Banks and financial aid providers use various documents for their clients’ services. The main reason for these legal forms is to assure that clients’ identities are factual and exact.

One document that banks use is a bank loan application and checklist form. This is essential in accompanying other paperwork that clients must complete.

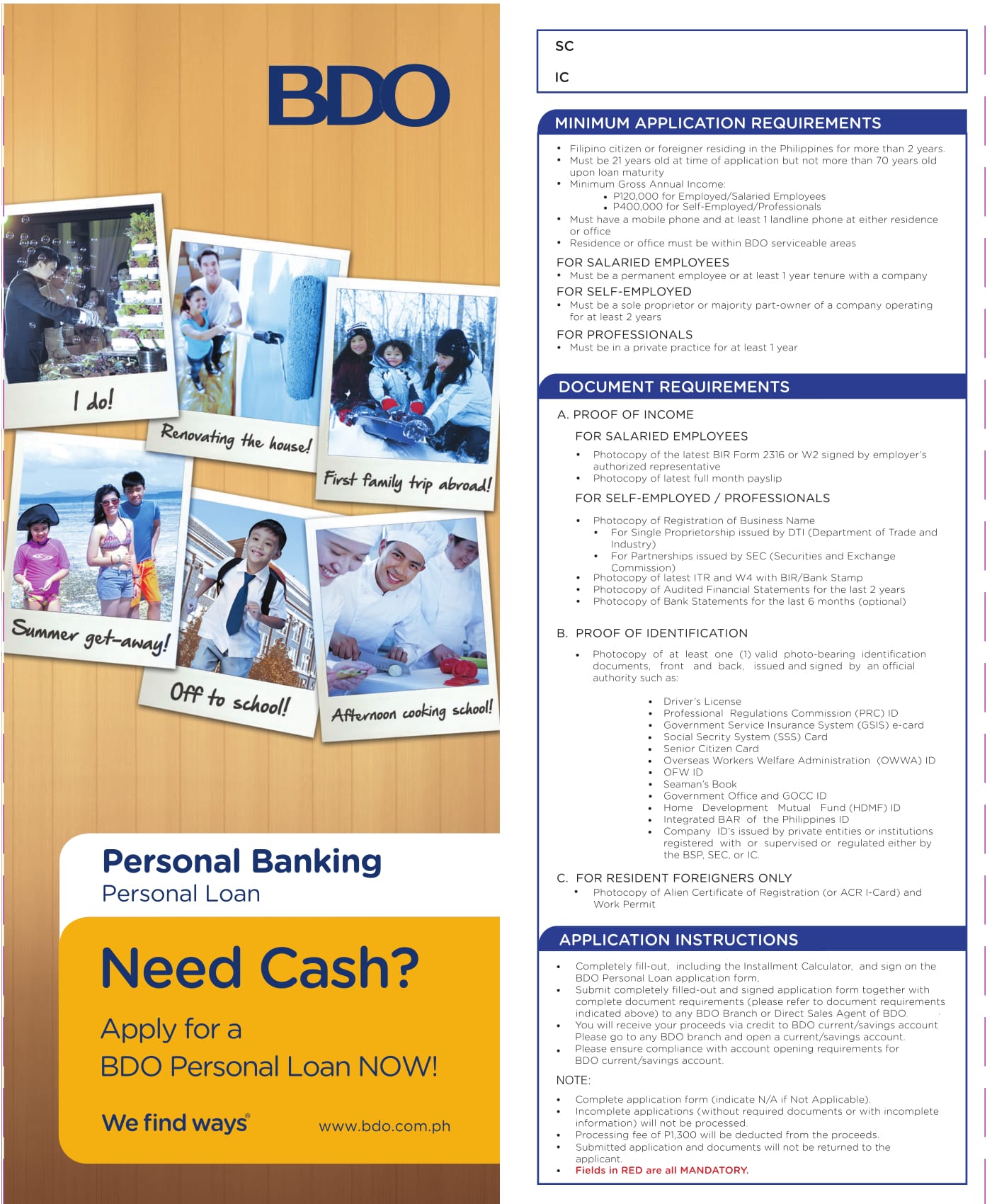

Bank Loan Application Form Sample

What Is a Bank Loan Application Form and Checklist Form?

A bank loan application and checklist form can either be a single document or two separate forms depending on the bank’s preferences. Specifically, this form is essential in determining whether the client has provided all of his general information for the loan application process.

If the application and checklist are combined to be in a single form, then there will be evidently two sections on the form to allow an easier identification of where the areas for the client and bank personnel are allotted. The first section will mainly cater the client’s details while the succeeding section is for the personnel who will check if there are fields left unanswered by the client. You can also like loan application review form.

