A Self-Employment Form is a crucial tool for freelancers and business owners to track their income, expenses, and tax obligations. This comprehensive guide covers everything you need to know about Self-Assessment Form and Employment Form. From understanding the purpose and benefits to exploring various templates and examples, you’ll learn how to effectively use these forms to manage your self-employment activities. Proper documentation not only ensures compliance with tax regulations but also helps in maintaining a clear financial overview of your business. Dive into our guide to streamline your self-employment process and make informed financial decisions.

Download Self-Employment Form Bundle

What is Self-Employment Form?

A Self-Employment Form is a document used by individuals who work for themselves to report income, expenses, and other financial information. This Self-Assessment Form helps in accurately calculating taxes and maintaining records. It includes sections for listing income sources, business expenses, and other relevant details. Understanding and using this form ensures compliance with tax laws and aids in financial management.

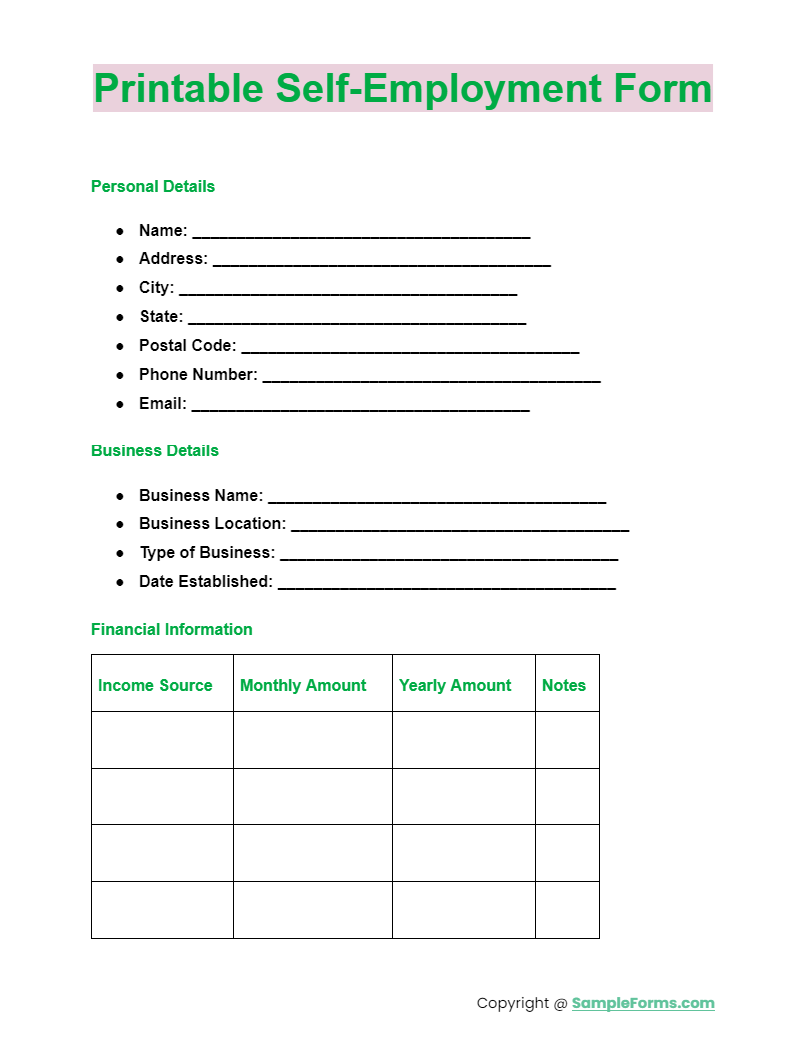

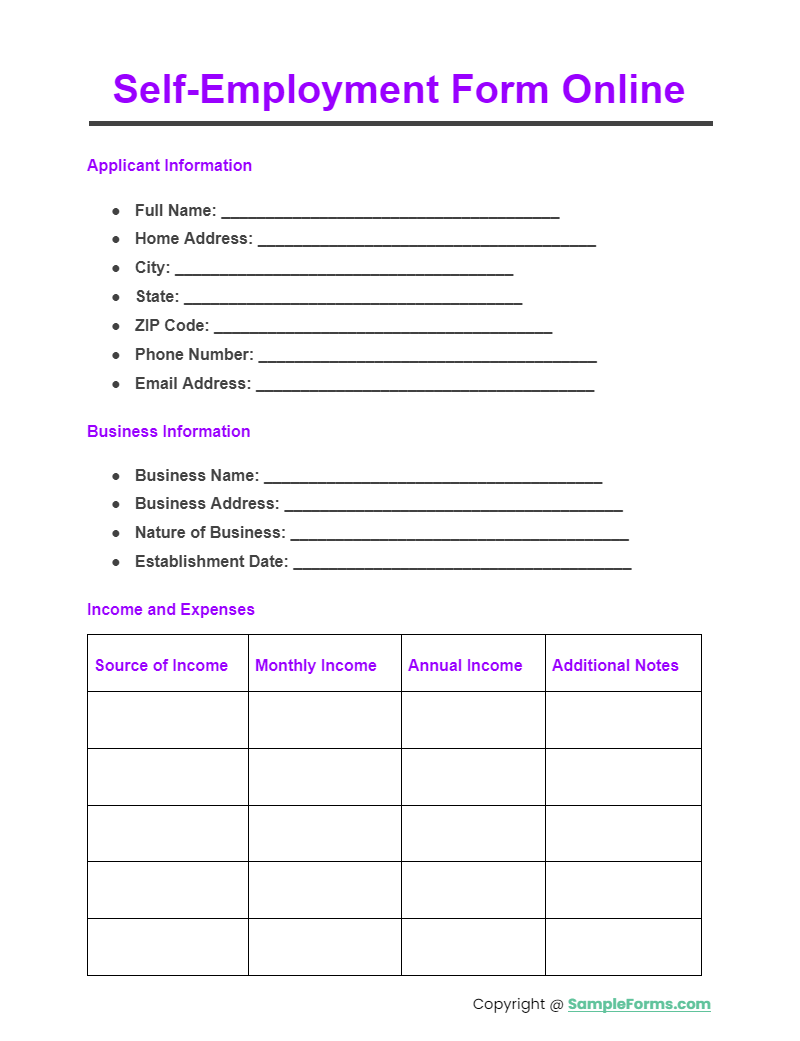

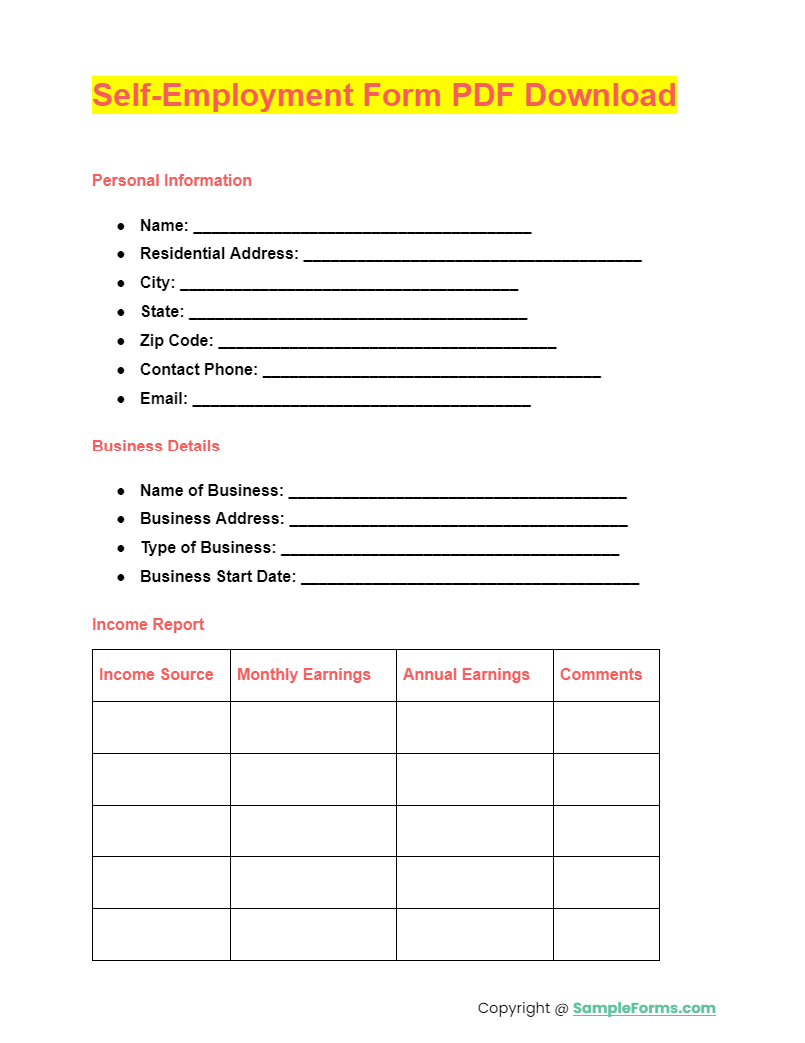

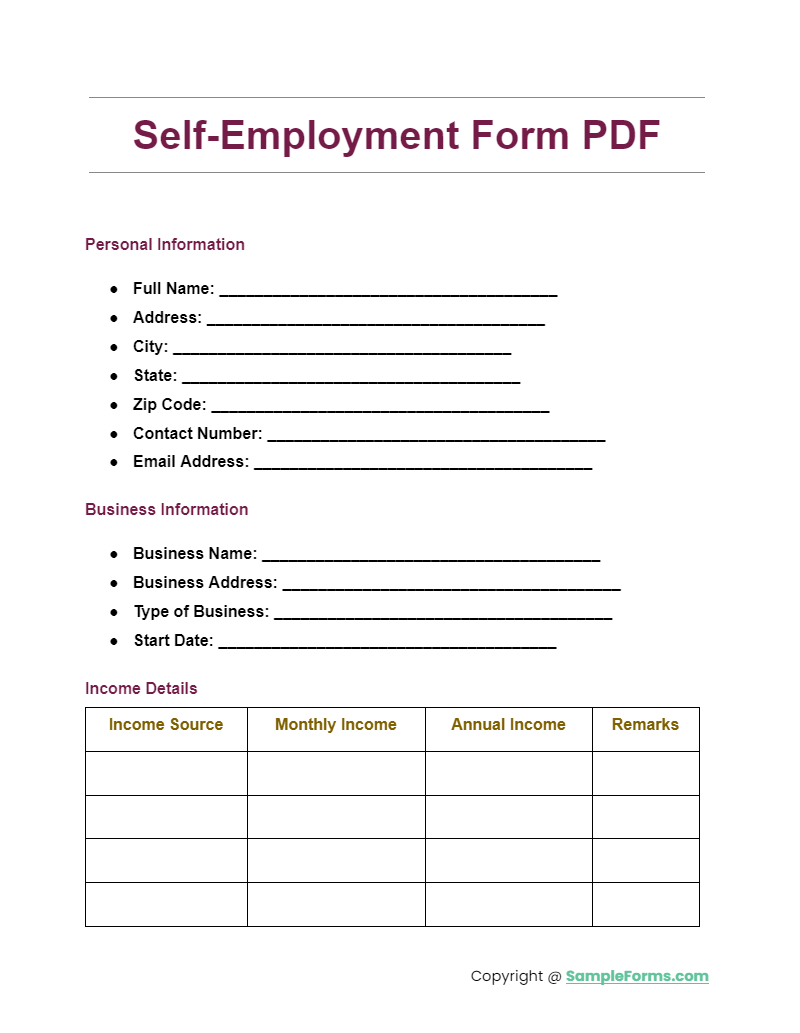

Self-Employment Format

