Learning how to properly validate any piece of information is essential in learning whether or not what was received is both accurate and truthful. If one were to required to conduct and advisor invitation verification, then that person must submit information his or her proposed study that is needed by an advisor for proper assessment.

Verifying information is especially important within the world of business. A good example would be if one were to do a verification of property wherein a real estate agent absolves a property from any liabilities, as well as proving that the buyer has had the opportunity to look at the property.

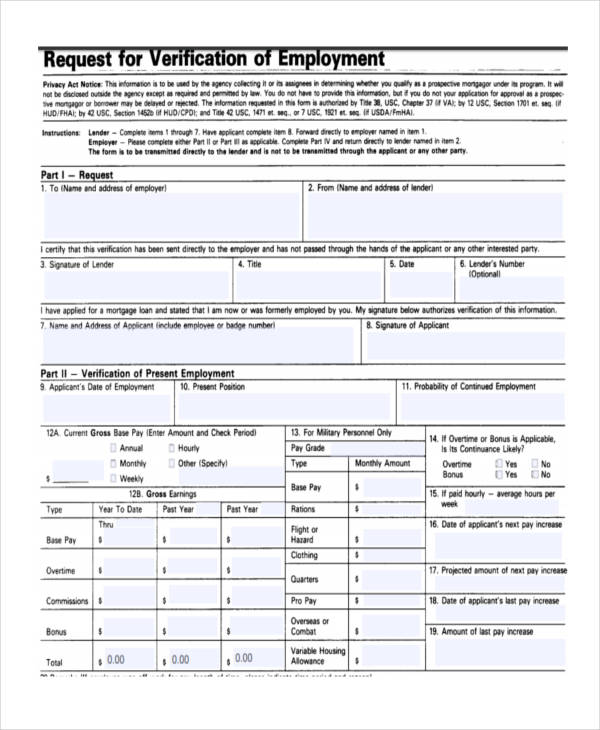

Employment Mortgage

Blank Mortgage

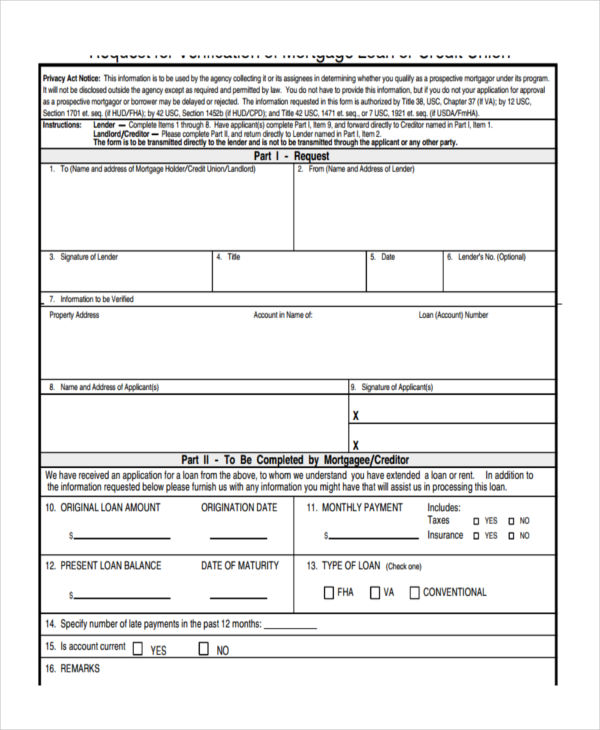

Mortgage Loan Form

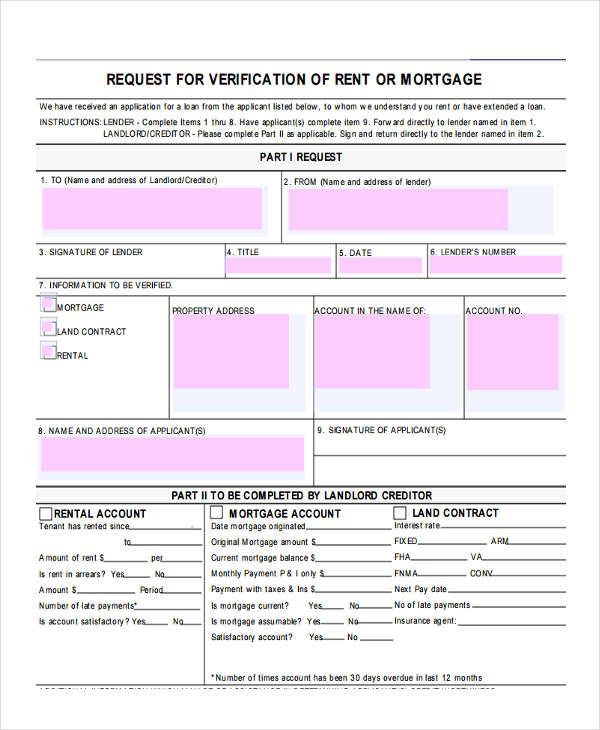

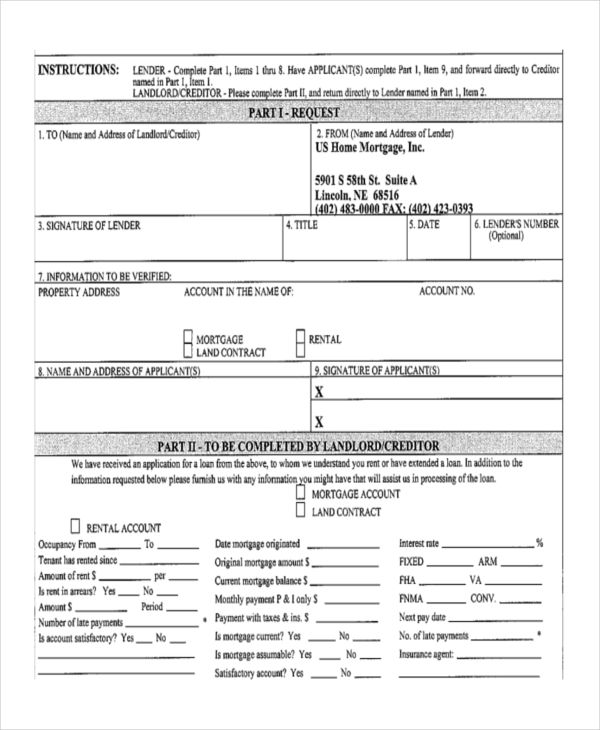

Mortgage Rent

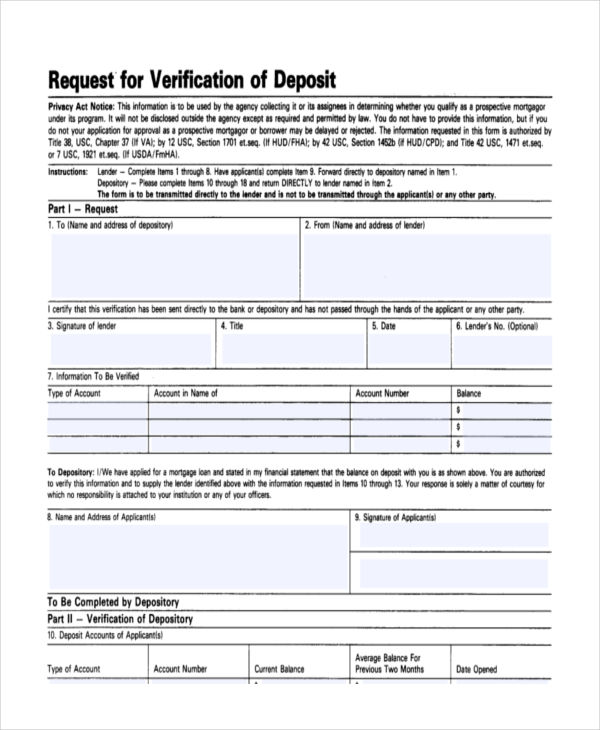

Mortgage Verification of Deposit

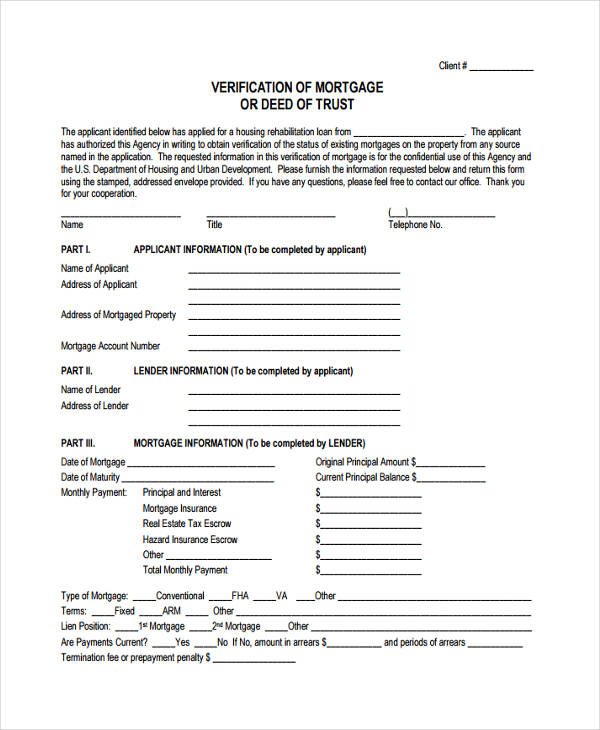

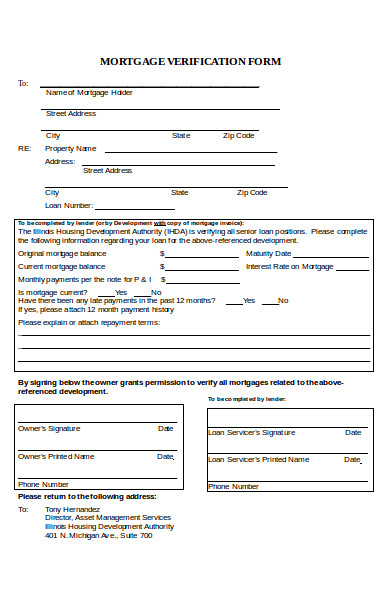

What Is Mortgage Verification?

A mortgage verification is a documentation that checks on a borrowers mortgage payment history. This type of verification is often required when one wishes to issue a loan. This is used to verify one’s existing account balance and monthly payments, as well as seeing of the person has made any late payments with his or her account.

