Imagine holding an awful lot of money in your hands with a single piece of paper. Convenient, isn’t it? Imagine doing the opposite, and it will be an open invitation for robbers to strip you bare. Checks are what we, scrooges like you and me, consider as the greatest invention of all time. So great that they were even used by one of our founding fathers, like John Hancock, in the pursuit of income and profit and played a crucial role in US history. Checks are financial instruments that are used as payment in large sums. Since checks involve money, they needed to be recorded in a document every time a transaction using those are made.

What Are Checkbook Register Forms?

Checkbook register forms are financial forms used to record and track monetary transactions every time a transaction—bank transactions—is made involving checks. These forms record the amount of withdrawals and deposits, and payments as well. These forms are used side-by-side with a bank statement to determine each document’s accuracy and correctness. Checkbook register are essentially useful to better manage our finances and could be used by everyone who have checking accounts in their banks.

FREE 6+ Checkbook Register Forms in PDF | Excel

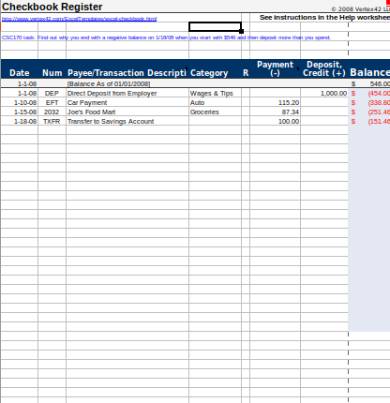

1. Checkbook Register Spreadsheet Form

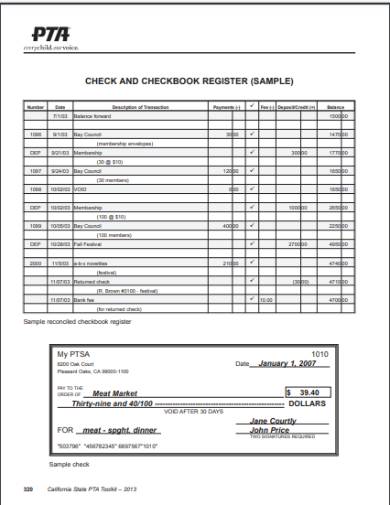

2. Check & Checkbook Register Form

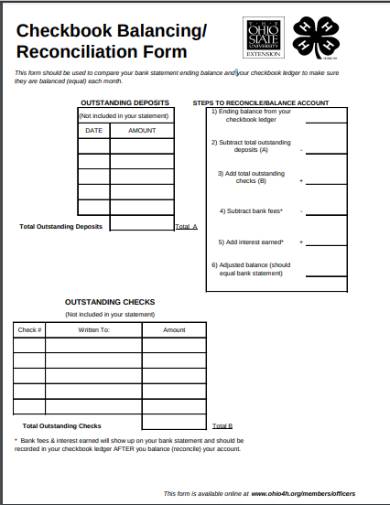

3. Checkbook Register Balancing Form

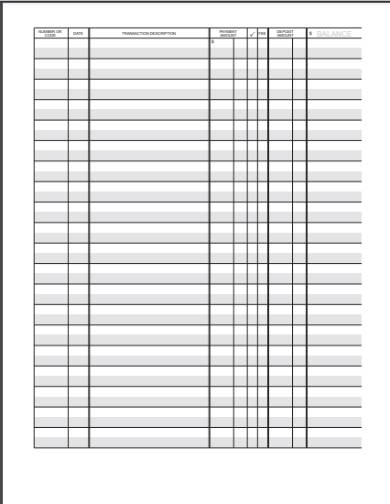

4. Blank Checkbook Register Form

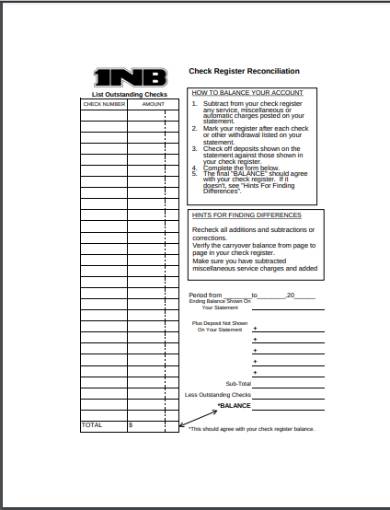

5. Checkbook Register Reconciliation Form

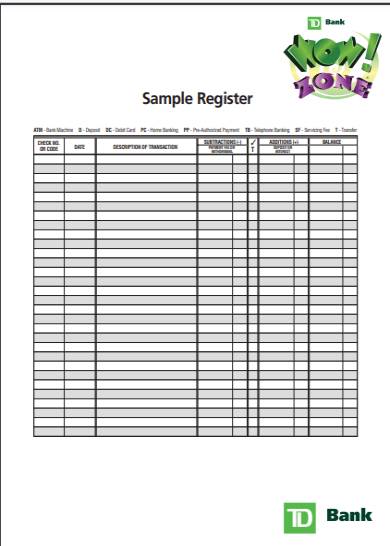

6. Sample Checkbook Register Form

7. Large Print Checkbook Register Form

What Are the Purpose of Checkbook Registers?

Checkbook registers, as mentioned, are used to record and track one’s finances. They are used to manage our finances better, as well. Checkbook registers are included in checkbooks, the first time we open a checking account with our bank. These allow us to record each transaction every time we write a check to someone. Checks are a popular mode of payment in the US, aside from credit cards and cash. In fact, $33.8 billion worth of checks are reportedly written and collected every day in 2018, according to statistics.

Tracking and recording one’s finances are not the sole purpose of a checkbook register; they are the reason why they exist in the first place. The main purpose of a checkbook register is to ensure that your finances are properly reported by your bank and as security against fraud of any form. Aside from those, checkbook registers have another purpose, as well. And, they are listed below along with their definitions.

1. Balancing the Checking Account

Balancing, in accounting, is the act of determining the amount left in your bank account. The amount that you deposited when you opened your checking account is your opening balance. That is the amount that will be deducted every time you make a transaction using your checks. The resulting amount will then be your balance for the day and will be the amount that will be deducted in the next cycle.

2. Reconciliation of the Checking Account

