For business industries, it is important that the company knows how to keep track of their expenses. One way to do so is with the use of their expense forms that will help them identify what for and where their cash are spent.

Proper allocation of business expenses should be included in the monthly meetings in order to monitor and control the cash flow of the company. This is to track where and when the cash comes in and for what reason they go out. The tracking and monitoring is done formally with expense forms. Examine these different kinds of expense forms used in businesses.

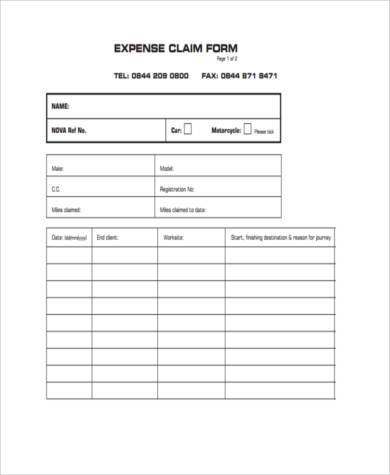

Business Mileage Expense Claim Form

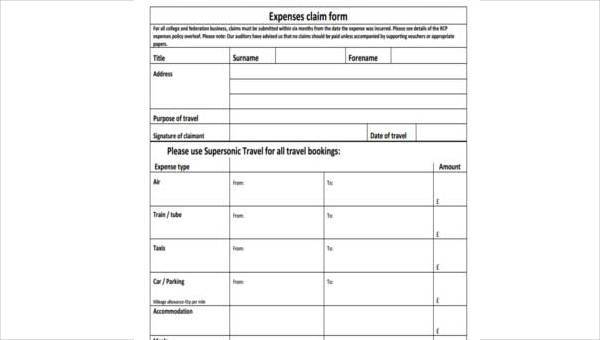

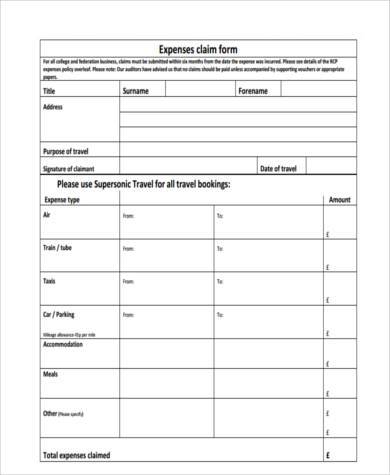

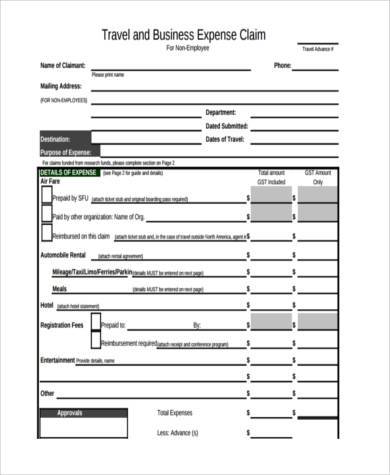

Business Travel Expense Claim Form

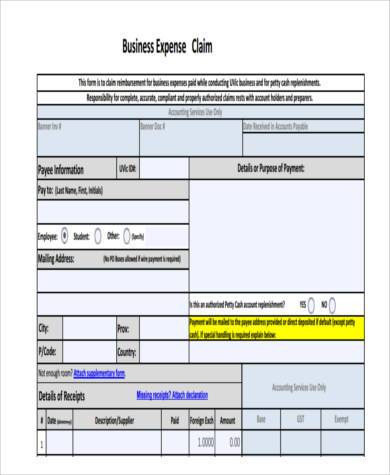

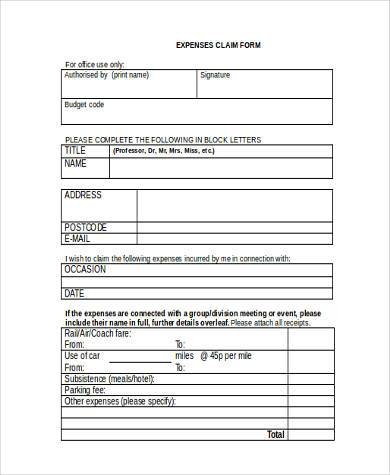

Business Expense Claim Form Example

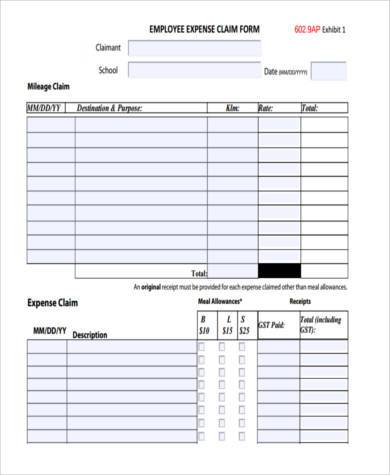

Employee Expense Claim Form

What is Business Expense Claim?

Business expense claims are used as a proof or an evidence that an amount has been spent for a particular purpose which is related to the business company. The business expense claim is done formally with a business expense claim form where exact details regarding the expenses made are indicated. This claim form is often used as a reimbursement of an employee or anyone who had spent some amount of his personal money for the business.

The expenses made are tracked in reference to the business expense forms which will be finalized in financial statements. Financial statements play the most essential role in financial accounting since these are used to determine if the business is making profits.

These expenses as mentioned earlier should be proper allocated in order to avoid discrepancies in the account. Proper allocation of these financial accounts are best done with qualified finance or accounting staffs. Understanding these accounting forms are not going to be that easy, which is why it is important that the staff-in-charge of keeping track the financial accounts have complete understanding regarding these forms and statements.

Refer to these sample forms provided for you on this article for different kinds of business expense claim forms and formats.

Free Business Expense Claim Form

Business Expense Claim Form in PDF

Travel and Business Expense Claim Form

Business Expense Claim Form in Doc

How to Complete a Business Expense Claim Form

Business expense claim forms vary on what it pertains to. These expense claims could be for mileage expense claim forms, or business travel expense claim forms. A mileage expense claim form is filed by an employee when he/she uses their private car for work purposes.

This claim form also serves as the employee’s reimbursement from the company for the expenses that were spent, such as the gasoline and/or the parking fees or payments. In the mileage expense claim form, here are the following that are required for fill up:

- the date/s of when the private vehicle was used

- from and to what destination

- for what purpose/s were those journey are for

- the number of passengers

- the parking fee/s or any expenses that were spent for something

- the distance in miles of the journey

- the signature that the claim is true and accurate

- the mileage rate and the amount reimbursed.

For the travel expense claim forms, the following are the essential elements that are needed for fill up in completing the form:

- the travel information such as the dates, the destination

- the claimant’s information such as name and contact

- the details of the expenses for the transportation (air fare and automobile rental)

- the meals expenses

- the hotel accommodation

- the fees for registration, parking, and other fees

- the the total amount with the taxes included