The schedule forms are in use for and by the taxpayers and any organization that is liable to tax and has to report their financial data to the Internal Revenue Service. There are different kinds, almost around 800 various forms available within and these are used to assess taxes to be paid. A tax schedule is a form the IRS obliges you to get ready for your tax return when you have certain sorts of pay or reasoning. Every category under each schedule holds a different set of requirements and limitations.

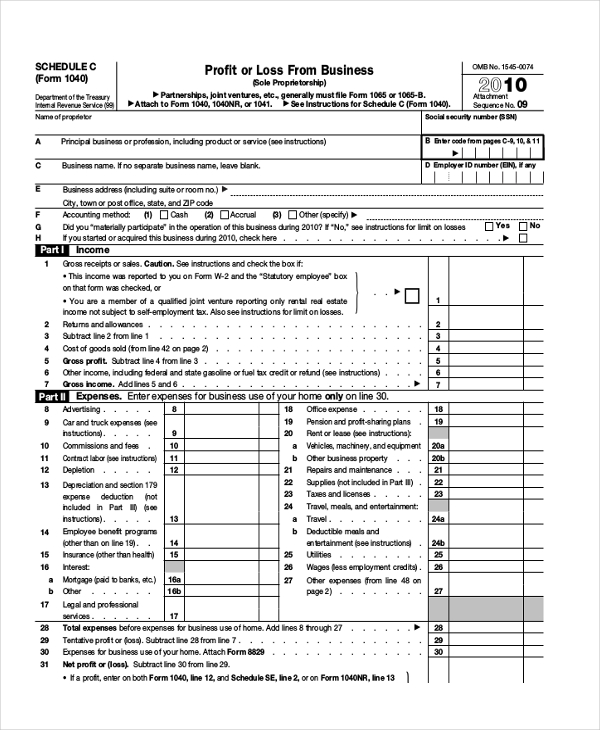

Schedule C Form

If you are self-employed, then this schedule form is prepared for you to report how much money you have made and lost in your business. This form must be completed and submitted with your IT Return of your self-employment inform.