Self-Employment Declaration

Personal Information

- Name:

- Address:

Business Details

- Business Name:

- Nature of Business:

Income Details

- Annual Income:

- Sources of Income:

Declaration

I declare that the above information is true and correct to the best of my knowledge.

- Signature:

- Date:

Self-Employment Form PDF

More Self-Employment Form Samples

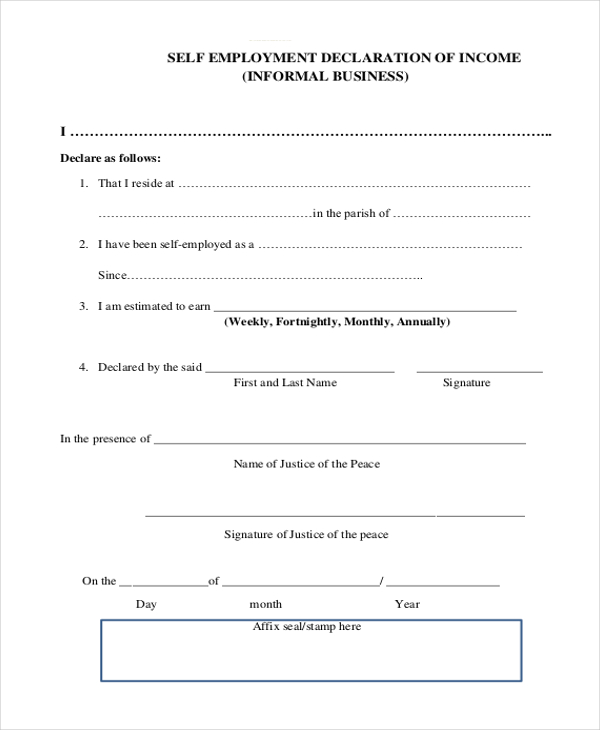

Sample Self-Employment Declaration of Income Form

Declaration of income is mandatory regardless of your type of business. It is important to provide accurate information for review. You can use the Self-Employment Declaration of Income to provide the data.

