Globally, there are over fifty million loan borrowers which are in the student and educational loan category. This statistical number just proves that loans are evident everywhere and does not limit to those who are in the employment industry for as long as one is in his eligible age and has a valid reason.

An individual who aims to acquire a loan may need to go through various processes of setting up documentations and talking to professionals. A loan application form is the first document that a borrower will face which is to be followed along with other sets of paperwork for achieving the loan. In the event that a borrower has already had his loan yet wants to verify his information and wants to know if his data was correct, he can use a loan verification form and send it to the loan provider.

Discharged Loan Verification Form

Who Demands a Loan Verification Form?

The most known people who will demand this type of document is a loan underwriter. These people are working with loan providers and their main job description is to assist the loan applicants or borrowers in looking for the right loan for them. The underwriters will do an applicant or loan candidate evaluation and assessment before granting the loan. Together with the other staff in the loan agency, the underwriters will determine whether an applicant or prospective borrower will be heading straight to a loan agreement or if he will need to provide other documents such as an employment verification letter or maybe a medical record as an assurance that the applicant will be able to fully pay the loan on time.

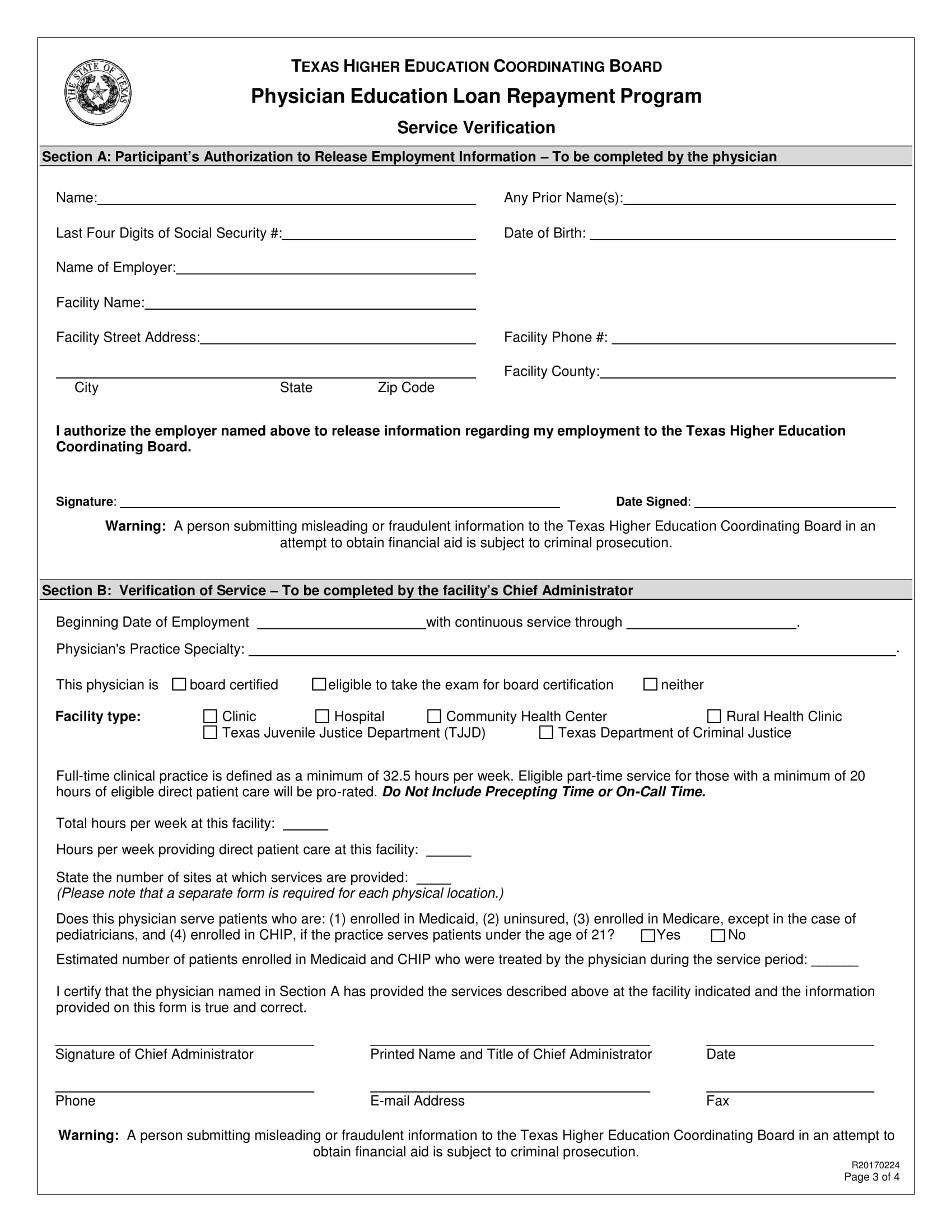

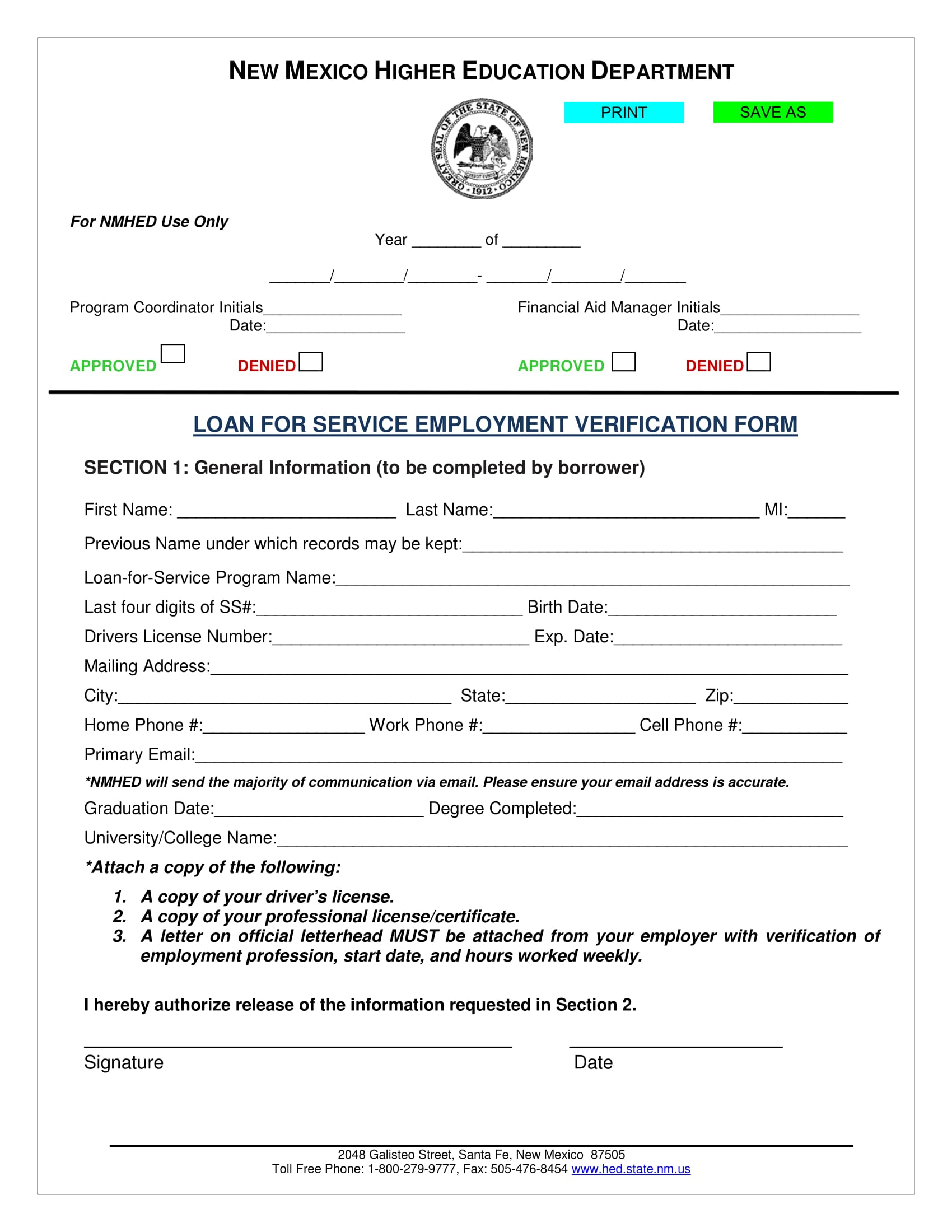

Service and Loan Verification Form

What Is the Main Purpose of Having a Loan Verification?

The main purpose of a loan verification is to have an assurance that an applicant or a borrower does not have any outstanding debts from other agencies and that he is capable enough to grant payment for the loan. Most loan providers will require a lot of documents just to supply enough and adequate proof for the capability of the borrower. Nonetheless, before pursuing a loan application, prospective borrowers should clear out their debts, choose an affordable loan, know his limitations, and list down his responsibilities. When deemed that a borrower has a percentage of capability and that he had been rated as a responsible person, he will then sooner receive a loan confirmation from the loan provider to signify that his application had been successfully processed.

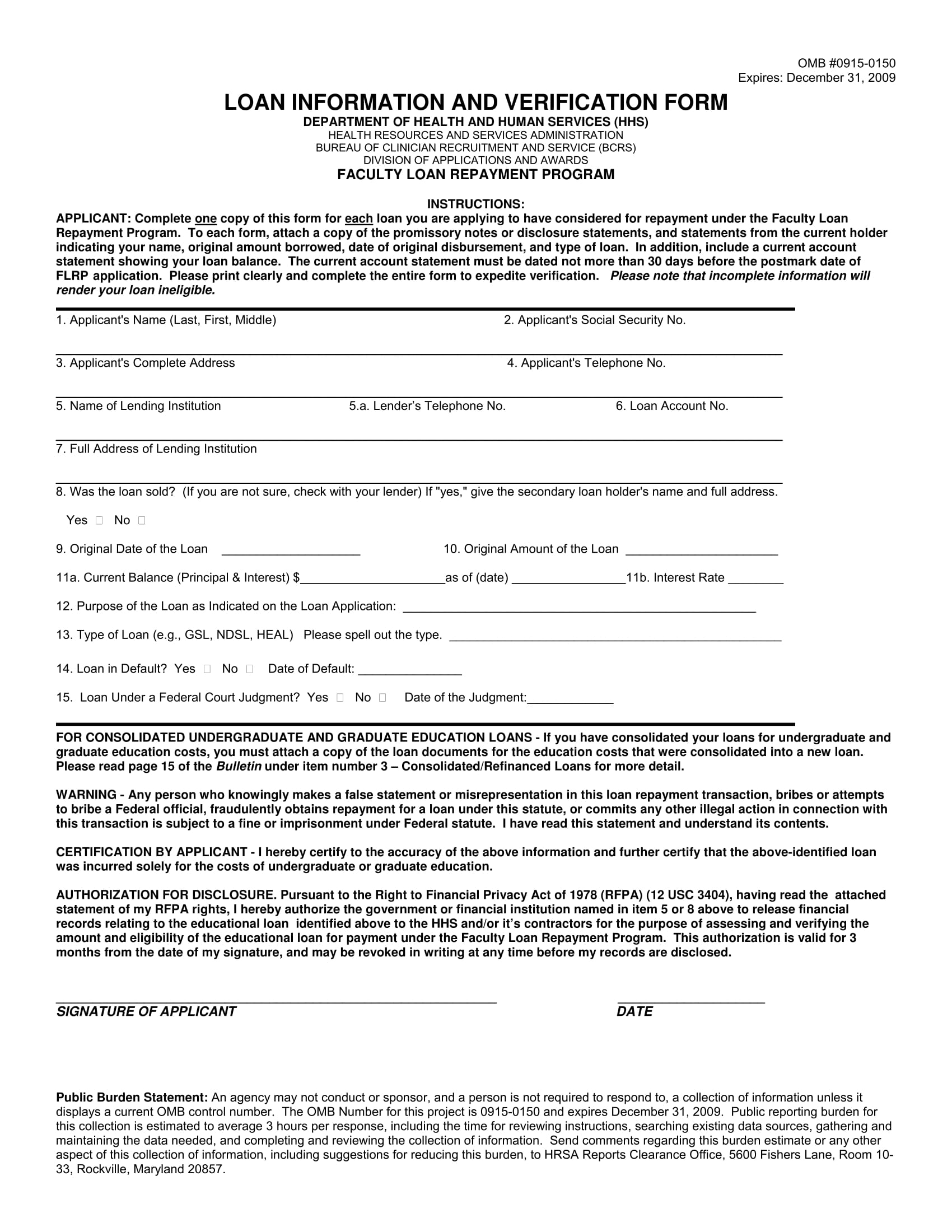

Faculty Applicant Loan Verification Form

When Should You Use a Loan Verification Form?

The instances of using a verification form for a loan are limited and few. Listed below are the following incidents when a loan verification form will come in handy:

- During a loan discharge. In the common world, the term discharge refers to the particular action of leaving or letting another party leave with the aid of a proper permission. This definition is similar to the world of loans and banks where a loan discharge means that the borrower will no longer be obligated to pay his loans due to various reasons such as death, bankruptcy, and in the event that the loan has been fully paid. To allow a borrower and a guardian verify a loan under this purpose, they will need to complete a loan discharge verification form. However, a discharge may only be granted with the representation of adequate documents which may include the borrower’s affidavit of death for the purpose of death discharge and other forms which will supply legal information about the discharge reasons.

- Laying down repayment plans. Similar to constructing an action plan or filling out a schedule form, a loan verification will aid the user in verifying his benefits and the repayment plans that he may be required to follow for the duration of the loan.

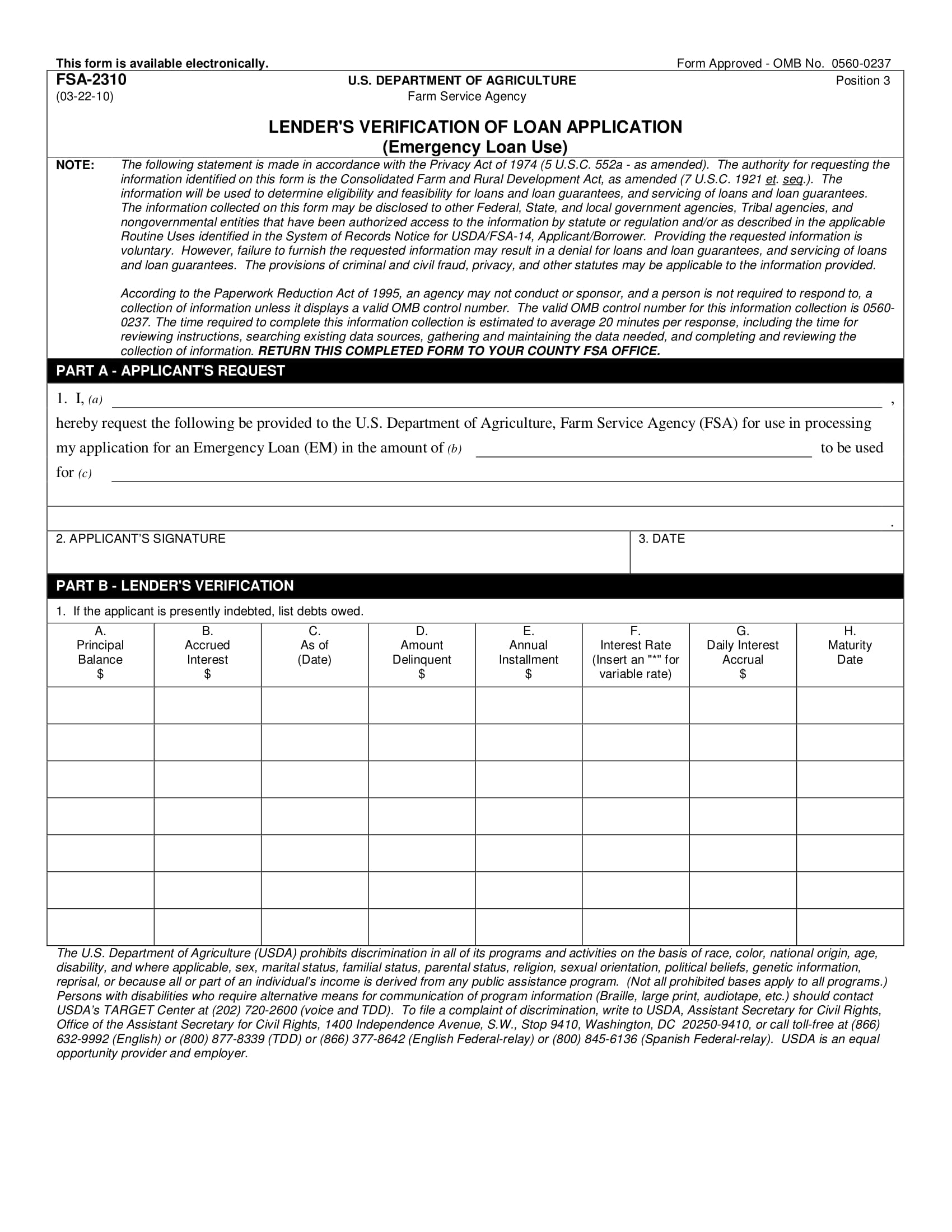

Lender’s Loan Verification Form

- Assuring an educational course. Student loans are common nowadays which allow student applicants to choose their educational course and live their dreams of graduating in it. With a student loan agreement and verification form, the borrower will be able to indicate the chosen course and all his reasons for requiring the loan. However, regardless if a student is living in a dormitory and has been away from his parents as he continues going to school, he will still need to acquire his parent’s consent with the help of a consent form. The parents will also serve as guarantors for the loans and to assure the loan provider that the borrowed money will be paid.

- Checking the balance. Aside from knowing and laying down the plans of repayments, a borrower may also use a verification form to check his remaining loan balance. Though a loan estimate will be helpful, it is always better to have and know the exact balance amount in order to acquire a computation of when will the loan be at it’s due.

- Reassessing the information. The general information stated by the borrower may not be the same as the time passes by such as his last name or other data about his identity. The most common event that a change of name will happen is during marriage where the borrower will also have to do an update with his information.

Service Employment Loan Verification Form

Steps in Filling out a Loan Verification Form

Verification forms which deal with monetary values and properties have slightly similar areas. Nonetheless, here are the steps that you should follow to complete your loan verification form:

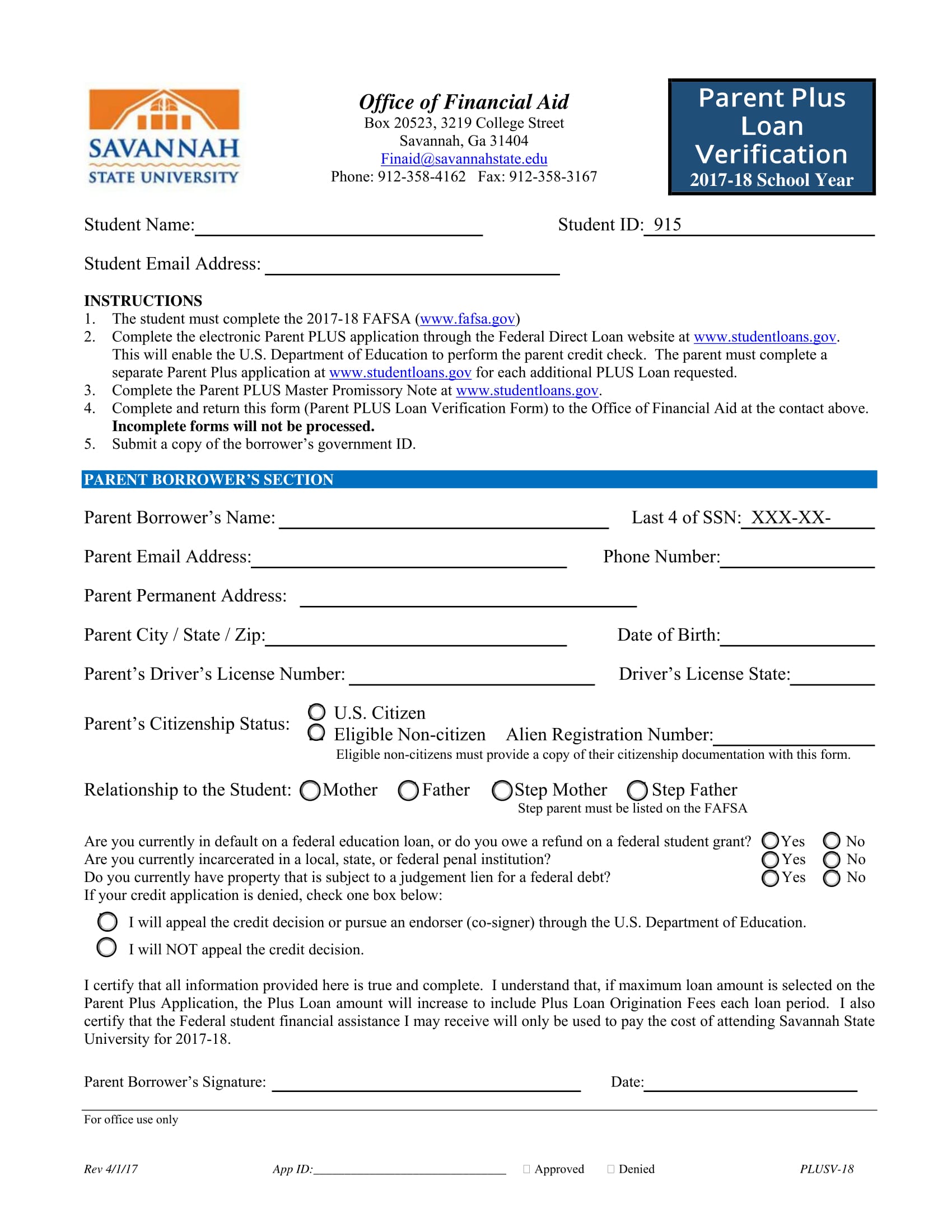

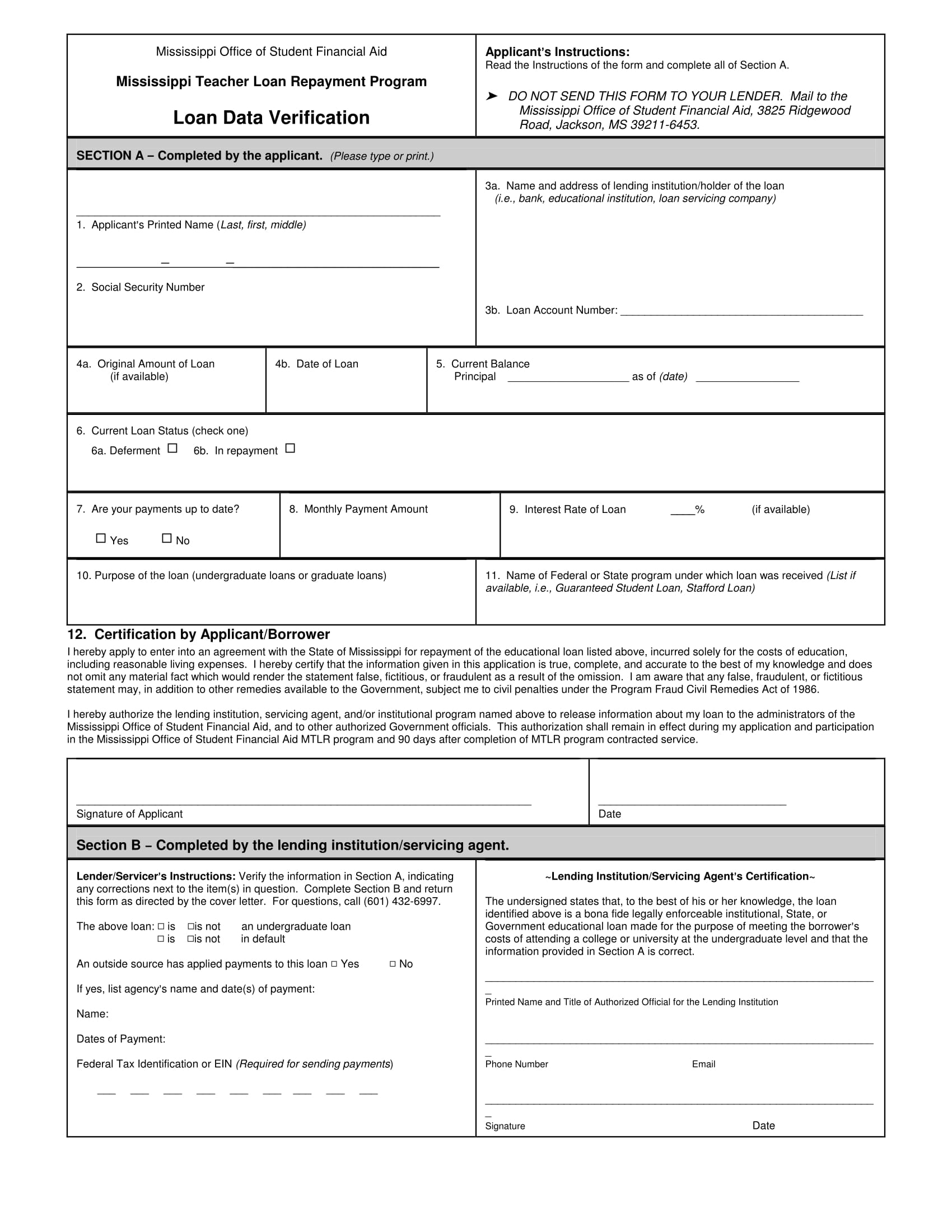

Step 1: Choose the right type of loan verification form. Each form from various institutes will be different, therefore, requiring the borrower to know what sort of legal form he will be needing. For student loans, you will need to have a student loan verification form, while for a parent, a parent loan verification form will be essential.

Step 2: Know your area. There are three main parts in a loan verification form which is highly similar to a wage verification. The first part is for the borrower or the applicant, the second is for the lenders, and the third is for acknowledgment and other statements.

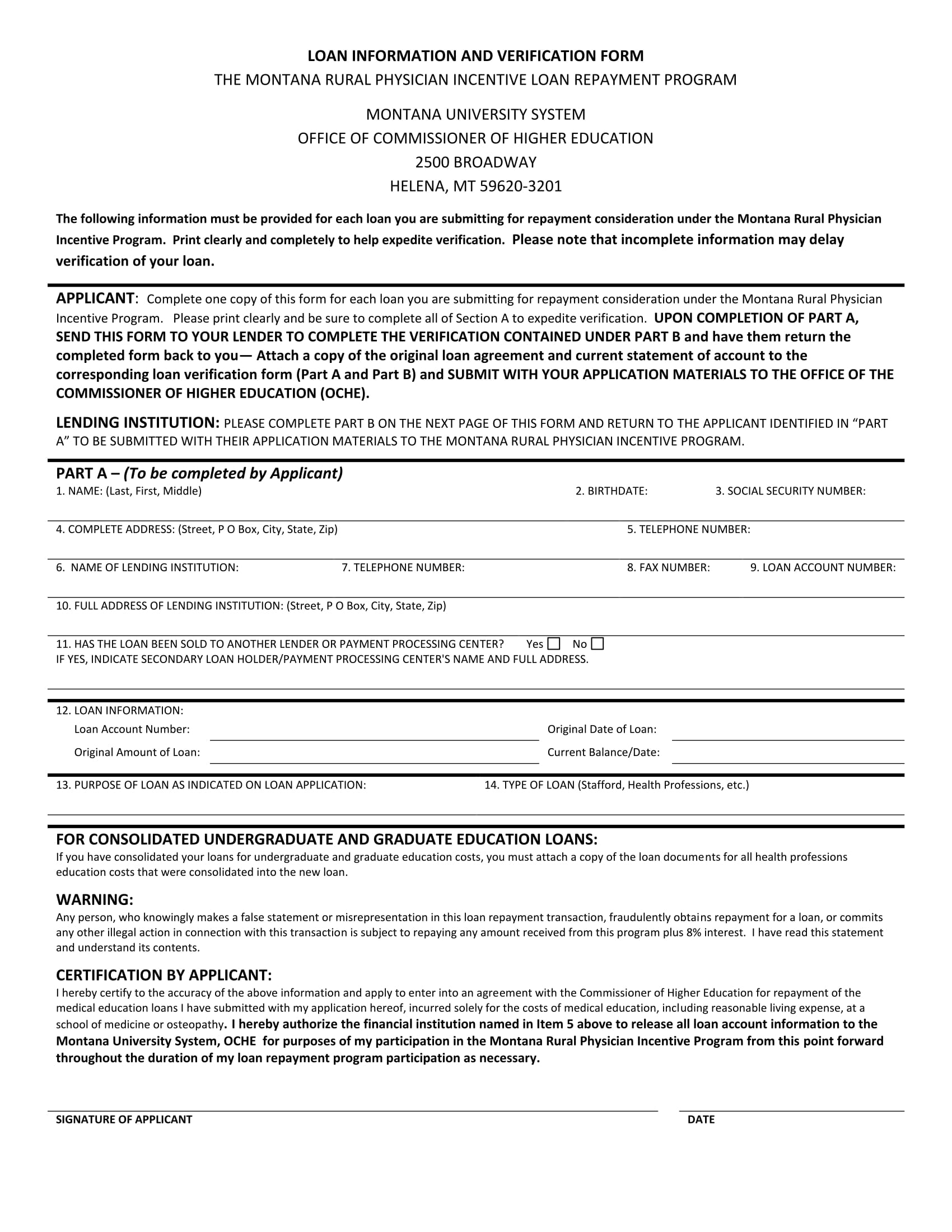

Loan Information and Verification Form

For the borrower or applicant:

The area for the applicant will mainly contain the applicant’s information and the oath or a section of a contract agreement for the applicant.

Step 1: Start filling the fields with the appropriate information. Fill out the first area or section of the form with your basic and personal information.

Step 2: Affix your signature on the blank space provided under the applicant’s oath or agreement. By signing the form, you are agreeing with the loan provider to process the verification and give ample data about you to your lender.

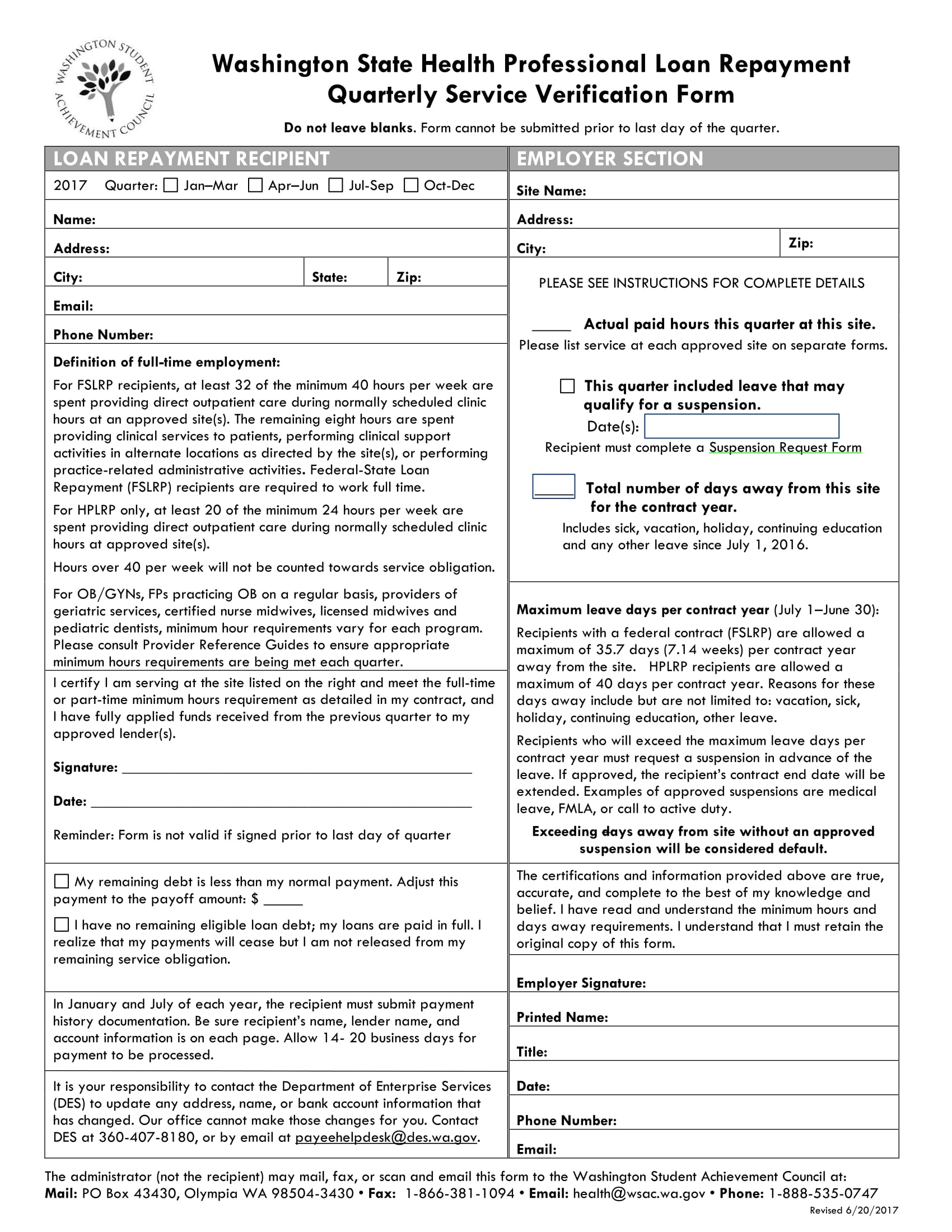

Loan Quarterly Service Verification Form

For the lender:

The lender will be having the rest of the form which was left blank by the applicant.

Step 1: Read the instructions about the debt table. This is the first part of the form which is allocated for the lender where he should supply the information that he knew and can support with evidence about the applicant.

Step 2: Write the applicant’s principal balance. With the balances of the applicant, the verification form will work similarly as a ledger account form but with only a few details included.

Step 3: Specify the applicant’s associated accrued interests. These interest amounts are common in loans and accounting as it should be paid by the applicant at fixed intervals. However, when stating the amount, you should have enough supporting documents to prove your financial statement and claims about the applicant’s debt.

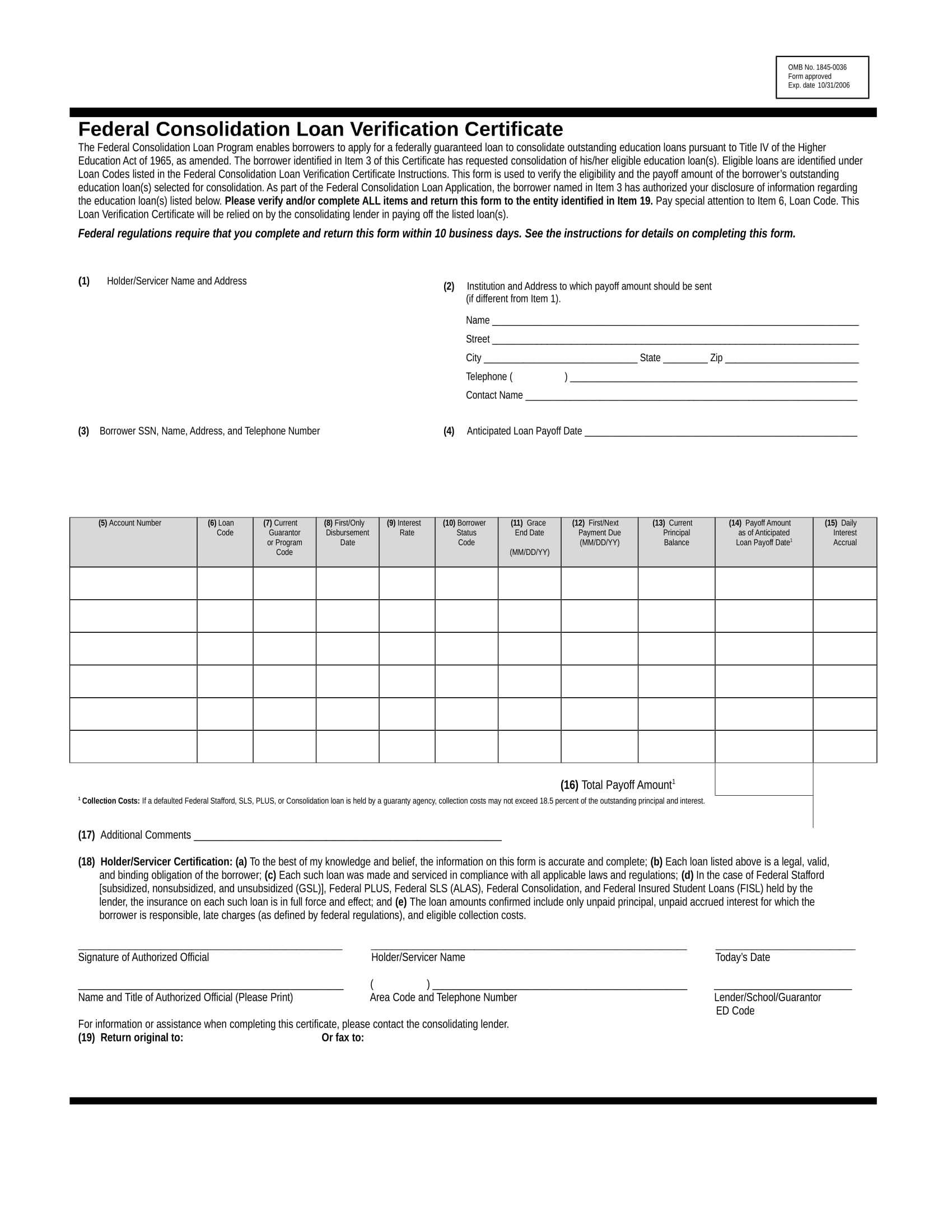

Loan Verification Certificate Form

Step 4: Indicate the loan’s maturity date. This specified date will help the new involved party to know whether the applicant has taken the loan into account or have left the loan with no payments.

Step 5: Answer the questionnaire. The same with other verification forms, it will have an attached questionnaire form which can aid all the parties involved to know more about the applicant and each side of each party. A common question will arise about the willingness of the previous lender to continue granting a loan to the applicant which proves the applicant’s good relationship with the lender.

Step 6: Sign the acknowledgment. Though this is a separate area of the form, it is dedicated for the lender of the applicant. It will have the name and address of the previous lender, the signature, and the date when the form was signed.

Parent Plus Loan Verification Form

Top Instructions to Follow in a Loan Verification Form

- Fill out the form within the stated time duration which is mostly twenty minutes.

- Know your rights by reading the privacy and confidentiality agreement or act on top of the form.

- Respond to the form if it contains the correct government or lending provider issued control number.

- All the personal information required for you to provide is voluntary or are up to you.

- Only fill out the part of the form where your data will be needed.

Teacher Loan Data Verification Form

Though these are simple mechanics and instructions to be understood by anyone, it is always an advantage to know what sorts of steps and information you should state in every legal form that you will be handling to avoid future setbacks and problems.

Related Posts

-

FREE 9+ Sample Loan Confirmation Forms in PDF

-

FREE 50+ Application Verification Forms Download – How to Create Guide, Tips

-

FREE 50+ Medical Insurance Verification Forms Download – How to Create Guide, Tips

-

FREE 6+ Pregnancy Verification Forms Download – How to Create Guide, Tips

-

FREE 10+ Verification of Mortgage Forms Download – How to Create Guide, Tips

-

Enrollment Verification Form

-

FREE 30+ Attendance Verification Forms in PDF | MS Word

-

FREE 4+ Employment Eligibility Verification Forms in PDF

-

FREE 5+ Auto Insurance Verification Forms in PDF

-

FREE 11+ Medical Health Insurance Verification Forms in PDF

-

FREE 8+ VIN Verification Forms in PDF

-

Bank Verification Form

-

Notary Verification Form

-

How to Fill out a Dependent Verification Form [ Usages, Purpose, Steps ]

-

Proof of AA Attendance Form