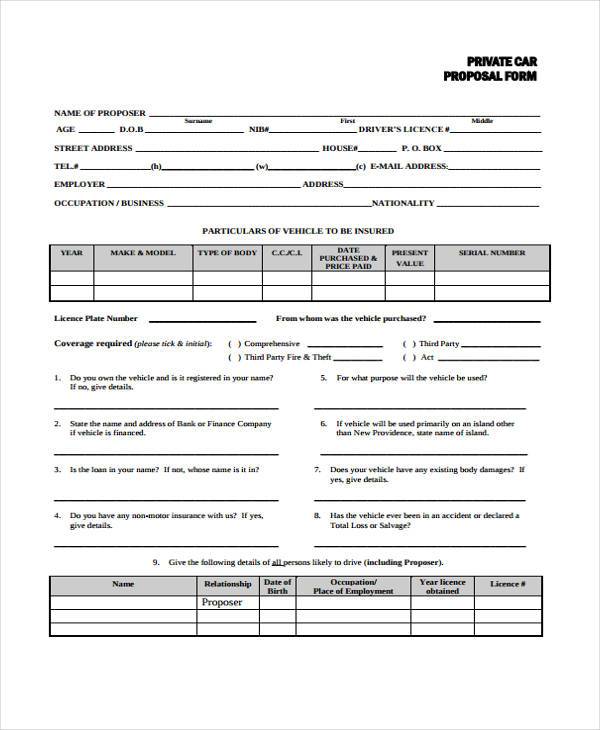

A proposal form is usually used in the insurance industry when prospective clients want to get insurance coverage. This form serves as the application document that the client fills out with the help of an insurance agent. The proposal form is then evaluated by the insurance company’s underwriters and they will determine the terms and scope of the insurance coverage they can give the client.

