A Verification of Mortgage (VOM) form is a crucial document in the realm of real estate and lending. It serves as a means to confirm the details of a borrower’s existing mortgage, offering lenders, real estate professionals, and financial institutions a comprehensive view of an applicant’s financial history. In this comprehensive guide, we will delve into the meaning and significance of VOM forms, explore the different types and examples, provide insights on creating them effectively, and offer valuable tips for navigating the world of mortgage verification.

What is a Verification of Mortgage Form? – Definition

A Verification of Mortgage (VOM) form is a standardized document used in the real estate and lending industries to verify the details of a borrower’s existing mortgage or mortgages. This essential paperwork provides comprehensive information about the borrower’s mortgage history, including the outstanding balance, payment history, interest rate, and other crucial details. Lenders, financial institutions, and real estate professionals often rely on VOM forms to assess a borrower’s financial stability and make informed lending decisions.

What is the Meaning of the Verification of Mortgage Form?

The meaning of Verification of Mortgage Forms, often referred to as VOM forms, lies in their role as essential documents used in real estate and lending. These printable forms serve the purpose of verifying and confirming critical details related to a borrower’s existing mortgage or mortgages.

When individuals apply for new loans or mortgages, lenders and financial institutions utilize VOM forms to gain a comprehensive understanding of the applicant’s financial history and mortgage obligations. The information included in these forms typically covers key aspects such as the outstanding mortgage balance, payment history, interest rate, and any other pertinent details related to the borrower’s existing mortgage agreements.

Verification of Mortgage Forms are invaluable tools in the lending industry, helping lenders assess the creditworthiness and financial stability of applicants. By examining the information contained in these forms, financial institutions can make well-informed lending decisions, mitigating risks associated with new loans and mortgages.

In summary, the meaning of Verification of Mortgage Forms revolves around their function as crucial documents that facilitate the verification and confirmation of a borrower’s mortgage-related information, ultimately aiding lenders and financial institutions in making informed lending decisions.

What is the Best Sample Verification of Mortgage Form?

The best sample Verification of Mortgage (VOM) Forms comprise various sections, each serving a specific purpose to accurately verify mortgage-related information. Here’s a detailed breakdown of key sections typically found in an effective VOM form:

1. Borrower Information:

- Full Name: The borrower’s complete legal name.

- Social Security Number (SSN): The borrower’s unique identifier.

- Contact Details: The borrower’s address, phone number, and email.

2. Mortgage Details:

- Mortgage Account Number: The unique identifier for the mortgage being verified.

- Loan Origination Date: The date when the mortgage originated.

- Original Loan Amount: The initial loan amount borrowed.

3. Lender Information:

- Lender’s Name: The name of the current mortgage lender or servicer.

- Lender’s Contact Information: Address, phone number, and email for the lender or servicer.

4. Verification Request Details:

- Purpose of Verification: Specify the reason for the verification, such as loan application, refinancing, or other purposes.

- Specific Requirements: If the requesting party has specific requirements or documents needed, mention them here.

5. Payment History:

- Monthly Payment Amount: The regular monthly mortgage payment.

- Due Date: The date when the mortgage payment is due each month.

- Payment History: A detailed record of monthly payments made, including dates and amounts.

6. Outstanding Balance:

- Current Outstanding Balance: The total amount remaining on the mortgage, including principal, interest, and any fees.

- Accrued Interest: Specify any interest accrued but not yet paid.

7. Interest Rate:

- Interest Rate: The current interest rate on the mortgage.

- Adjustable Rate Details: If the mortgage has an adjustable rate, provide information on how it adjusts and when.

8. Loan Terms:

- Loan Type: Specify whether the mortgage is fixed-rate, adjustable-rate, or other.

- Loan Term: The length of the mortgage, such as 15 years or 30 years.

- Terms and Conditions: Include any specific terms, conditions, or special provisions.

9. Property Information:

- Legal Description: Detailed legal description of the property securing the mortgage.

- Property Type: Indicate whether the property is residential, commercial, or other.

- Current Market Value: Estimate of the property’s current market value.

10. Signatures and Authorization: – Borrower’s Signature: Space for the borrower’s signature and date. – Lender’s Representative: Space for the lender’s authorized representative to sign and date. – Authorization: A statement indicating that the information provided is accurate and authorized.

11. Notarization: – Notary Acknowledgment: If required, a section for notary acknowledgment with space for the notary public’s signature, seal, and date.

