A Dental Insurance Verification Form is essential for ensuring accurate insurance coverage details. Much like a Verification Form helps confirm accuracy in various sectors, this document plays a pivotal role in managing dental claims and minimizing disputes. From patient data to coverage specifics, the form provides a detailed outline, ensuring all necessary information is available. Comparable to an Insurance Verification Form in medical fields, it simplifies communication between providers and insurers. This comprehensive guide explains the form’s purpose, components, and how to use it effectively for streamlined dental service operations.

Download Dental Insurance Verification Form Bundle

What is Dental Insurance Verification Form?

A Dental Insurance Verification Form is a document used to confirm patient coverage details with their insurance provider. It ensures accurate claims and reduces billing errors, facilitating smooth operations for dental practitioners and patients alike.

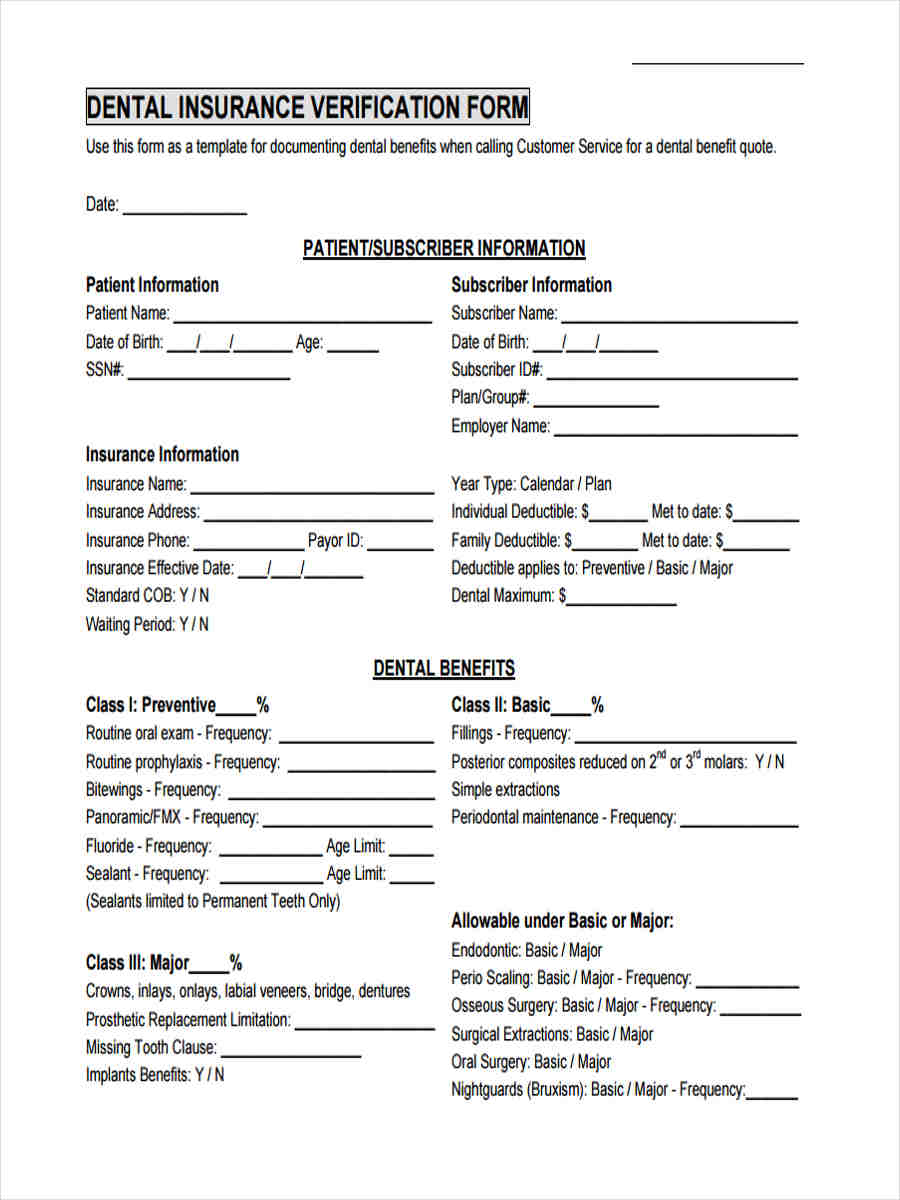

Dental Insurance Verification Format

Patient Information

Name: _________________________________

Date of Birth: ___________________________

Insurance Provider: ______________________

Insurance Details

Policy Number: ___________________________

Coverage Details: ________________________

Co-pay Amount: __________________________

Verification Confirmation

Representative Name: ______________________

Verification Date: ________________________