Reconciliation is done whenever you ask your bank for a bank statement. A bank statement is like a written report that shows the status of your bank account and it’s contents. Every time a bank statement is sent to you by your bank, you immediately check it against your checkbook register. This how you reconcile your checking account. This is done to ensure the accuracy and correctness of both documents and to spot any potential fraud.

How to Fill Out a Checkbook Register

Say, you just opened a checking account in your bank for the first time. And, it goes without saying that you’ve absolutely no idea of what to do, especially on how use the register that came with it. Don’t worry, this article will help you with that. To begin with, checkbook registers are where you record every transaction made every time you write a check. It is done so you can track and manage your spendings. To get you started, here are the steps to help you fill out your checkbook register, the first time.

Step 1. Open your Checkbook Register

First, open your checkbook and go to the last page. That is where you’ll find your checkbook register. Your checkbook register will feature rows and columns in tabulated format. The register itself will also have sections intended for specific information to be written on. These sections will ask about dates, check numbers, name of transactions, and amounts.

Step 2. Record the Check Number

Next, start filling out your checkbook register by writing the check number of the check issued. To start, write the check number in the cell found on the lefthand side of the form. Your blank checks are numbered in a series and are properly indicated on their faces. These numbers allow you and the bank to track the number of checks that you’ve written.

Step 3. Write the Transaction Name

Then, Write the name of the transaction that you paid with your check. This will be written in the table next to where check numbers are written. Doing this allows you to know where your money went and what you used them for. Make sure to write them as accurately as possible.

Step 4. Enter the Amount

After you’ve written the nature of the transaction that you paid for using your blank check, enter the amount of the transaction on the respective cell that they belong to. Each amount that you will write on the register has to be written as a withdrawal every time you write a check to pay for something. There are also cells dedicated for deposits every time you top-up your checking account.

Step 5. Do the Math

The last and final step in filling out your checkbook register is to compute them using basic math. There are three important sections in the form involving this process. The withdrawal, deposit, and balance section. To illustrate, you deduct an amount from your balance when making withdrawals, and, add an amount in your balance when making a deposit. Confusing? Here let me enlighten you. Deposits are when you add money to your checking account and Withdrawals whenever you purchase or pay for something.

Related Posts

-

Check Register Form

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Corporate Accounting Forms in PDF