Upon receipt of your loan application, the lending company or bank must provide you with a Loan Estimate Form within 3 business days. A Loan Estimate Form provides you with information regarding the terms of the loan you are applying for. It provides you with an estimate of what your monthly payments and interest rates will look like if you decide to go forward with it. What it is not, though, is an indication that the lender has denied or approved your application. You may also see our Sample Construction Forms if you are working on a construction project.

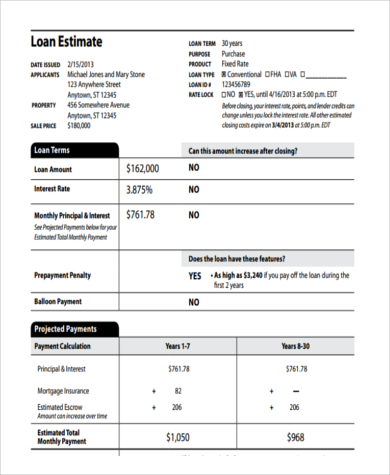

Sample New Loan Estimate Form

Blank Loan Estimate Form in PDF

Loan Estimate & Closing Disclosure Form

Mortgage Loan Estimate Form

The Information Needed to Draft a Loan Estimate Form

Lenders are required to provide you with a Loan Estimate Form if you have presented to them the following information:

- Your name

- Your monthly income

- Your Social Security Number for them to pull up a copy of your credit report

- How much you plan to loan or the loan amount

Although you are not required to provide more information, the more information the lender has on your current financial situation, like any debts or credits, and additional income, the more accurate your Loan Estimate is going to be. It would also help if you would specify to the lender what specific loan or loan types you would want. You may also see our Home Appraisal Forms for conducting appraisals on your home.

Proposed Loan Estimate Form

Loan Estimate Model Form Example

Printable Loan Estimate Form

Simple Loan Estimate Form

What Information Is in a Loan Estimate Form?

- Loan Amount

- Interest Rate: It will also show if your loan is fixed-rate or adjustable-rate. A fixed-rate loan is when the interest rate is fixed all throughout the term of the loan, while an adjustable-rate loan is when the interest rate can either go up or down. Usually, an adjusted-rate loan starts off with a lower interest rate than a fixed-rate loan and can stay that way for months or years, but the drawback is that it doesn’t protect you from sudden and significant increases in your monthly payments.

- Monthly Payment: This includes payments like the principal payment, which is the amount you pay to reduce your monthly payment and cover charges for interest. This includes mortgage insurance and estimated escrow for the bills the lender has to pay on your behalf.

- Origination Costs: These are the charges for getting the loan, like mortgage application fees and underwriting fees among others.

- Closing Cost: This is the amount you would need to bring to close the loan.

- Comparisons: This will show a projection of how much you will have paid in five years, your annual percentage rate, and your total interest percentage. You can use this information to compare with other loans.

Getting a Loan Estimate Form from the lender can really help you compare loans so that you can decide which one is best for you. It can also help you prepare financially and make room in your budget for when you finally get the loan. For personal budgeting, you may use our Financial Statement Forms to compare your income against your expenses.

Related Posts

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 17+ Sample Printable Accounting Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Accounting Expense Forms in PDF | MS Word | MS Excel

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 39+ Estimate Forms in PDF | Ms Word

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 5+ Accounting Transfer Forms in PDF