This can also be used for employment purposes to see determine an employee’s previous wages. If you would like to know more about mortgage verification, then you may view our verification forms in Word to help you get the information you need.

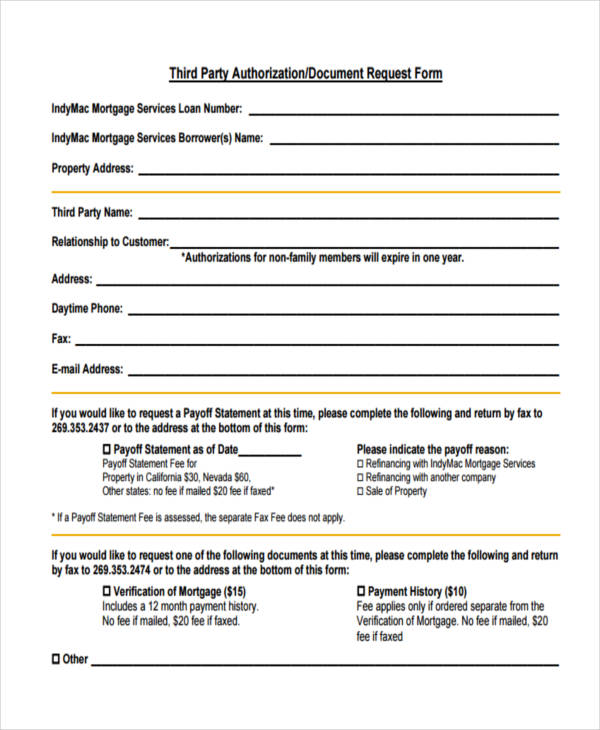

How to Get a Verification of Mortgage

For those that would like to obtain verification of mortgage, then follow these steps to help:

- Make sure to collect your most recent mortgage statement, mortgage loan account number, and both you and your spouse’s social security number.

