Being a new business owner, you may know not what to do with your financial documents, specifically your invoices. You keep a copy of all invoices that your company creates after each successful transaction with a customer or supplier occurs. You eventually hired an accountant to help you with how to utilize the sample financial documents. The accountant told you to create a vendor ledger and compile all the invoices in the ledger. Chronologically arrange the invoices. When the accountant conducts an audit, he’ll only view the ledger, and check the total amount.

What Is a Vendor Ledger?

A vendor ledger is an accounting document that lists all the sample commercial invoices you create through the usage of accounts payable. The vendor may be the supplier who keeps sending you goods and materials that you need for your business’s productivity. Through the use of accounts payable, you may access all of your invoices that you incurred so far. All the details of the invoice can be obtained, such as the date, list of purchased items, prices, etc. Should you want to have a physical copy, you may download and print the list of invoices that present chronologically.

Most businesses only collects all of their financial documents. Most do not make an effort to compile it. Financial documents—profit and sales statements, invoices, receipts, etc.—are necessary files whenever a financial audit will occur, usually done by an accountant. Accountants also utilize vendor ledgers to look at the transactions the company made so far and compute if the debit and credit are balanced. Without a vendor ledger, an accountants computation will not result to a precise result. The accountant may backtrack and may even ask you if you missed recording a couple of invoices.

FREE 6+ Vendor Ledger Samples in PDF

Displayed below are seven examples of vendor ledger sample forms that we took from the Internet. Vendor ledgers are easy to create but are relevant nonetheless, especially to accounting audit reports. Look carefully at the samples below and see if there are any differences or similarities that you can find. Compare and contrast each of the examples. You may use the samples as reference when you will create your very own vendor ledger soon!

