Confirming, conventional, secured, and open-ended are some of the known types of loans that are offered by various financial aid providers. With this, the clients will need to complete different documents and legal forms for them to request the loan application.

The providers also use forms for recording their client’s general information and for determining if a client is responsible enough or valid to take a loan. One kind of document that financial providers use is known as a loan application review form.

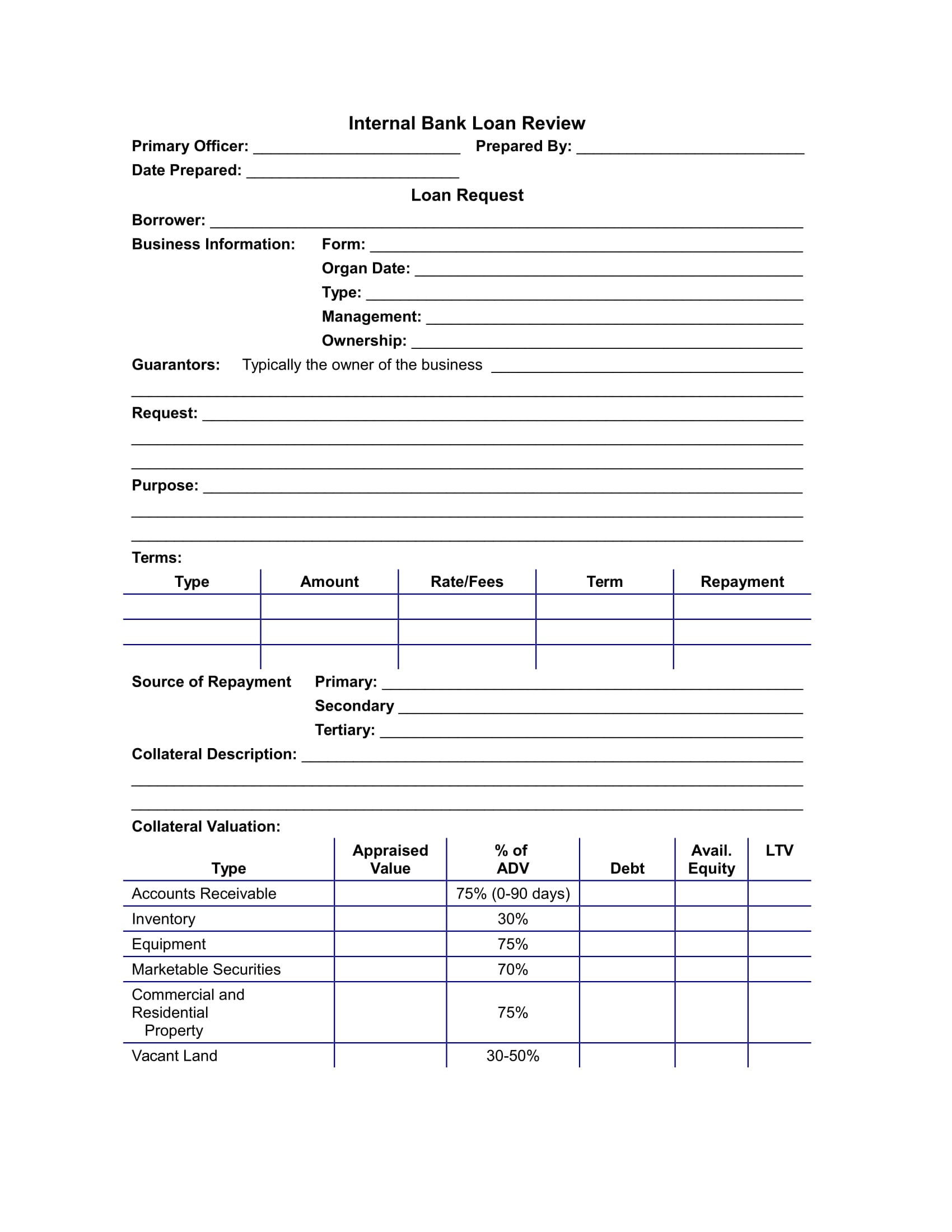

Bank Loan Request Review Form

What Is a Loan Application Review Form?

A loan application review form is the document that financial aid and loan providers use for investigating their loan applicants’ entries. The form contains the names of the people or authorized personnel who collected the personal information of the client for the review process. Additionally, the document will be sent out to the investigator of the financial aid provider agency who will go through the loan and work history of the client.

How to Complete a Loan Application Review Form

Completing any type of document is easy especially with the use of forms that provide sufficient information about the client. Nonetheless, the steps below will aid you, as the user of the form, to complete and fulfill the areas of a loan application review forms sample:

1. Gather the data of the client.

As the authorized personnel of the financial provider’s agency, you must assure that you have all the documents that are associated with the client’s application. This includes the client’s loan application form, the photocopy of his identification cards, and other essential documents that will prove the client’s background.

2. Identify yourselves.

State your name of the form along with the name of the person or officer in your company who have presented you the client’s documents. This is essential in order to acknowledge who will be held responsible for events of loss or misplaced paperwork.

