Emergencies, retirement plans, and college education are three of the known reasons and intentions of why an individual aim to enroll in an insurance coverage benefit. And though there are countries who offer various affordable insurance plans, there is still an average rate of people who were not able to become a part of such ideal dream. Nonetheless, the importance of being an insurance coverage and policyholder is due to the greater possibility of assuring an action plan and attaining immediate help with regards to financing and support whether in an employment company or inside a family.

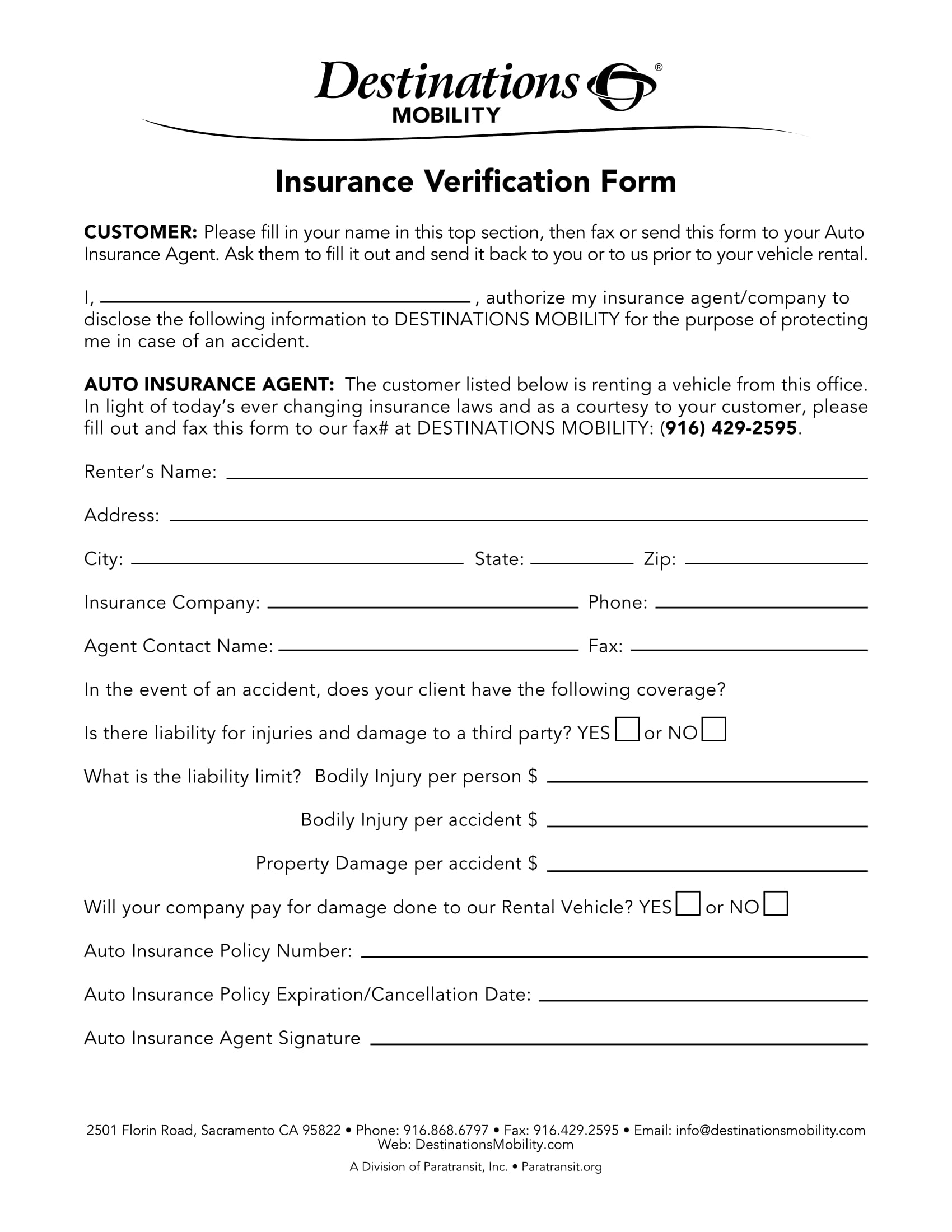

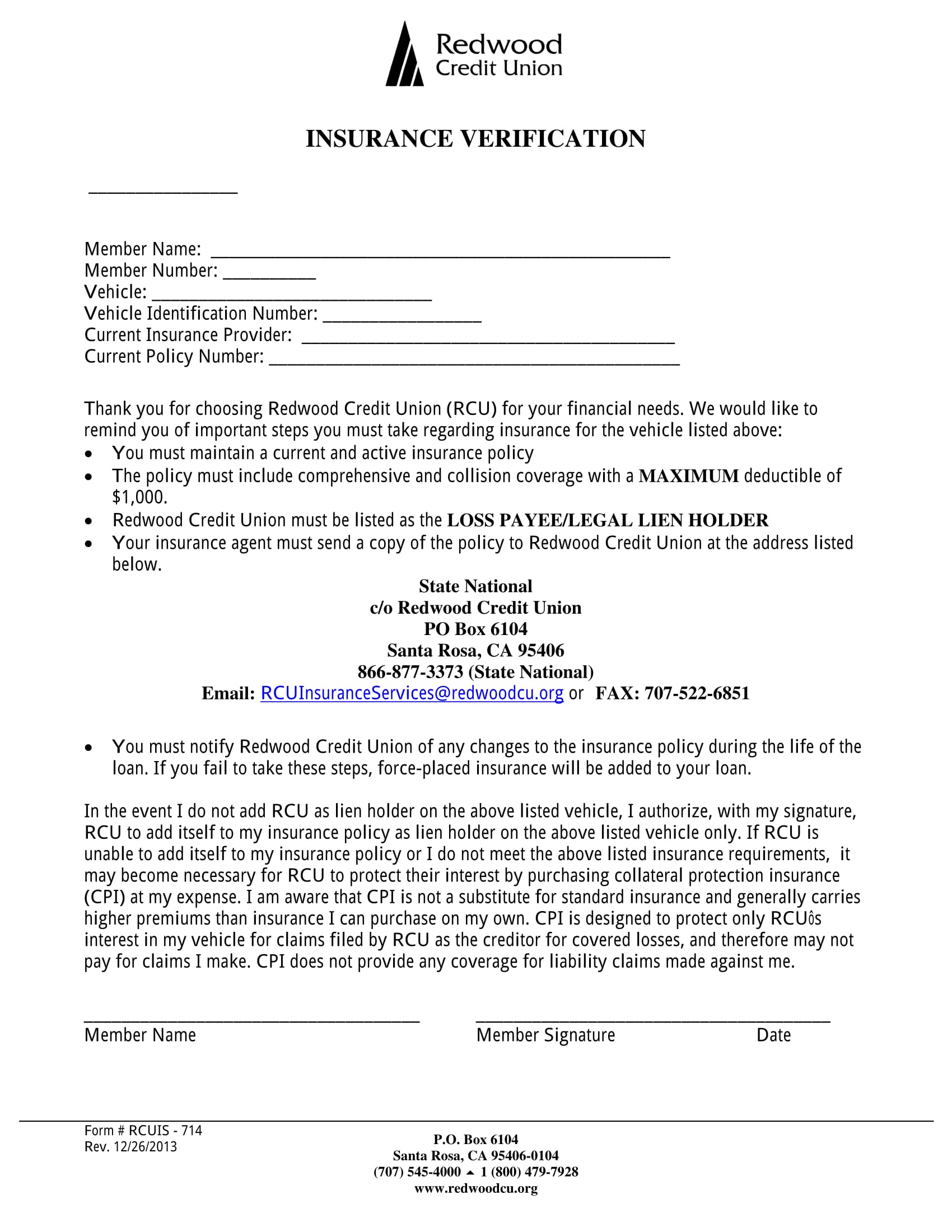

