An Annual Budget is a budget plan created to cover a 12-month period and outlines both expected income and expenditures to be garnered or paid over the next year. Annual Budget Plans may be conducted by individuals, corporations, government agencies, and other organizations as a means to control cost and limit expenses.

Budget Plans, regardless of the time period coverage, have to be accurate and realistic enough in order to be implemented. A common problem faced by people when creating a Budget Plan is that these tend to be too technical, making it difficult for others to follow. When making a Budget Plan, make sure that it properly coincides with the amount of income and outlines all expenses with the accurate amount. Our Budget Forms and Sample Budget Forms provide accessibility and flexibility to help you manage your budget easily.

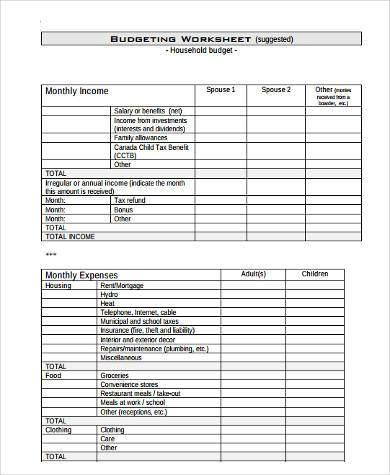

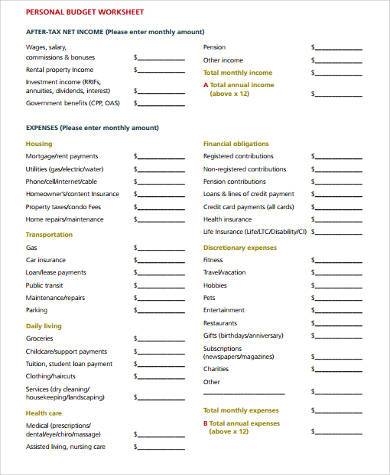

Annual Household Budget Form

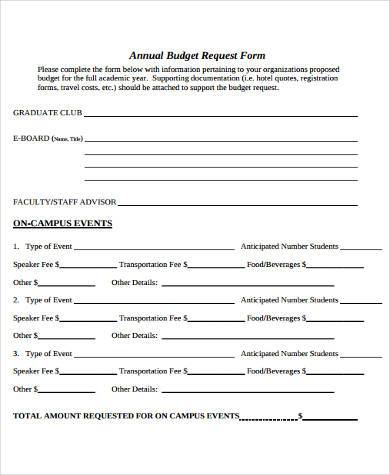

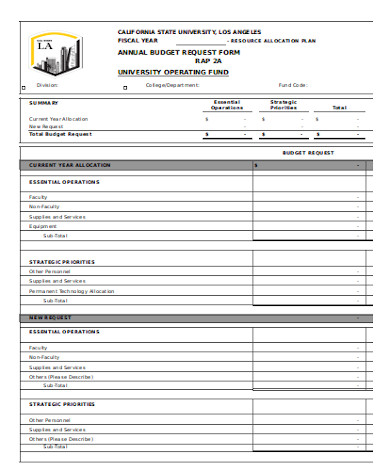

Annual Budget Request Form

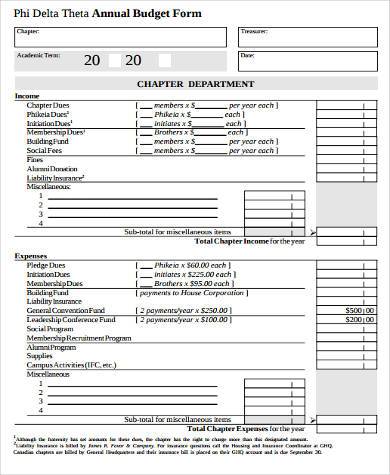

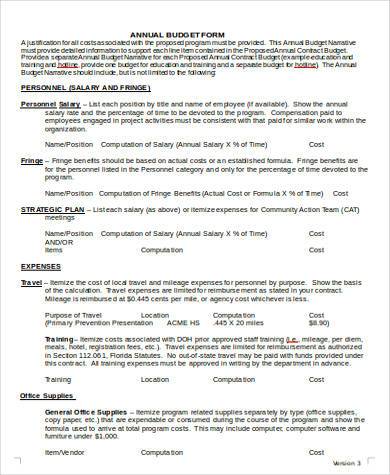

Annual Budget Form in PDF

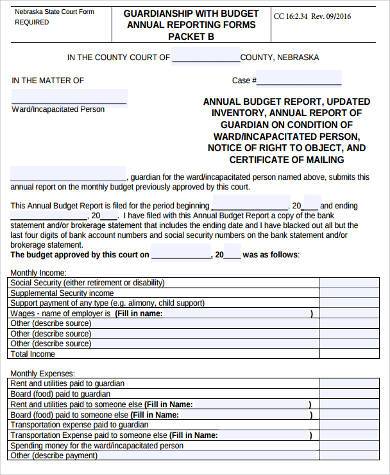

Annual Budget Reporting Form

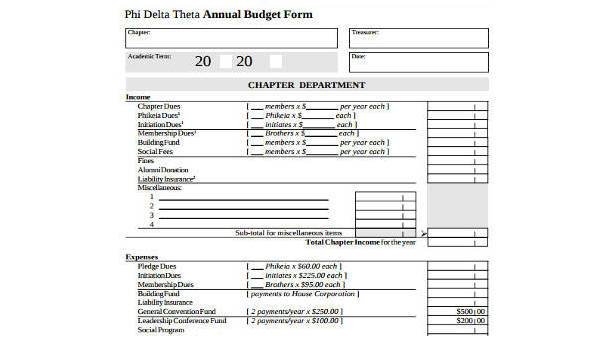

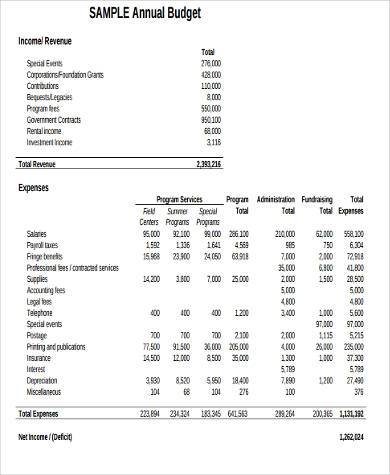

Annual Budget Form Example

The How-tos to Yearly Planning

Budgeting can be quite a challenge for a majority of people. Being able to properly determine the amount of money coming in, the amount of money coming out, and sticking to your plan can be a difficult feat. Below are a few tricks to easy Budget Planning.

Go Past Usual Expenses

One way to properly forecast your income and expenditures over the next 12 moths is to determine how much you actually spent previously and which items you essentially need to spend on. Gathering past credit card statements, utility bills, check stubs, and receipts can help you determine an average as to how much you actually spend in a month.

Determining Your Expected Income

