Taxes has been considered one of constant things in the world. Employers, governments, and even academic institutions use tax verification forms to determine if a person has paid his/her taxes. And finding out if a person or entity has been paid correct taxes isn’t as simple as filling out a signature verification form.

A tax verification form is vastly different from a signature verification form. The latter is used to confirm a person’s identity while the former is used to confirm if the correct amount of tax has been paid to the government or not. Contrary to popular beliefs, it is also not used for verification of property ownership.

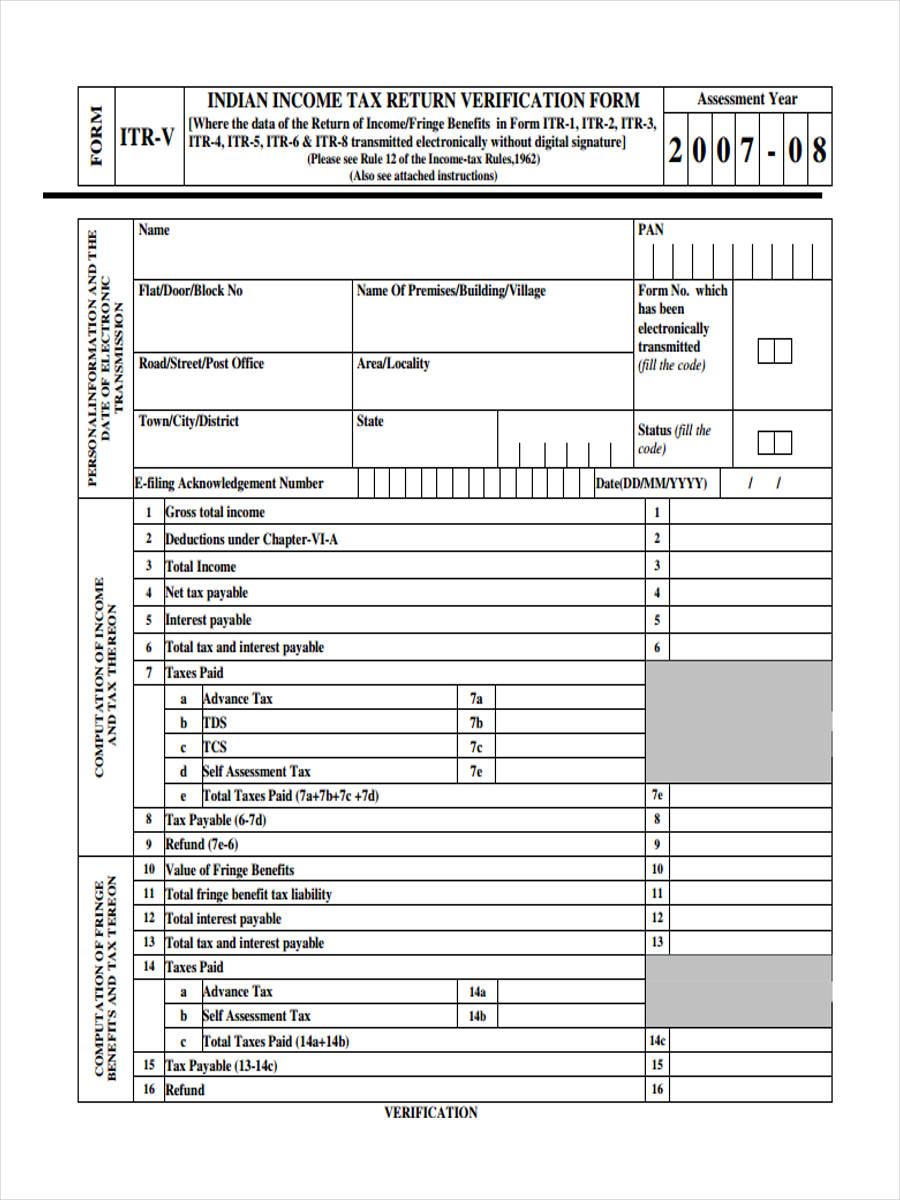

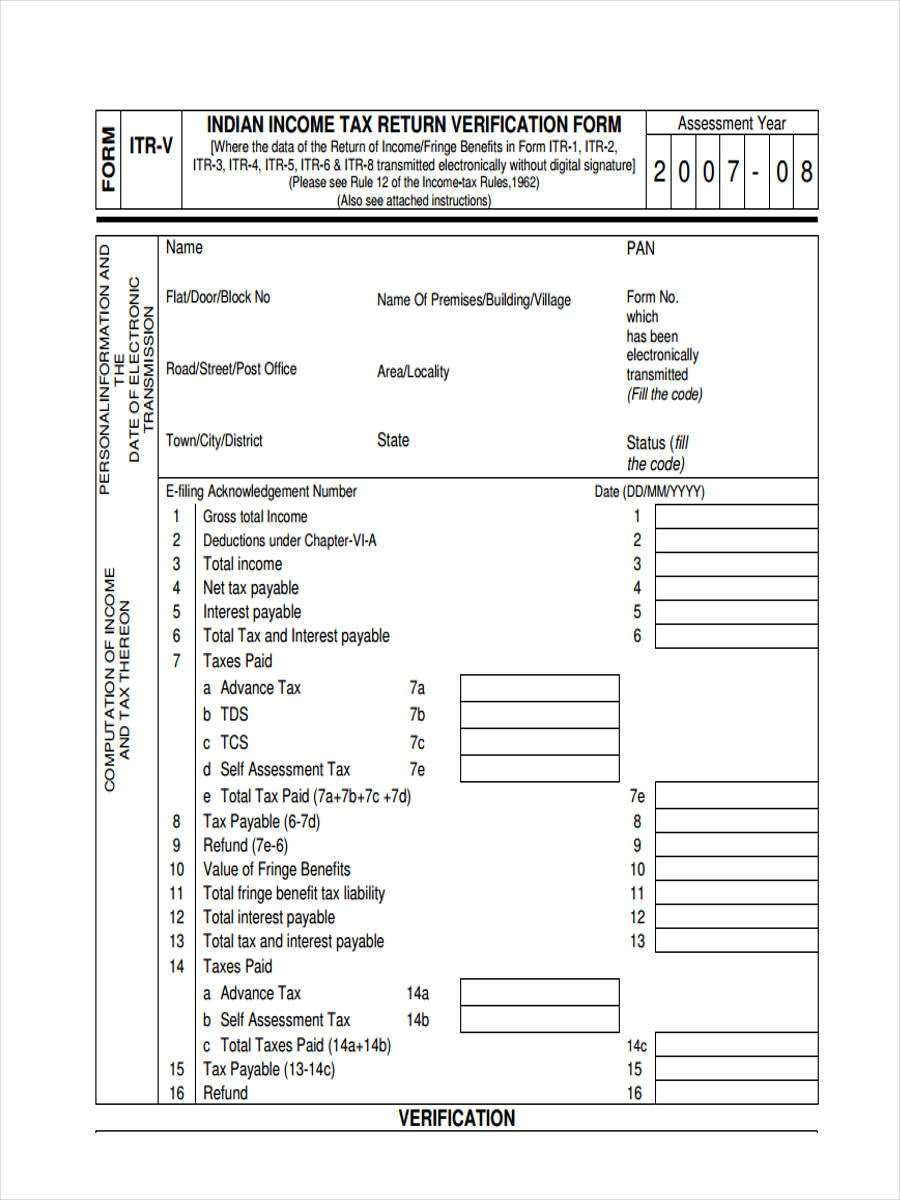

Income Tax Verification Form Sample

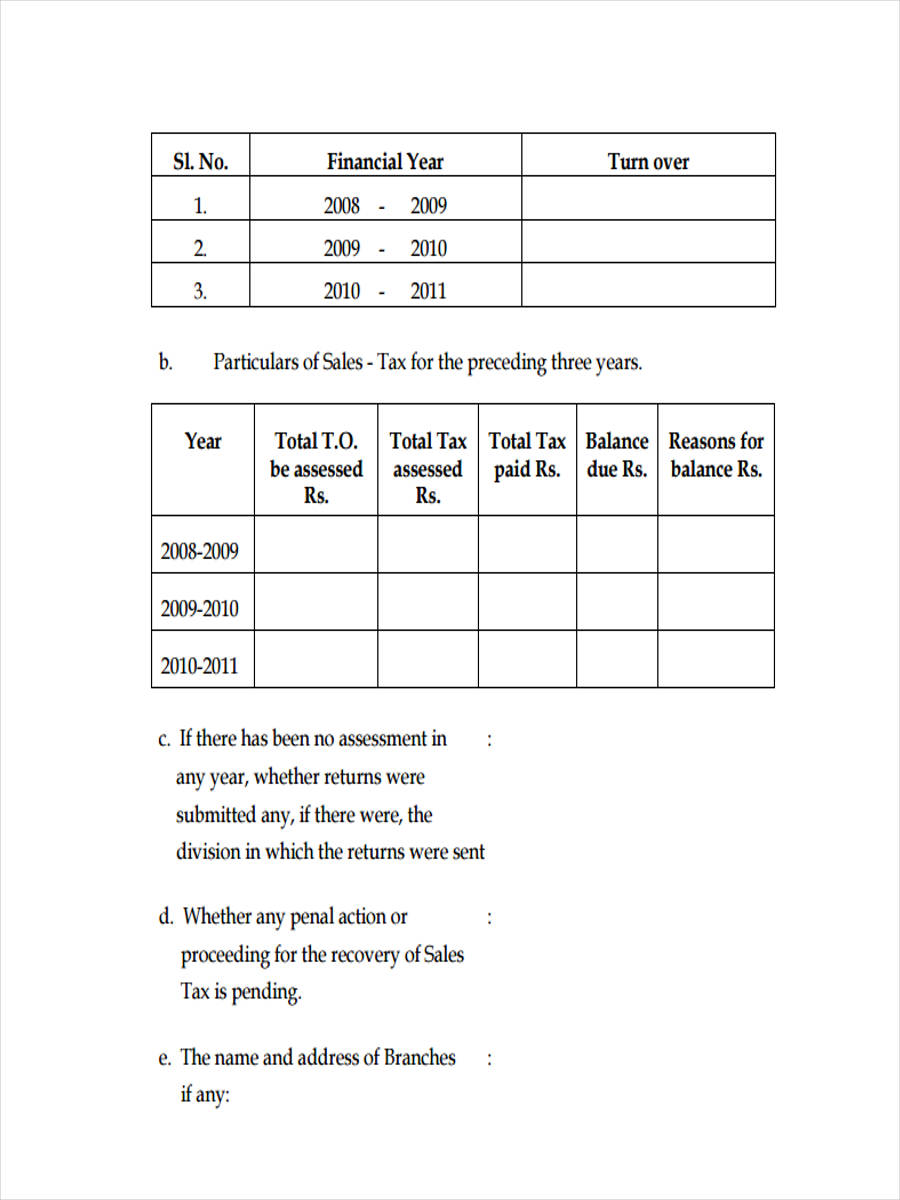