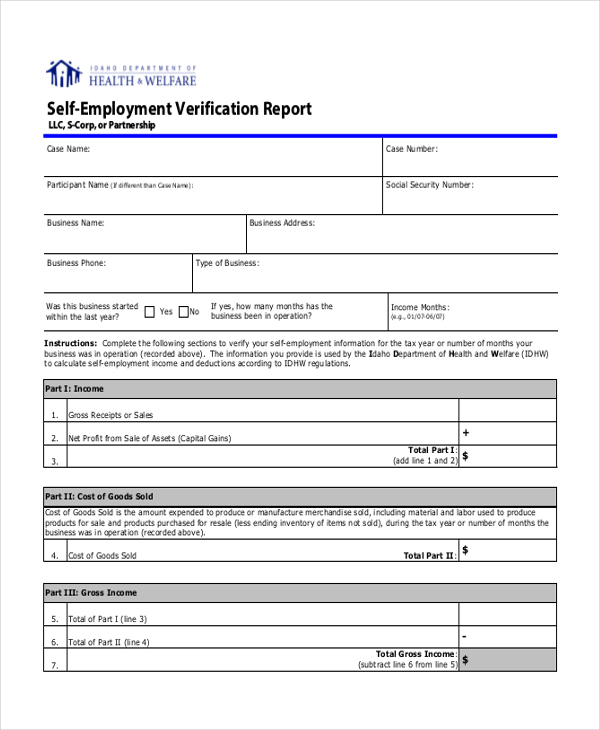

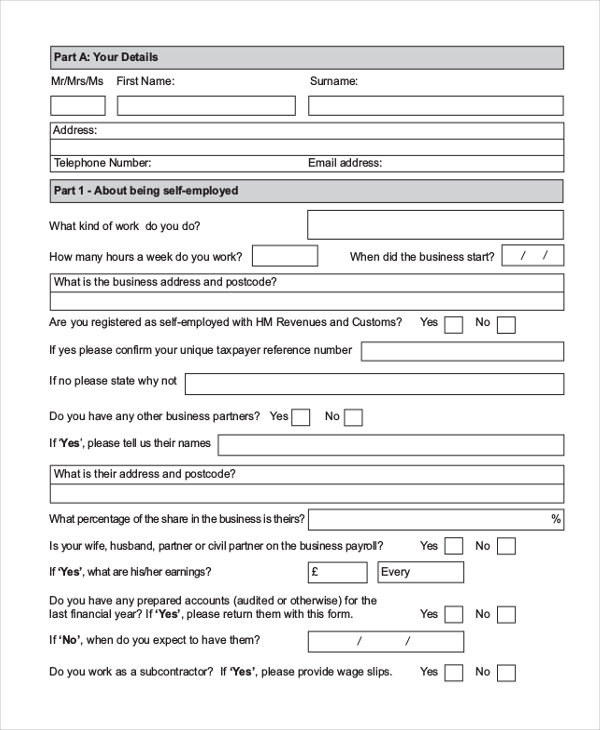

Self-Employment Verification Report Form

A self-employment verification report is an information you provide the authority in the case where there is an urgent need for you to verify that you are self-employed. Use this template for verification.

Self-Employment Earning Report Form

Providing a self-employment earning report is necessary because, at the end of the day, you still have to pay taxes like everyone else. The authority thus requires that you provide accurate info about your business.

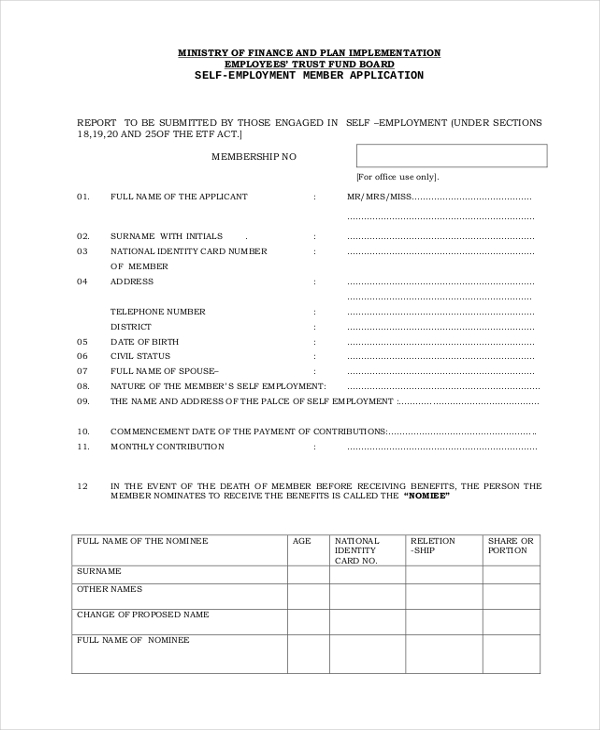

Sample Self-Employment Member Application Form

There are many empowerment groups for the self-employed out there. If you would like to join any of these chains, you should fill a membership application and submit for reviews and approvals.