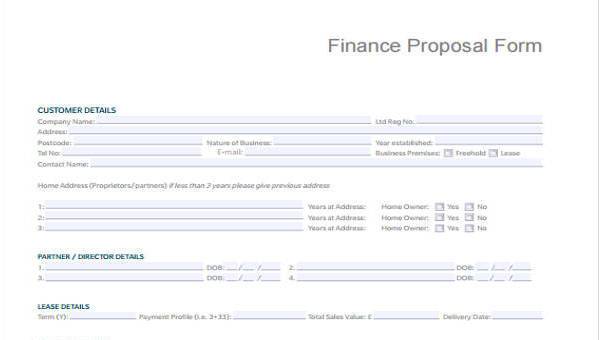

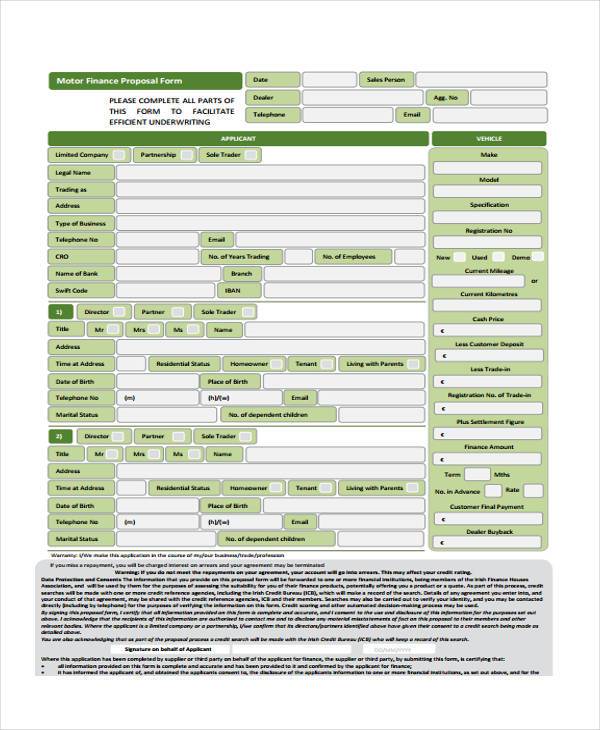

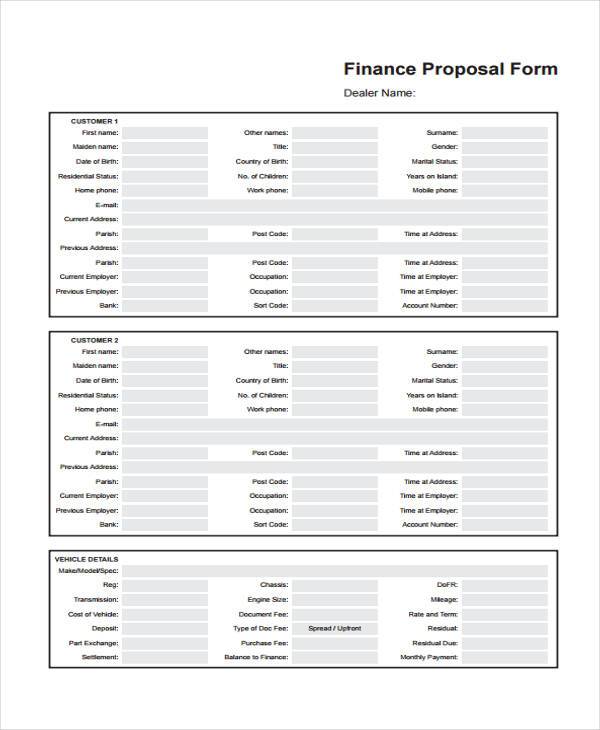

In the financial sector, a similar document called a finance proposal form is used by clients when they need help in funding a house, car, business, or other form of acquisition. This serves as the client’s introduction into financing firms that can lend him the amount that he/she may need.

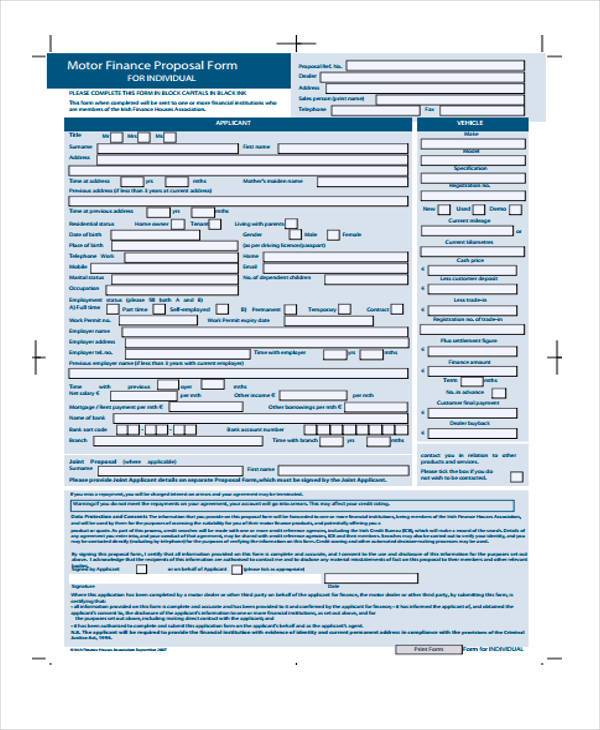

Motor Finance Proposal Form

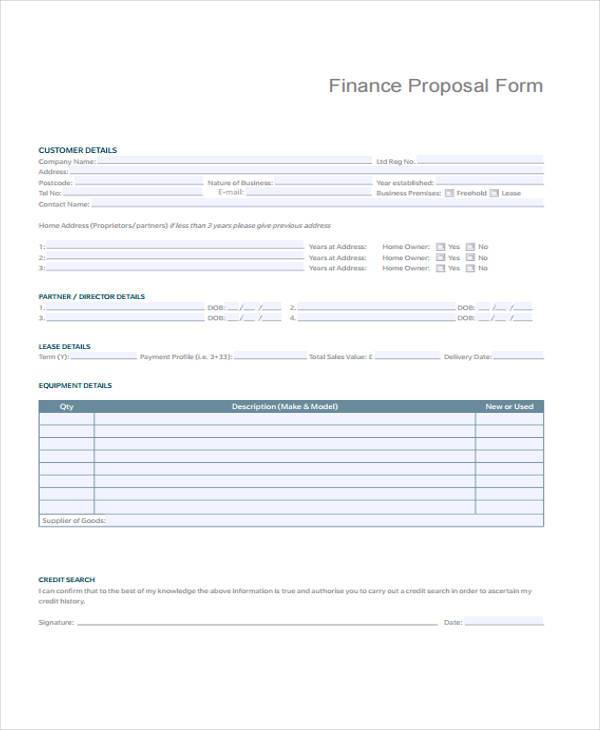

Standard Finance Proposal Form

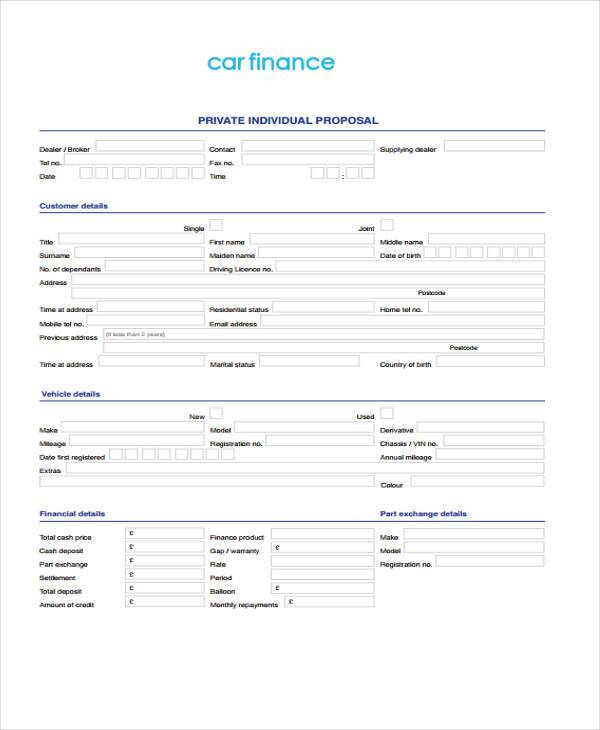

Private Car Proposal Form

Free Finance Proposal Form

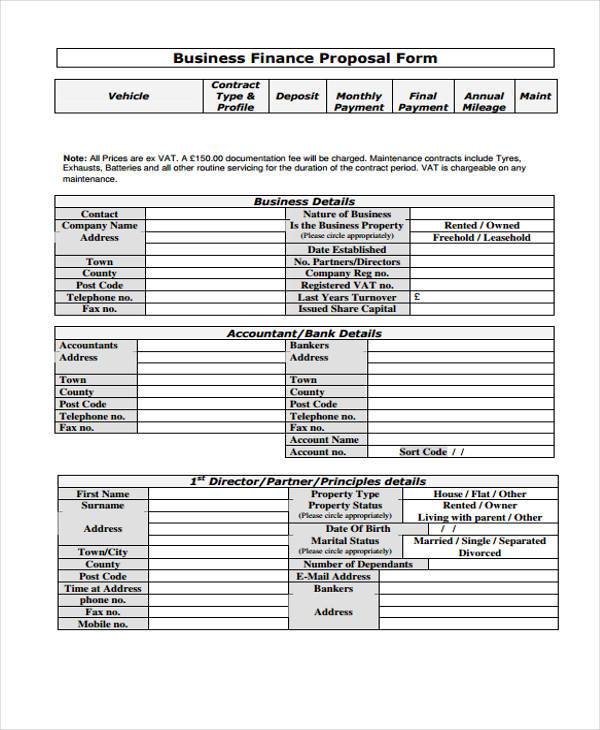

Business Finance Proposal Form Example

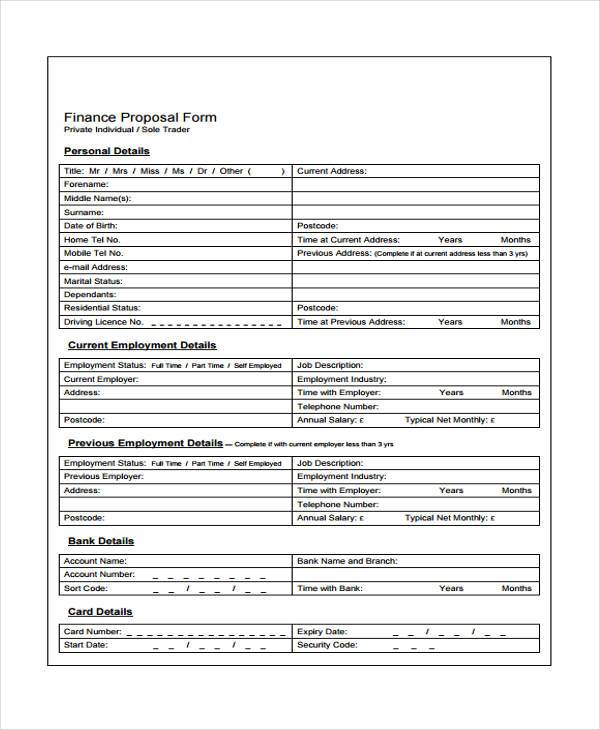

Private Individual Finance Proposal Form

What Is a Finance Proposal?

When you want to build a house, own a car, or start a business but you do not have enough funds to do so, you have the option to ask for a loan from financial institutions. Some firms or banks will need you to first fill out a Financial Proposal Form before they can start evaluating your loan application.

A Finance Proposal is a written record containing your personal and financial information needed when applying for asset financing. Finance proposal forms are unique compared to most common loans, since approval of such loans means the bank/firm agrees to help finance and pay for your car/house/business/property. This also means that the bank has equity (ownership interest) on the property and, therefore, can sell the property if the borrower is unable to make payments.

If you want to start a business, investment proposal forms may be used if you want help in funding. This form works just like a finance proposal form and will help banks assess your business idea and the risks they are willing to take if they approval your proposal.

There are many variations of a finance proposal form depending on the asset that you need funding help with. In this article, we have included more than ten examples of finance proposal forms that you can freely browse through.

