Business is all about profit and loss. However, calculating this is really not as easy as doing a mathematical problem. With huge amounts of capital in question and a large number of transactions taking place on a daily basis, this calculation can be quite complicated and even overwhelming at times. However, the use of Schedule C form definitely adds a touch of simplicity to it. The Schedule Forms follows a format which allows the business owners to list their transactions under various subheadings making the whole process easy to decipher and calculate.

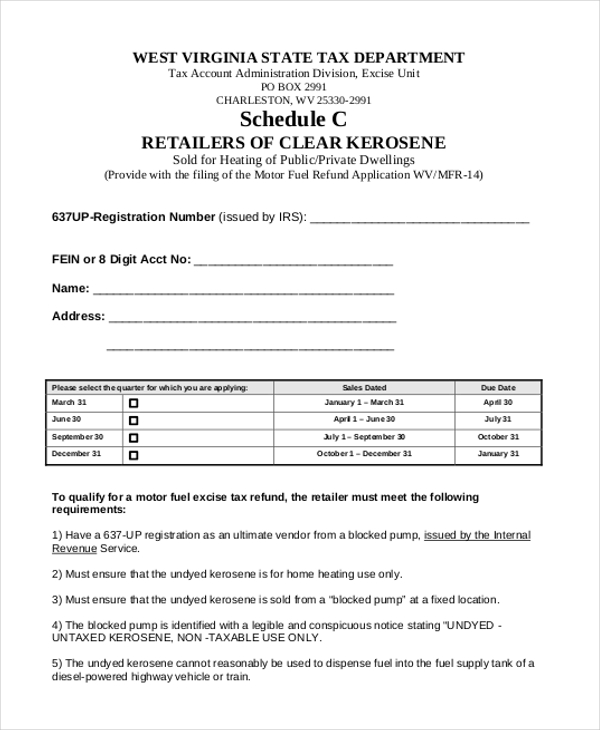

Sample Schedule C Tax Form

This form can be used by an organization to calculate its profit and losses in accordance with the tax laws and then submit these to the taxation department. The format followed is defined and guarded by the taxation law making the process simpler. You may also see Payroll Tax Forms.

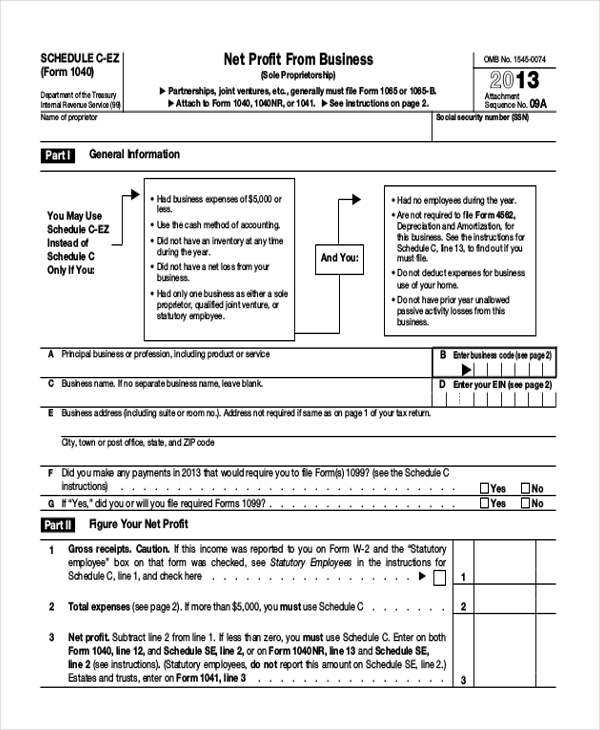

Example of Schedule C-EZ Form

If an organization adheres to all the terms and regulations specified under Schedule C-EZ, then it can use this form to calculate its profits. The form comprises of a format which makes it easier for the person to calculate the profit.

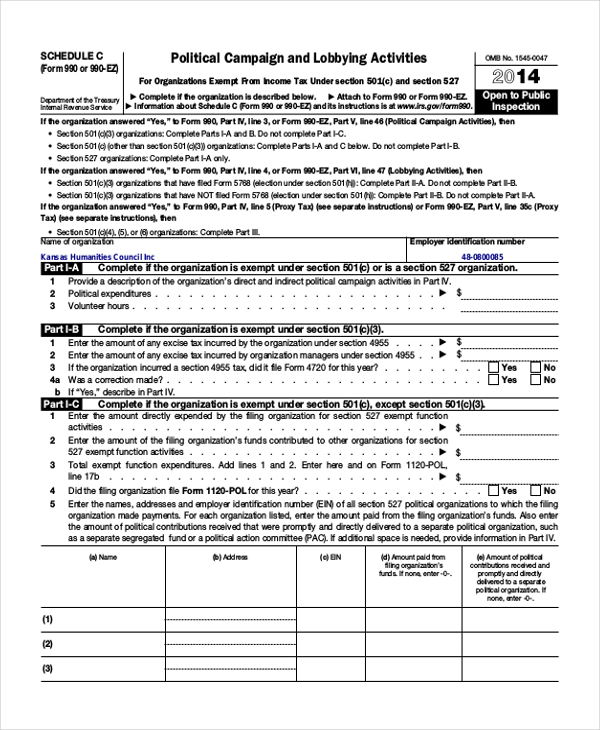

Schedule C Form 990

A certain amount of an organization’s profits is eligible for tax exemptions under the taxation law. The company can use the aforesaid form to calculate this profit and then present it to the taxation department to avail the exemptions.