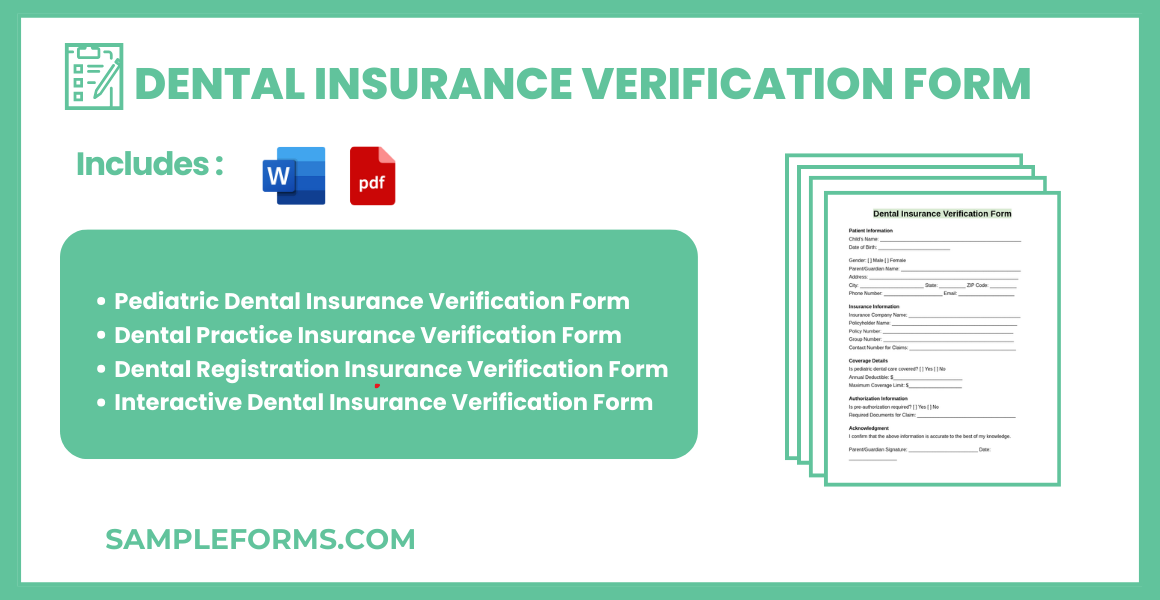

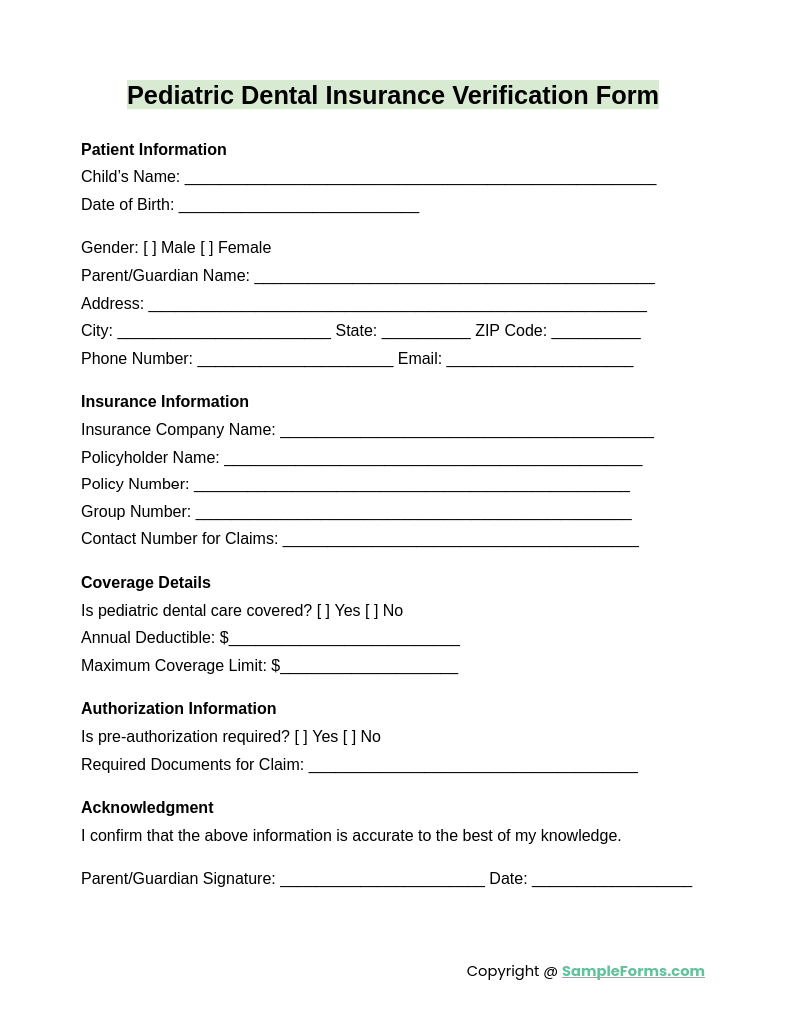

Pediatric Dental Insurance Verification Form

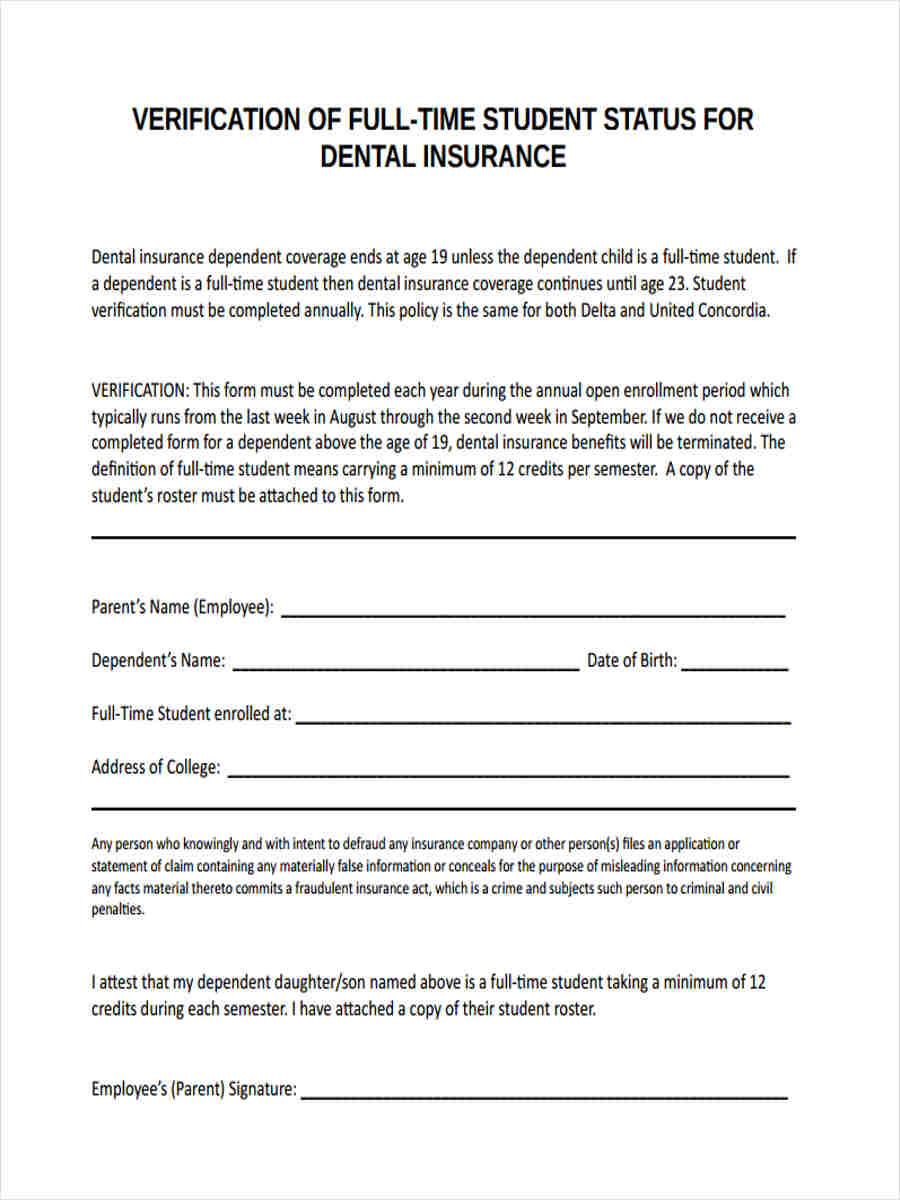

The Pediatric Dental Insurance Verification Form ensures accurate coverage verification for children’s dental care. It simplifies claim processes, similar to an Enrollment Verification Form validating academic or healthcare enrollment details.

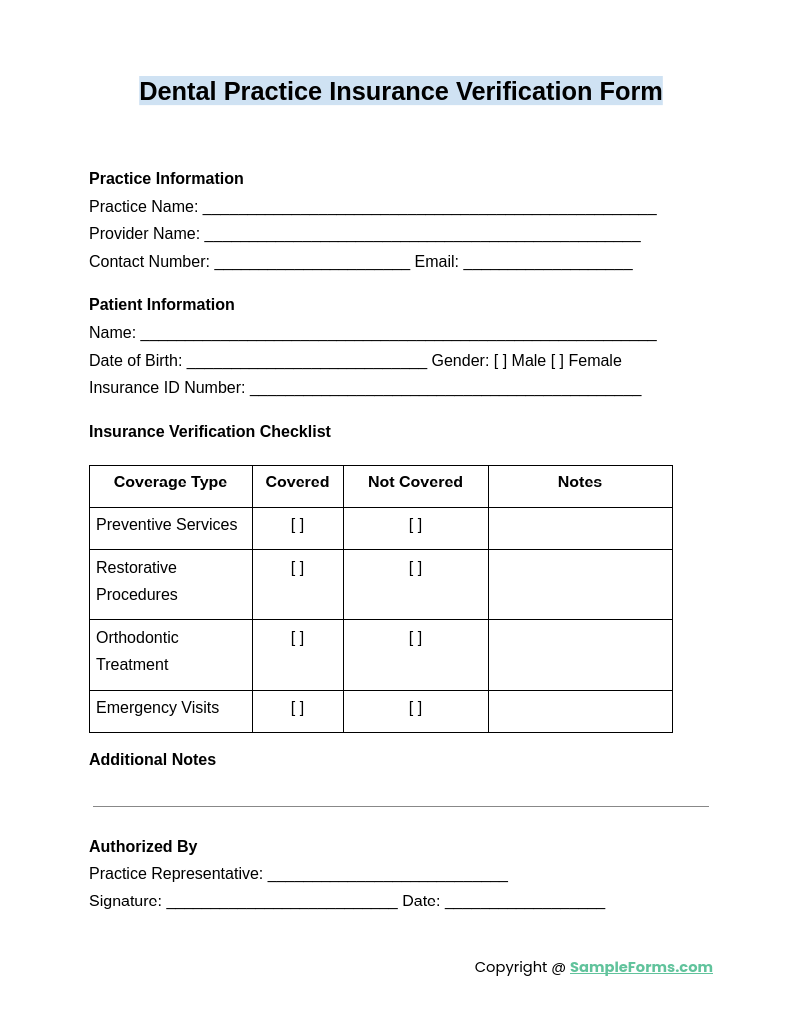

Dental Practice Insurance Verification Form

A Dental Practice Insurance Verification Form helps dental offices verify patient coverage efficiently, streamlining claims and reducing errors, much like a Notary Verification Form ensures authentication in legal documents.