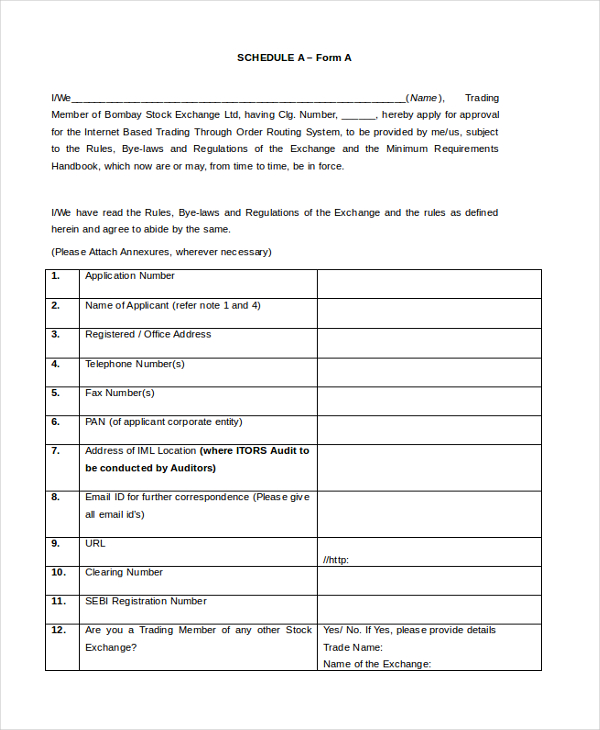

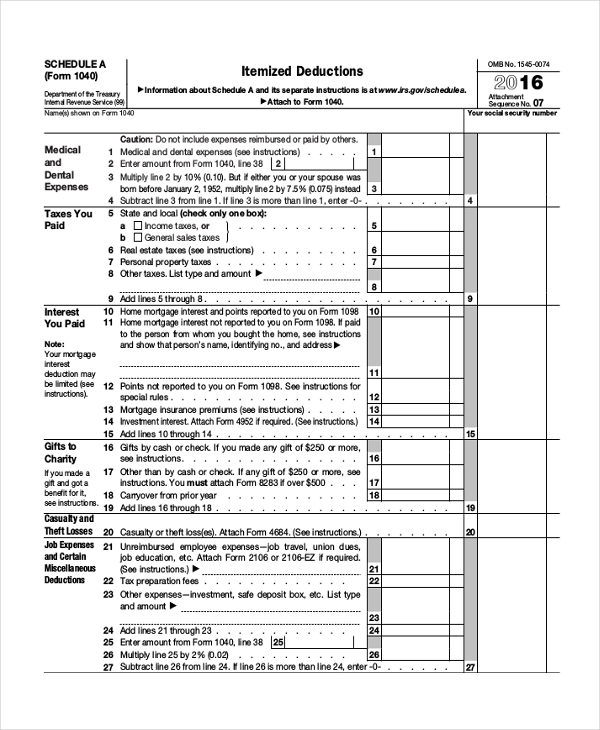

Schedule A Form

Schedule A form is to calculate your itemized deductions. In the majority of the cases, the federal income tax is expected to be comparatively less if one goes on taking a larger part of any one of the two deductions.

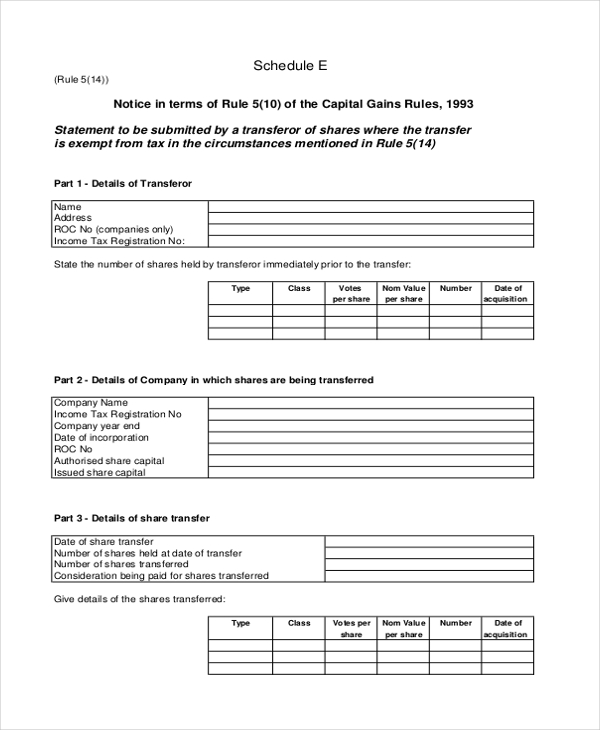

Schedule E-Form

If you earn a rental income or you own a building and receive royalties or you have your income reported on a schedule k-1 from a partnership, then you are required to fill this schedule form and your personal tax return.

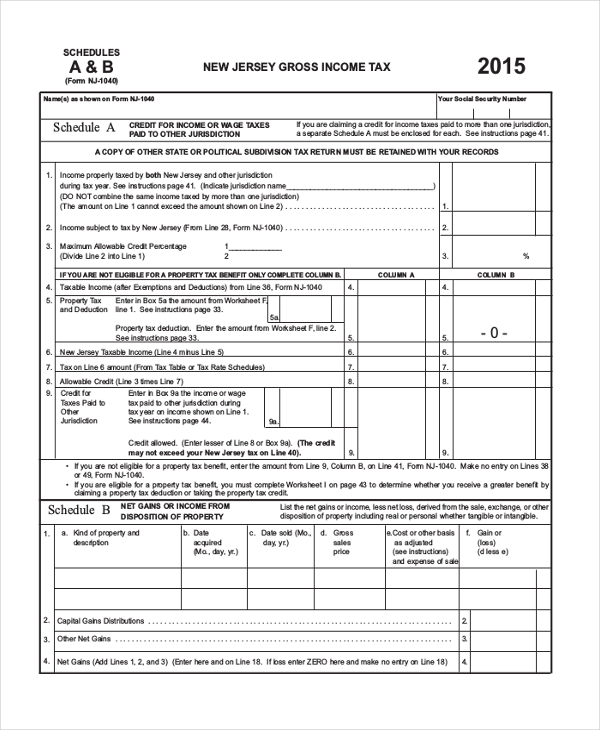

Schedule A Tax Form

This schedule form is to arrange your deductions allowing you to claim a number of personal expenses. However, it may not do any good to the financial health of your business if you give up the standardized deduction.