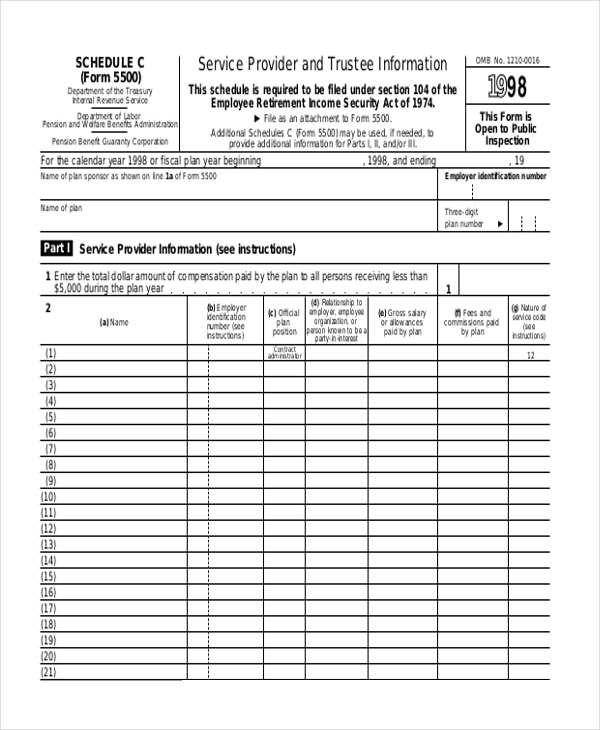

Form 5500 Schedule C Format

The government expects a business organization to file all the employees’ details and their annual compensation that is offered by the company. The aforesaid form is used for the purpose.

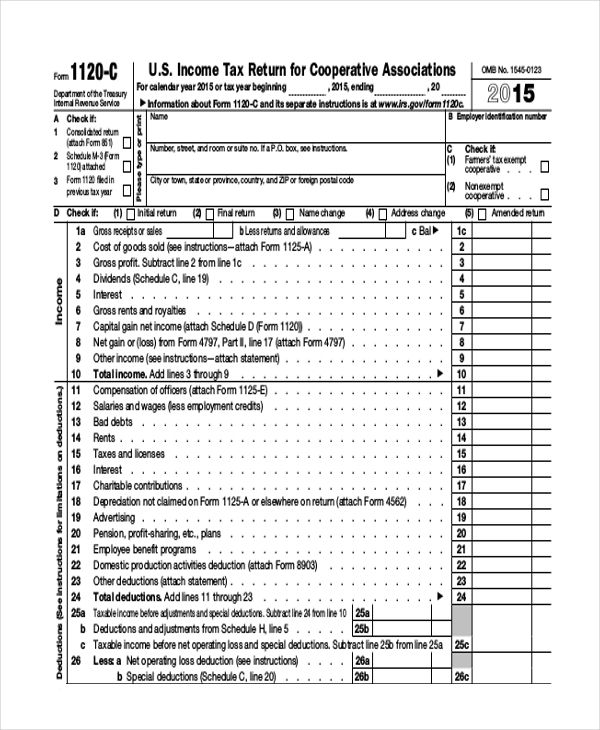

Schedule C 1120 Form

Once an organization calculates its profits and losses for a year, it can file tax returns and request the taxation department to refund any amount that may have been deducted due to the lack of proof of exemption. The organization can use the aforesaid form for the purpose.

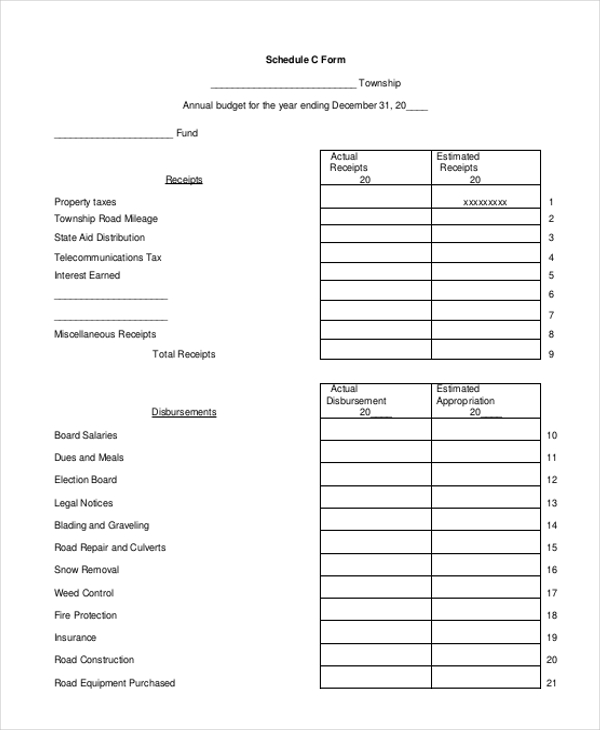

Blank Schedule C Form in PDF

As the name indicates, this is a blank schedule C form which contains all the important segments that will allow an organization to calculate its profits and losses. The company can customize this form with its personal details.