12. Instructions: – Clear instructions for completing the form accurately and completely.

13. Additional Documentation: – Mention if any additional documents, such as mortgage statements or payment records, should accompany the VOM form.

14. Contact Information: – Contact details for inquiries or assistance related to the form’s completion.

15. Legal Compliance: – Assurance that the form complies with local and federal laws governing mortgage verification processes.

A well-structured VOM form with these sections provides a standardized and comprehensive framework for verifying mortgage-related information effectively, helping lenders and financial institutions make informed decisions in the real estate and lending industries.

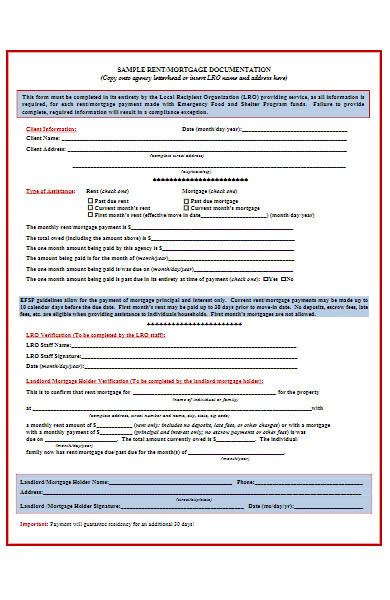

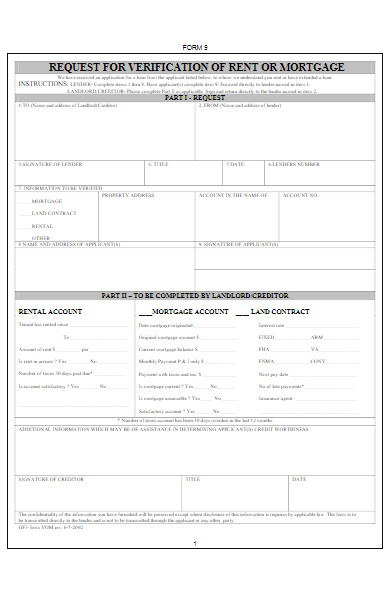

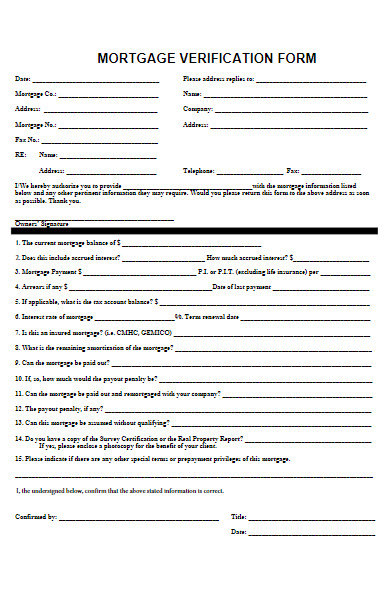

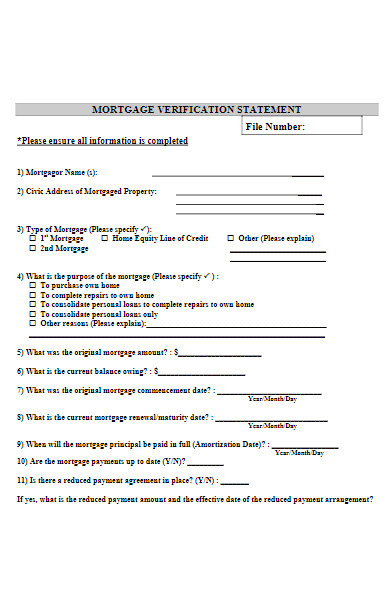

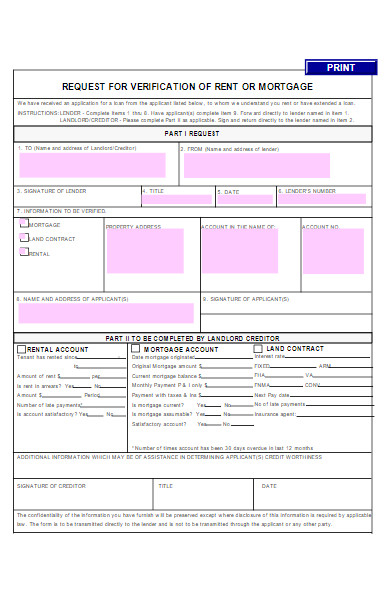

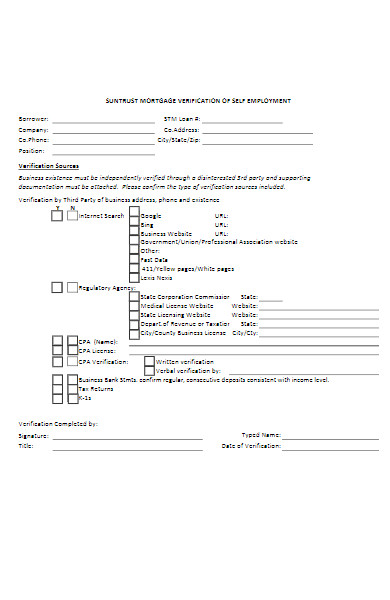

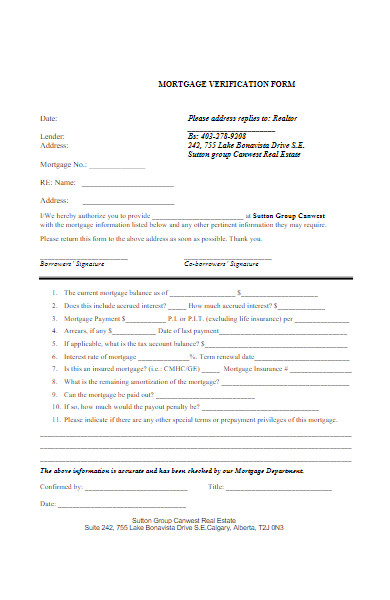

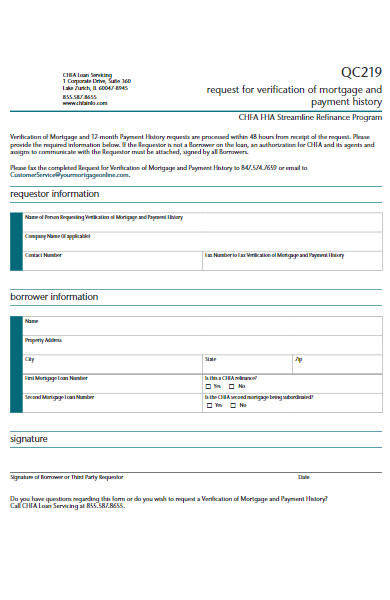

FREE 10+ Verification of Mortgage Forms in PDF

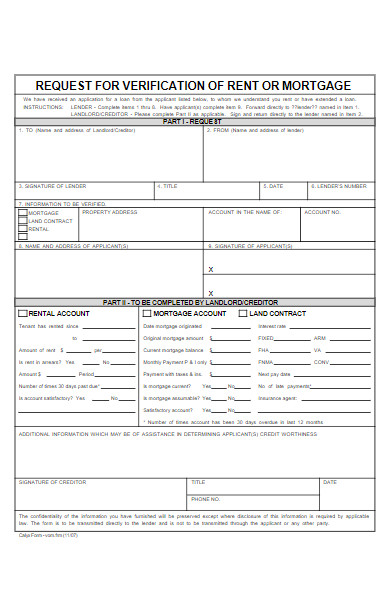

11. Request for Verification of Mortgage History Form

When Is a VOM Form Required?

A Verification of Mortgage (VOM) form is typically required in various scenarios within the real estate and lending industry. Here are common situations when a VOM form is needed:

- Mortgage Application: When applying for a new mortgage, lenders often request a VOM form to verify the borrower’s existing mortgage obligations, payment history, and outstanding balance.

- Refinancing: Borrowers looking to refinance their existing mortgage may need to provide a VOM form to demonstrate their current mortgage status and financial history.

- Home Equity Loans or Lines of Credit: Lenders may request a VOM form when homeowners apply for home equity loans or lines of credit secured by their property.

- Loan Modifications: In cases where borrowers seek loan modifications or adjustments to their existing mortgages, lenders may require a VOM form to assess the borrower’s financial situation.

- Credit Evaluation: When individuals apply for credit or loans unrelated to real estate, such as personal loans or auto loans, lenders may use a VOM form to gather information about the borrower’s overall debt obligations.

- Verification of Assets: VOM forms can be used as part of a broader process to verify a borrower’s assets, particularly when applying for larger loans or investments.