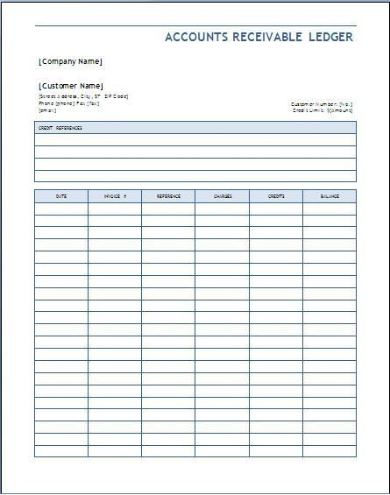

1. Sample Accounts Receivable Ledger

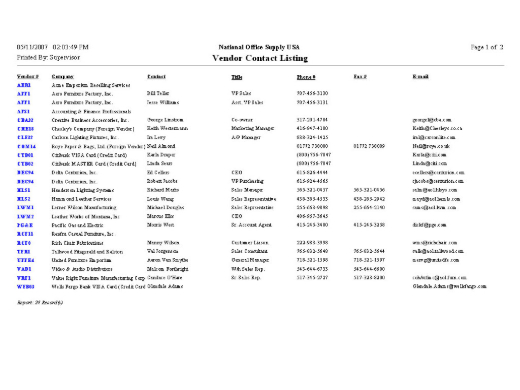

2. Sample Vendor Contact Listing Ledger

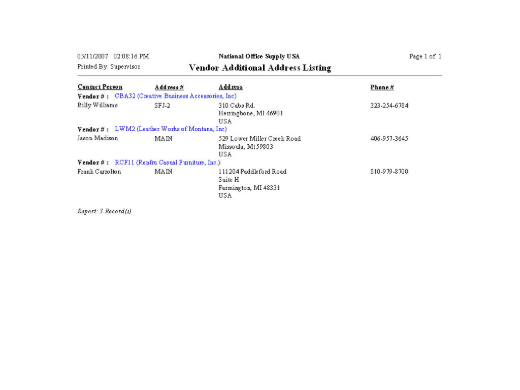

3. Sample Vendor Additional Address Listing Ledger

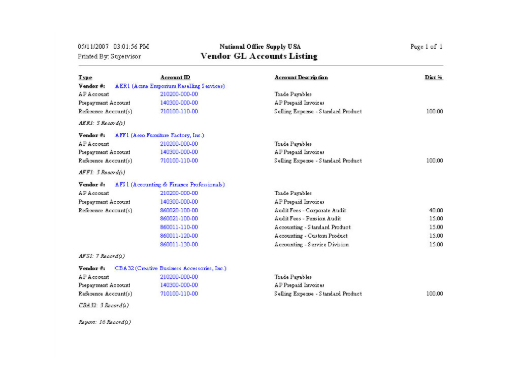

4. Sample GL Accounts Listing Ledger

5. Sample Vendor Listing Ledger

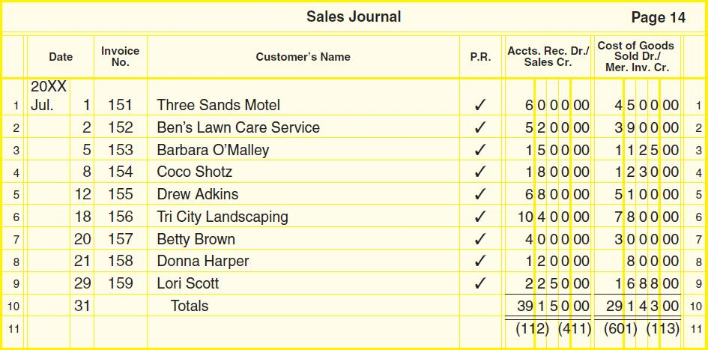

6. Sample Sales Journal Ledger

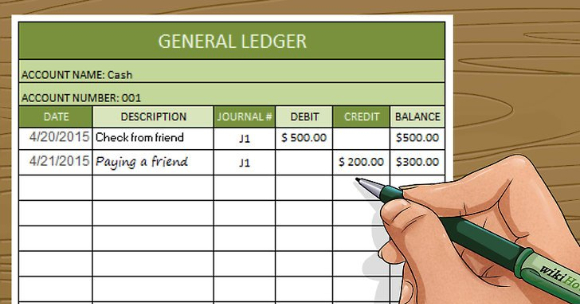

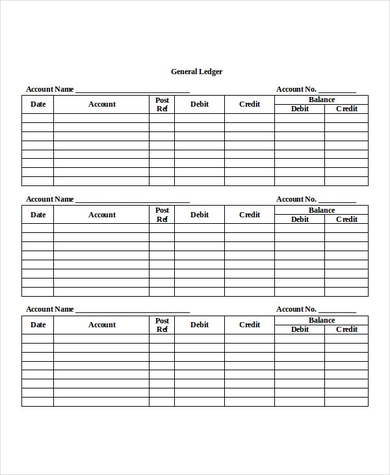

7. Sample General Ledger

Benefits of a Vendor Ledger

A vendor ledger is a useful document to business owners and accountants, especially when it comes to auditing a company’s finances. Vendor ledgers list down and keep track of all of the company’s transactions with their supplier. And I mean all of the product transactions. In this manner, the list form helps the auditing process become easier. Instead of looking at all the files, the auditor may just look at the vendor ledger and compute. For the business owner, if he wants to go further into detail regarding a certain transaction, he may merely look at the vendor ledger too since of all the activity and exchange between the company and the supplier is there in the list.

How to Fill Up a Vendor Ledger

We prepared a few systematic processes of how you can fill up and utilize a sample vendor ledger. Vendor ledgers are useful business forms, so start creating your very own file now and help ease the trouble of having to look at every invoice! Here are a few tips that will help you create your very own vendor ledger.

Step 1: Compile Your Vendor Invoices

Gather all of your company’s financial documents, especially the invoices that contain the transaction you incurred with your company’s suppliers. Remember to gather all of the materials that contain all of the sample company sales. You must make sure that the documents are complete, and not a single paper passes your eye. If you miss even one text, it could spell big trouble for the accountant when he conducts the company financial audit. All of the transactions must be evident in the paper, and all of the legal files must be present.

Step 2: List the Transactions

Once all the papers are present, you must organize all of them by date. Carefully look at the date of each invoice and start arranging them. The bottom document must be the recent company transaction, and the top material must be the first transaction that the company incurred with a supplier. Afterward, you can start listing the transactions on the vendor ledger. Whenever you write down the operations of the company, you must make sure that you write the correct one. Chances are you might have written down the same item twice or thrice.

Step 3: Organize The List Chronologically

List the company transactions as to how you organized the papers—chronologically. Start the list with the first transaction and end it with the most recent one. Chronologically listing the items is the smartest thing you can do since it is practical and neat, avoiding the hassle of manually sifting through various financial sample forms.

Step 4: Review the Vendor Ledger

No business document must receive the cue for printing without undergoing sample assessment and edit. Business documents must receive an evaluation to receive the cleansing of any errors in the content. Let a professional who possesses knowledge on how a ledger works handle the assessment and editing process of the business form.

Step 5: Download the Vendor Ledger

Once the sample evaluation finishes, download the file and do not forget to save a copy of your progress on a folder in your laptop for security purposes. Print the final output so you may use it to record the needed transactions with the company’s suppliers!

Related Posts

-

Accounts Receivable Ledger Form

-

Ledger Account Form

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

Check Register Form