Basic Finance Proposal Form

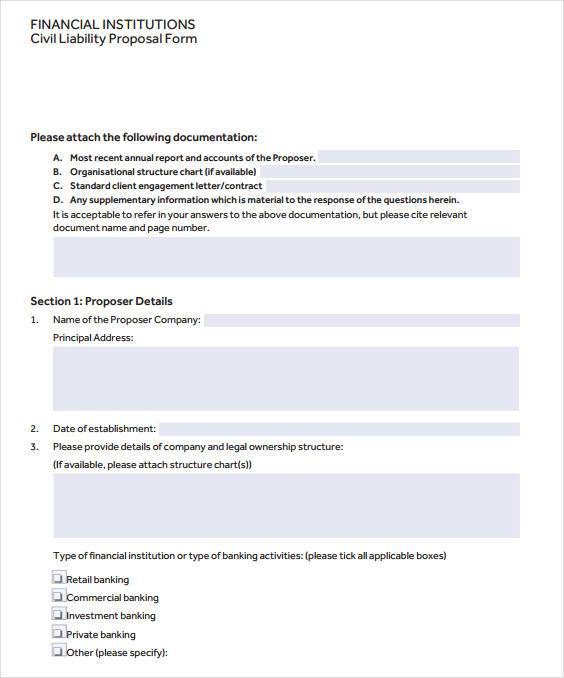

Financial Institutions Proposal Form

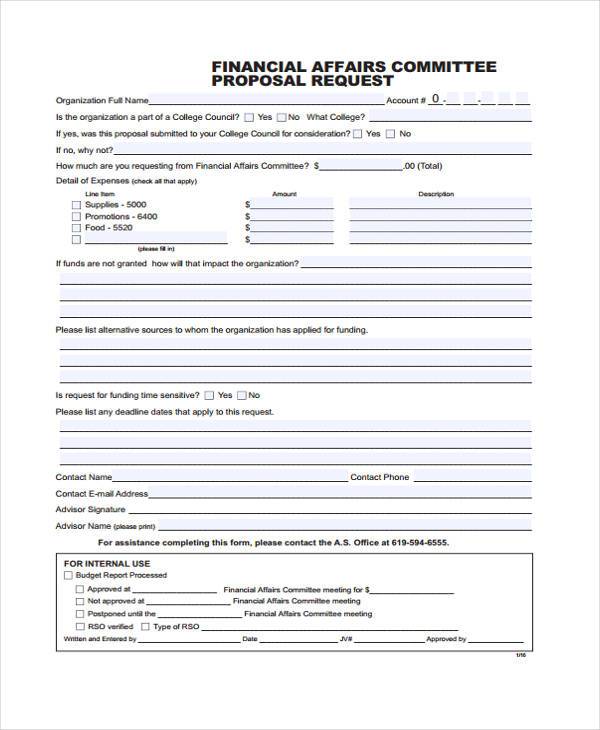

Finance Affairs Committee Proposal Request Form

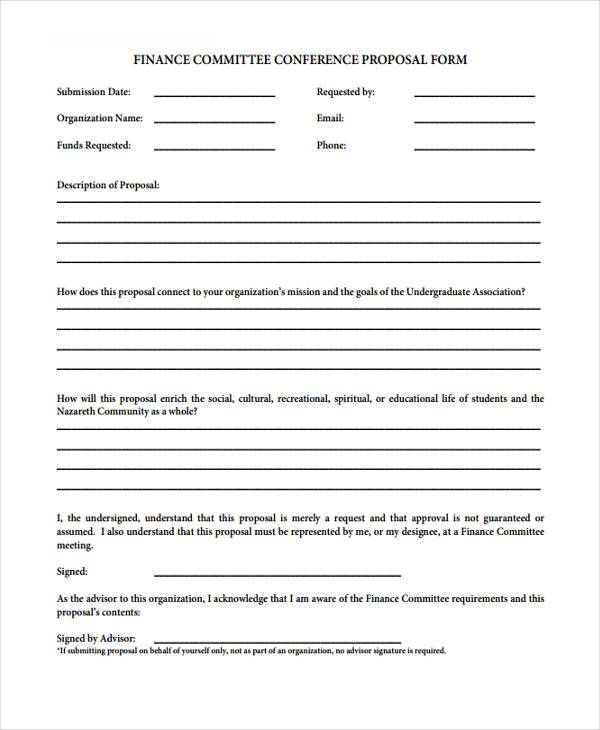

Finance Committee Proposal Form Sample

Motor Finance Proposal Form Example

Guidelines for Filling Out Finance Proposal Forms

Filling out finance proposal forms can be more time-consuming than filling out insurance proposal forms since you need to enter updated financial information. We have listed below a few tips that may help you out when crafting a winning finance proposal form:

- Enter accurate and consistent data. Anyone’s financial information can be authenticated through various means like tax and income verification, credit checks, and background checks. Banks may flag applications that contain inconsistent information.

- Prepare for a hard pull on your credit history. Applying for loans and/or bank financing will almost always result in a hard credit check. Multiple checks may occur if you have been shopping around and submitting finance proposals to different companies.

- Make sure the finance proposal form you’ve signed has a privacy clause. Most finance proposal forms will include a line item or clause indicating that any personal information entered on the form will only be used by the intended party for loan application purposes. Be wary of firms using forms without these clauses.

- Don’t hesitate to ask questions. Dealing with financial firms and their employees can be overwhelming. But do not let this deter you from asking for clarifications regarding the forms or the loan terms and conditions. This will help you avoid bad deals and allow you to learn the trade.

Related Posts

-

What is Importance of Proposal Forms in Insurance? [ Roles, Elements ]

-

Cleaning Proposal Form

-

What is a Project Proposal Form? [ Tips, Guidelines ]

-

How to Write a Proposal Form? [ Definition, Guidelines ]

-

What is a Proposal Evaluation Form? [ Uses, How to, Guidelines ]

-

Proposal Form

-

Seminar Proposal Form

-

Field Trip Proposal Form

-

FREE 9+ Course Proposal Forms in PDF

-

FREE 8+ Video Proposal Forms in PDF | MS Word

-

FREE 9+ Book Proposals Forms in PDF | MS Word

-

FREE 9+ Bid Proposal Forms in PDF | MS Word

-

FREE 8+ Proposal Summary Forms in PDF | MS Word

-

FREE 8+ Program Proposal Forms in PDF | MS Word

-

FREE 7+ Sample Community Proposal Forms in PDF | MS Word