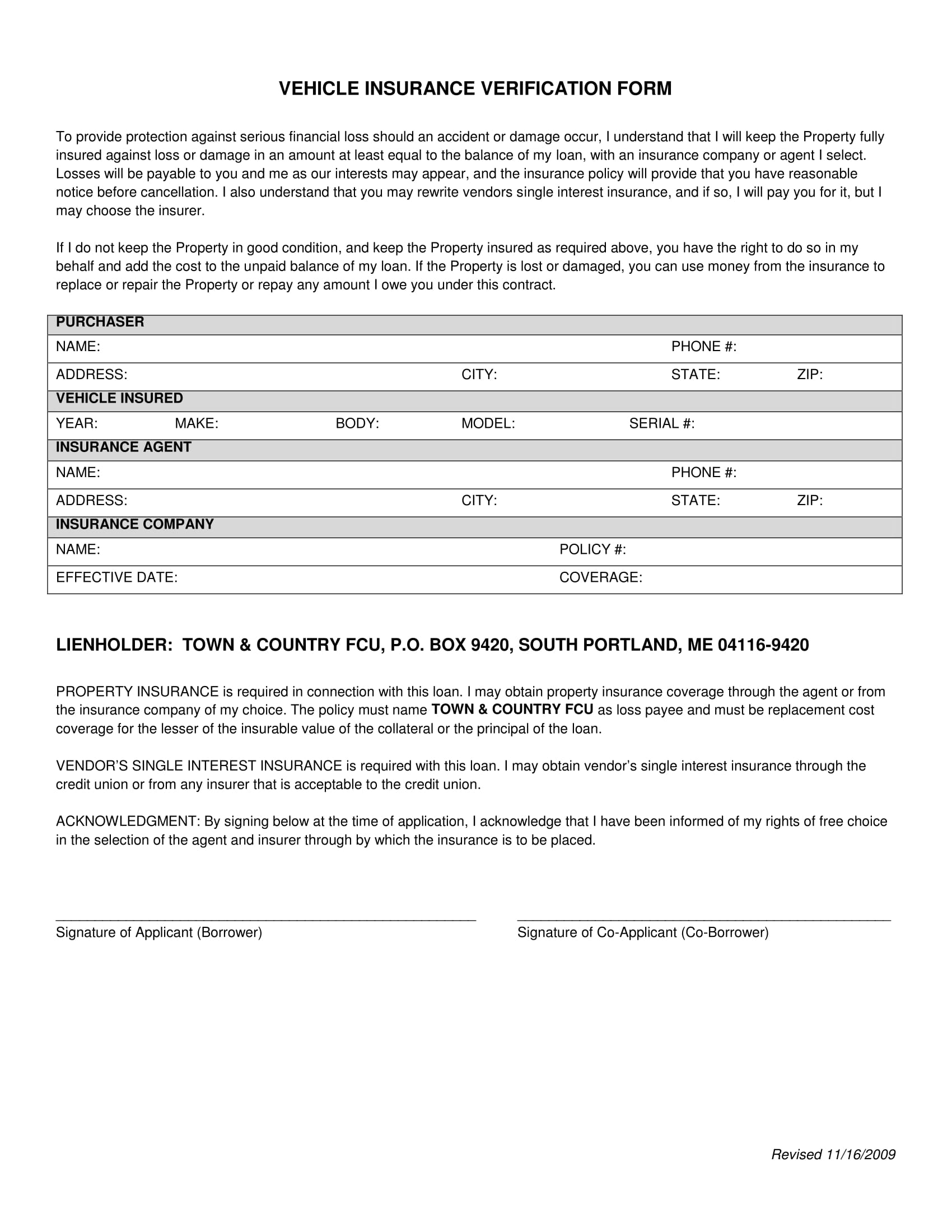

Automobile Insurance Verification Form

Enrolling in an insurance coverage will demand numerous insurance form and documents such as the primary application form. These documents will state all the needed personal information of the applicant who aims to apply for a specific coverage. The applicant may apply by visiting the page of an insurance company, calling an insurance agent, or heading straight to an insurance office to start the application process. The financial statement and claims of an insurance applicant may matter as a part of the qualification in attaining a coverage depending on the requirements of the plans offered by an insurance company or provider.