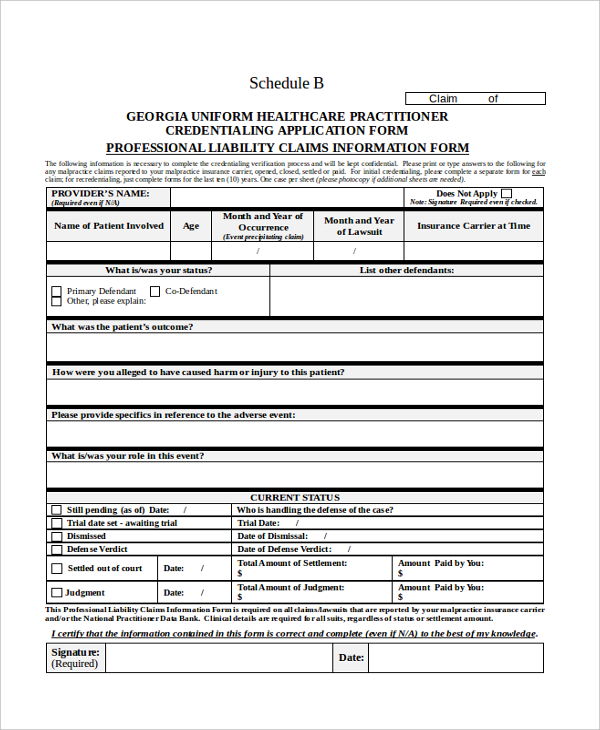

Schedule B Form

This Schedule form reports the interest and profit salary you get amid the assessment year. Nonetheless, you don’t have to append a Schedule B consistently you win interest or profits.

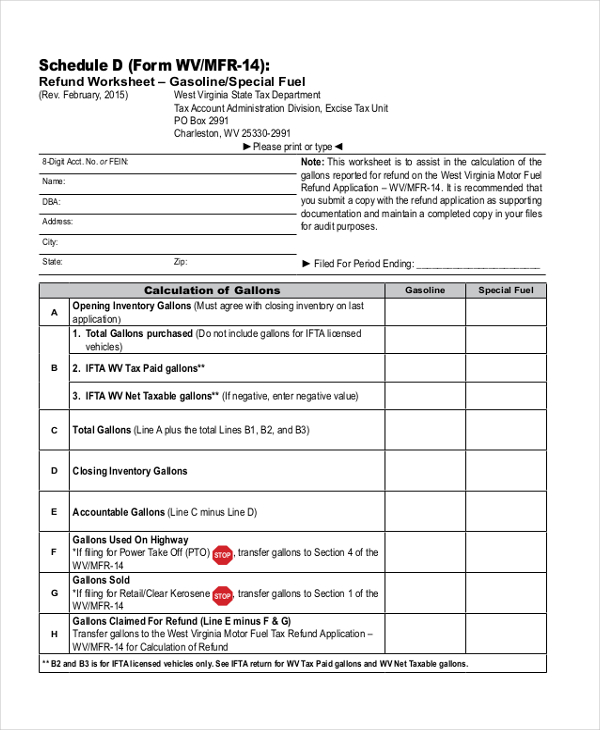

Schedule D Form

This schedule form reports the increases and misfortunes from the deal or trading of primary assets. When you profit by offering a capital resource, it gets provided details regarding Schedule D.