3. Fill in the business-related fields.

These fields and sections will demand the client’s business information which includes the type and name of the client’s business organization.

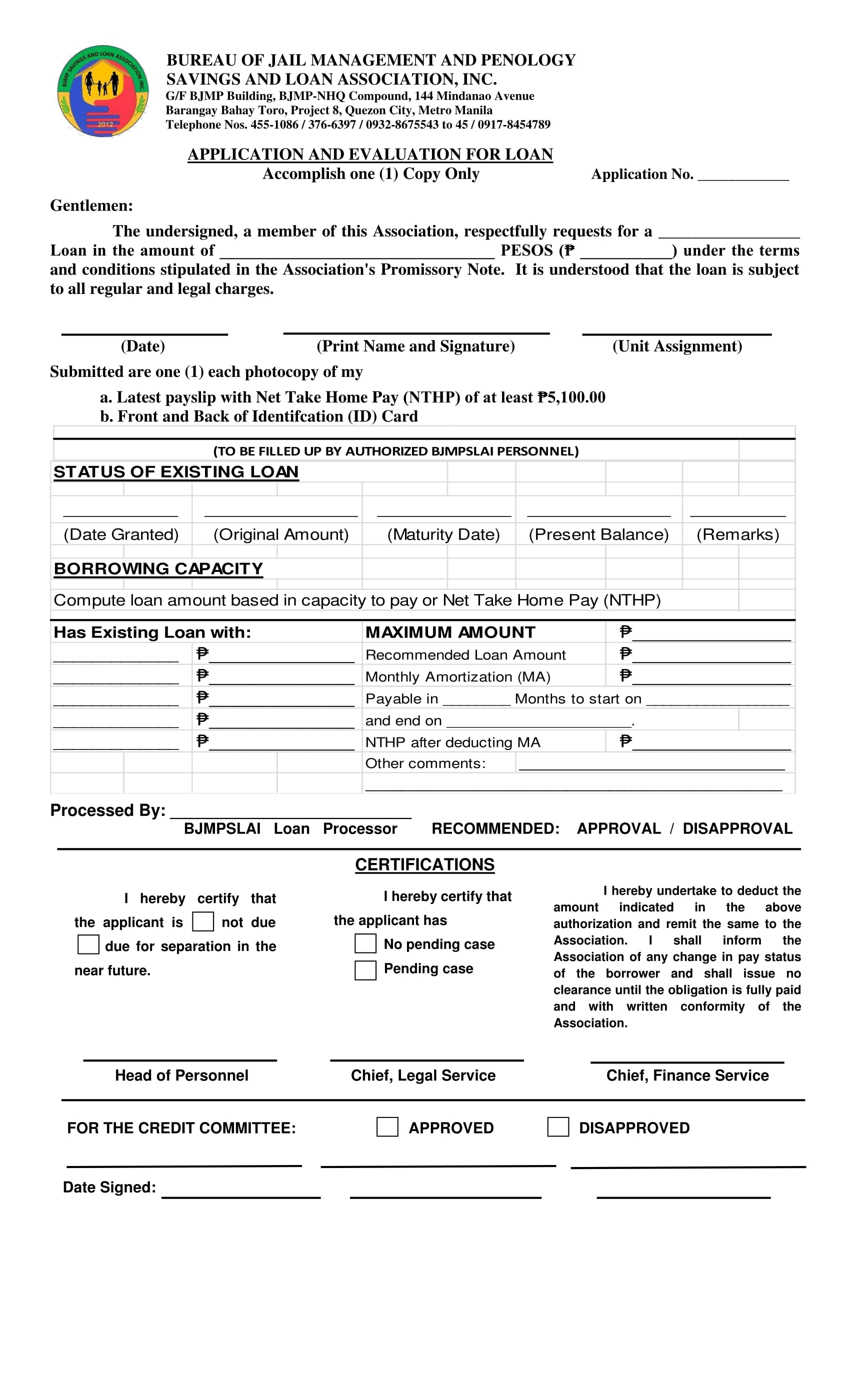

Loan Application Evaluation Form

4. List down the guarantors and collaterals.

The client’s loan guarantors are the individuals who will be liable for paying the client’s remaining loan amount whenever the client will not be able to provide further payments. With this, you must state the guarantors’ contact information as well as their residential addresses.

The collateral, on the other hand, is the property that the loan borrower will surrender upon default of his loan. It is important that the collateral property has undergone a property evaluation to know how much the collateral actually cost for a sale.

5. Determine the client’s repayment methods.

Whether the client will be paying his loan on a monthly or daily basis needs to be stated in the form to indicate the expected responsibilities and obligations of the client regarding loan repayments.

6. Certify the form.

After completing the fields on the form, you must allow the client to recheck the entries and affix his signature along with yours on the certification section. This will prove that the client has agreed to the statements and claims written in the document.