Sales Tax Verification

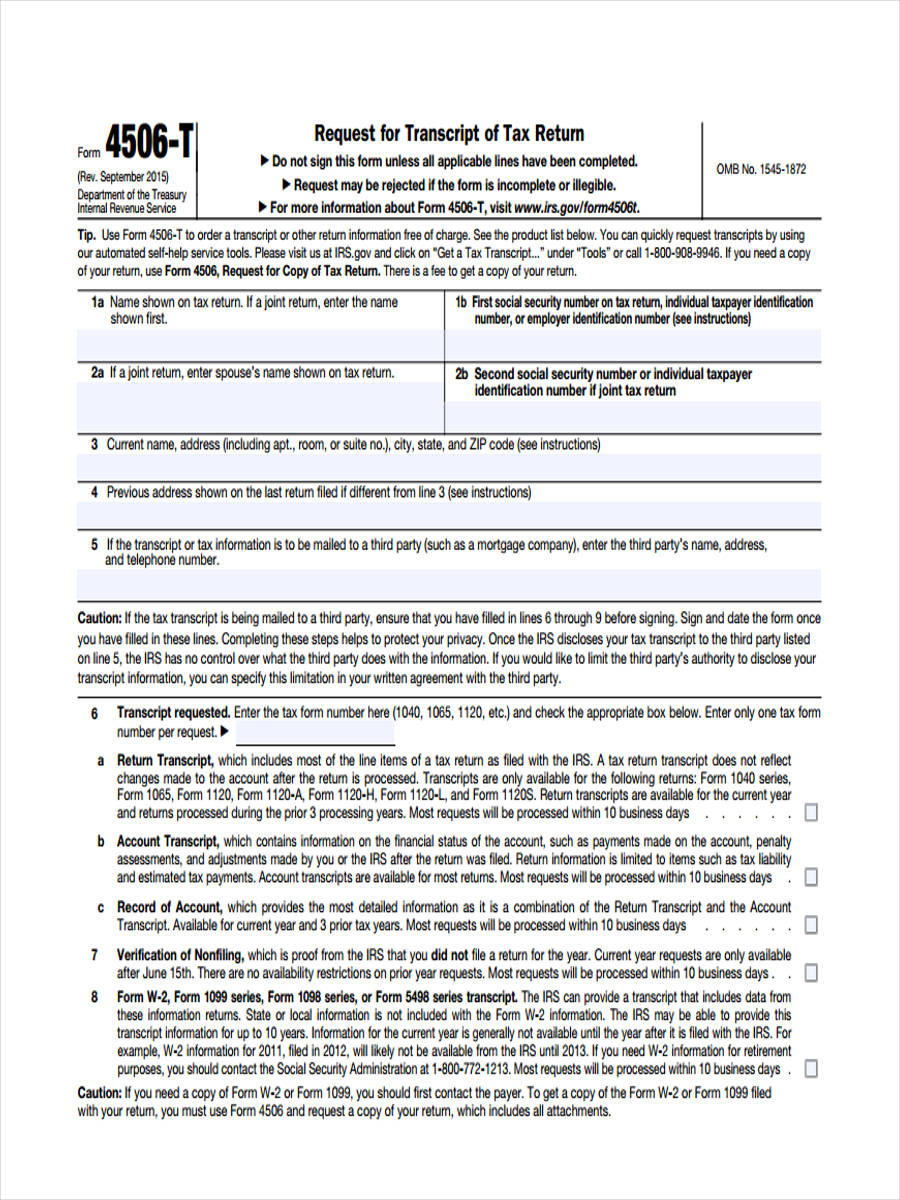

IRS Tax Verification

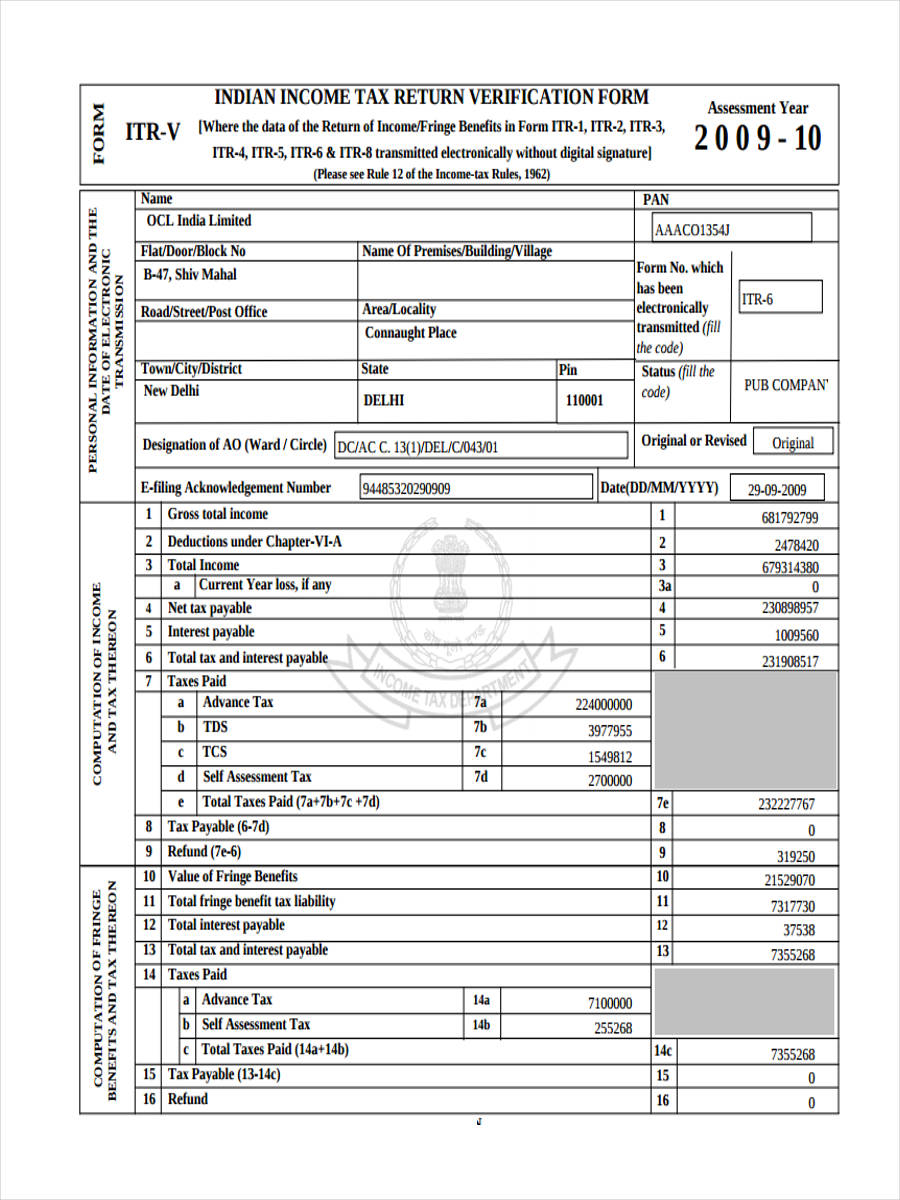

Tax Return

Tax Map

What Is a Tax Verification Form?

As mentioned above, a tax verification form is a data sheet asking for an individual’s personal income and tax payments. Employers, governments, and financial institutions use a tax verification form to supplement their knowledge of an individual or a business’ tax practices and/or to determine his/her financial capability.