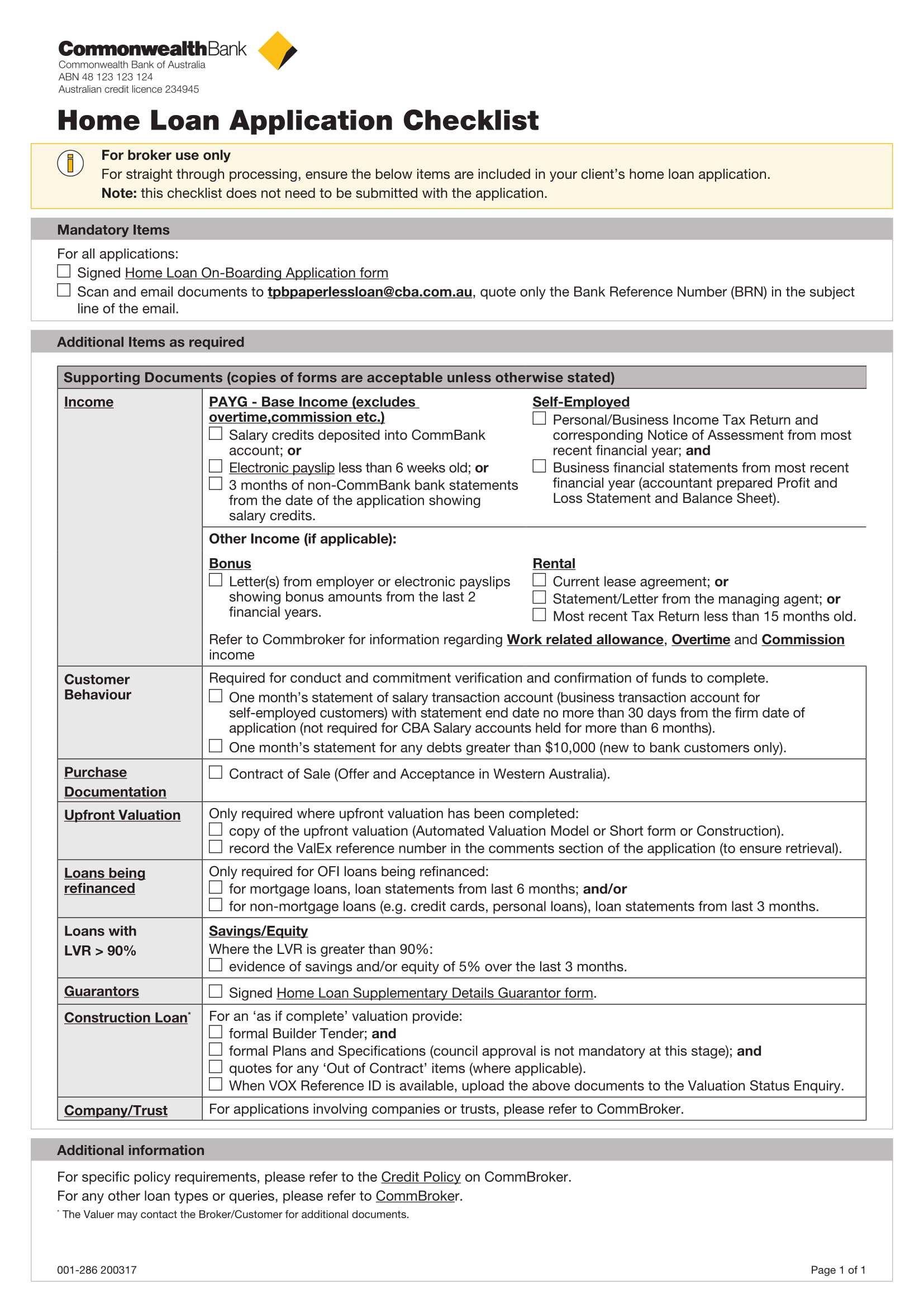

Bank Home Loan Application Checklist Form

Why Use a Bank Loan Application Form and Checklist Form?

Understanding the client’s preferences and limitations are easier if the client has already stated and declared the necessary facts about himself. This includes his income statement, employment or work history, as well as his repayment history. These declarations will only be obtained by the bank if they use the appropriate form which is the bank loan application and checklist form. You can also like loan proposal forms.

With this application form, the bank can assess their clients properly and determine if the client can qualify for the specific loan that he is applying for. Additionally, the checklist also serves as a guide for the bank personnel in scoring their clients and determining if a client is responsible for dealing with the loan.