- Investor Requirements: Investors in mortgage-backed securities or real estate transactions may require VOM forms to assess the creditworthiness of underlying mortgage assets.

- Property Sales: In some property sales transactions, the buyer’s lender may request VOM forms from the seller to ensure that there are no outstanding mortgages or liens on the property.

- Government Programs: Certain government-backed mortgage programs, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), may require VOM forms as part of the application process.

- Audits and Due Diligence: Mortgage servicers and financial institutions may use VOM forms during audits and due diligence processes to verify the accuracy of mortgage information.

It’s essential to note that the specific requirements for providing a VOM form can vary depending on the lender, the type of loan, and the circumstances of the transaction. Borrowers and homeowners should be prepared to provide this documentation when requested by lenders, as it plays a vital role in the assessment of creditworthiness and risk in mortgage and lending processes. You should also take a look at our Satisfaction of Mortgage form.

What Information Does a VOM Form Verify?

A Verification of Mortgage (VOM) form is used to verify and confirm critical information related to a borrower’s existing mortgage or mortgages. The specific details that a VOM form typically verifies include:

- Outstanding Mortgage Balance: The form confirms the current unpaid balance on the borrower’s mortgage, including both the principal amount and any accrued interest.

- Payment History: It verifies the borrower’s payment history by detailing the dates and amounts of monthly mortgage payments made, including any late payments or missed payments.

- Interest Rate: The VOM form typically includes the current interest rate on the mortgage, whether it is a fixed rate or adjustable rate.

- Loan Type: It specifies the type of mortgage, whether it’s a fixed-rate mortgage, adjustable-rate mortgage (ARM), or another type, as well as the terms and conditions of the loan.

- Loan Origination Date: The form includes the date when the mortgage originated, providing insights into how long the borrower has held the mortgage.

- Lender Information: It confirms the name and contact details of the current mortgage lender or loan servicer responsible for managing the mortgage.

- Property Information: The VOM form may include details about the property securing the mortgage, such as its legal description, property type (e.g., residential or commercial), and estimated market value.

- Late Payments: In some cases, the form may highlight any instances of late payments or delinquencies in the borrower’s payment history.

- Other Mortgage-Related Information: Depending on the lender’s requirements and the specific transaction, the VOM form may include additional information related to the mortgage, such as the presence of escrow accounts for property taxes and insurance.

- Confirmation of Mortgage Existence: It confirms the existence of the mortgage itself, ensuring that the borrower indeed has an active mortgage on the specified property.

- Verification Request Purpose: The form may also include a section indicating the purpose of the verification, whether it’s for a loan application, refinancing, credit evaluation, or other financial transactions.

- Authorization: Typically, the borrower provides authorization for the release of this information to the requesting party, acknowledging that the details provided are accurate and can be shared as needed.

These verified details are essential for lenders and financial institutions to assess a borrower’s financial stability, creditworthiness, and ability to take on new financial obligations, such as additional loans or mortgages. The information provided in a VOM form plays a significant role in making informed lending decisions and managing risk in real estate and lending transactions. Our mortgage release form is also worth a look at

How Does a VOM Form Benefit Borrowers?

Verification of Mortgage (VOM) forms benefits borrowers in several ways, offering advantages that can positively impact their financial situations and lending experiences. Here’s how borrowers benefit from the use of VOM forms:

- Streamlined Application Process: VOM forms help streamline the mortgage application process. By providing verified information about their existing mortgage(s), borrowers can expedite the application process, reducing paperwork and administrative burdens.

- Increased Credibility: Submitting a VOM form demonstrates a borrower’s willingness to cooperate and provide accurate information to lenders. This can enhance the borrower’s credibility in the eyes of the lender, potentially leading to more favorable lending terms.

- Improved Loan Approval Chances: Accurate and verified information in a VOM form can increase a borrower’s chances of loan approval. Lenders rely on this information to assess the borrower’s creditworthiness and financial stability.

- Negotiating Power: With a VOM form that showcases a strong payment history and responsible mortgage management, borrowers may have more negotiating power when discussing loan terms, including interest rates and loan conditions.

- Refinancing Opportunities: For borrowers seeking to refinance their existing mortgages, a VOM form can help demonstrate their financial stability and prompt lenders to offer better refinancing options, potentially leading to lower interest rates and reduced monthly payments.

- Access to Credit: VOM forms can be useful when applying for other forms of credit, such as personal loans or credit cards, as they provide a clear picture of the borrower’s financial commitments and ability to manage debt.

- Enhanced Borrowing Capacity: A favorable VOM form can contribute to an increased borrowing capacity, allowing borrowers to qualify for larger loan amounts or secure more favorable lending terms.

- Smoother Real Estate Transactions: In property sales transactions, providing a VOM form to potential buyers can instill confidence in the seller’s financial stability and make the transaction process smoother.

- Reduced Risk of Delays: Accurate mortgage verification through a VOM form reduces the risk of delays in loan processing due to discrepancies or incomplete information, ensuring a more efficient lending experience.

- Demonstrated Responsibility: By providing a VOM form with a positive payment history, borrowers demonstrate their financial responsibility and commitment to meeting their mortgage obligations, which can positively influence lenders’ decisions.

- Compliance with Lender Requirements: Some lenders may require VOM forms as part of their lending process. Complying with these requirements is essential for borrowers to proceed with their loan applications.

In summary, VOM forms benefit borrowers by simplifying the application process, improving their credibility with lenders, enhancing their chances of loan approval, and providing access to better lending terms. Whether applying for a new mortgage, refinancing, or seeking other forms of credit, borrowers can leverage the advantages of accurate mortgage verification to achieve their financial goal action form more effectively.

Do All Lenders Use VOM Forms?

While Verification of Mortgage (VOM) forms are commonly used by many lenders, it’s important to note that not all lenders follow the same practices or requirements. The use of VOM forms can vary depending on the lender’s policies, the type of loan, and specific lending scenarios. Here’s what you should know:

- Common Practice: Many traditional lenders, such as banks and mortgage companies, routinely request VOM forms from borrowers during the mortgage application and approval process. These forms help lenders verify the borrower’s mortgage-related information.

- Government-Backed Loans: Lenders offering government-backed loans, such as those insured by the Federal Housing Administration (FHA) or guaranteed by the Department of Veterans Affairs (VA), often require VOM forms as part of their underwriting and approval processes.

- Non-Traditional Lenders: Some non-traditional or online lenders may have different verification methods and documentation requirements. They may use alternative means to assess a borrower’s creditworthiness and financial stability.

- Refinancing and Loan Modification: When borrowers seek to refinance an existing mortgage or request loan modifications, lenders may commonly request VOM forms to assess the borrower’s mortgage history.

- Property Sales Transactions: In property sales transactions, especially when buyers are obtaining financing, lenders may require VOM forms from sellers to ensure there are no outstanding mortgages or liens on the property.

- Investor Requirements: Investors in mortgage-backed securities or real estate transactions may have specific requirements regarding the use of VOM forms, which lenders must adhere to.

- Credit Evaluation: While not always called VOM forms, lenders may use similar documents to verify a borrower’s mortgage obligations when assessing creditworthiness for loans beyond real estate transactions.

- Lender Discretion: Ultimately, the decision to use VOM forms or alternative methods for mortgage verification often rests with the individual lender. Lenders may choose to adopt these forms as part of their standard operating procedures or rely on other documentation and verification processes.

Borrowers should be prepared to provide VOM forms when requested by their lenders, particularly when applying for mortgages or seeking mortgage-related transactions. It’s essential to understand the specific requirements of the lender and comply with their documentation requests to facilitate the loan application or approval process effectively. In addition, you should review our Mortgage Application form.

What Are the Different Types of VOM Forms?

Verification of Mortgage (VOM) forms can vary in type and complexity, depending on the lender’s requirements and the specific purpose of the verification. Here are some of the different types of VOM forms commonly used in real estate and lending:

- Full VOM Form: This is the most comprehensive type of VOM form and provides a detailed verification of all relevant mortgage-related information, including outstanding balance, payment history, interest rate, and more. Lenders often request full VOM forms for mortgage applications and refinancing.

- Short-Form VOM: Short-form VOMs are simplified versions of the full VOM form. They typically focus on key information such as the outstanding balance, payment history, and interest rate. Short-form VOMs are often used for quicker verifications or in cases where a detailed verification is not required.

- Online VOM Requests: Some lenders have adopted online systems or portals where borrowers can request VOM verifications electronically. Borrowers provide consent, and the lender obtains the necessary information directly from mortgage servicers and databases. This approach can expedite the verification process.