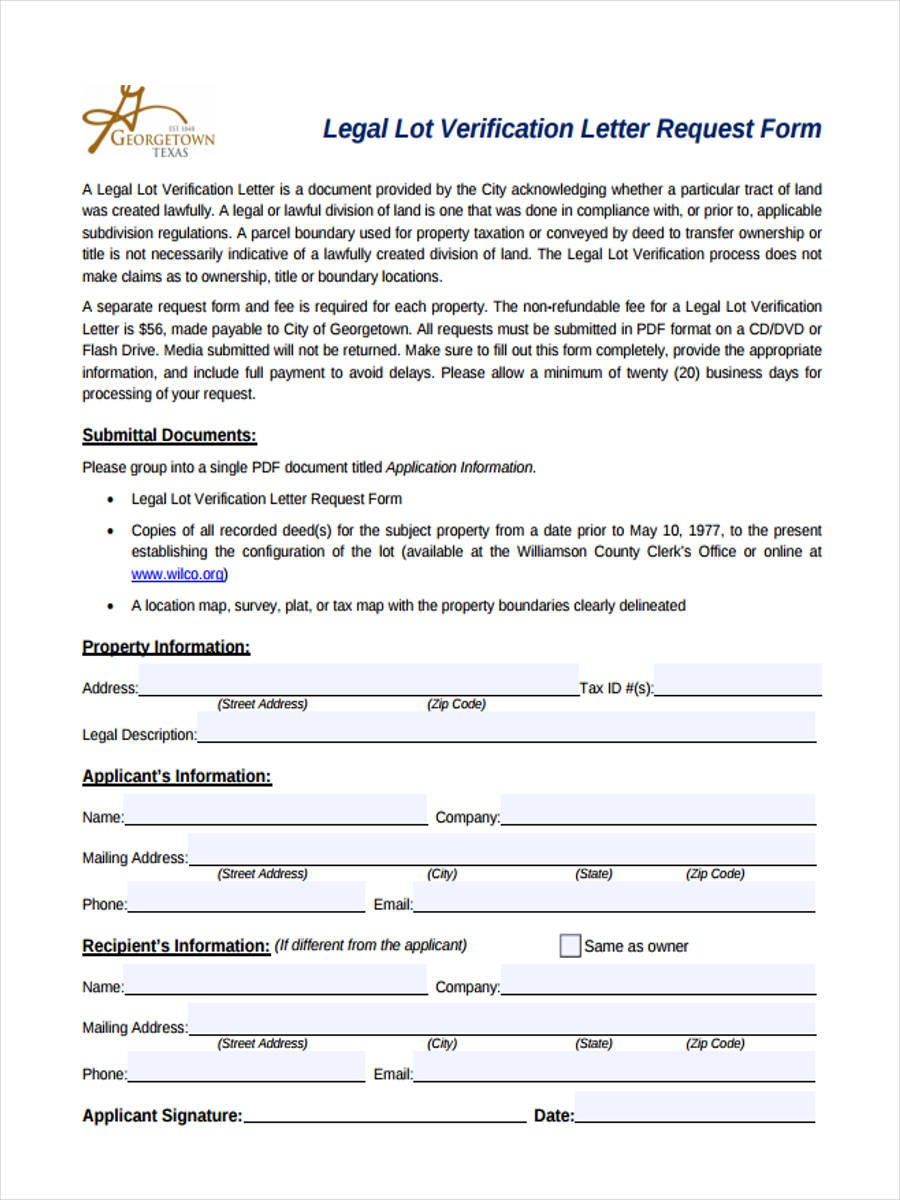

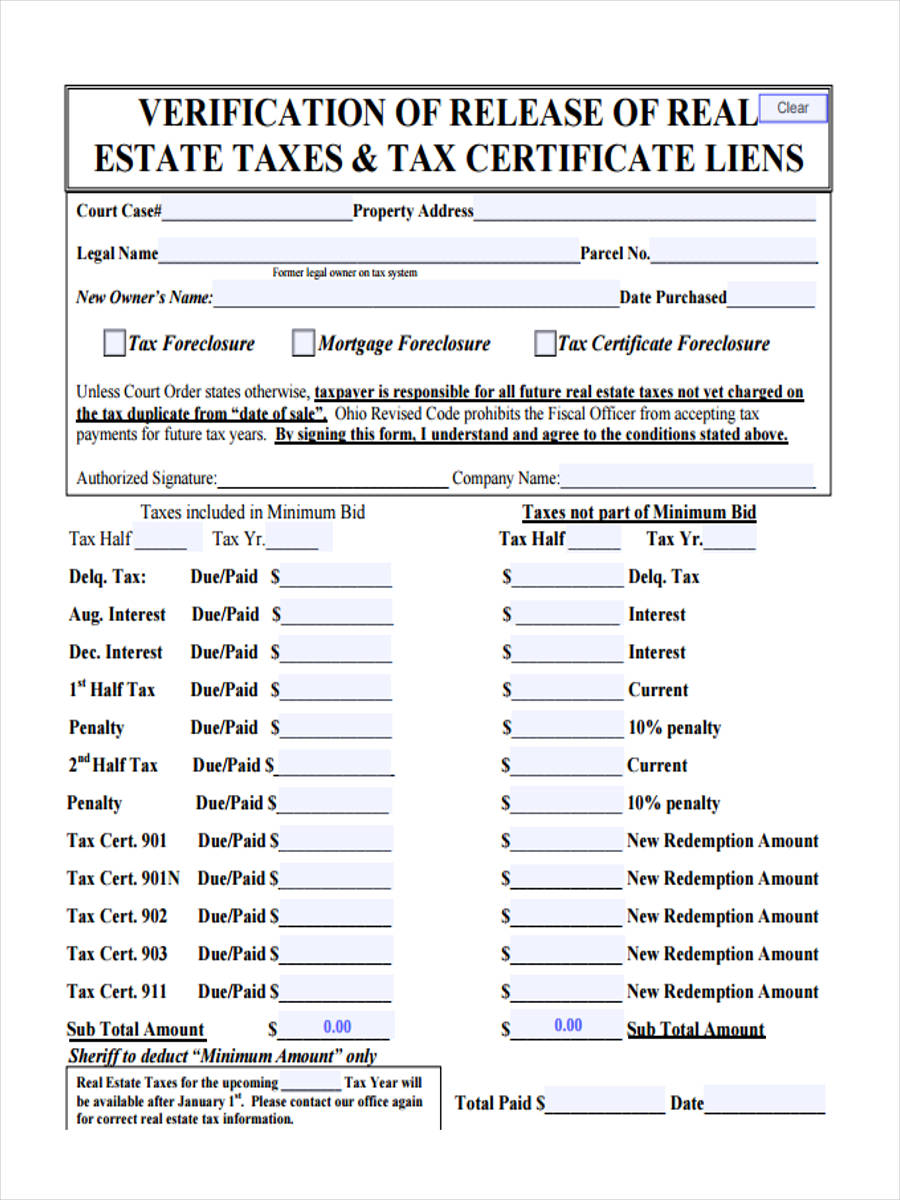

Tax verification forms may not only concern an individual’s tax paying capability. It can also refer to sales taxes paid by businesses or real estate taxes paid for during real estate transactions. It is important to note these distinctions since knowledge of different types of income verification forms will help you when you travel, sell a property, or start a business.

How to Request for Tax ID Verification

In most countries, citizens are issued tax identification numbers upon entering the workforce or attaining the age of majority. Employers and governments can then request for tax ID verification by filling out a tax verification form. Institutions and employers will have these verification forms in PDF at ready for use anytime they need to verify a prospective employee’s income.