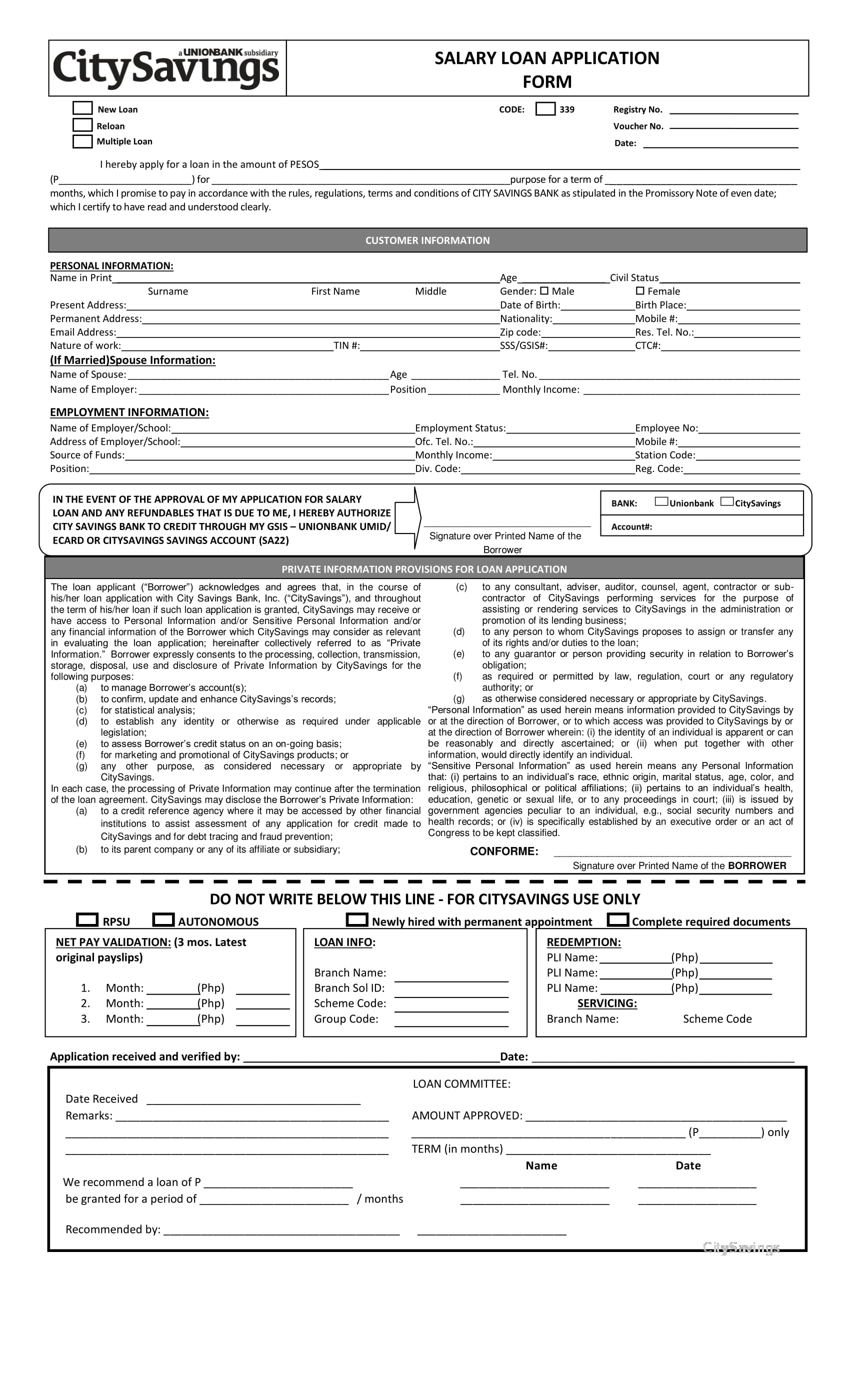

Bank Salary Loan Application Form

What’s in a Bank Loan Application Form and Checklist Form?

Bank loan application and checklist forms have significant areas that must be completed before the document is submitted for the next step in a loan application process. Aside from the personal data that the client provides, this form must also have a table wherein the bank personnel will indicate a check mark that corresponds to each area or entry of the client. You can also like credit application forms.

The checklist contains the income categorization of the client, the observations and interview assessment of the personnel about the client’s behavior upon presentation of his identity, and the documentation that the client was able to prove for the application.

