expenses

Organize your expenses by putting them into categories. One category should be the expenses that are important or the items that are essential while the other one contains extra expenses or items that you do not necessarily need unless you have extra cash.

Be Flexible with Extra Expenses

Look through your list of extra expenses and mark those that you do not immediately need to purchase or pay immediately.

Add Up the Total Amount for Both Categories

Add up the total cost of expenses for both extra and essential expenses. Get the separate total for your extras and a separate total for your essentials.

Take the Total Amount of the Cost for Essentials from Your Income

Deduct the total amount of essential expenses from your total income and if you still have extra, see if it is able to cover for the expenses listed in your extra expenses.

Learn to Cut Back

If you still have extra money left after covering both essential and extra expenses, then good for you! You can use that extra money to add to your savings. However, if covering your essential costs alone already gives you a negative amount, then look into your list again and see where you can cut back.

One necessary point in budgeting is to live within your means. If your current salary does not give you enough leeway to buy a new car, then don’t. When people live beyond their means, they usually end up in debt.

Related Posts

-

FREE 9+ Project Budget Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 6+ Sample Family Budget Forms in MS Word | PDF

-

FREE 8+ Sample Business Budget Forms in PDF | MS Word

-

Restaurant Budget Form

-

Church Budget Form

-

Line Item Budget Form