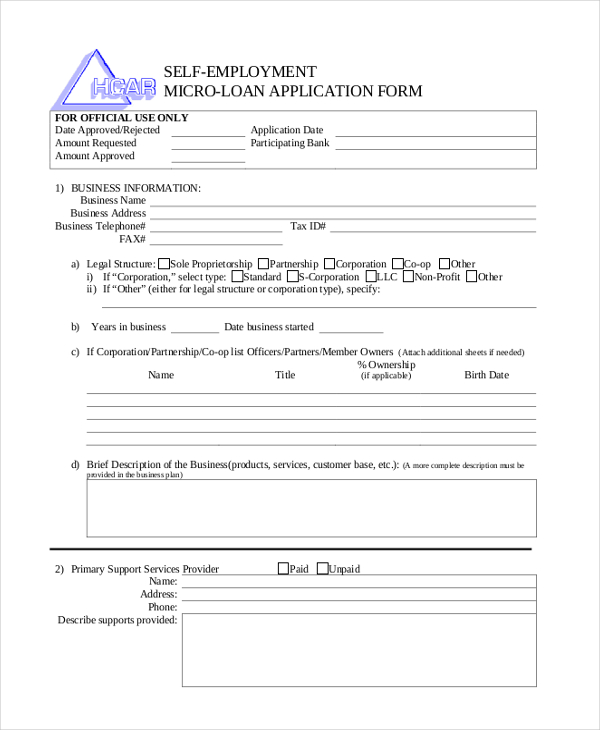

Self-Employment Micro Loan Application Form

It’s easy to get a self-employment micro loan to start a business. Whether you are seeking support from private lenders or a public corporation, you can use the self-employment micro loan application form to request a loan.

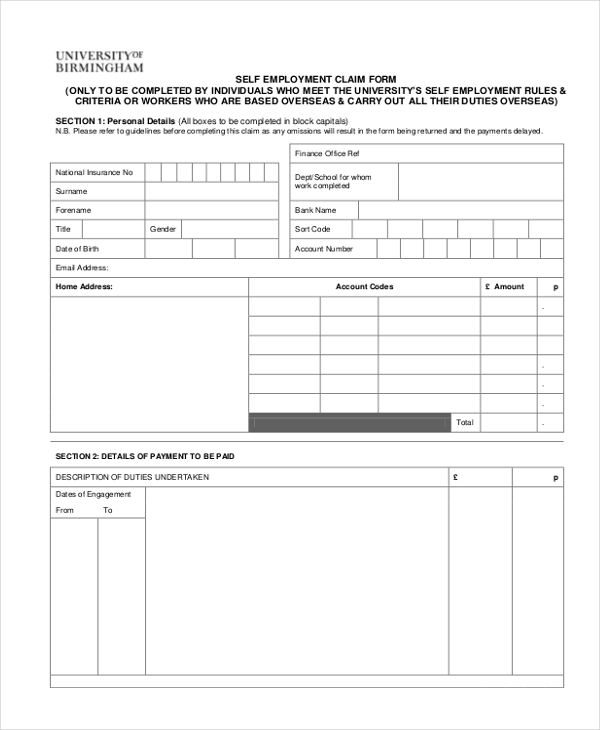

Sample Self-Employment Claim Form

For easy income tax benefits and reviews, it is important that you provide an accurate self-employment claim. You can do this by providing the necessary information using the self-employment claim form.

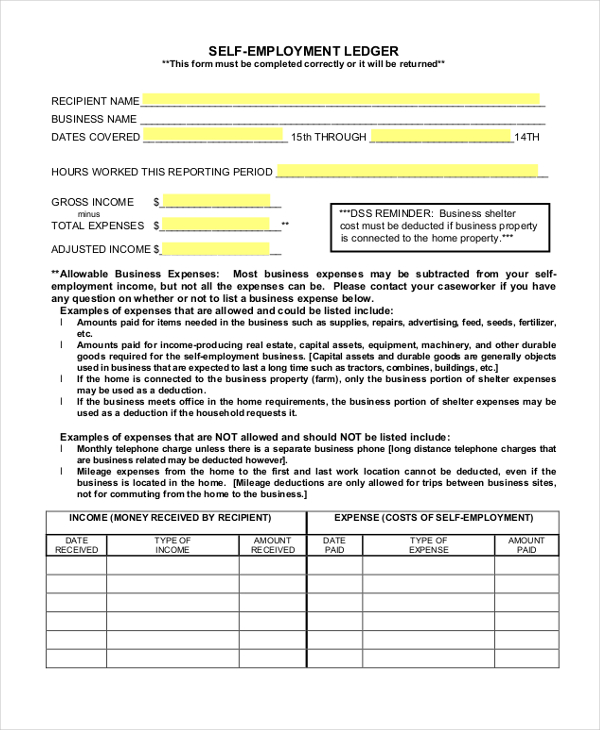

Self-Employment Ledger Form

You can use a self-employment ledger form to provide an up to date information about what your business deals in. Whether you are a small business owner or a fast growing chain of personal businesses, this form is for you.