- Manual VOM Request: In cases where online systems are not available or appropriate, lenders may request manual VOM verifications. Borrowers must contact their mortgage servicers or lenders to request the necessary information, and the servicer completes the form manually.

- VOM for Loan Modifications: Lenders may use specialized VOM forms when borrowers request loan modifications. These forms focus on key details related to the modification process, such as proposed changes to interest rates or loan terms.

- VOM for Credit Evaluation: In scenarios where borrowers are applying for credit other than mortgages, such as personal loans or credit cards, lenders may use VOM-like forms to verify mortgage obligations as part of the credit evaluation process.

- Government-Specific VOMs: Government-backed loan programs, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), may have specific VOM forms tailored to their program requirements.

- Investor-Specific VOMs: Investors in mortgage-backed securities may have unique VOM forms designed to meet their specific needs and compliance requirements.

- Customized VOM Forms: In some cases, lenders or financial institutions may develop customized VOM forms to align with their internal processes and requirements. These forms may include additional fields or information specific to the lender’s criteria.

It’s important for borrowers to be aware of the type of VOM form their lender requests and to provide the requested information accurately and promptly. Different lenders and lending scenarios may require different types of VOM forms to facilitate the verification process effectively.

Can I Request My Own VOM Form?

Yes, in many cases, you can request your own Verification of Mortgage (VOM) form. Here’s how you can typically go about requesting your own VOM form:

- Contact Your Mortgage Servicer: Reach out to the mortgage servicer that manages your existing mortgage loan. You can find their contact information on your mortgage statements or their website. Explain that you need a VOM form for a specific purpose, such as a loan application or refinancing.

- Specify the Purpose: Clearly communicate the purpose of the VOM form to the mortgage servicer. This helps them understand why you need the form and ensures they provide the appropriate information.

- Provide Necessary Details: Be prepared to provide your personal information, including your full name, Social Security number, loan account number, and the address of the property securing the mortgage. This information is essential for the servicer to locate your mortgage account.

- Request the Form: Ask the mortgage servicer if they have a specific VOM form they use, or if they can provide the information in a standard VOM format. Some servicers have their own VOM forms, while others may provide the required details on their letterhead.

- Authorization: Most servicers will require your authorization to release the information to you or a third party. Be prepared to complete any authorization forms or provide your consent in writing.

- Processing Time: Inquire about the processing time for the request. Mortgage servicers typically have specific timelines for fulfilling VOM requests. Ensure you request the form with enough lead time to meet your application or transaction deadlines.

- Fees: Ask about any fees associated with the request. Some servicers may charge a nominal fee for providing a VOM form or related documentation.

- Delivery Method: Confirm how the VOM form will be delivered to you. It may be sent electronically, by mail, or made available for download from the servicer’s secure portal.

- Follow Up: Keep track of your request and follow up with the mortgage servicer if you haven’t received the VOM form within the specified timeframe. Ensure all the information on the form is accurate.

Remember that the process of requesting a VOM form may vary depending on the mortgage servicer and their specific procedures. It’s essential to maintain clear communication with the servicer and provide all requested information promptly to facilitate the request efficiently.

How Do I Obtain a VOM Form?

Obtaining a Verification of Mortgage (VOM) form typically involves contacting your mortgage servicer or lender to request the necessary documentation. Here’s a step-by-step guide on how to obtain a VOM form:

- Identify Your Mortgage Servicer: Determine the entity that currently services your mortgage loan. This information can be found on your mortgage statements or by contacting your original lender if your loan has been transferred.

- Contact Your Mortgage Servicer: Reach out to your mortgage servicer using the contact information provided on your mortgage statements or their official website. You may also find a customer service phone number for inquiries.

- Specify Your Request: Clearly explain the purpose for which you need the VOM form. Whether it’s for a mortgage application, refinancing, credit evaluation, or other financial transaction, conveying the reason is essential.

- Provide Personal and Loan Information: Be prepared to provide your personal information, including your full name, Social Security number, and the loan account number associated with your mortgage. You may also need to provide the address of the property securing the mortgage.

- Request the VOM Form: Ask the mortgage servicer if they have a standard VOM form that they use or if they can provide the required information in a standard VOM format. Some servicers have their own VOM forms, while others may provide the details on their letterhead.

- Authorization: Most servicers will require your authorization to release the information on the VOM form to you or a third party, such as a lender or financial institution. This authorization can be completed using forms provided by the servicer or through written consent.