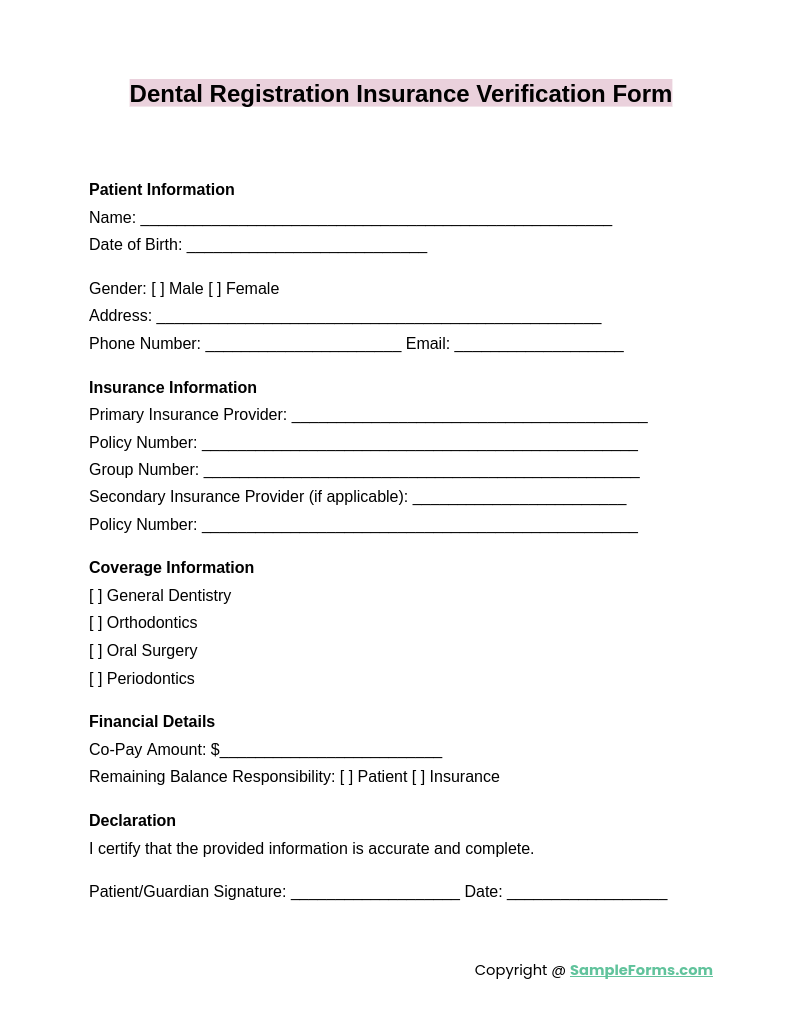

Dental Registration Insurance Verification Form

The Dental Registration Insurance Verification Form captures patient insurance details during registration, simplifying billing processes. It mirrors the efficiency of an Employee Verification Form in confirming staff credentials for seamless operations.

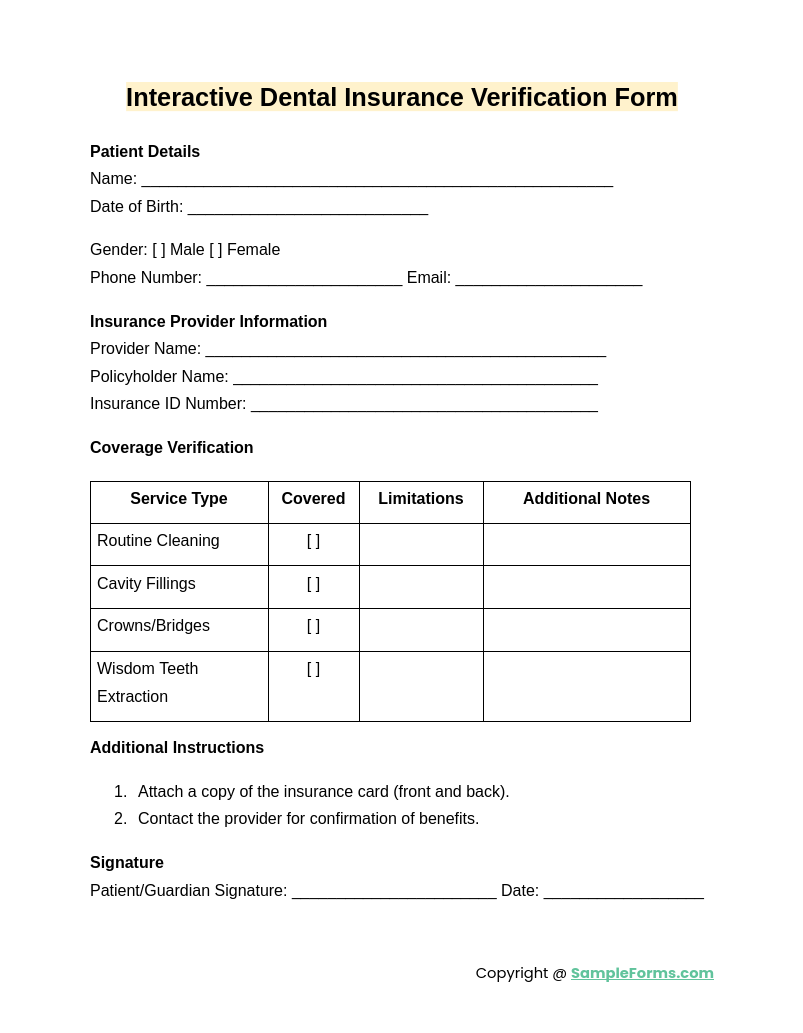

Interactive Dental Insurance Verification Form

An Interactive Dental Insurance Verification Form uses digital tools to verify patient coverage dynamically, ensuring accuracy. It functions like an Employment Verification Form, offering real-time data for precise decision-making.