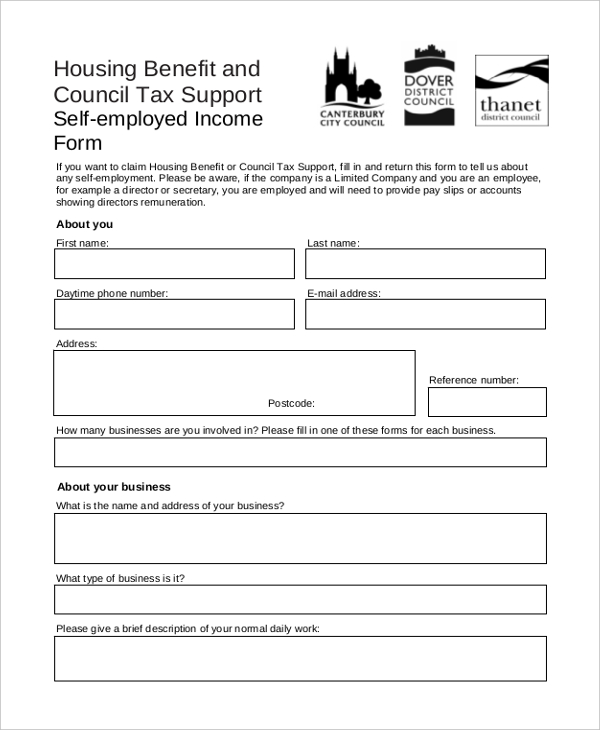

Self-Employment Income Form

Regardless of your choice of business, you will still have to write a report of your business income. The type of return you complete is quite significant. It is important to provide relevant information for accurate income taxation.

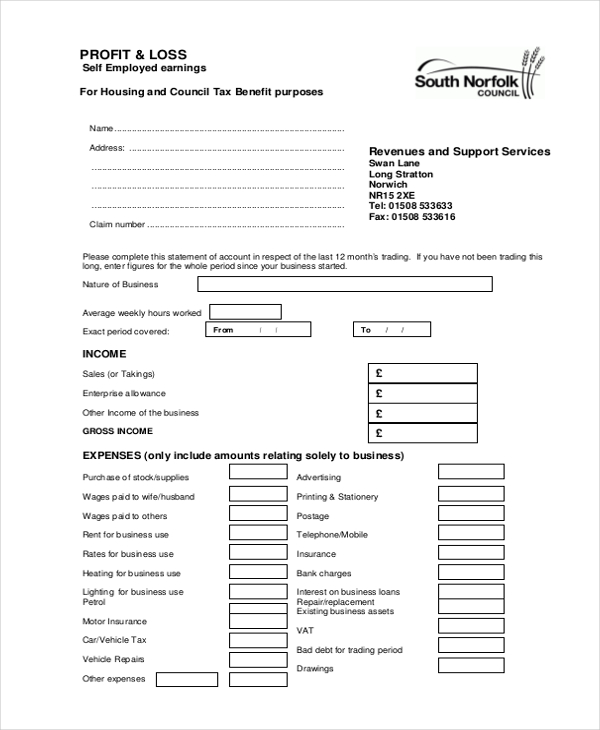

Sample Profit and Loss Self-Employed Form

Declaring the profit and loss your business made over a given period of time provides accurate details about the sales of your business during those times. Outline the relevant details on this form.

Self-Employment Disclosure Form

Standard Self-Employment Form

What is Self-Employment in Relation to Income Tax Purpose?

First, there must be enough evidence to prove that you are actually self-employed as you claim. The best way to verify the claim is to provide a self-employment verification report. As a verified self-employed individual, your business is defined in the terms of goods sold or services provided with am an expectation of income and profits thereof. For the sale of income tax purposes, it is proper to include only those activities that generate profit to your business, although you have the liberty to record those goods and services that don’t necessarily earn your business any profit. You may also see Employee Counseling Form

Important Points to Keep in Mind as a Self-Employed Person

It is important to understand that as long as you are self-employed or you have people working on your behalf, it will be a must that you provide a report about your business. Know that how you report your business depends on the structure the enterprise. Usually, the structure of your business will determine the type of returns you complete as well as the income of your business. Additional information to provide is whether you are an employer, the type of your business, whether you conduct your business on the web or not, and the format used for business information recording. You may also see Employee Requisition Form

What’s the Purpose of Self-Employment Income Reporting?