Income is generally the money you expect to receive or earn in the next 12 months. Income can come in varying forms, such as wages, tips, bonuses, rent or royalties, interests and dividends, alimony, child support, salary, retirement income, pension, benefits, entitlements, etc. For most people, determining the amount of expected income is easier than determining expenses. When your income is unpredictable or varies according to a project or through commission, the rule of thumb is to underestimate your amount of receivables rather than overestimating it only to end up disappointed.

Annual Budget Form in Word Format

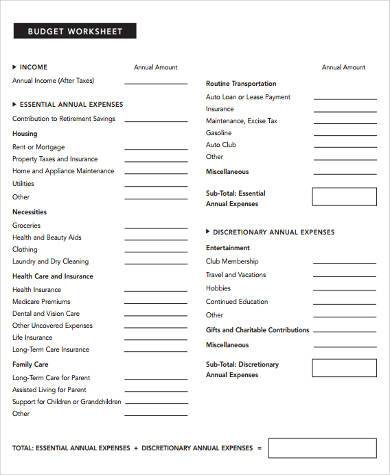

Annual Budget Worksheet Form

Personal Annual Budget Form

Simple Personal Annual Budget Form

General Annual Budget Form

Estimating Expenses

To be able to plot your annual Budget Plan, you will have to accurately determine your projected expenses. This can be quite a challenging task, but is not entirely impossible. Determining your fixed expenses should be easy. Fixed expenses are those that you essentially spend on each month, such as your rent payments, loans, mortgage, credit card bills, utility, car loans, etc. Variable expenses, on the other hand, are those that are a little tricky to determine. Variable expenses may eventually be a regular expense or a temporary expense, such as gasoline and electricity bills. These types of expenses usually vary from season to season.

Saving Discretionary Expenses for Last

Discretionary expenses are expenses that you do not necessarily need but are more of wants, such as a new dress, trips to the salon, eating out, etc. Your discretionary expenses should be the last in your priority list when you draft your Budget Plan. If you still have some money left over after you have subtracted your fixed ad variable expenses from your expected income, then the money left over can be put into savings or used for discretionary spending.

Related Posts

-

FREE 9+ Project Budget Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel

-

FREE 6+ Sample Family Budget Forms in MS Word | PDF

-

FREE 8+ Sample Business Budget Forms in PDF | MS Word

-

Restaurant Budget Form

-

Church Budget Form

-

Line Item Budget Form