Browse More Dental Insurance Verification Forms

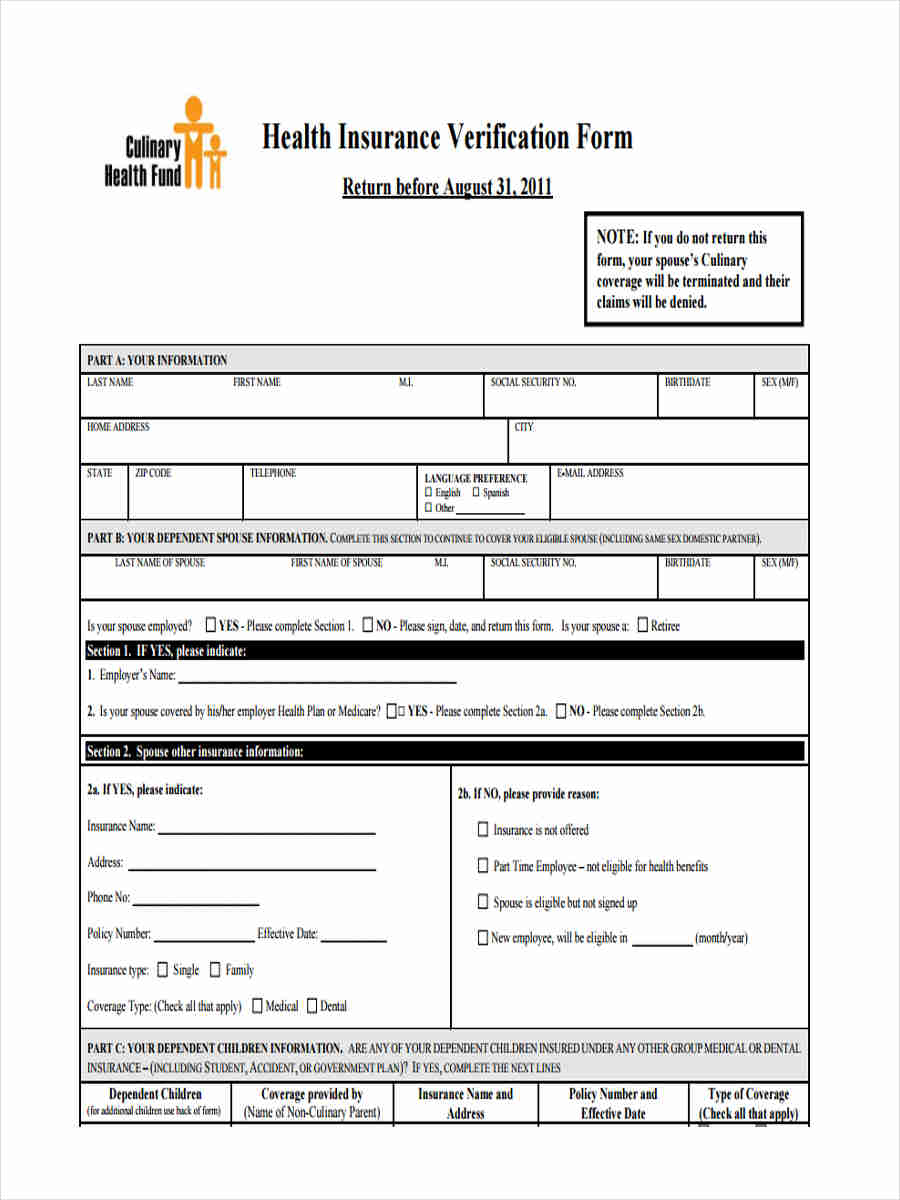

Dental Health Insurance Verification Form

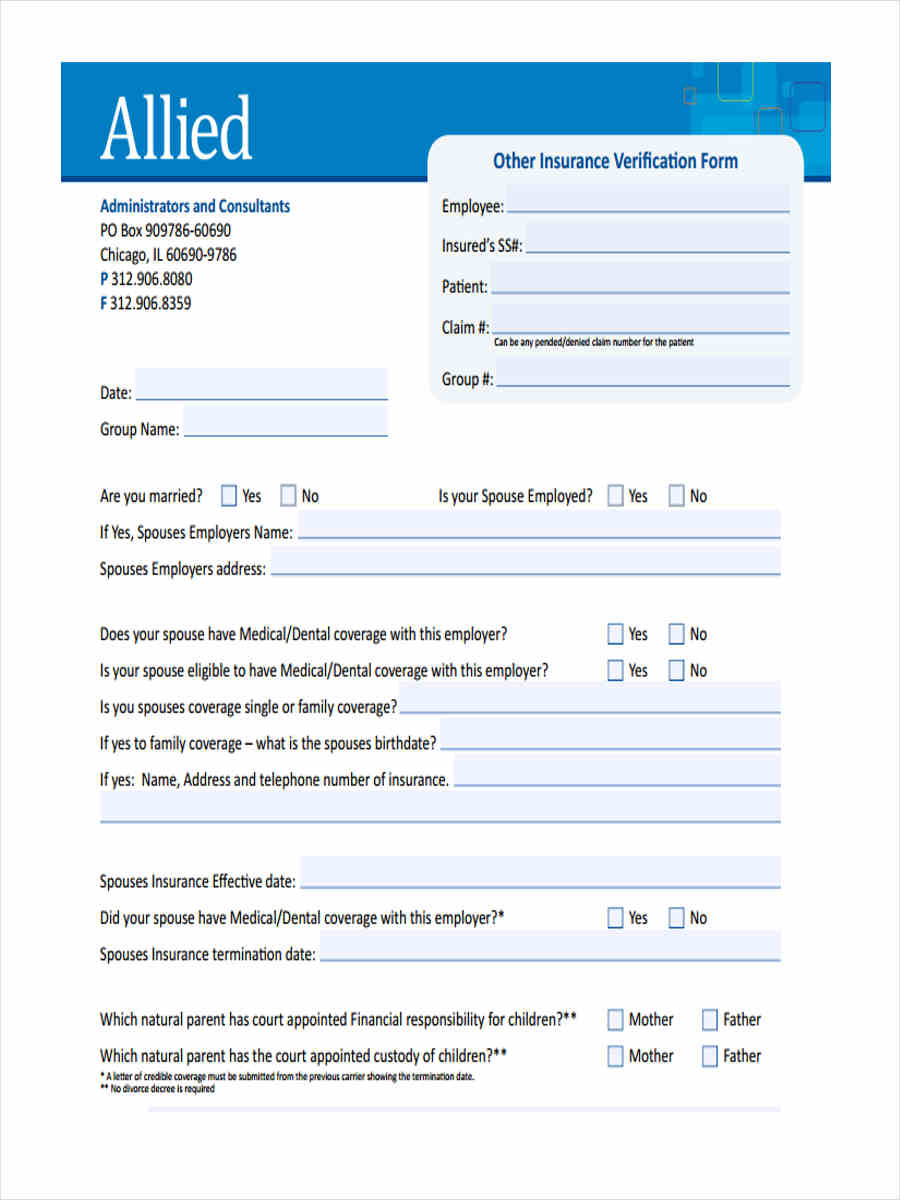

Other Insurance

Dental Insurance Verification

Student Dental Insurance

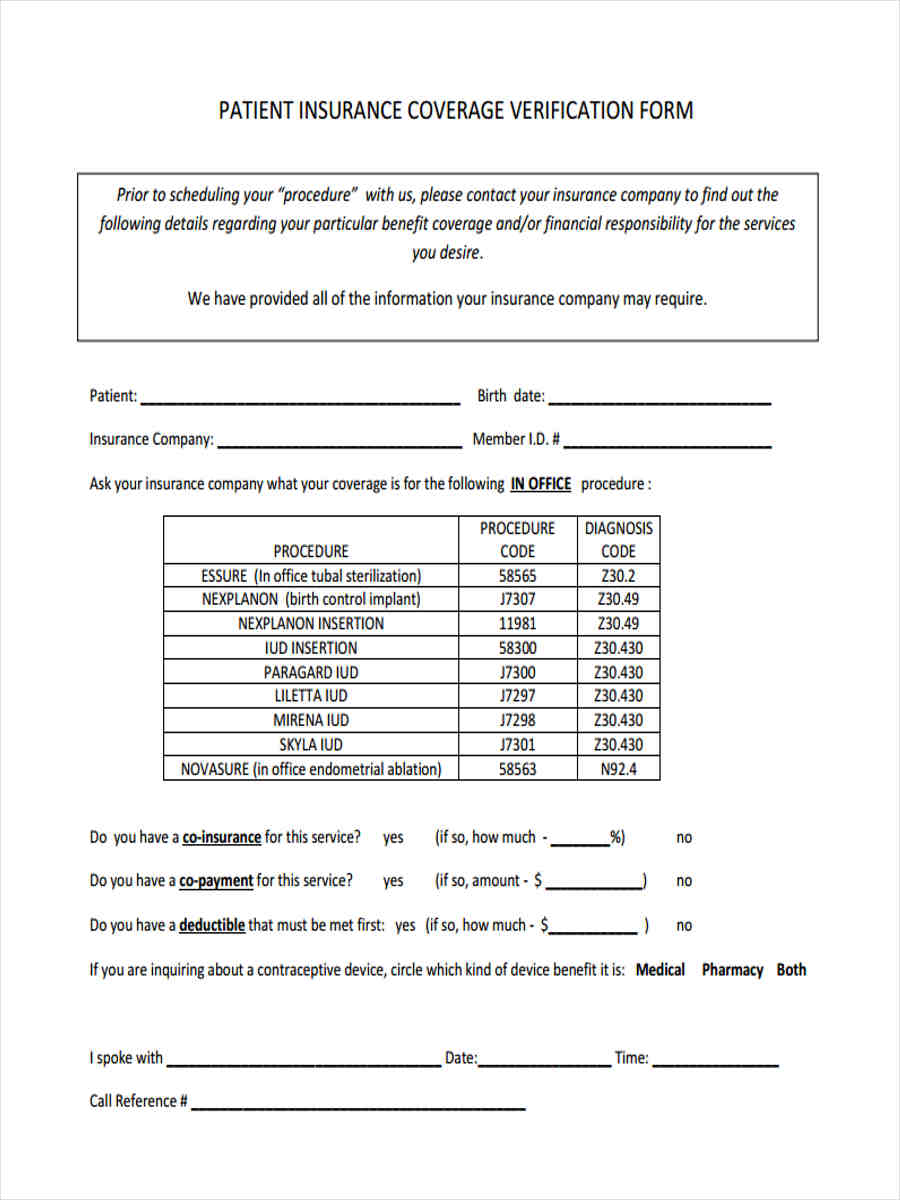

Patient Insurance Coverage Verification

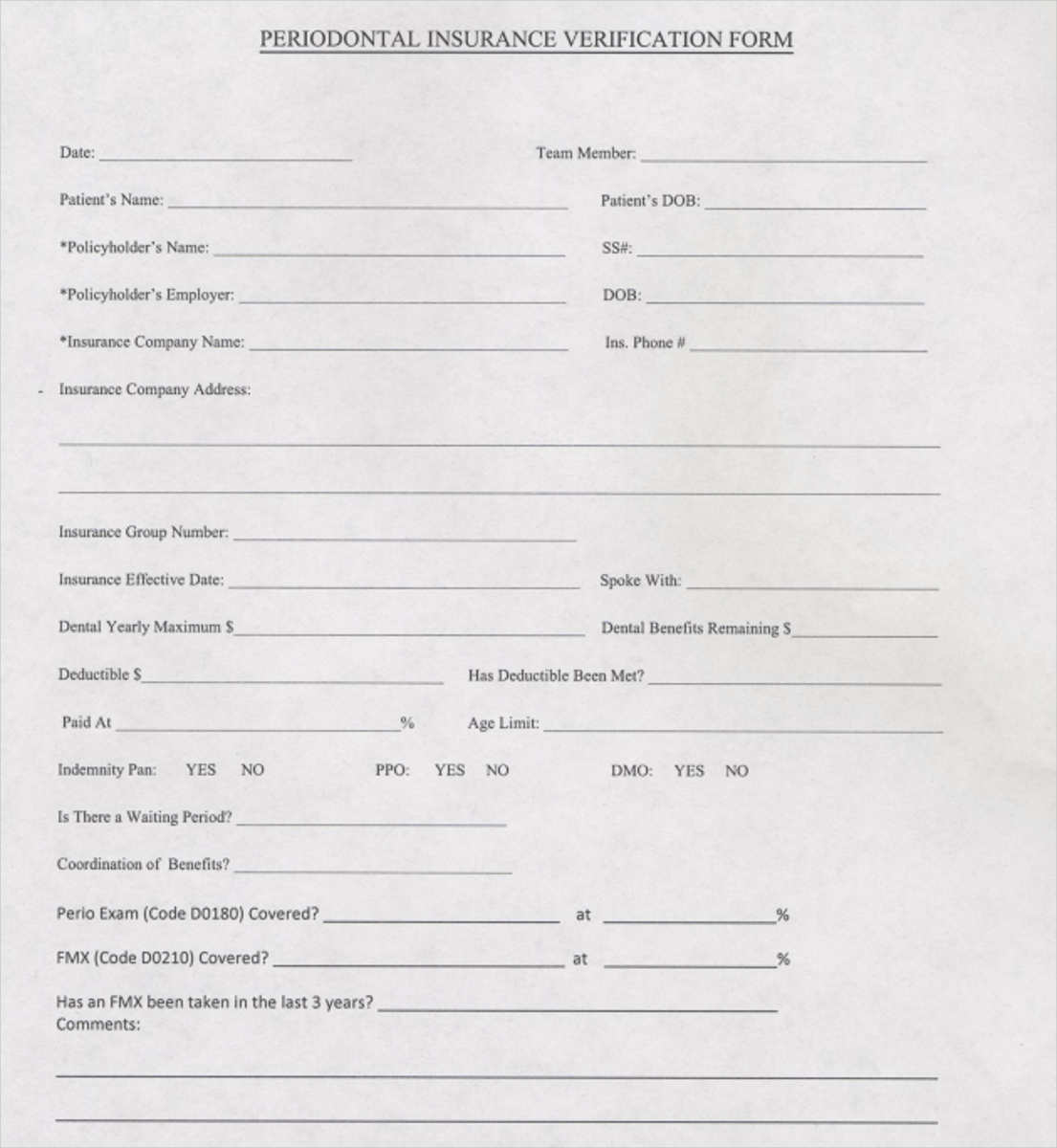

Periodontal Insurance

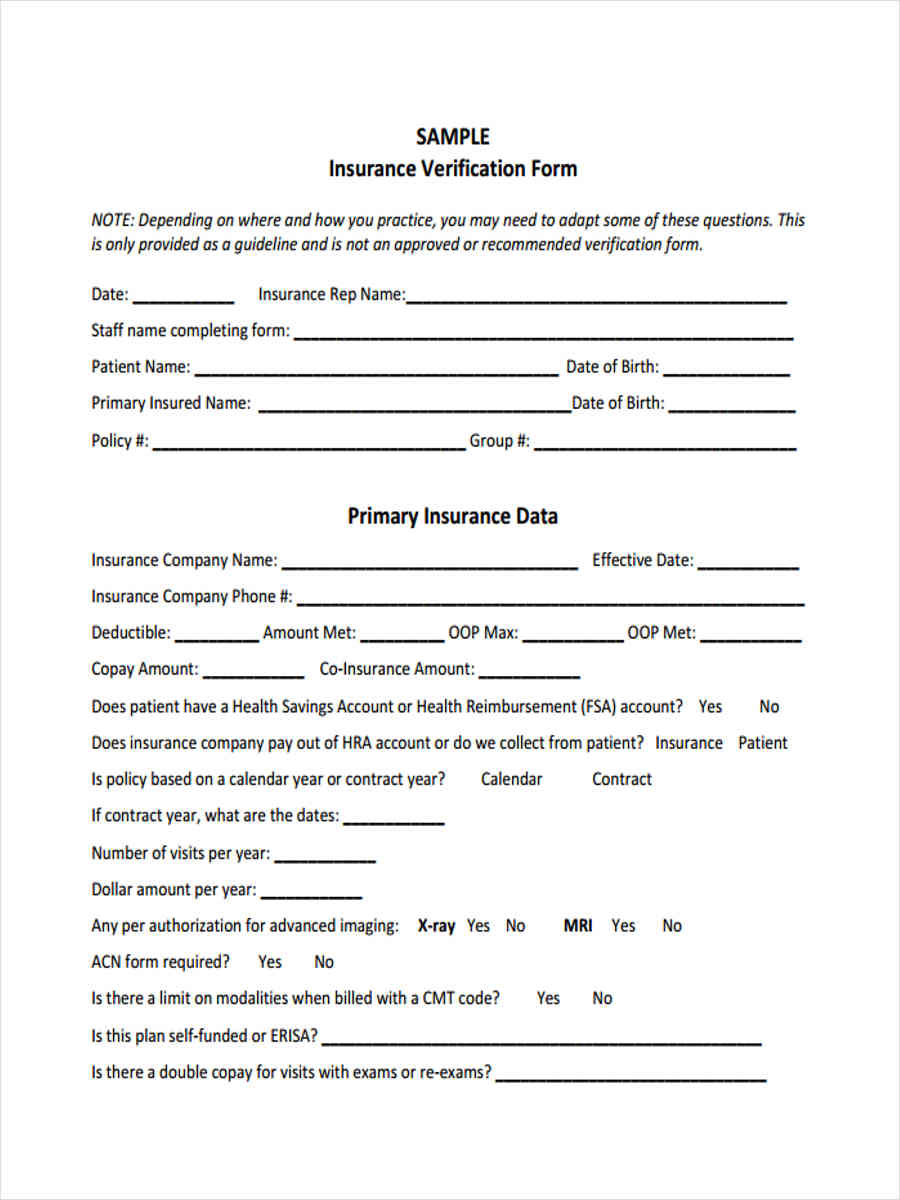

Sample Insurance Verification

Why do dentists need insurance?

Dentists require insurance to protect against liabilities and financial risks. It ensures patient safety and smooth operations, similar to a Rental Verification Form ensuring tenant credibility.