The purpose of reporting is to help you determine your earnings (profits) for the period you earn the money. You can use the accrual method to write your report. In this case, you record the payment in the fiscal period, regardless of the time you receive a payment. The same goes for business expenses; you must account them in the same fiscal period your business incurs them. You may also see Employee Waiver Form

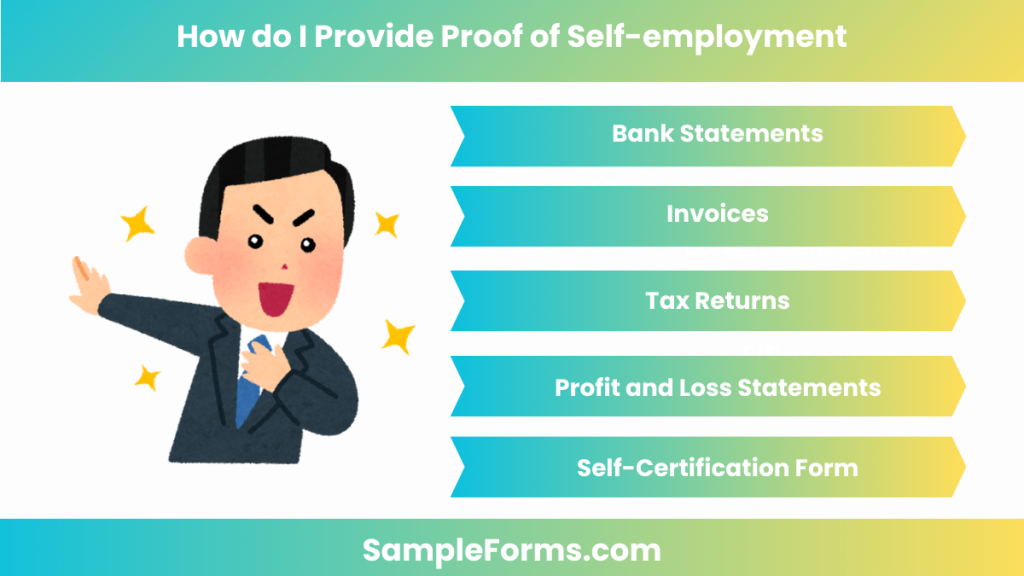

How do I provide proof of self-employment?

Providing proof of self-employment is essential for various purposes, including applying for loans or verifying income. This process can be streamlined using forms similar to an Employee Self Evaluation Form.

- Bank Statements: Use detailed bank statements showing regular deposits.

- Invoices: Present invoices sent to clients.

- Tax Returns: Provide copies of filed tax returns.

- Profit and Loss Statements: Prepare a comprehensive profit and loss statement.

- Self-Certification Form: Fill out a self-certification form detailing your self-employment activities. You may also see Employee Release Form

How do I register as self-employed in the US?

Registering as self-employed in the US involves a few critical steps to ensure legal and tax compliance. This can be as straightforward as completing a Self Appraisal Form for your business.

- Choose a Business Structure: Decide whether you will operate as a sole proprietor, LLC, or corporation.

- Register Your Business Name: Register your business name with local authorities.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS.

- Register for State Taxes: Register for state taxes where applicable.

- Self-Appraisal: Conduct a self-appraisal to ensure all legal requirements are met. You may also see Employee Misconduct Form

How do I declare self-employment income?

Declaring self-employment income correctly is crucial for tax purposes. This process can be simplified by using a Self-Certification Form.

- Track All Income: Keep detailed records of all income received.

- Use Accounting Software: Use accounting software to track and categorize income.

- Fill Out Schedule C: Report income on Schedule C of your tax return.

- Calculate Estimated Taxes: Calculate and pay estimated taxes quarterly.

- Self-Evaluation: Regularly perform a self-evaluation to ensure all income is accounted for. You may also see Employee Medical History Form

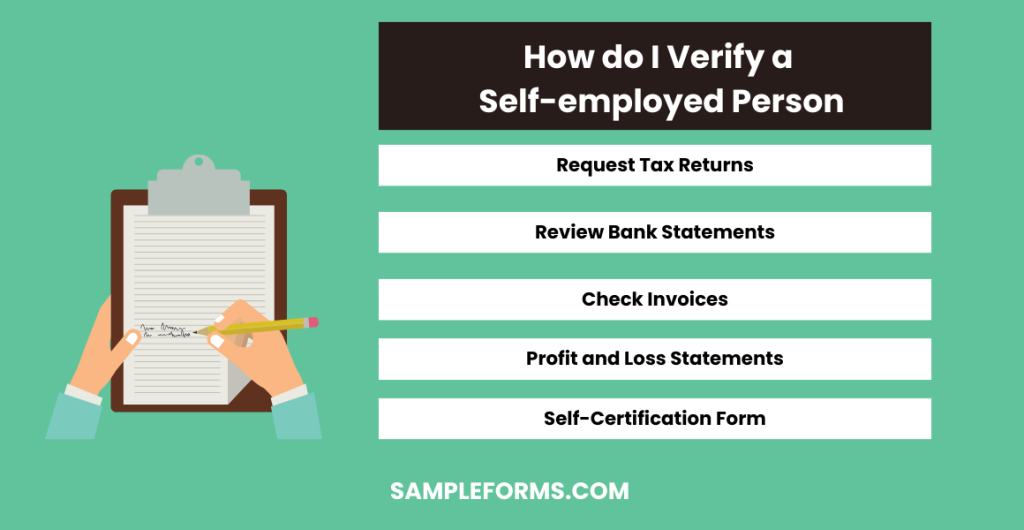

How do I verify a self-employed person?

Verifying a self-employed person requires collecting and reviewing specific documentation, akin to filling out an Employee Self-Evaluation form.

- Request Tax Returns: Ask for recent tax returns.

- Review Bank Statements: Examine bank statements showing business transactions.

- Check Invoices: Verify invoices issued to clients.

- Profit and Loss Statements: Analyze profit and loss statements.

- Self-Certification Form: Have the person complete a self-certification form. You may also see Employee Clearance Form

How do I fill out a W4 with self-employment income?

Filling out a W4 with self-employment income involves careful planning and estimation. This can be approached similarly to completing a Self-Appraisal.

- Estimate Annual Income: Estimate your total annual self-employment income.

- Calculate Deductions: Calculate any deductions you are eligible for.

- Adjust Withholding: Use the IRS withholding calculator to adjust your withholding.

- Complete the W4: Fill out the W4 form with the appropriate adjustments.

- Self-Evaluation: Regularly evaluate your withholding status to avoid underpayment. You may also see Employee Confirmation Form

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Eligibility Criteria: Employees must meet certain criteria, such as tenure and performance, to qualify for study leave.

- Leave Form Submission: Employees must submit a detailed Leave Form specifying the duration and purpose of the leave.

- Approval Process: The leave must be approved by the relevant authorities within the organization.

- Return to Work: Employees must return to work immediately after the study leave ends, with no extensions unless approved.

- Financial Obligations: Any financial support provided by the employer may need to be repaid if the employee leaves the organization shortly after the leave. You may also see Employee Review Form

What form do I use for self-employment?

Self-employed individuals typically use Schedule C (Form 1040) to report income or loss from a business. This form, similar to a Student Self-Assessment Form, helps detail your earnings and expenses.

How much do you have to make to file taxes as self-employed?

You must file a tax return if your net earnings from self-employment were $400 or more. This is comparable to completing a Self Assessment for tax purposes.

How much can you make on a 1099 before you have to claim it?

You must report any amount over $600 received from a client on a 1099-MISC form. This threshold is akin to filling out a Fall Risk Self Assessment Form for financial health.

Is form 7202 only for self-employed?

Form 7202 is used by self-employed individuals to claim sick and family leave tax credits. It’s a specific form much like a Self-Review Form for your financial situation.

Can I use w2 for self-employment?

No, a W-2 is for employees. Self-employed individuals report earnings on Schedule C, not a W-2, just like using an Employee Form for employment details.

What qualifies me as self-employed?

You are self-employed if you run a trade or business as a sole proprietor, independent contractor, or are otherwise in business for yourself, similar to completing an Employee Shift Swap Form for your business hours.

How do I report self-employment income paid in cash?

Report cash payments as income on Schedule C. Keep detailed records of all cash transactions, akin to maintaining an Employee Address Form for accuracy.

Can you get a tax refund if you are self-employed?

Yes, you can receive a tax refund if your payments and credits exceed your tax liability, much like receiving feedback from an Employee Assessment Form.

Adhering to specific rules and regulations ensures that study leave is managed effectively. Key rules include:

- Eligibility Criteria: Employees must meet certain criteria, such as tenure and performance, to qualify for study leave.

- Leave Form Submission: Employees must submit a detailed Leave Form specifying the duration and purpose of the leave. You may also see Employee Verification Form

- Approval Process: The leave must be approved by the relevant authorities within the organization.

- Return to Work: Employees must return to work immediately after the study leave ends, with no extensions unless approved.

- Financial Obligations: Any financial support provided by the employer may need to be repaid if the employee leaves the organization shortly after the leave. You may also see Employee Payroll Form

A Self-Employment Form is essential for managing your financial records and ensuring accurate tax reporting. This guide provides Sample, Forms, and Letters to help you efficiently track your self-employment income and expenses, much like an Employee Reimbursement Form. By using these forms, you can maintain clear records, make informed financial decisions, and stay compliant with tax regulations. Proper documentation not only simplifies the tax filing process but also helps you gain a better understanding of your business’s financial health. Use our examples and templates to streamline your self-employment journey.

Related Posts

-

Employment Rejection Letter

-

Employment Reference Form

-

Employee Pay Increase Form

-

FREE 3+ Employee Contact Forms in MS Word | PDF

-

FREE 4+ Employee Observation Forms in PDF | MS Word

-

FREE 4+ Incorporation Forms in PDF | MS Word

-

FREE 4+ New Employee Forms in PDF | MS Word | Excel

-

New Hire Form

-

FREE 4+ Employee of the Month Voting Forms in PDF | MS Word

-

FREE 6+ Employee Manual Acknowledgment Forms in MS Word | Pages | PDF

-

Employee Nomination Form

-

FREE 4+ Employee Time Sheet Forms in MS Word | Excel | PDF