- Schedule the meeting with your loan officer or finance company and provide them with the information you have collected to ask for a mortgage verification

- Make sure to review the mortgage verification to see whether there are any discrepancies. In the event that there are any, contact your lender.

In the event that you would like to verify other information, such as using income verification forms to verify one’s monthly income, then you may view our other sample verification forms to help you.

Mortgage Deed Form

Mortgage Verification Request

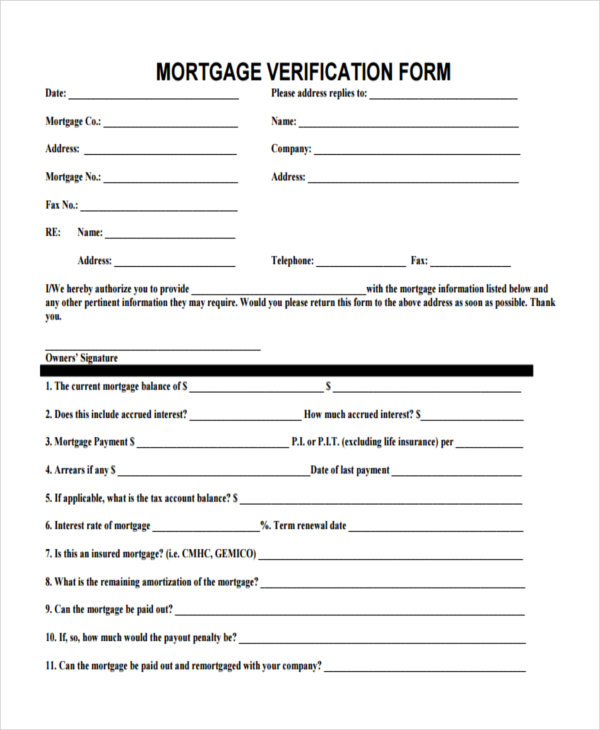

Mortgage Verification Information

Sample Mortgage Verification Form

Requirements of Mortgage Verification and Validation

- It is important to verify one’s employment for a mortgage verification. So you may acquire employment verification request forms to help you with that.

- at least 30 days worth of pay stubs must be provided

- statements regarding of one’s assets

- Supporting statements regarding any payroll deductions such as alimony or child support.

- Validate a borrowers appraisal figures with the help of automated valuation models.

Be sure that all of the information above is provided in the event that you are requested to make a mortgage verification and validation.

Verification of Deposit For Mortgage Companies

Mortgage companies that require information to see whether a person is eligible for a loan must be provided with the following:

- Account number

- Type of Account

- Name of account holders

- Account holder’s current balance

- Account holder’s current interest rate

- Previous 2 average statement balances

- Previous 2 months interest paid.

If you would like to know more on how to properly verify one’s ability to apply for a loan, then you may view our verification forms in PDF to help you out.

Related Posts

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

FREE 9+ Sample Loan Confirmation Forms in PDF

-

FREE 8+ Sample Tax Verification Forms in PDF

-

FREE 8+ Sample Reference Verification Forms in PDF

-

FREE 8+ Sample Social Security Verification Forms in PDF | MS Word

-

FREE 9+ Sample Medical Verification Forms in PDF | MS Word

-

FREE 8+ Sample Education Verification Forms in PDF | MS Word

-

FREE 9+ Sample Work Experience Forms in PDF | MS Word

-

Enrollment Verification Form

-

Bank Verification Form

-

Notary Verification Form