An Expense Form is used in an organization to record the expenses incurred by said organization and its employees.

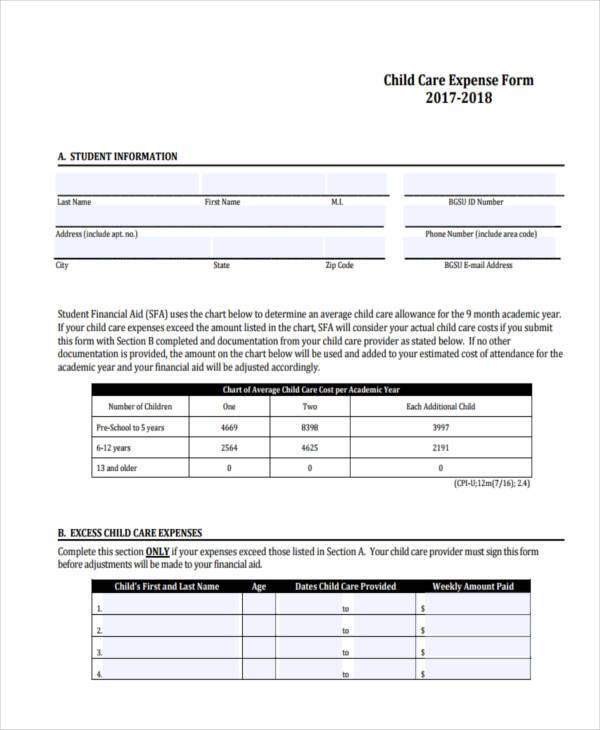

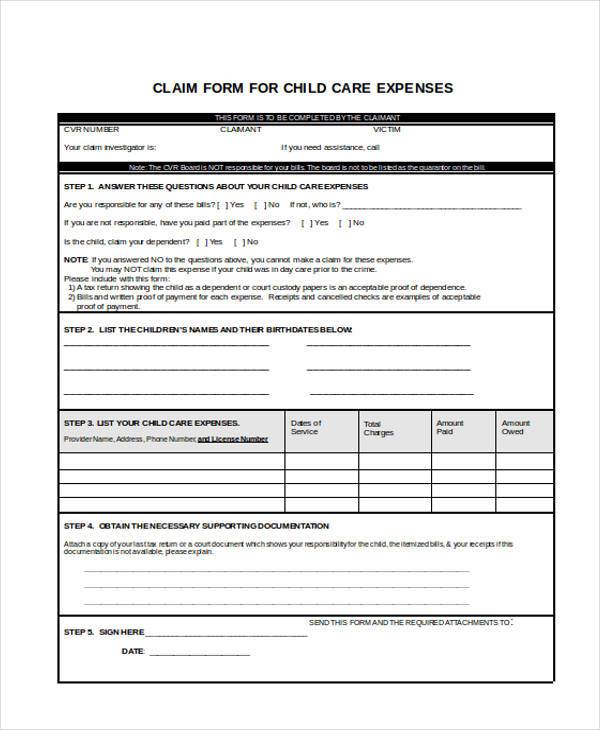

A Child Care Expense Form is an example of an Expense Form that allows you to identify and record child care expenses. Eligible child care expenses consist of daycare or babysitting, boarding school, and certain camp expenses while costs unsuitable for or are not covered by child care expenses are medical expenses, education costs, transportation, and clothing rates.

Below are some examples of Child Care Expense Forms that we can share to you. You can download and fill them up for your child and dependent credits.