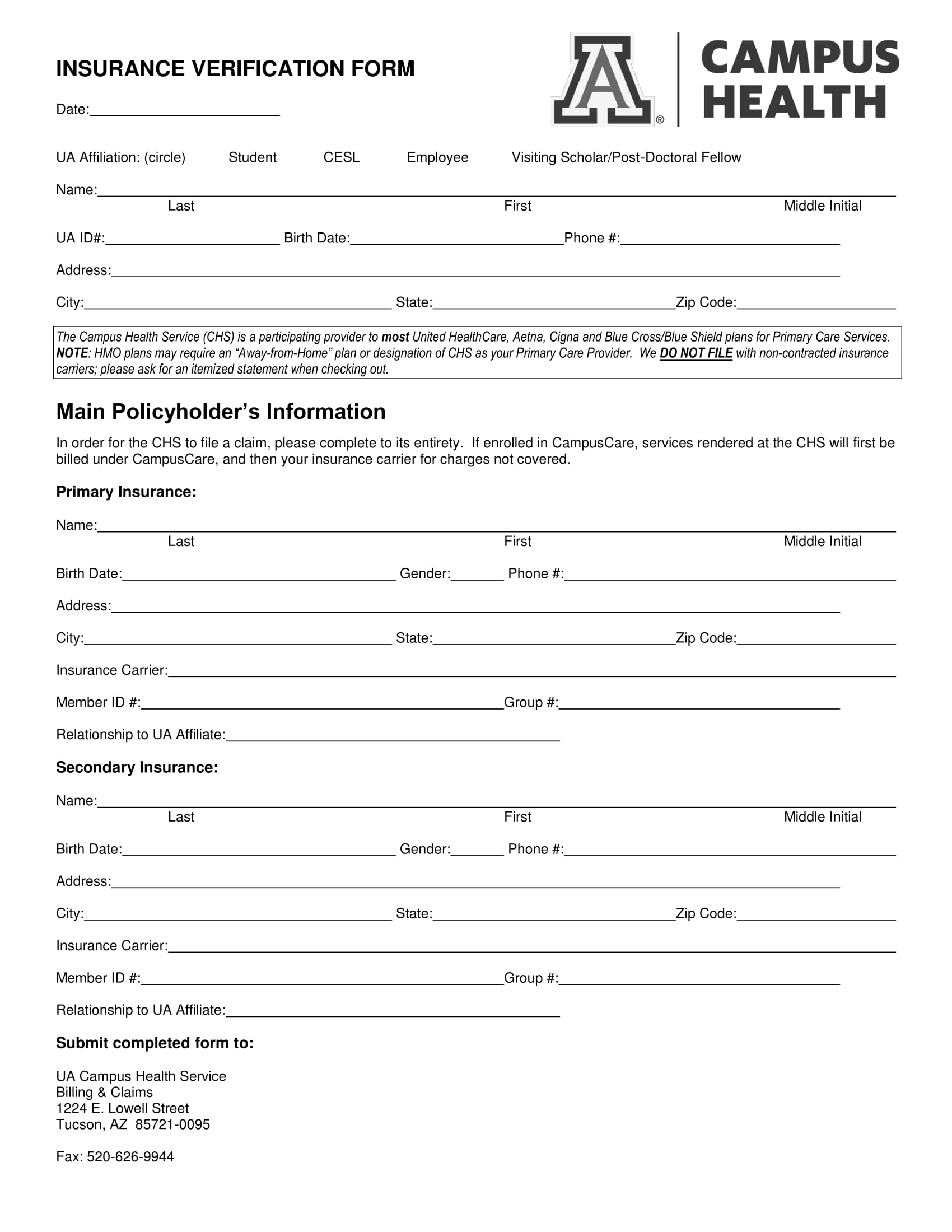

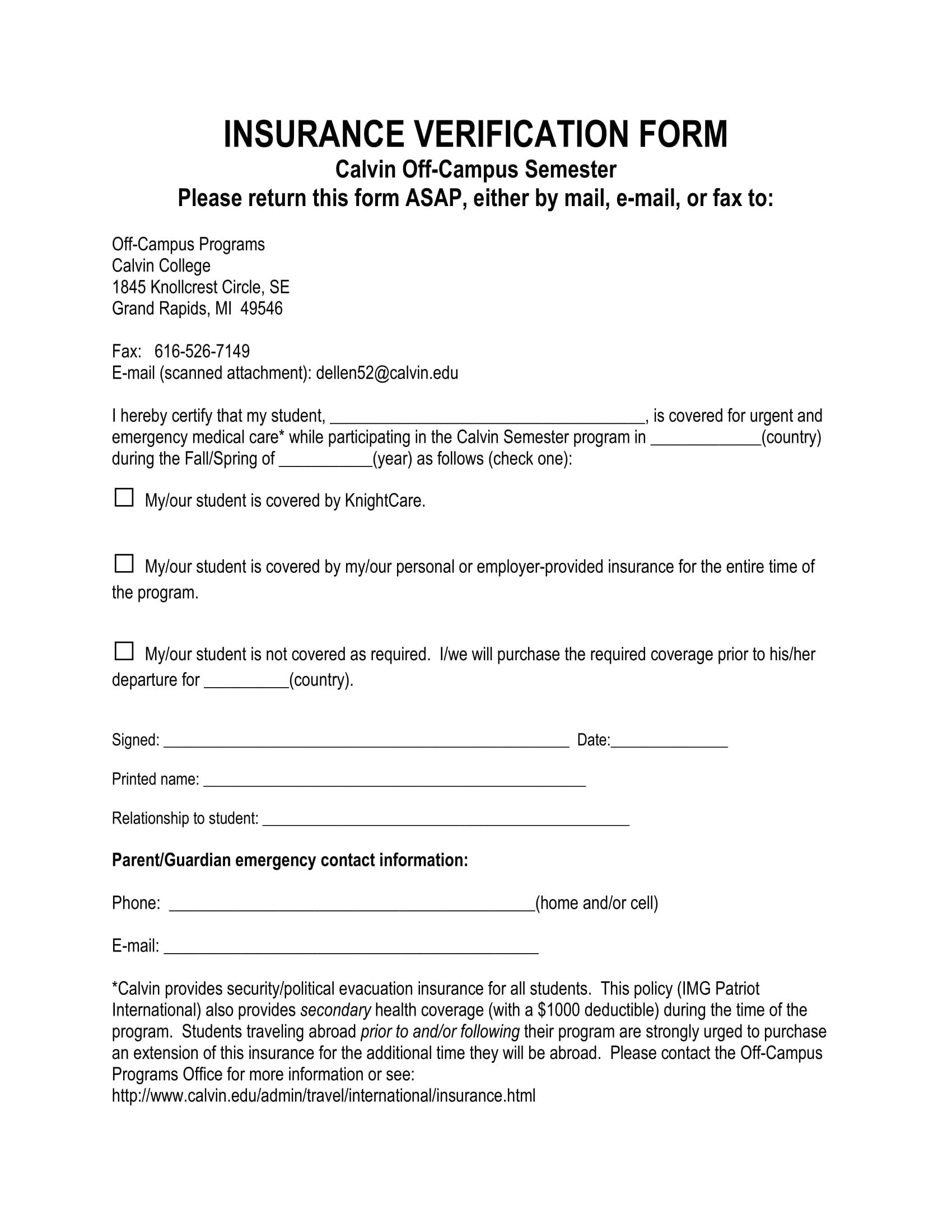

Campus Insurance Verification Form

What Is an Insurance Verification?

An insurance verification is a process of verifying an insurance information and data. This verification process is not limited to validating an insurance coverage for an insurance policyholder but also for all other inquiries which will supply data to prove an insurance claim. The length of the verification process, however, will highly depend on what sort of information and who is the person who requires to be verified. An insurance specialist will be the personnel who will aid the verifying individual towards the process wherein the specialist will likely demand various documentations to show that he is a valid person and that he is authorized to verify the insurance records. The verification will also use a form to cater all the requests, needs, and the information to be verified by the policyholder. Specifically, an insurance verification form will be required and presented to the policyholder for him to indicate his data and completely fill it out. In the completion of the form, the specialist will then start to verify and send the results back to the policyholder when the process had been done.

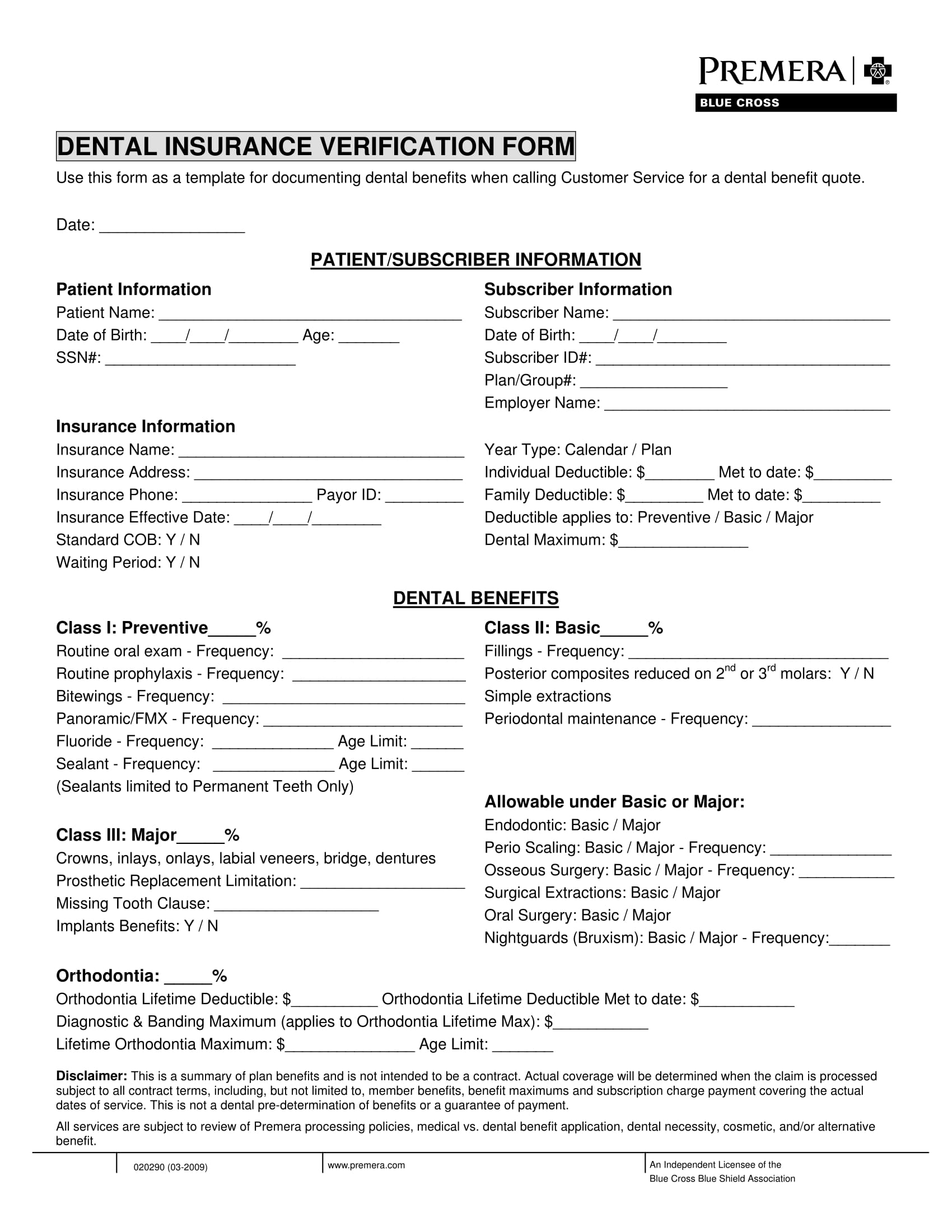

Dental Insurance Verification Form

When to Use an Insurance Verification Form?

A verification form’s main purpose is to document the accuracy, and validity of an information. With this, the form will be used in a variety of situations and may be used by anyone who aims to grab the truth of a claim. Listed below are the following situations wherein an insurance verification form will serve a great use:

Claiming a benefit coverage. This is common when an insurance policyholder or coverage holder dies after a certain illness, or accident, as well as a suicide. A life insurance coverage is known to all men which aim to cover a range of debts and expenses which include funeral expenditures of an insurance beneficiary. The health and lifestyle of the insurance policyholder will be the particular aspects which are to be included in an insurance questionnaire form provided by the providers. To claim and verify the benefits in the event of an insurance policyholder’s death, the relatives who are named as beneficiaries must present the required documents needed by the insurance company as a proof that the claimant is a valid beneficiary of the policyholder. Proof of identity documents will also be helpful to ease up the claiming and verifying process, however, if the claimant could not present any valid proof, he may need to fill out an identification verification form to state his details and let the insurance provider verify his identity.

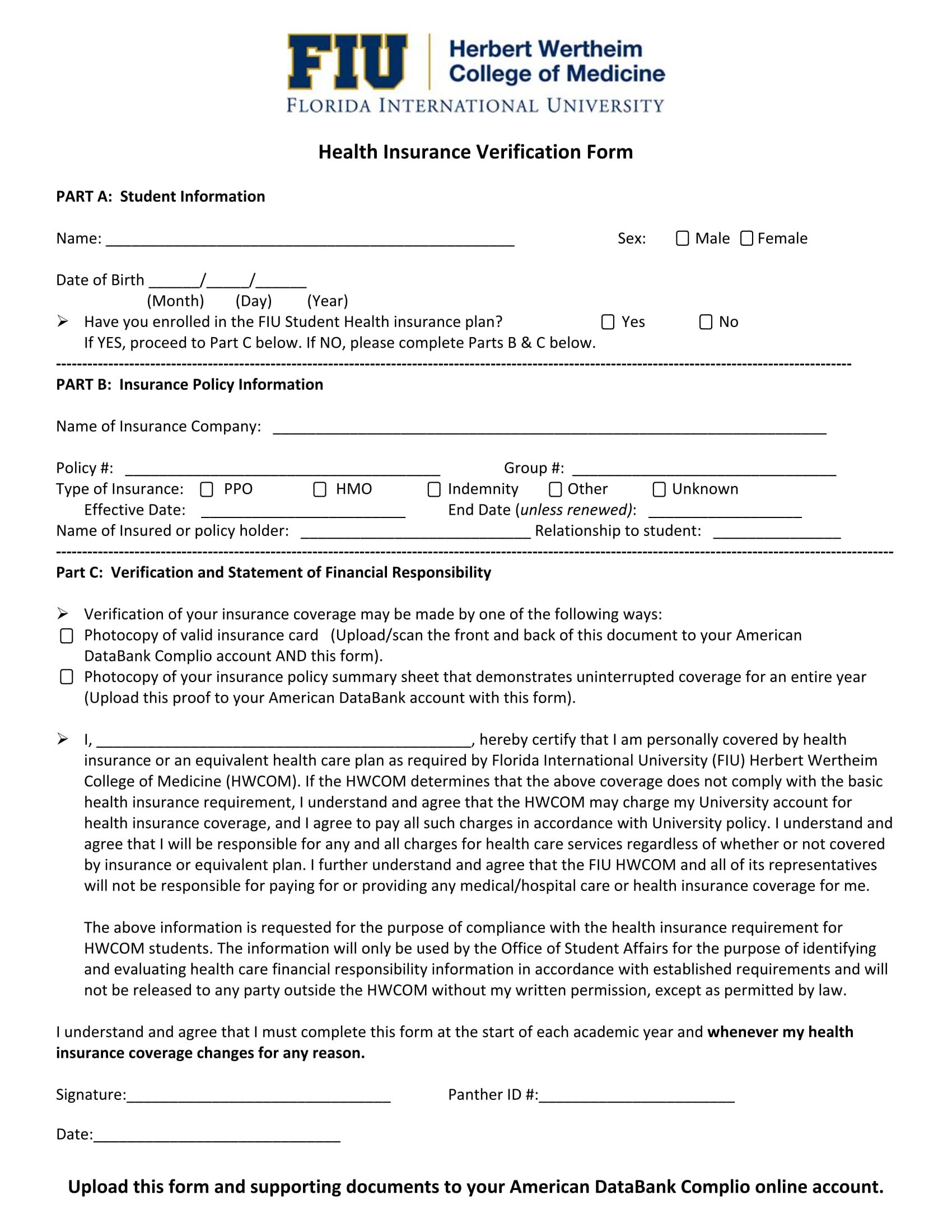

Health Insurance Verification Form

Assuring an employer’s payment. There are some employment companies who serve as the bridge for employees and insurance policies to meet. With this, an employee who wants to assure that he is indeed insured may use the insurance verification form to his advantage. The employee must state the necessary details about his employment especially the starting date when he officially signed the employment contract which then signifies the beginning of his employment. Most of the insurance coverage that an employment company will cater for their employees include a health and medical coverage as well as a package for a long-term employee’s retirement plan.

Lien Holder Insurance Verification Form

Acquiring an amount for a disaster or emergency. Some countries promote a flood insurance plan for those whose areas and residential locations which are prone to flood or natural disasters. It is essential for an insurance policyholder under this category to regularly check and verify his data in the records of the insurance company to assure that he will be able to acquire