- Liability Coverage: Safeguards against malpractice or treatment-related claims.

- Property Protection: Covers damage to dental equipment or premises.

- Income Security: Ensures income continuity during unforeseen events.

- Compliance Assurance: Meets legal and professional requirements for operation.

- Enhanced Credibility: Builds trust among patients and partners.

Why is it important to verify a patient’s dental insurance?

Verifying dental insurance ensures accurate billing, preventing claim disputes. It’s akin to using a Landlord Verification Form to confirm tenant reliability.

- Coverage Confirmation: Identifies benefits and limitations of patient plans.

- Cost Estimation: Calculates out-of-pocket expenses for patients.

- Avoiding Denials: Minimizes claim rejections by ensuring eligibility.

- Efficient Billing: Streamlines payment processes between patients and insurers.

- Improved Patient Trust: Enhances transparency and service satisfaction.

What are the cons of dental insurance?

Dental insurance can limit treatment choices and involve high premiums. It parallels challenges in a Bank Verification Form, ensuring financial accuracy but requiring scrutiny.

- Limited Coverage: May exclude certain procedures or specialist treatments.

- High Premiums: Costs might outweigh the benefits for minimal treatments.

- Complex Claims: Processing claims can be time-consuming.

- Network Restrictions: Limits the choice of dental practitioners.

- Annual Caps: Coverage is often capped, leading to out-of-pocket expenses.

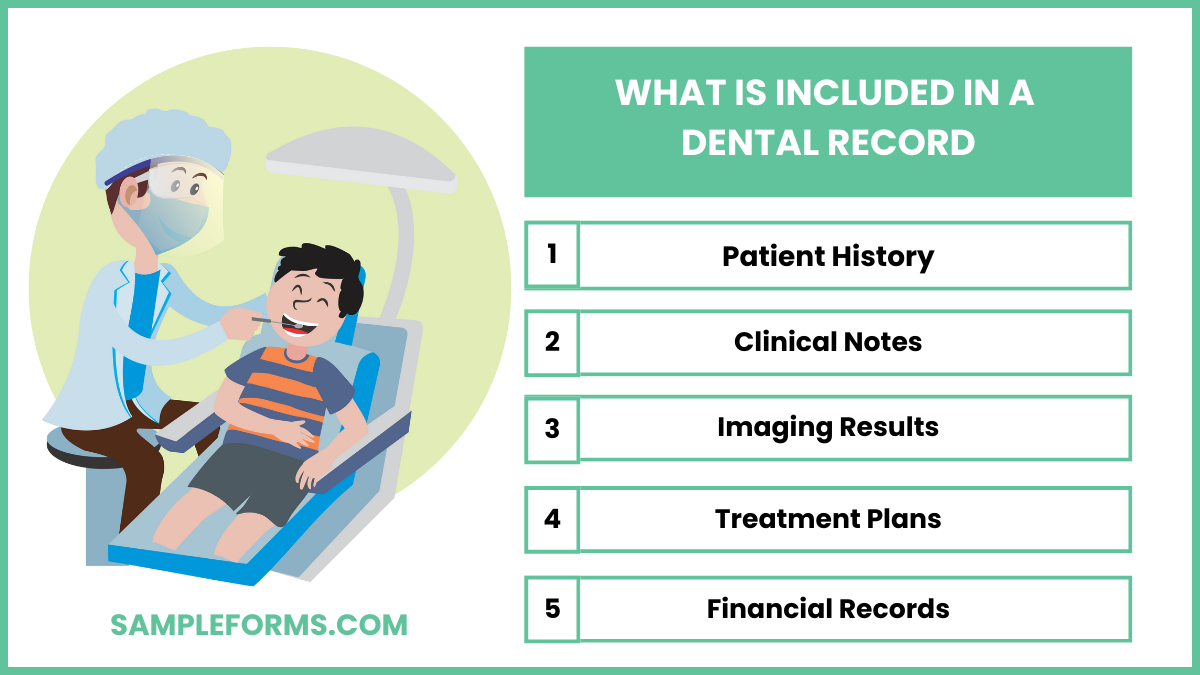

What is included in a dental record?

Dental records document patient history, treatments, and progress, functioning like a Background Verification Form for ensuring detailed information integrity.

- Patient History: Includes medical conditions, allergies, and past treatments.

- Clinical Notes: Records examinations, diagnoses, and procedures performed.

- Imaging Results: X-rays or scans for diagnostic purposes.

- Treatment Plans: Outlines recommended and completed procedures.

- Financial Records: Tracks payments and insurance claims.

Which tasks are completed during insurance coverage verification?

Verifying insurance coverage involves detailed tasks ensuring claims are valid, much like a Shelter Verification Form confirming housing eligibility.

- Patient Information Collection: Gathers accurate personal and policy details.

- Policy Validation: Confirms active status and benefits with the insurer.

- Preauthorization: Secures insurer approval for specific treatments.

- Cost Analysis: Calculates co-payments and deductibles for patients.

- Claim Preparation: Organizes required documentation for seamless processing.

How do you do insurance verification?

Insurance verification involves confirming patient details with the provider, ensuring coverage and benefits align. It’s similar to using an Asset Verification Form to validate assets.

When should insurance verification take place?

Insurance verification should occur before appointments to confirm active coverage. This process parallels using a Work Verification Form for timely employment confirmation.

What is the best insurance to have for dental?

The best dental insurance offers comprehensive coverage, affordability, and a wide network, akin to using an Attendance Verification Form for accurate monitoring.

Whose responsibility is it to verify insurance coverage?

Healthcare staff handles insurance verification to ensure accuracy, similar to using a Volunteer Verification Form to confirm service eligibility.

How often should the patient’s insurance coverage be verified?

Patient insurance should be verified at every visit to ensure updates, much like a Mortgage Verification Form validates details regularly.

Why do I need to validate my insurance?

Validating insurance ensures active coverage and accurate billing, paralleling the need for a VIN Verification Form to confirm vehicle identification.

What is the main purpose for verifying a patient’s insurance coverage at every visit?

Verifying insurance ensures current coverage, avoids claim rejections, and aligns with using an Education Verification Form for updated credentials.

What is an insurance verification representative?

An insurance verification representative confirms patient coverage with providers, akin to using a Dependent Verification Form for dependent eligibility confirmation.

How to use Availity to verify insurance?

Availity enables real-time insurance checks for active policies and benefits, much like using a Tenant Verification Form for rental confirmations.

What is the verification validation process?

Verification validation involves confirming details for accuracy and reliability, similar to using a Residential Verification Form to ensure housing legitimacy.

A Dental Insurance Verification Form is vital for confirming patient insurance details and coverage limits. Similar to a Tax Verification Form, it ensures accurate communication and transparency, streamlining billing and enhancing patient experience.

Related Posts

-

Bank Verification Form

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

Notary Verification Form

-

Tenant Employment Verification Form

-

What Is a Volunteer Verification Form? [ Definition, Types, Importance ]

-

Proof of AA Attendance Form

-

Verification Certificate Form

-

What Is a Training Verification Form? [ Definition, Uses, Significance ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

Birth Verification Form

-

Background Verification Form

-

FREE 10+ Asset Verification Forms in PDF | MS Word

-

Address Verification Form

-

Signature Verification Form