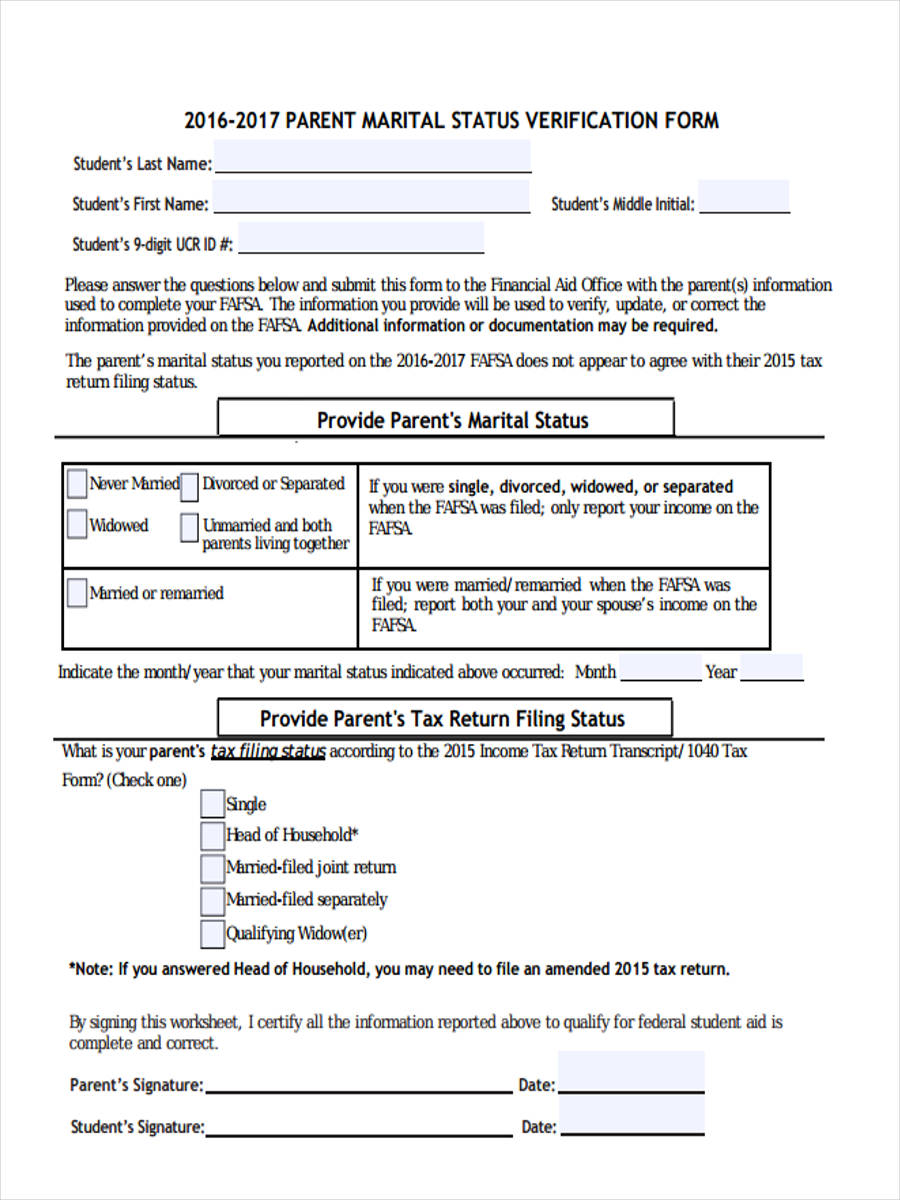

Also note that tax verification will need the consent of the taxpayer unless you are the IRS. Internal Revenue departments have the authority to exercise their auditing powers to prevent and/or correct tax evasion and tax avoidance. Real estate and parent marital tax verification forms also need the signatures of the concerned parties.

Tax Return Verification

Parent Marital Tax Status Verification

Property Tax Form

Real Estate Tax

Things You Need to Know about Tax Verification

Employers and other institutions may request for tax verification of any prospective employee. They may hire third party auditing companies to do this or the Internal Revenue Service may do an audit on their own.

- It is important to note that tax audits may show up in your credit record if the internal revenue department finds out that you owe tax payments. Depending on the payment plan that you have worked out with the IRS, a tax payment lien will still appear on your credit history which will reduce your credit score.

- There are government-issued tax verification forms that you need to fill out before a tax verification request can be formalized. You may download these verification forms in Word format and fill them out from your home.

Guidelines of Tax Verification

Take note of these additional guidelines when a tax verification requested from you:

-

Don’t worry. If you have been meticulous in paying your taxes in the past few years, you will not have any problem with the results of the tax verification.

-

Provide all necessary documents. If you are scheduled to be audited, you may be asked to submit additional documents like tax return receipts, proofs of income or lack thereof, etc.

-

Submit documents before the deadline. It is always better to be prompt in submitting any requirements so that the verification process can commence earlier. This way, you will get the tax verification out of your hair and concentrate on other things in your life.

-

Be ready with the results of the verification. Whatever the results are, some institutions may allow you to have another audit and sign other employer verification forms. But usually, the result is final. This may cause a reduction in your financial grants, a fine, or becoming ineligible for a grant or visa altogether. Just be prepared for whatever the outcome is.

Related Posts

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

FREE 9+ Sample Loan Confirmation Forms in PDF

-

FREE 8+ Sample Mortgage Verification Forms in PDF | Ms Word

-

FREE 8+ Sample Reference Verification Forms in PDF

-

FREE 8+ Sample Social Security Verification Forms in PDF | MS Word

-

FREE 9+ Sample Medical Verification Forms in PDF | MS Word

-

FREE 8+ Sample Education Verification Forms in PDF | MS Word

-

FREE 9+ Sample Work Experience Forms in PDF | MS Word

-

Enrollment Verification Form

-

Bank Verification Form

-

Notary Verification Form