a specified amount when this type of incident will happen. By keeping up to date legal forms and insurance documents, the claimant will have an easy way to receive his needed benefits.

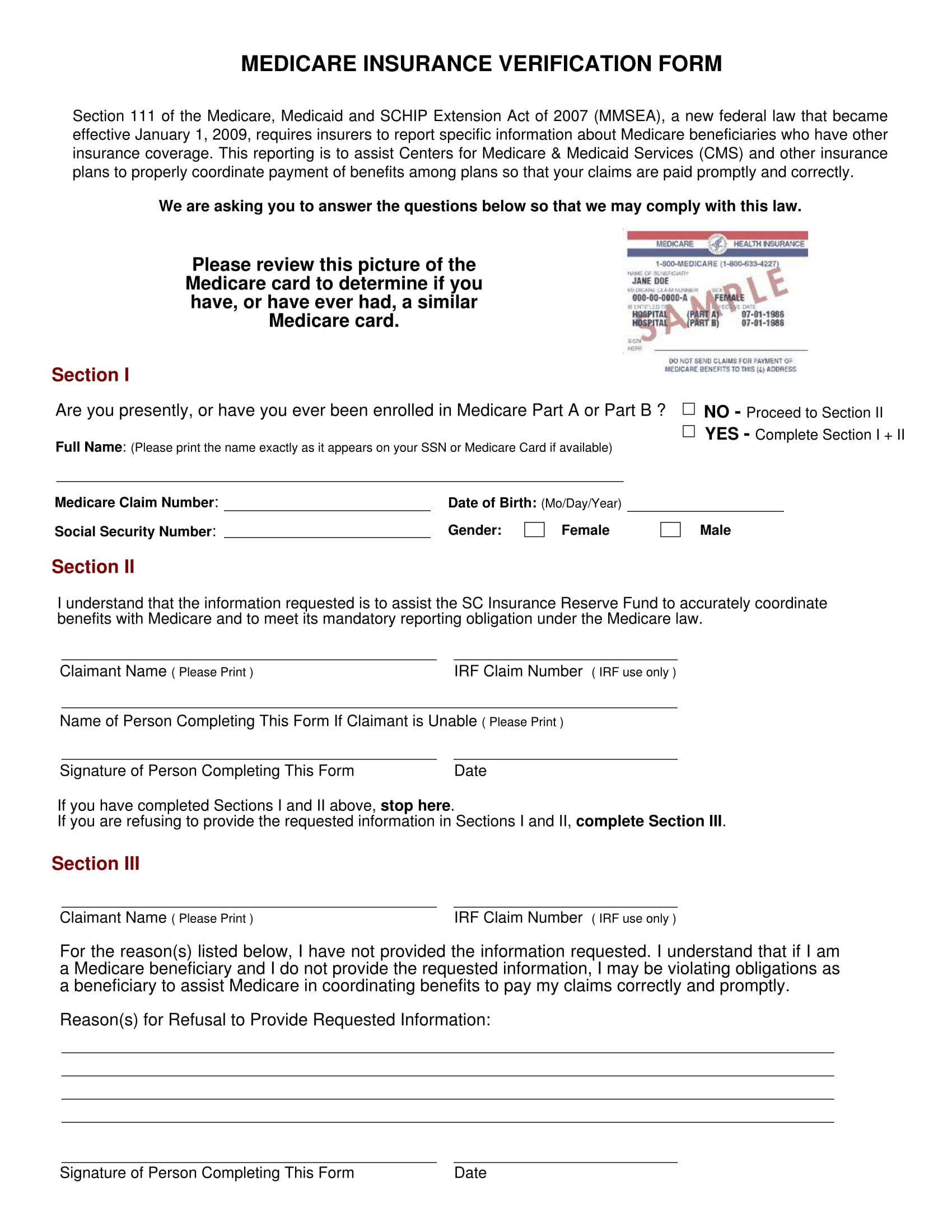

Medicare Insurance Verification Form

Validating a discount. One benefit that an insurance policyholder can have is to receive discounts and all sorts of promotion gifts from the insurance company or provider. The discounts may also include services of medical health procedures as well as veterinary services for pet insurances. During the validation of a discount, the veterinarian will do a quick insurance assessment with regards to the request of the policyholder. However, in the event that the veterinarian is not satisfied with the proofs provided by the policyholder, he may contact the insurance provider and begin an insurance verification process. Doing this allows the veterinarian to be rest assured that he is giving the right type of service to the policyholder and that his veterinary office or company will be receiving the appropriate payment for their provided services from the insurance provider.