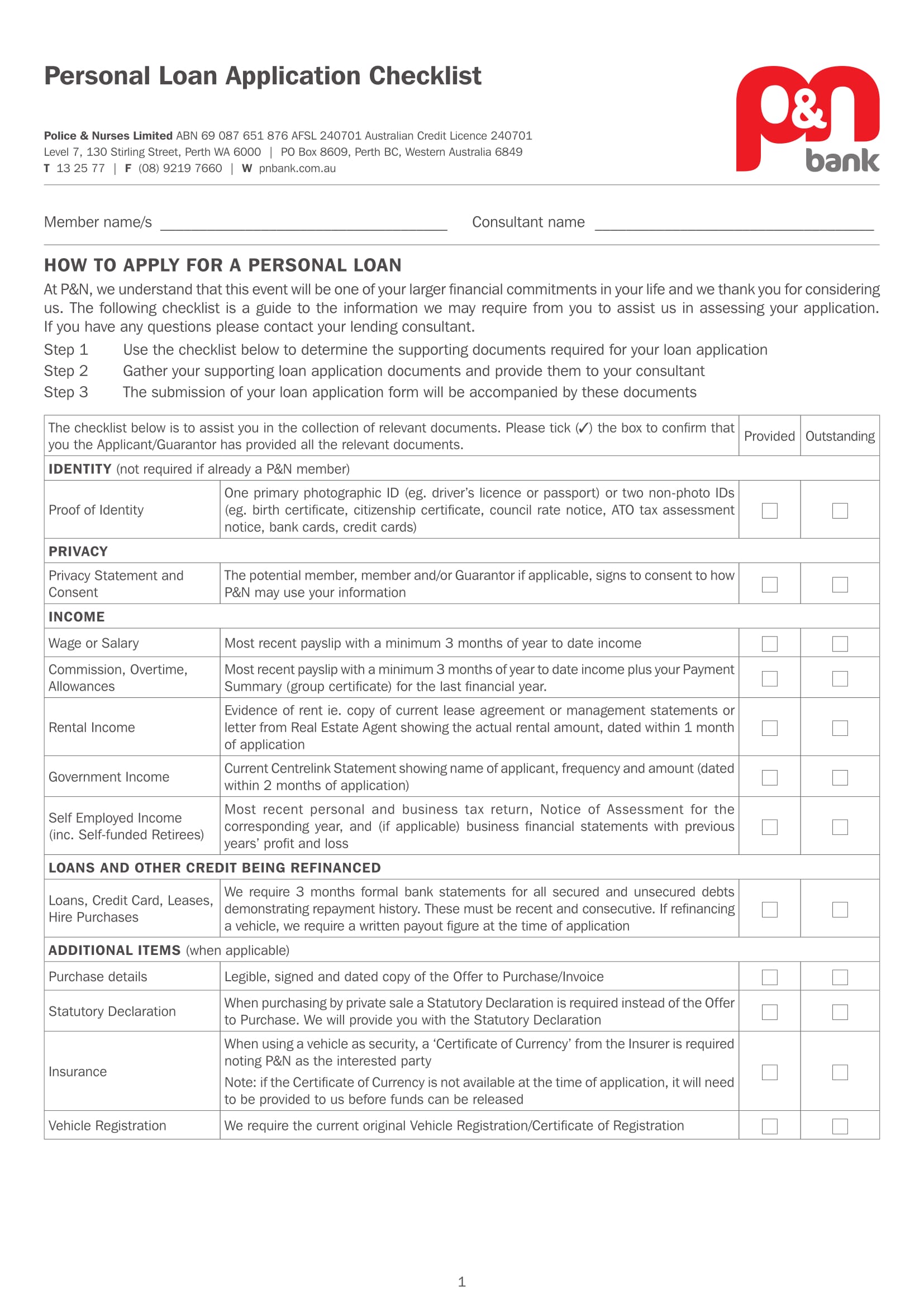

Personal Loan Application Checklist Form

Checklist forms are not only limited to be used during a bank loan application but also to other financial services that the banks provide for their clients. These services can include scholarship applications, as well as opening debit and savings, account for companies and agencies.

However, regardless of the variety of services that a client prefers, the bank must conduct a detailed investigation and assessment before accepting the client’s application. This will not only protect the bank from allowing identity thieves to acquire a loan but will also aid the bank in collecting enough information for an efficient data documentation.

Related Posts

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Loan Estimate Forms in PDF | MS Word

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

Check Register Form

-

Investment Trading Journal Form

-

General Journal Form

-

Balance Sheet Form

-

Cash Receipt Journal Form

-

Accounts Receivable Ledger Form

-

Credit Debit Form

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word