- Inquire About Fees: Ask the servicer about any fees associated with the request for the VOM form. Some servicers may charge a nominal fee for providing this documentation.

- Processing Time: Inquire about the estimated processing time for your request. Mortgage servicers typically have specific timelines for fulfilling VOM requests. Ensure you request the form with enough lead time to meet your application or transaction deadlines.

- Delivery Method: Confirm how the VOM form will be delivered to you. It may be sent electronically, by mail, or made available for download from the servicer’s secure portal.

- Follow Up: Keep track of your request and follow up with the mortgage servicer if you haven’t received the VOM form within the specified timeframe. Ensure all the information on the form is accurate.

Remember that the exact process for obtaining a VOM form may vary depending on the mortgage servicer and their specific procedures. Clear communication and timely submission of required information are essential to facilitate the request efficiently.

Is a VOM Form Required for Refinancing?

Yes, a Verification of Mortgage (VOM) form is often required when you are refinancing your existing mortgage. Here’s why a VOM form is typically necessary for refinancing:

- Assessing Creditworthiness: Lenders use the information on a VOM form to assess your creditworthiness and financial stability when you apply for a refinance. They want to verify your existing mortgage history, including payment history and outstanding balance, to determine if you qualify for the new loan.

- Verifying Mortgage Obligations: Lenders need to confirm your existing mortgage obligations to calculate your debt-to-income (DTI) ratio accurately. This ratio plays a significant role in the refinance approval process, as it helps determine your ability to make payments on the new loan.

- Evaluating Payment History: A VOM form helps lenders evaluate your payment history on your current mortgage. A positive payment history can strengthen your refinance application and may lead to more favorable terms.

- Determining Interest Rate: The information on the VOM form, such as your current interest rate, helps lenders calculate potential savings or benefits from the refinance. This information is crucial for offering competitive refinancing rates.

- Reviewing Existing Loan Terms: The VOM form provides details about your existing loan terms, such as whether it’s a fixed-rate or adjustable-rate mortgage. This information is essential for assessing the benefits of the refinance and structuring the new loan.

- Calculating Loan-to-Value (LTV) Ratio: Lenders use the VOM form to determine the current value of your property and calculate the loan-to-value (LTV) ratio. The LTV ratio impacts the terms and approval of your refinance, as lower LTV ratios are generally more favorable.

- Title Search: In some cases, lenders may use the VOM form to conduct a preliminary title search on your property to identify any liens or encumbrances that could affect the refinance.

While a VOM form is commonly required for refinancing, it’s essential to check with your specific lender or mortgage broker to understand their documentation requirements. The lender will guide you on how to obtain and submit the VOM form as part of your refinancing application. Providing accurate and timely documentation, including the VOM form, can help facilitate the refinance process and increase your chances of approval for the new loan. You may also be interested in our Mortgage Questionnaire Form.

How to Create a Verification of Mortgage Form?

Creating a Verification of Mortgage (VOM) form involves compiling the necessary information and formatting it in a standardized manner. Here’s a step-by-step guide on how to create a VOM form:

Step 1: Identify the Purpose and Requirements

- Determine the specific purpose of the VOM form (e.g., mortgage application, refinancing, credit evaluation).

- Research the requirements and guidelines for VOM forms established by relevant institutions or lenders.

Step 2: Gather Required Information

- Collect all essential information that should be included in the VOM form, such as:

- Borrower’s name and contact information

- Mortgage account number

- Property address and description

- Current outstanding balance

- Payment history (dates and amounts of payments)

- Interest rate and loan type

- Loan origination date

- Lender or mortgage servicer contact details

- Authorization for release of information

Step 3: Design the Form Layout

- Create a clear and organized layout for the VOM form. Use a word processing or design software for this purpose.

- Include sections or fields for each piece of information to be verified. Ensure the form is easy to read and complete.

Step 4: Add Legal Language and Authorization

- Include legal language that outlines the purpose of the form, the borrower’s consent for verification, and any relevant disclaimers.

- Provide space for the borrower’s signature and date to authorize the release of information.

Step 5: Include Contact Information

- Include contact information for the entity that will verify the mortgage information. This may be the mortgage servicer, lender, or an authorized agent.

Step 6: Formatting and Styling

- Ensure the VOM form follows a consistent and professional formatting style.

- Use legible fonts and standard font sizes for ease of reading.

- Consider using tables or grids to organize information neatly.