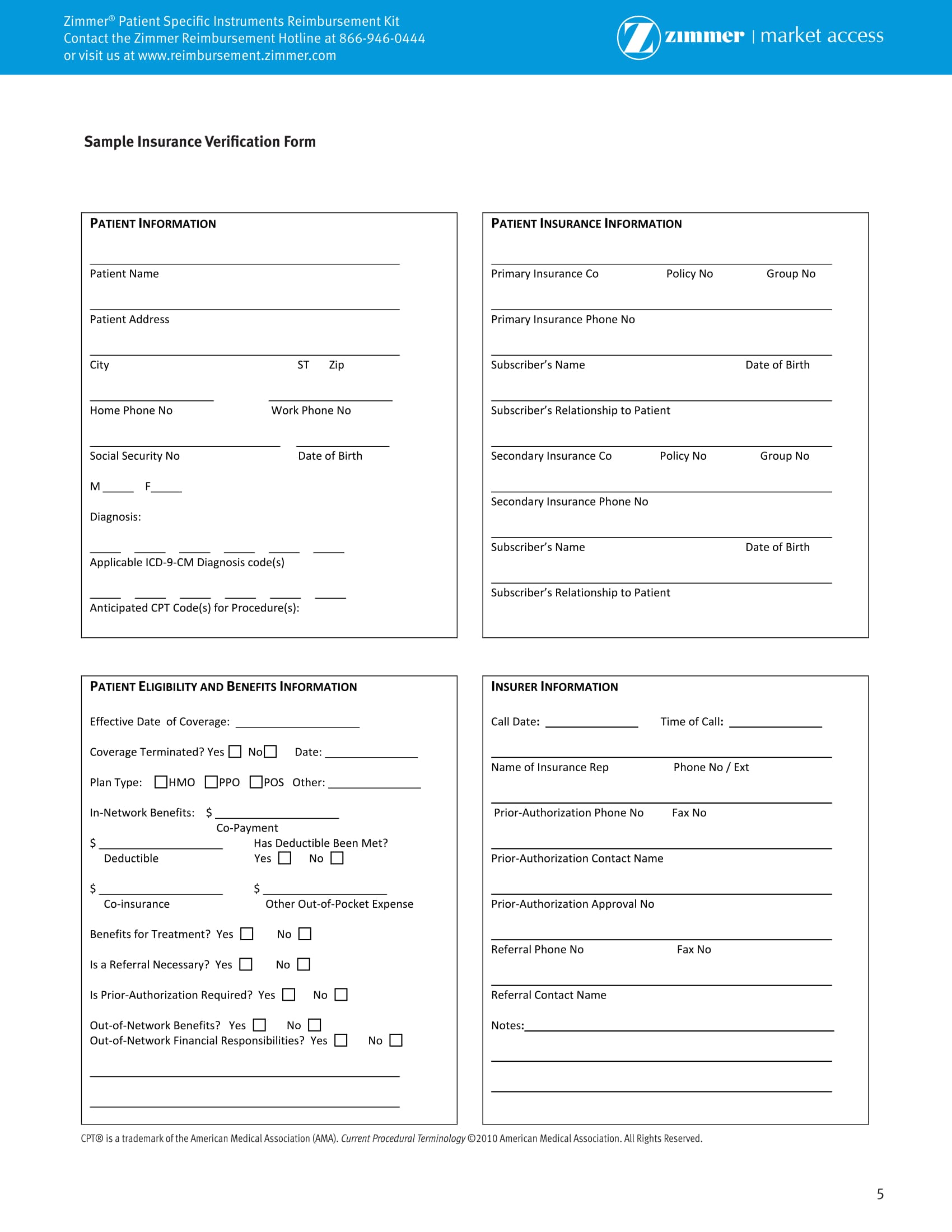

Patient Insurance Verification Form

Justifying for a student’s insurance. Students and children are mostly the known beneficiaries of an insurance coverage due to their parents who are policyholders. When a parent submits a student application for his child to enter the field of education, he must verify and inform the school that their child is a valid beneficiary of an insurance coverage to acquire a safety assurance. By using the results of a verified and certified insurance verification form, the school will know what particular medical services and emergency protocols will be covered by the child’s benefits range. This does not only help the school to lessen their expenses when an emergency arises, but it also serves as a call for the parents to feel secure as their child heads to the school campus and participate in any school-related activities.

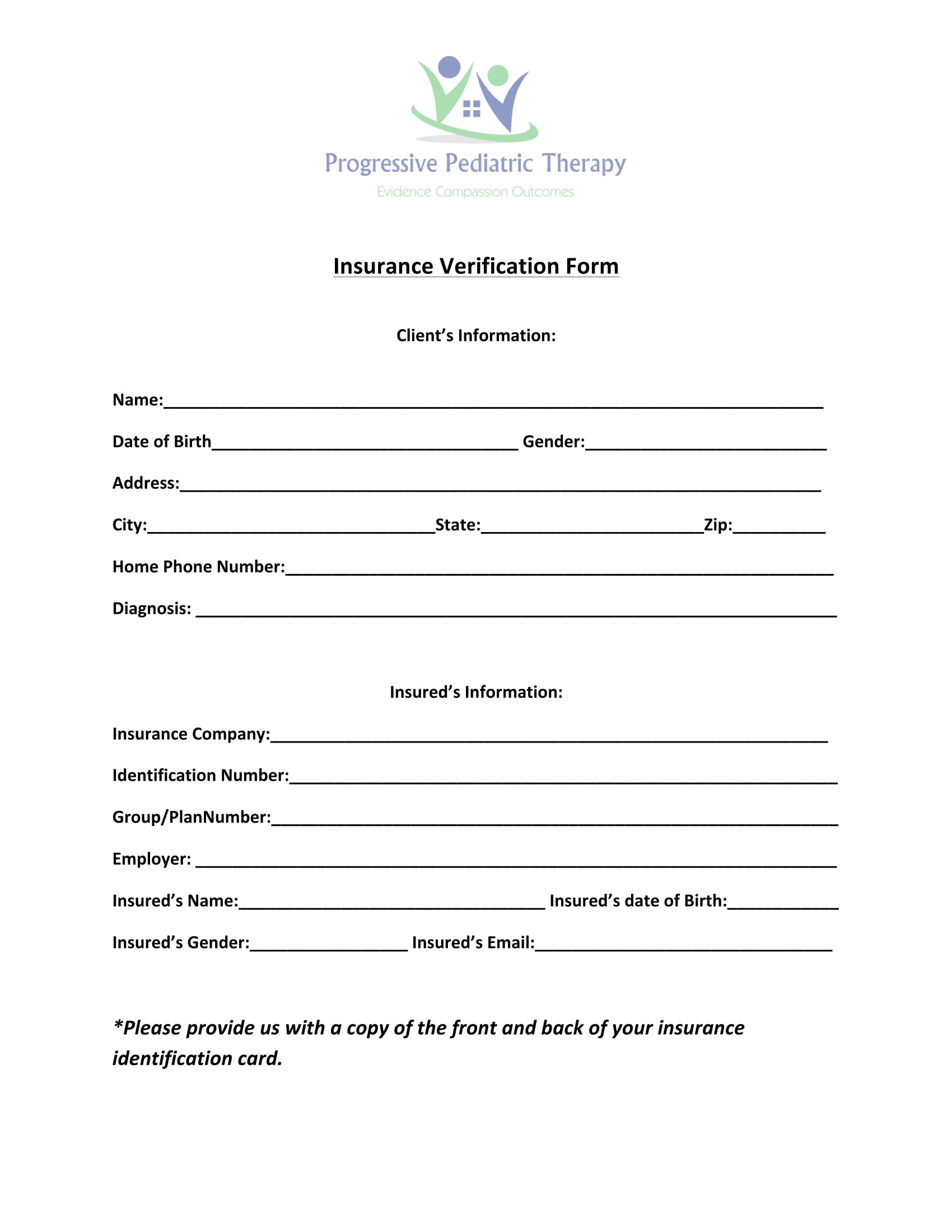

Pediatric Insurance Verification Form

Checking the beneficiaries. An insurance verification form can also be used if an insurance policyholder wants to check and secure that he had listed all the important and qualified people to be categorized as his beneficiaries. There are two types of beneficiaries which may be elected by the insurance policyholder, the primary and the contingent beneficiary. The primary beneficiary is mostly the spouse or the parents of the policyholder which will then demand a presentation of a marriage certificate form for the spouse to claim the payout. The other type of beneficiary is a contingent beneficiary who is often the insurance policyholder’s trustee. The trustee may be a colleague, a sibling, or any other person who is not the child or the spouse of the policyholder. Naming a trustee will benefit the other beneficiaries in the event that the policyholder dies since the trustee will be the person who will be held responsible for designating and allocating the payout amount.

Student Insurance Verification Form

Authenticating an update. This situation of authenticating an insurance update will be done after an insurance policyholder has submitted a service request to the insurance provider. The service request or a request for service form will have sections with regards to the particular areas that the policyholder wants to change or update. The policyholder may change the list of his beneficiaries, his name, his addresses, contact information, as well as his insurance coverage. Changing an insurance policyholder’s name will require a name change form and a proof or reason of why he will prefer to do the changes. After which, the insurance verification form will then be used to check if the changes have been stated and recorded in the database of the insurance company.

Vehicle Insurance Verification Form

Why Is There a Need to Verify an Insurance?

The need to verify an insurance is due to the aim of an insurance provider as well as involved organizations to provide the right services to a client and to receive the appropriate rewards for the services. By verifying, a fraud information, false claim, and even a stolen identity will be captured and pointed out to the authority. Insurance providers and companies also want to assure a heightened security as they are dealing with millions of people and will be facing various insurance claims every single day. Lastly, verifying an insurance also promotes responsibility for the insurance policyholders and allows them to be well-informed about their coverage, benefits, and the information that they have provided to the insurance company.

Related Posts

-

FREE 50+ Medical Insurance Verification Forms Download – How to Create Guide, Tips

-

FREE 5+ Auto Insurance Verification Forms in PDF

-

FREE 11+ Medical Health Insurance Verification Forms in PDF

-

Dental Insurance Verification Form

-

FREE 23+ Insurance Verification Forms in PDF | MS Word

-

FREE 50+ Application Verification Forms Download – How to Create Guide, Tips

-

FREE 6+ Pregnancy Verification Forms Download – How to Create Guide, Tips

-

FREE 10+ Verification of Mortgage Forms Download – How to Create Guide, Tips

-

Enrollment Verification Form

-

FREE 30+ Attendance Verification Forms in PDF | MS Word

-

FREE 4+ Employment Eligibility Verification Forms in PDF

-

FREE 8+ VIN Verification Forms in PDF

-

Bank Verification Form

-

Notary Verification Form

-

Tenant Employment Verification Form