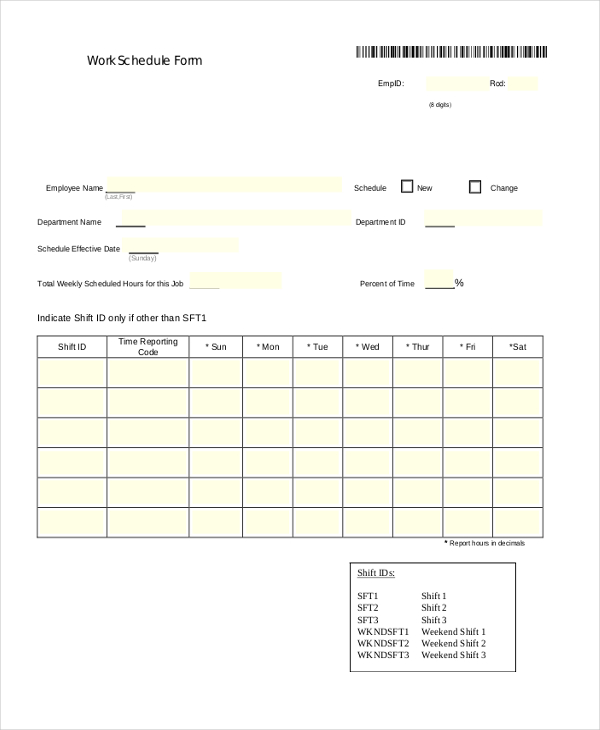

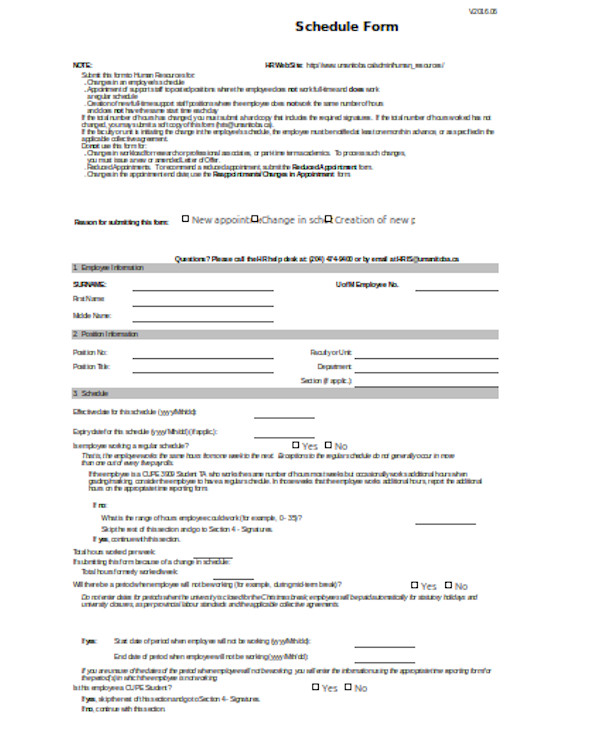

Work Schedule Form

This work schedule form indicates the details of the employee and the shift he/she has been taking. In simple words, if there is a change in a schedule or an employee is appointed on a shift basis, this form could be used.

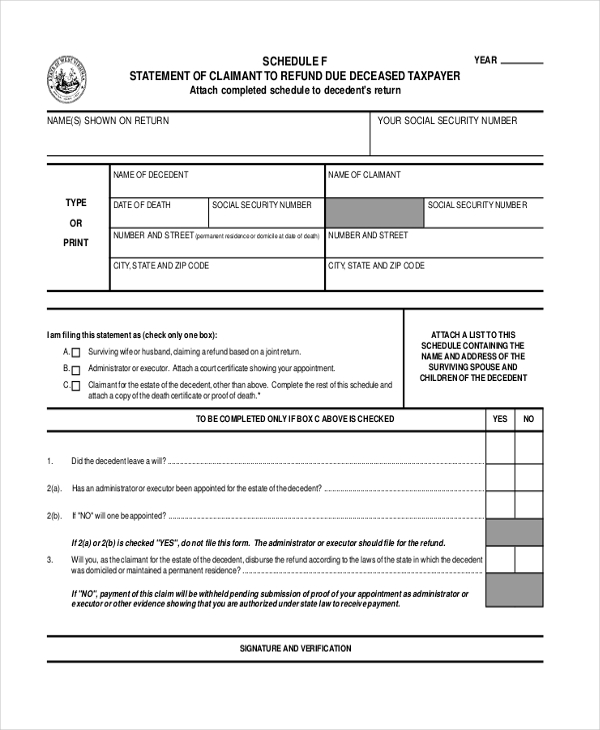

Schedule F Form

On the off chance that you procure a living is an independently employed rancher, you might need to incorporate a Schedule F connection with your expense form to report your benefit or misfortune for the year