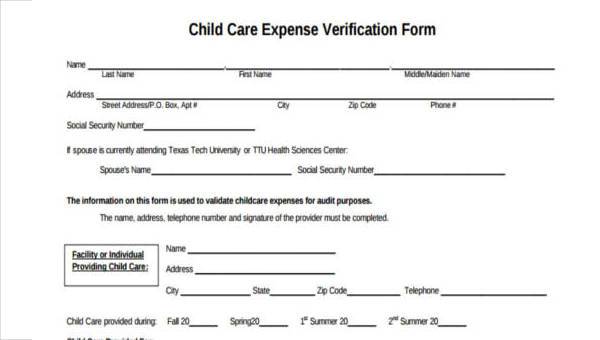

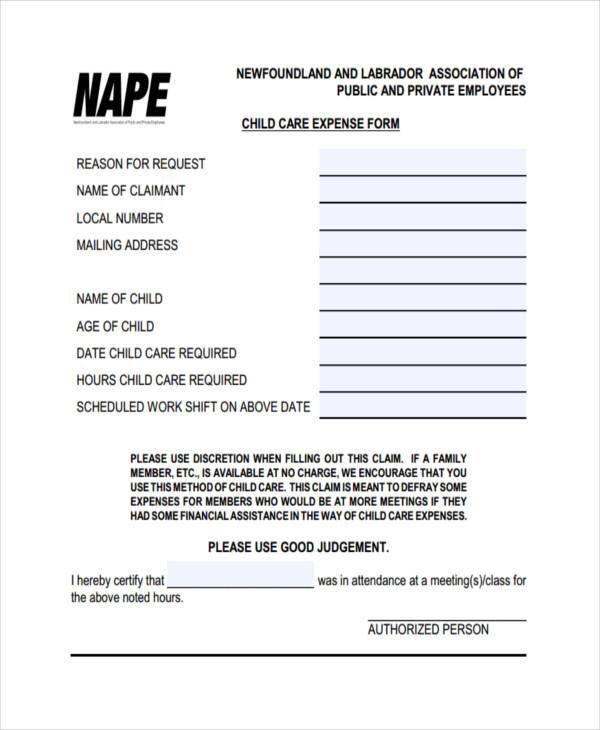

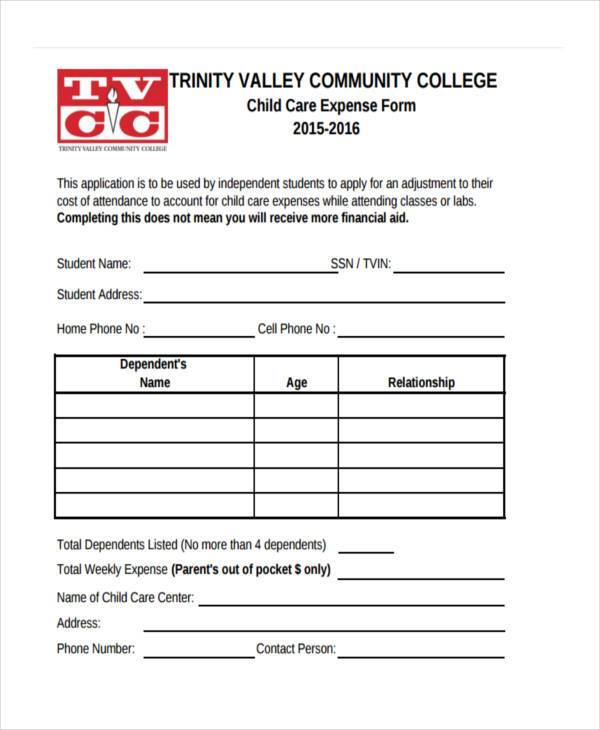

Child Care Expense Form

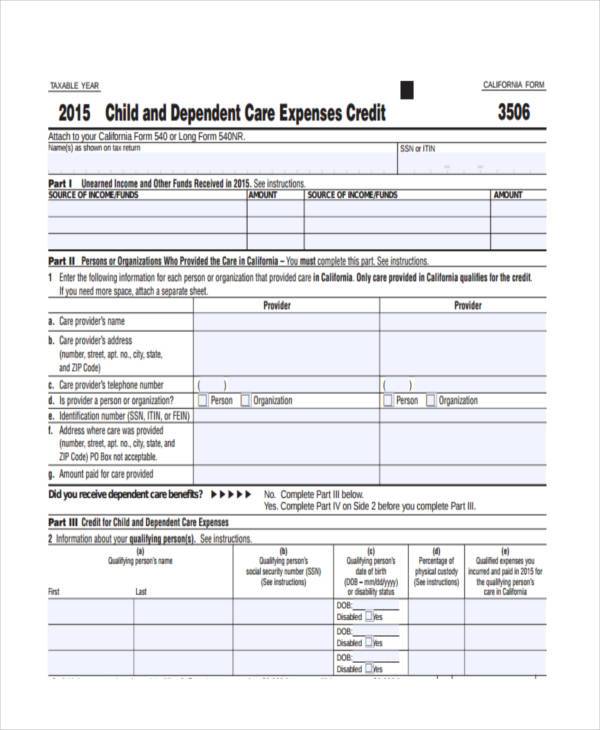

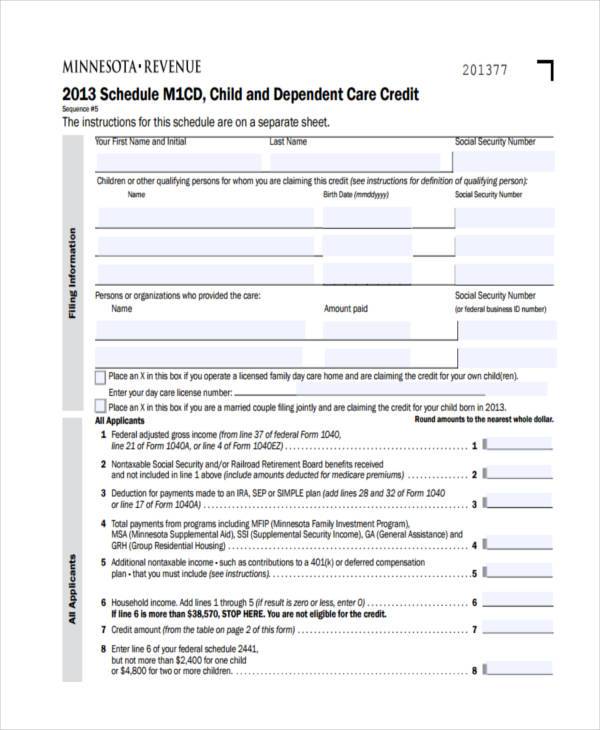

Child and Dependent Care Expense Tax Form

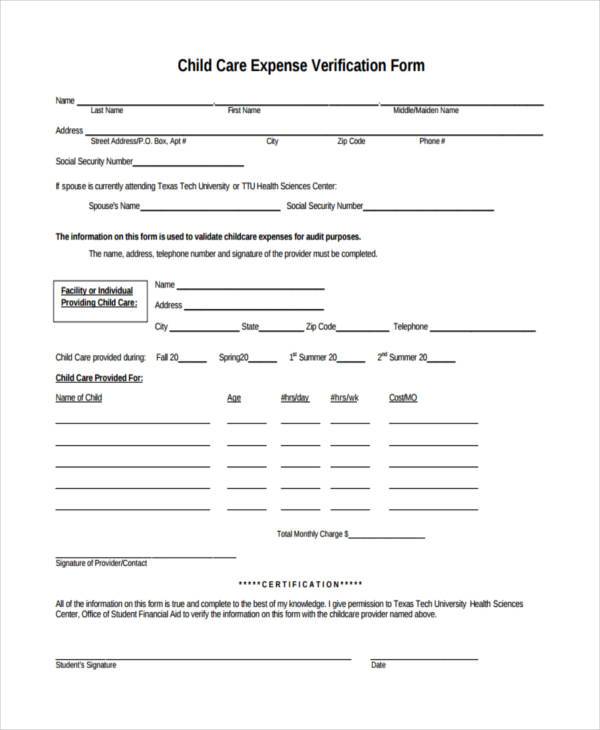

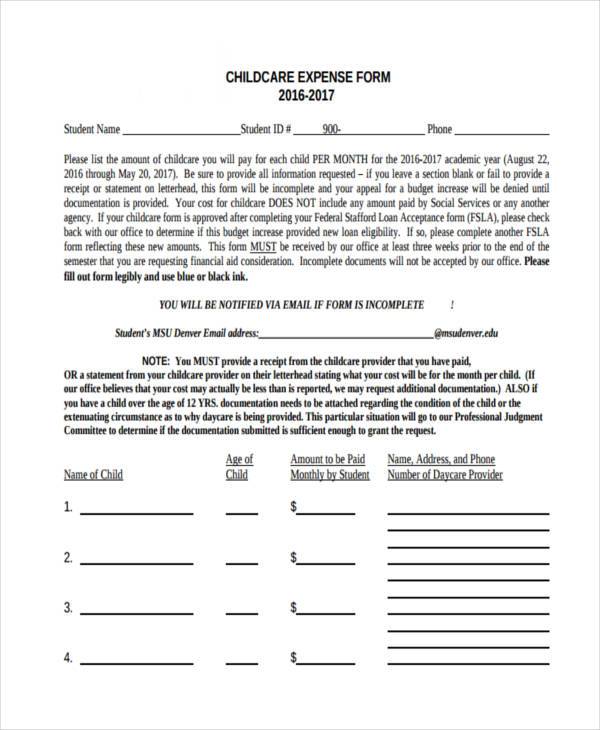

Child Care Expense Verification Form

Child Care Expense Form in PDF

Child Care Expenses Schedule Form

Who Can Use Child Care Expense Forms?

The parents of the child who wish to apply for the child care expense credit so they can record and keep track of the costs spent on their child.

When to Use the Child Care Expense Form?

Parents can only use the Child Care Expense Form if they wish to apply for the child care expense credit. Parents cannot use this form for other expense purposes.

Who Can Claim the Child Care Expense?

With both parents still living with the child, the parent with the lower net income is entitled to claim the expense of deduction. A parent with no income is considered to have the lower income and, for this reason, must