Schedule C 1040 Form Downloadable

A person who may be a sole proprietor of a business or a service organization can use this form to calculate his profits and losses over a period of time and then submit this to the taxation department.

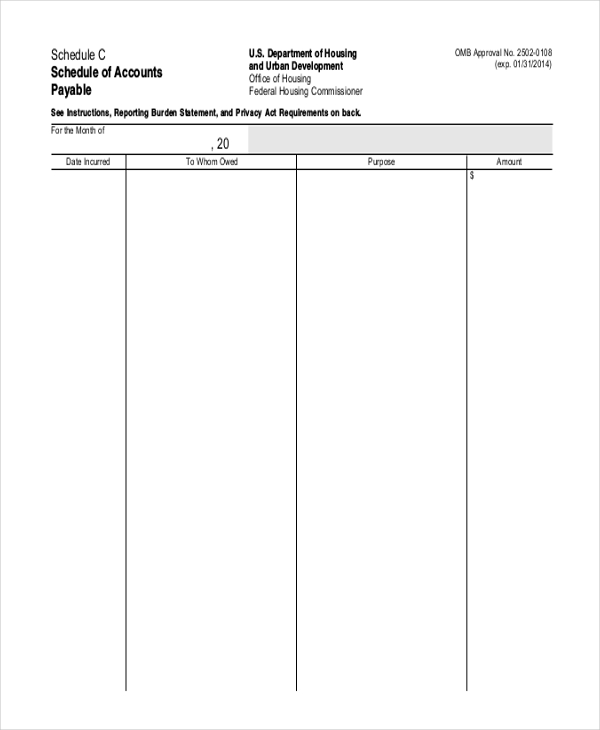

Schedule C Accounts Payable Form

Business organizations that may have borrowed money from financiers can use this form to estimate the total amount that they are expected to pay to these people or firms.

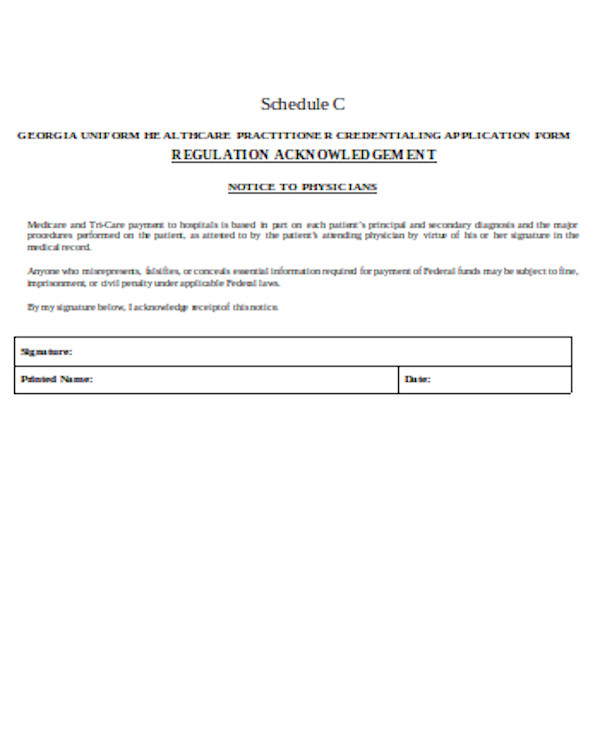

Simple Schedule C Form

Target Audience for Schedule C Forms

Schedule C forms help business and service organizations to calculate their profits and losses over a certain period of time. This, in turn, helps them to avail certain provisions offered by the government like tax deductions, tax returns, financial aids etc. Thus, the target audience for these forms is

- Business organizations

- Service organizations

- Accountants

- Accounting agencies

- Tax departments

- Government offices

What are The Benefits of Using Schedule C Forms?

- These forms follow a very organized format which allows the user to list down all his business details and transactions in a systematic manner. This, in turn, ensures that the calculations are made easy

- With all the important sub heads in place, the user can be assured that he does not leave out any important data, which may be crucial in the calculation of profit and losses

- These can be customized by the organizations and used as their standard calculation method for each financial year

Not sure how to design a Schedule C form for your company? Don’t worry. Take a look at our collection of schedule forms and choose the one that is best suited for you. Easy to download and customize, these forms help you to design a unique schedule C form for your company, that too without any expert help. You may also see Federal Tax Forms.

Related Posts Here

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form