Step 7: Review and Proofread

- Review the VOM form thoroughly to check for accuracy and completeness of information.

- Proofread the content to eliminate any errors in grammar, spelling, or formatting.

Step 8: Testing

- Test the VOM form by filling it out as if you were the borrower. Ensure that all fields are functional and that the form is easy to complete.

Step 9: Save and Share

- Save the completed VOM form in a common file format, such as PDF, to preserve its formatting.

- Share the form with relevant parties, including borrowers, lenders, and mortgage servicers, as needed.

Step 10: Update as Needed

- Periodically review and update the VOM form to ensure it aligns with current requirements and regulations.

It’s important to note that if you are a borrower or individual seeking a VOM form, you should request it directly from your mortgage servicer or lender, as they typically have their own standardized forms and procedures for verification. This guide is intended for creating VOM forms for internal use or as templates for lenders and financial institutions.

Tips for creating an Effective Verification of Mortgage Form

Creating an effective Verification of Mortgage (VOM) form is crucial for accurate and efficient mortgage verification. Here are some tips to help you create an effective VOM form:

- Clear and Concise Language:

- Use clear and straightforward language throughout the form. Avoid jargon or overly technical terms that may confuse borrowers or verifiers.

- Structured Format:

- Organize the form into sections or categories for different pieces of information, such as borrower details, mortgage account information, and payment history. A well-structured format makes it easier for both borrowers and verifiers to navigate.

- Standardized Fields:

- Use standardized fields and formatting for consistency. Fields for names, dates, and amounts should be uniform and easy to fill out.

- Legal Compliance:

- Ensure the form complies with all relevant laws and regulations governing mortgage verification, data privacy, and consumer rights.

- Authorization Language:

- Include clear authorization language where borrowers consent to the release of mortgage information. Make it explicit that the borrower is allowing the disclosure of this information to a third party, if applicable.

- Privacy and Data Security:

- Include statements about data privacy and security, assuring borrowers that their personal and financial information will be handled confidentially and securely.

- Verification Contact Details:

- Clearly provide contact information for the entity that will verify the mortgage information. Include phone numbers, email addresses, and mailing addresses for easy communication.

- Checklist or Summary:

- Consider adding a checklist or summary section at the beginning or end of the form that outlines all the required documents or information that should accompany the VOM form. This helps borrowers provide complete submissions.

- Instructions for Borrowers:

- Include brief instructions or tips for borrowers on how to complete the form accurately. This can help prevent errors or omissions.

- Space for Special Instructions:

- Reserve space for any special instructions or notes that borrowers or verifiers may need to include. This can accommodate unique situations or additional requests.

- Readability and Clarity:

- Choose a legible font and font size to ensure readability. Use headings and subheadings to break up sections and make the form more scannable.

- Version Control:

- Maintain version control for the VOM form. Clearly label each version with a date or version number to track updates and ensure that the most current form is being used.

- Testing and Feedback:

- Test the form internally before deploying it. Gather feedback from staff or colleagues to identify any potential issues or improvements.

- Accessibility:

- Ensure that the form is accessible to individuals with disabilities. Use accessible PDF formats and provide alternatives for those who may require them.

- Regular Updates:

- Periodically review and update the VOM form to align with any changes in regulations, industry standards, or internal processes.

By following these tips, you can create an effective and user-friendly Verification of Mortgage form that serves its intended purpose while maintaining compliance with legal requirements and industry best practices.

Verification of Mortgage (VOM) forms play a vital role in the lending and real estate industries. They verify critical mortgage information, aiding borrowers in securing loans or refinancing. With various types tailored to specific needs, VOM forms serve as reliable documentation. Creating an effective form requires clarity, compliance, and attention to detail. Keeping them up-to-date ensures their continued relevance in the ever-evolving financial landscape. You may also be interested to browse through our other Verification Form.

Related Posts

-

Enrollment Verification Form

-

Bank Verification Form

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

Notary Verification Form

-

Tenant Employment Verification Form

-

What Is a Volunteer Verification Form? [ Definition, Types, Importance ]

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

Verification Certificate Form

-

What Is a Training Verification Form? [ Definition, Uses, Significance ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

FREE 8+ Sample Mortgage Verification Forms in PDF | Ms Word

-

FREE 8+ Sample Tax Verification Forms in PDF

-

FREE 6+ Service Confirmation Forms in MS Word | PDF