be the one to claim the expenses. The supporting parent with the higher income may only claim a deduction only during the period in which the lower income spouse or partner is bedridden or physically disabled, attending full-time at a secondary school or a designated educational institution, or locked up in a correctional facility and is physically and mentally unstable. Single parents have a different set of rules that will be applied to them and to those who have separated during the year and / or are divorced.

Travel Expense Forms are another kind of Expense Form used by organizations or companies to keep track of and maintain the travel expenses for employees sent on business tours.

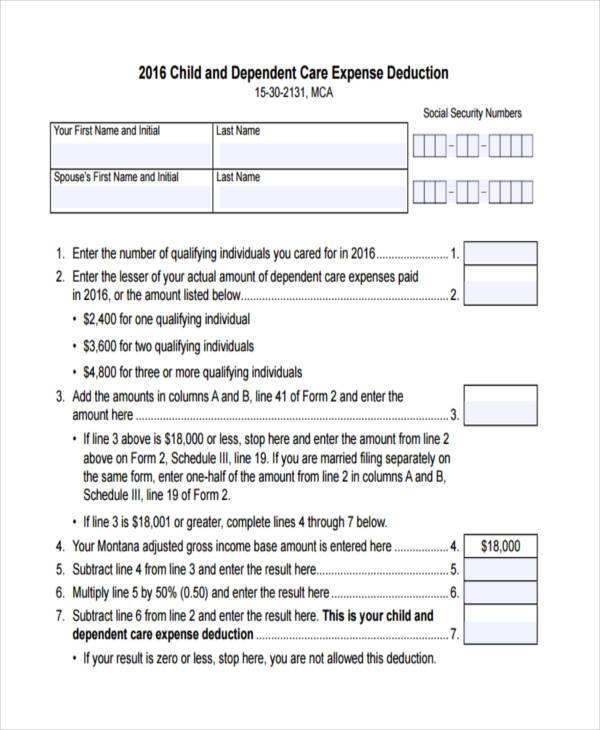

Child Care Expenses Deduction Form

Child Care Expense Form Example

Free Child Care Expense Form

Child Care Expense Form in Word Format

6 Things to Know about Childcare Expenses

- Get your receipts together – Getting a receipt from your childcare provider for your childcare expenses is the first step in making a proper claim.

- When making the claim – The parent with the lower income or with no income is entitled to claim the expense of deduction.

- All in the family – You can claim the amount you pay if your parent is caring for your children.

- Minors don’t count – If you pay a 12 year-old to look after his or her brothers or sisters, this does not count as an eligible and appropriate childcare expense.

- Maternity leave income – Childcare expenses can only be claimed against employment income and other earned income. Benefits during your maternity leave are not considered “earned” income; you can’t claim childcare expenses against it.

- Lunch-time supervision at school – The supervision fees are considered an eligible childcare expense if you’re paying to have them stay at school to eat lunch. The cost of the food is not included.

Raising kids can be costly and expensive, but hopefully these tips and the given sample forms for Child Care Expenses can help you save along the way.

Expense Report Forms are an example of an expense form in which an individual or an organization enables an expense report to present and describe the details of the expenses easily.