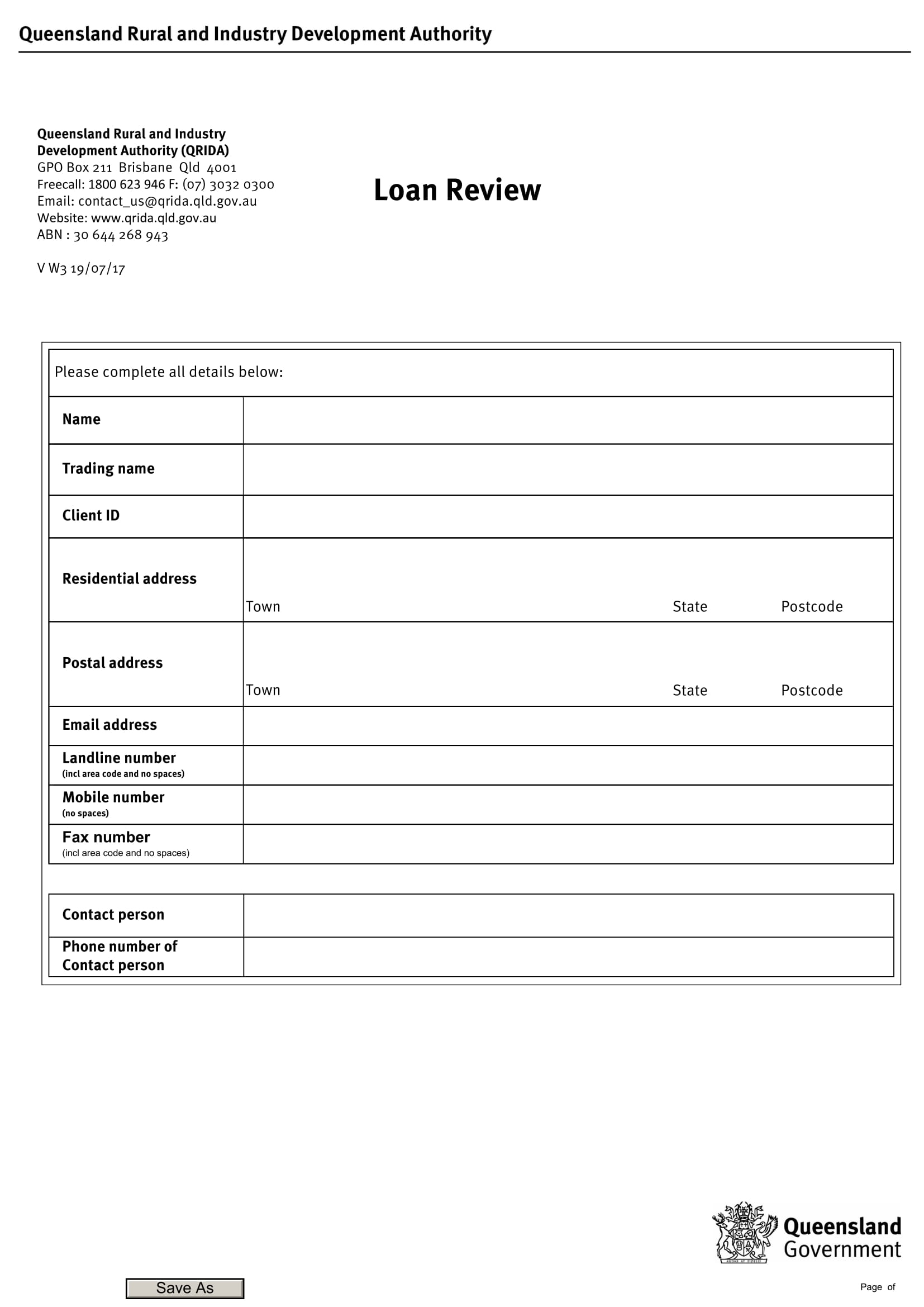

Loan Review Form Sample

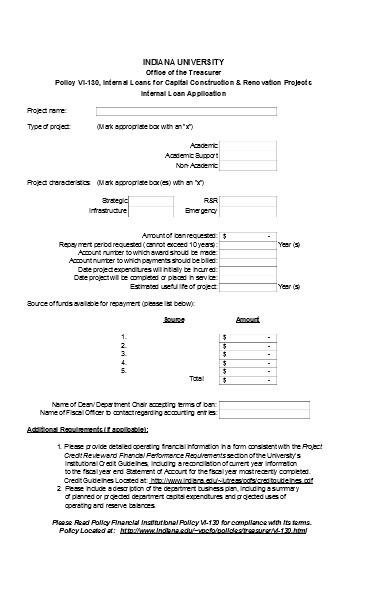

Internal Loan Application Review Form

Although the form’s fields for the client’s data have been completed, you still need to do a review with the aid of a checklist at the bottom of the form. The checklist boxes should be complete with marks and indications for each area of the form. Once done, the assessment of the client’s loan application will then continue to the next step which is the application’s approval.

Related Posts

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 7+ Sample Loan Estimate Forms in PDF | MS Word

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF