Traveling is one of the widely known hobbies of people, most commonly the millennials, nowadays. However, traveling is not only a hobby but also an activity that companies and organizations do for their businesses or meeting their goals and group objectives. For instance, a conference that will be held out of the country or at a certain distance away from the company’s premises will need the representation of an employee who will be sent to travel to the conference’s location.

- Sample Expense Forms

- Free Expense Forms

This is when particular forms are used to document the budget that the employee or the company representative will need for the conference. Basically, a travel expense reimbursement form is a document that is used for this accounting and financial record-gathering process.

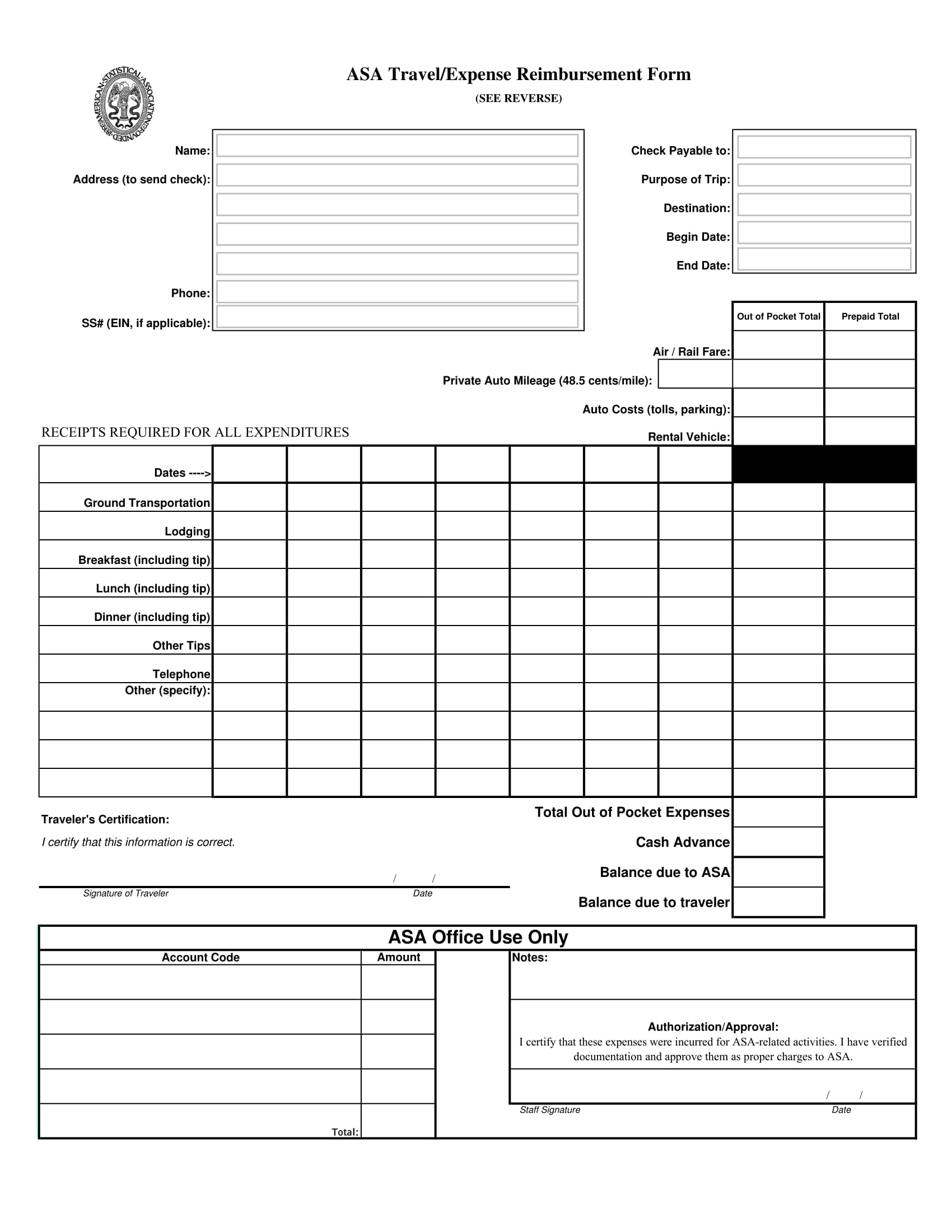

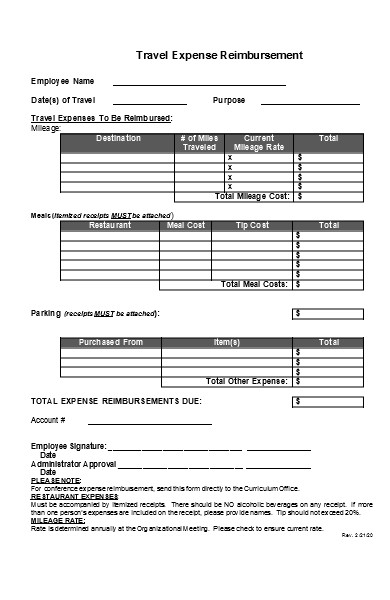

Travel Expense Reimbursement Form Sample

What Is a Travel Expense Reimbursement Form?

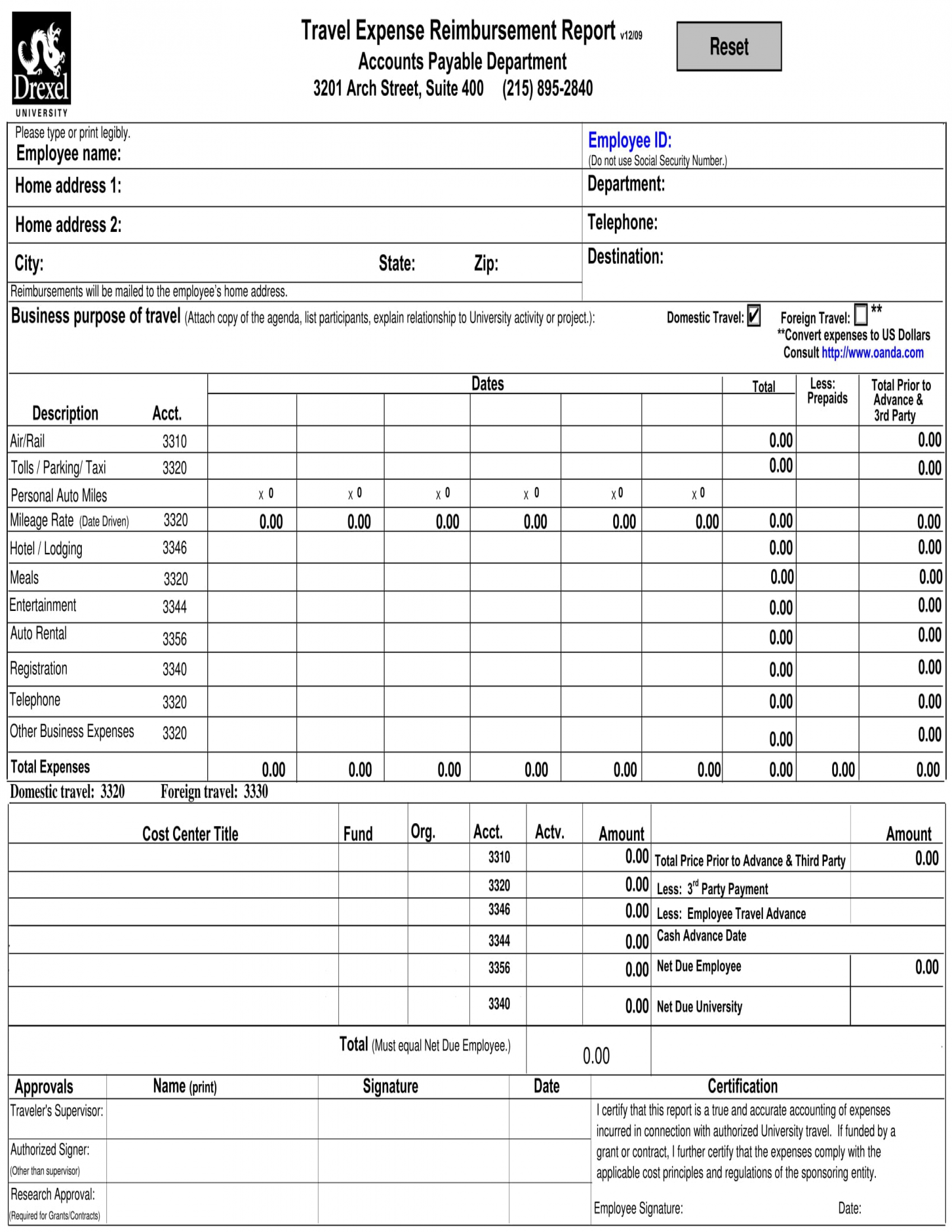

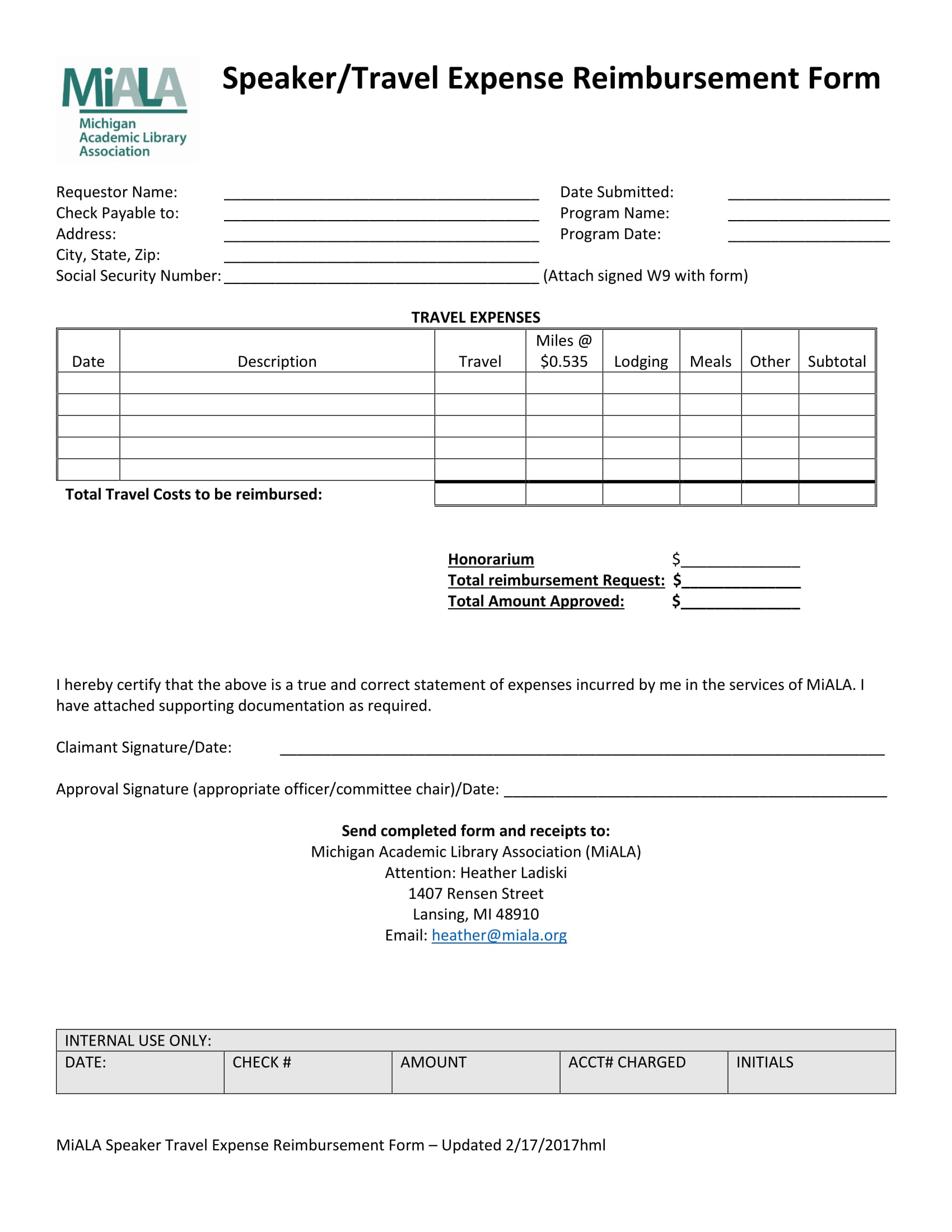

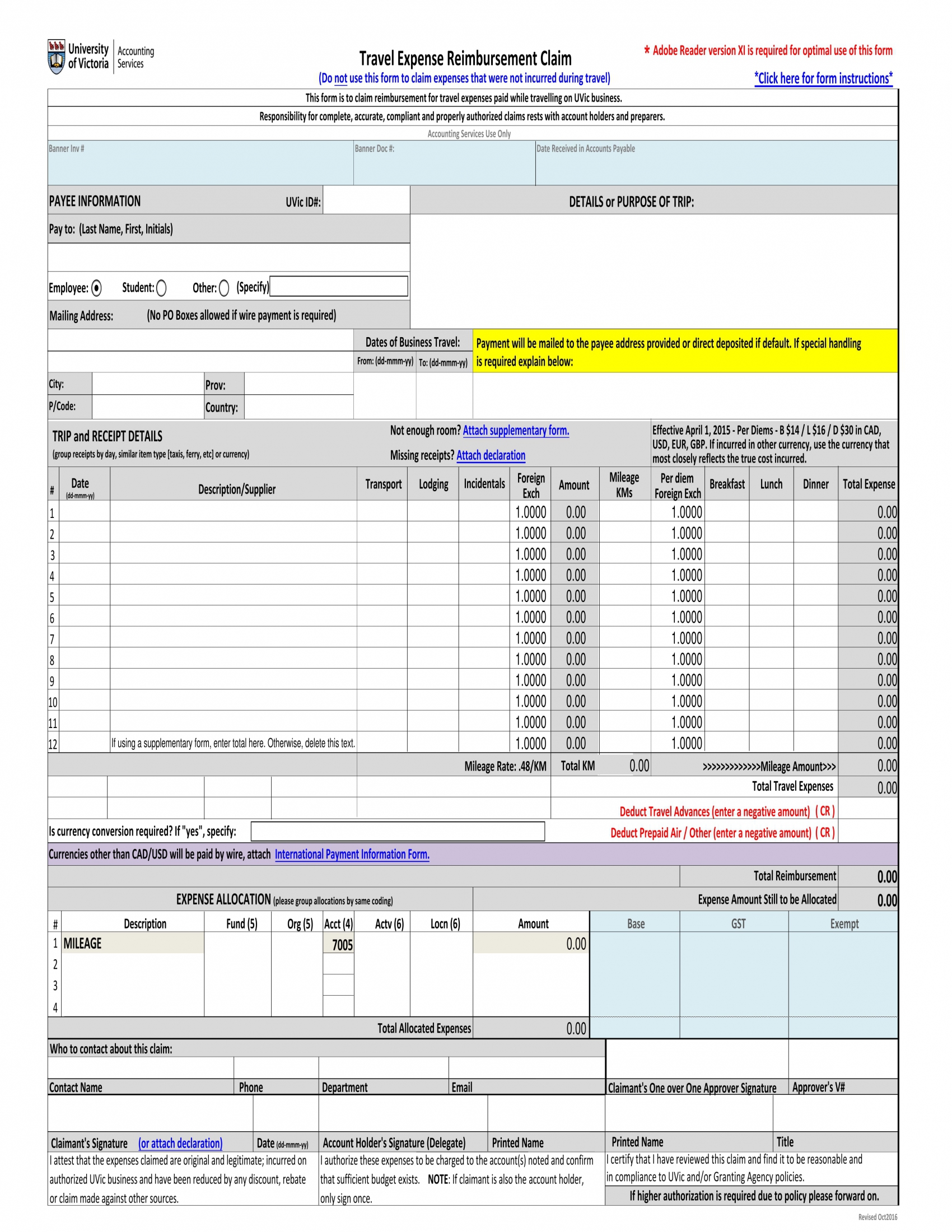

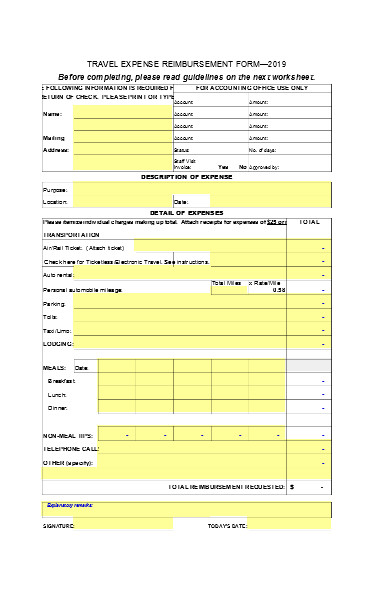

A travel expense reimbursement form contains the general information of an individual’s flight, transportation, and his spent amount for lodging a hotel for the duration of his company’s business conference. It is important that the employee or the company representative will completely state the different expenditures in order to inform the company about the specific amount that they will need to reimburse to the employee’s salary.

Interactive Travel Expense Reimbursement Report

How to Complete a Travel Expense Reimbursement Form

Completing any sort of reimbursement form is easy if the user is able to gather the necessary receipt forms to prove his expenditures. Nonetheless, below are the steps to aid you, as the user, in completing a travel expense reimbursement form for any company:

1. Begin with your personal information.

You must state your full name as the employee of the company or business representative on the first section of the form. Additionally, your home addresses will also be needed to complete this section.

2. State your employment details.

This includes the date when you signed the employment agreement and became an official employee of the company. Your job position and the department where you are located in the company are also included to be written in your employment information. The importance of having these data is to assure that the employee who is chosen to represent the company has an adequate and related background to the subject of the conference or event.

3. Distinguish your travel purpose and destination.

By indicating these details, the company will be able to determine whether your reasons are valid for you to acquire the repayment or reimbursement. The destination of your travel is essential to inform the company about the exact amount of transportation fare you have paid during the conference. You may also like expense report forms.

4. List down and describe your expenses.

A table is allotted for the list of expenses which must accompany its descriptions, amount, and the dates when you purchased the material. After listing the materials and purchases, you must total the amount that you spent and indicate it in the last section of the table.

5. Sign the form and seek the approval of your head officials.

Affix your signature with your name and the date when you finished the fields of the form. Then, submit the document to your manager or supervisor in order for them to relay your travel reimbursement to the human resource and accounting department of the company.

Speaker Travel Reimbursement Form

Travel Expense Reimbursement Claim Form

Employee Travel Expense Reimbursement Form

Basic Travel Expense Reimbursement Form

Although company and business conferences are beneficial to any individual, he must be supplied with the right budget for him to enjoy the whole event without worrying about his finances. Additionally, the company can also be able to reimburse if the employee has reported and recorded his spent amount immediately upon his return.

Related Posts

-

FREE 8+ Sample Accounting Expense Forms in PDF | MS Word | MS Excel

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Corporate Accounting Forms in PDF