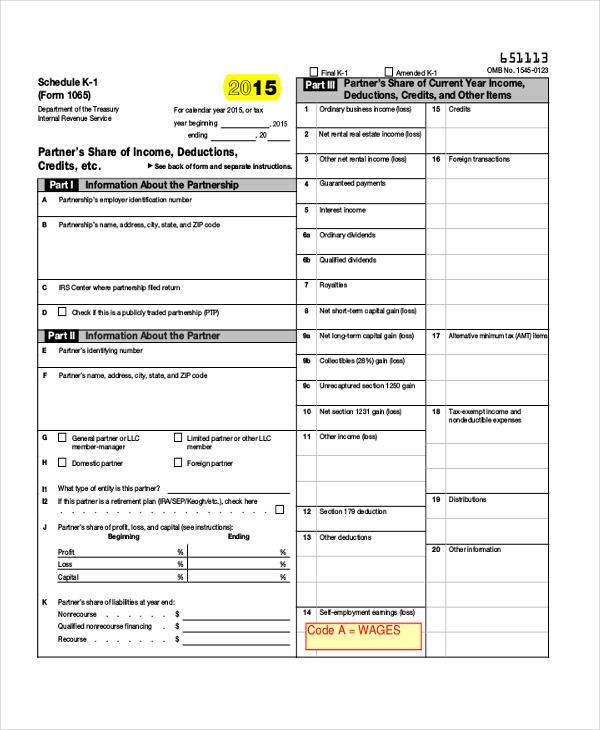

Schedule K-1 Form 1065

The United States tax code permits certain sorts of elements to use go through tax collection. The Schedule K-1 is the form that reports the sums that are gone through to every gathering that has an interest in the entity.

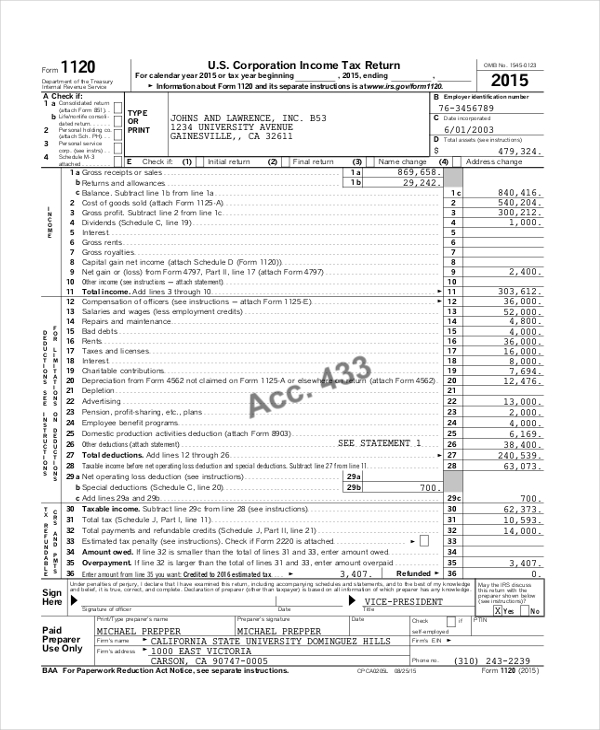

Schedule G-Form 1120

This form is utilized by and for business people. It must be recorded by each enterprise that approves of the Form 1120, Schedule K, specifically, the Questions 4a or 4b, with a specific end goal to give the extra data that is asked for specific entities owning the organization’s authority.

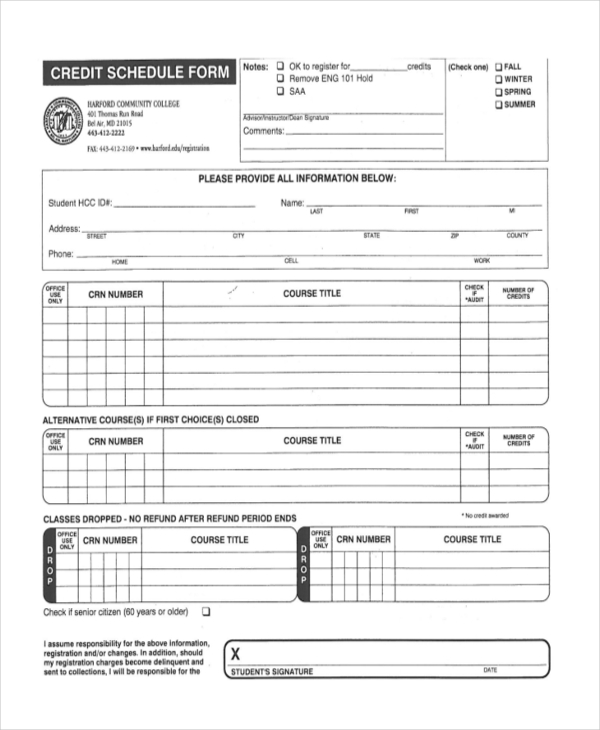

Credit Schedule Form

This credit schedule form is used for students to itemize their official refund details. If a student needs to withdraw from classes after the date the refund is being made, he/she must submit a credit schedule form.

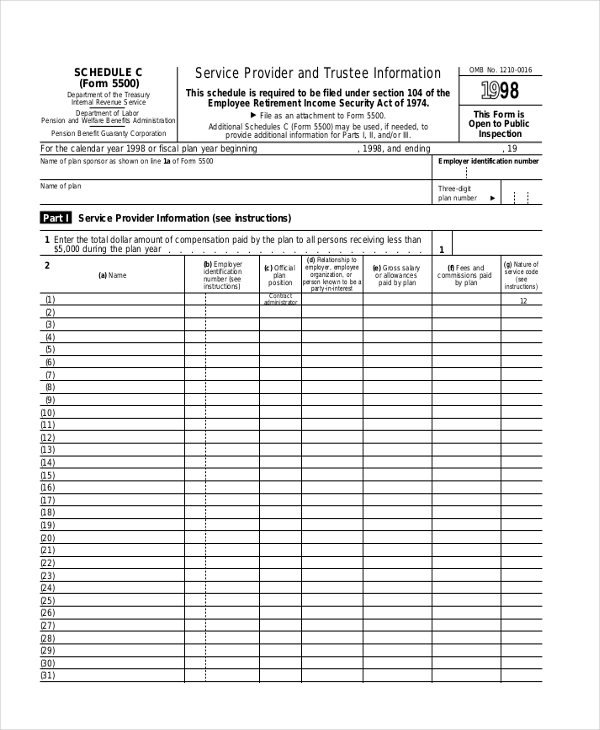

Form 5500 Schedule C

This form is submitted to the Departments of Treasury IRS and labor pension and welfare benefits administration. This contains the information of the employer and the trustee including the termination information.

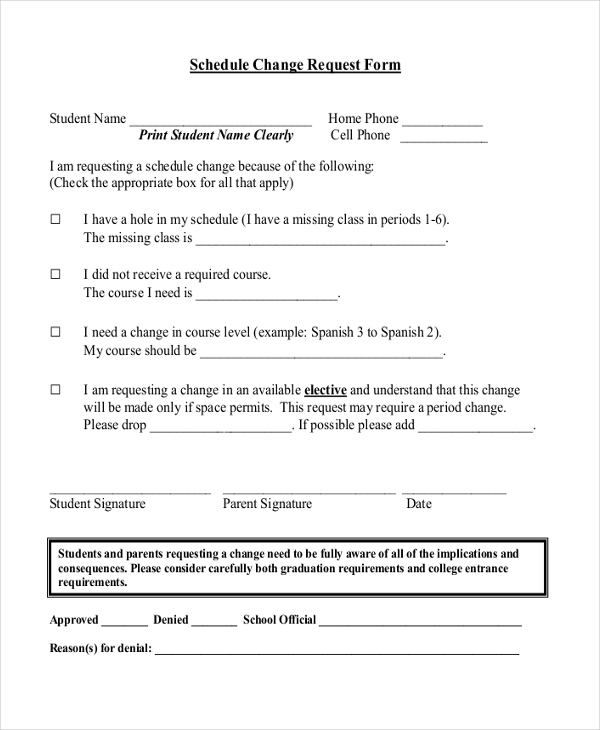

Schedule Change Request Form

This form is used by students if they need to make a change in their course schedule or level or if they need to request a change for the elective. An appropriate reason is expected to change the course, elective or level.

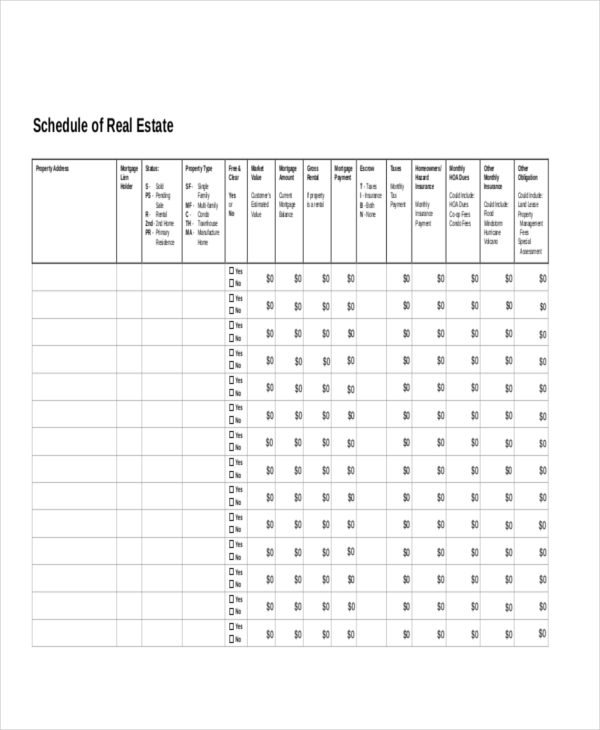

Real Estate Schedule Form

A real estate schedule form comprises of data of the property, along with its status, mortgage lien holder, current balance, monthly dues, taxes and other obligation. Any and every detail about the property can be picked up from this form.

Form 1040 Schedule A

This form showcases the seven existing categories present in the Schedule A form and its detailed sub-categories. Medical and Dental expenses to theft losses, one can itemize their deduction here.

Salary Schedule Form

This Salary Schedule form is used to indicate the salary of an employee and show the deductions made in the name of Unemployment Insurance from the employee’s account. This form is submitted to Department of Labour Salary.

Professional Schedule Form

What is Form 8822?

Subsequent to moving into another home, you might need to utilize Form 8822 to advise the Internal Revenue Service of your change of address. The Internal Revenue Service may send you sees, discounts paid with a paper check and other correspondence identifying with your own, blessing and domain charges. In the event that you don’t tell the IRS that you moved, it sends all the correspondence to your last known address, the one recorded on your latest government form.

What are Household Employment Taxes?

In the event that you procure individuals to do work around your home all the time, they may be considered family unit representatives. Being a business accompanies a few obligations regarding paying and reporting work charges, which incorporates documenting a Schedule H with your government expense form. In any case, regardless of the possibility that you have family unit representatives, recording Schedule H is required just if the aggregate wages you pay them is more than certain edge sums determined by government assess law.

These usually incorporate things like noteworthy measures of intrigue salary, contract intrigue or altruistic commitments. For the most part, the sums you process on these schedules are exchanged to your Form 1040. When you meet all requirements to finish a less complex tax form, for example, the Form 1040EZ, then extra schedules are not required.

Related Posts

Sample College Application Form - 7+ Free Documents in PDF

9+ Sample Service Request Forms Sample Forms

Contract Forms in PDF

Change Request Form Samples - 9+ Free Documents in Word, PDF

Sample Employee Shift Change Forms - 7+ Free Documents in ...

8+ Sample Schedule C Forms

Sample Blank Schedule Forms - 9+ Free Documents in Word, PDF

Sample School Complaint Forms - 7+ Free Documents in Word, PDF

Sample Employee Survey Forms - 8+ Free Documents in Word, PDF

Sample Construction Variation Forms - 8+ Free Documents in Word ...

8+ Conference Registration Form Samples - Free Sample, Example ...

Sample Business Tax Forms - 9+ Free Documents in Word, PDF

Sample Location Release Form - 10+ Free Documents in PDF

Sample Construction Contract Form - 10+ Free Documents in PDF ...

Sample Change Request Form - 8+ Free Documents in Word, PDF